Inventec Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inventec Bundle

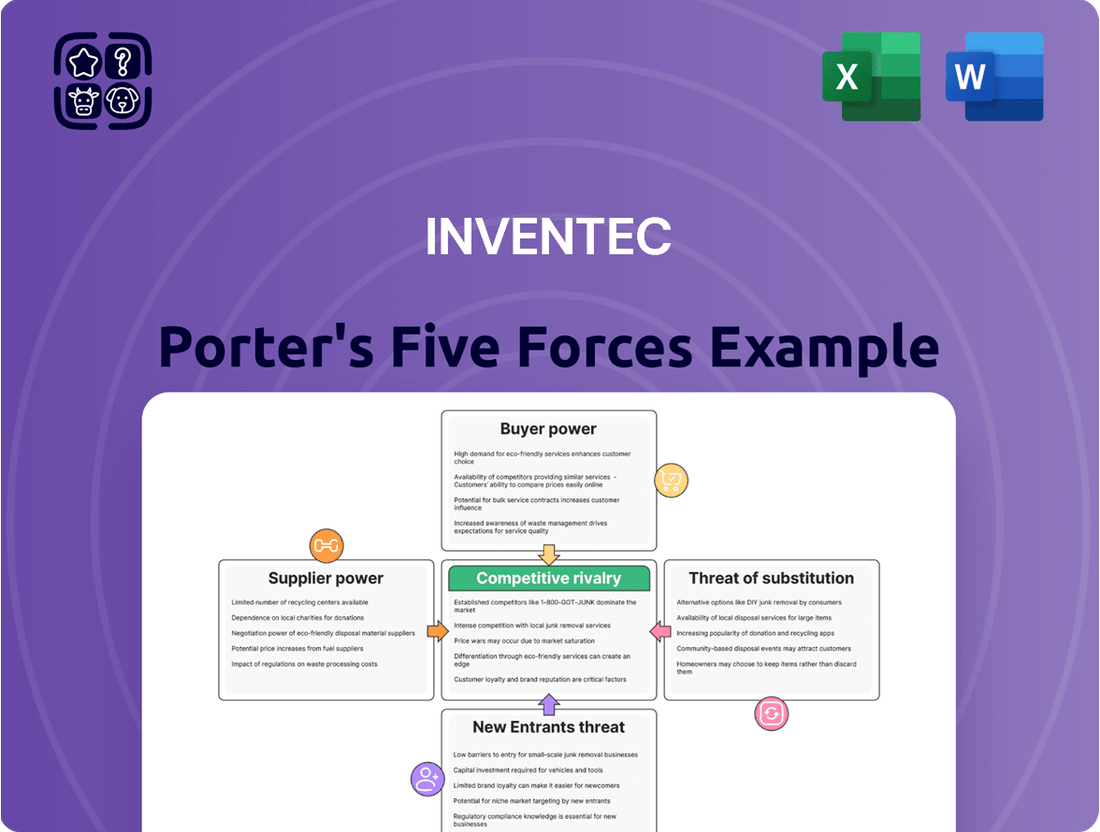

Inventec's competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the constant threat of new entrants. Understanding these dynamics is crucial for any stakeholder looking to navigate its market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Inventec’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Inventec's reliance on a global supply chain for critical components like semiconductors and displays means supplier concentration can heavily influence its costs and production. When a few dominant suppliers control specialized or patented parts, their bargaining power increases significantly.

For example, the burgeoning AI server market, a key growth area for Inventec, often depends on a limited number of advanced chip manufacturers. This concentration allows these suppliers to dictate terms, potentially impacting Inventec's profit margins in 2024 and beyond.

Inventec faces significant bargaining power from its suppliers due to high switching costs. These costs arise when components are deeply integrated into Inventec's product designs, necessitating extensive re-qualification and rigorous testing procedures to ensure compatibility and maintain certifications. For instance, in the semiconductor industry, where Inventec operates, qualifying a new chip supplier can take 12-18 months and cost hundreds of thousands of dollars, giving established suppliers considerable leverage.

Suppliers of unique or highly customized inputs, like the advanced processors and specialized chipsets crucial for AI servers, possess considerable bargaining power. This is particularly relevant for Inventec, given its strategic pivot towards the burgeoning AI server market.

Inventec's growing emphasis on AI servers inherently means a dependence on high-tech components. Companies that develop and control proprietary technology in this space, such as NVIDIA with its advanced GPUs, can wield significant influence over pricing and contract terms, directly impacting Inventec's costs and supply chain stability.

Threat of Forward Integration

The threat of a key supplier moving into manufacturing, known as forward integration, could indeed boost their leverage. This is less frequent in the electronics manufacturing services (EMS) sector because the significant capital and operational expertise needed for large-scale Original Design Manufacturer (ODM) or Original Equipment Manufacturer (OEM) work are substantial barriers.

Most suppliers find it more strategic to concentrate on excelling in their primary area: component production. For instance, a major semiconductor supplier might have the technical capability to assemble finished products, but the logistical and market-facing challenges of becoming an EMS provider are often prohibitive.

- Capital Intensity: Establishing large-scale manufacturing facilities can require billions of dollars in investment, a significant hurdle for component makers.

- Operational Complexity: Managing diverse customer needs, supply chains, and quality control for finished goods is a different ballgame than producing components.

- Focus on Core Competency: Suppliers typically aim to maximize their return by specializing in what they do best, rather than diversifying into a capital-intensive and competitive manufacturing space.

Importance of Volume to Supplier

Inventec's substantial production volumes as a leading Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) grant it considerable purchasing power. This allows Inventec to negotiate favorable terms and pricing for the components it sources. For instance, if Inventec orders millions of units of a specific component, suppliers are incentivized to offer better pricing to secure such a large contract.

However, the bargaining power of suppliers is not absolute and depends heavily on the criticality and demand for their specific components. For suppliers of highly specialized or in-demand components, such as advanced semiconductor chips that are essential across the entire electronics sector, even Inventec's large orders may not significantly shift the power dynamic. These suppliers often face high demand from numerous major electronics manufacturers, reducing their dependence on any single buyer like Inventec.

- High Volume Procurement: Inventec's significant scale in manufacturing allows it to procure components in massive quantities, typically measured in millions of units per product cycle.

- Supplier Dependence: The degree to which a supplier relies on Inventec's business directly impacts their bargaining power; suppliers with a larger portion of their revenue coming from Inventec have less leverage.

- Component Criticality: For essential components with limited suppliers or high industry-wide demand, such as cutting-edge processors or specialized memory modules, suppliers retain significant power regardless of buyer volume.

- Industry Trends: In 2024, the ongoing global demand for semiconductors and advanced display technologies continues to empower suppliers in these critical areas, even for large buyers like Inventec.

Inventec's bargaining power with suppliers is significantly influenced by the criticality and availability of components. For essential, high-demand parts like advanced AI processors, suppliers hold considerable sway, as evidenced by the continued tight supply and premium pricing in 2024 for leading-edge GPUs. This dynamic means that even Inventec's large order volumes may not fully offset the suppliers' leverage in these specific segments.

Suppliers of specialized or proprietary components, particularly those crucial for emerging technologies like AI servers, possess strong bargaining power. This is due to high switching costs for Inventec, often involving lengthy qualification processes that can take over a year and cost hundreds of thousands of dollars, reinforcing supplier dominance in 2024.

| Component Type | Supplier Concentration | Inventec's Bargaining Power (2024) | Example |

|---|---|---|---|

| Advanced GPUs for AI Servers | High (Limited Manufacturers) | Low | NVIDIA's pricing power due to high demand |

| Standard Semiconductors | Medium to High | Medium | Negotiation based on volume |

| Customized Display Panels | Medium (Few Specialized Suppliers) | Medium to Low | Dependence on specific panel technology |

What is included in the product

This analysis examines the competitive intensity and profitability of Inventec's operating environment by evaluating the power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within its industry.

Instantly identify and mitigate competitive threats with a dynamic, visual representation of each force.

Customers Bargaining Power

Inventec's reliance on a few major global brands, such as Dell Technologies, HP, and Lenovo, for its server and notebook production, highlights a significant customer concentration.

This concentration grants these large clients considerable bargaining power. Their substantial purchasing volumes allow them to negotiate for lower prices, more favorable contract terms, and specialized product configurations.

For instance, in 2023, the top three customers likely accounted for a substantial portion of Inventec's revenue, giving them leverage to influence pricing and product development roadmaps.

Switching costs for customers engaging with ODM/OEM partners like Inventec, while present due to re-tooling and qualification processes, are generally manageable. This is particularly true when compared to the complexities faced by customers dealing with vertically integrated manufacturers.

The competitive landscape of the global EMS and ODM market, which saw significant growth with the electronics manufacturing services market valued at approximately $723.7 billion in 2023 and projected to reach $987.8 billion by 2028, offers customers a wide array of choices. This abundance of capable providers inherently limits Inventec's leverage in dictating terms, as customers can readily explore alternative partners.

Large technology brands possess the potential to bring manufacturing in-house, a move known as backward integration. This capability directly influences their bargaining power by offering an alternative to relying on contract manufacturers like Inventec.

However, the substantial capital investment, intricate operational management, and the inherent loss of agility that comes with in-house production often make outsourcing a more pragmatic and cost-effective strategy. In fact, data from 2024 indicates that over 62% of original equipment manufacturers (OEMs) opt for outsourcing to enhance operational efficiency and reduce expenses.

Price Sensitivity of Customers

Inventec operates in markets where customers, particularly in consumer electronics and enterprise solutions, exhibit a strong price sensitivity. This means they actively hunt for the best deals and cost savings, directly impacting Inventec's pricing strategies and profit margins.

This high price sensitivity forces Inventec to continually optimize its manufacturing and supply chain to offer competitive pricing. For instance, in 2024, the global consumer electronics market saw intense price competition, with average selling prices for many product categories experiencing downward pressure due to increased supply and evolving consumer demand for value.

- Price Sensitivity: Customers in consumer electronics and enterprise solutions are highly attuned to price, seeking cost efficiencies.

- Competitive Pressure: This sensitivity exerts significant pressure on Inventec to maintain competitive pricing.

- Profitability Impact: Optimizing manufacturing processes is crucial for Inventec to sustain profitability amidst this price pressure.

- Market Trends (2024): The consumer electronics sector in 2024 experienced notable price competition, impacting average selling prices across various product segments.

Product Differentiation of Inventec

Inventec, operating as an Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM), leverages its product differentiation through advanced design, manufacturing prowess, and a track record of quality. Its capacity to manage intricate projects, especially in high-demand sectors like AI servers, sets it apart. For instance, Inventec's expertise in high-density server designs and advanced cooling solutions for AI workloads is a key differentiator in a competitive market.

However, the bargaining power of Inventec's customers remains significant. Because the final products bear the customer's brand, Inventec has limited direct control over consumer-facing pricing strategies. This means customers, often large tech companies, can exert considerable influence on the terms and pricing of the manufacturing contracts. In 2024, the intense competition among ODMs for lucrative contracts, particularly for next-generation AI hardware, further amplifies customer leverage.

- Design and Manufacturing Expertise: Inventec's strength lies in its ability to translate complex customer specifications into high-quality, efficient manufactured products, a crucial factor for clients in the fast-evolving tech landscape.

- Specialized Capabilities: The company's proficiency in handling specialized and complex projects, such as advanced AI server configurations, provides a competitive edge and reduces the number of viable alternatives for demanding clients.

- Customer Branding Limitation: The OEM/ODM model inherently limits Inventec's direct influence on end-consumer pricing, as the brand identity and market positioning are controlled by the client.

- Market Dynamics in 2024: The robust demand for AI infrastructure in 2024 has intensified competition among manufacturers, giving major clients substantial bargaining power in negotiating production volumes and costs.

Inventec's customer concentration, with major clients like Dell, HP, and Lenovo, grants these buyers significant leverage to negotiate lower prices and favorable contract terms, especially given their substantial order volumes.

While switching costs exist, they are manageable for customers compared to vertically integrated manufacturers, and the broad EMS/ODM market, valued at over $723 billion in 2023, offers ample alternatives, limiting Inventec's pricing power.

Customers' ability to consider backward integration, though capital-intensive, acts as a constant threat, reinforcing their bargaining position, with over 62% of OEMs still preferring outsourcing in 2024 for efficiency.

Inventec's customers, particularly in price-sensitive consumer electronics and enterprise sectors, actively seek cost savings, forcing Inventec to optimize operations to remain competitive amidst downward price pressure observed in 2024.

| Customer Type | Leverage Factors | Impact on Inventec |

|---|---|---|

| Major Global Brands (e.g., Dell, HP, Lenovo) | High purchasing volume, potential for backward integration | Negotiating power for lower prices, favorable terms, influencing product roadmaps |

| Price-Sensitive Segments (Consumer Electronics, Enterprise) | Focus on cost savings, competitive market landscape | Pressure on pricing and profit margins, need for operational efficiency |

| Clients in High-Demand Sectors (e.g., AI Servers) | Need for specialized capabilities, intense competition among ODMs | Amplified leverage in contract negotiations, particularly in 2024's AI hardware boom |

Preview the Actual Deliverable

Inventec Porter's Five Forces Analysis

This preview showcases the complete Inventec Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, providing actionable insights without any alterations or omissions.

Rivalry Among Competitors

The electronics manufacturing services (EMS) and original design manufacturing (ODM) landscape is intensely competitive, featuring a broad array of global participants. This crowded field includes significant players such as Foxconn, Pegatron, Quanta, Wistron, Flex, Jabil, and Sanmina, all vying for market share.

Foxconn, a particularly dominant force, is anticipated to hold the position of the world's largest server vendor, underscoring the scale and power of key competitors within the industry.

The global EMS and ODM market is on a solid growth trajectory, fueled by the ever-increasing appetite for electronic gadgets and the embrace of cutting-edge tech like IoT and 5G. This expansion is projected to see the market climb from an estimated USD 867.12 billion in 2024 to a substantial USD 1501.06 billion by 2032, marking a Compound Annual Growth Rate of 7.1%. Such robust expansion naturally heats up the competition, as firms aggressively pursue greater market share.

While Original Design Manufacturers (ODMs) like Inventec often provide similar core manufacturing and design services, true differentiation emerges from specialized expertise, such as in high-demand areas like AI servers. Inventec's investment in advanced technological capabilities and a robust global manufacturing footprint allows it to stand out. Strong quality control processes are also paramount, as demonstrated by the industry's reliance on rigorous testing for complex electronic products.

Exit Barriers

Inventec, like many in the Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) sectors, faces substantial exit barriers. These are primarily driven by the immense capital required for manufacturing facilities and specialized machinery. For instance, setting up advanced semiconductor fabrication plants or sophisticated electronics assembly lines can easily run into billions of dollars, making it incredibly difficult for companies to divest or shut down operations without incurring massive losses.

This high level of sunk cost means that even when market conditions turn unfavorable, with declining profitability or intense price wars, companies are often compelled to remain in the industry. They might continue operating at reduced capacity or accept lower margins simply to avoid the catastrophic financial implications of exiting. This reluctance to leave the market can exacerbate competitive rivalry, as a larger number of players fight for a shrinking or stagnant profit pool.

Consider the broader electronics manufacturing landscape in 2024. Many companies that invested heavily in capacity during previous boom cycles are now finding themselves with excess inventory and underutilized facilities. The cost of maintaining these assets, coupled with the difficulty of selling specialized equipment, creates a powerful incentive to stay operational, even if it means competing aggressively on price. This dynamic directly contributes to Inventec's competitive environment.

- High Capital Investment: The cost of establishing and maintaining advanced manufacturing capabilities, including specialized machinery and cleanroom facilities, represents a significant barrier to exiting the ODM/OEM market.

- Sunk Costs: Once capital is invested in these specialized assets, it is largely irrecoverable, forcing companies to continue operations to mitigate losses.

- Industry Persistence: High exit barriers encourage companies to remain in the market even during periods of low profitability, intensifying competition.

- Asset Specialization: The highly specialized nature of manufacturing equipment in sectors like electronics or semiconductors limits resale value, further increasing the cost of exit.

Strategic Importance of the Industry

The electronics manufacturing sector holds significant strategic weight as a linchpin in the global technology ecosystem. Its importance is underscored by the substantial investments and policy considerations governments and major tech firms direct towards securing and strengthening domestic supply chains.

This strategic imperative often translates into protective measures or collaborative ventures aimed at bolstering national manufacturing capabilities. For instance, the ongoing shifts in global trade dynamics, including tariffs, have prompted companies like Inventec to re-evaluate their production footprints, with plans for a US manufacturing presence being a direct response to these strategic considerations and a move to mitigate such risks.

- Global Supply Chain Role: Electronics manufacturing is critical for enabling technological advancements across various sectors.

- Government and Corporate Support: Strategic alliances and domestic manufacturing initiatives are common, influencing industry competition.

- Inventec's US Expansion: The company's move to establish a US base highlights the industry's strategic importance and the need to navigate trade policies.

Competitive rivalry within the EMS and ODM sector is fierce, driven by a large number of global players like Foxconn, Pegatron, and Wistron. Inventec, as an ODM, competes by specializing in high-demand areas such as AI servers, leveraging advanced technological capabilities and a strong manufacturing footprint to differentiate itself. This intense competition is further fueled by the projected growth of the global EMS and ODM market, expected to reach USD 1.5 trillion by 2032.

High exit barriers, stemming from massive capital investments in specialized manufacturing facilities and machinery, force companies to remain in the market even during periods of low profitability. This persistence intensifies competition, as firms with significant sunk costs continue to operate, often leading to price wars and reduced margins for all participants, including Inventec.

The strategic importance of electronics manufacturing for global technology supply chains also influences rivalry. Government support and trade policies, such as tariffs, encourage companies like Inventec to adapt their production strategies, for example, by establishing a US manufacturing presence, to mitigate risks and maintain competitiveness.

SSubstitutes Threaten

The most significant threat of substitution for Inventec's electronics manufacturing services comes from its own brand-name customers opting for in-house manufacturing. This direct substitution allows clients to bring production entirely under their control.

However, the trend leans heavily towards outsourcing. In 2024, over 62% of original equipment manufacturers (OEMs) continue to outsource their production. This widespread adoption of outsourcing highlights the value proposition offered by EMS providers like Inventec, which includes cost efficiencies, enhanced flexibility, and the ability to scale operations rapidly.

The threat of customers switching to alternative contract manufacturers, often referred to as Electronics Manufacturing Services (EMS) or Original Design Manufacturers (ODM) providers, is significant. This is largely driven by the highly competitive nature of the industry.

Companies like Foxconn, Flex, Jabil, and Pegatron are major players, offering similar services. If Inventec's pricing, product quality, or overall customer service falls behind these competitors, clients have readily available alternatives to consider.

For instance, in 2024, the EMS industry continued to see intense competition, with major players like Foxconn reporting revenues exceeding $200 billion annually, demonstrating their scale and ability to absorb large contracts. This competitive pressure means Inventec must consistently deliver value to retain its customer base.

While a broad technological shift towards cloud-based or software-only services might seem like a substitute for some physical electronic devices, it doesn't directly replace Inventec's core manufacturing services. In fact, the growing reliance on cloud infrastructure and the proliferation of IoT devices actually fuels demand for the very hardware Inventec produces, such as data center components and connected devices.

Emergence of New Manufacturing Technologies

New manufacturing technologies, like advanced additive manufacturing and micro-factories, present potential substitutes for traditional electronics production. These innovations offer flexibility and localized production capabilities. However, for the high-volume, intricate electronics that Inventec specializes in, established Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) models still hold sway. This dominance is largely due to the significant cost advantages derived from economies of scale and the robust, deeply integrated global supply chains that have been built over decades.

The threat of substitutes in this sector is currently moderate. While 3D printing has seen advancements, its application in mass-producing complex, high-performance electronics at competitive price points remains limited. For instance, while 3D printing is excellent for prototyping and specialized components, it struggles to match the speed and cost-efficiency of traditional methods for mass-market devices. In 2023, the global 3D printing market was valued at approximately $19 billion, a fraction of the multi-trillion dollar global electronics manufacturing industry, highlighting the current gap in substitutability for high-volume production.

- Technological Maturity: Additive manufacturing is still evolving for mass-produced, complex electronics, lacking the cost-effectiveness of traditional methods.

- Economies of Scale: Existing ODM/OEM models benefit from established large-scale production, offering lower per-unit costs for high-volume electronics.

- Supply Chain Integration: Inventec leverages extensive and efficient global supply chains that are difficult for newer technologies to replicate quickly.

- Cost Competitiveness: For most consumer electronics, traditional manufacturing remains significantly more cost-efficient than emerging alternative technologies.

Changes in Business Models of Customers

A significant shift in how Inventec's major customers operate could present a threat of substitutes. If these customers increasingly move from selling physical hardware to offering services or licensing models, the direct demand for Inventec's core manufacturing capabilities might diminish.

However, current market trends indicate a sustained need for physical electronic components. Inventec's business remains robustly supported by the ongoing demand for sophisticated hardware like servers and the expanding market for smart devices. For instance, the global server market was valued at approximately $110 billion in 2023 and is projected to grow, indicating continued demand for manufacturing services in this sector.

- Customer Business Model Evolution: A pivot by key clients from hardware sales to service-based revenue streams could reduce their reliance on contract manufacturing for physical products.

- Sustained Hardware Demand: Despite potential shifts, the market for servers and smart devices remains strong, currently supporting Inventec's manufacturing volumes.

- Market Data: The global server market size, a key area for Inventec, was estimated at around $110 billion in 2023, demonstrating continued demand for the hardware they produce.

The threat of substitutes for Inventec's core electronics manufacturing services is currently moderate. While newer technologies like additive manufacturing (3D printing) are advancing, they are not yet cost-competitive or efficient enough for the high-volume, complex electronics that Inventec specializes in. For example, the global 3D printing market was valued at approximately $19 billion in 2023, a small fraction of the overall electronics manufacturing sector, indicating limited immediate substitutability for mass production.

The primary substitute threat comes from Inventec's own customers choosing to manufacture in-house, but the strong industry trend favors outsourcing. In 2024, over 62% of OEMs continue to outsource production, valuing the cost efficiencies and scalability that EMS providers like Inventec offer. Furthermore, shifts in customer business models from hardware sales to services don't directly eliminate the need for hardware, especially with sustained demand in sectors like servers, which was valued at around $110 billion in 2023.

| Threat Type | Description | Impact on Inventec | 2024 Relevance |

| In-house Manufacturing | Customers bringing production internally. | Directly reduces demand for Inventec's services. | Trend favors outsourcing, limiting this threat's prevalence. |

| Alternative EMS/ODM Providers | Customers switching to competitors. | Requires Inventec to maintain competitive pricing and quality. | High competition, with major players like Foxconn showing significant scale. |

| New Manufacturing Technologies | e.g., Additive Manufacturing (3D Printing). | Potential to disrupt traditional manufacturing methods. | Currently limited by cost and scale for high-volume complex electronics. |

| Customer Business Model Shift | From hardware sales to service-based models. | Could reduce demand for physical product manufacturing. | Offset by continued strong demand for hardware like servers. |

Entrants Threaten

The Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM) sector demands significant upfront capital. New companies need to invest heavily in state-of-the-art manufacturing plants, sophisticated machinery, and ongoing research and development to compete effectively. This high barrier to entry naturally limits the number of new players that can realistically enter the market.

Inventec's strategic moves, like their planned expansion into a US manufacturing facility, underscore the substantial capital commitments necessary in this industry. Such investments, often running into millions of dollars, are crucial for maintaining technological parity and operational efficiency, thereby deterring less capitalized competitors.

Inventec, as an established Original Design Manufacturer (ODM) and Original Equipment Manufacturer (OEM), benefits immensely from economies of scale. This means their large production volumes allow for lower per-unit costs in purchasing raw materials, manufacturing processes, and research and development. For instance, in 2024, the semiconductor manufacturing industry, a key sector for ODMs, saw continued investment in advanced fabrication plants, with companies like TSMC investing tens of billions of dollars, creating a high barrier to entry for smaller players needing similar scale for cost competitiveness.

New entrants face a significant hurdle in matching Inventec's cost efficiencies. To achieve comparable economies of scale, a new company would need to invest heavily in production capacity and secure large-volume contracts, which is challenging without an existing customer base or proven track record. This cost disadvantage makes it difficult for newcomers to compete on price, a crucial element in the highly competitive ODM/OEM market where clients often prioritize the most cost-effective solutions.

New entrants into Inventec's market would struggle to replicate the deep-seated relationships the company has cultivated with major global brands. These partnerships, a cornerstone of Inventec's success, are not easily formed and require years of demonstrated reliability and performance. For instance, in the competitive electronics manufacturing sector, securing contracts with leading smartphone or automotive manufacturers often involves rigorous vetting processes and existing supplier agreements, making it difficult for new players to gain a foothold.

Proprietary Technology and Expertise

Inventec, as a leading Original Design Manufacturer (ODM), leverages its deep-seated design and engineering prowess, particularly in intricate fields such as server architecture and AI hardware integration. This specialized knowledge, honed over years of operation, represents a substantial barrier to entry for newcomers aiming to replicate its capabilities. For instance, the significant R&D investment required to develop and patent advanced cooling solutions or high-density server designs can easily run into tens of millions of dollars, making it difficult for smaller firms to compete on a technological level.

The accumulation of highly skilled talent, essential for innovation in areas like advanced semiconductor packaging and custom silicon development, also poses a considerable challenge. New entrants would face intense competition for these specialized engineers, often requiring substantial compensation packages and a compelling vision to attract them away from established players like Inventec. The cost of building a team with comparable expertise could easily exceed $50 million annually, further deterring potential competitors.

- Proprietary Technology: Inventec's advanced server designs and AI integration capabilities are protected by numerous patents, creating a significant technological moat.

- Engineering Expertise: The company's deep understanding of thermal management and power efficiency in high-performance computing is a hard-to-replicate asset.

- Talent Acquisition: Attracting and retaining top-tier engineers in specialized fields like custom silicon design requires substantial investment and a strong employer brand.

- R&D Investment: The ongoing commitment to research and development, estimated to be over 5% of revenue annually, fuels continuous innovation and maintains a competitive edge.

Government Policy and Regulations

Government policies and regulations significantly shape the threat of new entrants for Inventec. For instance, stringent environmental regulations, like those enacted in various regions to curb emissions, can increase the capital expenditure required for new facilities, thereby raising the barrier to entry. In 2024, many countries continued to implement or strengthen environmental standards, potentially impacting the cost structure for new competitors in electronics manufacturing.

Trade agreements also play a crucial role. Favorable trade pacts can reduce import duties and streamline customs processes, making it easier for new international players to enter a market. Conversely, protectionist policies, such as tariffs on imported components, can escalate production costs for newcomers, diminishing the industry's attractiveness. For example, ongoing trade discussions and potential adjustments to tariffs in 2024 could alter the competitive landscape.

- Government policy can act as a significant barrier or facilitator for new entrants.

- Environmental regulations often necessitate substantial upfront investment, increasing entry costs.

- Trade agreements and tariffs directly influence the cost of imported materials and finished goods.

- Incentives for local manufacturing can encourage domestic players while potentially deterring foreign ones.

The threat of new entrants for Inventec is moderate, primarily due to high capital requirements and established brand loyalty. New companies need substantial investment in advanced manufacturing and R&D to compete, a hurdle that deters many. For instance, in 2024, the global semiconductor industry saw capital expenditures exceeding $150 billion, highlighting the immense financial commitment required.

Inventec's strong customer relationships with major brands, built over years of reliable performance, present another significant barrier. These established partnerships are difficult for newcomers to replicate, as they often involve rigorous vetting and long-term commitments. For example, securing contracts with leading tech firms typically requires a proven track record of quality and innovation.

The company's proprietary technology and deep engineering expertise, particularly in areas like AI hardware integration, create a substantial technological moat. The significant R&D investment needed to develop and patent such advanced solutions, potentially tens of millions of dollars, makes it challenging for smaller firms to match Inventec's capabilities.

| Factor | Impact on New Entrants | Inventec's Advantage |

| Capital Requirements | High | Economies of scale, established infrastructure |

| Brand Loyalty & Relationships | Difficult to replicate | Long-standing partnerships with major clients |

| Technology & Expertise | High R&D costs, steep learning curve | Proprietary patents, specialized engineering talent |

| Talent Acquisition | Intense competition, high salary demands | Strong employer brand, established R&D teams |

Porter's Five Forces Analysis Data Sources

Our Inventec Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, investor relations materials, and industry-specific market research reports to provide a comprehensive view of the competitive landscape.