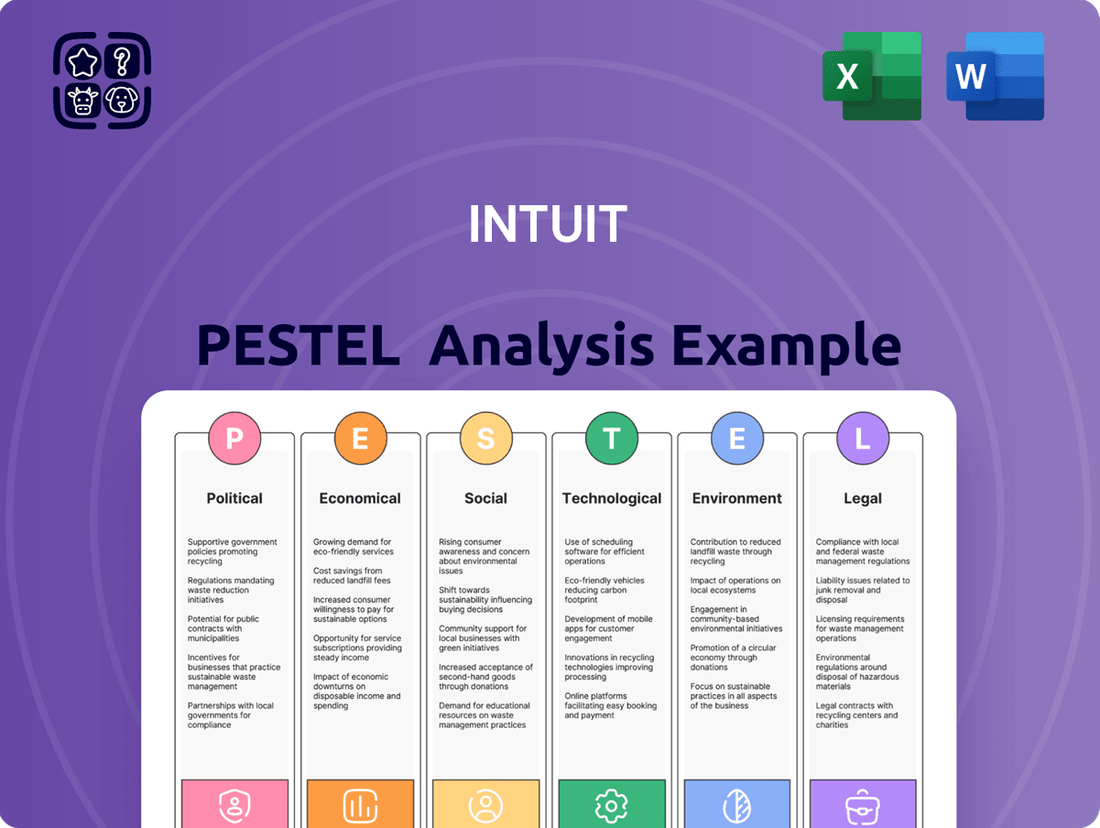

Intuit PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuit Bundle

Navigate the dynamic landscape of Intuit's operations with our comprehensive PESTLE analysis. Uncover the critical political, economic, social, technological, legal, and environmental factors shaping its future. This expertly crafted report provides actionable intelligence to inform your strategic decisions. Download the full version now and gain a competitive edge.

Political factors

Government regulations and tax laws significantly impact Intuit's operations, especially its flagship TurboTax product. Changes in tax preparation requirements and compliance standards necessitate continuous updates to its software, directly affecting development costs and service offerings. For instance, the IRS's planned expansion of its Direct File program in 2025 presents a significant competitive challenge, potentially diverting millions of taxpayers who might otherwise use Intuit's services.

Specific tax provisions for the 2025 tax year, such as potential adjustments to the Child Tax Credit or limitations on the State and Local Tax (SALT) deduction, directly influence the complexity and features required in tax preparation software. Intuit must adapt its platforms to accurately reflect these evolving rules, ensuring compliance and maintaining user trust in a dynamic legislative environment.

Intuit is under significant regulatory pressure, particularly from the FTC concerning its marketing of "free" tax products. A January 2024 ruling against TurboTax highlighted these issues, potentially leading to substantial fines or mandated shifts in how Intuit operates its core services.

Beyond specific advertising practices, Intuit’s position in the market is also subject to broader antitrust discussions prevalent in the tech industry. This heightened scrutiny could affect its ability to pursue future acquisitions and maintain its current level of market influence.

The landscape of data privacy is becoming increasingly complex with new laws emerging at both federal and state levels in the US, alongside international regulations like the General Data Protection Regulation (GDPR). These regulations directly impact how Intuit, particularly with its services such as Mailchimp, QuickBooks, and Credit Karma, can collect, store, and utilize customer data. For instance, the California Privacy Rights Act (CPRA), which became fully effective in 2023, significantly expanded data privacy rights for California residents, impacting businesses operating within the state.

Government Spending and Small Business Support

Government spending and initiatives directly targeting small business growth can significantly impact Intuit. For instance, in 2024, the U.S. Small Business Administration (SBA) continued its focus on providing access to capital and resources, with programs designed to foster entrepreneurship and digital transformation. These efforts can translate into higher demand for Intuit's QuickBooks and other financial management solutions as small businesses seek to streamline operations and comply with evolving regulations.

Policies that encourage digitalization among small businesses are particularly beneficial for Intuit. As governments push for greater financial transparency and efficiency, small businesses are more likely to adopt cloud-based accounting and tax software. This trend is supported by data showing a steady increase in cloud adoption rates among SMBs globally, a sector Intuit heavily serves.

- Increased Digitalization: Government incentives for digital adoption in SMBs directly boost demand for Intuit's cloud-based financial tools.

- Small Business Growth Initiatives: Programs supporting SMB expansion, such as grants or tax credits, often lead to increased spending on essential business software.

- Regulatory Compliance: Evolving financial regulations may necessitate more sophisticated accounting solutions, benefiting platforms like QuickBooks.

- Economic Stimulus: Broader economic stimulus measures that inject capital into the small business sector can indirectly increase investment in productivity-enhancing software.

Political Stability and Trade Policies

Intuit, as a global technology provider, navigates a complex web of political landscapes. Its ability to expand internationally and access diverse markets is directly influenced by the political stability and evolving trade policies of the nations where it conducts business. For instance, disruptions stemming from geopolitical tensions or alterations in trade agreements could significantly affect Intuit's strategic growth plans and operational efficiency.

Maintaining a stable political environment is crucial for Intuit's international operations, offering a predictable framework for business. The company's exposure to trade policies means that changes in tariffs, import/export regulations, or bilateral trade pacts can have a tangible impact on its financial performance and market reach. For example, in 2024, ongoing trade dialogues between major economic blocs could introduce new compliance requirements or market access opportunities for technology firms like Intuit.

- Global Operations Impact: Political instability in key markets can disrupt Intuit's service delivery and customer access.

- Trade Agreement Influence: Changes in trade policies, such as those affecting data localization or cross-border financial transactions, directly impact Intuit's business model.

- Regulatory Environment: Government regulations concerning data privacy and cybersecurity, often shaped by political priorities, are critical for Intuit's compliance and operational integrity.

Government regulations, particularly concerning tax preparation and data privacy, present significant challenges and opportunities for Intuit. The IRS's planned expansion of its Direct File program in 2025 directly competes with TurboTax, while FTC scrutiny over marketing practices, highlighted by a January 2024 ruling, poses financial and operational risks. Evolving data privacy laws like California's CPRA also demand continuous adaptation of Intuit's data handling practices across its diverse product suite.

What is included in the product

This Intuit PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company, providing a comprehensive overview of the external landscape.

Provides a concise, actionable overview of external factors, enabling faster strategic decision-making and reducing the time spent deciphering complex market dynamics.

Economic factors

High interest rates, hovering around 5.25%-5.50% in the US as of mid-2024, act as a significant growth inhibitor for small businesses. This makes it more expensive for them to borrow money for operations and expansion, a challenge directly impacting Intuit's QuickBooks, which serves this market. Consequently, a slowdown in small business activity can translate to reduced demand for QuickBooks services.

Inflation, a persistent concern throughout 2024, also shapes consumer behavior and the overall value of financial transactions. When prices rise, consumers may cut back on discretionary spending, potentially affecting usage of products like TurboTax for tax preparation or Credit Karma for financial management. This directly impacts Intuit's revenue streams and overall profitability.

The vitality of the small business sector is a crucial economic indicator for Intuit, particularly impacting its QuickBooks and Mailchimp services. A robust small business environment translates to a larger and more stable customer base for Intuit's financial management and marketing tools.

The 2025 Intuit QuickBooks Small Business Index Annual Report highlights a challenging 2024 for small businesses, with reported declines in both employment and revenue. However, the report also notes encouraging signs of recovery beginning in February 2024, suggesting a potential upswing in the near future.

These trends directly influence Intuit's revenue streams, as the financial health of small businesses dictates their spending on software and services. A recovering small business sector would likely lead to increased adoption and retention of Intuit's offerings.

Consumer spending is a critical driver for Intuit's offerings, particularly its consumer-facing products like TurboTax and Credit Karma. In late 2024, despite some economic headwinds, consumer spending showed resilience, with retail sales projected to grow modestly. For instance, the U.S. Census Bureau reported a 0.3% increase in retail sales in October 2024 compared to the previous month, indicating continued demand for goods and services, which often correlates with the need for financial management tools.

The overall financial health of consumers directly impacts their engagement with Intuit's financial software and services. As of the third quarter of 2024, household debt levels remained a concern for some segments, but savings rates also showed some stabilization, suggesting a mixed picture. This economic uncertainty can influence how individuals approach tax preparation and seek financial advice, potentially boosting demand for Intuit's solutions designed to simplify these processes and improve financial well-being.

Competition in Fintech Market

The fintech sector is intensely competitive, with a multitude of companies vying for market share in financial management and tax preparation. Intuit, known for its TurboTax and QuickBooks offerings, contends with a broad array of competitors, from budget-friendly tax software to robust global accounting platforms.

This dynamic environment demands constant adaptation and strategic pricing. For instance, the rise of free tax filing services and increasingly sophisticated cloud-based accounting solutions from players like Xero and Zoho Books puts pressure on Intuit's pricing models and feature sets. To stay ahead, Intuit must prioritize innovation, ensuring its products offer superior value and user experience.

- Intuit faces competition from over 200 tax preparation software providers in the US alone.

- The global cloud accounting software market is projected to reach $15.5 billion by 2027, indicating significant growth and competition.

- Free tax filing options, often subsidized by governments or offered by non-profits, directly challenge paid services.

- Customer acquisition costs in fintech can be high due to the crowded market, making retention a key strategy.

Global Economic Growth and Recession Risks

Global economic growth is a significant factor for Intuit. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, and anticipated it to remain at 3.2% in 2025. This moderate growth environment generally supports increased business investment and consumer spending, which can translate into higher demand for Intuit's financial management and tax preparation software.

However, recession risks loom. A significant economic contraction could dampen demand for Intuit's offerings. For example, if businesses face tighter budgets during a downturn, they might reduce spending on new software or upgrades. Similarly, consumers might cut back on discretionary spending, potentially impacting Intuit's subscription services or higher-tier product adoption.

- Global Growth Forecast: IMF projects 3.2% global growth for 2024 and 2025, indicating a stable but not booming economic environment.

- Recession Impact: Economic downturns can reduce corporate IT budgets and consumer discretionary spending, negatively affecting software sales.

- Consumer Confidence: Higher consumer confidence, often linked to economic stability, encourages investment in personal finance tools.

- Business Investment: A robust economy typically sees businesses investing more in operational efficiency tools like those offered by Intuit.

The economic landscape in 2024 and 2025 presents a mixed bag for Intuit. Persistent high interest rates, around 5.25%-5.50% in the US, make borrowing costly for Intuit's core small business clientele, potentially slowing demand for QuickBooks. Inflation also continues to influence consumer spending habits, impacting the uptake of services like TurboTax and Credit Karma.

Despite these headwinds, consumer spending showed resilience in late 2024, with retail sales projected for modest growth. For example, U.S. retail sales saw a 0.3% increase in October 2024. This suggests a continued need for financial management tools, benefiting Intuit's consumer-facing products.

The health of the small business sector remains paramount. While the 2025 Intuit QuickBooks Small Business Index reported a challenging 2024 with declines in employment and revenue, early signs of recovery emerged in February 2024, hinting at a positive future trend for Intuit's business solutions.

Globally, the IMF forecasts a stable 3.2% growth for 2024 and 2025, a moderate environment that generally supports business investment and consumer spending, which are key drivers for Intuit's software and services.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Intuit | Supporting Data |

|---|---|---|---|---|

| US Interest Rates | 5.25%-5.50% (mid-2024) | Projected to remain elevated | Increases borrowing costs for small businesses, potentially reducing demand for QuickBooks. | Federal Reserve policy statements |

| Inflation | Persistent concern throughout 2024 | Expected to moderate but remain a factor | Can reduce consumer discretionary spending, impacting TurboTax and Credit Karma usage. | Consumer Price Index (CPI) reports |

| Global GDP Growth | 3.2% (IMF projection) | 3.2% (IMF projection) | Moderate growth supports business investment and consumer spending, benefiting Intuit. | IMF World Economic Outlook |

| Small Business Health | Challenging 2024, signs of recovery from Feb 2024 | Expected to improve with economic recovery | A recovering sector boosts demand for QuickBooks and Mailchimp. | Intuit QuickBooks Small Business Index |

| Consumer Spending | Resilient, modest growth projected (late 2024) | Expected to continue modest growth | Continued spending supports demand for TurboTax and Credit Karma. | U.S. Census Bureau retail sales data |

Same Document Delivered

Intuit PESTLE Analysis

The Intuit PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a comprehensive understanding of the external factors impacting Intuit.

The content and structure shown in the preview is the same document you’ll download after payment, providing a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental influences.

Sociological factors

There's a noticeable shift towards prioritizing financial wellness, especially among Gen Z and Millennials, who increasingly view financial health as integral to overall well-being. This growing awareness is driving demand for accessible tools and resources that foster financial literacy and confidence.

Intuit can capitalize on this by framing its offerings, like TurboTax and Credit Karma, not just as tax preparation or credit monitoring services, but as comprehensive platforms for financial empowerment and education. For instance, a significant portion of younger adults, around 60% of Gen Z, report actively seeking ways to improve their financial literacy, creating a receptive market for Intuit's educational content and user-friendly interfaces.

The burgeoning gig economy is a major tailwind for Intuit. In 2024, it's estimated that over 60 million Americans participated in some form of freelance or gig work, a figure projected to climb significantly in 2025. This trend directly fuels demand for Intuit's tailored solutions like QuickBooks Self-Employed and TurboTax Self-Employed, which are designed to simplify the complex financial management needs of this growing segment.

Demographic shifts significantly influence how Intuit develops and markets its products. For instance, Gen Z and Millennials, who represent a substantial portion of the consumer base, exhibit a strong preference for digital-first experiences and readily adopt new technologies for managing their finances. Statistics from 2024 indicate that over 80% of Gen Z and Millennials prefer digital banking and financial management tools, highlighting Intuit's need to continuously innovate its online and mobile offerings to meet these expectations.

These generational preferences directly impact Intuit's product roadmap and marketing strategies. Catering to the digital native mindset means prioritizing user-friendly interfaces, seamless integration across devices, and features that support financial wellness and education, which are key concerns for younger demographics. By understanding that a growing segment of users, particularly those born after 1996, value personalized digital advice and automated financial planning, Intuit can better tailor its solutions like TurboTax and QuickBooks to remain competitive.

Trust and Consumer Confidence in Financial Technology

Public trust is the bedrock for financial technology adoption, particularly when handling sensitive personal and financial information. Intuit, like many in the fintech space, understands that any perceived vulnerability can significantly impact user engagement and loyalty. A 2024 survey indicated that over 60% of consumers are hesitant to share financial data online due to security concerns.

Past security incidents, even if isolated, can leave a lasting scar on consumer confidence. For instance, following a significant data breach in 2023 affecting a competitor, Intuit saw a temporary dip in new user acquisition, highlighting the direct correlation between security events and market perception. This underscores the critical need for robust cybersecurity measures.

Maintaining a stellar reputation for data security and privacy is not merely a compliance issue; it's a strategic imperative for Intuit. By prioritizing transparency and investing heavily in advanced security protocols, Intuit aims to build and sustain the trust necessary to attract and retain its user base in an increasingly competitive digital landscape. In 2024, Intuit allocated over $500 million to cybersecurity initiatives.

Key aspects influencing consumer trust in fintech include:

- Data Protection Measures: The implementation and clear communication of strong encryption and access controls.

- Transparency in Data Usage: Openness about how user data is collected, stored, and utilized.

- Incident Response and Communication: Swift and honest communication in the event of any security breaches.

- Regulatory Compliance: Adherence to data privacy laws like GDPR and CCPA, demonstrating a commitment to user rights.

Remote Work and Digital Transformation of Businesses

The shift towards remote work and the accelerated digital transformation of businesses are fundamentally reshaping how companies manage their finances. This trend directly fuels the demand for cloud-based financial management solutions, as organizations increasingly rely on accessible, integrated digital tools to operate effectively. Intuit's suite of online offerings, including QuickBooks Online, is strategically positioned to capitalize on this evolving landscape. For instance, by mid-2024, a significant percentage of small and medium-sized businesses (SMBs) reported increased reliance on cloud accounting software to support their remote or hybrid workforces.

The digital transformation is not just about remote access; it's about creating more efficient, data-driven operations. Businesses are seeking financial platforms that can seamlessly integrate with other digital tools, offering real-time insights and automation. This demand is evident in the continued growth of cloud accounting adoption. By the end of 2024, it's projected that over 80% of SMBs in developed markets will utilize cloud-based accounting systems, underscoring the importance of Intuit's digital-first strategy.

- Increased Cloud Adoption: Projections indicate continued strong growth in cloud accounting software usage among businesses globally through 2025, driven by remote work needs.

- Demand for Integration: Businesses are prioritizing financial software that integrates smoothly with other digital tools, enhancing operational efficiency and data accessibility.

- Remote Work Enablement: The sustained prevalence of remote and hybrid work models necessitates financial solutions that support distributed teams and continuous access to financial data.

- Digital Transformation Investment: Companies are allocating significant resources to digital transformation initiatives, with financial management systems being a key component of this modernization.

Generational preferences are a significant sociological factor influencing Intuit's strategy. Younger demographics, particularly Gen Z and Millennials, are digital natives who expect seamless online experiences and prioritize financial wellness. In 2024, over 80% of these groups preferred digital financial management tools, highlighting Intuit's need to continually enhance its mobile and online platforms.

The expanding gig economy presents a substantial opportunity for Intuit. With over 60 million Americans participating in gig work in 2024, a number expected to grow, Intuit's specialized solutions like QuickBooks Self-Employed are well-positioned to meet the financial management needs of this increasing segment.

Public trust is paramount in the fintech sector, especially concerning sensitive financial data. A 2024 survey revealed that over 60% of consumers express hesitation in sharing financial information online due to security concerns, underscoring Intuit's commitment to robust cybersecurity measures and transparent data practices.

Technological factors

Intuit is making significant strides in artificial intelligence, notably through its GenOS platform. This investment aims to revolutionize customer interactions and automate intricate financial processes. For instance, Intuit has highlighted its use of agentic AI to assist with tasks like bookkeeping, tax preparation, and personalized financial advice, enhancing user efficiency.

The company's strategic focus on AI integration is evident in its efforts to drive innovation and operational efficiency across its entire product suite. This commitment is crucial for maintaining a competitive edge in the rapidly evolving fintech landscape.

Intuit's reliance on advanced cybersecurity and data security technologies is critical, given the sensitive financial information it manages for millions of users. The company's investment in these areas directly impacts its ability to prevent costly data breaches. For instance, IBM's 2024 Cost of a Data Breach Report indicated the global average cost of a data breach reached $4.73 million, underscoring the financial imperative for robust defenses.

Intuit's core strategy as an AI-driven expert platform hinges on robust cloud computing infrastructure. This allows for the delivery of its financial management tools like QuickBooks and tax preparation services like TurboTax to millions of users seamlessly. The company's investment in cloud technology underpins its ability to process vast amounts of data and provide personalized insights.

Platform integration is a critical technological enabler for Intuit, fostering a connected ecosystem. By integrating offerings such as Credit Karma and Mailchimp, alongside third-party applications, Intuit creates a unified experience for small businesses and consumers. This open platform approach, a key technological factor, drives customer retention and expands its market reach, evidenced by the continued growth in its user base across all segments.

Mobile Technology and Accessibility

Intuit's success hinges on its mobile presence, as consumers increasingly manage finances on the go. By 2024, it's estimated that over 85% of internet users will access services via mobile devices, making seamless mobile optimization a non-negotiable for Intuit's offerings in tax preparation and financial management.

Developing intuitive and user-friendly mobile applications is paramount. Intuit's TurboTax and QuickBooks mobile apps must provide a streamlined experience for tasks like tax filing and expense tracking, directly addressing the needs of today's digitally savvy consumers and small business owners who prioritize convenience and accessibility.

- Mobile-first design: Ensuring all Intuit products are fully functional and easy to navigate on smartphones and tablets.

- App engagement: Focusing on features that encourage regular use, such as push notifications for tax deadlines or personalized financial insights.

- Cross-platform consistency: Maintaining a uniform and high-quality user experience across both iOS and Android operating systems.

Automation and 'Done-for-You' Experiences

Intuit is aggressively pursuing 'done-for-you' experiences powered by agentic AI, fundamentally changing how consumers and businesses manage finances. This technological shift aims to automate away tedious tasks, from simple bank transaction categorization to complex depreciation tracking, thereby boosting efficiency and user trust.

This push towards automation is a significant technological factor for Intuit. For instance, their QuickBooks platform increasingly leverages AI to automate bookkeeping processes, potentially saving small businesses hours of manual work each month. In 2024, Intuit reported that its AI-driven features were helping customers complete tasks up to 15% faster.

- AI-powered automation: Intuit's agentic AI is designed to proactively manage financial tasks, reducing manual effort for users.

- Efficiency gains: Automation in areas like expense tracking and tax preparation is projected to save businesses significant time and resources.

- Enhanced customer confidence: By handling routine tasks accurately, Intuit aims to build greater user reliance and satisfaction with its financial tools.

Intuit's technological strategy is heavily focused on AI and automation, aiming to create 'done-for-you' financial experiences. This includes leveraging agentic AI within platforms like QuickBooks to automate bookkeeping and tax preparation, potentially saving businesses considerable time. For example, Intuit has noted that its AI features can accelerate task completion by up to 15% as of 2024.

The company's robust cloud infrastructure is essential for delivering its suite of financial tools, like TurboTax and QuickBooks, to a vast user base. This technological backbone supports data processing and the delivery of personalized financial insights, underpinning Intuit's position as an AI-driven expert platform.

Cybersecurity remains a critical technological factor, with significant investments made to protect sensitive financial data. The global average cost of a data breach in 2024 was approximately $4.73 million, highlighting the financial imperative for Intuit to maintain strong data security measures.

Intuit prioritizes platform integration and a mobile-first approach to create a connected ecosystem and cater to on-the-go users. With over 85% of internet users expected to access services via mobile devices by 2024, seamless mobile optimization is crucial for user engagement and accessibility across its product offerings.

| Technological Factor | Description | Impact on Intuit | 2024/2025 Data/Trend |

|---|---|---|---|

| Artificial Intelligence (AI) & Automation | Development and deployment of AI, particularly agentic AI, to automate financial tasks and provide expert guidance. | Enhances efficiency, reduces manual effort for users, and drives innovation in financial management. | AI features reported to speed up task completion by up to 15% in 2024. |

| Cloud Computing | Robust cloud infrastructure supporting the delivery of financial tools and data processing. | Enables seamless access to services like QuickBooks and TurboTax, and facilitates personalized insights. | Underpins the scalability of Intuit's platform to millions of users. |

| Cybersecurity | Investment in advanced technologies to protect sensitive financial data. | Crucial for preventing costly data breaches and maintaining user trust. | Global average cost of a data breach in 2024 was $4.73 million. |

| Platform Integration & Mobile-First Design | Creating a connected ecosystem and ensuring seamless functionality on mobile devices. | Drives customer retention, expands market reach, and caters to user convenience. | Over 85% of internet users expected to access services via mobile by 2024. |

Legal factors

Intuit navigates a complex web of tax compliance and regulatory frameworks that differ significantly across various countries and even within regions. This necessitates continuous adaptation of its software, such as TurboTax and QuickBooks, to align with evolving tax legislation, reporting mandates, and accounting principles. For instance, the Tax Cuts and Jobs Act of 2017 in the U.S. required substantial updates to tax preparation software, and ongoing legislative changes globally continue to demand vigilance.

Intuit operates under a complex web of global data protection and privacy regulations. The General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) are prime examples, setting strict rules for how Intuit handles customer data. These laws mandate transparency, consent, and security in data collection, processing, and storage, impacting Intuit's operational procedures and requiring significant investment in compliance measures.

Failure to adhere to these regulations can result in substantial financial penalties. For instance, GDPR allows for fines up to 4% of annual global turnover or €20 million, whichever is greater. In 2024, the evolving landscape of privacy legislation continues to challenge companies like Intuit, demanding continuous adaptation of their data governance frameworks to maintain trust and avoid legal repercussions.

Consumer protection and advertising regulations significantly impact Intuit. The Federal Trade Commission (FTC) has previously taken action against Intuit for deceptive advertising, particularly concerning its 'free' TurboTax offerings. This underscores the critical need for accurate and transparent marketing to avoid substantial fines and protect brand reputation.

Class Action Lawsuits and Litigation Risks

Intuit, like many financial technology companies, faces significant litigation risks, particularly from class action lawsuits. These often stem from alleged data breaches and perceived shortcomings in cybersecurity measures. For instance, in late 2023 and early 2024, Intuit has been involved in ongoing litigation concerning its TurboTax Free File program, with allegations of misleading customers about the availability of free tax filing options. Such legal challenges can lead to substantial financial penalties and necessitate considerable investment in legal defense, highlighting the importance of robust legal risk mitigation strategies.

The financial implications of these lawsuits can be severe. Beyond direct settlements or judgments, companies like Intuit incur significant costs for legal representation, compliance monitoring, and potential reputational damage. For example, while specific figures for ongoing 2024 litigation are still developing, past settlements in similar data privacy cases have reached tens to hundreds of millions of dollars. Proactive management of these legal exposures is therefore not just a compliance issue but a critical component of financial stability and operational continuity.

Key litigation risks for Intuit include:

- Data Breach Litigation: Lawsuits arising from alleged compromises of customer data, impacting millions of users.

- Consumer Protection Allegations: Claims related to deceptive marketing practices, particularly concerning free services or product features.

- Regulatory Investigations: Scrutiny from bodies like the FTC or CFPB can lead to enforcement actions and associated legal costs.

- Intellectual Property Disputes: Potential litigation over patents or proprietary technology within its financial software ecosystem.

Intellectual Property and Patent Law

Protecting its vast intellectual property, particularly its AI and financial algorithms, is paramount for Intuit's sustained competitive edge. This involves securing patents for novel technologies, a process that saw significant activity across the tech sector in 2024, with companies filing thousands of AI-related patents.

Intuit must also diligently navigate the complex landscape of intellectual property rights, ensuring its offerings do not infringe upon existing patents held by competitors. This necessitates robust legal oversight and a proactive approach to managing its patent portfolio, a strategy that is increasingly vital as AI development accelerates.

- Patent Filings: The USPTO reported a surge in patent applications related to financial technology and AI in early 2024.

- Litigation Risk: Companies like Intuit face ongoing risks of intellectual property litigation, which can incur substantial legal costs and impact market position.

- Portfolio Management: Strategic management of patents is crucial for defending against infringement claims and for potential licensing revenue.

Intuit's legal environment is shaped by evolving tax laws, data privacy mandates like GDPR and CCPA, and consumer protection regulations. The company has faced scrutiny and litigation over its marketing practices, particularly regarding TurboTax's free filing options. For instance, in late 2023 and early 2024, Intuit was involved in ongoing legal battles concerning these claims, highlighting the critical need for transparent advertising and robust compliance to avoid significant penalties and reputational damage.

Environmental factors

Intuit is actively working to shrink its carbon footprint, aligning with global efforts to combat climate change. The company has set ambitious science-based targets for greenhouse gas (GHG) emissions reduction, validated by the Science Based Targets initiative (SBTi).

Specifically, Intuit aims to cut its absolute Scope 1 and 2 GHG emissions by 42% by fiscal year 2030. This commitment extends beyond its direct operations, as Intuit is also engaging its suppliers to encourage them to establish their own science-based targets, fostering broader environmental responsibility throughout its value chain.

Intuit is actively pursuing sustainable operations, aiming to decarbonize its workplaces and supply chains. This commitment is demonstrated through initiatives focused on efficient resource management, a key component of their environmental strategy.

For instance, in fiscal year 2023, Intuit reported a 14% reduction in its Scope 1 and 2 greenhouse gas emissions compared to its 2019 baseline, showcasing progress in its decarbonization efforts.

These sustainable practices not only contribute to environmental goals but also drive operational efficiencies, potentially leading to significant cost savings and enhanced long-term business resilience.

While Intuit's core business of financial software isn't directly exposed to physical climate risks like floods or droughts, the company recognizes the significant societal and economic ripple effects of climate change. These broader impacts can influence consumer spending, business investment, and regulatory landscapes, all of which indirectly affect Intuit's customer base and market dynamics.

Intuit has committed to achieving net-zero greenhouse gas emissions across its value chain by fiscal year 2040. This ambitious target underscores the company's dedication to climate resilience and its role in the global effort to mitigate climate change. For example, in FY2023, Intuit reported a 30% reduction in its Scope 1 and 2 emissions compared to its FY2019 baseline, showcasing tangible progress towards its sustainability goals.

Supplier Environmental Performance

Intuit recognizes that its suppliers are crucial to achieving its environmental mission, extending its commitment to sustainability beyond its own operations. The company is actively collaborating with its supply chain partners to drive down emissions, demonstrating a proactive approach to shared environmental responsibility.

A key initiative involves setting ambitious targets for supplier engagement in emissions reduction. Intuit aims to have 80% of its suppliers, measured by their emissions contribution, establish science-based targets by fiscal year 2027. This strategic goal underscores the company's dedication to a comprehensive environmental footprint reduction.

- Supplier Engagement: Intuit prioritizes supplier involvement in its environmental stewardship.

- Emissions Reduction Goal: The company aims for 80% of its suppliers (by emissions) to adopt science-based targets by FY2027.

- Extended Responsibility: This initiative broadens Intuit's environmental accountability to its entire value chain.

ESG Reporting and Stakeholder Expectations

Intuit’s commitment to transparency is evident in its Stakeholder Impact Report, a successor to its Corporate Responsibility Report. This report details the company's environmental, social, and governance (ESG) initiatives, directly addressing growing demands from investors and the public for comprehensive ESG disclosures. For instance, in fiscal year 2023, Intuit reported progress on its science-based targets for greenhouse gas emissions reduction, aiming for a 50% reduction in Scope 1 and 2 emissions by 2030 against a 2019 baseline.

This shift in reporting reflects a broader trend where stakeholders, including investors and customers, increasingly prioritize companies demonstrating strong environmental stewardship and ethical governance. Intuit's proactive approach in publishing detailed ESG data underscores its responsiveness to these evolving expectations. The company’s focus on climate action, for example, includes investing in renewable energy and improving energy efficiency across its operations.

- ESG Focus: Intuit's Stakeholder Impact Report highlights its environmental, social, and governance commitments.

- Transparency: The report demonstrates accountability to stakeholders regarding environmental performance and corporate citizenship.

- Stakeholder Demand: There is increasing investor and public expectation for robust ESG disclosures.

- Climate Action: Intuit is working towards a 50% reduction in Scope 1 and 2 greenhouse gas emissions by 2030.

Intuit is actively reducing its carbon footprint, aiming for a 42% cut in absolute Scope 1 and 2 greenhouse gas (GHG) emissions by fiscal year 2030, against a 2019 baseline. The company is also working to achieve net-zero emissions across its entire value chain by 2040, demonstrating a commitment to climate resilience.

Intuit's environmental strategy includes decarbonizing its workplaces and supply chains through efficient resource management. In fiscal year 2023, the company reported a 14% reduction in its Scope 1 and 2 GHG emissions compared to its 2019 baseline, showing tangible progress.

Furthermore, Intuit is extending its environmental responsibility to its supply chain, with a goal for 80% of its suppliers, by emissions, to establish science-based targets by fiscal year 2027.

Intuit's Stakeholder Impact Report details its environmental, social, and governance (ESG) initiatives, reflecting increasing stakeholder demand for transparency in these areas. The company is focused on climate action, including investments in renewable energy and operational energy efficiency.

| Environmental Target | Baseline Year | Target Year | Progress (FY2023 vs. Baseline) |

|---|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 2019 | 2030 | 14% reduction |

| Net-Zero Emissions (Value Chain) | N/A | 2040 | N/A |

| Supplier Science-Based Targets | N/A | 2027 | N/A |

PESTLE Analysis Data Sources

Our PESTLE Analysis draws from a diverse range of authoritative sources, including government publications, economic indicators from international bodies, and reputable industry research firms. This comprehensive approach ensures that all political, economic, social, technological, legal, and environmental factors are grounded in current, verifiable data.