Intuit Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuit Bundle

Curious about Intuit's winning formula? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Download the full version to gain a comprehensive understanding of how they innovate and dominate the market.

Partnerships

Intuit deeply collaborates with numerous financial institutions, leveraging Credit Karma to connect users with personalized financial products like credit cards, loans, and insurance. These relationships are fundamental to Credit Karma's revenue generation, as Intuit receives commissions for successful customer acquisitions through these referrals.

This affiliate marketing model enables Credit Karma to offer valuable services such as free credit scores and reports to its user base, creating a symbiotic relationship where users benefit from free tools and financial institutions gain access to a targeted customer pool.

In 2024, Credit Karma's partnerships with financial institutions are projected to drive significant revenue growth, building on the platform's established user base of over 130 million members, with a substantial portion actively engaging with financial product recommendations.

Intuit partners with technology and platform integrators to enrich its offerings and create a more robust financial ecosystem. A prime example is their collaboration with Adyen, which embeds payment services directly into QuickBooks Online, simplifying digital transactions for small and medium-sized businesses. This strategic alignment ensures users benefit from a more integrated and efficient financial management experience.

Intuit's key partnerships heavily rely on accounting professionals and firms. These experts are crucial as they not only use Intuit's QuickBooks and ProConnect software for their own practices but also recommend them to their diverse client base, significantly driving customer acquisition for Intuit.

Through platforms like QuickBooks Online Accountant, Intuit cultivates a synergistic relationship with these professionals. This collaboration empowers accountants with advanced tools, enabling them to better serve their clients and, in turn, solidifying Intuit's presence within the small business and self-employed markets.

In 2023, Intuit reported that over 100,000 accounting professionals were using QuickBooks Online Accountant, highlighting the sheer scale and importance of this partnership segment for client retention and market penetration.

E-commerce and Business Service Providers

Intuit actively cultivates key partnerships with e-commerce giants and a wide array of business service providers. These collaborations are designed to create seamless, integrated experiences for their small business and self-employed user base. For example, Intuit's acquisition of Mailchimp in 2021 for $12 billion significantly bolstered its ability to offer robust marketing and customer engagement tools, which are often integrated with e-commerce platforms.

These alliances are crucial for enabling businesses to streamline their operations across various functions, from sales and marketing to essential financial management. By integrating with platforms like Shopify, Etsy, or Square, Intuit's accounting software can automatically import sales data, simplifying bookkeeping and providing a clearer financial picture. This interconnectedness helps businesses operate more efficiently and effectively.

- E-commerce Integration: Partnerships with platforms like Shopify and Etsy allow for direct data syncing with Intuit products, automating sales and inventory tracking.

- Marketing and CRM Tools: Collaborations with marketing automation and CRM providers, such as the Mailchimp integration, enhance customer outreach and relationship management.

- Payment Processing: Alliances with payment gateways and processors ensure smooth transaction management and reconciliation within Intuit's financial ecosystem.

- Workflow Automation: Partnerships with various business service providers enable the creation of end-to-end workflows, connecting disparate business functions for greater efficiency.

Strategic Alliances for AI and Innovation

Intuit actively forms strategic alliances to accelerate its AI-driven expert platform. These collaborations are vital for integrating cutting-edge AI research and data into its core offerings.

These partnerships are instrumental in continuously improving the AI capabilities powering products such as Intuit Assist, TurboTax, and QuickBooks. For instance, in 2024, Intuit continued to invest in AI talent and partnerships, with a reported 30% increase in AI-related job postings year-over-year, signaling a strong commitment to innovation.

The ultimate aim is to provide customers with increasingly intelligent, automated, and personalized financial management experiences. This focus on enhanced AI integration is designed to drive greater customer value and market differentiation.

- AI Research Collaborations: Partnering with leading AI research institutions to stay at the forefront of technological advancements.

- Data Provider Partnerships: Securing access to diverse and high-quality datasets to train and refine AI models.

- Technology Integrations: Collaborating with other tech companies to embed AI capabilities seamlessly into existing workflows.

- Industry-Specific Alliances: Working with financial institutions and fintechs to tailor AI solutions for specific market needs.

Intuit's key partnerships are vital for expanding its ecosystem and delivering integrated financial solutions. These collaborations span financial institutions, technology providers, accounting professionals, and e-commerce platforms, all contributing to a seamless user experience.

In 2024, Intuit's strategic alliances, particularly with financial institutions via Credit Karma, continue to be a primary revenue driver, connecting over 130 million members with financial products. Furthermore, partnerships with accounting professionals are critical, with over 100,000 utilizing QuickBooks Online Accountant in 2023, reinforcing Intuit's market dominance.

The company's investment in AI partnerships is also accelerating, with a 30% year-over-year increase in AI job postings in 2024, aiming to enhance its AI-driven expert platform and deliver more personalized financial management.

What is included in the product

A structured framework outlining Intuit's core business elements, from customer relationships and value propositions to revenue streams and cost structures.

Provides a structured framework to systematically address and alleviate common business challenges.

Helps businesses pinpoint and resolve operational inefficiencies by visualizing key relationships.

Activities

Intuit's core activity revolves around the relentless development and innovation of its financial management and compliance software suite. This commitment ensures that products like TurboTax, QuickBooks, Credit Karma, and Mailchimp not only remain relevant but also lead the market with enhanced functionalities and seamless integrations.

A key driver of this innovation is Intuit's strategic investment in Artificial Intelligence, aiming to deliver 'done-for-you' experiences and automate complex financial tasks for its users. This focus on AI integration is designed to streamline workflows and provide proactive financial guidance, a trend that has seen significant acceleration in the 2024 fiscal year.

Intuit's core activities revolve around leveraging massive datasets through advanced analytics and artificial intelligence. This integration powers personalized financial guidance and automates complex tasks for millions of users.

AI algorithms are crucial for automatically categorizing expenses, identifying potential tax deductions, and proactively offering tailored financial recommendations. For instance, Intuit's AI can analyze spending patterns to suggest savings opportunities or flag unusual transactions.

This focus on data analysis and AI aims to significantly simplify financial management for individuals and small businesses. By automating processes and providing actionable insights, Intuit enhances user decision-making and overall financial well-being.

Intuit actively promotes its financial software through a multi-channel approach. This includes robust digital marketing, leveraging search engines and social media to connect with individuals and businesses seeking financial solutions. For instance, in fiscal year 2024, Intuit continued to invest heavily in customer acquisition and retention through these digital avenues.

Direct sales efforts are also crucial, particularly for reaching larger businesses and accounting firms who benefit from tailored solutions and dedicated support. Intuit's sales teams work to demonstrate how their products, like QuickBooks and TurboTax, streamline financial management and tax preparation.

The company's marketing campaigns consistently highlight the core value proposition: simplifying complex financial tasks and empowering users to achieve prosperity. This message resonates across their diverse customer base, from individual taxpayers to small business owners and professional accountants.

Customer Support and Expert Assistance

Intuit’s customer support and expert assistance are paramount, especially evident in offerings like TurboTax Live and QuickBooks Live. These services provide a vital bridge, connecting users with qualified professionals for tailored advice.

This hybrid model, blending digital tools with human interaction, is designed to foster trust and confidence among users navigating complex financial tasks. For instance, TurboTax Live saw significant adoption, with millions of users seeking expert help during the 2024 tax season, demonstrating the demand for this personalized support.

Key activities include:

- Facilitating virtual consultations: Enabling direct, real-time interaction between customers and financial experts via video or chat.

- Providing specialized guidance: Offering expert advice on tax preparation, accounting, and financial management.

- Ensuring accessibility: Making expert help readily available through integrated platforms, reducing user friction.

- Leveraging technology for efficiency: Utilizing AI and data analytics to route customers to the right experts and personalize support experiences.

Acquisitions and Strategic Investments

Intuit consistently seeks acquisitions and strategic investments to enhance its product suite, expand its customer base, and acquire new technologies. This approach is a cornerstone of its strategy to build a comprehensive financial ecosystem. For instance, the acquisition of Credit Karma in 2020 for $7.1 billion and Mailchimp in 2021 for $12 billion significantly diversified Intuit's revenue streams and customer touchpoints, moving beyond its traditional accounting and tax software roots.

These key activities are crucial for Intuit's long-term growth trajectory, allowing it to integrate new capabilities and reach a wider audience. The integration of Credit Karma, for example, aims to provide personalized financial insights and credit management tools to millions, while Mailchimp offers marketing and engagement solutions for small businesses. These moves underscore Intuit's commitment to becoming a central platform for financial management and growth.

- Acquisition Strategy Intuit actively acquires companies to broaden its product portfolio and technological capabilities.

- Key Acquisitions Notable examples include Credit Karma ($7.1 billion in 2020) and Mailchimp ($12 billion in 2021).

- Ecosystem Development These investments are vital for creating a connected financial ecosystem for consumers and small businesses.

- Market Reach Expansion Acquisitions help Intuit access new customer segments and geographic markets.

Intuit's key activities center on developing and enhancing its financial software, leveraging AI for automation and personalized insights, and providing expert customer support. The company also actively pursues strategic acquisitions to broaden its ecosystem and market reach.

Preview Before You Purchase

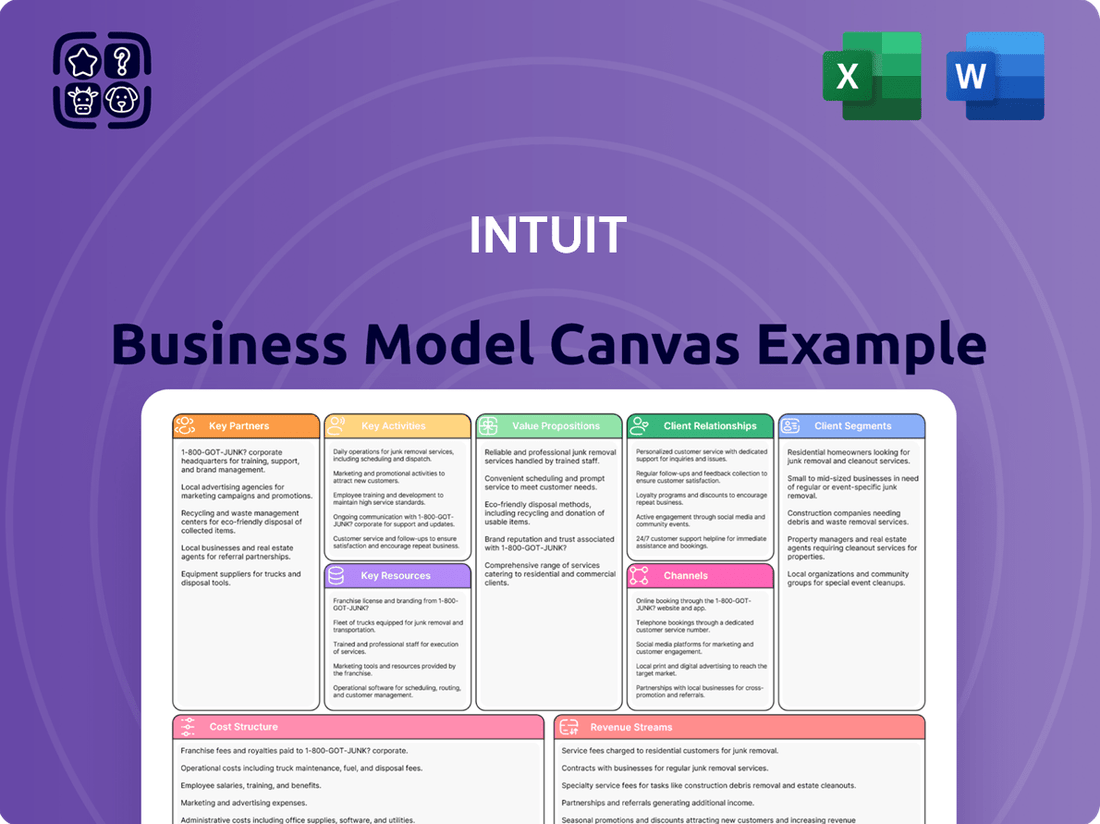

Business Model Canvas

The Business Model Canvas you're previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the final deliverable, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas.

Resources

Intuit's core strength lies in its proprietary technology and software, encompassing the robust platforms for TurboTax, QuickBooks, Credit Karma, and Mailchimp. This intellectual property, including its unique code and algorithms, is the bedrock of its comprehensive financial management and compliance offerings.

The company consistently allocates significant resources to research and development, a crucial factor in maintaining its competitive edge and ensuring its software remains cutting-edge. For instance, in fiscal year 2023, Intuit reported investing $3.4 billion in R&D, underscoring its commitment to innovation and technological advancement.

Intuit's vast customer data, encompassing millions of individual and small business financial transactions, is a cornerstone of its business model. This data fuels AI-driven insights that personalize financial advice and automate tasks, as seen with Intuit Assist. For instance, in 2023, Intuit reported serving over 100 million customers globally, a testament to the sheer scale of data available for analysis and product enhancement.

Intuit's strong brand recognition, exemplified by products like TurboTax and QuickBooks, is a cornerstone of its business model. This recognition translates directly into customer trust and loyalty, acting as a powerful magnet for both individual consumers and small businesses seeking reliable financial solutions.

The company's established reputation in the financial management space significantly streamlines customer acquisition and retention efforts. This deep-seated trust means less friction in bringing new users onboard and a higher likelihood of existing customers continuing their relationship with Intuit's offerings.

This brand equity is not merely about recognition; it's a tangible competitive advantage. In a marketplace often saturated with financial tools, Intuit's well-regarded name cuts through the noise, making it easier for customers to choose their products over less familiar alternatives.

Skilled Talent and Human Experts

Intuit's business model heavily leverages skilled talent, encompassing software engineers, data scientists, and financial experts. This human capital is crucial for developing and maintaining their innovative financial software solutions.

The company's AI-driven expert platform strategy, particularly evident in TurboTax Live and QuickBooks Live, relies on human experts to provide invaluable assistance. These professionals, including tax advisors and bookkeepers, directly complement the automated services, offering a hybrid approach to customer support.

- Human Expertise: Intuit employs a significant number of financial professionals and customer support specialists.

- AI Integration: These experts work alongside AI to enhance customer experience and provide personalized guidance.

- Service Delivery: Platforms like TurboTax Live and QuickBooks Live showcase the direct impact of human experts in delivering value.

Global Customer Base and Network Effects

Intuit's vast global customer base, exceeding 100 million users as of early 2024, is a cornerstone of its business model. This extensive reach is not just a number; it's a powerful engine for growth and innovation.

The sheer volume of users fuels significant network effects. As more individuals and businesses engage with Intuit's financial management tools, the aggregate data grows, enhancing the sophistication of its AI-driven insights and personalized recommendations.

This interconnected ecosystem allows for seamless cross-selling opportunities. A user of QuickBooks, for instance, is more likely to adopt TurboTax or Credit Karma, further solidifying their relationship with Intuit and expanding the platform's utility.

- Global Reach: Approximately 100 million users worldwide.

- Network Effects: Expanding data pool improves AI and platform value.

- Ecosystem Growth: Facilitates cross-selling and deeper customer engagement.

Intuit's key resources include its proprietary software platforms like TurboTax and QuickBooks, which are built upon sophisticated algorithms and extensive intellectual property. The company's significant investment in research and development, totaling $3.4 billion in fiscal year 2023, ensures these platforms remain at the forefront of financial technology. Furthermore, Intuit leverages its vast customer data, with over 100 million users globally as of early 2024, to power AI-driven insights and personalized financial advice.

| Resource Category | Specific Resource | Impact/Value |

|---|---|---|

| Intellectual Property | Proprietary Software (TurboTax, QuickBooks, Credit Karma, Mailchimp) | Core functionality, competitive advantage, unique algorithms |

| Financial Investment | R&D Investment ($3.4 billion in FY23) | Innovation, platform advancement, maintaining technological edge |

| Data Assets | Customer Data (100M+ users globally as of early 2024) | AI-driven insights, personalization, product enhancement |

| Human Capital | Skilled Talent (Engineers, Data Scientists, Financial Experts) | Development, maintenance, expert-led services |

| Brand Equity | Brand Recognition (TurboTax, QuickBooks) | Customer trust, loyalty, streamlined acquisition |

Value Propositions

Intuit’s primary value is making tricky financial jobs much easier for everyone, from individuals to companies. Think about tax season; TurboTax handles all the complicated calculations, saving users hours of work. In 2024, millions relied on such tools to navigate tax laws.

For businesses, QuickBooks is a game-changer. It simplifies everything from tracking expenses and sending invoices to managing payroll, cutting down on administrative headaches. This allows entrepreneurs to focus more on growing their business rather than getting bogged down in paperwork.

Intuit instills confidence by ensuring financial accuracy, especially with its tax and accounting tools. For instance, TurboTax Live's AI-driven deduction suggestions and access to tax experts help users feel secure in their filings and maximize their financial returns.

This commitment to accuracy is crucial, as demonstrated by the fact that in 2023, Intuit reported a 15% increase in revenue, partly driven by the adoption of its AI-powered features, indicating user trust in its reliable financial solutions.

Intuit's value proposition centers on empowering businesses to grow and operate more efficiently. For small businesses and the self-employed, QuickBooks simplifies financial management, expense tracking, and payment processing, freeing up valuable time. Mailchimp, also part of the Intuit ecosystem, enhances customer engagement and marketing efforts, directly contributing to growth.

These tools are designed to streamline operations, allowing businesses to focus on their core activities. For instance, QuickBooks Online reported over 3.6 million global customers as of early 2024, highlighting its widespread adoption and impact on efficiency for a vast number of small businesses.

Beyond small businesses, Intuit extends its support to mid-market companies through the Intuit Enterprise Suite. This offering provides more sophisticated reporting and financial planning capabilities, crucial for scaling operations and making strategic decisions that drive further growth and maintain efficiency.

Personalized Financial Insights and Recommendations

Intuit leverages Credit Karma's extensive user base, which boasted over 130 million members as of early 2024, to provide highly personalized financial insights. This data-driven approach allows for tailored recommendations, helping individuals navigate debt and improve their credit scores.

For businesses, Intuit's platform offers customized advice aimed at enhancing cash flow and pinpointing avenues for expansion. This strategic guidance is powered by AI, analyzing financial data to suggest actionable steps.

- Personalized Credit Guidance: Credit Karma members, numbering over 130 million in early 2024, receive specific advice on managing and improving their credit health.

- AI-Driven Product Matching: Intuit's AI connects users with financial products, such as loans or credit cards, that best suit their individual financial profiles and goals.

- Business Cash Flow Optimization: Small and medium-sized businesses benefit from AI-powered insights that identify opportunities to improve liquidity and operational efficiency.

- Growth Opportunity Identification: Intuit's recommendations help businesses spot potential areas for revenue growth and strategic investment based on their financial performance.

Access to Experts and Support

Intuit's value proposition centers on providing direct access to human expertise, a crucial element for users navigating complex financial matters. This is clearly demonstrated through services like TurboTax Live and QuickBooks Live, where customers can connect with tax professionals and accounting experts, respectively.

This integration of AI-powered tools with live, personalized support ensures that users receive tailored advice, fostering greater confidence and trust in their financial management. For instance, in the 2023 tax season, TurboTax Live assisted millions of customers, highlighting the demand for this human-assisted digital service.

- Expert Guidance: Connect with certified tax professionals or bookkeeping experts for personalized assistance.

- Problem Resolution: Get help with specific tax questions or accounting challenges from qualified individuals.

- Enhanced Trust: The presence of human experts builds confidence in the accuracy and completeness of financial tasks.

- Tailored Solutions: Receive advice that is specifically relevant to your unique financial situation and needs.

Intuit's core value is simplifying complex financial tasks for individuals and businesses, making financial management accessible and less daunting. This is achieved through intuitive software that automates processes, saves time, and reduces errors.

For individuals, TurboTax provides a user-friendly platform for tax preparation, ensuring accuracy and maximizing deductions. In 2024, millions of taxpayers utilized TurboTax to navigate the complexities of tax filing.

Businesses benefit from QuickBooks, which streamlines accounting, invoicing, and payroll, allowing entrepreneurs to focus on growth. As of early 2024, QuickBooks Online served over 3.6 million global customers, underscoring its impact on business efficiency.

Intuit also fosters financial confidence through its AI-powered features and access to live experts. TurboTax Live, for example, offers AI-driven suggestions and direct access to tax professionals, enhancing user trust.

The company's commitment to accuracy and user empowerment is reflected in its financial performance, with a 15% revenue increase in 2023, partly driven by AI feature adoption.

| Value Proposition | Description | Key Feature/Product | Target Audience | Supporting Data (Early 2024) |

|---|---|---|---|---|

| Financial Task Simplification | Making complex financial tasks easy and accessible. | TurboTax, QuickBooks | Individuals, Small Businesses | Millions of TurboTax users; 3.6M+ QuickBooks Online customers |

| Business Growth & Efficiency | Enabling businesses to operate smoothly and focus on expansion. | QuickBooks, Mailchimp | Small & Medium Businesses | Mailchimp enhances customer engagement for growth. |

| Financial Confidence & Accuracy | Ensuring users feel secure and accurate in their financial dealings. | TurboTax Live, QuickBooks Live | Individuals, Businesses | AI deductions in TurboTax Live; Expert access for accuracy. |

| Personalized Financial Insights | Providing tailored advice for credit management and financial well-being. | Credit Karma | Individuals | 130M+ Credit Karma members; AI product matching. |

Customer Relationships

Intuit heavily relies on automated self-service to manage its customer relationships, offering robust digital tools. This includes extensive online help centers, frequently asked questions (FAQs), and AI-powered chatbots integrated into their platforms like QuickBooks and TurboTax.

This strategy empowers users to resolve common issues and complete tasks independently, enhancing efficiency and providing 24/7 support. For instance, Intuit reported that in fiscal year 2023, over 70% of customer inquiries were resolved through self-service channels, a testament to the effectiveness of this approach.

Intuit’s expert-assisted services, like TurboTax Live and QuickBooks Live, represent a crucial customer relationship strategy. These offerings connect users with human tax professionals and bookkeepers, providing personalized guidance for more complex financial tasks.

This model is particularly effective for customers seeking a higher level of support, blending the ease of digital tools with the confidence of expert advice. For instance, in the 2023 tax season, TurboTax Live saw significant adoption, indicating a strong demand for this hybrid approach among individuals and small businesses navigating intricate tax laws.

Intuit actively fosters community and peer support, recognizing its value in enhancing the user experience. Through dedicated online forums and user groups, customers can connect, share insights, and troubleshoot issues together.

This peer-to-peer interaction not only provides immediate assistance but also cultivates a sense of belonging. For instance, Intuit's QuickBooks Community saw millions of active users in 2024, demonstrating the scale of this collaborative ecosystem.

By facilitating these connections, Intuit strengthens customer loyalty and reduces reliance on direct support channels. This community engagement is a crucial element in their customer relationship strategy, offering a scalable and effective way to support their user base.

Personalized Communication and Notifications

Intuit leverages data analytics to craft personalized communication, ensuring customers receive timely and relevant product updates and financial insights. This approach enhances engagement by tailoring messages, such as emails and in-app notifications, to individual user behavior and financial situations. For instance, Intuit's QuickBooks platform might send tailored tips to small businesses based on their industry and transaction volume, aiming to improve their financial management.

This strategy fosters a strong customer connection by making them feel understood and supported. By providing customized recommendations and alerts, Intuit helps users navigate their financial journeys more effectively. In 2024, Intuit reported that personalized recommendations within its TurboTax platform led to a 15% increase in customer satisfaction scores for tax filing assistance.

- Data-Driven Personalization: Intuit uses customer data to tailor communications, product updates, and financial advice.

- Tailored Engagement: This includes personalized emails, in-app notifications, and recommendations based on user behavior and financial profiles.

- Customer Satisfaction: In 2024, personalized recommendations in TurboTax boosted customer satisfaction by 15%.

- Fostering Connection: The goal is to keep customers engaged and informed, creating a sense of individualized care.

Subscription Management and Account Managers

Intuit offers dedicated account management for its larger business clients, particularly those using QuickBooks Enterprise Suite. This personalized approach aims to foster long-term value and client retention.

This relationship model emphasizes proactive engagement and strategic guidance, ensuring key clients receive a higher caliber of support for their recurring revenue products.

- Dedicated Account Managers: Assigned to high-value clients, providing personalized support and strategic advice.

- Proactive Engagement: Focused on anticipating client needs and offering solutions before issues arise.

- Long-Term Value Focus: Building enduring relationships through consistent support and demonstrating ongoing value.

- Retention Strategy: Subscription management and account management are key pillars in Intuit's strategy to retain its enterprise customer base.

Intuit's customer relationship strategy is multifaceted, blending automated self-service with expert human interaction and community building. This approach ensures scalability while catering to diverse customer needs, from simple queries to complex financial advice.

Data-driven personalization is key, with tailored communications and recommendations enhancing user experience and satisfaction. For instance, in 2024, personalized TurboTax recommendations improved customer satisfaction by 15%.

The company also prioritizes community support, as seen with millions of active users in the QuickBooks Community in 2024, fostering peer-to-peer assistance and loyalty.

Finally, dedicated account management for larger clients, like those using QuickBooks Enterprise, ensures proactive support and long-term value, a critical component for retaining its enterprise customer base.

Channels

Intuit leverages its robust direct-to-consumer online platforms, including TurboTax.com, QuickBooks.com, CreditKarma.com, and Mailchimp.com, as its primary distribution channels. These digital storefronts are crucial for customer acquisition, enabling seamless product discovery, purchase, and ongoing access to Intuit's suite of financial tools.

This direct digital engagement allows Intuit to maintain complete control over the customer journey and experience, fostering strong relationships and gathering valuable data. For instance, Intuit reported that in fiscal year 2024, its online platforms facilitated millions of customer interactions and transactions, underscoring their significance in driving revenue and customer loyalty.

Intuit's mobile applications for TurboTax, QuickBooks, Credit Karma, and Mailchimp are vital channels, enabling users to manage their financial lives and business operations from anywhere. These apps offer unparalleled convenience, reflecting the growing trend of mobile-first engagement for both consumers and small businesses.

By placing these powerful tools directly into users' pockets, Intuit reinforces its strategy of deep customer integration and constant accessibility. For instance, QuickBooks Online saw a significant portion of its user base actively engaging through its mobile app in 2024, facilitating on-the-go invoicing and expense tracking.

Intuit’s accounting professional networks, including Certified ProAdvisors and QuickBooks Solution Providers (QSPs), are crucial indirect channels. These experts, numbering over 100,000 globally, actively recommend and implement Intuit products like QuickBooks to their small and medium-sized business clients.

This network is highly effective because businesses often trust their accountants for software decisions. In 2024, Intuit continued to invest in these partnerships, recognizing that professional endorsements drive significant adoption, especially within the vast small business market that relies heavily on expert guidance.

Strategic Partnerships and Integrations

Strategic partnerships and integrations are crucial channels for Intuit, enabling them to reach a wider audience and embed their financial management solutions. By collaborating with financial institutions and payment processors, Intuit expands its ecosystem and customer touchpoints.

These integrations allow Intuit's services to be accessed directly within other platforms or recommended by trusted third parties. For instance, integrations with payment processors like Adyen streamline payment collection for small businesses using Intuit products. In 2023, Intuit reported that its QuickBooks platform served over 3.5 million small businesses globally, a testament to the reach facilitated by such strategic alliances.

- Financial Institution Alliances: Partnerships with banks and credit unions allow for seamless data flow and integrated banking features within Intuit's software, enhancing user experience and data accuracy.

- Payment Processor Integrations: Collaborations with companies like Adyen and Stripe enable businesses to accept payments directly through Intuit's platforms, simplifying transactions and improving cash flow management.

- Business Service Provider Collaborations: Integrating with other essential business software and service providers broadens Intuit's value proposition, offering a more comprehensive solution for clients.

- Ecosystem Expansion: These channels effectively extend Intuit's market reach, embedding its services into the workflows of a vast number of businesses and professionals.

Retail and Digital Marketplaces (Limited)

Intuit has historically leveraged retail channels, such as electronics stores, for distributing boxed versions of its software, including older iterations of QuickBooks Desktop. This approach provided a tangible presence and accessibility for customers who preferred physical media.

While the company is actively transitioning to a recurring subscription model, a segment of its customer base still utilizes and purchases these desktop versions through these traditional retail and digital marketplace avenues. For instance, in 2024, while direct online sales dominate, some legacy QuickBooks Desktop products were still available through select retailers.

The shift towards digital marketplaces and direct online subscriptions is a strategic move by Intuit to streamline distribution and reinforce its subscription-based revenue streams. This transition is largely complete for its desktop offerings, with a strong emphasis on cloud-based solutions.

- Historical Retail Presence: Intuit previously relied on physical retail for software sales, offering boxed products like QuickBooks Desktop.

- Digital Marketplace Integration: While less prominent now, digital marketplaces have also served as distribution points for Intuit's software.

- Transition to Subscription: The company is completing its move to a subscription-based model, reducing reliance on traditional retail and one-time purchases.

- 2024 Focus: In 2024, the primary strategy centers on direct online subscriptions, though some legacy desktop versions may still be found through indirect channels.

Intuit's channels are predominantly digital, focusing on direct-to-consumer online platforms like TurboTax.com and QuickBooks.com, alongside robust mobile applications for all its products. These digital avenues are critical for customer acquisition and ongoing engagement, allowing Intuit to control the user experience and gather valuable data. In fiscal year 2024, Intuit reported millions of customer interactions across these online platforms, highlighting their central role in revenue generation and customer retention.

Customer Segments

Individual consumers represent a massive market for Intuit, with millions relying on TurboTax for tax preparation and Credit Karma for financial health. In 2024, TurboTax continued to be a dominant force, serving a wide range of taxpayers from those with straightforward returns to complex situations needing expert guidance.

Credit Karma users, also a significant part of this segment, leverage the platform for credit monitoring, personalized financial insights, and debt management tools. This focus on simplifying personal finance management empowers individuals to make better financial decisions.

Small businesses represent a foundational customer segment for Intuit, heavily relying on QuickBooks for essential financial operations. These businesses, spanning diverse sectors from retail to services and employing anywhere from a single individual to dozens of staff, use Intuit's suite for everything from tracking income and expenses to managing payroll and sending invoices. In 2024, Intuit reported that over 7 million small businesses globally utilize QuickBooks, highlighting its critical role in their day-to-day management and growth strategies.

Self-employed individuals and freelancers represent a significant and expanding customer base. This segment includes gig economy workers, independent contractors, and solo entrepreneurs who require specialized financial management tools. For instance, in 2024, the freelance economy continued its robust growth, with platforms reporting substantial increases in user activity and earnings.

Intuit addresses the distinct needs of this group by offering solutions designed for income tracking, expense management, and navigating self-employment taxes. Products like QuickBooks Self-Employed and specific TurboTax packages are built to simplify these complex financial obligations.

These tailored offerings aim to ease the burden of financial compliance for independent workers, allowing them to focus more on their core business activities. The increasing number of individuals opting for freelance careers underscores the ongoing demand for such specialized financial support.

Mid-Market Businesses

Intuit is actively expanding its reach into the mid-market sector, recognizing the more sophisticated financial management requirements of these businesses compared to smaller entities. This strategic shift is evident in their development of specialized solutions.

The Intuit Enterprise Suite is a prime example, tailored to serve larger organizations. It provides robust capabilities for advanced reporting, detailed financial planning, and consolidated oversight for companies operating across multiple entities.

This segment is a key growth driver for Intuit. For instance, in the fiscal year 2023, Intuit reported that its Small Business and Self-Employed Group, which increasingly serves the lower end of the mid-market, saw revenue growth driven by the adoption of its integrated platform.

- Targeting Complexity: Mid-market businesses often require more advanced features like multi-entity consolidation and sophisticated forecasting tools, areas Intuit is enhancing.

- Enterprise Suite Focus: Intuit's investment in the Enterprise Suite directly addresses the needs of these larger clients with integrated financial management solutions.

- Growth Trajectory: The mid-market represents a significant opportunity for Intuit, as evidenced by their strategic focus and product development efforts aimed at this segment.

Accounting Professionals

Accounting professionals, including accountants, bookkeepers, and tax preparers, form a vital customer segment for Intuit. These professionals leverage Intuit's specialized platforms such as ProConnect, Lacerte, ProSeries, and QuickBooks Online Accountant to efficiently manage their client portfolios.

Intuit recognizes these professionals as key partners, equipping them with robust tools designed for managing numerous client accounts, facilitating seamless collaboration, and enabling the delivery of valuable advisory services. This focus underscores Intuit's strategy to empower the accounting ecosystem.

- Client Management: Tools allow professionals to oversee multiple client books simultaneously, streamlining workflows.

- Collaboration: Features facilitate efficient communication and data sharing with clients and within accounting teams.

- Advisory Services: Platforms support the expansion of service offerings beyond traditional compliance, enabling proactive client guidance.

- Platform Adoption: In 2023, Intuit reported that over 100,000 accounting firms utilize their professional tax and accounting software, highlighting significant market penetration.

Intuit serves individual consumers through TurboTax for tax preparation and Credit Karma for financial health management. In 2024, TurboTax remained a leading platform for diverse taxpayer needs, while Credit Karma provided millions with credit monitoring and financial insights, simplifying personal finance decisions.

Cost Structure

Intuit dedicates a substantial portion of its resources to Research and Development (R&D), a critical investment for its ongoing innovation in AI, platform integration, and the creation of new product features. This commitment ensures Intuit remains at the forefront of financial technology, consistently delivering advanced solutions to its customers. For instance, in fiscal year 2023, Intuit reported R&D expenses of $2.2 billion, highlighting the significant financial commitment to developing its ecosystem and AI capabilities.

Intuit invests heavily in sales and marketing, a significant component of its cost structure, to acquire and keep its broad customer base. This spending supports advertising for flagship products like TurboTax and QuickBooks, along with promotional deals and the operational costs of its sales teams. In fiscal year 2023, Intuit reported $2.8 billion in selling and marketing expenses, a 14% increase year-over-year, highlighting the ongoing commitment to customer acquisition and brand visibility.

Intuit's reliance on a robust technology infrastructure, including extensive cloud hosting and data center operations, represents a substantial cost. These investments are crucial for maintaining the scalability, reliability, and security of its financial software and services, which are accessed by millions of users worldwide.

For the fiscal year 2023, Intuit reported significant expenses related to its technology infrastructure and cloud services. While specific breakdowns for cloud hosting alone are not always itemized separately, general technology and development costs, which encompass these elements, amounted to approximately $2.2 billion, reflecting the ongoing investment needed to support its global operations and product innovation.

Personnel and Expert Compensation

Personnel and expert compensation represent a substantial portion of Intuit's cost structure. This includes salaries, benefits, and ongoing training for a diverse workforce, from software engineers developing their platforms to customer support teams assisting users. A significant investment is made in compensating the human experts who power services like TurboTax Live and QuickBooks Live, as their specialized knowledge and personalized advice are key value propositions.

For instance, in fiscal year 2024, Intuit's total operating expenses were approximately $7.5 billion. A significant portion of this would be allocated to personnel costs, reflecting the company's reliance on skilled employees and contracted experts to deliver its financial software and services.

- Salaries and Benefits: Covering compensation for engineers, support staff, and live experts.

- Expert Compensation: A key expense for personalized advice services.

- Training and Development: Ensuring staff and experts remain up-to-date with tax laws and software features.

Acquisition-Related Costs and Integration

Intuit’s cost structure includes significant acquisition-related expenses, which are not regular operational costs but are crucial for growth. These encompass fees for mergers and acquisitions, costs associated with integrating new businesses, and potential performance-based payments, known as earn-outs. For example, the acquisition of Credit Karma in 2020 for approximately $7.1 billion and Mailchimp in 2021 for about $12 billion represented substantial investments.

The integration of these acquired entities into Intuit's existing platform is a complex and financially demanding process. It requires substantial resources to align technologies, data, and operational processes, ensuring a seamless experience for customers and maximizing the value of the acquisition. These integration efforts are vital for realizing the strategic benefits of expanding Intuit's product ecosystem and customer reach.

- M&A Fees: Costs associated with legal, financial advisory, and due diligence services for acquisitions.

- Integration Expenses: Investments in technology, personnel, and operational adjustments to merge acquired businesses.

- Earn-outs: Potential future payments to sellers contingent on the acquired business achieving specific performance targets.

- Strategic Impact: Acquisitions like Credit Karma and Mailchimp are key to Intuit's strategy of connecting consumers and small businesses with financial solutions.

Intuit's cost structure is heavily influenced by its investment in talent and expertise. This includes competitive salaries, comprehensive benefits packages, and ongoing training for its workforce, which spans software developers, customer support specialists, and financial advisors. The company also compensates specialized experts for services like TurboTax Live and QuickBooks Live, recognizing their crucial role in delivering value.

Intuit's operational expenses are significantly driven by its technology infrastructure. This encompasses substantial spending on cloud hosting, data centers, and cybersecurity measures necessary to support its vast array of financial software and services. These investments ensure the reliability, scalability, and security demanded by millions of users globally.

A considerable portion of Intuit's costs is allocated to sales and marketing efforts. This investment fuels advertising campaigns for key products such as TurboTax and QuickBooks, along with promotional activities and the operational costs of its sales teams, all aimed at customer acquisition and retention.

Intuit also incurs costs related to mergers and acquisitions, including integration expenses for newly acquired companies like Credit Karma and Mailchimp. These strategic investments are vital for expanding its ecosystem and customer reach.

| Cost Category | Description | Fiscal Year 2023 (Approx.) |

|---|---|---|

| Research & Development | Investment in AI, platform integration, and new features | $2.2 billion |

| Sales & Marketing | Customer acquisition, advertising, and sales team operations | $2.8 billion |

| Technology Infrastructure | Cloud hosting, data centers, and security | Included in overall tech/dev costs (approx. $2.2 billion) |

| Personnel & Expert Compensation | Salaries, benefits, training, and expert fees | Significant portion of total operating expenses (approx. $7.5 billion total operating expenses in FY24) |

| Acquisitions & Integration | M&A fees and integration of acquired businesses | Significant investments for Credit Karma ($7.1B) and Mailchimp ($12B) |

Revenue Streams

Intuit's software subscriptions are a cornerstone of its revenue, with QuickBooks Online and Mailchimp leading the charge. Customers opt for monthly or annual plans, with pricing often scaling based on features and the number of users. This recurring model ensures a consistent and reliable income stream.

Intuit's QuickBooks Payments and Payroll services are significant revenue drivers, generating income through transactional fees. These fees are structured as a percentage of processed payment volumes or a per-employee charge for payroll processing.

This revenue stream directly correlates with customer adoption and the volume of transactions processed through Intuit's platform. For instance, in fiscal year 2023, Intuit reported that its Small Business and Self-Employed Group, which heavily features QuickBooks, saw substantial growth, indicating increased usage of these transactional services.

Intuit's TurboTax Live service is a significant and expanding revenue driver, offering customers direct access to qualified tax professionals for guidance or complete tax preparation. This premium offering allows users to connect with experts via phone, chat, or screen-sharing, enhancing the filing experience and providing peace of mind.

This expert-assisted model generates a higher average revenue per tax return compared to the do-it-yourself (DIY) versions of TurboTax. For instance, in fiscal year 2023, Intuit reported robust growth in its Small Business and Self-Employed segment, which includes TurboTax, indicating strong customer adoption of these enhanced services.

Credit Karma Commissions and Referrals

Credit Karma's revenue engine hums with commissions and referral fees. They partner with financial institutions, earning a cut when users successfully sign up for recommended credit cards, loans, or insurance products. This affiliate model positions Credit Karma as a crucial intermediary, connecting consumers with financial services.

In 2024, Intuit, which acquired Credit Karma, reported significant growth in its Credit Karma segment. For instance, during fiscal year 2024, Intuit highlighted the increasing contribution of Credit Karma's platform to its overall revenue, driven by these strategic partnerships and user engagement.

- Affiliate Marketing: Credit Karma earns revenue by referring users to financial product providers.

- Commission-Based: Payments are typically received when a user applies for or is approved for a financial product.

- Partnerships: Revenue is directly tied to the volume and success of its partnerships with banks, lenders, and insurers.

Premium Features and Add-on Services

Intuit generates significant revenue through premium features and add-on services across its QuickBooks, TurboTax, and Mailchimp platforms. These offerings cater to businesses and individuals seeking more advanced capabilities, driving increased customer lifetime value. For instance, QuickBooks Online Advanced, launched in 2023, provides enhanced reporting, automation, and dedicated support, targeting larger or more complex businesses.

These premium tiers often include features like advanced inventory management, project profitability tracking, and custom reporting tools. For example, QuickBooks Enterprise, a desktop solution, offers specialized versions for specific industries such as manufacturing, wholesale, and retail, each with tailored functionalities that command higher subscription fees. This strategy allows Intuit to capture a wider range of customer needs and price points.

The company also offers dedicated account teams and specialized support as premium add-ons, particularly for its enterprise-level clients. This personalized service model enhances customer retention and provides a clear upsell path. In 2024, Intuit continued to refine its tiered pricing strategies, aiming to maximize average revenue per user (ARPU) by clearly delineating the value proposition of each premium offering.

- Enhanced Reporting: Advanced analytics and customizable financial dashboards in QuickBooks Online Advanced.

- Advanced Inventory Management: Features like batch/lot tracking and FIFO costing in QuickBooks Enterprise.

- Dedicated Account Teams: Personalized support and strategic guidance for higher-tier subscribers.

- Specialized Industry Editions: Tailored functionalities within QuickBooks Enterprise for sectors like construction and non-profits.

Intuit's revenue streams are diversified, primarily driven by subscriptions to its software platforms like QuickBooks and TurboTax, along with transactional fees from services such as QuickBooks Payments and Payroll. The company also leverages its Credit Karma acquisition for affiliate marketing and commissions.

In fiscal year 2023, Intuit reported total revenue of $14.4 billion, with its Small Business and Self-Employed Group, which includes QuickBooks, accounting for a significant portion. The company's strategy focuses on recurring revenue models and expanding its ecosystem of financial tools and services.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approximate) |

|---|---|---|

| Software Subscriptions | Recurring fees for QuickBooks Online, TurboTax, Mailchimp. | Majority of total revenue |

| Transactional Services | Fees from QuickBooks Payments, Payroll. | Significant contributor |

| Credit Karma | Affiliate marketing and referral fees from financial partnerships. | Growing segment |

Business Model Canvas Data Sources

The Business Model Canvas is built using comprehensive market research, internal financial data, and competitive analysis. These sources ensure each canvas block is filled with accurate, up-to-date, and actionable information.