Intuit Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intuit Bundle

Intuit operates in a dynamic market shaped by intense competition, evolving customer needs, and technological advancements. Understanding the interplay of these forces is crucial for strategic planning.

The full Porter's Five Forces Analysis delves into the specific pressures impacting Intuit, from the bargaining power of its buyers and suppliers to the threat of new entrants and substitutes. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Intuit's dependence on cloud infrastructure providers like AWS, Microsoft Azure, and Google Cloud means these suppliers hold considerable sway. The switching costs and the specialized nature of cloud services can elevate their bargaining power, potentially impacting Intuit's operational expenses and flexibility.

While the market has several large players, the deep integration and significant investment required to migrate cloud services mean Intuit might not easily shift providers. This can give suppliers leverage, especially if Intuit requires highly customized solutions or specific service level agreements. For instance, in 2023, the global cloud computing market was valued at over $590 billion, highlighting the scale and importance of these infrastructure providers.

The bargaining power of suppliers in the context of talent and skilled labor presents a significant factor for Intuit. The demand for professionals in fields like artificial intelligence, data science, and cybersecurity is exceptionally high. For instance, in 2024, the U.S. Bureau of Labor Statistics projected a 35% growth for information security analysts, much faster than the average for all occupations. This scarcity directly empowers skilled individuals, allowing them to command higher salaries and better benefits, thereby increasing Intuit's operational costs.

Intuit's reliance on external data providers and integration platforms, such as financial institutions and payroll services, grants these suppliers a degree of bargaining power. For instance, the ability to seamlessly integrate with major banks or tax authorities is crucial for Intuit's product functionality.

The dependence on specific data feeds or API access can create leverage for these suppliers. However, Intuit's substantial market share and large customer base often provide a strong negotiating position, allowing them to secure favorable terms.

In 2023, Intuit reported that its QuickBooks platform served over 3.7 million small businesses globally, highlighting the significant volume of transactions and data processed, which strengthens its hand in negotiations with data providers.

Payment Processing Networks

Intuit's payment processing networks, crucial for services like QuickBooks, face significant supplier bargaining power. Major networks such as Visa and Mastercard, with their established infrastructure and limited competition, can dictate terms. In 2024, these networks continued to exert influence, impacting Intuit's costs and service delivery for its small business clientele.

This supplier leverage means Intuit must actively manage these partnerships to secure favorable processing fees and maintain reliable transaction services. The concentration of power among a few key players underscores the importance of these relationships for Intuit's ecosystem.

- Dominant Networks: Visa and Mastercard hold substantial sway due to their widespread acceptance and network effects.

- Cost Negotiation: Intuit's ability to negotiate competitive rates directly impacts the profitability of its payment solutions.

- Service Reliability: Dependence on these networks means Intuit must ensure seamless integration to avoid disrupting its users.

Specialized Technology and Software Components

Intuit might source specialized software components or unique algorithms from third-party vendors to bolster its product suite. The bargaining power of these suppliers hinges on how unique their technology is and whether other options exist. For instance, if a supplier develops a proprietary AI algorithm that significantly enhances Intuit's tax preparation software, their leverage increases.

As artificial intelligence becomes more integrated across financial services, the demand for advanced AI models and tools from specialized providers is expected to grow. This burgeoning demand could amplify the bargaining power of these niche technology suppliers. In 2024, the market for AI development services saw significant investment, with many smaller firms specializing in specific AI applications, potentially giving them more sway with larger tech companies like Intuit.

- Supplier Dependence: Intuit's reliance on a few specialized technology providers for critical software functions can grant those suppliers considerable bargaining power.

- Uniqueness of Technology: If a supplier offers technology that is difficult to replicate or substitute, their ability to negotiate favorable terms is enhanced.

- AI Market Dynamics: The increasing demand for AI expertise in 2024 has empowered specialized AI firms, potentially increasing their leverage in negotiations with companies like Intuit.

Intuit's reliance on key infrastructure providers like AWS, Microsoft Azure, and Google Cloud means these suppliers hold considerable sway due to high switching costs and specialized services. The global cloud computing market surpassed $590 billion in 2023, underscoring the scale and importance of these providers.

The bargaining power of talent, particularly in AI and cybersecurity, is significant. In 2024, the U.S. Bureau of Labor Statistics projected a 35% growth for information security analysts, empowering skilled individuals to negotiate higher compensation.

External data providers and integration platforms, such as financial institutions, also exert influence. Intuit's substantial user base, with over 3.7 million QuickBooks small businesses served globally in 2023, provides a strong negotiating position.

Payment processing networks like Visa and Mastercard, with their entrenched positions and limited competition, dictate terms. These networks continued to exert influence in 2024, impacting Intuit's operational costs.

| Supplier Category | Key Players | Impact on Intuit | 2024 Trend/Data Point |

|---|---|---|---|

| Cloud Infrastructure | AWS, Azure, Google Cloud | Operational costs, flexibility | Global cloud market value over $590 billion (2023) |

| Skilled Talent | AI Specialists, Cybersecurity Experts | Labor costs, talent acquisition | 35% projected growth for Information Security Analysts (2024) |

| Data & Integration | Financial Institutions, Tax Authorities | Product functionality, data access | 3.7M+ global QuickBooks small businesses (2023) |

| Payment Processing | Visa, Mastercard | Transaction fees, service reliability | Continued network dominance and fee structures |

What is included in the product

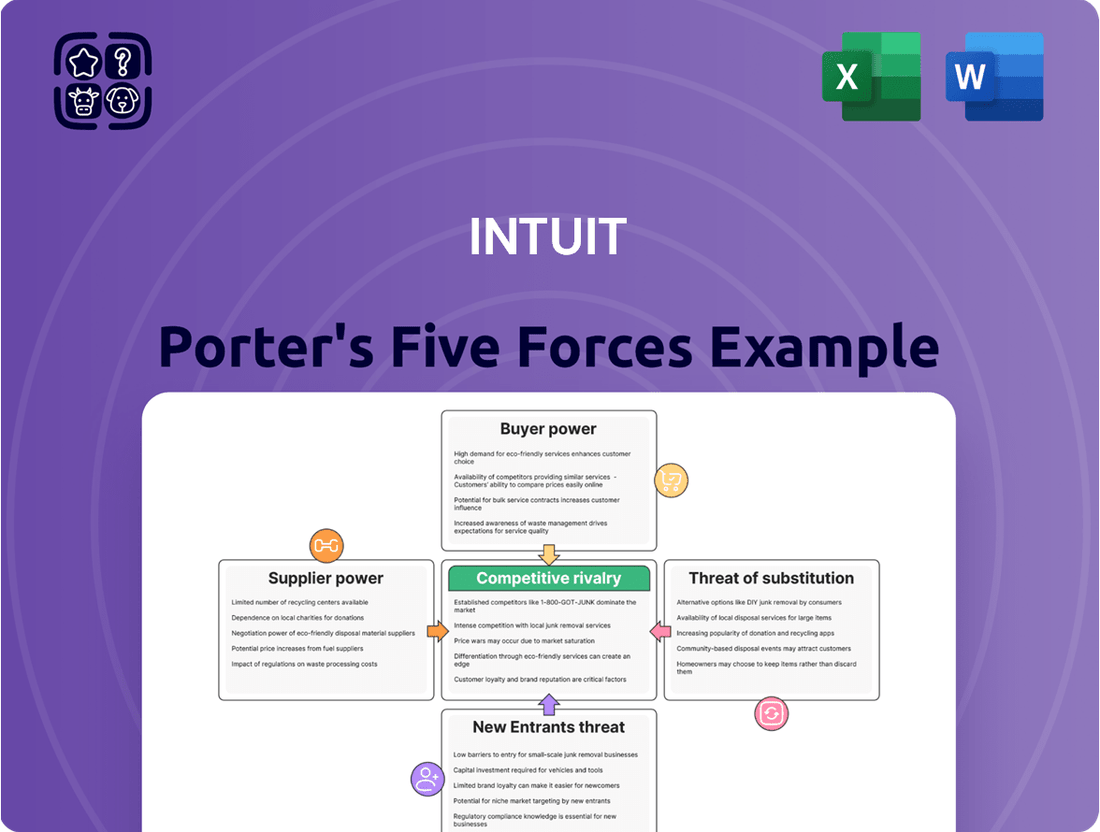

This analysis details the five competitive forces impacting Intuit, revealing the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on Intuit's market position.

Quickly identify and quantify competitive pressures, allowing for proactive strategy adjustments to mitigate threats.

Customers Bargaining Power

For small businesses, the deep integration of QuickBooks into daily financial tasks like bookkeeping, payroll, and invoicing presents substantial switching costs. This lock-in effect is a significant factor in Intuit's favor.

The process of migrating critical financial data, retraining employees on a new system, and re-establishing workflows can be both time-consuming and disruptive for these businesses. For instance, a survey in 2024 found that over 60% of small businesses consider data migration the biggest hurdle when changing accounting software.

Consequently, this high barrier to switching effectively diminishes the immediate bargaining power of existing business customers, encouraging continued loyalty to Intuit's QuickBooks platform.

Intuit benefits from significant brand loyalty, with its flagship products like TurboTax and QuickBooks being household names. This strong recognition fosters trust and reduces the perceived risk for customers, making them less likely to explore competitors. For instance, in fiscal year 2023, Intuit reported that over 90% of its small business customers used QuickBooks, showcasing deep integration and reliance.

The company strategically builds an ecosystem by integrating its offerings, such as connecting QuickBooks data with TurboTax or Credit Karma insights. This interconnectedness creates a seamless experience for users managing their finances, making it cumbersome to extract data and switch to separate, non-integrated solutions. This ecosystem lock-in significantly diminishes the bargaining power of individual customers.

While Intuit's TurboTax dominates individual tax preparation, consumers can still be price-sensitive. This is particularly true for straightforward tax situations or ancillary services like credit monitoring offered through Credit Karma. The presence of free or low-cost competitors in these areas directly enhances consumer bargaining power, forcing Intuit to be competitive on pricing for its more basic products.

Availability of Multiple Alternatives

The availability of multiple alternatives significantly enhances customer bargaining power against Intuit. Even with Intuit's strong position in accounting, tax, and financial software, users can readily switch to competitors. For instance, in the accounting software market, Xero and Sage offer robust features, and in tax preparation, H&R Block provides a well-known alternative. This competitive environment means customers can easily compare pricing, features, and support, driving down the cost of Intuit's services.

This abundance of choice directly impacts Intuit's pricing strategies and forces the company to remain competitive. Customers are not locked into a single provider and can leverage alternative offerings to negotiate better terms or simply migrate if Intuit's pricing or product suite no longer meets their perceived value. For example, a small business owner looking for accounting software in 2024 might find that switching to a competitor like Xero could save them an estimated 15-20% annually on subscription fees, depending on the plan.

- Broad Competitive Landscape: Intuit faces rivals across its core product lines, including accounting (Xero, Sage), tax preparation (H&R Block, TurboTax competitors), and financial management tools.

- Customer Choice Amplifies Power: The presence of viable alternatives allows customers to easily compare offerings and switch providers, increasing their leverage.

- Price Sensitivity: In 2024, many small businesses and individuals are highly sensitive to software costs, making them more likely to explore and adopt lower-cost alternatives if available.

- Feature Parity: Many competitors offer comparable features to Intuit's products, reducing the switching costs and further empowering customers to seek better value.

Access to Information and Reviews

Customers today are incredibly well-informed, thanks to readily available product reviews, comprehensive comparison websites, and transparent pricing data. This accessibility allows them to make truly informed decisions about financial software. For instance, a 2024 survey indicated that over 80% of consumers research products online before purchasing, with reviews being a primary factor.

This transparency regarding features, pricing, and user experiences across various financial software solutions significantly empowers customers. They can easily compare Intuit’s offerings against competitors, understanding the value proposition of each. This knowledge gives them leverage to negotiate better terms or simply walk away if Intuit’s products don’t meet their perceived value threshold.

- Informed Decision-Making: Customers can access detailed reviews and comparisons, leading to more educated choices.

- Price Transparency: Easy access to pricing information allows customers to benchmark Intuit's offerings.

- Negotiation Power: Informed customers can leverage knowledge of alternatives to negotiate better deals.

- Switching Propensity: High transparency can increase the likelihood of customers switching to competitors if value is perceived elsewhere.

The bargaining power of customers against Intuit is moderate, influenced by the availability of alternatives and increasing price sensitivity. While Intuit's integrated ecosystem creates some lock-in, customers can still switch, especially for less complex needs. For example, in 2024, many small businesses actively sought cost-effective accounting solutions, with an estimated 15-20% annual savings possible by switching to competitors like Xero.

Customers are also empowered by readily available information. Over 80% of consumers research products online before purchasing, using reviews and comparisons to assess value. This transparency allows them to benchmark Intuit's offerings and negotiate better terms or switch if perceived value is higher elsewhere.

| Factor | Impact on Intuit | Supporting Data (2024) |

|---|---|---|

| Availability of Alternatives | Moderate | Competitors like Xero and Sage offer comparable accounting features; H&R Block is a key tax alternative. |

| Price Sensitivity | Moderate to High | Small businesses can save 15-20% annually by switching accounting software. |

| Customer Information & Transparency | Moderate | Over 80% of consumers research products online before purchase, influencing choices. |

| Switching Costs (Ecosystem Lock-in) | Moderate | While integration offers convenience, data migration remains a hurdle for some, but not insurmountable. |

What You See Is What You Get

Intuit Porter's Five Forces Analysis

This preview showcases the complete Intuit Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is precisely what you will receive instantly upon purchase, ensuring no discrepancies or missing information. You can be confident that this professionally formatted analysis is ready for immediate download and application to your strategic planning needs.

Rivalry Among Competitors

Intuit's commanding presence in its key markets fuels intense competition. For instance, QuickBooks holds a substantial 81% share of the small business accounting software sector, while TurboTax dominates the U.S. tax preparation software market with a 60% share. This strong market position makes Intuit a prime target for rivals aiming to chip away at its dominance.

Intuit operates in markets with formidable, established competitors. In the small business accounting sector, companies like The Sage Group plc and Xero offer robust solutions that directly challenge Intuit's QuickBooks. These rivals have significant market share and a long history, meaning Intuit must constantly enhance its offerings to maintain its position.

The tax preparation landscape also presents intense rivalry, particularly from H&R Block. This long-standing competitor has a strong brand recognition and a vast network of physical locations, providing a significant alternative for consumers. This competitive pressure necessitates continuous innovation and customer-centric strategies from Intuit.

Competitive rivalry within the fintech space, particularly for Intuit, is amplified by aggressive innovation, especially in artificial intelligence. Intuit is investing heavily in AI-powered expert platforms and financial assistants, aiming to deepen customer engagement and provide more sophisticated solutions. For instance, Intuit's 2024 fiscal year saw continued expansion of its AI capabilities across its product suite, including TurboTax and QuickBooks, to offer more personalized advice and automate complex tasks.

This intense focus on AI is a direct response to competitors who are also rapidly integrating AI for automation, personalization, and operational efficiency. This ongoing technological arms race means companies must constantly innovate to maintain a competitive edge, driving up the intensity of rivalry in the sector. The market is characterized by a dynamic environment where early adoption and effective implementation of AI can significantly impact market share and customer acquisition.

Diversified Product Portfolios of Competitors

Intuit faces intense rivalry from competitors offering broad financial software suites. Many rivals, like Xero and Sage, provide integrated accounting, payroll, and invoicing solutions, directly challenging Intuit's core offerings. This forces Intuit to continuously innovate and enhance its value proposition across its entire product ecosystem to retain market share.

The competitive landscape is further complicated by specialized players excelling in niche areas. For instance, in email marketing, while Mailchimp is now part of Intuit, it contends with platforms like Klaviyo and HubSpot. These competitors often integrate marketing tools with comprehensive Customer Relationship Management (CRM) capabilities, presenting a strong alternative for businesses seeking unified solutions.

- Intuit's QuickBooks competes with Xero and Sage, which offer integrated accounting and payroll services.

- Mailchimp, an Intuit company, faces competition from HubSpot and Klaviyo in the email marketing and CRM space.

- The need to maintain a strong value proposition across its diverse product suite is critical for Intuit.

Pricing Strategies and Freemium Models

Competitive rivalry within Intuit's market is significantly shaped by diverse pricing strategies, notably freemium models and aggressive discounting, particularly in consumer-oriented segments like credit monitoring and basic tax preparation. Intuit itself leverages free tiers for certain offerings, but the presence of entirely free or substantially lower-priced alternatives from rivals intensifies this price-driven competition.

This dynamic compels Intuit to carefully calibrate the balance between offering robust features and maintaining competitive price points. For instance, in the tax preparation software market, while Intuit's TurboTax offers a free version for simple returns, competitors like H&R Block and TaxAct also provide free filing options, directly challenging Intuit's market share based on cost. This means Intuit must continuously innovate its premium features to justify higher price points, while remaining competitive on its entry-level offerings.

- Freemium Adoption: Many competitors offer basic versions of financial software for free, forcing Intuit to match or offer compelling upgrades to its paid tiers.

- Discounting Practices: Aggressive promotional pricing and discounts are common, especially during tax season, putting pressure on Intuit’s revenue margins.

- Price Sensitivity: Consumers, particularly in the small business and individual tax preparation segments, are often price-sensitive, making cost a significant factor in their purchasing decisions.

- Feature Differentiation: Intuit counters price competition by emphasizing advanced features and integrations within its QuickBooks and TurboTax ecosystems, aiming to provide superior value beyond just price.

Intuit faces intense competition from established players and emerging fintechs, all vying for market share in accounting, tax, and financial management. Companies like Xero and Sage directly challenge QuickBooks with integrated solutions, while H&R Block offers a strong alternative in tax preparation, leveraging brand recognition and physical presence. The rapid integration of AI by competitors further escalates this rivalry, pushing Intuit to continuously innovate its offerings to maintain its leading positions.

| Competitor | Intuit Product | Key Market | Competitive Action |

|---|---|---|---|

| Xero | QuickBooks | Small Business Accounting | Offers integrated accounting, payroll, and invoicing. |

| Sage Group plc | QuickBooks | Small Business Accounting | Provides robust accounting solutions with a long market history. |

| H&R Block | TurboTax | Tax Preparation | Strong brand recognition and extensive physical locations. |

| HubSpot | Mailchimp | Email Marketing & CRM | Integrates marketing tools with comprehensive CRM capabilities. |

| Klaviyo | Mailchimp | Email Marketing & CRM | Specializes in email marketing and customer data platforms. |

SSubstitutes Threaten

Despite the widespread adoption of accounting software, manual methods like spreadsheets and traditional tax preparers still present a threat to Intuit. For very small businesses or individuals with intricate tax needs, these manual approaches offer a personalized service that some users find more trustworthy than automated solutions. This personal touch can be a significant factor, particularly for those less comfortable with technology.

The continued reliance on human expertise for tax preparation, even with advanced software available, highlights a persistent substitute. While Intuit offers robust automation, the perceived value of a human advisor who can navigate unique financial scenarios remains. This segment of the market, though potentially shrinking, still represents a viable alternative for certain customer segments.

For basic financial tracking, general-purpose spreadsheet software like Microsoft Excel or Google Sheets can act as a substitute for some of Intuit's simpler accounting features. These tools, while lacking specialized automation, are widely accessible and often free, making them a low-cost option for micro-businesses or individuals with straightforward needs.

The threat of substitutes is moderate for Intuit's core accounting and tax preparation services. While powerful, these spreadsheet programs require manual data entry and lack the robust reporting and compliance features of Intuit's offerings. For instance, as of 2024, the vast majority of small businesses still rely on dedicated accounting software for efficiency and accuracy, indicating that the substitute is not a perfect replacement for most professional users.

Large enterprises, particularly those with unique operational complexities, may choose to develop in-house financial management systems. These custom-built solutions can offer a level of integration and control that off-the-shelf products, even those like QuickBooks Enterprise, cannot match. This allows them to bypass commercial software entirely.

While the initial investment and ongoing maintenance costs for proprietary systems are substantial, they provide a significant competitive advantage by precisely aligning with a company's specific workflows and data requirements. This makes them a potent substitute for Intuit's higher-end business solutions, as they offer a tailored, end-to-end experience.

Direct Bank and Financial Institution Offerings

Banks and financial institutions are increasingly developing and offering their own in-house financial management tools, budgeting applications, and even tax preparation services. These directly integrated banking solutions are becoming viable substitutes for Intuit's offerings, particularly for customers who prioritize the convenience of managing their finances within a single, established relationship.

This trend can diminish the perceived need for Intuit's standalone products, especially among consumers and small businesses. For instance, many major banks in 2024 now provide sophisticated budgeting dashboards and spending analysis tools directly through their online banking portals, aiming to retain customer loyalty and capture more of their financial activity.

- Integrated Banking Solutions: Many banks now offer budgeting, expense tracking, and financial planning tools within their existing platforms.

- Customer Convenience: Consumers and small businesses may opt for these integrated solutions to simplify their financial management by keeping everything in one place.

- Potential Reduction in Intuit's Market Share: As these direct offerings improve, they could draw users away from Intuit's QuickBooks and TurboTax, especially for basic needs.

Alternative Credit Monitoring and Financial Planning Apps

The threat of substitutes for Credit Karma is significant, as numerous independent apps and services provide comparable credit monitoring and financial planning tools. Platforms like Experian CreditWorks, WalletHub, and Credit Sesame offer similar core functionalities, often with unique data sources or specialized features that can attract users seeking tailored solutions.

These substitutes directly compete by offering alternative ways for consumers to track credit scores and manage personal finances, potentially eroding Credit Karma's user base. For instance, WalletHub, as of 2024, provides a comprehensive suite of free credit scores and reports from multiple bureaus, alongside extensive financial advice, directly challenging Credit Karma's primary value proposition.

- Experian CreditWorks: Offers detailed credit reports and monitoring services.

- WalletHub: Provides free credit scores, reports, and a wide array of financial planning tools.

- Credit Sesame: Focuses on credit monitoring, personalized recommendations, and debt management.

The threat of substitutes for Intuit's offerings is varied, ranging from manual methods to integrated banking solutions. While dedicated software like QuickBooks remains dominant, especially for businesses needing robust features, simpler alternatives persist. For instance, in 2024, many small businesses still opt for spreadsheets due to cost or perceived simplicity, even though this requires more manual effort and lacks advanced reporting capabilities.

Entrants Threaten

Developing advanced financial software, particularly with AI integration, demands significant capital for research and development. For instance, companies entering this space must invest heavily in data scientists, software engineers, and robust cloud infrastructure, often running into tens of millions of dollars annually.

Newcomers must also create secure, scalable, and intuitive platforms to challenge established players like Intuit. Building a product that matches QuickBooks or TurboTax's feature set and reliability requires years of development and substantial upfront investment, creating a formidable barrier.

These high capital and R&D costs effectively deter many potential new entrants, thereby protecting Intuit's market position. The sheer expense and technical expertise needed to compete means only well-funded and highly specialized firms can realistically consider entering this sector.

The fintech industry faces significant hurdles for newcomers due to stringent regulations surrounding data privacy, security, and financial reporting. For instance, in 2024, the European Union continued to enforce GDPR, requiring substantial investment in compliance infrastructure for any new player handling personal financial data.

Navigating this intricate web of rules and securing the necessary licenses and certifications is a protracted and expensive undertaking. This complexity acts as a considerable deterrent, favoring established firms with proven compliance track records.

Intuit's decades of experience in managing regulatory compliance, particularly with its QuickBooks and TurboTax platforms, provides a substantial moat. Their established processes and expertise in adhering to evolving financial regulations, such as those impacting tax preparation and small business accounting, create a formidable barrier to entry for nascent competitors.

Intuit's established brand recognition, cultivated over decades with flagship products like TurboTax and QuickBooks, presents a formidable barrier for new entrants. These products are deeply ingrained in the minds of consumers and small businesses as the go-to solutions for tax preparation and accounting, respectively. This strong association translates into significant customer trust, a critical factor when individuals and businesses entrust their sensitive financial information.

New companies entering the financial software market face the immense challenge of replicating Intuit's decades-long effort in building brand loyalty and customer confidence. For instance, in 2024, consumer trust in established financial brands remained a key differentiator, with surveys indicating that over 70% of individuals prefer using financial tools from companies with a proven track record when dealing with personal tax or business finances.

Network Effects and Ecosystem Advantage

Intuit enjoys powerful network effects, especially with QuickBooks. This creates a robust ecosystem of accountants, developers offering integrated apps, and readily available training materials.

New competitors struggle to build a comparable network, which is a significant barrier. This extensive integration offers substantial value to Intuit’s existing customer base, making it difficult for newcomers to gain traction.

- Network Effects: QuickBooks has a vast user base, encouraging more accountants and developers to integrate with it, thereby increasing its value to all users.

- Ecosystem Advantage: The sheer volume of integrated third-party applications and readily available support resources makes switching to a new platform costly and inconvenient for users.

- High Switching Costs: Businesses are hesitant to abandon established workflows and data structures built around Intuit's integrated solutions.

- Deterrent to New Entrants: Replicating Intuit's established ecosystem and the trust associated with it presents a formidable challenge for any new market entrant.

Access to Data and AI Expertise

Developing advanced AI-powered financial tools demands extensive, varied financial data for model training and specialized AI talent. Intuit's vast customer base provides a substantial data advantage, making it difficult for new entrants to gather comparable high-quality datasets.

Attracting top-tier AI expertise is another significant hurdle for newcomers. The demand for skilled AI professionals remains exceptionally high, with the global AI market projected to reach $1.5 trillion by 2030, according to some forecasts. This intense competition for talent can make it challenging for new companies to build the necessary capabilities to compete with established players like Intuit.

- Data Acquisition Costs: New entrants face high costs in acquiring and cleaning the diverse financial data needed for robust AI model development.

- Talent Scarcity: The limited supply of experienced AI engineers and data scientists creates a competitive hiring environment, driving up compensation and making it harder for startups to secure essential personnel.

- Intuit's Data Moat: Intuit's access to anonymized data from millions of users of its TurboTax and QuickBooks products creates a significant barrier, allowing for more sophisticated and personalized AI features.

The threat of new entrants for Intuit is moderately low, primarily due to the substantial capital investment required for developing sophisticated financial software, especially with AI integration. Companies entering this space must invest heavily in R&D, data scientists, and cloud infrastructure, often in the tens of millions of dollars annually.

Furthermore, regulatory compliance, particularly concerning data privacy and financial reporting, presents a significant hurdle. For instance, in 2024, the EU's GDPR continued to necessitate substantial investment in compliance for any new player handling personal financial data, a complex and expensive undertaking.

Intuit's established brand recognition and powerful network effects, especially with QuickBooks, create formidable barriers. The vast user base fosters an ecosystem of accountants and developers, making it difficult for newcomers to replicate this value and gain traction, as switching costs for businesses are often high.

| Barrier Type | Description | Impact on New Entrants | Example/Data Point |

|---|---|---|---|

| Capital Requirements | High R&D, infrastructure, and talent costs | Deters smaller or less-funded entrants | Annual R&D budgets in the tens of millions for advanced software |

| Regulatory Compliance | Data privacy, security, financial reporting rules | Increases time and cost to market | Ongoing GDPR compliance costs in 2024 |

| Brand Loyalty & Network Effects | Established trust and integrated ecosystems | Difficult to attract users and partners | Over 70% of consumers prefer established financial brands (2024 survey data) |

| Switching Costs | Data migration, workflow changes, training | Discourages adoption of new platforms | Businesses hesitant to abandon Intuit's integrated solutions |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, publicly available financial statements, and expert commentary from financial analysts to provide a comprehensive competitive landscape.