Intersnack Group GmbH & Co. KG Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intersnack Group GmbH & Co. KG Bundle

Dive into the Intersnack Group's marketing prowess! Discover how their product portfolio, from beloved snack brands to innovative new offerings, captures consumer attention. Understand their strategic pricing, ensuring accessibility and value across diverse markets.

Explore Intersnack's sophisticated distribution networks, placing their products conveniently within reach of snack lovers worldwide. Uncover their dynamic promotional strategies, building brand loyalty and driving sales through engaging campaigns.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Intersnack Group GmbH & Co. KG. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Intersnack Group's diverse savory snack portfolio, encompassing potato chips, nuts, baked snacks, and more, is a cornerstone of its marketing strategy. This broad offering, which saw the company achieve over €4 billion in net sales in 2023, effectively targets a wide spectrum of consumer tastes and snacking occasions. The variety ensures broad market appeal, from casual, everyday consumption to more specialized events.

Intersnack Group leverages a robust brand portfolio, featuring popular names like Chio, funny-frisch, POM-BÄR, Tyrrells, and Estrella, to connect with consumers. This diverse range of well-established brands allows Intersnack to cater to various taste preferences and market segments across Europe and beyond. For instance, Tyrrells, known for its premium, hand-cooked crisps, targets a more discerning consumer, while funny-frisch often appeals to a broader, value-conscious audience.

Complementing its strong brand presence, Intersnack strategically utilizes private labels. This dual approach provides significant market penetration capabilities, allowing them to meet the specific demands of retailers and expand their reach into different distribution channels. By offering both proprietary brands and private label options, Intersnack ensures a comprehensive presence in the snack market, maximizing shelf space and consumer choice.

Intersnack Group GmbH & Co. KG places a strong emphasis on innovation, consistently striving to bring fresh and appealing snack choices to market. A prime example is their strategic expansion into oven-baked potato chips in Hungary, catering to a growing consumer preference for lighter options.

Complementing this drive for novelty, Intersnack is deeply committed to maintaining high product quality. This dedication ensures that their snacks not only offer great taste but also foster consistent consumer satisfaction, a critical factor in building brand loyalty.

This dual focus on innovation and quality is fundamental to Intersnack's competitive edge. It allows them to effectively adapt to changing consumer tastes, particularly the increasing demand for healthier alternatives and unique snacking experiences in the dynamic global snack market.

Healthier Development

Intersnack's 'Healthier Development' strategy is a direct response to evolving consumer preferences for more nutritious snack options. They are actively reformulating their recipes, with a significant push towards clean and natural ingredients. This initiative is projected to see the removal of all remaining artificial taste enhancers, colors, and sweeteners from their branded products across Europe by 2025.

This commitment to 'Mindful Indulgence' is not just about health; it also supports a more sustainable product portfolio. For instance, a 2024 survey indicated that 65% of European consumers are actively seeking snacks with fewer artificial ingredients, a trend Intersnack is directly addressing.

- Recipe Reformulation: Intersnack is prioritizing the enhancement of nutritional profiles in its snack products.

- Clean Label Focus: The company is committed to using clean and natural ingredients, moving away from artificial additives.

- Artificial Ingredient Removal: A key target is the elimination of all artificial taste enhancers, colors, and sweeteners from European branded products by 2025.

- Consumer Trend Alignment: This strategy directly caters to the growing consumer demand for healthier snack alternatives and 'Mindful Indulgence'.

Sustainable Practices

Intersnack Group GmbH & Co. KG's approach to sustainable practices within its product strategy is multifaceted, aiming to create responsibly made snacks. This involves a commitment to minimizing waste and enhancing the recyclability of packaging materials, alongside a focus on responsible ingredient sourcing.

The company's overarching sustainability strategy is structured around key areas: climate action, the implementation of circular economy solutions, and the promotion of sustainable agriculture. These pillars are designed to foster a positive environmental and social impact across the entire product lifecycle.

For instance, Intersnack has set targets to reduce greenhouse gas emissions. By 2024, the company aimed to achieve a 15% reduction in Scope 1 and 2 emissions compared to a 2019 baseline. Furthermore, in 2023, Intersnack reported that 87% of its packaging was designed to be recyclable, reusable, or compostable, a significant step towards its 2025 goal of 100%.

- Climate Action: Intersnack is working towards reducing its carbon footprint, with a goal to decrease Scope 1 and 2 emissions by 15% by 2024 (vs. 2019 baseline).

- Circular Solutions: The company is prioritizing recyclable, reusable, or compostable packaging, reporting 87% achievement in 2023 against a 2025 target of 100%.

- Sustainable Agriculture: Intersnack actively engages in sourcing practices that support environmental stewardship and social responsibility in its agricultural supply chains.

- Waste Reduction: Efforts are in place to minimize waste generation throughout the production and supply chain processes.

Intersnack's product strategy centers on a diverse portfolio, including potato chips, nuts, and baked snacks, aiming for broad market appeal. This variety, contributing to over €4 billion in net sales in 2023, caters to numerous consumer preferences and snacking occasions, from everyday enjoyment to special events.

The company effectively utilizes a strong stable of well-known brands such as funny-frisch, Chio, and Tyrrells, allowing them to target distinct market segments and consumer tastes across Europe. This brand strength is further amplified by a strategic use of private labels, ensuring extensive market penetration and shelf presence.

Innovation is a key driver, with Intersnack focusing on healthier options like oven-baked chips and a commitment to clean labels, aiming to remove artificial ingredients by 2025. This aligns with consumer demand, as 65% of Europeans sought fewer artificial ingredients in 2024.

Sustainability is integrated through climate action, circular packaging solutions, and responsible sourcing. Intersnack achieved 87% recyclable packaging in 2023, working towards a 100% goal by 2025, and aimed for a 15% reduction in Scope 1 and 2 emissions by 2024 (vs. 2019 baseline).

| Product Strategy Element | Description | Key Data/Facts |

|---|---|---|

| Portfolio Diversity | Broad range of savory snacks including chips, nuts, and baked items. | Over €4 billion net sales in 2023. Targets diverse consumer tastes and occasions. |

| Brand Portfolio | Leverages popular brands like Chio, funny-frisch, POM-BÄR, Tyrrells, Estrella. | Caters to various taste preferences and market segments. Tyrrells targets premium, funny-frisch broader audience. |

| Private Labels | Strategic use of private labels alongside proprietary brands. | Enhances market penetration and meets retailer demands. Maximizes shelf space. |

| Innovation & Health | Focus on new product development and healthier alternatives. | Expansion into oven-baked chips. Goal to remove artificial ingredients by 2025. 65% of Europeans sought fewer artificial ingredients in 2024. |

| Sustainability | Commitment to climate action, circular economy, and sustainable agriculture. | 87% recyclable packaging in 2023 (100% target by 2025). Aimed 15% Scope 1 & 2 emission reduction by 2024 (vs. 2019). |

What is included in the product

This analysis provides a comprehensive overview of Intersnack Group's marketing mix, detailing their product portfolio, pricing strategies, distribution channels, and promotional activities.

It offers a deep dive into how Intersnack leverages its 4Ps to maintain its market leadership in the savory snack industry.

Provides a clear, actionable framework to address Intersnack's marketing challenges, transforming potential pain points into strategic opportunities by optimizing product, price, place, and promotion for market success.

Place

Intersnack Group boasts an impressive footprint, operating in over 30 countries across Europe, Australia, and New Zealand. This extensive international presence, supported by 45 production sites, ensures its savory snacks are readily available to a vast consumer base. The company's reach extends beyond Europe, solidifying its position as a global player in the snack industry.

Intersnack Group ensures its diverse snack portfolio reaches consumers through an extensive network of distribution channels. This includes major supermarket chains and hypermarkets, providing broad accessibility. By the end of 2023, Intersnack's brands were available in over 100,000 retail outlets across Europe, highlighting their significant market penetration.

Strategic partnerships with key retailers are fundamental to Intersnack's market reach. These collaborations allow for prominent product placement and efficient stock management, crucial for maintaining brand visibility. For instance, their strong relationships with grocery giants like Tesco and Carrefour in the UK and France respectively, are vital for consistent sales performance.

This multi-channel strategy prioritizes customer convenience, enabling shoppers to purchase their preferred snacks across various retail formats. Whether in a large supermarket or a local convenience store, Intersnack aims to be readily available, catering to different shopping habits and occasions. This widespread availability is a core element of their go-to-market strategy.

Intersnack Group operates a significant global production and logistics network, boasting 45 production sites worldwide. This extensive infrastructure is crucial for ensuring efficient product distribution and availability across diverse markets.

The company is actively enhancing its operational capabilities through strategic investments. For instance, a substantial €85 million investment is being directed towards modernizing and expanding its Alsbach plant in Germany, focusing on increasing production capacity and bolstering sustainability efforts.

These ongoing investments underscore Intersnack's commitment to maintaining a resilient and agile supply chain, vital for meeting consumer demand and supporting its market presence.

Local and International Market Adaptation

Intersnack masterfully balances local relevance with international reach, a key strength in its marketing mix. This strategy involves tailoring product offerings and distribution channels to suit the unique tastes and preferences of consumers in each of its diverse operating markets. For instance, the company is launching a new oven-baked chip line across 15 European countries, demonstrating a commitment to localized product innovation within a broader global framework.

This adaptability is crucial for navigating varied consumer behaviors and competitive landscapes. In 2024, Intersnack's portfolio, which includes brands like Lorenz Snack-World and Tayto, continued to see strong performance driven by these localized strategies. The group's international presence spans over 100 countries, underscoring its capacity to implement market-specific adaptations effectively.

- Global Reach, Local Flavor: Intersnack operates in over 100 countries, yet ensures product portfolios reflect local tastes.

- Product Innovation Rollout: A new oven-baked chip range is being introduced in 15 European markets in 2024.

- Market Penetration Strategy: Adapting distribution and marketing to regional consumer preferences drives market share growth.

- Brand Portfolio Diversity: Brands like Lorenz and Tayto are managed with distinct local market approaches.

Acquisitions for Market Expansion

Intersnack Group's market expansion strategy heavily relies on targeted acquisitions. A prime example is the 2024 acquisition of Whole Earth Foods, a move that significantly broadened its healthy snack offerings and reach. This follows a pattern of strategic integration, including the earlier acquisitions of Tyrrells and popchips, which have demonstrably enriched its brand portfolio.

These strategic integrations are not merely about adding brands; they are crucial for enhancing Intersnack's global footprint and distribution capabilities. By acquiring established players like Whole Earth Foods, Intersnack strengthens its market position and gains access to new consumer segments and geographic regions, solidifying its competitive edge in the evolving snack market.

- 2024: Acquisition of Whole Earth Foods, expanding into the healthy snacks category.

- Previous Acquisitions: Integration of brands like Tyrrells and popchips to diversify the portfolio.

- Strategic Benefit: Bolstered brand portfolio, enhanced global footprint, and strengthened distribution networks.

- Market Impact: Improved market position and increased competitive advantage in the global snack industry.

Intersnack Group's place strategy is defined by its extensive international presence, operating in over 100 countries with 45 production sites, ensuring widespread availability of its snack products. This global reach is complemented by strategic partnerships with major retailers, securing prominent shelf space and efficient distribution. The company's commitment to accessibility is further demonstrated by its multi-channel approach, catering to diverse shopping habits.

Preview the Actual Deliverable

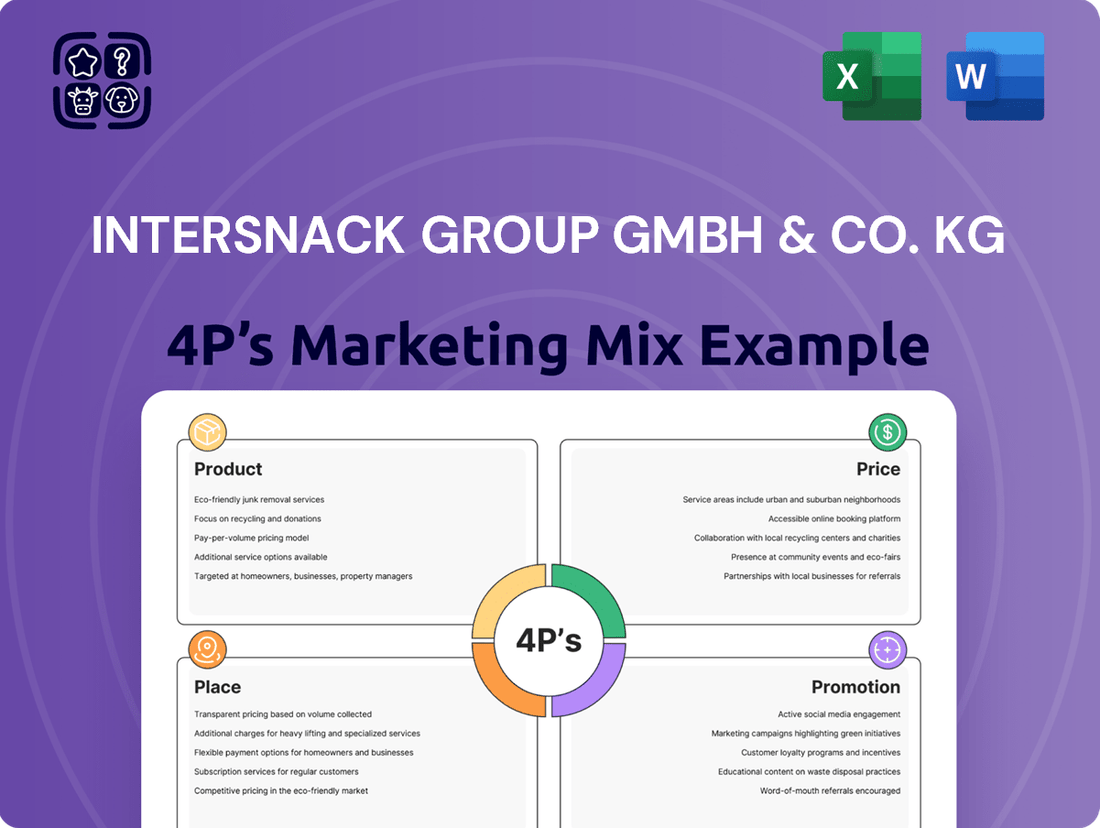

Intersnack Group GmbH & Co. KG 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of the Intersnack Group GmbH & Co. KG 4P's Marketing Mix is fully complete and ready for immediate use.

Promotion

Intersnack Group GmbH & Co. KG masterfully employs brand-centric communication, showcasing its diverse stable of popular snack brands like Chio, funny-frisch, POM-BÄR, and Tyrrells. Each brand is carefully cultivated with a distinct identity, allowing Intersnack to effectively communicate unique product benefits and market differentiators to specific consumer segments.

Intersnack leverages strategic partnerships to amplify its brand presence and connect with a wider audience. A prime example is the funny-frisch brand's multi-year deal with Bundesliga International, securing significant advertising and communication rights across television and digital platforms. This strategic alliance aims to integrate the brand deeply within the passions and daily routines of its target consumers.

Intersnack Group's digital and social media engagement, exemplified by their partnership with Bundesliga International, leverages exclusive access to moving image content for dynamic campaigns. This strategic move highlights a clear commitment to digital channels for reaching consumers.

While precise campaign metrics are proprietary, the broader snack industry saw substantial growth in digital advertising spend in 2024, with social media platforms accounting for a significant portion. Intersnack's approach likely mirrors this trend, aiming to capitalize on viral marketing and user-generated content to foster brand connection and excitement.

Consumer-Focused Messaging

Intersnack Group is committed to providing consumers with clear and honest information about their snack products. Their messaging highlights exceptional taste and superior quality, increasingly incorporating elements of sustainability and health to resonate with modern consumer preferences.

This approach directly addresses the growing consumer demand for products that align with a health-conscious and environmentally aware lifestyle. For instance, by 2024, over 70% of European consumers indicated they are actively seeking healthier snack options, a trend Intersnack's messaging actively supports.

- Transparency: Clearly communicating ingredients and product attributes.

- Key Selling Points: Emphasizing taste, quality, and value.

- Evolving Focus: Integrating sustainability and health benefits into communications.

- Market Alignment: Responding to consumer trends for healthier and eco-friendly choices.

Public Relations and Sustainability Reporting

Intersnack Group GmbH & Co. KG leverages public relations through its dedicated sustainability reporting, fostering transparency and building consumer trust. These reports are a crucial element of their marketing mix, communicating progress on key environmental and social initiatives.

The company's annual progress reports detail specific actions taken to reduce its environmental footprint, such as targets for greenhouse gas emission reductions. For example, Intersnack aimed to reduce Scope 1 and 2 emissions by 15% by 2025 compared to a 2019 baseline, with initial progress showing a reduction of 5.8% by the end of 2023.

Furthermore, Intersnack's PR strategy emphasizes responsible sourcing and the enhancement of nutritional profiles in its products. This commitment is often highlighted through partnerships and certifications, reinforcing their positive brand image. In 2024, the company reported that 85% of its palm oil was sustainably sourced, a key metric for demonstrating responsible supply chain management.

- Annual Sustainability Reports: Intersnack publishes comprehensive reports detailing environmental, social, and governance (ESG) performance.

- Environmental Footprint Reduction: Focus on initiatives like reducing greenhouse gas emissions and waste. For instance, a 5.8% reduction in Scope 1 and 2 emissions was achieved by the end of 2023 against a 2019 baseline.

- Responsible Sourcing: Commitment to ethically and sustainably sourcing raw materials, with 85% of palm oil certified sustainable as of 2024.

- Nutritional Profile Enhancement: Efforts to improve the health and wellness aspects of their snack products, communicated through product development and marketing.

Intersnack Group utilizes a multi-faceted promotional strategy, heavily leaning on brand-specific campaigns and strategic partnerships to engage consumers. Their digital presence, bolstered by collaborations like the one with Bundesliga International, allows for dynamic content delivery and deep integration into consumer lifestyles. This approach is further amplified by a commitment to transparency, highlighting product quality, taste, and increasingly, health and sustainability benefits to align with evolving market demands.

Price

Operating within the mature and highly competitive European savory snack market, Intersnack Group likely adopts aggressive competitive pricing. The European snack products market was valued at a substantial USD 191 billion in 2023, underscoring the intense rivalry for consumer spending and market share.

This dynamic environment necessitates strategic pricing to maintain visibility and attract price-sensitive consumers. Intersnack's pricing decisions would therefore be closely aligned with competitor offerings, potentially utilizing price matching or value-based pricing to differentiate its brands.

Intersnack's value-based pricing strategy leverages its diverse brand portfolio, including premium offerings like Tyrrells. This approach allows for differentiated pricing that aligns with the perceived quality and brand equity of each product. For instance, Tyrrells, known for its artisanal approach and premium ingredients, can command a higher price point, reflecting its superior perceived value.

The pricing strategy for Intersnack Group's snacks is directly tied to the volatile costs of its primary raw materials, notably potatoes and nuts. For instance, global potato prices saw significant upward pressure in late 2023 and early 2024 due to adverse weather conditions in key growing regions, impacting input costs for brands like Pringles and Lorenz. Similarly, nut prices, crucial for products like Ültje, have experienced fluctuations driven by supply chain disruptions and changing agricultural yields.

These raw material cost swings directly affect Intersnack's production expenses. An increase in potato or nut prices necessitates a review of product pricing to maintain profit margins. For example, a 10% rise in potato procurement costs could translate to a need for a price adjustment on potato-based snacks, assuming other operational costs remain stable.

Consequently, Intersnack must be agile in its pricing to reflect these input cost dynamics. This might involve strategic price increases, optimizing sourcing strategies, or exploring product reformulation to mitigate the impact of commodity price volatility on their final product offerings and competitive positioning in the snack market.

Market Demand and Consumer Trends

Market demand and consumer trends significantly shape Intersnack's pricing. The growing preference for healthier and plant-based snacks means consumers are often willing to pay a premium for products meeting these criteria. For instance, the global plant-based food market was valued at approximately USD 27.0 billion in 2023 and is projected to reach USD 118.0 billion by 2030, demonstrating a clear willingness to spend more on these evolving preferences.

Intersnack can leverage this by adjusting prices for their offerings that emphasize reduced salt, lower fat content, or utilize sustainable sourcing and packaging. This strategic pricing allows them to capture value from consumers actively seeking these attributes, thereby aligning product cost with perceived consumer benefit.

- Health-Conscious Pricing: Consumers are increasingly willing to pay more for snacks with improved nutritional profiles.

- Plant-Based Premium: The robust growth in the plant-based sector indicates a price sensitivity towards sustainable and ethical food choices.

- Value-Based Adjustment: Pricing strategies will likely adapt to reflect the added value consumers perceive in healthier or sustainably produced snacks.

Economies of Scale and Efficiency

Intersnack's extensive manufacturing footprint, boasting 45 production sites, enables significant economies of scale. This large-scale operation allows for lower per-unit production costs, directly impacting their ability to offer competitive pricing in the snack market. For instance, their substantial sales volume in 2023, reaching €3.2 billion, underscores this advantage.

Strategic investments in operational efficiency further bolster Intersnack's cost optimization. The €85 million investment in modernizing their Alsbach plant, completed in early 2024, exemplifies this commitment. Such upgrades enhance productivity and reduce waste, allowing for more favorable pricing strategies to maintain market share.

- Economies of Scale: 45 production sites and significant sales volume (€3.2 billion in 2023) lead to lower per-unit costs.

- Investment in Technology: The €85 million modernization of the Alsbach plant (early 2024) enhances production efficiency.

- Cost Optimization: Investments aim to reduce operational costs, enabling competitive pricing.

- Market Competitiveness: Optimized costs allow Intersnack to maintain attractive price points for consumers.

Intersnack's pricing strategy navigates a competitive European snack market valued at USD 191 billion in 2023. They likely employ competitive pricing, potentially using price matching or value-based strategies for brands like Tyrrells, which command a premium due to perceived quality. Raw material cost fluctuations, such as those impacting potatoes and nuts in late 2023/early 2024, directly influence their pricing to maintain margins.

Consumer demand for healthier and plant-based options, a market projected to grow significantly, allows Intersnack to implement premium pricing for products meeting these criteria. The company's extensive manufacturing base of 45 sites and €3.2 billion in 2023 sales contribute to economies of scale, supporting competitive pricing, further enhanced by efficiency investments like the €85 million Alsbach plant upgrade in early 2024.

| Pricing Factor | Impact on Intersnack | Supporting Data/Example |

|---|---|---|

| Market Competition | Necessitates aggressive or value-based pricing. | European snack market valued at USD 191 billion (2023). |

| Raw Material Costs | Directly affects production expenses and necessitates price adjustments. | Potato and nut price volatility impacts brands like Lorenz and Ültje. |

| Consumer Trends | Allows for premium pricing on health-conscious and plant-based offerings. | Plant-based food market projected to reach USD 118.0 billion by 2030. |

| Economies of Scale | Enables competitive pricing through lower per-unit costs. | 45 production sites and €3.2 billion sales (2023). |

4P's Marketing Mix Analysis Data Sources

Our Intersnack 4P's Marketing Mix analysis is grounded in a comprehensive review of company-published materials, including annual reports, investor relations documents, and official brand websites. We also incorporate insights from reputable industry reports and market research databases to capture pricing strategies, distribution networks, and promotional activities.