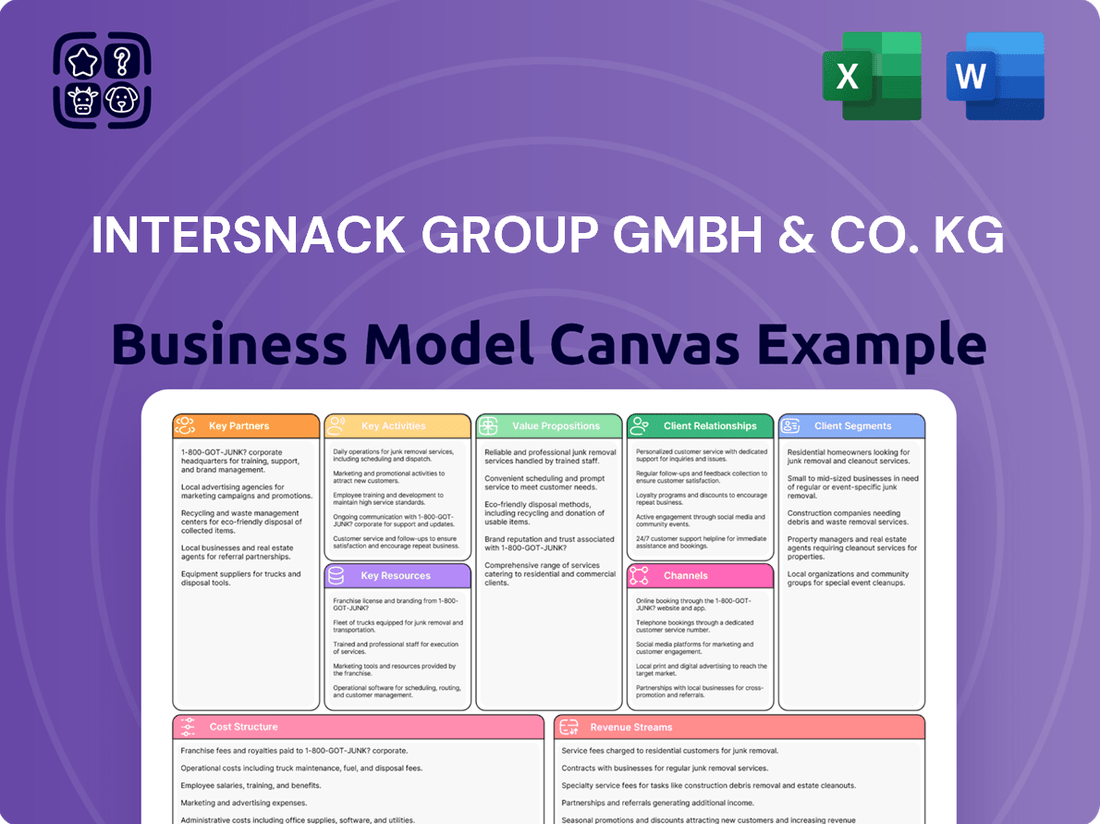

Intersnack Group GmbH & Co. KG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intersnack Group GmbH & Co. KG Bundle

Unlock the strategic blueprint behind Intersnack Group GmbH & Co. KG's success with our comprehensive Business Model Canvas. This detailed analysis reveals their core customer segments, unique value propositions, and key revenue streams, offering invaluable insights for market strategists.

Partnerships

Intersnack Group GmbH & Co. KG heavily depends on its raw material suppliers, primarily focusing on agricultural commodities like potatoes, nuts, and corn. These relationships are vital for maintaining the consistent quality and stable supply of ingredients essential for their snack products. For instance, Intersnack's potato sourcing is critical, with the company processing millions of tons of potatoes annually across Europe, underscoring the importance of reliable agricultural partnerships.

Intersnack's strategic alliances with major supermarket chains, convenience stores, and wholesale distributors are critical. These partnerships, such as those with Tesco in the UK or Rewe in Germany, ensure Intersnack's products reach a vast consumer base. For instance, in 2024, Intersnack's extensive retail network contributed to its estimated €3 billion in annual revenue, highlighting the sheer scale of these distribution channels.

Intersnack actively engages in crucial multi-stakeholder partnerships, such as the Sustainable Agriculture Initiative (SAI) and the Sustainable Nut Initiative (SNI). These collaborations are essential for advancing sustainable farming methods and sharing best practices across the industry.

Through these alliances, Intersnack contributes to addressing complex, industry-wide sustainability challenges, fostering a more ethical and environmentally conscious supply chain. For instance, SAI Platform's work aims to improve agricultural practices globally, with many of its members, including those in the snack sector, reporting progress in water usage reduction and soil health improvement by 2024.

Joint Ventures and Acquisitions

Intersnack Group strategically utilizes joint ventures to tap into new markets and product categories. A notable example is their collaboration with Menken Orlando, focusing on the burgeoning Asian snacks sector, and their partnership with Grefusa to strengthen their presence in the Spanish and Portuguese markets. These alliances allow Intersnack to share risks and leverage complementary expertise.

Acquisitions are another cornerstone of Intersnack's growth strategy, enabling them to broaden their brand portfolio and extend their geographical reach. In a significant move in November 2024, Intersnack acquired Whole Earth Foods, a brand recognized for its peanut butter and plant-based products. This acquisition is expected to enhance Intersnack's offering in the health-conscious food segment.

- Strategic Joint Ventures: Partnerships with Menken Orlando (Asian snacks) and Grefusa (Spain/Portugal) expand market access and product diversity.

- Acquisition of Whole Earth Foods: Completed in November 2024, this move diversifies Intersnack's brand portfolio into the plant-based and healthy foods category.

- Market Expansion: Both joint ventures and acquisitions are key drivers for Intersnack to achieve broader market penetration and brand recognition.

Technology and Solutions Providers

Intersnack Group's reliance on technology and solutions providers is critical for maintaining a competitive edge. These partnerships enable the company to implement advanced systems that streamline operations and ensure high product quality. For instance, Intersnack leverages platforms like SAP for enterprise resource planning and Ataccama for data management, which are foundational for efficient business processes.

Further enhancing their operational capabilities, Intersnack has adopted manufacturing operations management solutions such as CDC Factory. This investment in specialized software is aimed at optimizing production workflows, minimizing waste, and improving overall output efficiency. In 2024, such technology investments are increasingly vital for food manufacturers aiming to meet growing consumer demand and stringent quality standards.

- SAP: A cornerstone for managing Intersnack's extensive business operations, from finance to supply chain.

- Ataccama: Utilized for robust data governance and quality management, ensuring reliable information across the organization.

- CDC Factory: Implemented to drive efficiency and reduce waste within manufacturing processes, a key focus for operational excellence.

- Strategic Technology Alignment: These partnerships ensure Intersnack's technological infrastructure supports its strategic goals for growth and market leadership.

Intersnack's key partnerships extend to technology providers who are crucial for operational efficiency and quality control. The company utilizes enterprise resource planning systems like SAP and data management solutions from Ataccama, which are fundamental for managing its vast operations. Furthermore, Intersnack has implemented manufacturing operations management solutions, such as CDC Factory, to optimize production and minimize waste, a critical aspect for food manufacturers in 2024 aiming to meet high demand and quality standards.

| Technology Partner | Purpose | Impact in 2024 |

|---|---|---|

| SAP | Enterprise Resource Planning | Streamlining finance, supply chain, and overall business processes. |

| Ataccama | Data Management & Governance | Ensuring data quality and reliability across the organization. |

| CDC Factory | Manufacturing Operations Management | Optimizing production workflows, reducing waste, and enhancing output. |

What is included in the product

The Intersnack Group's Business Model Canvas focuses on delivering a wide range of branded and private label savory snacks to diverse consumer segments through extensive retail and wholesale channels, emphasizing product innovation and strong supplier relationships.

The Intersnack Group's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex operations, allowing for rapid identification of inefficiencies and opportunities to streamline their snack production and distribution.

Activities

Intersnack's core business revolves around the efficient, large-scale manufacturing of a wide array of savory snacks. This includes popular items like potato chips, various nuts, baked snacks, and other specialized products designed to meet diverse consumer preferences.

The company operates a significant global production footprint, managing 45 production sites worldwide. This extensive network is crucial for meeting demand across its international markets and ensuring product availability.

Maintaining high product quality is paramount, achieved through the implementation of modern manufacturing technologies and rigorous quality control processes across all facilities. This commitment ensures consistency and safety in every snack produced.

Intersnack Group's brand management and marketing activities are crucial for maintaining its market presence. A core function involves nurturing its diverse brand portfolio, featuring popular names like Chio, funny-frisch, and POM-BÄR, across various European markets. This strategic focus ensures sustained consumer engagement and market share.

These efforts translate into significant marketing investments. For instance, in 2024, Intersnack likely continued its robust advertising spend, a common practice for leading snack manufacturers aiming to reinforce brand recall and drive sales. Such campaigns are vital for differentiating their products in a competitive landscape.

Intersnack Group's commitment to innovation is a cornerstone of its business, with a strong emphasis on developing clean-label snacks. This means a dedicated effort to create products free from artificial taste enhancers, colors, and sweeteners, aligning with growing consumer demand for healthier options. For example, in 2024, the company continued to expand its portfolio of snacks with simpler ingredient lists across its various brands.

This continuous research and development is crucial for staying ahead in the competitive snack market. By introducing new and appealing snack varieties, Intersnack ensures it meets evolving consumer preferences, driving both brand loyalty and market share. Their innovation pipeline in 2024 focused on flavor profiles and formats that resonate with health-conscious consumers.

Supply Chain and Logistics Management

Intersnack Group's key activities heavily rely on the efficient management of its intricate supply chain and logistics. This encompasses everything from procuring raw ingredients like potatoes and oils to getting the final snack products onto store shelves. The company's operations span over 30 countries, necessitating a highly optimized distribution network to ensure consistent product availability and minimize transportation expenses.

Key to this activity is the careful planning and execution of logistics to reduce costs and maintain freshness. Intersnack focuses on optimizing routes and modes of transport to serve its broad geographic reach effectively.

- Sourcing: Securing high-quality raw materials, such as potatoes, oils, and flavorings, from reliable suppliers.

- Production: Efficiently transforming raw materials into a wide variety of snack products through advanced manufacturing processes.

- Distribution: Managing a complex network of warehouses and transportation to deliver products to retailers across numerous international markets.

- Inventory Management: Maintaining optimal stock levels to meet demand while minimizing waste and storage costs.

Sustainability and Responsible Sourcing

Intersnack Group GmbH & Co. KG actively implements and advances its comprehensive sustainability strategy. This includes focused efforts on reducing Scope 1, 2, and 3 emissions, a critical area for environmental impact. For instance, Intersnack aims to achieve a 40% reduction in Scope 1 and 2 emissions by 2030 compared to a 2019 baseline, with a significant portion of this reduction coming from renewable energy adoption in their manufacturing facilities.

Promoting sustainable agriculture is another core activity, ensuring that raw materials are sourced responsibly. This involves working with farmers to adopt practices that improve soil health and biodiversity. In 2023, Intersnack reported that over 80% of their key agricultural raw materials, such as potatoes and palm oil, were sourced from certified sustainable programs.

Improving packaging recyclability is a vital part of their commitment to environmental stewardship. Intersnack is actively working towards making 100% of its packaging recyclable, reusable, or compostable by 2025. By the end of 2024, they had already achieved a 75% recyclability rate across their product portfolio.

- Emissions Reduction: Targeting a 40% decrease in Scope 1 and 2 emissions by 2030 (vs. 2019 baseline).

- Sustainable Sourcing: Over 80% of key agricultural raw materials were sustainably sourced in 2023.

- Packaging Innovation: Aiming for 100% recyclable, reusable, or compostable packaging by 2025, with a 75% rate achieved by end of 2024.

Intersnack's key activities center on creating and distributing a wide range of savory snacks, from potato chips to nuts, across numerous global markets. This involves extensive manufacturing operations at 45 production sites, supported by robust brand management and marketing efforts for popular brands like Chio and funny-frisch. The company also prioritizes innovation, focusing on developing clean-label products with simpler ingredients to meet evolving consumer demands.

Efficient supply chain management and logistics are critical, ensuring raw material procurement and product delivery across over 30 countries. This includes optimizing inventory and distribution networks to maintain product freshness and availability while controlling costs. Intersnack's sustainability initiatives are also a core activity, targeting significant reductions in emissions and increasing the recyclability of packaging, with a goal of 100% by 2025.

| Key Activity | Description | 2024/2025 Data Point |

| Manufacturing & Production | Large-scale production of diverse savory snacks. | Operates 45 production sites globally. |

| Brand Management & Marketing | Nurturing and promoting a portfolio of popular snack brands. | Continued robust advertising spend to drive sales and brand recall. |

| Innovation & Product Development | Creating new snack varieties, with a focus on clean-label products. | Expanding portfolio of snacks with simpler ingredient lists. |

| Supply Chain & Logistics | Managing procurement, production, and distribution across 30+ countries. | Optimizing routes and transport for efficient delivery and cost control. |

| Sustainability | Reducing environmental impact through emissions reduction and packaging innovation. | 75% packaging recyclability achieved by end of 2024; aiming for 100% by 2025. |

Full Document Unlocks After Purchase

Business Model Canvas

The Business Model Canvas for Intersnack Group GmbH & Co. KG that you are previewing is the exact document you will receive upon purchase. This comprehensive overview details Intersnack's key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams, providing a complete and actionable strategic blueprint.

Resources

Intersnack Group boasts a robust brand portfolio, featuring over 15,000 employees and a collection of highly recognized local and international snack brands. These include strong performers like Chio, funny-frisch, POM-BÄR, and ültje, which resonate deeply with consumers and build significant brand equity.

The strength of these brands, such as funny-frisch holding a leading market position in Germany, underpins Intersnack's customer loyalty and market penetration. This established consumer trust is a critical asset, driving consistent sales and brand recognition across diverse geographical regions.

Intersnack Group's extensive production facilities are a cornerstone of its business model, with 45 state-of-the-art manufacturing sites strategically located across Europe, Asia, Australia, and New Zealand. This vast network allows for high-volume production and stringent quality control for a wide array of snack products.

These facilities are not just about scale; they provide crucial flexibility to adapt to diverse market demands and product innovations. The ability to produce a varied snack portfolio efficiently is a key competitive advantage, underpinning Intersnack's market presence.

Intersnack Group’s strength lies in its global team of over 15,000 employees. This diverse workforce brings a wealth of experience across critical areas like production, supply chain management, brand development, and innovation.

The company's success is significantly driven by the specialized skills of its people in manufacturing efficiency, intricate logistics, impactful marketing campaigns, and cutting-edge research and development. This human capital is a core asset.

Robust management expertise underpins Intersnack’s operational excellence and fuels its strategic expansion. The leadership team's ability to navigate complex markets and drive growth is paramount to the group's sustained performance.

Robust Distribution Network

Intersnack’s robust distribution network is a cornerstone of its business model, enabling it to reach consumers across more than 30 countries. This expansive reach is built on strong relationships with a diverse array of retail partners and wholesalers, ensuring its products are readily available in numerous markets.

The group’s logistical prowess allows for efficient product placement and market penetration, a critical factor in the fast-moving consumer goods sector. By leveraging these established channels, Intersnack effectively manages its supply chain and maintains a consistent presence on store shelves.

- Geographic Reach: Operates in over 30 European countries.

- Partnerships: Collaborates with major retailers and numerous wholesalers.

- Market Penetration: Facilitates widespread availability of its snack products.

- Logistical Efficiency: Supports a high volume of sales and product turnover.

Proprietary Recipes and Production Technology

Intersnack Group’s proprietary recipes and production technology are cornerstones of its competitive advantage. These unique formulations and advanced manufacturing processes are protected intellectual property, setting their snack products apart in a crowded market.

The company actively invests in upgrading its technological capabilities. For instance, the integration of CDC Factory solutions across its operations is designed to boost production efficiency, ensure unwavering quality across batches, and foster the development of new and innovative snack offerings.

- Intellectual Property: Unique snack recipes and advanced manufacturing processes are key assets.

- Technology Investment: Continuous upgrades, like CDC Factory solutions, improve efficiency and quality.

- Innovation Driver: Technology supports the development of new product variations and flavors.

- Competitive Edge: Proprietary knowledge helps maintain market differentiation and consumer loyalty.

Intersnack's key resources include a powerful portfolio of established snack brands like funny-frisch and Chio, which hold significant market share in regions such as Germany. Their extensive network of 45 manufacturing sites across multiple continents ensures efficient, high-quality production. The company leverages a global workforce of over 15,000 employees with specialized expertise in production, logistics, and marketing. Furthermore, proprietary recipes and ongoing investment in advanced production technologies, like CDC Factory solutions, provide a distinct competitive edge and drive innovation.

Value Propositions

Intersnack Group delights consumers with a broad portfolio of savory snacks, encompassing popular categories like potato chips, nuts, and baked goods. This diverse offering ensures there's something for every palate, reflecting a deep understanding of varied consumer tastes and preferences.

The company's core mission revolves around providing high-quality, delicious products that aim to bring joy and small moments of happiness into consumers' daily lives. Intersnack's commitment to taste and enjoyment is a key driver of its value proposition.

In 2024, Intersnack continued to innovate within its snack categories, with a strong focus on taste profiles that resonate with a global audience. The company's brands consistently rank high in consumer preference, underscoring the success of its diverse and great-tasting snack strategy.

Intersnack Group's business model thrives on its portfolio of trusted and iconic brands, offering consumers familiar favorites like funny-frisch, Chio, and POM-BÄR. These established names provide a crucial sense of quality assurance and reliability, building deep consumer loyalty.

Intersnack Group GmbH & Co. KG prioritizes innovation to consistently offer sought-after snack choices, with a significant focus on developing clean-label products. This means their snacks are crafted without artificial taste enhancers, colors, or sweeteners, aligning with growing consumer preferences for healthier options.

Their commitment to continuous improvement, exemplified by a reported €1.1 billion in net sales for the fiscal year 2023, ensures that Intersnack products not only meet high quality benchmarks but also adapt swiftly to changing consumer demands and market trends.

Responsibly Produced and Sustainable Products

Intersnack Group GmbH & Co. KG prioritizes sustainability across its operations, embedding responsible practices from sourcing raw materials to the final packaging. This commitment resonates with a growing segment of consumers who actively seek out products made with environmental consciousness in mind.

The company's strategy focuses on minimizing its ecological impact and actively promoting sustainable agricultural methods. For instance, in 2024, Intersnack continued its efforts to reduce plastic in its packaging, aiming for increased recyclability and the use of recycled content in its snack bags.

- Sustainable Sourcing: Intersnack works with farmers to implement practices that improve soil health and biodiversity, contributing to long-term agricultural resilience.

- Reduced Environmental Footprint: The company targets reductions in greenhouse gas emissions and water usage throughout its production processes.

- Eco-Friendly Packaging: Initiatives in 2024 focused on increasing the use of recycled materials and designing packaging for better recyclability.

- Consumer Appeal: By highlighting these responsible production efforts, Intersnack aims to attract and retain environmentally aware consumers, a key demographic in the current market.

Convenience and Widespread Availability

Intersnack Group leverages its vast distribution network to ensure its popular snack brands, like Chio and Kelly's, are readily available to consumers. This extensive reach, spanning over 100 countries by 2024, makes their products incredibly convenient for everyday snacking needs.

Strong relationships with a multitude of retail partners, from large supermarkets to smaller convenience stores, are key to this widespread availability. This strategic placement guarantees that Intersnack products are easily accessible whenever a consumer desires a snack.

- Extensive Distribution: Products available in over 100 countries.

- Retail Partnerships: Strong presence in major supermarket chains and convenience stores.

- Consumer Accessibility: Easy to find Intersnack snacks for impulse purchases and planned buys.

Intersnack Group delivers a wide array of enjoyable snacks, from potato chips to nuts, catering to diverse consumer tastes. Their commitment to quality and taste brings moments of joy to consumers' daily lives.

The company's strength lies in its portfolio of beloved brands, offering consumers familiar favorites and building strong loyalty. Intersnack prioritizes innovation, focusing on clean-label products and adapting to evolving consumer preferences for healthier options.

With a significant global presence, Intersnack ensures its products are readily available through extensive distribution networks and strong retail partnerships. This accessibility, combined with a focus on sustainability and responsible sourcing, appeals to a growing environmentally conscious consumer base.

| Key Value Propositions | Description | 2023/2024 Relevance |

| Product Variety & Quality | Broad portfolio of savory snacks (chips, nuts, baked goods) known for taste and quality. | Continued innovation in taste profiles and product development in 2024. |

| Brand Trust & Loyalty | Iconic brands like funny-frisch and Chio provide consumer reassurance and familiarity. | Established brand recognition drives repeat purchases and market share. |

| Health & Sustainability Focus | Development of clean-label products and commitment to sustainable sourcing and packaging. | Increased consumer demand for healthier and eco-friendly options in 2024. |

| Global Accessibility | Extensive distribution network reaching over 100 countries by 2024 through strong retail partnerships. | Ensures widespread availability for impulse and planned snack purchases. |

Customer Relationships

Intersnack cultivates deep customer loyalty through the unwavering quality and taste of its beloved snack brands, like the popular Pom-Bär and Chio. This consistent delivery of enjoyable products creates positive brand experiences, driving consumers to make repeat purchases and foster enduring relationships with the company.

Intersnack Group is dedicated to crafting 'happy snacking moments' that genuinely enrich consumers' lives. This commitment is built on a deep understanding of evolving consumer preferences and a proactive approach to incorporating feedback.

By actively listening to and responding to customer input, Intersnack ensures its product portfolio remains relevant and delightful. For instance, in 2024, the company continued to invest in market research, analyzing over 50,000 consumer touchpoints across its key European markets to refine flavor profiles and packaging innovations.

This focus on engagement and adaptation directly translates into high levels of consumer satisfaction, a cornerstone of Intersnack's customer relationship strategy. Their ongoing efforts aim to foster loyalty and create memorable snacking experiences that keep consumers coming back for more.

Intersnack actively engages customers through diverse marketing and promotional activities, with a notable emphasis on in-store promotions. These initiatives are strategically designed to capture new clientele, reinforce brand presence with existing customers, and ultimately boost product visibility and sales volume.

In 2024, Intersnack continued its robust marketing spend, a key driver for brand recall and market penetration in the competitive snacks sector. For instance, their extensive use of point-of-sale displays and special offers in major retail chains across Europe directly contributes to impulse purchases and reinforces brand loyalty.

Sustainability Communication

Intersnack Group actively communicates its sustainability journey and achievements through detailed reports and public statements. This commitment to transparency fosters trust with consumers, particularly as a significant portion of the market now actively seeks out ethically produced and environmentally responsible products.

The company's engagement with environmental and social responsibility directly addresses a growing consumer demand. For instance, Intersnack's 2023 sustainability report highlighted a 15% reduction in water usage across its European operations compared to 2020 benchmarks, demonstrating tangible progress that resonates with eco-conscious shoppers.

- Transparency: Regular publication of sustainability reports detailing progress on environmental, social, and governance (ESG) goals.

- Consumer Engagement: Highlighting sustainable sourcing and production practices to appeal to ethically minded consumers.

- Impact Communication: Sharing data on reduced environmental footprint, such as carbon emission reductions and waste management improvements.

- Partnerships: Collaborating with organizations to amplify sustainability messages and initiatives.

Partnerships with Retailers

Intersnack cultivates robust partnerships with its business-to-business clientele, primarily retailers and distributors. These collaborations are crucial for market penetration and brand visibility.

The company engages in joint initiatives with its retail partners, focusing on areas like efficient logistics, in-store merchandising, and coordinated promotional campaigns. This symbiotic approach ensures that Intersnack's products are well-presented and readily available to consumers.

- Collaborative Logistics: Streamlining supply chains with retailers to ensure timely product delivery and reduce stockouts.

- Merchandising Support: Working with retailers on optimal product placement and display strategies in stores.

- Joint Promotional Planning: Developing and executing marketing campaigns with retail partners to drive sales and consumer engagement.

- Data Sharing: Exchanging sales data and consumer insights with key retailers to refine product offerings and marketing efforts.

Intersnack prioritizes direct consumer engagement through various channels, fostering brand loyalty by consistently delivering quality and taste. This approach is reinforced by active feedback mechanisms and a commitment to innovation, ensuring products align with evolving preferences.

In 2024, Intersnack's focus on consumer relationships was evident in their continued investment in market research, analyzing over 50,000 consumer touchpoints across Europe to refine product offerings and marketing strategies.

The company actively engages customers via in-store promotions and marketing campaigns, aiming to capture new clientele and reinforce brand presence. For instance, their extensive use of point-of-sale displays in major European retail chains directly contributes to impulse purchases and strengthens brand loyalty.

Intersnack also builds trust by transparently communicating its sustainability efforts, a key factor for a growing segment of consumers seeking ethically produced goods. Their 2023 sustainability report, for example, detailed a 15% reduction in water usage across European operations compared to 2020, demonstrating tangible progress.

| Customer Relationship Aspect | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Quality & Taste | Consistent delivery of enjoyable snack experiences to drive repeat purchases. | Continued investment in R&D for flavor innovation. |

| Consumer Feedback | Actively incorporating consumer input to ensure product relevance. | Analysis of over 50,000 consumer touchpoints across key European markets. |

| Marketing & Promotions | Engaging customers through in-store activities and campaigns. | Extensive use of point-of-sale displays and special offers in major retail chains. |

| Sustainability Communication | Building trust through transparent reporting on ESG initiatives. | Highlighting achievements like a 15% reduction in water usage (2023 report vs. 2020). |

Channels

Supermarkets and hypermarkets represent a cornerstone for Intersnack, acting as primary channels for reaching a vast consumer base. These large-format retailers are responsible for a substantial share of Intersnack's overall revenue, offering unparalleled product visibility and ease of access for millions of shoppers.

In 2023, the German grocery market, a key territory for Intersnack, saw supermarket chains like Edeka and Rewe dominate with significant market shares. For instance, Edeka reported sales of approximately €70 billion in 2023, highlighting the sheer volume potential within these channels. Strategic shelf placement and targeted in-store promotions within these outlets are vital for Intersnack to maximize sales volume and brand presence.

Convenience stores are a vital distribution channel for Intersnack, offering immediate access to their snack products for on-the-go consumers. This channel thrives on impulse buys, making Intersnack's accessible and appealing product range a perfect fit. In 2024, the convenience store sector continued its growth trajectory, with sales in many European markets showing a steady increase, underscoring the importance of this channel for Intersnack's reach.

Intersnack leverages wholesalers as a crucial part of its distribution strategy, enabling access to a vast network of smaller retailers, independent grocers, and various food service establishments. This approach significantly expands their market penetration beyond major supermarket chains.

By working with wholesalers, Intersnack ensures its popular snack brands, such as Lorenz Snack-World and Chio, are readily available to consumers across diverse geographical locations and smaller sales channels. This broadens their reach and strengthens their market presence in the competitive snack industry.

International Distribution Networks

Intersnack Group leverages its extensive presence across more than 30 countries, utilizing well-established international distribution networks to bring its snack products to a wide array of consumers. This broad geographical reach is a cornerstone of its business model, enabling access to diverse markets. For instance, in 2024, the company continued to solidify its position in key European markets while also focusing on expansion in regions like Australia and New Zealand, demonstrating its commitment to a global strategy.

The company's distribution strategy is designed to cater to varied consumer preferences and retail landscapes across these international territories. This involves partnerships with local distributors and retailers, ensuring efficient product placement and availability. Intersnack's ability to navigate these different market dynamics is crucial for its sustained growth and market penetration.

Key aspects of Intersnack's international distribution include:

- Extensive Market Coverage: Operations in over 30 countries, reaching a significant portion of the global snack market.

- Diverse Distribution Channels: Utilizing a mix of wholesale, retail, and direct-to-consumer channels tailored to local market needs.

- Strategic Partnerships: Collaborating with local entities to optimize logistics and market access, particularly in emerging markets.

- Brand Portfolio Adaptation: Tailoring product offerings and marketing strategies to resonate with local consumer tastes and cultural preferences across its international network.

Direct Sales Representatives

Direct Sales Representatives are a crucial element of Intersnack Group's strategy, with over 1,000 individuals dedicated to managing relationships and negotiating terms directly with retail partners. This extensive field force allows for personalized engagement, ensuring that sales strategies are finely tuned to the specific needs of each retailer.

This direct approach facilitates effective communication, enabling Intersnack to quickly adapt to market changes and retailer feedback. It also plays a key role in optimizing product placement on shelves, maximizing visibility and sales potential for their diverse snack portfolio.

- 1,000+ Direct Sales Representatives

- Relationship Management & Negotiation with Retailers

- Tailored Sales Strategies & Optimized Product Placement

- Ensures Effective Communication and Market Responsiveness

Intersnack's distribution network is a multifaceted system designed to ensure broad consumer access to its snack products. This includes leveraging large-format retailers like supermarkets and hypermarkets, which are critical for high-volume sales and brand visibility. The company also utilizes convenience stores for impulse purchases, tapping into the on-the-go consumer market. Furthermore, Intersnack employs wholesalers to reach a wider array of smaller retailers and food service outlets, significantly expanding its market penetration.

The company's global reach is substantial, operating in over 30 countries and adapting its distribution strategies to diverse local market conditions. This international presence is supported by a dedicated team of over 1,000 direct sales representatives who manage retailer relationships and optimize product placement. In 2024, Intersnack continued to strengthen its foothold in established European markets while pursuing growth opportunities in regions like Australia and New Zealand.

| Channel Type | Key Characteristics | 2024 Relevance/Data Points |

|---|---|---|

| Supermarkets/Hypermarkets | High volume, broad consumer reach, product visibility | Essential for market share; German grocery market sales in the tens of billions annually |

| Convenience Stores | Impulse buys, on-the-go consumption | Continued sector growth in Europe, driving accessibility |

| Wholesalers | Access to smaller retailers, independent grocers, food service | Expands market penetration beyond major chains |

| International Distribution | Operations in 30+ countries, local partnerships | Focus on European markets, expansion in Australia/New Zealand |

| Direct Sales | 1,000+ representatives, retailer relationship management | Optimized placement, market responsiveness |

Customer Segments

Intersnack's mass market consumers represent a vast and diverse group, seeking accessible and enjoyable savory snacks for daily consumption. This segment, spanning numerous age brackets and lifestyle backgrounds, prioritizes satisfying taste profiles, easy portability, and a wide selection to cater to different preferences. In 2024, the global savory snacks market continued its robust growth, projected to reach over $160 billion, underscoring the significant demand from this broad consumer base.

Families represent a core customer segment for Intersnack, with brands like POM-BÄR directly targeting this demographic. These snacks are designed with appealing features for children, such as fun shapes and milder flavors, while also being acceptable to parents. In 2024, the global snack market, which includes family-oriented products, continued its robust growth, with Intersnack aiming to capture a significant share through its family-focused offerings.

Health-conscious consumers are a key focus for Intersnack, driven by a clear market trend towards cleaner labels and better-for-you snack options. This segment actively seeks out products that minimize artificial ingredients and often prioritizes reduced fat content, aligning with growing consumer awareness of dietary impacts.

In 2024, the global healthy snacks market is projected to reach over $130 billion, with a significant portion of this growth attributed to consumers actively seeking out natural ingredients and transparent labeling, a demand Intersnack is well-positioned to meet.

Retailers and Wholesalers (B2B)

Intersnack's Retailers and Wholesalers (B2B) customer segment is foundational, encompassing major supermarket chains, convenience store networks, and broadline wholesale distributors. These partners are the primary conduits through which Intersnack's diverse snack portfolio reaches the end consumer. Securing shelf space and maintaining strong distribution agreements with these entities is paramount for achieving significant sales volumes and broad market coverage.

The success of Intersnack hinges on its ability to foster enduring partnerships within this B2B segment. These relationships are built on reliable supply, consistent product quality, and effective promotional support. For instance, Intersnack's strategic alliances with leading European grocery retailers directly translate into high visibility and accessibility for brands like Lorenz Snack-World and Chio.

- Key B2B Partners: Major supermarket chains (e.g., Tesco, Carrefour), convenience store operators, and wholesale distributors across Europe.

- Sales Channels: Direct sales to large retail chains and distribution through wholesale partners to smaller independent stores.

- Relationship Importance: Critical for market penetration, sales volume, and brand visibility.

- 2024 Focus: Continued emphasis on collaborative planning and promotional activities to drive category growth.

International Markets

Intersnack Group GmbH & Co. KG actively engages with a broad international customer base, reaching consumers in over 30 countries. This extensive reach spans key markets such as Europe, Australia, and New Zealand, demonstrating a significant global footprint.

The company's international operations are characterized by a need to cater to diverse cultural preferences and distinct snacking habits. This necessitates the development of highly localized product portfolios and tailored marketing approaches to resonate with consumers in each specific region.

- Global Reach: Intersnack operates in over 30 countries, including significant presence in Europe, Australia, and New Zealand.

- Cultural Diversity: The customer base exhibits varied cultural preferences and snacking habits, requiring adaptable strategies.

- Localization Strategy: Product offerings and marketing campaigns are customized to meet local tastes and consumer behaviors.

- Market Penetration: Intersnack's international segment is crucial for its overall revenue and market share growth, with continued expansion efforts in emerging markets.

Intersnack's customer segments are diverse, encompassing mass-market consumers seeking everyday snacks, families looking for kid-friendly options, and a growing segment of health-conscious individuals. The company also relies heavily on its Business-to-Business (B2B) relationships with retailers and wholesalers to ensure broad market access.

The company's international presence, spanning over 30 countries, highlights its ability to adapt to varied cultural preferences and snacking habits, a crucial factor for sustained global growth. In 2024, the global snack market continued its upward trajectory, with Intersnack strategically positioned to leverage these diverse consumer demands.

| Customer Segment | Key Characteristics | 2024 Market Relevance |

|---|---|---|

| Mass Market Consumers | Broad demographic, seeking accessible, enjoyable, and convenient snacks. | Savory snacks market projected over $160 billion globally in 2024, indicating high demand. |

| Families | Targeted with child-appealing products (e.g., POM-BÄR), balancing taste and parental acceptance. | Continued strong performance in the family snack sector, a key growth area for Intersnack. |

| Health-Conscious Consumers | Prioritizing natural ingredients, cleaner labels, and reduced fat content. | Global healthy snacks market expected to exceed $130 billion in 2024, driven by ingredient transparency. |

| Retailers & Wholesalers (B2B) | Major supermarket chains, convenience stores, and distributors; critical for product distribution. | Strong B2B partnerships are essential for shelf visibility and sales volume, with ongoing collaborative planning in 2024. |

Cost Structure

Raw material procurement represents a substantial cost for Intersnack Group, with key inputs including potatoes, nuts, and corn. For instance, in 2024, global potato prices experienced notable volatility due to weather patterns and supply chain disruptions, directly impacting Intersnack's input expenses.

Managing these fluctuating costs is critical, as Intersnack relies on efficient sourcing strategies to mitigate price volatility and maintain the high quality of its snack products. The company's ability to secure favorable contracts and optimize its supply chain directly influences its overall profitability.

Intersnack Group's manufacturing and production expenses are significant, driven by the operation of 45 global production sites. These costs encompass energy, machinery upkeep, workforce wages, and waste handling. For instance, in 2024, energy costs alone represented a substantial portion of operational expenditures across the food manufacturing sector, with many companies reporting increases due to market volatility.

The company actively invests in optimizing these costs through more efficient production techniques and sustainability efforts. These initiatives are crucial for maintaining competitiveness in the snack food industry. In 2023, a trend towards investing in energy-efficient machinery was observed across the industry, aiming to reduce long-term operating expenses and environmental impact.

Intersnack Group's cost structure heavily features logistics and distribution, a significant expense given their extensive reach across national and international markets. Transporting a wide array of snack products to diverse retail and wholesale locations requires substantial investment in fleet management, warehousing, and route optimization. For instance, in 2024, global logistics spending was projected to reach over $10 trillion, highlighting the scale of these operations.

The company's commitment to supply chain efficiency directly impacts its profitability. By investing in advanced tracking systems and strategic warehousing, Intersnack aims to minimize transit times and reduce fuel consumption, thereby controlling these considerable costs. Efficient distribution networks are not just about moving products; they are a critical lever for maintaining competitive pricing and ensuring product freshness.

Marketing, Sales, and Brand Development Costs

Intersnack Group dedicates substantial resources to marketing, advertising, and brand development, recognizing their crucial role in maintaining its competitive edge across a diverse product portfolio. These expenditures are designed to build brand loyalty and drive consumer demand for its snack offerings.

The company's strategy involves significant investments in in-store promotions and widespread advertising campaigns. Furthermore, managing an extensive sales force to ensure product availability and effective market penetration represents a considerable operational cost within this category.

- Marketing & Advertising: Intersnack's commitment to brand visibility is evident in its consistent spending on advertising across various media channels and in-store promotional activities to capture consumer attention at the point of purchase.

- Sales Force Management: Costs associated with maintaining and incentivizing a large, geographically dispersed sales team are integral to ensuring broad market reach and effective distribution of Intersnack's products.

- Brand Development: Ongoing investment in nurturing and evolving its numerous brands is essential for Intersnack to adapt to changing consumer preferences and maintain market relevance in the dynamic snack industry.

Research, Development, and Innovation Costs

Intersnack significantly invests in research, development, and innovation to drive new product introductions, refine existing offerings with clean-label ingredients, and pioneer sustainable packaging. These expenditures are crucial for staying ahead in a dynamic market and catering to shifting consumer preferences.

For instance, Intersnack's commitment to innovation was evident in its product pipeline development. While specific R&D spending figures for 2024 are not publicly disclosed, the company consistently allocates substantial resources to these areas. In 2023, the broader food industry saw continued growth in demand for healthier options, with clean-label products becoming a significant trend. Intersnack's focus on these areas directly addresses this market shift.

- Product Innovation: Development of new snack varieties and flavor profiles.

- Clean-Label Reformulation: Improving ingredient transparency and reducing artificial additives.

- Sustainable Packaging: Researching and implementing eco-friendly packaging materials.

- Market Responsiveness: Adapting to evolving consumer demands for healthier and more sustainable products.

Intersnack Group's cost structure is heavily influenced by raw material procurement, especially for core ingredients like potatoes and nuts, with global commodity prices in 2024 showing significant fluctuations impacting these expenses. Manufacturing and production costs are also substantial, covering energy, labor, and machinery for its 45 global sites, with energy costs in 2024 being a notable concern across the food sector. Logistics and distribution represent another major cost area, driven by the need to transport products across extensive national and international networks, with global logistics spending exceeding $10 trillion in 2024.

| Cost Category | Key Drivers | 2024 Impact/Trend |

| Raw Materials | Potatoes, nuts, corn | Price volatility due to weather and supply chain issues |

| Manufacturing & Production | Energy, labor, machinery maintenance | Increased energy costs impacting operational expenditures |

| Logistics & Distribution | Fleet management, warehousing, route optimization | High global logistics spending, focus on efficiency |

| Marketing & Sales | Advertising, promotions, sales force | Investment in brand visibility and market penetration |

| R&D and Innovation | New product development, packaging | Focus on clean-label and sustainable solutions |

Revenue Streams

Intersnack Group's core revenue is generated through the sale of its diverse portfolio of branded savory snacks. This includes well-known categories like potato chips, nuts, and various baked snack items, catering to a broad consumer base across Europe.

Key brands such as Chio, funny-frisch, and POM-BÄR are major drivers of this sales revenue. These established brands have strong market recognition and loyalty, underpinning Intersnack's consistent performance in the competitive snack market.

In 2023, the European savory snacks market, a key operating region for Intersnack, was valued at approximately €45 billion, with a projected compound annual growth rate (CAGR) of around 3.5% through 2028, indicating a robust environment for Intersnack's primary revenue stream.

Intersnack Group GmbH & Co. KG also earns revenue by creating and selling savory snacks under private labels for different retail partners. This strategy broadens their income streams and makes good use of their production facilities.

Intersnack Group generates significant revenue from its international market sales, operating in over 30 countries. This global footprint, encompassing key regions like Europe, Australia, and New Zealand, is a primary driver of its financial performance.

The company's growth strategy heavily relies on expanding into new international territories and deepening its market penetration in established ones. For instance, Intersnack's presence in the Australian market, a significant contributor to its global sales, demonstrates its successful international expansion.

Acquisition-driven Growth

Intersnack Group’s acquisition strategy is a significant driver of its revenue streams. By strategically acquiring companies, Intersnack expands its brand portfolio and enters new product categories, directly boosting top-line growth. For instance, the 2024 acquisition of Whole Earth Foods brought a well-established plant-based food brand into the Intersnack family, broadening its market appeal and revenue base.

This approach allows Intersnack to:

- Expand Market Reach: Acquisitions provide immediate access to new geographic markets and customer segments.

- Diversify Product Offerings: Integrating new brands, like Whole Earth Foods, enhances the variety of snacks and food products available to consumers.

- Leverage Synergies: Acquired companies can benefit from Intersnack's existing distribution networks and operational efficiencies, contributing to profitability and further revenue generation.

Innovation and Premium Product Offerings

Intersnack generates significant revenue through the sale of innovative and premium snack products. These offerings often feature clean-label attributes or distinctive flavor profiles, enabling the company to position them at higher price points. This strategy directly targets consumers actively seeking specialized or healthier snack alternatives, thereby expanding Intersnack's revenue capture capabilities.

The company's focus on premiumization allows for increased margin capture. For instance, Intersnack's investment in product development, such as exploring plant-based ingredients or exotic flavor combinations, can lead to products that command a premium over standard offerings. This approach is supported by market trends showing a growing consumer willingness to pay more for perceived quality, health benefits, or unique taste experiences.

- Premium Product Pricing: Sales of innovative and premium snacks, including clean-label and unique flavor options, allow Intersnack to achieve higher average selling prices.

- Targeting Health-Conscious Consumers: The demand for healthier snack options provides a direct revenue stream as consumers are willing to pay a premium for products perceived as better for them.

- Market Differentiation: Unique flavor profiles and ingredient innovations differentiate Intersnack's products, reducing price sensitivity and supporting premium pricing strategies.

Intersnack's revenue is primarily driven by the sale of branded savory snacks across Europe, with key brands like Chio and funny-frisch holding significant market share. The company also generates income through private label production for retailers, leveraging its manufacturing capacity. International sales across over 30 countries, including Australia and New Zealand, are a crucial component of its financial performance, supported by strategic market expansion.

The company's acquisition strategy, exemplified by the 2024 addition of Whole Earth Foods, broadens its brand portfolio and product categories, directly impacting top-line growth. Furthermore, Intersnack capitalizes on premiumization by offering innovative snacks with clean-label attributes or unique flavors, allowing for higher price points and catering to health-conscious consumers.

| Revenue Source | Description | Key Drivers | Market Context (2023/2024) |

| Branded Snack Sales | Sale of potato chips, nuts, baked snacks | Brand recognition (Chio, funny-frisch), market penetration | European savory snacks market valued at ~€45 billion (2023) |

| Private Label Production | Manufacturing for retail partners | Production capacity utilization, retailer relationships | Supports volume sales and operational efficiency |

| International Sales | Sales in over 30 countries | Global distribution network, market expansion strategy | Key presence in Europe, Australia, New Zealand |

| Premium/Innovative Products | Higher-priced snacks with unique attributes | Clean-label, plant-based, unique flavors, R&D investment | Growing consumer demand for healthier and specialized options |

| Acquisitions | Integration of acquired brands/companies | Strategic M&A activity (e.g., Whole Earth Foods in 2024) | Expands brand portfolio and market access |

Business Model Canvas Data Sources

The Intersnack Group Business Model Canvas is built upon a foundation of extensive market research, internal financial reporting, and competitive landscape analysis. These data sources are crucial for accurately defining customer segments, value propositions, and revenue streams.