Intersnack Group GmbH & Co. KG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Intersnack Group GmbH & Co. KG Bundle

The Intersnack Group operates in a dynamic snack market, facing moderate buyer power due to brand loyalty and a wide array of choices. The threat of new entrants is tempered by significant capital requirements and established distribution networks.

While substitute products exist, the strong brand recognition of Intersnack's key brands offers some protection. Supplier power is generally moderate, though specialized ingredients can shift this balance.

The competitive rivalry within the snack industry is intense, with numerous players vying for market share. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Intersnack Group GmbH & Co. KG’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The bargaining power of suppliers for Intersnack can be significant if the supply of crucial raw materials like potatoes, sunflower oil, or specific flavorings is concentrated among a few major players. This concentration allows these suppliers to potentially dictate higher prices or less favorable terms, directly affecting Intersnack's cost of goods sold. For instance, a drought impacting potato yields in a key region could severely limit supply, giving remaining growers more leverage.

The quality and consistency of agricultural raw materials, especially potatoes for chips, are paramount for Intersnack's product excellence and brand image. Suppliers of these key inputs wield significant power if supply is limited or prices are volatile due to weather, disease, or geopolitical events. For instance, potato yields can vary significantly; in 2023, certain European regions experienced reduced potato harvests due to drought, impacting raw material availability.

If Intersnack faces significant expenses or operational hurdles when changing suppliers, such as adapting production machinery or validating new ingredient sources, their existing suppliers gain more influence. This is particularly true if long-term agreements or unique processing demands are in place, making a switch costly. For example, in 2024, the global food ingredient market saw price volatility, making supplier reliability a key concern for companies like Intersnack.

Supplier's Ability to Forward Integrate

A supplier's ability to forward integrate, meaning they could start producing the final savory snacks themselves, presents a notable threat. If a key ingredient supplier, for example, decided to enter the snack market directly, it would significantly alter the competitive landscape for Intersnack. This scenario, while perhaps less likely for basic raw materials, becomes more pertinent for providers of highly specialized ingredients or proprietary processing technologies.

This potential for forward integration by suppliers acts as a substantial barrier if Intersnack were to consider backward vertical integration, such as acquiring its own ingredient production facilities. For instance, if a critical potato supplier for Intersnack's crisps also had the capacity and strategic intent to manufacture crisps, they could leverage their position. While specific data on Intersnack's supplier forward integration capabilities isn't publicly detailed, the broader food industry in 2024 saw continued consolidation, with some ingredient manufacturers exploring value-added product lines.

- Supplier Capability: Suppliers of specialized ingredients or advanced processing technologies possess a higher potential for forward integration into snack manufacturing.

- Market Entry Threat: Direct entry by a key supplier into the savory snack market would intensify competition and potentially disrupt Intersnack's supply chain.

- Vertical Integration Barrier: The threat of supplier forward integration makes Intersnack's potential backward vertical integration more challenging and costly.

- Industry Trends: The food industry in 2024 has shown a trend towards consolidation and value-added product development among ingredient suppliers, increasing this risk.

Differentiation of Supplier's Products

If suppliers provide highly unique or proprietary ingredients crucial for Intersnack's distinct product recipes, their bargaining power strengthens. This could involve specific potato types, specialized flavorings, or specialized packaging. For instance, a supplier of a patented, sustainably sourced potato variety that is key to Intersnack's premium crisp line would hold significant sway.

Intersnack's focus on innovation and maintaining high quality standards often necessitates sourcing these differentiated inputs. This reliance on unique components means suppliers of such materials can command higher prices or more favorable terms, directly impacting Intersnack's cost structure.

- Supplier Differentiation: Suppliers offering unique ingredients like patented potato strains or proprietary flavor blends can exert greater influence.

- Intersnack's Reliance: Intersnack's commitment to innovation and quality means they may depend on these specialized inputs, increasing supplier leverage.

- Impact on Costs: The need for differentiated ingredients can lead to higher procurement costs for Intersnack, affecting profit margins.

The bargaining power of suppliers for Intersnack is influenced by the concentration of key raw material providers. If a few suppliers dominate the market for essential inputs like potatoes or specialized flavorings, they can exert significant price leverage. For example, in 2024, the global agricultural sector faced price volatility due to factors like weather patterns and geopolitical events, which can amplify supplier power.

Intersnack's reliance on specific, high-quality ingredients, such as unique potato varieties or proprietary flavor compounds, also bolsters supplier influence. The cost and complexity of switching suppliers for these differentiated inputs can make Intersnack more susceptible to supplier demands. Industry trends in 2024 highlighted increased consolidation among ingredient manufacturers, potentially further concentrating power.

The potential for suppliers to integrate forward into snack production represents a notable threat, increasing their bargaining power. If a key ingredient provider were to enter the savory snack market, it would directly challenge Intersnack. This dynamic also complicates Intersnack's own potential for backward vertical integration.

| Factor | Impact on Intersnack | 2024 Relevance |

|---|---|---|

| Supplier Concentration | Higher if few suppliers for key inputs | Geopolitical events and climate impacts affecting agricultural output in 2024 increased concentration risks for certain commodities. |

| Switching Costs | Significant for specialized/proprietary ingredients | Innovation in food science means more unique ingredients, raising switching costs and supplier leverage. |

| Supplier Forward Integration | Threatens market share and supply chain stability | Consolidation in the food industry in 2024 saw some ingredient firms exploring value-added products, increasing this risk. |

What is included in the product

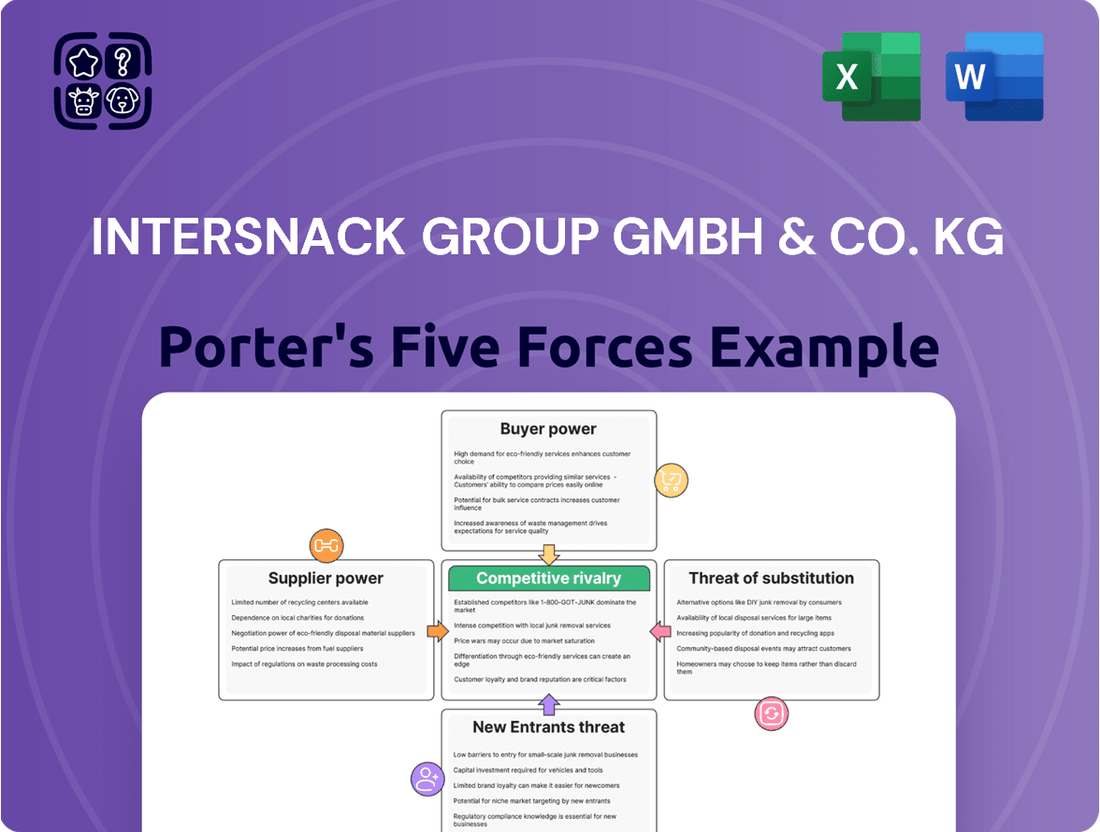

This Porter's Five Forces analysis for Intersnack Group GmbH & Co. KG details the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes within the snack food industry.

Instantly identify and mitigate competitive threats with a clear, actionable Porter's Five Forces analysis, designed for Intersnack to strategically navigate market pressures.

Customers Bargaining Power

Intersnack's reliance on large retailers, such as supermarkets and hypermarkets, significantly amplifies customer bargaining power. These retail giants, controlling a substantial portion of the European snack market, leverage their purchasing volume to negotiate favorable terms, including pricing and prime shelf placement. In 2024, supermarkets alone represented 50% of the total snack sales value across Europe, underscoring their influence.

Consumers in the savory snack market, particularly for widely consumed items like potato chips, often exhibit significant price sensitivity. This means that even small price increases can lead to a noticeable shift in purchasing behavior, putting pressure on companies like Intersnack to maintain competitive pricing strategies.

This price sensitivity directly empowers the end-consumer, and by extension, the retailers who act as intermediaries. When consumers are highly attuned to price, retailers gain leverage in negotiations with manufacturers, as they can more easily switch suppliers if prices become unappealing. This dynamic limits Intersnack's flexibility in passing on rising operational costs, such as ingredient or energy expenses.

While the European snack market is projected for growth, with estimates suggesting a compound annual growth rate (CAGR) of around 3.5% through 2028, price remains a critical determinant of market share. For instance, in 2023, the average price per kilogram for potato chips across major European markets saw fluctuations, underscoring the constant need for brands to balance quality with affordability to capture and retain consumer loyalty.

The bargaining power of customers is significantly amplified by the sheer abundance of snack choices available. Consumers can readily switch to alternative brands or entirely different snack categories if Intersnack's offerings don't meet their expectations on price or quality. This is particularly true in the European market, which is a hotbed of competition.

In 2024, the European savory snacks market alone was valued at an estimated €35 billion, showcasing the vast array of products consumers can choose from. This competitive landscape means that Intersnack Group GmbH & Co. KG must remain highly attuned to customer preferences and pricing strategies to retain market share, as switching costs for consumers are negligible.

Private Label Growth

The rise of private label brands significantly amplifies customer bargaining power. Retailers can use these in-house brands to directly challenge established manufacturers like Intersnack, potentially negotiating more favorable terms or presenting consumers with competing options. This trend is particularly evident in markets like the UK, where consumer preference for private label goods continues to grow substantially.

This shift means customers have more choices, often at lower price points, directly impacting Intersnack's pricing power. Retailers can effectively use their private label offerings as leverage in negotiations.

- Increased Retailer Competition: Retailers are increasingly developing their own brands to compete directly with manufacturers.

- Consumer Preference for Private Labels: In markets like the UK, consumer demand for private label products has seen significant growth, empowering retailers.

- Negotiating Power: The availability of private label alternatives strengthens customers' ability to demand better prices and terms from brands like Intersnack.

Consumer Health and Wellness Trends

The increasing consumer emphasis on health and wellness significantly boosts the bargaining power of customers in the snack industry. This trend drives demand for healthier, natural, and sustainably sourced options, compelling companies like Intersnack to align their product offerings with these evolving preferences. For instance, the global healthy snacks market was valued at approximately $115.7 billion in 2023 and is projected to grow substantially, indicating a strong consumer mandate for attribute-specific products.

This shift in consumer focus grants customers greater leverage, as they can readily switch to brands that better cater to their desire for nutritious and ethically produced snacks. Intersnack's ability to adapt its portfolio to meet these demands directly influences purchasing decisions, effectively transferring power to the consumer. The healthy snacks segment represents a substantial and expanding market, reinforcing the consumer's influential position.

- Growing Health Consciousness: Consumers are actively seeking snacks that contribute positively to their well-being, prioritizing ingredients and nutritional content.

- Demand for Natural and Sustainable Options: There's a rising preference for snacks made with natural ingredients and produced through sustainable practices, influencing brand loyalty.

- Market Growth in Healthy Snacks: The healthy snacks market is a significant and expanding sector, demonstrating consumers' willingness to pay for products that meet their health and wellness criteria.

- Consumer Influence on Product Development: Evolving consumer preferences empower customers to influence product attributes and innovation within the snack industry.

The bargaining power of customers is substantial for Intersnack, primarily due to the concentrated nature of the retail sector and the price sensitivity of consumers. Retailers, especially major supermarket chains, wield significant influence through their purchasing volume, demanding favorable pricing and prominent shelf space. In 2024, supermarkets accounted for a significant portion of European snack sales, reinforcing their negotiating leverage.

Consumers' price sensitivity, particularly for staple snacks like potato chips, means that price fluctuations can directly impact Intersnack's market share. This empowers retailers, as they can easily switch suppliers if pricing becomes uncompetitive, limiting Intersnack's ability to absorb rising operational costs.

The wide array of snack choices available, coupled with the growing popularity of private label brands, further amplifies customer bargaining power. Consumers can readily opt for alternative brands or retailer-owned products, often at lower price points. In 2024, the European savory snacks market, valued at approximately €35 billion, highlights the competitive landscape and the pressure on Intersnack to maintain attractive pricing and quality.

| Factor | Impact on Intersnack | Supporting Data (2024 Estimates) |

|---|---|---|

| Retailer Concentration | High Bargaining Power | Supermarkets represent ~50% of European snack sales value. |

| Consumer Price Sensitivity | High Bargaining Power | Price is a critical determinant of market share in the snack industry. |

| Product Availability & Private Labels | High Bargaining Power | European savory snacks market valued at ~€35 billion, offering diverse choices. |

| Health & Wellness Trend | Increasing Bargaining Power | Global healthy snacks market valued at ~$115.7 billion in 2023. |

What You See Is What You Get

Intersnack Group GmbH & Co. KG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. Our comprehensive Porter's Five Forces analysis of the Intersnack Group GmbH & Co. KG details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the snack industry. This in-depth report is designed to provide actionable insights for strategic decision-making.

Rivalry Among Competitors

The European savory snack market is intensely competitive, featuring a broad array of both regional specialists and large multinational corporations. This fragmentation means Intersnack must constantly innovate and differentiate to maintain its market position.

Global powerhouses such as PepsiCo, with brands like Lay's and Cheetos, and Mondelez International, alongside Kellogg Company's Pringles, exert significant pressure. These companies possess vast resources for marketing, distribution, and product development, making them formidable rivals.

Beyond these giants, Intersnack also contends with strong regional players like Lorenz Snack-World, which often have deep understanding of local tastes and consumer preferences. This diverse competitive landscape necessitates a dynamic and responsive strategy for Intersnack.

The European snack market is growing steadily, especially for healthier and convenient options. However, many Western European countries have mature snack markets, meaning companies are intensely competing for a slice of an already established pie. This dynamic fuels rivalry as businesses fight for every percentage point of market share.

Projections indicate the European snack market will achieve significant revenue by 2030, with some estimates suggesting it could surpass €150 billion. This substantial market size, coupled with its maturity in key regions, intensifies the pressure on companies like Intersnack to innovate and differentiate to capture consumer attention and loyalty.

Competitive rivalry in the snack industry is intense, with companies constantly striving to stand out. This means a continuous stream of new flavors, exciting textures, and healthier ingredient options hitting the shelves. For Intersnack Group, staying ahead means a strong emphasis on product innovation.

Intersnack's commitment to innovation is evident in its development of products like clean-label options and formulations with reduced fat content. This focus is not just about keeping up; it's essential for maintaining a competitive edge in a market that's always evolving. Product diversification and ongoing innovation are indeed the primary engines for growth in this sector.

Brand Loyalty and Marketing Intensity

In the competitive snack industry, cultivating robust brand loyalty is paramount. Intersnack Group benefits from a portfolio of established local and international brands, which aids in customer retention. However, this requires continuous and significant investment in marketing and advertising to cut through the noise and maintain consumer engagement against aggressive competitors.

- Brand Loyalty: Intersnack's strength lies in brands like Tayto, Lorenz, and Chio, which have cultivated significant consumer trust and repeat purchases.

- Marketing Spend: The snack sector is characterized by high marketing intensity. For instance, major players often allocate substantial portions of their revenue to advertising campaigns to build brand visibility and preference.

- Competitive Pressure: Rivals like PepsiCo and Mondelez International also invest heavily in marketing, creating an environment where brand loyalty must be constantly reinforced through innovative product offerings and promotional activities.

- Market Dynamics: In 2024, the snack market continues to see innovation in healthier options and unique flavor profiles, demanding ongoing marketing efforts to communicate these benefits to consumers.

Acquisitions and Consolidations

The snack food industry is characterized by a degree of consolidation, with larger companies frequently acquiring smaller brands. This strategy allows them to broaden their product offerings and tap into new customer bases. For instance, Intersnack's acquisition of Whole Earth Foods in 2024 exemplifies this trend, demonstrating a clear move towards expanding its market presence through strategic mergers.

This consolidation activity intensifies competitive rivalry as it creates larger, more resource-rich entities. These consolidated players often benefit from economies of scale, enhanced distribution networks, and greater bargaining power with suppliers and retailers. Consequently, smaller, independent snack producers face increased pressure to innovate or risk being acquired themselves.

- Market Consolidation: Recent years have seen a notable trend of mergers and acquisitions within the snack sector.

- Strategic Acquisitions: Companies are acquiring smaller brands to expand their portfolios and market reach.

- Intersnack's Growth: Intersnack's acquisition of Whole Earth Foods in 2024 highlights this consolidation strategy.

- Competitive Impact: Such consolidations lead to larger, more dominant players, increasing pressure on smaller competitors.

The competitive rivalry within the European savory snack market is fierce, driven by a mix of global giants and agile regional players. Intersnack Group faces constant pressure from major corporations like PepsiCo and Mondelez, who leverage extensive resources for marketing and product development. This intense competition necessitates continuous innovation in flavors, textures, and healthier options to capture consumer attention and maintain market share.

The market is characterized by significant marketing spend, with companies investing heavily to build brand loyalty and visibility. Intersnack's own brand portfolio, including established names, provides a foundation for customer retention, but ongoing investment is crucial. The trend of market consolidation, exemplified by Intersnack's 2024 acquisition of Whole Earth Foods, further intensifies rivalry by creating larger, more powerful entities.

| Competitor | Key Brands | Estimated 2024 Market Share (Europe) | Notes |

|---|---|---|---|

| PepsiCo | Lay's, Doritos, Cheetos | 10-15% | Strong global presence, extensive distribution. |

| Mondelez International | Oreo, Ritz, Cadbury | 8-12% | Diversified snack portfolio, significant marketing investment. |

| Intersnack Group | Tayto, Lorenz, Chio | 5-10% | Focus on private label and branded snacks, strategic acquisitions. |

| Lorenz Snack-World | NicNacs, Saltletts | 3-5% | Strong regional presence, particularly in Germany. |

SSubstitutes Threaten

The savory snack market, where Intersnack operates, faces a considerable threat from a wide spectrum of alternative snack categories. Consumers can easily opt for sweet biscuits, confectionery, ice cream, fruit snacks, snack bars, or dairy products to satisfy a momentary craving, diverting spending away from traditional savory options. This broad availability of alternatives means consumers have many choices when looking for a quick bite.

The impact of these substitutes is amplified by the significant role snacks play in overall food consumption. In fact, snacks now account for a substantial 40% of all edible grocery sales across Europe. This high percentage underscores the competitive landscape Intersnack navigates, as a large portion of grocery spending is dedicated to snack items, many of which are not direct savory competitors.

The increasing popularity of healthy and functional snacks presents a significant threat of substitutes for traditional savory snacks. Consumers are actively seeking out options that offer added nutritional benefits, such as vitamins, protein, and fiber, or those that align with dietary preferences like being plant-based, clean-label, or low in sugar. This shift in consumer preference directly challenges the market share of established snack manufacturers.

The healthy snack market has seen robust growth, with projections indicating continued expansion. For instance, the global healthy snacks market was valued at approximately $85.3 billion in 2023 and is expected to grow at a compound annual growth rate of around 6.1% from 2024 to 2030. This substantial market expansion means more consumers are choosing these alternatives over conventional savory snacks.

The threat of substitutes for Intersnack's snack products is growing as consumers increasingly turn to meal replacement and on-the-go options. This trend broadens the competitive set to include not just traditional snack brands but also ready-to-eat meals and more substantial, filling snack alternatives designed for convenience. Data from 2024 indicates that a significant portion of consumers, nearly 58%, now favor snacks as meal replacements, directly challenging the traditional snacking occasions Intersnack typically serves.

Homemade and Fresh Food Alternatives

Consumers increasingly opt for homemade snacks or fresh food items like fruits, vegetables, and yogurt, viewing them as healthier choices compared to Intersnack's packaged savory snacks. This trend is amplified by a growing consumer emphasis on food transparency and sustainability, driving demand for less processed options.

The perceived health benefits and control over ingredients in homemade snacks present a significant substitute. For instance, a 2024 survey indicated that 45% of consumers are actively reducing their intake of processed foods, with snacks being a primary focus.

- Health Consciousness: Growing awareness of health and wellness promotes fresh, unprocessed alternatives.

- Ingredient Transparency: Consumers prefer knowing exactly what goes into their food, a benefit of homemade options.

- Sustainability Concerns: The environmental impact of packaged goods can lead consumers to choose simpler, locally sourced fresh foods.

- Cost-Effectiveness: In some cases, preparing snacks at home can be more economical than purchasing pre-packaged items.

Beverages as Snack Substitutes

The threat of substitutes for Intersnack's savory snacks is amplified by the growing popularity of beverages that can fulfill similar roles. Smoothies and protein shakes, for instance, increasingly act as convenient, on-the-go options that provide energy and satiety, directly competing with traditional snack products. This trend is particularly relevant as consumer health consciousness rises, potentially shifting spending away from processed snacks towards these liquid alternatives.

For example, the global market for nutritional shakes and meal replacements was projected to reach over $15 billion by 2024, indicating a significant and growing consumer preference for these beverage-based alternatives. This segment's expansion suggests a tangible diversion of consumer spending that might otherwise go towards snack items.

- Beverage-based snacks: Smoothies and protein shakes offer quick energy and satiety, directly competing with savory snacks.

- Health consciousness driver: Rising consumer focus on health is pushing demand towards perceived healthier liquid alternatives.

- Market growth: The global market for nutritional shakes was expected to exceed $15 billion by 2024, highlighting a significant substitute market.

The threat of substitutes for Intersnack's savory snacks is substantial, encompassing a wide array of food and beverage categories. Consumers can easily choose sweet snacks, fruits, dairy, or even meal replacement beverages, diverting spending from traditional savory options. This broad competitive set is further intensified by the growing trend towards healthier, more transparent, and convenient alternatives.

The market for healthy snacks is expanding rapidly, with global valuations reaching approximately $85.3 billion in 2023 and projected to grow at a 6.1% CAGR through 2030. Furthermore, nearly 58% of consumers in 2024 reported favoring snacks as meal replacements, directly impacting occasions traditionally served by savory snacks. This indicates a significant shift in consumer behavior, favoring options perceived as healthier or more functional.

| Substitute Category | Key Drivers | Market Data/Trends (2024 Focus) |

|---|---|---|

| Healthy Snacks | Health consciousness, nutritional benefits, clean labels | Global market ~$85.3 billion (2023), 6.1% CAGR projected |

| Meal Replacements/On-the-go | Convenience, satiety | 58% of consumers favor snacks as meal replacements |

| Homemade Snacks | Ingredient transparency, perceived health, cost | 45% of consumers reducing processed food intake |

| Beverage-based Snacks (Smoothies, Shakes) | Convenience, energy, health focus | Nutritional shake market projected >$15 billion (2024) |

Entrants Threaten

Entering the savory snack manufacturing sector demands significant upfront capital for state-of-the-art production equipment, extensive distribution channels, and robust marketing campaigns. This high barrier makes it challenging for new players to gain a foothold, especially against established giants like Intersnack Group.

Intersnack's existing infrastructure, boasting 45 production sites globally, provides a considerable competitive advantage, leveraging economies of scale and established market reach.

For instance, Intersnack's recent €85 million investment in expanding production at one of its key plants underscores the substantial financial commitment required to compete effectively in this industry, further solidifying its position against potential new entrants.

New entrants into the snack market face significant hurdles due to Intersnack's deeply ingrained brand loyalty. Consumers often gravitate towards familiar names like Chio, funny-frisch, and Estrella, making it challenging for newcomers to capture market share. This loyalty is built over years of consistent quality and marketing efforts.

Securing prime shelf space in supermarkets is another formidable barrier. Intersnack benefits from established relationships with retailers, ensuring its products are prominently displayed. For a new entrant, gaining this essential visibility requires substantial investment in trade promotions and often involves lengthy negotiations with distributors.

The cost of building brand recognition from scratch is substantial. In 2024, advertising and promotional spending in the fast-moving consumer goods (FMCG) sector, which includes snacks, continued to be a significant factor in market entry. New companies must invest heavily to even approach the awareness levels Intersnack already commands.

Intersnack Group, a major player in the snack industry, benefits significantly from economies of scale. Their vast production volumes allow for reduced per-unit costs in manufacturing, sourcing raw materials, and distributing finished goods. For instance, in 2024, Intersnack's extensive supply chain network likely secured more favorable pricing on potatoes and oils compared to a smaller, emerging competitor. This cost advantage makes it challenging for new entrants to compete on price, as they cannot immediately achieve the same operational efficiencies.

Regulatory Hurdles and Food Safety Standards

The food industry, including snack production, faces significant regulatory hurdles and rigorous food safety standards across Europe. New companies entering this market must invest heavily in understanding and complying with these complex requirements, which often involve extensive testing, documentation, and adherence to specific manufacturing practices. This can be a substantial barrier, deterring potential new entrants due to the upfront costs and time commitment. Intersnack Group, for instance, maintains a strong focus on compliance, holding various certifications and adhering to stringent internal policies to ensure product safety and quality.

Navigating these regulatory landscapes is a critical factor for any new player. For example, the European Food Safety Authority (EFSA) continuously updates guidelines, and compliance with regulations like HACCP (Hazard Analysis and Critical Control Points) is non-negotiable. The financial burden associated with meeting these standards can be considerable, requiring dedicated resources for quality control and legal expertise. This complexity effectively raises the barrier to entry, protecting established players like Intersnack from immediate, widespread competition.

- Regulatory Complexity: New entrants must comply with diverse national and EU food safety laws, including labeling, ingredient sourcing, and production hygiene.

- Cost of Compliance: Meeting these standards involves significant investment in quality assurance systems, certifications, and potentially facility upgrades.

- Time Investment: Obtaining necessary approvals and establishing compliant operations can be a lengthy process, delaying market entry.

- Intersnack's Position: Intersnack's established compliance infrastructure and certifications provide a competitive advantage against nascent competitors.

Access to Raw Materials and Supply Chains

New companies entering the snack food market, particularly those focused on potato-based products like Intersnack, face significant hurdles in securing consistent access to high-quality raw materials at competitive prices. Established players often leverage their scale and long-standing relationships with farmers and suppliers, giving them an advantage in sourcing essential inputs like potatoes. For instance, Intersnack's extensive network likely ensures favorable terms and a stable supply, which is difficult for newcomers to replicate quickly.

The complexity of agricultural supply chains adds another layer of difficulty. New entrants may struggle with the logistical challenges of procurement, quality control, and managing seasonal variations in crop yields. Intersnack's established infrastructure and expertise in supply chain management, built over years of operation, provide a critical competitive edge. This includes efficient transportation, storage, and processing capabilities, all vital for maintaining product quality and cost-effectiveness.

- Supply Chain Dominance: Established companies like Intersnack benefit from deep-rooted supplier relationships, often secured through long-term contracts that guarantee volume and price stability.

- Economies of Scale: Larger players can negotiate better prices for raw materials due to their purchasing volume, a benefit not readily available to new entrants.

- Logistical Expertise: Managing the flow of perishable goods like potatoes requires specialized knowledge and infrastructure, which incumbents have already developed.

- Quality Assurance: Consistent quality is paramount; established firms have robust quality control systems in place from farm to factory, minimizing risks for new competitors.

The threat of new entrants into the savory snack market, particularly for a company like Intersnack Group, is moderately low due to substantial capital requirements for production facilities and distribution networks. Established players benefit from strong brand loyalty and significant marketing budgets, making it difficult for newcomers to gain traction. For instance, the significant investments Intersnack made in 2024, such as expanding production capacity, highlight the financial scale needed to compete.

New entrants also face considerable challenges in securing prime shelf space and building brand recognition against established brands like funny-frisch and Chio. The cost of advertising and promotional activities in the FMCG sector remains high, requiring substantial upfront investment. Intersnack's established relationships with retailers and its strong brand equity present a formidable barrier.

Regulatory complexity and the cost of compliance with food safety standards across Europe are additional deterrents. New companies must invest in quality assurance systems and navigate lengthy approval processes. Intersnack's existing compliance infrastructure and certifications provide a clear advantage, making it harder for new competitors to enter the market without significant resources and expertise.

Securing consistent access to high-quality raw materials at competitive prices is another major hurdle. Intersnack's economies of scale and long-standing supplier relationships allow for better pricing and stable supply chains, which are difficult for new entrants to replicate. Their logistical expertise in handling perishable goods like potatoes also offers a significant competitive edge.

Porter's Five Forces Analysis Data Sources

Our Intersnack Group Porter's Five Forces analysis is built upon a foundation of publicly available information, including Intersnack's annual reports and financial statements, alongside industry-specific market research from sources like Euromonitor and Statista. We also incorporate data from trade associations and news articles to capture current market trends and competitive dynamics.