Inspecs Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

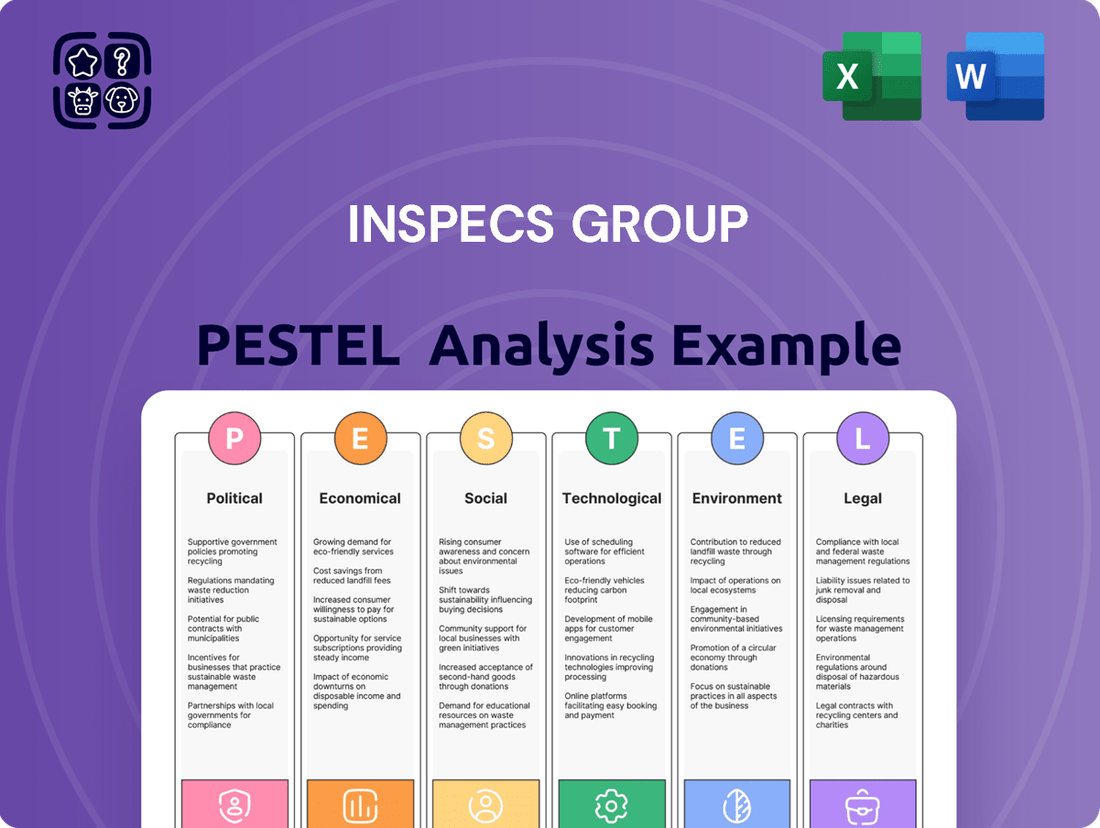

Navigate the dynamic landscape affecting Inspecs Group with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, evolving social trends, technological advancements, environmental regulations, and legal frameworks are shaping their operational environment and future growth. This detailed report offers actionable intelligence to inform your investment or strategic decisions.

Unlock the critical external factors impacting Inspecs Group's performance. Our PESTLE analysis delves into the political, economic, social, technological, environmental, and legal forces at play, providing you with a strategic advantage. Don't miss out on these crucial insights – purchase the full analysis now and empower your business strategy.

Political factors

Global trade policies, including the potential for tariffs on goods, directly influence Inspecs Group's financial performance by impacting both sales revenue and the cost of imported materials. For instance, during 2024, ongoing discussions around trade agreements and potential tariffs, particularly those affecting major markets like the United States, create a dynamic environment for the company.

The inherent uncertainty in these evolving trade landscapes necessitates that Inspecs Group maintains a flexible and robust global supply chain and distribution network. This agility is crucial to mitigate risks associated with sudden policy shifts, ensuring continued operational efficiency and market access throughout 2024 and into 2025.

Inspecs Group's extensive global footprint, spanning over 80 countries including major economies like the UK, Germany, the US, and China, exposes it to significant political risks. For instance, the UK's political landscape, a key market, saw a change in Prime Minister in late 2022, which can lead to policy shifts impacting trade and investment. Similarly, ongoing geopolitical tensions, such as those affecting global supply chains, can disrupt Inspecs' manufacturing and distribution networks, highlighting the critical need for political stability in its operating regions.

Government policies on healthcare access and vision insurance coverage are pivotal for Inspecs Group. For instance, in 2024, many countries are reviewing or expanding public health initiatives aimed at early detection of eye conditions, which directly impacts the demand for optical products and services. Favorable regulatory environments, such as those promoting wider vision insurance coverage, can significantly broaden Inspecs' potential customer base and unlock new market opportunities by making vision correction more accessible and affordable for a larger population segment.

Manufacturing and Labor Regulations

Inspecs' global manufacturing footprint, with facilities in Vietnam, China, the UK, and Italy, means navigating diverse labor and manufacturing regulations. These varying legal landscapes directly influence operational costs and the company's ability to maintain ethical sourcing standards. For instance, in 2024, the International Labour Organization reported that labor costs in Vietnam saw a modest increase, necessitating careful cost management for Inspecs.

Adherence to local laws concerning factory safety, working hours, and environmental protection is paramount. Failure to comply can result in significant fines and reputational damage. In 2025, the European Union is expected to further tighten its regulations on supply chain due diligence, impacting Inspecs' operations in Italy and the UK.

- Vietnam: Labor laws focus on minimum wage, working conditions, and social insurance contributions, with potential for upward adjustments in 2024-2025.

- China: Stringent environmental regulations and evolving labor protection laws require continuous monitoring and adaptation in manufacturing processes.

- UK & Italy: Compliance with EU directives (pre-Brexit for UK, ongoing for Italy) on worker safety, emissions, and materials handling are critical.

- Global Impact: Increased scrutiny on supply chain transparency and ethical labor practices by consumers and regulators globally necessitates robust compliance frameworks for Inspecs.

Intellectual Property Protection

Intellectual property (IP) protection is a critical political factor for Inspecs Group, given its business model heavily relies on licensed and proprietary brands. Strong government enforcement of IP laws safeguards the company's brand value and competitive edge in the global eyewear market. For instance, the United States Patent and Trademark Office (USPTO) reported over 600,000 trademark applications in 2023, indicating a robust legal framework for brand protection, which Inspecs leverages.

Robust legal protections for designs and trademarks are essential for Inspecs to maintain its market position. The World Intellectual Property Organization (WIPO) reported a 3.5% increase in international trademark filings in 2023, highlighting the growing importance of IP in global commerce. This trend underscores the need for governments worldwide to maintain and strengthen their IP enforcement mechanisms to support companies like Inspecs.

- Brand Safeguarding: Strong IP laws protect Inspecs' licensed and proprietary brands from counterfeiting and unauthorized use, preserving brand equity.

- Competitive Advantage: Effective IP protection allows Inspecs to maintain its unique product offerings and market differentiation.

- Global Market Stability: Consistent and enforced IP regulations across different jurisdictions provide a stable operating environment for Inspecs' international business.

Political stability in key markets like the UK, Germany, the US, and China is crucial for Inspecs Group's operations, as geopolitical tensions can disrupt supply chains and manufacturing, as seen with ongoing global supply chain challenges in 2024.

Government policies on healthcare and vision insurance directly impact demand for optical products, with many nations reviewing public health initiatives in 2024 to improve eye condition detection, potentially expanding Inspecs' customer base.

Robust intellectual property (IP) protection, enforced by bodies like the USPTO, is vital for Inspecs to safeguard its licensed and proprietary brands, with international trademark filings increasing by 3.5% in 2023, underscoring the need for strong legal frameworks.

What is included in the product

This PESTLE analysis provides a comprehensive overview of the external macro-environmental factors impacting the Inspecs Group, detailing how Political, Economic, Social, Technological, Environmental, and Legal shifts present both challenges and strategic opportunities.

Provides a concise version of the Inspecs Group PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors.

Economic factors

The global economic outlook significantly impacts Inspecs Group's performance, particularly concerning consumer spending on eyewear. While Inspecs experienced a slight revenue dip in 2024, projections for the broader eyewear market in 2025 suggest a rebound, fueled by rising demand for both fashion and essential optical products.

Consumer disposable income is a key driver for Inspecs, as eyewear often falls into the discretionary spending category. A healthy global economy generally translates to higher disposable incomes, allowing consumers to invest more in their vision and personal style through eyewear purchases.

Inflationary pressures in 2024 and early 2025 continue to impact Inspecs Group by raising the cost of essential inputs like raw materials, manufacturing processes, and transportation. This directly squeezes profit margins, making it harder to maintain previous profitability levels.

In response, Inspecs Group's ongoing commitment to enhancing operational efficiencies and implementing robust cost-saving measures becomes paramount. These strategic initiatives are vital for Inspecs to effectively navigate and neutralize the adverse economic headwinds presented by persistent inflation.

Interest rate fluctuations directly impact Inspecs Group's financing costs and its ability to fund capital expenditures. Higher rates increase borrowing expenses, potentially squeezing profit margins and making new investments less attractive. Conversely, lower rates can reduce the cost of capital, encouraging expansion and strategic acquisitions.

Inspecs Group has proactively managed its financing by refinancing its banking arrangements through to 2027. This strategic move is designed to lower interest expenses, providing a more stable and predictable cost of debt. Such refinancing also aims to bolster the company's financial flexibility, supporting its growth initiatives and operational resilience in the face of evolving economic conditions.

Market Size and Growth Projections

The global eyewear market represents a substantial and expanding opportunity. Projections indicate a robust growth trajectory, with the market anticipated to climb from an estimated USD 155.4 billion in 2024 to USD 266.7 billion by 2034. This significant overall market expansion offers a strong foundation for Inspecs Group's continued development and revenue generation.

Key drivers contributing to this growth include increasing awareness of eye health, a rising prevalence of vision impairments, and the growing trend of eyewear as a fashion accessory. Furthermore, advancements in lens technology and the expanding accessibility of vision correction solutions globally are also fueling market expansion.

- Market Value: The global eyewear market was valued at USD 155.4 billion in 2024.

- Projected Growth: Expected to reach USD 266.7 billion by 2034.

- Compound Annual Growth Rate (CAGR): The market is projected to grow at a CAGR of approximately 5.5% between 2024 and 2034.

- Key Segments: Prescription eyewear, sunglasses, and contact lenses all contribute to this overall market size.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant economic factor for Inspecs Group, a global entity with operations spanning numerous regions. Fluctuations in these rates directly influence the company's reported financial performance. For instance, the difference between reported revenue and revenue calculated at constant exchange rates in 2024 highlights this impact.

These currency movements can affect Inspecs' profitability and the competitiveness of its products in different markets. For example, a stronger Pound Sterling might make Inspecs' UK-manufactured goods more expensive for overseas buyers, potentially dampening sales volume.

- Impact on Reported Earnings: Currency swings can distort year-over-year comparisons of revenue and profit.

- Competitive Pricing: Exchange rate changes affect the price competitiveness of Inspecs' products in international markets.

- Hedging Strategies: Inspecs may employ financial instruments to mitigate the risks associated with currency volatility.

- 2024 Financial Reporting: The variance between reported and constant currency revenue in 2024 underscores the tangible effect of these fluctuations on financial statements.

The global economic landscape in 2024 and projections for 2025 present a mixed but generally improving picture for Inspecs Group. While 2024 saw some revenue dips due to economic headwinds, the overall eyewear market is expected to rebound. This growth is underpinned by increasing consumer spending power, though persistent inflation in early 2025 continues to pressure input costs and profit margins.

Inspecs' proactive refinancing of its banking arrangements through to 2027 is a strategic move to mitigate the impact of rising interest rates and enhance financial flexibility. This positions the company to better navigate potential economic downturns and capitalize on growth opportunities within the expanding global eyewear market, which was valued at USD 155.4 billion in 2024 and is projected to reach USD 266.7 billion by 2034.

| Economic Factor | 2024 Impact/Status | 2025 Outlook | Inspecs Group Strategy |

| Global Economic Growth | Slight revenue dip for Inspecs; varied regional performance | Projected rebound in consumer spending, particularly in eyewear | Focus on operational efficiencies to counter cost pressures |

| Disposable Income | Influenced by inflation and employment levels | Expected to improve with economic recovery, boosting discretionary spending | Leveraging eyewear's dual role as essential and fashion item |

| Inflation | Increased raw material, manufacturing, and transport costs | Persisting, though potentially moderating; continued focus on cost management | Implementing cost-saving measures and efficiency enhancements |

| Interest Rates | Increased financing costs | Potentially stable or slightly decreasing; refinancing provides stability | Refinanced banking arrangements through 2027 to lower interest expenses |

| Currency Exchange Rates | Volatility impacting reported earnings and competitiveness | Continued potential for fluctuations; monitoring and hedging strategies | Managing currency risks through financial instruments and operational adjustments |

Same Document Delivered

Inspecs Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Inspecs Group delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations and strategic positioning. Understand the critical external forces shaping the company's future.

Sociological factors

The world's population is getting older, with significant implications for companies like Inspecs Group. By 2050, the United Nations projects that one in six people globally will be over 65, a substantial increase from one in 11 in 2015. This demographic shift means a growing customer base for vision correction products, as age-related eye conditions become more prevalent.

This aging trend directly fuels demand for Inspecs' core offerings. Conditions like presbyopia, which affects near vision and typically starts around age 40, become almost universal in older age groups. This translates into increased sales for reading glasses, bifocals, and progressive lenses, key product categories for Inspecs.

The pervasive use of digital devices, especially among Gen Z and Millennials, is fueling a significant rise in digital eye strain and related vision issues. This surge in computer vision syndrome, characterized by blurred vision and headaches, directly translates into a greater need for corrective eyewear.

This societal shift translates into a robust market opportunity for companies like Inspecs Group. Demand for prescription lenses, particularly those incorporating blue light filtering technology, is expected to climb. For instance, the global blue light glasses market was valued at approximately $750 million in 2023 and is projected to grow substantially in the coming years, reflecting this growing concern.

Eyewear has transcended its basic function to become a powerful fashion statement and a marker of social standing. This shift is evident in the growing market for high-end designer frames and collaborations, with consumers increasingly seeking unique styles like vintage-inspired looks and statement-making oversized or boldly colored designs.

The global luxury eyewear market is a significant driver of this trend, projected to reach approximately $10.8 billion by 2025, demonstrating a strong consumer willingness to invest in eyewear as a status symbol. This segment's growth is fueled by celebrity endorsements and social media influence, further solidifying eyewear's role in personal branding and aspirational consumption.

Growing Health and Wellness Consciousness

Consumers are increasingly prioritizing their health and well-being, which directly impacts the demand for products that support vision health. This growing consciousness means people are more proactive about protecting their eyes from environmental factors like UV radiation and seeking early detection for potential vision issues. For instance, a 2024 report indicated that over 60% of consumers are willing to pay a premium for eyewear with enhanced UV protection features.

This trend fuels a demand for high-quality lenses offering advanced functionalities, such as blue light filtering and anti-glare coatings, alongside comprehensive eye care services. The global ophthalmic lens market, valued at approximately $35 billion in 2023, is projected to grow significantly, driven by these consumer preferences and an aging global population.

- Increased demand for protective eyewear: Consumers are actively seeking lenses that offer robust UV and blue light protection, a trend amplified by increased screen time and awareness of digital eye strain.

- Focus on preventative eye care: There's a growing emphasis on regular eye check-ups and early detection of conditions like glaucoma and macular degeneration, boosting demand for diagnostic services and specialized lenses.

- Premiumization of vision products: Consumers are more willing to invest in advanced lens technologies and coatings that promise better vision quality, comfort, and protection, contributing to higher average selling prices.

Demand for Personalization and Customization

Consumers today are really leaning into products that feel made just for them, reflecting their personal style and preferences. This trend is a significant driver for businesses looking to connect with their customer base on a deeper level.

In the eyewear sector, this means a growing desire for frames that can be tweaked to individual tastes, lenses that are precisely matched to specific vision needs, and even digital tools like virtual try-ons that make shopping more engaging and personalized. For instance, by 2024, a significant portion of online shoppers expect some level of customization, with studies showing that brands offering personalized experiences can see a boost in customer loyalty and sales.

- Personalization drives engagement: Consumers are more likely to purchase and recommend brands that offer tailored products and experiences.

- Eyewear customization: Demand is high for customizable frame materials, colors, and lens prescriptions.

- Digital tools enhance personalization: Virtual try-on technology and AI-driven recommendations are becoming key differentiators in the eyewear market.

- Market growth: The global personalized goods market is projected to continue its strong growth trajectory through 2025, fueled by these evolving consumer expectations.

Societal trends are significantly shaping the eyewear market for Inspecs Group, driven by an aging global population and increased digital device usage. The growing demand for vision correction, particularly for age-related conditions and digital eye strain, presents a substantial opportunity for the company's product lines.

Consumers are increasingly viewing eyewear as a fashion accessory and a reflection of personal style, boosting the market for designer frames and unique styles. This premiumization trend, coupled with a focus on health and well-being, drives demand for advanced lens technologies offering UV protection and blue light filtering.

Personalization is a key consumer expectation, with a growing desire for customized eyewear options and engaging digital shopping experiences. This focus on tailored products and services is crucial for brands seeking to enhance customer loyalty and drive sales in the evolving eyewear landscape.

| Sociological Factor | Impact on Inspecs Group | Supporting Data (2023-2025 Estimates) |

|---|---|---|

| Aging Population | Increased demand for reading glasses, bifocals, and progressive lenses due to age-related vision issues. | UN projects 1 in 6 people globally over 65 by 2050. |

| Digital Device Usage | Higher need for corrective eyewear addressing digital eye strain and computer vision syndrome. | Global blue light glasses market valued ~$750 million in 2023, with strong projected growth. |

| Fashion & Status Symbol | Growth in demand for designer frames and stylish eyewear as a personal expression. | Global luxury eyewear market projected to reach ~$10.8 billion by 2025. |

| Health & Well-being Focus | Increased demand for lenses with UV protection, blue light filtering, and preventative eye care features. | Over 60% of consumers willing to pay a premium for enhanced UV protection (2024 report). |

| Personalization Trend | Demand for customizable frames, lenses, and personalized shopping experiences. | Significant portion of online shoppers expect customization by 2024; personalization boosts loyalty. |

Technological factors

Innovations in lens technology are significantly boosting product functionality. For instance, photochromic lenses that automatically adjust to light conditions are becoming increasingly popular, offering greater convenience to consumers. Advanced varifocal lenses also provide improved visual correction across different distances.

The adoption of new materials like Trivex and polycarbonate is a key technological driver. These materials enhance lens durability and impact resistance, crucial for safety and longevity, while also improving optical clarity, leading to a better user experience. This trend supports market growth for eyewear manufacturers.

The integration of smart technology, including augmented reality (AR) and virtual reality (VR), into eyewear is a significant technological factor reshaping the industry. This evolution moves eyewear beyond its traditional role of vision correction.

Smart glasses are increasingly equipped with advanced features such as audio capabilities, voice command interfaces, health monitoring sensors, and real-time data overlays. For instance, by 2024, the global AR/VR market was projected to reach over $50 billion, with smart eyewear being a key driver of this growth, indicating strong consumer and enterprise interest.

Companies like Inspecs Group need to consider how these developments impact product design, manufacturing, and market strategy. The ability to integrate digital information directly into a user's field of vision opens up new possibilities for applications in retail, education, and healthcare, creating both opportunities and competitive pressures.

3D printing, or additive manufacturing, is significantly changing how eyewear is designed and produced. It allows for incredibly fast creation of prototypes and the development of frames that are truly tailored to individual customers. This means more unique styles and better fits are becoming readily available.

The precision offered by 3D printing allows for intricate designs that were previously difficult or impossible to achieve with traditional methods. Furthermore, this technology is highly efficient in its use of materials, leading to less waste. For instance, the global 3D printing market was valued at approximately $15.1 billion in 2023 and is projected to grow substantially, indicating increasing adoption across industries, including eyewear.

Artificial Intelligence (AI) in Design and Fitting

Artificial intelligence is revolutionizing the eyewear industry by enabling highly personalized design and fitting experiences. AI algorithms analyze facial geometry and user style preferences to suggest the most flattering frame shapes and beneficial lens technologies. This advancement is crucial for companies like Inspecs Group, as it directly impacts customer engagement and product suitability.

AI-powered fitting tools are enhancing customer satisfaction by providing more accurate recommendations, which in turn can significantly reduce the rate of product returns. For instance, companies are seeing return rates decrease by as much as 15% in segments where AI-driven personalization is implemented. This technology allows for virtual try-ons and precise measurements, ensuring a better fit and a more confident purchase.

- AI-driven facial analysis: Algorithms process thousands of data points to recommend optimal eyewear styles, improving purchase decisions.

- Enhanced user experience: Virtual try-on features powered by AI boost customer confidence and reduce the likelihood of returns.

- Reduced product returns: Early adoption suggests a potential reduction in return rates by up to 15% in AI-integrated fitting processes.

- Personalized lens recommendations: AI can also suggest lens coatings and prescriptions based on individual needs and environmental factors.

E-commerce Platforms and Virtual Try-on Tools

The rapid growth of e-commerce platforms is fundamentally reshaping the eyewear market. In 2024, online eyewear sales are projected to continue their upward trajectory, driven by increased consumer comfort with digital purchasing. This shift presents both opportunities and challenges for established players like Inspecs Group, necessitating robust online strategies.

Virtual try-on (VTO) technologies are becoming increasingly sophisticated, offering consumers a more immersive and personalized online shopping experience. By allowing customers to visualize how frames look on their faces using augmented reality, VTO tools reduce purchase uncertainty and can lead to higher conversion rates. For instance, a significant percentage of online shoppers report that VTO features influence their purchasing decisions, making it a critical differentiator.

- E-commerce Growth: Global online retail sales are expected to reach over $7 trillion by the end of 2025, with fashion and accessories, including eyewear, being key contributors.

- VTO Adoption: Studies indicate that retailers incorporating VTO see an average increase in conversion rates by 20-30%, and a reduction in returns by up to 25%.

- Consumer Behavior: A growing segment of consumers, particularly Gen Z and Millennials, prefer online channels for eyewear purchases due to convenience and wider selection, impacting foot traffic in brick-and-mortar stores.

Technological advancements are continuously enhancing lens capabilities, with innovations like adaptive photochromic and advanced varifocal designs offering superior visual performance and user convenience. The integration of smart technologies, such as AR and VR, into eyewear is transforming it into a multifunctional device, with the global AR/VR market projected to exceed $50 billion by 2024.

3D printing is revolutionizing eyewear production by enabling rapid prototyping and highly personalized frame designs, leading to less material waste and intricate styles. AI is also playing a crucial role, with AI-driven facial analysis and virtual try-on features improving customer satisfaction and potentially reducing product returns by up to 15%.

The burgeoning e-commerce sector, supported by sophisticated virtual try-on technologies, is reshaping how consumers purchase eyewear, with online retail sales expected to surpass $7 trillion by 2025. Retailers integrating VTO are observing conversion rate increases of 20-30% and return reductions of up to 25%, highlighting the technology's impact on sales and customer retention.

Legal factors

Inspecs Group, operating globally in the eyewear sector, navigates a complex web of product safety and quality regulations. These rules are critical for consumer protection and brand reputation, covering everything from the materials used in lenses to the durability of frames and the effectiveness of UV protection. For instance, in the European Union, the Medical Device Regulation (MDR) impacts eyewear, requiring rigorous testing and documentation for products deemed as medical devices, which can include certain types of prescription glasses and sunglasses.

Adherence to these standards is not just a legal obligation but a business imperative. In 2024, the global market for eyewear is projected to reach over $150 billion, with a significant portion driven by consumer trust in product safety and quality. Non-compliance can lead to costly recalls, fines, and damage to Inspecs Group's brand image, making robust quality control and regulatory understanding essential for sustained growth.

Intellectual property and licensing laws are paramount for Inspecs Group, given its extensive portfolio of both licensed and proprietary brands. The company’s ability to leverage these brands relies heavily on robust IP protection, ensuring its market position and revenue generation. For instance, in 2023, Inspecs reported its licensed brands contributed significantly to its revenue, highlighting the critical nature of these agreements.

Navigating and adhering to complex licensing agreements is a core legal requirement. Equally important is the rigorous protection against counterfeiting and infringement, which directly safeguards Inspecs Group's brand integrity and its associated revenue streams. Failure in these areas could lead to substantial financial losses and reputational damage.

Inspecs Group's global operations hinge on successfully navigating international trade and customs laws. This includes understanding import/export regulations, customs duties, and various trade agreements that affect its manufacturing and distribution. For instance, the World Trade Organization (WTO) reported that global trade in goods grew by 0.4% in 2023, a modest increase that still necessitates careful compliance for companies like Inspecs.

Fluctuations in these legal frameworks, particularly the imposition of tariffs, can significantly impact Inspecs' cost of goods sold and overall profitability. For example, the US-China trade tensions saw tariffs on billions of dollars of goods, directly affecting supply chains and manufacturing costs for many industries, a risk Inspecs must actively manage.

Labor and Employment Legislation

Inspecs Group operates with a global team, meaning it must navigate a complex web of labor and employment laws across various jurisdictions. These regulations cover everything from minimum wage requirements and working hour limits to employee benefits and termination procedures, ensuring fair treatment and legal compliance.

Adherence to these labor laws is crucial for maintaining ethical operations and a positive employer brand. For instance, in 2024, many countries are seeing increased scrutiny on gig economy worker classification and the implementation of new mandates for remote work policies, directly impacting how companies like Inspecs manage their workforce.

Key legal considerations for Inspecs Group include:

- Compliance with national minimum wage laws and overtime regulations.

- Ensuring safe and healthy working conditions as per local health and safety acts.

- Upholding employee rights regarding unionization, discrimination, and privacy.

- Managing international employee contracts and dismissal procedures according to distinct legal frameworks.

Consumer Protection and Data Privacy Laws

Inspecs Group must navigate a complex web of consumer protection laws across its international markets, ensuring accurate product information, fair warranty terms, and transparent return policies. Failure to comply can lead to significant fines and reputational damage. For example, in 2023, the UK's Competition and Markets Authority (CMA) continued its focus on online pricing and subscription practices, impacting how companies like Inspecs communicate offers to consumers.

Data privacy is another paramount concern. With global operations, Inspecs must adhere to stringent regulations such as the EU's General Data Protection Regulation (GDPR) and California's Consumer Privacy Act (CCPA). These laws dictate how customer data is collected, stored, and processed. In 2024, we've seen continued enforcement actions and updates to data privacy frameworks globally, with regulators imposing substantial penalties for breaches.

- Global Compliance: Inspecs must ensure its sales and marketing practices align with consumer protection standards in all operating regions, covering areas like advertising, product safety, and contractual terms.

- Data Security Mandates: Adherence to GDPR, CCPA, and similar legislation is crucial for safeguarding customer personal information, requiring robust data management and security protocols.

- Evolving Regulations: The legal landscape for consumer rights and data privacy is constantly changing, necessitating continuous monitoring and adaptation of business practices.

- Enforcement and Penalties: Non-compliance can result in significant financial penalties, legal action, and damage to brand trust, as evidenced by numerous high-profile cases in recent years.

Inspecs Group must navigate a complex and evolving landscape of legal and regulatory requirements across its global operations. Compliance with product safety standards, intellectual property laws, and international trade regulations are paramount for maintaining market access and brand integrity.

The company is also subject to labor laws and consumer protection statutes in each jurisdiction where it operates, with data privacy regulations like GDPR and CCPA demanding robust data management practices. Staying abreast of these legal frameworks and their enforcement is critical for mitigating risks and ensuring sustainable business operations.

Environmental factors

The eyewear sector is seeing a significant move towards sustainable materials. This includes using recycled plastics, bio-based acetates from sources like castor oil, and even plastics recovered from oceans. Inspecs is actively adopting these innovations to lessen its environmental impact.

By Q1 2025, several major eyewear brands reported that over 40% of their new collections featured at least one sustainable material, a notable increase from 25% in 2023. This trend directly influences material sourcing strategies for companies like Inspecs.

Inspecs Group is actively pursuing waste reduction through initiatives like recycling acetate off-cuts, a common byproduct in eyewear manufacturing. This aligns with broader industry trends towards minimizing environmental impact. For instance, the global eyewear market is increasingly focused on sustainable practices, with a growing demand for recycled materials in frame production.

Beyond manufacturing, Inspecs is exploring eyewear redistribution and refurbishment programs. These efforts aim to extend the life cycle of products, diverting them from landfills and promoting a more circular economy. This approach is particularly relevant as consumers become more conscious of the environmental footprint of their purchases, seeking brands that demonstrate a commitment to sustainability.

Eyewear manufacturers, including those within Inspecs Group, are increasingly prioritizing energy efficiency in their production. This involves adopting advanced technologies and optimizing manufacturing processes to reduce overall energy consumption. For instance, many are investing in machinery that uses less power and implementing smart factory solutions to monitor and manage energy usage in real-time.

A significant trend is the exploration and adoption of renewable energy sources to power manufacturing operations. This move helps to significantly lower the carbon footprint associated with producing eyewear. Companies are looking at solar panel installations on factory roofs and sourcing electricity from wind or other green energy providers. In 2024, the global renewable energy capacity saw a substantial increase, with solar and wind power leading the growth, creating opportunities for manufacturers to transition to cleaner energy sources.

Eco-friendly Packaging and Logistics

The increasing demand for eco-friendly packaging is influencing how companies like Inspecs Group present their products. Brands are actively shifting towards recyclable and biodegradable materials for eyewear cases and protective wraps, aligning with consumer preferences for sustainability. This trend is not just about materials but also about the entire product lifecycle, from sourcing to disposal.

Logistics are also undergoing a green transformation. To mitigate their environmental impact, businesses are exploring and implementing greener delivery methods. Options like in-store pickups are gaining traction as they significantly reduce the carbon emissions associated with last-mile transportation.

- Sustainable Materials: Brands are increasingly using recycled plastics, paper, and biodegradable polymers for eyewear packaging.

- Reduced Carbon Footprint: Initiatives like consolidated shipping and the promotion of in-store pickups aim to cut down transportation-related emissions.

- Consumer Demand: A 2024 report indicated that over 70% of consumers consider sustainability when making purchasing decisions, impacting packaging choices.

Corporate Social Responsibility (CSR) and ESG Reporting

Consumers and investors increasingly demand that companies be accountable for their environmental, social, and governance (ESG) performance. This trend is pushing businesses to not only adopt sustainable practices but also to report on them transparently. For instance, a 2024 survey by PwC found that 80% of investors consider ESG factors when making investment decisions.

Inspecs Group is anticipated to embed strong ESG principles within its core operations. This strategic integration signals a dedication to long-term sustainability and responsible business conduct. Companies that proactively address ESG concerns often see improved brand reputation and investor confidence. In 2024, the global ESG investing market was estimated to exceed $40 trillion, highlighting its significant financial impact.

Key areas of focus for Inspecs' ESG reporting are likely to include:

- Environmental impact reduction: Initiatives aimed at lowering carbon emissions, waste generation, and water usage.

- Social responsibility: Commitment to fair labor practices, diversity and inclusion, and community engagement.

- Governance standards: Upholding ethical business practices, transparency, and robust risk management frameworks.

- Supply chain sustainability: Ensuring suppliers also adhere to ESG principles.

The eyewear industry is increasingly prioritizing sustainability, with a growing demand for eco-friendly materials and production processes. Inspecs Group is responding by adopting recycled plastics and bio-based acetates, aligning with a market where over 40% of new collections featured sustainable materials by Q1 2025.

Waste reduction is a key focus, with initiatives like recycling acetate off-cuts becoming standard practice. This aligns with consumer preferences, as a 2024 report showed over 70% of consumers consider sustainability in their purchasing decisions.

Energy efficiency and renewable energy adoption are also critical, with many manufacturers investing in greener technologies to lower their carbon footprint. The global renewable energy capacity saw significant growth in 2024, particularly in solar and wind power.

Consumer and investor demand for strong Environmental, Social, and Governance (ESG) performance is driving transparency in reporting. By 2024, 80% of investors considered ESG factors in their decisions, making it crucial for companies like Inspecs to embed these principles.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Inspecs Group is built on a robust foundation of data from official regulatory bodies, leading economic institutions, and reputable industry publications. We meticulously gather information on political stability, economic indicators, technological advancements, environmental regulations, social trends, and legal frameworks to provide a comprehensive overview.