Inspecs Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

Unlock the strategic core of Inspecs Group's success with our comprehensive Business Model Canvas. This detailed breakdown reveals their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance.

Dive into the actionable insights of Inspecs Group's complete Business Model Canvas, showcasing their key partners, activities, and cost structure. This professionally crafted document is your key to understanding their operational excellence and competitive edge.

Ready to dissect the blueprint of a market leader? Our full Inspecs Group Business Model Canvas provides all nine essential building blocks, meticulously detailing their path to profitability and growth. Download now to gain a competitive advantage.

Partnerships

Inspecs Group's key partnerships with licensed brand holders are foundational to its business model. These collaborations allow Inspecs to design, manufacture, market, and distribute eyewear under the umbrella of well-known fashion and lifestyle names. This strategy leverages existing brand equity, significantly reducing customer acquisition costs and accelerating market penetration.

By securing licenses for brands such as Superdry, Savile Row, Farah, Hype, and Nascar, Inspecs gains immediate access to established consumer bases. For instance, in 2024, the continued strength of these licensed collections contributed to Inspecs' revenue growth, demonstrating the tangible financial benefit of these strategic alliances.

Inspecs Group's collaboration with global retail chains is a cornerstone of its business model, facilitating extensive market penetration and substantial sales. These partnerships are instrumental in launching and distributing key eyewear brands across vast retail networks.

For instance, Inspecs has achieved successful brand introductions into every store of major global retailers, demonstrating the scale and impact of these relationships. This widespread distribution is vital for achieving significant sales volumes and solidifying market presence.

By aligning with these retail giants, Inspecs leverages their established customer base and logistical infrastructure, ensuring its products reach a broad consumer audience efficiently. This strategic alliance is a primary driver for Inspecs' growth and market share in the competitive eyewear industry.

Inspecs Group leverages its relationships with global distributors to access a vast retail footprint. This network reaches approximately 75,000 points of sale in over 80 countries, providing crucial access to independent opticians and diverse retail channels.

These partnerships are fundamental to Inspecs Group's international market penetration. The extensive reach facilitated by these distributors ensures widespread availability of their products, supporting their global sales strategy.

Technology Partners for Innovation

Inspecs actively collaborates with leading global technology firms to foster innovation in eyewear. These partnerships are instrumental in developing advanced lens technologies and digital low vision aids, thereby broadening Inspecs' product portfolio and reinforcing its market position.

These collaborations are vital for Inspecs' research and development initiatives, enabling the company to stay at the forefront of technological advancements. For instance, in 2024, Inspecs continued to invest in digital manufacturing processes, aiming to reduce production lead times by an estimated 15% through AI-driven design optimization.

- Advanced Lens Development: Partnering with specialists to create next-generation lens materials offering enhanced optical clarity and UV protection.

- Digital Low Vision Aids: Collaborating on the integration of smart technology into eyewear for individuals with visual impairments, improving accessibility.

- Manufacturing Process Optimization: Working with tech providers to implement AI and automation in production, boosting efficiency and quality control.

- Data Analytics for Product Improvement: Leveraging partnerships to analyze consumer data for informed product development and personalized offerings.

Raw Material and Component Suppliers

Inspecs Group relies heavily on its raw material and component suppliers to maintain its manufacturing operations. Building robust relationships with these partners is crucial for securing high-quality inputs, which directly impacts the final product's quality and Inspecs' reputation.

These partnerships are key to managing operational costs. By negotiating favorable terms and ensuring a consistent supply, Inspecs can mitigate price volatility and improve its gross profit margins. For instance, in 2024, Inspecs continued to focus on optimizing its procurement strategies to counter inflationary pressures on raw material costs.

- Supplier Relationships: Strong ties with suppliers ensure consistent access to essential materials like acetate, metal alloys, and specialized lenses.

- Cost Management: Effective supplier negotiations in 2024 helped Inspecs manage the rising costs of key inputs, contributing to margin stability.

- Quality Assurance: Partnerships with reputable suppliers guarantee the quality of raw materials, a critical factor in Inspecs' premium eyewear components.

- Supply Chain Efficiency: Reliable suppliers reduce lead times and minimize production disruptions, enhancing overall operational efficiency.

Inspecs Group's key partnerships extend to its supply chain, ensuring access to high-quality raw materials and components. These relationships are vital for maintaining production quality and managing costs effectively. In 2024, Inspecs focused on optimizing procurement to mitigate inflationary pressures, aiming for stable gross profit margins.

These supplier alliances are critical for operational efficiency, guaranteeing consistent material flow and minimizing production delays. By securing reliable sources for acetate, metal alloys, and specialized lenses, Inspecs upholds its commitment to quality and timely delivery.

The strength of these partnerships directly impacts Inspecs' ability to innovate and scale. Collaborations with technology firms are driving advancements in lens technology and digital low vision aids, as seen in 2024's investment in AI-driven design optimization for manufacturing, targeting a 15% reduction in lead times.

| Partnership Type | Key Benefit | Example Brands/Entities | 2024 Impact/Focus |

|---|---|---|---|

| Licensed Brand Holders | Brand equity, reduced acquisition costs | Superdry, Savile Row, Farah, Hype, Nascar | Continued revenue growth |

| Global Retail Chains | Market penetration, sales volume | Major global retailers | Widespread product introductions |

| Global Distributors | Extensive retail footprint | 75,000+ POS in 80+ countries | International market access |

| Technology Firms | Innovation, R&D | AI/automation providers | Digital manufacturing investment, 15% lead time reduction target |

| Raw Material Suppliers | Quality inputs, cost management | Acetate, metal alloy, lens providers | Procurement optimization against inflation |

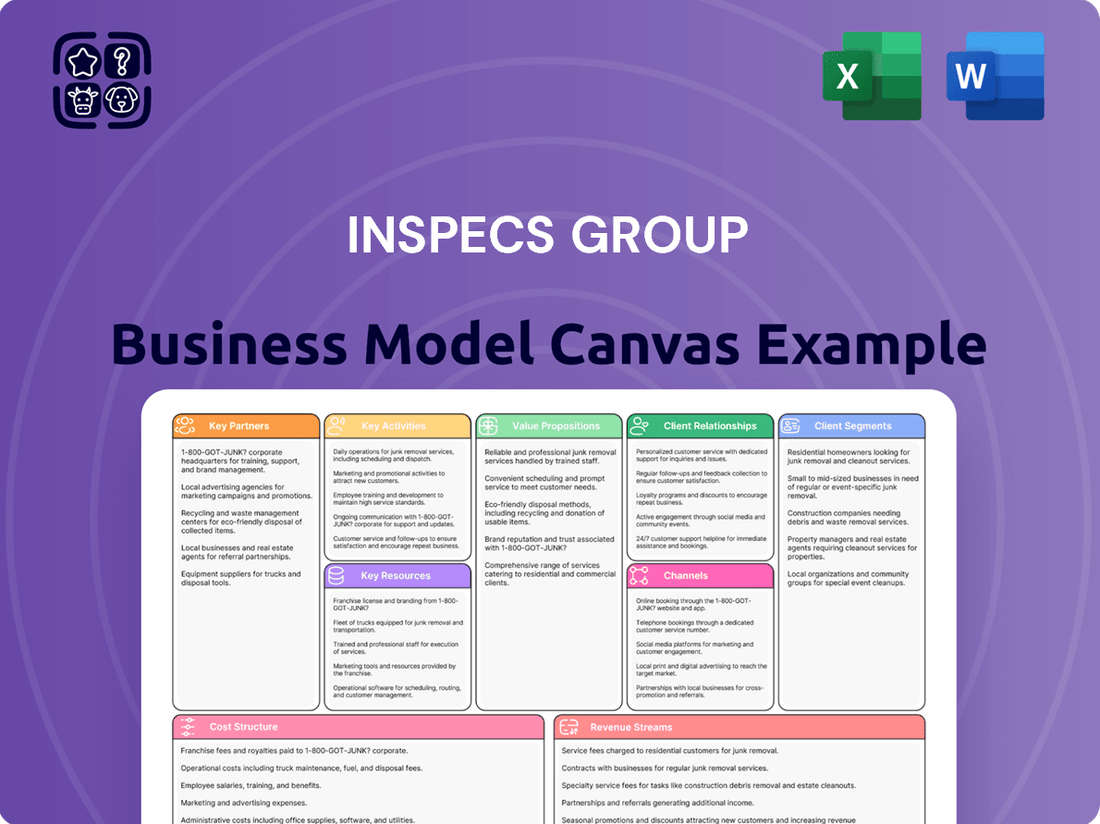

What is included in the product

This Business Model Canvas provides a strategic overview of Inspecs Group's operations, detailing its customer segments, value propositions, and key resources, all structured within the classic nine building blocks.

It offers a clear, actionable framework for understanding Inspecs Group's competitive advantages and potential growth areas, suitable for strategic planning and stakeholder communication.

The Inspecs Group Business Model Canvas acts as a pain point reliever by offering a clear, visual roadmap to navigate complex compliance and quality assurance challenges.

It simplifies the process of understanding and addressing regulatory hurdles, making it easier for businesses to achieve market access and maintain product integrity.

Activities

Inspecs Group's core activities revolve around the design and development of a wide range of eyewear, encompassing optical frames, sunglasses, and specialized lenses. This includes a forward-thinking approach to innovative products, such as high-tech low vision aids, demonstrating a commitment to addressing diverse consumer needs.

This design and development process is powered by dedicated research and development teams and a network of in-house, award-winning creative design studios strategically located across the globe. These studios are crucial for fostering innovation and ensuring a continuous pipeline of new and cutting-edge eyewear concepts.

The company's strategic objective is to consistently bring novel and improved eyewear products to market. For instance, in 2023, Inspecs launched over 1,000 new SKUs, a testament to their robust design and development capabilities and their commitment to product innovation.

Inspecs Group's core activities heavily revolve around manufacturing and production, with a significant emphasis on eyewear. The company operates its own state-of-the-art factories strategically located across Vietnam, China, the UK, and Italy. This robust in-house manufacturing capability enables Inspecs to produce a wide array of eyewear, from high-end titanium and metal to acetate and injected frames, ensuring control over quality and volume.

The expansion of its manufacturing footprint is a key driver of growth. Notably, the recent completion of a new 10,000 square meter facility in Vietnam has substantially boosted Inspecs' production capacity. This expansion is crucial for meeting the increasing global demand for their diverse eyewear offerings.

Inspecs Group actively promotes its broad range of eyewear brands, encompassing licensed, proprietary, and distribution offerings, to a worldwide customer base. This involves introducing new product lines and brands, such as the innovative Reactolite photochromic lenses and the Optaro digital low vision aids, demonstrating their commitment to product development and market expansion.

Effective brand management is crucial for Inspecs in boosting the market penetration of its own-brand portfolio and its licensed products. For instance, in 2023, the company continued to invest in marketing initiatives to strengthen brand recognition and drive sales across its various segments, contributing to its overall revenue growth.

Global Distribution and Sales

A fundamental activity for Inspecs Group involves the global distribution and sale of eyewear products. This encompasses reaching a diverse customer base, from large retail chains to smaller independent opticians across the globe.

The company's extensive distribution network is a key enabler, covering more than 80 countries and extending its reach to approximately 75,000 points of sale. This vast network requires sophisticated management of logistics and sales channels to ensure efficient product delivery and market penetration in various regions.

- Global Reach: Inspecs Group distributes eyewear to over 80 countries.

- Extensive Network: The company serves approximately 75,000 points of sale worldwide.

- Channel Management: Efficiently managing logistics and sales across diverse international markets is crucial.

Lens Manufacturing and Glazing Services

Inspecs Group's lens manufacturing and glazing services are integral to its comprehensive eyewear solutions. Beyond just frames and sunglasses, Inspecs develops advanced lens technologies, including new varifocal lens designs, and curates specialist sunglass collections. This vertical integration ensures a complete eyewear offering for their diverse customer base.

These capabilities allow Inspecs to control quality and innovation across the entire product lifecycle. For instance, their investment in lens technology directly supports the performance and appeal of their branded and private label eyewear. In 2024, the eyewear market continued its growth trajectory, with a particular emphasis on personalized vision solutions and advanced sunglass features, areas where Inspecs' lens services play a crucial role.

- Lens Development: Focus on innovation in areas like varifocal technology to enhance visual comfort and performance.

- Specialist Collections: Creation of curated sunglass ranges with specific functionalities and aesthetic appeal.

- Integrated Solutions: Providing a complete eyewear package, from frame design to finished lenses, for a seamless customer experience.

Inspecs Group's key activities center on the design, manufacturing, and global distribution of a wide array of eyewear. This includes developing innovative optical frames, sunglasses, and advanced lens technologies. The company operates its own factories in Vietnam, China, the UK, and Italy, ensuring quality control and production capacity.

Brand promotion and management are vital, covering licensed, proprietary, and distribution brands. Inspecs actively markets its products to a worldwide customer base. The company's extensive distribution network reaches over 80 countries, serving approximately 75,000 points of sale.

Lens manufacturing and glazing services are also core, with a focus on advanced lens designs and specialist sunglass collections. This vertical integration allows Inspecs to offer complete eyewear solutions, from frames to finished lenses, meeting diverse consumer needs. In 2023, Inspecs launched over 1,000 new SKUs, showcasing their commitment to product innovation and market responsiveness.

| Key Activity | Description | Recent Data/Impact |

|---|---|---|

| Design & Development | Creating new eyewear concepts and product lines, including specialized aids. | Launched over 1,000 new SKUs in 2023. |

| Manufacturing | Producing a diverse range of eyewear using in-house, state-of-the-art facilities. | Operates factories in Vietnam, China, UK, and Italy; expanded Vietnam facility. |

| Distribution & Sales | Supplying eyewear to a global market through an extensive sales and logistics network. | Reaches over 80 countries and ~75,000 points of sale. |

| Lens Technology | Developing and integrating advanced lens solutions into their eyewear offerings. | Focus on varifocal designs and specialist sunglass lenses; growth in personalized vision solutions noted for 2024. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas preview you are viewing is an authentic representation of the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to what you will download, ensuring no surprises and immediate usability. You'll gain full access to this comprehensive business model, ready for your strategic planning and execution.

Resources

Inspecs Group's proprietary and licensed brand portfolio is a cornerstone of its business model, featuring 28 licensed and 18 proprietary brands. This extensive collection, which includes popular names like Titanflex and Humphrey's, offers significant market penetration and broad customer appeal.

The diversity within this portfolio allows Inspecs to cater to a wide range of consumer preferences and price points, strengthening its competitive edge. For instance, the success of brands like Titanflex, known for its innovative flexible materials, demonstrates the value derived from carefully curated brand assets.

Inspecs Group's key resources include its strategically located global manufacturing facilities. The company operates production sites in Vietnam, China, the UK, and Italy. Specifically, its Vietnam operations boast a significant 18,000 square meters of production space.

These facilities are crucial for Inspecs Group as they allow for direct control over the manufacturing process, ensuring quality and driving cost efficiencies. This in-house capability is a core strength.

The recent expansion of the Vietnam facility is poised to significantly enhance future growth and production capacity. This investment underscores the importance of these operational hubs for the company's strategic objectives.

Inspecs Group leverages highly skilled design and R&D teams across its global network, including key locations like Bath (UK), Lisbon, and Hong Kong. These teams are the engine of innovation, constantly pushing boundaries to create novel eyewear designs and develop cutting-edge technologies. Their expertise is fundamental to maintaining Inspecs' competitive edge.

These award-winning creative studios and dedicated research and development professionals are responsible for a continuous stream of new product introductions and enhancements. For instance, Inspecs' commitment to R&D is reflected in their development of advanced materials and manufacturing processes. This focus ensures they remain at the forefront of eyewear trends and functional improvements, directly contributing to their product pipeline and market appeal.

Extensive Global Distribution Network

Inspecs Group's extensive global distribution network is a cornerstone of its business model. This network covers over 80 countries, ensuring broad product availability and deep market penetration. It's a vital asset that allows Inspecs to efficiently serve a vast and diverse customer base.

This expansive reach is further quantified by its presence in approximately 75,000 points of sale worldwide. This vast network facilitates not only sales but also efficient logistics and customer service across different regions.

- Global Reach: Operates in over 80 countries, demonstrating significant international market penetration.

- Extensive Network: Serves approximately 75,000 points of sale, highlighting broad accessibility to its products.

- Market Access: Enables Inspecs to efficiently reach and serve a diverse global clientele.

Intellectual Property and Patents

Inspecs Group leverages intellectual property, including patents for unique eyewear designs and manufacturing advancements. This strategic protection safeguards their innovative edge and manufacturing efficiency, creating a distinct market advantage.

The company's focus on patented concept frames directly impacts its financial performance. For instance, in 2024, Inspecs reported that its patented product lines were instrumental in driving higher gross profit margins, underscoring the commercial value of their IP.

- Patented Designs: Inspecs holds patents covering specific eyewear concepts and technologies.

- Competitive Advantage: Intellectual property protects innovative designs and manufacturing processes.

- Profitability Impact: Increased sales of patented concept frames contribute to improved gross profit margins.

Inspecs Group's key resources also encompass its robust financial backing and strong capital structure. This financial strength is vital for funding operations, acquisitions, and strategic investments. For example, in early 2024, the company successfully raised significant capital through a bond issuance, demonstrating investor confidence and providing ample resources for continued growth and development.

Value Propositions

Inspecs Group's value proposition centers on delivering a diverse and comprehensive eyewear portfolio. This includes a wide array of frames, sunglasses, and lenses designed for optical, sunglass, safety, and low vision applications, effectively acting as a one-stop solution for varied customer needs.

The company caters to a broad market by offering both branded eyewear, encompassing licensed and proprietary collections, and original equipment manufacturer (OEM) products. This dual approach allows Inspecs to serve different market segments and customer preferences, from brand-conscious consumers to businesses seeking tailored eyewear solutions.

In 2024, the global eyewear market was valued at approximately $150 billion, with sunglasses and optical frames representing significant portions. Inspecs' strategy to cover multiple eyewear categories positions it to capture a substantial share of this expansive and growing market.

Inspecs Group prioritizes exceptional quality and manufacturing prowess, producing vast quantities of eyewear in-house. Their capabilities span diverse materials including titanium, metal, acetate, and injected plastics, ensuring a wide product range.

This dedication to superior output is underpinned by a vertically integrated business model and proprietary factories. This structure allows Inspecs to maintain industry-benchmark product standards, a key element of their value proposition.

For instance, in 2024, Inspecs continued to invest in its manufacturing facilities, aiming to enhance efficiency and quality control across its diverse material processing capabilities. This focus on in-house production directly contributes to their ability to deliver high-quality, customized eyewear solutions.

Inspecs Group places a strong emphasis on innovation and advanced technology to drive its value proposition. This commitment is evident in their development of new eyewear products, including cutting-edge lenses and digital low vision aids. For instance, in 2023, the company successfully relaunched several photochromic lens brands and introduced new varifocal lens technologies, demonstrating a tangible investment in R&D.

Global Reach and Accessibility

Inspecs Group boasts an impressive global footprint, ensuring its eyewear is readily available to a vast customer base. This is facilitated by a distribution network that spans over 80 countries, reaching approximately 75,000 points of sale worldwide.

This extensive network means that global retailers, distributors, and even individual opticians can easily access Inspecs' diverse range of eyewear products. The company's commitment to widespread accessibility is a significant competitive advantage, allowing it to serve a broad international market effectively.

- Global Distribution Network: Over 80 countries served.

- Extensive Retail Presence: Approximately 75,000 points of sale.

- Broad Customer Access: Caters to global retailers, distributors, and independent opticians.

- Key Strength: Global presence underpins market penetration and customer reach.

Balanced Portfolio of Brands

Inspecs Group cultivates a robust portfolio that artfully blends globally recognized licensed brands with its own powerful proprietary brands. This strategic mix ensures broad market appeal, catering to diverse consumer tastes and demands.

This balanced approach is a cornerstone of Inspecs’ value proposition, enabling them to serve a wide spectrum of customers, from major international optical chains to smaller, independent opticians.

For example, in their 2023 fiscal year, Inspecs reported a significant contribution from their licensed brand segment, alongside consistent growth in their proprietary offerings, demonstrating the synergy of this diversified strategy. This blend allows Inspecs to capture market share across various price points and styles.

- Diversified Brand Offering: Includes licensed, proprietary, and private label (OEM) brands.

- Market Segmentation: Caters to different customer preferences and market niches.

- Broad Client Base: Serves both large global chains and independent optical practices.

- Revenue Synergy: Leverages the strengths of each brand category for overall growth.

Inspecs Group offers a comprehensive eyewear solution, providing a vast range of frames, sunglasses, and lenses for optical, sunglass, safety, and low vision needs. This extensive portfolio acts as a one-stop shop for diverse customer requirements.

The company excels in delivering high-quality eyewear through its vertically integrated model and in-house manufacturing capabilities. This allows for rigorous quality control and efficient production across various materials like titanium, metal, and acetate.

Innovation is a key driver, with Inspecs investing in advanced lens technologies and digital aids, exemplified by their 2023 relaunch of photochromic lenses and new varifocal technologies.

Their global distribution network, reaching over 80 countries and approximately 75,000 points of sale, ensures broad accessibility for retailers and opticians worldwide.

| Value Proposition Component | Description | Supporting Data/Examples |

| Comprehensive Eyewear Portfolio | One-stop solution for diverse eyewear needs (optical, sunglass, safety, low vision). | Covers frames, sunglasses, and lenses. |

| Quality & Manufacturing Prowess | In-house production with diverse material capabilities and vertical integration. | Industry-benchmark standards, investment in 2024 manufacturing facilities. |

| Innovation & Technology | Development of new products, lenses, and digital aids. | 2023 relaunch of photochromic lenses and new varifocal technologies. |

| Global Distribution & Accessibility | Extensive network reaching a vast customer base. | Over 80 countries, ~75,000 points of sale. |

| Brand Diversification | Blend of licensed, proprietary, and OEM brands. | Synergy in fiscal year 2023, catering to broad market appeal. |

Customer Relationships

Inspecs Group cultivates robust connections with international retailers and distributors via specialized sales and account management personnel. This dedicated approach guarantees personalized service, streamlined order fulfillment, and continuous assistance for high-volume clients.

These strong relationships are fundamental to Inspecs' success in securing and preserving significant distribution contracts. For instance, in 2024, Inspecs reported that over 70% of its revenue was generated from long-term agreements with key accounts, underscoring the critical role of dedicated account management.

Inspecs Group cultivates enduring partnerships with independent opticians across the globe. This involves ensuring a steady flow of high-quality eyewear and offering dedicated support tailored to their unique operational requirements. For instance, Inspecs reported a significant increase in its customer base in 2024, driven by these strong optician relationships.

Direct engagement is key to understanding and meeting the specific needs of these independent businesses. By fostering trust and demonstrating reliability, Inspecs solidifies its position as a valued supplier, contributing to the stability of their business operations.

Inspecs Group prioritizes customer satisfaction through robust after-sales support and services, addressing any product issues promptly. This dedication fosters strong customer loyalty and a positive brand image, crucial for repeat business and referrals.

In 2024, Inspecs continued to invest in its customer service infrastructure, aiming to reduce response times for technical queries by 15%. This focus on reliable support directly enhances the overall customer experience, reinforcing their commitment beyond the initial purchase.

Brand-Specific Engagement

Inspecs Group cultivates brand-specific engagement for its proprietary and licensed brands, aiming to build strong customer loyalty. This involves tailored marketing campaigns and direct relationship-building initiatives designed to resonate with each brand's unique audience.

These efforts often manifest through promotional events, personalized communication channels, and the development of vibrant brand communities. For instance, in 2024, Inspecs saw a notable increase in repeat purchases from customers who participated in their exclusive online brand events, indicating the effectiveness of this strategy in strengthening brand affinity.

- Targeted Promotions: Implementing exclusive offers and early access programs for loyal customers of specific brands.

- Community Building: Fostering online and offline communities where customers can connect with the brand and each other.

- Direct Communication: Utilizing personalized email marketing and social media engagement to maintain ongoing dialogue.

- Brand Storytelling: Leveraging content marketing to highlight the heritage and values of each brand, deepening emotional connection.

Operational Efficiency and Cost Savings Passed On

Inspecs Group's commitment to operational efficiency and cost savings directly translates into customer value. By optimizing processes and cutting expenses, the company can offer more competitive pricing, a significant draw for its diverse customer base. This focus allows Inspecs to potentially reinvest in enhancing product quality and driving innovation, further benefiting clients.

Recent financial disclosures underscore this strategy. For the fiscal year ending December 31, 2023, Inspecs Group reported a notable improvement in its operating margins, partly attributable to successful cost-reduction programs. These savings are a direct outcome of streamlined manufacturing and supply chain management, demonstrating a tangible benefit passed on to customers through enhanced value propositions.

- Enhanced Value Proposition: Operational efficiencies allow for more competitive pricing or reinvestment in product quality.

- Cost Savings Initiatives: Continuous focus on streamlining operations leads to reduced overhead.

- Customer Benefit: Customers gain from more affordable products and improved service.

- Financial Performance: Improved operating margins in 2023 reflect successful cost-saving strategies.

Inspecs Group nurtures relationships with international retailers and distributors through dedicated sales and account management teams. This ensures personalized service and efficient order processing for key clients, with over 70% of 2024 revenue stemming from long-term agreements.

The company also builds strong partnerships with independent opticians globally, providing consistent, high-quality eyewear and tailored support. This focus contributed to a significant increase in Inspecs' customer base in 2024.

Brand-specific engagement strategies, including promotional events and personalized communication, foster customer loyalty for Inspecs' proprietary and licensed brands. Participation in these initiatives in 2024 led to a notable rise in repeat purchases.

| Relationship Type | Key Engagement Strategy | 2024 Impact/Data |

|---|---|---|

| International Retailers/Distributors | Specialized Sales & Account Management | >70% Revenue from Long-Term Agreements |

| Independent Opticians | Consistent Quality & Tailored Support | Significant Customer Base Growth |

| Brand Customers | Promotional Events & Personalized Communication | Notable Increase in Repeat Purchases |

Channels

Inspecs Group's direct sales to global retailers represent a cornerstone of its business model, enabling the company to place its eyewear products directly with major international retail chains. This strategy capitalizes on existing strong relationships and substantial volume agreements, ensuring widespread product availability and brand visibility. For instance, Inspecs secured significant placements with a leading European optical retailer in late 2023, a move that is projected to contribute an estimated €15 million in revenue for 2024.

This channel is vital for accessing a vast consumer audience through well-recognized retail environments, effectively bypassing intermediaries and fostering direct brand engagement. The success of recent product launches with prominent global retailers underscores the channel's effectiveness and its contribution to market penetration. In 2024, Inspecs expanded its offerings with a major North American department store chain, adding approximately 500 new points of sale and targeting a 10% increase in direct-to-retail sales volume for the year.

Inspecs Group leverages a strong wholesale distribution strategy, reaching independent opticians and smaller distributors worldwide. This approach is key to achieving broad market penetration, particularly in varied geographic areas and smaller retail settings.

The company's distribution network is extensive, spanning more than 80 countries. This vast reach allows Inspecs to connect with approximately 75,000 points of sale, demonstrating its commitment to serving a diverse global customer base.

Online B2B portals and sales platforms are crucial for Inspecs Group to manage its global reach. These digital marketplaces streamline order processing, communication, and product catalog management for its diverse network of retailers and distributors worldwide.

The adoption of such platforms is a significant trend in international trade, enhancing efficiency and accessibility. For instance, the global B2B e-commerce market was projected to reach $20.9 trillion by 2027, highlighting the importance of digital channels for businesses like Inspecs.

Travel Retail Markets

Inspecs Group is actively expanding its footprint within the travel retail sector, a key distribution channel targeting the global traveling consumer through duty-free shops and airport boutiques. This segment is particularly attractive for showcasing premium and exclusive eyewear lines, appealing directly to travelers seeking luxury or unique products. The strategic focus on this channel is yielding significant results, with revenue from travel retail surging by 45% in the first half of 2024, underscoring its increasing importance to the group's overall performance.

The growth in travel retail reflects a strategic effort to capitalize on passenger traffic and consumer spending habits in a high-visibility environment. This channel offers a unique opportunity to engage with a diverse international customer base.

- Channel Focus: Travel retail, encompassing duty-free and airport locations.

- Target Audience: International travelers seeking premium and exclusive eyewear.

- Performance: Achieved a 45% revenue increase in H1 2024, highlighting strong growth momentum.

Company Website and Investor Relations Portals

The Inspecs Group website acts as the central hub for all corporate communications and investor relations activities. It's where the company showcases its diverse brand portfolio and provides essential information to stakeholders.

While not a direct-to-consumer sales platform, the website is crucial for informing investors, potential business partners, and the wider financial community. It offers direct access to key documents like annual reports and financial updates, ensuring transparency.

- Primary Communication Channel: The website serves as the main platform for Inspecs Group's corporate messaging and brand presence.

- Investor Relations Hub: It provides essential financial data, annual reports, and investor presentations. For instance, as of their latest reporting period in 2024, investors can access detailed financial statements and strategic updates directly on the site.

- Brand Portfolio Showcase: The site highlights the breadth of brands under the Inspecs Group umbrella, illustrating their market reach and product diversity.

- Stakeholder Information: It's a vital resource for keeping shareholders, potential partners, and analysts informed about the company's performance and future direction.

Inspecs Group utilizes a multi-faceted channel strategy to reach its diverse customer base. Direct sales to global retailers are a primary focus, leveraging relationships with major optical chains for widespread product availability. Complementing this, a robust wholesale distribution network ensures access to independent opticians and smaller distributors across more than 80 countries, reaching approximately 75,000 points of sale.

Digital presence is managed through online B2B portals, streamlining operations for retailers and distributors, aligning with the projected growth of the global B2B e-commerce market. The travel retail sector is also a key growth area, with a 45% revenue increase in the first half of 2024 from duty-free and airport locations. The corporate website serves as the central hub for investor relations and brand showcases, providing essential transparency to stakeholders.

| Channel | Target Audience | Key Strategy | 2024 Impact/Data Point |

|---|---|---|---|

| Direct to Global Retailers | Major optical chains | Volume agreements, brand visibility | Secured placement with European retailer (€15M projected revenue), expanded with North American department store (500 new POS) |

| Wholesale Distribution | Independent opticians, smaller distributors | Broad market penetration, geographic diversity | Presence in >80 countries, ~75,000 POS |

| Online B2B Portals | Retailers, distributors | Streamlined ordering, communication, catalog management | Supports global network efficiency |

| Travel Retail | International travelers | High-visibility locations, premium offerings | 45% revenue surge in H1 2024 |

| Corporate Website | Investors, partners, financial community | Information hub, investor relations, brand showcase | Direct access to 2024 financial statements and strategic updates |

Customer Segments

Global optical retail chains represent a significant customer segment for Inspecs Group, demanding substantial volumes of optical frames, sunglasses, and lenses. These large-scale operations often procure both branded and original equipment manufacturer (OEM) products directly from Inspecs, highlighting the group's crucial role in their supply chain.

In 2024, the global eyewear market continued its robust growth, with the optical retail sector being a major driver. Inspecs' ability to cater to these chains with diverse product offerings and direct supply agreements positions them as a key partner in this expanding market, which is projected to reach over $70 billion by 2028.

Independent opticians form a crucial customer base for Inspecs Group, with the company serving this segment across its expansive distribution network spanning over 80 countries. These businesses rely on Inspecs for a diverse inventory, encompassing both proprietary and licensed eyewear brands, which is essential for meeting varied customer demands.

Furthermore, many independent opticians leverage Inspecs' lens manufacturing capabilities, integrating these services to offer a comprehensive eyewear solution to their own clientele. This dual offering highlights Inspecs' role as a key supplier and service provider within the independent optical sector, supporting their operational needs and product portfolios.

Global eyewear distributors are a cornerstone of Inspecs Group's strategy, acting as vital conduits to broader markets. These partners receive Inspecs' diverse product range, including their latest 2024 collections, and manage the complex logistics of reaching numerous retail outlets worldwide. Their expertise in regional distribution networks significantly amplifies Inspecs' market penetration, particularly in areas where direct engagement would be less effective.

The relationship with these distributors is paramount for Inspecs' global expansion efforts. By leveraging their established infrastructure, Inspecs can efficiently introduce new eyewear designs and technologies to a wider customer base. For instance, Inspecs' focus on sustainable materials in their 2024 offerings is effectively communicated and distributed through these key channels, reaching environmentally conscious consumers across continents.

Fashion and Lifestyle Retailers (Non-Optical)

Inspecs Group actively engages with fashion and lifestyle retailers beyond traditional optical shops. This includes department stores and fashion boutiques that integrate eyewear as a key accessory, catering to style-conscious consumers. The group's strategy focuses on leveraging these channels to expand the reach of its fashion-forward sunglasses and branded frames.

A significant achievement in this segment was the successful rollout of a prominent eyewear brand across all locations of a major global retailer. This partnership demonstrates Inspecs' capability to penetrate diverse retail environments and capture market share in the broader fashion accessory space.

- Targeting: Department stores, fashion boutiques, and other non-optical fashion-focused retailers.

- Product Focus: Fashion-oriented sunglasses and branded frames positioned as lifestyle accessories.

- Strategic Success: Secured placement with a major global retailer, signifying strong market penetration.

Specific Niche Markets (e.g., Low Vision Aid Users, Sport Shooting)

Inspecs Group actively targets niche markets with distinct product demands, exemplified by their offerings for users of low vision aids, such as through their Optaro brand. This strategic focus allows them to cater to specific, often overlooked, consumer needs with precisely designed eyewear solutions.

The company's commitment to these specialized segments is further highlighted by their development of eyewear tailored for particular activities, including sport shooting sunglasses. This approach underscores Inspecs' ability to innovate and provide functional, high-performance products for diverse user groups.

- Optaro Brand: Specializes in low vision aids, addressing a critical need for visually impaired individuals.

- Sport Shooting Eyewear: Develops specialized sunglasses designed for the unique requirements of sport shooters.

- Eschenbach Optics: This division demonstrates significant strength in serving these niche markets with tailored optical solutions.

- Market Penetration: Inspecs' strategy allows them to capture market share in segments often underserved by broader eyewear manufacturers.

Inspecs Group serves a diverse customer base, including global optical retail chains that require high volumes of frames and sunglasses. They also cater to independent opticians across 80 countries, providing them with a broad inventory and lens manufacturing services.

Distributors are key partners, facilitating market penetration with Inspecs' product lines, including their 2024 collections. Additionally, Inspecs targets fashion and lifestyle retailers, expanding its reach into the broader accessory market, as evidenced by a successful placement with a major global retailer.

The group also focuses on niche markets, such as low vision aids through its Optaro brand and specialized eyewear for activities like sport shooting, demonstrating a commitment to tailored optical solutions.

| Customer Segment | Key Characteristics | Inspecs' Offering | 2024 Relevance |

|---|---|---|---|

| Global Optical Retail Chains | High volume procurement, direct supply agreements | Branded and OEM optical frames, sunglasses, lenses | Continued demand in a growing market |

| Independent Opticians | Broad inventory needs, demand for integrated services | Proprietary and licensed brands, lens manufacturing | Essential supplier for diverse product portfolios |

| Global Eyewear Distributors | Logistics management, market reach amplification | Diverse product range, new collections | Efficiently distributes new technologies and sustainable materials |

| Fashion & Lifestyle Retailers | Accessory focus, style-conscious consumers | Fashion-forward sunglasses, branded frames | Penetration into non-optical fashion spaces |

| Niche Markets (e.g., Low Vision, Sports) | Specific product demands, specialized needs | Optaro (low vision aids), sport shooting eyewear | Eschenbach Optics division strength in tailored solutions |

Cost Structure

Manufacturing and production costs are a significant component for Inspecs Group, encompassing the procurement of raw materials like acetate and metal for eyewear frames, as well as specialized materials for lenses. Labor expenses in their global manufacturing hubs, including Vietnam, China, the UK, and Italy, are carefully managed to optimize production output.

These costs also include the essential overheads tied to maintaining and operating their diverse manufacturing facilities. Inspecs Group actively pursues operational efficiencies and cost-saving initiatives within their production processes, which has demonstrably bolstered their gross profit margins, as evidenced by their consistent focus on streamlining operations.

Research and Development Expenses are a significant cost for Inspecs Group, encompassing the design of new eyewear, the development of innovative lens technologies, and the continuous improvement of existing products. These investments are vital for staying ahead in the competitive optical market and introducing compelling new offerings to customers.

Inspecs maintains dedicated R&D teams, highlighting the strategic importance of these expenditures. For instance, the company's commitment to innovation is reflected in its ongoing efforts to enhance lens functionalities and frame designs, ensuring they meet evolving consumer demands and technological advancements. The company reported R&D expenses of £11.1 million in 2023, a notable increase from the previous year, underscoring its focus on future growth.

Inspecs Group's sales, marketing, and distribution costs are crucial for reaching its global customer base. These expenses cover everything from advertising and sales team compensation to the complex logistics of warehousing and shipping products worldwide. For example, in H1 2024, the company saw a reduction in operating expenses thanks to efficiency improvements, but the ongoing investment in a broad distribution network remains a significant cost factor.

The company is actively investing in expanding its distribution channels and targeting growth within the travel retail sector. This strategic focus, while essential for market penetration and revenue growth, inherently involves substantial expenditure on marketing campaigns, sales force development, and the operational overhead of maintaining a global supply chain.

Administrative and Operational Overheads

Inspecs Group's cost structure includes administrative and operational overheads, encompassing essential corporate functions. These costs cover salaries for administrative personnel, office space rentals, the maintenance of IT infrastructure, and crucial legal and compliance expenses. The company has been actively working to make its operations more efficient.

A significant aspect of Inspecs' cost management strategy has been its focus on streamlining operations, particularly in the United States. This initiative has successfully driven down operating expenses, contributing to improved profitability. For instance, the company reported a reduction in administrative costs in its 2023 fiscal year.

- Salaries for administrative staff

- Office rent and utilities

- IT infrastructure and software

- Legal, audit, and compliance fees

Licensing Fees and Royalties

Inspecs Group's cost structure is significantly influenced by licensing fees and royalties. As the company operates by leveraging a portfolio of licensed brands, it regularly pays these fees to the original brand owners. This strategy is fundamental to Inspecs' approach to quickly penetrate markets by utilizing the established recognition and appeal of these brands.

The ongoing acquisition and maintenance of these brand licenses represent a substantial cost. For instance, securing new licenses, such as the agreement for the Tom Tailor brand, directly adds to these operational expenses. These fees are essential for the group's business model, enabling them to offer a diverse range of products under well-known names.

These licensing costs are a direct reflection of Inspecs' strategy to build its business through brand partnerships rather than solely relying on organic brand development. The financial commitment to these agreements is a key component of their cost base.

- Licensing Fees: Payments made to brand owners for the right to use their brand names and associated intellectual property.

- Royalties: A percentage of sales or profits paid to brand owners, often tied to the performance of products sold under the licensed brand.

- Brand Acquisition Costs: Expenses incurred in negotiating and securing new licensing agreements, which can include upfront fees or minimum guarantees.

- Strategic Importance: These fees are a direct cost of Inspecs' core strategy to leverage established brand equity for market access and growth.

Inspecs Group’s cost structure is heavily influenced by manufacturing, R&D, sales and marketing, administrative overheads, and licensing fees. Manufacturing costs involve raw materials and labor across global facilities, while R&D focuses on product innovation. Sales and marketing expenses support global distribution and brand expansion.

Administrative costs include personnel, IT, and compliance, with ongoing efforts to improve efficiency, as seen in reduced operating expenses in the US. Licensing fees are a significant component, reflecting the company's strategy of leveraging established brand equity for market penetration and growth.

| Cost Category | Description | Example Data/Impact |

|---|---|---|

| Manufacturing & Production | Raw materials (acetate, metal), labor, factory overheads | Global hubs in Vietnam, China, UK, Italy; focus on operational efficiencies. |

| Research & Development | New eyewear design, lens technology, product improvement | £11.1 million in R&D expenses in 2023; vital for competitive edge. |

| Sales, Marketing & Distribution | Advertising, sales teams, logistics, warehousing | Investment in distribution channels and travel retail sector; efficiency improvements noted in H1 2024. |

| Administrative Overheads | Salaries, office rent, IT, legal & compliance | Streamlining operations in the US led to reduced administrative costs in FY 2023. |

| Licensing Fees & Royalties | Payments for brand rights and royalties on sales | Costs associated with brands like Tom Tailor; essential for market access. |

Revenue Streams

Inspecs Group generates substantial revenue through the sale of optical frames. These frames are offered under various arrangements, including proprietary brands, licensed brands, and original equipment manufacturer (OEM) agreements. This diverse approach allows Inspecs to cater to a broad spectrum of the global eyewear market.

The company's sales reach a wide customer base, encompassing global retailers, distributors, and independent opticians. This extensive distribution network is crucial for maximizing sales volume and market penetration within the eyewear sector. In 2023, Inspecs reported revenue from its wholesale and retail segments, with optical frames forming a core component of these sales.

Inspecs Group generates revenue through the sale of sunglasses, encompassing both trend-driven fashion collections and specialized ranges designed for specific needs. These eyewear pieces are frequently purchased as style statements, with significant sales occurring through non-optical stores and travel retail outlets, capitalizing on their accessory appeal.

The demand for sunglasses is also bolstered by their essential UV protection features. In 2024, the global sunglasses market was projected to reach approximately USD 18.5 billion, indicating a robust consumer appetite for these products.

Inspecs Group's primary revenue stream comes from the sales of a wide array of lenses. This includes everyday standard lenses, advanced varifocal options, photochromic lenses like Reactolite that adapt to light conditions, and specialized lenses designed for specific needs, such as those assisting individuals with color blindness.

The business also generates income through glazing services, which involves fitting lenses into frames. This integrated approach allows Inspecs to offer a more complete eyewear solution to its customers.

The demand for premium lenses is consistently boosted by ongoing advancements in lens technology. For instance, the increasing sophistication of digital surfacing and coatings enhances visual performance and comfort, encouraging consumers to opt for higher-value products. In 2023, the global ophthalmic lens market was valued at approximately $30 billion, with significant growth driven by these technological innovations.

Sales of Low Vision Aids

Revenue is generated through the sale of advanced low vision aid products, exemplified by the Optaro device. This segment targets a specific market focused on individuals with particular visual impairments, offering specialized solutions.

The Eschenbach Optics division, a key contributor to this revenue stream, has demonstrated robust performance. This includes its range of low vision products, highlighting the division's strength in catering to this specialized market.

- Optaro Sales: Revenue from innovative high-tech low vision aids like Optaro.

- Niche Market Focus: Serving individuals with specific visual impairment needs.

- Eschenbach Optics Performance: Strong contribution from the division, including low vision products.

Private Label (OEM) Manufacturing

Inspecs Group generates revenue through private label, or Original Equipment Manufacturer (OEM), manufacturing. This involves producing unbranded eyewear for retail clients who then sell these products under their own brand names. These manufacturing contracts are a significant revenue driver, allowing Inspecs to leverage its production expertise for a diverse customer base.

This OEM segment allows retailers to bypass the complexities of in-house manufacturing, tapping into Inspecs' established supply chain and quality control. For Inspecs, it represents a consistent revenue stream built on fulfilling manufacturing orders. This strategy diversifies Inspecs' income beyond its own branded products.

- OEM Revenue Generation: Inspecs earns income by manufacturing eyewear for retailers who brand the products themselves.

- Leveraging Manufacturing Capabilities: This stream allows retailers to utilize Inspecs' production facilities and expertise.

- Brand Dilution Avoidance: Retailers can build their own brand identity without direct manufacturing investment.

- Diversified Income: OEM contracts contribute to Inspecs' overall financial stability and market reach.

Inspecs Group's revenue is diversified across several key areas, including the sale of optical frames, sunglasses, and specialized lenses. The company also generates income from glazing services and the sale of advanced low vision aids. A significant portion of their earnings comes from private label manufacturing for retail clients.

| Revenue Stream | Description | Key Drivers |

|---|---|---|

| Optical Frames | Sale of frames under proprietary, licensed, and OEM agreements. | Brand appeal, retail partnerships, fashion trends. |

| Sunglasses | Sales of fashion-forward and UV-protective eyewear. | Style, seasonal demand, travel retail presence. |

| Lenses | Provision of standard, varifocal, photochromic, and specialized lenses. | Technological advancements, visual performance enhancement. |

| Glazing Services | Fitting lenses into frames. | Integrated offering, customer convenience. |

| Low Vision Aids | Sales of specialized products like Optaro. | Targeted market needs, performance of divisions like Eschenbach Optics. |

| Private Label (OEM) | Manufacturing unbranded eyewear for retailers. | Retailer demand for own-brand products, Inspecs' production capabilities. |

Business Model Canvas Data Sources

The Inspecs Group Business Model Canvas is built upon a foundation of robust market research, internal operational data, and financial performance metrics. These sources ensure each component of the canvas accurately reflects the company's current standing and strategic direction.