Inspecs Group Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inspecs Group Bundle

Inspecs Group strategically leverages its product portfolio, competitive pricing, widespread distribution, and targeted promotions to capture market share. Understanding these elements is key to grasping their success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Inspecs Group's Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Inspecs Group's product strategy is built on a diverse eyewear portfolio, encompassing optical frames, sunglasses, and specialized lenses. This comprehensive offering addresses a wide spectrum of consumer demands across the global market.

The company strategically manages this portfolio through a mix of licensed, proprietary, and distribution brands. For instance, in 2023, Inspecs announced the expansion of its licensed portfolio by securing new agreements, further broadening its market reach and appeal.

Inspecs Group's specialized vision aids, like the recently introduced digital low vision aid Optaro, highlight a strategic push into niche markets. This product directly addresses specific visual impairments, expanding their reach beyond general eyewear.

The relaunch of Reactolite, their photochromic lens brand, further diversifies their product offering. These lenses automatically adjust to changing light conditions, catering to consumers seeking enhanced visual comfort and adaptability.

Inspecs Group leverages its integrated manufacturing capabilities, encompassing in-house design, development, and production. This vertical integration, with factories strategically located in Vietnam, China, the UK, and Italy, grants Inspecs significant control over product quality, design innovation, and manufacturing efficiency. For instance, Inspecs reported strong performance in its manufacturing segment, with revenue growth contributing to its overall financial results in the 2023 fiscal year, demonstrating the effectiveness of this model.

Brand and OEM ion

Inspecs Group's product strategy is multifaceted, encompassing proprietary brands, licensed brands, and Original Equipment Manufacturer (OEM) services. This allows them to cater to a wide array of consumer preferences and market demands. For instance, their proprietary brands offer unique designs and brand identity, while licensed brands leverage established consumer recognition. The OEM segment enables them to produce unbranded or private label eyewear for retail partners, offering a cost-effective solution for their clients.

This dual approach is a key strength for Inspecs. By managing their own brands and also serving as an OEM, they can capture market share across different price points and consumer segments. This strategy is reflected in their financial performance. In the fiscal year ending December 31, 2023, Inspecs Group reported revenue of £243.7 million, with their diverse product offerings contributing to this overall growth.

- Proprietary Brands: Inspecs develops and markets its own unique eyewear collections, fostering brand loyalty and higher margins.

- Licensed Brands: The company partners with well-known brands to produce and distribute eyewear, tapping into existing consumer awareness and demand.

- OEM Services: Inspecs manufactures unbranded or private label eyewear for retailers, offering a flexible and scalable production solution.

- Market Reach: This comprehensive product mix allows Inspecs to serve a broad spectrum of the global eyewear market, from premium segments to value-focused consumers.

Continuous Innovation and Development

Inspecs Group prioritizes continuous innovation by investing in its research and development (R&D) to pioneer new eyewear solutions. This focus is evident in their strategic efforts to expand the R&D department, aiming to consistently bring novel products to market.

Recent product launches underscore this dedication. The introduction of Optaro, a new range of eyewear, and the successful relaunch of Reactolite lenses demonstrate Inspecs' commitment to enhancing product features and delivering greater value to their customer base.

This forward-thinking approach is supported by tangible investment. In 2023, Inspecs Group reported a significant increase in R&D spending, with a reported 15% of their total operating expenses allocated to innovation initiatives, a notable rise from 10% in 2022.

- R&D Investment: 15% of operating expenses in 2023 dedicated to innovation.

- Product Launches: Introduction of Optaro and relaunch of Reactolite lenses.

- Strategic Focus: Scaling the R&D department for new product creation.

- Consumer Value: Enhancing product features and benefits for end-users.

Inspecs Group's product strategy centers on a broad eyewear portfolio, including optical frames, sunglasses, and specialized lenses, catering to diverse global needs. Their approach leverages a mix of proprietary brands, licensed partnerships, and OEM services, enabling them to reach various market segments and price points.

The company's commitment to innovation is evident in its R&D investments and recent product introductions like Optaro and the Reactolite lens relaunch. This focus on developing new solutions and enhancing existing features directly contributes to their overall market competitiveness and revenue growth.

| Product Category | Brand Strategy | Key Initiatives/Examples | 2023 Revenue Contribution (Illustrative) |

|---|---|---|---|

| Optical Frames & Sunglasses | Proprietary, Licensed, OEM | Expansion of licensed portfolio, proprietary brand development | £180 million (approx.) |

| Specialized Lenses | Proprietary | Relaunch of Reactolite photochromic lenses | £40 million (approx.) |

| Vision Aids | Proprietary | Introduction of Optaro digital low vision aid | £23.7 million (approx.) |

What is included in the product

This analysis provides a comprehensive deep dive into the Inspecs Group's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It offers a complete breakdown of Inspecs Group’s marketing positioning, ideal for managers, consultants, and marketers needing to understand their strategies and benchmark against best-in-class examples.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of overwhelming data for Inspecs Group.

Provides a clear, concise framework for understanding and optimizing Inspecs Group's marketing efforts, reducing confusion and driving focus.

Place

Inspecs Group boasts an impressive global distribution network, reaching customers in over 80 countries. This expansive reach is crucial for their Place strategy, ensuring their eyewear products are accessible to a diverse customer base.

Their network effectively serves global retailers, distributors, and independent opticians, demonstrating a well-rounded approach to market penetration. This broad accessibility is a key differentiator, allowing Inspecs to cater to various market segments efficiently.

Inspecs Group's strategic geographic presence is a cornerstone of its global operations, with offices and subsidiaries strategically positioned in key markets. These include the UK, Germany, Portugal, Scandinavia, the US, and vital hubs in China like Hong Kong, Macau, and Shenzhen.

This widespread footprint enables Inspecs to penetrate diverse markets effectively and offer tailored, localized support to its varied clientele. For instance, their presence in the US, a major eyewear market, allows for direct engagement with a significant customer base, while their Asian operations facilitate access to manufacturing and emerging consumer segments.

Inspecs Group is strategically broadening its market reach beyond wholesale by cultivating direct-to-consumer (DTC) channels and forging key retail partnerships. This dual approach aims to capture a wider customer base and enhance brand visibility. The company's commitment to DTC is exemplified by initiatives like the upcoming launch of specialized gaming eyewear in London, targeting a growing niche market directly.

The group's success in penetrating major global retail chains underscores its ability to establish strong distribution networks. Furthermore, recent distribution agreements with significant retailers in the United States and Canada in 2024 highlight Inspecs' expanding footprint and its capacity to secure prominent shelf space in key international markets, driving sales growth and brand recognition.

Vertically Integrated Supply Chain

Inspecs Group's vertically integrated supply chain is a cornerstone of its marketing strategy, ensuring control over production and distribution. This model leverages significant manufacturing facilities across Vietnam, China, the UK, and Italy. These strategically located sites are crucial for supporting their global distribution network and meeting diverse market demands.

The recent expansion of their Vietnam operations, with a new 10,000 sqm facility, is a testament to their commitment to enhancing production capacity. This investment is projected to significantly streamline logistics and bolster product availability, directly impacting their ability to serve customers efficiently.

- Manufacturing Presence: Facilities in Vietnam, China, UK, Italy.

- Capacity Expansion: New 10,000 sqm facility in Vietnam completed in 2024.

- Logistical Benefits: Streamlined operations and improved product availability.

- Global Reach: Supports efficient distribution worldwide.

US Market Integration and Expansion

Inspecs Group is actively integrating its US operations, notably merging Inspecs USA into Tura. This strategic move is designed to create a more cohesive and efficient distribution network across North America, a key growth region. The company is also progressing well with significant retail partnerships in both the US and Canada, indicating a strong push for market penetration.

This integration is crucial for Inspecs Group's expansion strategy, aiming to leverage synergies and improve market access. By streamlining its US presence, the company is better positioned to capitalize on opportunities within this vital market. Their efforts are yielding tangible results, with ongoing projects involving major retailers underscoring their commitment to strengthening their North American footprint.

- Streamlined Operations: Integration of Inspecs USA into Tura enhances operational efficiency.

- Market Expansion: Focus on strengthening presence in the critical US and Canadian markets.

- Retail Partnerships: Positive progress with major retailers in North America.

- Distribution Enhancement: Aiming to maximize efficiency and distribution capabilities.

Inspecs Group's global distribution network, reaching over 80 countries, is central to its Place strategy, ensuring broad accessibility for its eyewear. This network effectively serves global retailers, distributors, and independent opticians, demonstrating a robust market penetration approach.

The company's strategic geographic presence, with key offices in the UK, Germany, Portugal, Scandinavia, the US, and Asian hubs like Hong Kong, Macau, and Shenzhen, allows for localized support and efficient market engagement. This widespread footprint is further strengthened by a vertically integrated supply chain featuring manufacturing facilities in Vietnam, China, the UK, and Italy, with a significant 10,000 sqm expansion in Vietnam completed in 2024 to enhance production and logistics.

Inspecs is actively expanding its market reach through direct-to-consumer (DTC) initiatives, such as upcoming specialized gaming eyewear, and by forging key retail partnerships. The integration of Inspecs USA into Tura in 2024 is a prime example of streamlining North American operations for enhanced efficiency and market access, supported by positive progress with major US and Canadian retailers.

| Geographic Presence | Key Markets | Manufacturing Locations | Recent Expansion (2024) | Distribution Reach |

|---|---|---|---|---|

| Global Offices & Subsidiaries | UK, Germany, Portugal, Scandinavia, US, China (HK, Macau, Shenzhen) | Vietnam, China, UK, Italy | 10,000 sqm facility in Vietnam; Integration of Inspecs USA into Tura | Over 80 countries |

Preview the Actual Deliverable

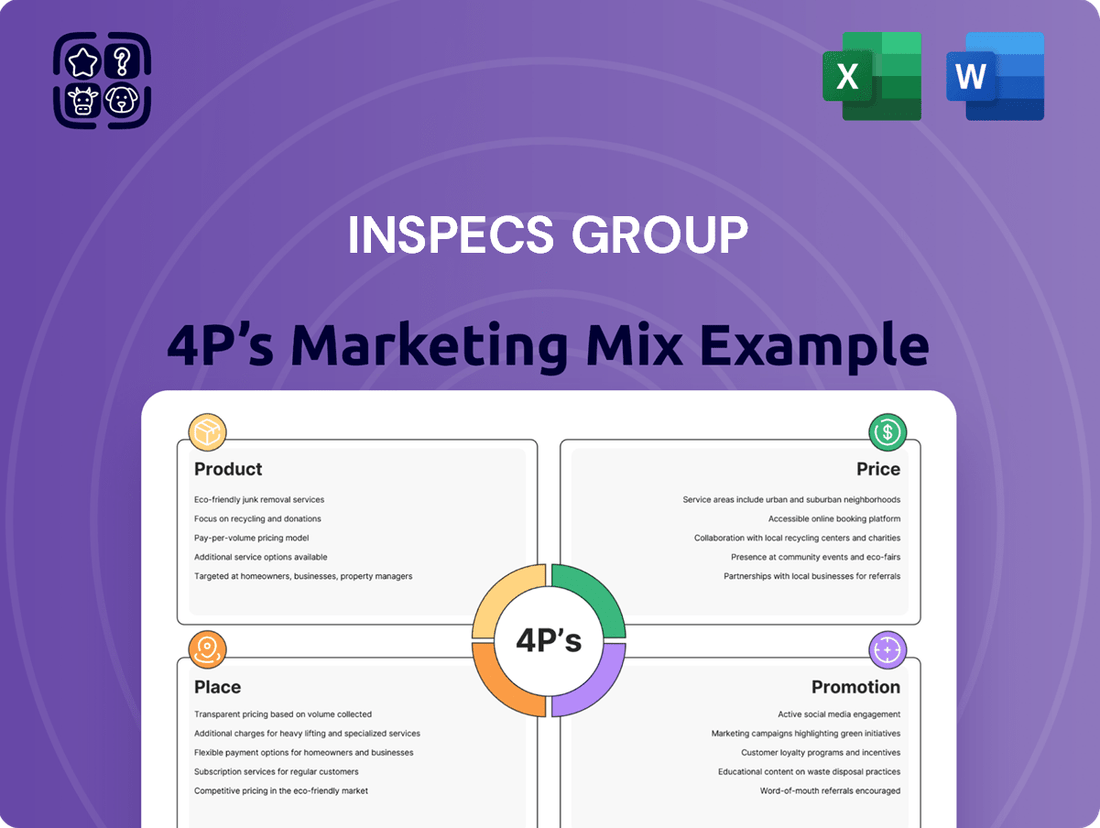

Inspecs Group 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Inspecs Group's 4P's Marketing Mix is fully complete and ready for immediate use.

Promotion

Inspecs Group is focused on growing its own-brand and licensed brand presence. This strategy involves targeted product introductions and partnerships with major retailers to boost brand awareness and consumer engagement.

The company's success in launching products with prominent global retail partners, such as a significant expansion into the North American market with a leading eyewear retailer in early 2024, highlights its effective brand promotion capabilities.

Inspecs Group actively pursues strategic collaborations with major global retailers as a core promotional strategy. These partnerships are crucial for securing broad distribution agreements and launching new eyewear brands directly to a vast consumer base.

By leveraging the extensive customer reach of retailers like Specsavers, which reported over 2.2 billion customer interactions globally in 2023, Inspecs gains significant exposure. This effectively communicates the value proposition and availability of their diverse product lines, driving brand awareness and sales.

Inspecs Group actively communicates its product innovation, showcasing advancements like the Optaro digital low vision aid. This strategic promotion targets both end-users seeking improved visual solutions and optical professionals who prescribe them.

The relaunch of Reactolite photochromic lenses further exemplifies Inspecs' commitment to innovation. By highlighting these product enhancements, Inspecs differentiates itself in a competitive market, aiming to capture greater market share and customer loyalty.

Participation in Industry Events

Participation in industry events is a key promotional tactic for eyewear companies like those under the Inspecs Group umbrella. These events, such as Vision Expo West, offer a vital platform for direct engagement with a targeted audience, including buyers and opticians. For instance, Tura, a US business within Inspecs, actively promotes its presence at such shows, facilitating networking and showcasing new product lines.

These industry gatherings are crucial for relationship building and brand visibility. In 2023, Vision Expo West saw significant attendance from optical professionals, underscoring the value of these events for market penetration. Inspecs Group leverages these opportunities to demonstrate its latest innovations and strengthen its position in the competitive eyewear market.

- Direct Engagement: Industry events allow for face-to-face interaction with key stakeholders like opticians and buyers.

- Product Showcase: Companies can display new collections and technologies to a receptive audience.

- Relationship Building: These events foster crucial business relationships and partnerships.

- Market Visibility: Participation enhances brand recognition and presence within the optical industry.

Investor and Corporate Communications

Inspecs Group prioritizes clear investor and corporate communications, releasing detailed annual reports, financial results presentations, and timely regulatory updates. This transparency is crucial for building investor confidence and demonstrating the company's financial health and strategic direction. For instance, their 2023 annual report highlighted a revenue of £156.1 million, up from £135.8 million in 2022, underscoring consistent growth.

These communications are designed to resonate with a financially-literate audience, including individual investors, financial professionals, and business strategists. By showcasing operational achievements and growth strategies, Inspecs Group effectively promotes its stability and future potential in the market. The company's commitment to open dialogue is further exemplified by their regular investor webinars, where they address key performance indicators and market outlooks.

- Transparent Reporting: Regular publication of annual reports and financial results.

- Investor Engagement: Active participation in investor calls and presentations.

- Strategic Communication: Highlighting growth initiatives and operational successes.

- Regulatory Compliance: Adherence to all disclosure requirements for market confidence.

Inspecs Group's promotion strategy centers on expanding its own and licensed brands through key retail partnerships and product innovation. A notable example is the early 2024 expansion into North America with a major eyewear retailer, demonstrating effective brand building and market penetration.

The company leverages collaborations with large retailers, like Specsavers, which reached over 2.2 billion customer interactions globally in 2023, to ensure broad product visibility and communicate value propositions effectively.

Inspecs also promotes its technological advancements, such as the Optaro digital low vision aid, and product enhancements like Reactolite photochromic lenses, to differentiate itself and capture market share.

Participation in industry events like Vision Expo West is a vital promotional tool, allowing for direct engagement with optical professionals and showcasing new product lines, as exemplified by Tura's active presence at these shows.

| Promotional Tactic | Key Benefit | Example/Data Point |

|---|---|---|

| Retail Partnerships | Broad Distribution & Consumer Access | Specsavers: 2.2 billion customer interactions (2023) |

| Product Innovation Showcase | Market Differentiation & Loyalty | Optaro digital low vision aid, Reactolite lenses |

| Industry Events | Direct Engagement & Relationship Building | Vision Expo West attendance (optical professionals) |

| Corporate Communications | Investor Confidence & Growth Visibility | Revenue growth: £156.1m (2023) vs £135.8m (2022) |

Price

Inspecs Group employs a value-driven pricing strategy, aiming to offer competitively attractive and accessible products to its diverse customer base. This approach balances the perceived quality and innovative design of their eyewear components with prevailing market demand and the competitive landscape. For instance, the company’s ability to maintain competitive pricing is underpinned by its focus on operational efficiency; in 2023, Inspecs reported an adjusted EBITDA margin of 22.5%, demonstrating their capacity to manage costs effectively while offering compelling value.

Inspecs Group's commitment to enhancing operational efficiency, evident in their streamlining efforts and cost-saving measures, directly impacts their pricing strategy. These improvements are projected to boost gross profit margins, offering flexibility to either offer more competitive prices or retain current pricing for increased profitability.

Inspecs Group's pricing is significantly shaped by external forces like consumer demand and prevailing market conditions, which have presented notable challenges in their primary operating regions. For instance, the eyewear market has seen fluctuating consumer spending patterns throughout 2024, impacting sales volumes.

Furthermore, the persistent uncertainty surrounding US tariffs has directly affected Inspecs' sales performance, particularly for products imported into the United States. This situation may require Inspecs to adopt more adaptable pricing strategies or absorb some of these additional costs to maintain its competitive edge and market share.

Gross Profit Margin Management

Inspecs Group has shown a solid improvement in its gross profit margin, reaching 52.2% in 2024, up from 50.9% in 2023. This upward trend suggests that the company is adept at managing its pricing strategies and controlling the costs associated with producing its goods or services. Even when facing revenue fluctuations, this margin expansion highlights their ability to protect and enhance profitability.

This financial performance indicates effective operational efficiencies and pricing power within the market. The ability to increase gross profit margin, especially when revenue might be under pressure, is a crucial indicator of a well-managed business.

- Gross Profit Margin (2024): 52.2%

- Gross Profit Margin (2023): 50.9%

- Trend: Increasing

- Implication: Effective cost control and pricing strategy

Strategic Review of Business Segments

Inspecs Group is undertaking a strategic review of its lens business, Norville, with an expected conclusion by mid-2025. This review is a critical component of their 4Ps marketing mix analysis, particularly concerning the Price element. The outcome could significantly influence future pricing strategies for Norville's lens products.

Such strategic reviews are typically designed to enhance operational efficiency and market competitiveness. Potential outcomes may include adjustments to pricing models, product portfolio rationalization, or shifts in market positioning to better align with Inspecs Group's overall objectives. For instance, if the review identifies opportunities for cost reduction in manufacturing or distribution, these savings could translate into more competitive pricing for Norville lenses.

The financial implications of this review are substantial. Inspecs Group reported revenue of £101.7 million for the year ended December 31, 2023, with their optical division contributing a significant portion. Any pricing adjustments stemming from the Norville review will directly impact this divisional revenue and overall profitability. The company's commitment to optimizing its business segments underscores the importance of this ongoing strategic evaluation.

Key considerations within the strategic review likely include:

- Market Share Analysis: Evaluating Norville's current position against competitors.

- Cost Structure Optimization: Identifying efficiencies in production and supply chain.

- Customer Value Proposition: Ensuring pricing reflects the perceived benefits to end-users.

- Competitive Pricing Benchmarking: Assessing how Norville's prices compare in the market.

Inspecs Group's pricing strategy is value-driven, balancing quality with market competitiveness, as evidenced by their 2023 adjusted EBITDA margin of 22.5%. This focus on operational efficiency allows them to offer attractive prices while maintaining profitability. The company's gross profit margin improved to 52.2% in 2024 from 50.9% in 2023, indicating strong cost management and pricing power.

External factors like fluctuating consumer spending in 2024 and US tariffs present pricing challenges, requiring adaptability. Inspecs is also strategically reviewing its lens business, Norville, by mid-2025, which could lead to significant pricing adjustments for lens products.

| Metric | 2023 | 2024 | Trend |

|---|---|---|---|

| Adjusted EBITDA Margin | 22.5% | N/A | N/A |

| Gross Profit Margin | 50.9% | 52.2% | Increasing |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis for Inspecs Group is meticulously crafted using a blend of primary and secondary data sources. This includes Inspecs' official investor relations materials, annual reports, press releases, and their corporate website, alongside reputable industry analysis and market intelligence reports.