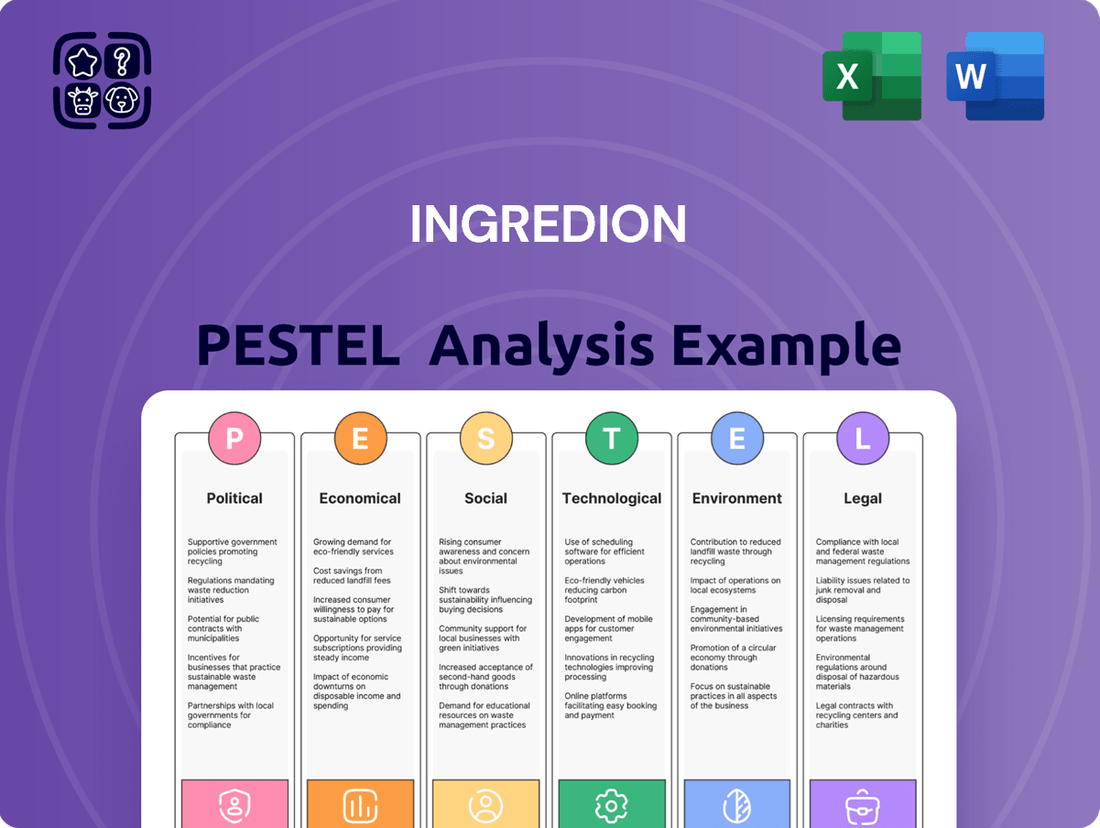

Ingredion PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

Navigate the complex global landscape impacting Ingredion with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, social trends, technological advancements, environmental regulations, and legal frameworks are shaping the company's operations and future growth. Gain a crucial competitive edge and make informed strategic decisions. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Governments globally are tightening rules on food safety and what's on product labels. For Ingredion, this means staying on top of these changes is crucial. It affects how they create their products, manage their suppliers, and sell in different countries. For instance, the US FDA's updated Human Foods Program and new definitions for 'healthy' claims are significant. In Europe, new rules about food waste and novel ingredients are also on the horizon.

Ingredion's reliance on global sourcing for plant-based ingredients means international trade policies and tariffs directly influence its raw material costs. For instance, shifts in trade agreements or the introduction of tariffs on key inputs like pea protein, a significant ingredient for Ingredion, can lead to increased expenses. In 2024, for example, ongoing trade tensions between major agricultural exporters and importers could create price volatility for corn and other vital crops Ingredion processes.

Ingredion's global sourcing of plant-based ingredients, such as corn and tapioca, makes political stability in key agricultural regions paramount. For instance, disruptions in major corn-producing areas like the United States or South America due to political unrest could significantly impact Ingredion's raw material supply. In 2023, the U.S. remained a top corn exporter, highlighting the vulnerability of supply chains to regional political climates.

Government Support for Sustainable Agriculture

Government support for sustainable agriculture significantly bolsters Ingredion's operational framework. Policies encouraging regenerative farming directly benefit Ingredion's supply chain by promoting practices that enhance soil health and reduce environmental impact, aligning with the company's 2030 sustainability targets for responsible sourcing.

These governmental initiatives often translate into financial incentives or technical assistance for farmers, making sustainable methods more accessible and attractive. For instance, the U.S. Department of Agriculture (USDA) has allocated substantial funding, with programs like the Conservation Reserve Program (CRP) and the Climate-Smart Agriculture and Natural Resource Conservation initiatives, to support farmers in adopting eco-friendly practices. In 2024, the USDA announced further investments aimed at climate-smart agriculture, potentially impacting Ingredion's key crop sourcing regions.

Ingredion's commitment to sustainability, including its goal to achieve a 30% reduction in absolute Scope 1 and 2 greenhouse gas emissions by 2030, is directly supported by these broader policy shifts. The company actively partners with growers to implement sustainable practices, and government backing amplifies the effectiveness and reach of these collaborations.

Key government actions influencing Ingredion's agricultural supply chain include:

- Policy Frameworks: Development of national and regional policies that mandate or incentivize sustainable farming practices, such as reduced pesticide use and water conservation.

- Financial Incentives: Government grants, subsidies, and tax credits available to farmers for adopting certified sustainable or regenerative agriculture methods.

- Research and Development: Funding for agricultural research that focuses on developing climate-resilient crops and sustainable farming technologies.

- Certification Standards: Government-backed or recognized certification programs that validate the sustainability of agricultural products, potentially easing Ingredion's sourcing verification processes.

Public Health Policies and Dietary Guidelines

Public health policies focusing on improved dietary habits, such as sugar reduction targets and the promotion of plant-based foods, significantly shape consumer preferences, directly impacting demand for Ingredion's ingredient portfolio. For instance, the World Health Organization's 2023 guidance recommending limiting free sugar intake to less than 10% of total energy intake, and ideally below 5%, encourages manufacturers to seek sugar alternatives. Ingredion's extensive range of sweeteners, including stevia and monk fruit-based options, positions the company to capitalize on this trend.

The company can strategically align its product development and marketing efforts with these evolving public health objectives. By offering ingredients that support healthier formulations, Ingredion can meet the growing consumer demand for products that adhere to dietary guidelines. In 2024, the global market for plant-based ingredients was projected to reach over $30 billion, a testament to the growing consumer shift that Ingredion is well-positioned to serve.

- Sugar Reduction Initiatives: Government mandates and public health campaigns encouraging reduced sugar consumption drive demand for Ingredion's low-calorie and natural sweeteners.

- Plant-Based Diets: The increasing popularity of plant-based eating patterns fuels demand for Ingredion's plant-derived starches, proteins, and fibers.

- Nutritional Labeling: Clearer nutritional labeling requirements push food manufacturers to reformulate products, creating opportunities for Ingredion's healthier ingredient solutions.

Governmental regulations on food safety and labeling directly impact Ingredion's operations, requiring constant adaptation to evolving standards like the US FDA's updated Human Foods Program. International trade policies and tariffs significantly influence Ingredion's raw material costs, with 2024 trade tensions potentially causing price volatility for key crops like corn.

Political stability in agricultural regions is crucial for Ingredion's supply chain, as demonstrated by the U.S. remaining a top corn exporter in 2023. Government support for sustainable agriculture, such as USDA initiatives in 2024, bolsters Ingredion's sourcing by incentivizing eco-friendly farming practices.

Public health policies promoting sugar reduction and plant-based diets, like the WHO's 2023 guidance, increase demand for Ingredion's alternative sweeteners and plant-derived ingredients. The global plant-based ingredient market, projected to exceed $30 billion in 2024, highlights Ingredion's strategic positioning.

What is included in the product

This Ingredion PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key trends and their implications for Ingredion's operations and market position.

Provides a concise version of Ingredion's PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for strategic decision-making.

Economic factors

Global economic growth is projected to be moderate in 2024 and 2025, with the IMF forecasting 3.2% growth for both years. Despite this, inflationary pressures remain a key consideration. While consumers may prioritize Ingredion's healthier product offerings even with rising prices, the company must navigate increasing input costs, such as for corn and energy, which were up significantly in late 2023 and early 2024.

Ingredion's profitability is significantly influenced by the fluctuating prices of key agricultural inputs like corn, tapioca, and potatoes. These commodity prices are inherently volatile, driven by weather events, shifts in global supply and demand dynamics, and geopolitical instability. For instance, in early 2024, corn prices saw notable swings due to concerns over South American crop yields and ongoing trade tensions, directly impacting Ingredion's cost of goods sold.

Consumer spending habits are a major driver for companies like Ingredion, as they directly impact demand for food and beverage products, and by extension, the ingredients Ingredion provides. In 2024, for instance, a significant portion of household budgets continues to be allocated to groceries, with discretionary spending on premium food items showing resilience despite inflationary pressures.

Disposable income levels play a crucial role here. As consumers' financial flexibility fluctuates, so does their capacity to purchase higher-value or specialty food ingredients. For example, a rise in disposable income in late 2024 and early 2025 could translate to increased demand for products featuring natural or health-focused ingredients, which Ingredion is well-positioned to supply.

The increasing consumer focus on specific product attributes, such as 'natural' or 'health benefits', presents a dual-edged sword for Ingredion. While it opens avenues for premium pricing and product innovation, it also necessitates continuous adaptation to evolving consumer preferences and potentially higher ingredient sourcing costs to meet these demands, a trend observed throughout 2024.

Market Demand for Food Ingredients

The global food ingredients market is experiencing robust growth, fueled by a rising global population and increasing urbanization, which in turn drives demand for convenient, ready-to-eat food options. This trend provides a solid economic backdrop for companies like Ingredion. Projections indicate continued strong expansion in this sector over the next several years.

Several key economic drivers underpin this growth:

- Population Growth: The United Nations projects the world population to reach 9.7 billion by 2050, directly increasing the need for food and its constituent ingredients.

- Urbanization: As more people move to cities, demand for processed and convenient food products, which rely heavily on specialized ingredients, escalates.

- Disposable Income: Rising disposable incomes in emerging economies often translate to increased spending on a wider variety of food products, including those with enhanced textures, flavors, and nutritional profiles provided by ingredients.

- Consumer Preferences: A growing consumer focus on health and wellness is also a significant economic factor, driving demand for functional ingredients, plant-based alternatives, and clean-label products.

Industry Consolidation and Competition

The food and beverage ingredient sector, including Ingredion's market, is experiencing significant consolidation. This trend intensifies competition, forcing companies to constantly refine their strategies. Ingredion's ability to innovate and streamline operations is paramount to holding its ground.

To stay ahead, Ingredion needs to offer unique solutions and capitalize on its worldwide presence. For example, the global food and beverage market was valued at approximately $6.4 trillion in 2023 and is projected to reach $8.9 trillion by 2028, indicating a competitive landscape where differentiation is key. Ingredion's focus on specialty ingredients and sustainable practices aims to achieve this.

- Intensifying Competition: Mergers and acquisitions in the food and beverage industry create larger, more formidable competitors.

- Innovation Imperative: Continuous development of new ingredients and applications is crucial for market differentiation.

- Operational Efficiency: Optimizing supply chains and production processes is vital to manage costs and maintain competitive pricing.

- Global Reach Advantage: Leveraging a broad international footprint allows Ingredion to serve diverse markets and mitigate regional economic downturns.

Ingredion's performance is closely tied to global economic growth, which the IMF projected at a moderate 3.2% for both 2024 and 2025. Despite this steady outlook, persistent inflation impacts both input costs, such as corn and energy, and consumer purchasing power. Ingredion must therefore balance managing rising operational expenses with catering to consumer demand for its products, which may remain resilient due to a focus on health and wellness attributes.

The company's profitability hinges on the volatile prices of agricultural commodities like corn, which experienced significant fluctuations in early 2024 due to weather concerns and trade tensions. These price swings directly affect Ingredion's cost of goods sold, necessitating careful supply chain management and hedging strategies to mitigate risk.

Consumer spending on food and beverages remains a critical economic factor, with grocery spending showing resilience even amidst inflation in 2024. Ingredion benefits from this stability, particularly as rising disposable incomes in emerging markets, expected to continue into 2025, drive demand for higher-value, specialized ingredients that enhance product texture, flavor, and nutritional content.

The food ingredients market is projected for robust expansion, driven by population growth and urbanization, creating a favorable economic environment for Ingredion. Key growth drivers include an increasing global population, expected to reach 9.7 billion by 2050, and a growing demand for convenient, processed foods in urban centers.

| Economic Factor | 2024/2025 Trend/Projection | Impact on Ingredion |

| Global Economic Growth | Moderate (IMF: 3.2% for 2024 & 2025) | Stable demand for food products, but sensitive to economic slowdowns. |

| Inflationary Pressures | Persistent | Increases input costs (corn, energy); may affect consumer discretionary spending. |

| Commodity Prices (e.g., Corn) | Volatile (e.g., early 2024 swings) | Directly impacts cost of goods sold and profit margins. |

| Consumer Spending | Resilient on groceries; focus on health/wellness | Supports demand for Ingredion's ingredients, especially specialty and healthier options. |

| Disposable Income | Fluctuating, but rising in emerging markets | Drives demand for premium and specialty food ingredients. |

What You See Is What You Get

Ingredion PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Ingredion delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic decisions.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a detailed examination of Ingredion's market landscape, competitive positioning, and future growth opportunities within the global ingredient solutions industry.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain valuable insights into how external forces shape Ingredion's business and inform its strategic planning.

Sociological factors

Consumers are increasingly prioritizing health and wellness, driving demand for ingredients that provide functional benefits like improved digestion, immunity support, and higher protein content. This societal shift is evident in market growth, with the global functional foods market projected to reach $350.4 billion by 2027, according to Grand View Research. Ingredion is strategically positioned to capitalize on this trend, offering a robust portfolio of nutritional ingredients and solutions focused on sugar reduction and clean labels, aligning perfectly with consumer preferences for healthier options.

The global plant-based food market is experiencing significant expansion, projected to reach $162 billion by 2030, a substantial increase from $27 billion in 2023. This growth is largely attributed to rising vegan and flexitarian consumer bases, motivated by health consciousness, environmental sustainability, and ethical considerations. Ingredion is well-positioned to capitalize on this trend, offering a diverse portfolio of plant-based ingredients like pea protein and pulse flours that empower food manufacturers to meet this escalating demand.

Consumers are actively seeking out products with simple, recognizable ingredients, often described as "clean label." This preference isn't just a fleeting trend; studies in 2024 indicated a significant portion of consumers, upwards of 60%, are willing to pay a premium for products that clearly list natural and familiar components. This shift directly impacts food manufacturers like those Ingredion serves, driving demand for ingredients that align with this transparency and simplicity.

Ingredion's strategy must therefore center on providing ingredient solutions that meet these evolving consumer expectations. This means developing and marketing ingredients derived from natural sources, with clear and understandable origins, to support brands aiming for a clean label positioning. The company's investment in plant-based and non-GMO ingredient portfolios directly addresses this growing market imperative.

Evolving Dietary Preferences and Lifestyle Choices

Consumers are increasingly aligning their food choices with broader personal values, extending beyond just health and plant-based diets. This shift means purchasing decisions are influenced by a desire for sustainability, accommodation of specific dietary needs like gluten-free, and the demand for convenient options.

Ingredion must therefore focus on developing and marketing ingredient solutions that are not only functional but also adaptable to these diverse and evolving consumer preferences. For instance, the demand for plant-based alternatives continues to surge, with the global plant-based food market projected to reach $162 billion by 2030, up from $29.7 billion in 2020, highlighting a significant opportunity for ingredient innovation.

- Sustainable Sourcing: Consumer preference for sustainably sourced ingredients is growing, with studies showing a significant percentage of shoppers willing to pay more for eco-friendly products.

- Dietary Inclusivity: The gluten-free market alone was valued at approximately $5.5 billion in 2023 and is expected to grow, necessitating Ingredion's expertise in allergen-friendly solutions.

- Convenience and Versatility: Busy lifestyles drive demand for convenient food preparation, pushing ingredient suppliers to offer solutions that simplify cooking and baking processes for consumers.

Influence of Social Media and Information Access

The explosion of social media and readily available digital information means consumers are more aware than ever about what's in their food and how it's made. This heightened transparency, fueled by platforms where ingredient sourcing and sustainability practices are openly discussed, directly impacts consumer choices. For a company like Ingredion, this translates into a need for greater openness in their own communications and a stronger focus on developing products that align with these informed consumer expectations.

By 2024, it's estimated that over 4.9 billion people worldwide will be active social media users, a significant portion of whom actively research brands and products online. This vast digital footprint means Ingredion, and indeed the entire food industry, must be more responsive to consumer inquiries and trends that gain traction on these platforms. Companies that proactively address ingredient concerns and highlight sustainable practices often see a more positive brand perception, directly influencing purchasing decisions.

- Informed Consumers: Over 70% of consumers globally now research food ingredients and brand ethics online before purchasing.

- Digital Influence: Social media sentiment analysis is increasingly used by food companies to gauge public perception of ingredients and production methods.

- Transparency Demand: Reports in late 2023 indicated a 25% year-over-year increase in consumer searches for "clean label" and "sustainable sourcing" related to food products.

- Proactive Communication: Companies investing in clear, accessible information about their supply chains and ingredient functionalities tend to build stronger brand loyalty.

Societal shifts toward health and wellness continue to drive demand for functional ingredients, with consumers increasingly seeking products that support digestion and immunity. Ingredion's focus on sugar reduction and clean labels directly addresses this, aligning with a market where functional foods are projected to reach $350.4 billion by 2027.

The plant-based food market is booming, expected to hit $162 billion by 2030, fueled by health, environmental, and ethical concerns. Ingredion's portfolio of plant-based ingredients like pea protein positions them to meet this escalating demand effectively.

Consumers are prioritizing "clean label" products with simple, recognizable ingredients, with over 60% willing to pay a premium for them in 2024. This trend necessitates transparency and natural sourcing, areas where Ingredion's ingredient solutions are crucial for food manufacturers.

Dietary inclusivity, particularly for gluten-free options, is a significant market driver, with the gluten-free sector valued at approximately $5.5 billion in 2023. Ingredion's expertise in allergen-friendly solutions is vital for serving this growing consumer need.

Technological factors

Ingredion’s commitment to innovation in ingredient science is a key technological driver. For instance, their development of clean label starches addresses consumer preferences for simpler ingredient lists. This focus on novel solutions in areas like texture modification and sugar reduction is vital for staying competitive.

Ingredion is leveraging significant advancements in processing technologies to enhance its operations. For instance, innovations in enzyme technology and fermentation processes, which saw substantial investment and development through 2024, allow for more efficient extraction of valuable components from plant-based raw materials like corn and tapioca. This translates directly to improved yields and reduced waste, ultimately lowering production costs.

These technological leaps empower Ingredion to develop novel ingredients with specific functionalities, meeting growing consumer demand for plant-based and clean-label products. By optimizing existing methods and exploring new biotechnological pathways, the company can create differentiated offerings. For example, advancements in particle size reduction and encapsulation techniques, highlighted in industry reports throughout 2024, enable the creation of ingredients with enhanced solubility and controlled release properties.

Ingredion's embrace of digital transformation, including Laboratory Information Management Systems (LIMS) and sophisticated data analytics, is a key technological driver. This allows for streamlined operations, enhanced quality control, and a clearer understanding of production processes and market shifts.

The company's investment in these data-driven initiatives, as evidenced by their ongoing digital infrastructure upgrades, directly contributes to improved operational efficiency. For instance, in 2024, Ingredion reported significant gains in process optimization through the implementation of new data analytics platforms, leading to an estimated 5% reduction in waste across several key manufacturing sites.

Sustainable Innovation and Biotechnology

Technological advancements in sustainable innovation, particularly in biotechnology and fermentation, are crucial for developing eco-friendlier ingredients and manufacturing processes. Ingredion is actively investing in these areas to bolster its sustainability efforts and meet the growing demand for environmentally conscious products from both its clients and end consumers.

Ingredion's commitment to sustainable innovation is evident in its strategic focus on areas like plant-based proteins and upcycled ingredients. For instance, in 2023, the company reported a significant increase in its portfolio of plant-based solutions, catering to the booming market for alternative proteins. This aligns with broader industry trends, where companies are increasingly leveraging biotechnology to reduce their environmental footprint.

- Biotechnology Integration: Ingredion is exploring advanced fermentation techniques to produce novel ingredients with lower environmental impact.

- Sustainable Sourcing: The company is enhancing its use of upcycled byproducts from agricultural processes, transforming them into valuable food ingredients.

- Market Demand: Consumer preference for sustainable and plant-based foods is projected to continue its upward trajectory, with the global plant-based food market expected to reach over $160 billion by 2030.

Automation and Operational Efficiency

Technological advancements are a key driver for Ingredion's focus on automation and operational efficiency. The company's Cost2Compete program, for instance, leverages these technologies to streamline manufacturing. This strategic investment aims to significantly reduce the cost associated with poor quality products and bolster the reliability of operations across its worldwide network of facilities.

These technological investments are designed to optimize Ingredion's manufacturing processes, leading to enhanced efficiency and cost savings. By integrating advanced automation, Ingredion seeks to achieve a more predictable and cost-effective production cycle. For example, in 2023, Ingredion reported that its Cost2Compete initiatives contributed approximately $100 million in savings, underscoring the tangible impact of technological adoption on operational performance.

- Automation Investments: Ingredion is actively investing in automated systems to improve manufacturing precision and reduce manual intervention.

- Operational Efficiency Gains: The company targets enhanced reliability and optimized production workflows through technology adoption.

- Cost Reduction: Initiatives like Cost2Compete directly aim to lower overall operating expenses by minimizing waste and improving process yields.

- Global Facility Optimization: Technology deployment is a strategy to standardize and elevate operational standards across Ingredion's international manufacturing footprint.

Ingredion is significantly enhancing its product development through advanced biotechnology and ingredient processing. Innovations in enzyme technology and fermentation, with substantial investment through 2024, allow for more efficient extraction from raw materials like corn and tapioca, boosting yields and reducing waste. These advancements enable the creation of specialized ingredients, such as those with improved solubility and controlled release, driven by consumer demand for plant-based and clean-label options.

| Technology Area | Ingredion's Focus | Impact/Benefit | 2024/2025 Data Point |

|---|---|---|---|

| Biotechnology & Fermentation | Novel ingredient production, sustainable processes | Increased yield, reduced waste, eco-friendlier ingredients | Investment in advanced fermentation techniques for novel ingredient production. |

| Processing Technologies | Enzyme technology, particle size reduction, encapsulation | Enhanced functionality, improved texture, controlled release | Development of ingredients with enhanced solubility and controlled release properties. |

| Digital Transformation | LIMS, data analytics, automation | Streamlined operations, quality control, cost reduction | Implementation of new data analytics platforms led to an estimated 5% reduction in waste. |

Legal factors

Ingredion operates within a highly regulated global food safety environment, necessitating adherence to stringent standards for hazard analysis and preventive controls. The company must also ensure robust traceability systems are in place to meet evolving requirements.

Recent updates from the U.S. Food and Drug Administration (FDA), including structural changes and new traceability rules effective in 2024, underscore the critical importance of Ingredion maintaining rigorous compliance. Failure to meet these standards can result in significant operational and reputational risks.

Labeling and marketing laws are critical for Ingredion, influencing how its ingredients are presented to food manufacturers. Regulations around terms like 'healthy' and 'natural,' along with front-of-package nutrition labeling mandates, directly shape product positioning. For instance, the U.S. Food and Drug Administration (FDA) continues to refine its definition of 'healthy,' impacting ingredient claims, with proposed updates in 2024 aiming for clearer nutritional guidance.

Ingredion, like many global food ingredient companies, faces increasing scrutiny and regulation regarding its environmental footprint. New mandates, such as the EU's Corporate Sustainability Reporting Directive (CSRD), demand comprehensive disclosure of environmental impact, pushing companies to enhance their data collection and reporting infrastructure. These regulations are not just about transparency; they often include specific targets, like those for food waste reduction, which directly influence operational strategies and supply chain management.

International Trade and Customs Laws

Ingredion's extensive global footprint means its operations are deeply intertwined with a complex web of international trade and customs laws. These regulations, covering everything from import/export controls to varying tariff rates, directly influence how Ingredion sources its raw materials and distributes its finished ingredient products across different countries. For instance, the World Trade Organization (WTO) reported that global trade in goods grew by an estimated 2.6% in 2023, indicating a steady but potentially sensitive environment for international commerce.

Fluctuations in these trade policies can significantly alter Ingredion's cost structure and the overall efficiency of its supply chain. For example, a sudden imposition of new tariffs on corn, a key ingredient for Ingredion, in a major sourcing region could increase production costs, potentially impacting profitability and pricing strategies for its customers. Similarly, changes in import regulations in key markets could create delays or additional compliance burdens, disrupting the timely delivery of essential ingredients.

Navigating these legal landscapes requires constant vigilance and adaptation. Ingredion must stay abreast of evolving trade agreements, sanctions, and customs procedures in the numerous countries where it operates. The company's ability to manage these complexities is crucial for maintaining competitive pricing and ensuring the smooth flow of goods, which is vital for its business model.

- Tariff Volatility: Changes in import duties on agricultural commodities like corn and sugar can directly impact Ingredion's cost of goods sold.

- Export Controls: Restrictions on exporting certain food ingredients or technologies to specific countries can limit market access.

- Trade Agreements: The existence or absence of favorable trade agreements between nations can significantly affect Ingredion's ability to import raw materials and export finished products cost-effectively.

- Customs Compliance: Adhering to diverse customs documentation and valuation requirements across multiple jurisdictions is essential to avoid penalties and delays.

Labor Laws and Human Rights Compliance

Ingredion, as a global employer with a substantial workforce, navigates a complex landscape of labor laws and human rights regulations across its international operations. Compliance with these diverse legal frameworks is paramount, ensuring fair treatment and safe working conditions for all employees and those within its extended supply chain. The company's commitment to these principles is often detailed in its sustainability reporting.

Key areas of focus include adherence to regulations concerning working hours, wages, and the prohibition of child labor and forced labor. Ingredion's efforts in this domain are crucial for maintaining its social license to operate and for mitigating reputational risks. For instance, in 2023, Ingredion reported on its supplier audits, which aim to identify and address potential labor rights violations.

- Global Workforce Compliance: Ingredion employs tens of thousands of individuals worldwide, requiring adherence to varying national labor statutes.

- Human Rights Due Diligence: The company conducts due diligence to prevent and address human rights risks, including child labor, across its operations and supply chain.

- Sustainability Reporting: Ingredion's sustainability reports provide insights into its programs and performance related to labor practices and human rights.

Ingredion's operations are significantly shaped by food safety regulations, with the FDA's 2024 traceability rule updates highlighting the need for robust compliance and hazard control systems.

Labeling laws, particularly around terms like 'healthy' and 'natural,' are critical, as demonstrated by the FDA's ongoing refinement of nutritional guidance, impacting how Ingredion's ingredients are marketed.

Environmental regulations, such as the EU's CSRD, are pushing Ingredion towards comprehensive sustainability reporting and specific targets for areas like food waste reduction.

Environmental factors

Climate change presents substantial risks for Ingredion, influencing everything from agricultural supply chains to operational costs. The company is proactively addressing these challenges by focusing on reducing its greenhouse gas (GHG) emissions.

Ingredion has made significant strides, achieving a 22% absolute reduction in carbon emissions from its 2019 baseline. This accomplishment is a key part of their commitment to further reductions under the 2030 All Life plan, demonstrating a tangible effort to mitigate environmental impact.

Water scarcity is a significant environmental challenge, especially in the agricultural areas where Ingredion sources key ingredients like corn. This poses a direct risk to the company's supply chain stability and operational continuity.

Ingredion's commitment to water stewardship, demonstrated by its recognition from CDP for water security efforts, highlights its proactive approach. This focus on efficient water usage in its manufacturing facilities is vital for maintaining sustainable operations and mitigating risks associated with water stress.

Ingredion is making significant strides in sustainable sourcing, aiming for 100% of its Tier 1 priority crops to be sustainably sourced by 2025. This commitment is crucial for building a resilient supply chain, especially as climate change impacts agricultural yields.

The company is actively investing in and promoting regenerative agriculture practices. These methods, such as cover cropping and reduced tillage, aim to improve soil health, enhance biodiversity, and sequester carbon, contributing to a more stable and productive agricultural system for Ingredion's raw materials.

Waste Management and Circular Economy Initiatives

Ingredion faces growing pressure to reduce waste, especially food byproducts and plastic packaging. This environmental focus creates both hurdles and avenues for innovation in their operations. For instance, in 2024, the company continued to invest in technologies aimed at valorizing byproducts, turning potential waste streams into valuable ingredients, a key aspect of the circular economy.

The company's commitment to minimizing excess production and fostering recycling loops is crucial. Ingredion's 2025 sustainability goals include further targets for waste diversion from landfills, reflecting the evolving demands for more sustainable packaging solutions from consumers and regulators alike.

- Food Waste Reduction: Ingredion is exploring advanced processing techniques to convert agricultural co-products into higher-value ingredients, aligning with circular economy principles.

- Plastic Packaging: The company is actively researching and implementing more sustainable packaging materials, including those with higher recycled content and improved recyclability, aiming to meet 2025 targets.

- Circular Economy Integration: Ingredion's strategy involves building partnerships to create closed-loop systems for materials, reducing reliance on virgin resources and minimizing environmental impact.

Biodiversity and Ecosystem Protection

Ingredion's extensive agricultural sourcing directly influences biodiversity, given its reliance on crops like corn and sugarcane. The company's commitment to this area is evident through its engagement with frameworks such as the Sustainable Ag Initiative (SAI) Platform's Regenerative Together. This initiative aims to foster sustainable agricultural practices that protect and enhance ecosystem health.

Ingredion's participation in the Regenerative Together framework, launched in 2023, signals a proactive approach to mitigating its environmental footprint. This includes efforts to promote practices that support biodiversity on farms where its ingredients are grown, contributing to the overall health of agricultural ecosystems.

- Biodiversity Impact: Ingredion's sourcing of key ingredients like corn and sugarcane has a direct impact on biodiversity in agricultural landscapes.

- SAI Platform Engagement: The company is actively involved with the Sustainable Ag Initiative (SAI) Platform, a collaborative effort to advance sustainable agriculture.

- Regenerative Together: Ingredion's participation in the Regenerative Together framework underscores its commitment to biodiversity protection and ecosystem restoration.

Ingredion's environmental strategy centers on mitigating climate change impacts and promoting sustainable resource management. The company has achieved a 22% absolute reduction in carbon emissions from its 2019 baseline, aligning with its 2030 All Life plan for further reductions.

Water scarcity is a key concern, addressed through efficient water usage in operations and a commitment to sustainable sourcing, with a goal of 100% of Tier 1 priority crops being sustainably sourced by 2025.

Waste reduction and circular economy principles are also central, with investments in technologies to valorize byproducts and a focus on sustainable packaging materials, aiming for increased waste diversion from landfills.

Biodiversity is managed through engagement with frameworks like the SAI Platform's Regenerative Together, promoting practices that protect and enhance ecosystem health on farms where its ingredients are grown.

| Environmental Focus | 2024/2025 Data/Goals | Impact/Strategy |

|---|---|---|

| Carbon Emissions Reduction | 22% absolute reduction from 2019 baseline | Mitigating climate change impact, aligned with 2030 All Life plan |

| Sustainable Sourcing | 100% of Tier 1 priority crops by 2025 | Ensuring supply chain resilience against climate impacts |

| Water Stewardship | Recognition from CDP for water security efforts | Mitigating risks from water scarcity through efficient usage |

| Waste Reduction & Circularity | Investing in byproduct valorization technologies | Reducing waste, creating value from co-products, promoting circular economy |

| Biodiversity Protection | Engagement with SAI Platform's Regenerative Together | Promoting practices that enhance ecosystem health on sourcing farms |

PESTLE Analysis Data Sources

Our Ingredion PESTLE Analysis draws from a comprehensive blend of data sources, including reports from leading agricultural organizations, global economic indicators from institutions like the IMF and World Bank, and regulatory updates from relevant government bodies. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors impacting the food ingredients industry.