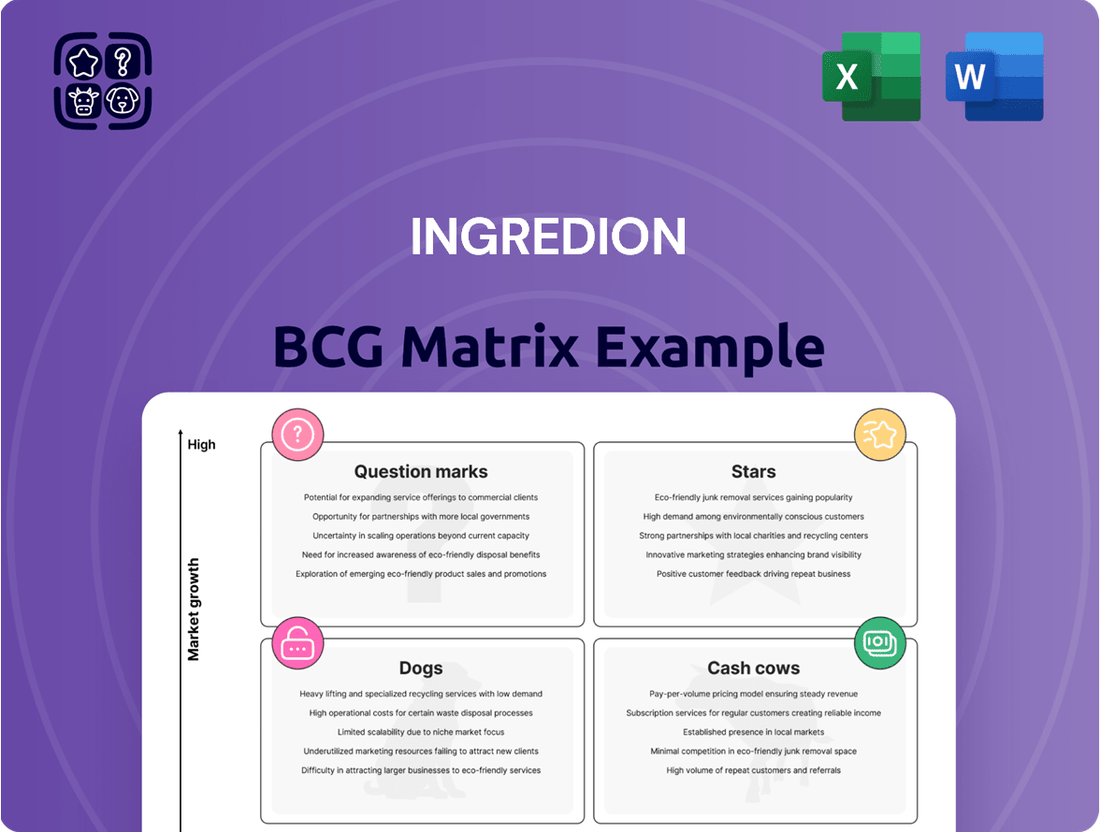

Ingredion Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

Unlock the strategic potential of Ingredion's product portfolio with a clear understanding of its position within the BCG Matrix. See which products are driving growth, generating cash, or requiring a closer look. Purchase the full BCG Matrix to gain a comprehensive breakdown and actionable insights for optimizing your investment strategy.

Stars

The Texture & Healthful Solutions segment is a star performer for Ingredion, showing robust growth. Operating income saw a significant 34% jump in Q1 2025, and this segment is expected to keep expanding at a mid-to-high single-digit pace. Ingredion is actively investing in innovation to boost both the growth and profitability of this crucial global business, making it a key contributor to the company's future financial success.

Ingredion stands out as a leader in clean label ingredient solutions, a segment experiencing robust consumer-driven growth and offering substantial profit opportunities for companies that embrace these formulations.

The company's commitment to innovation is evident in recent introductions such as NOVATION® Indulge 2940, a functional native starch, and FIBERTEX™ citrus fibers. These products underscore Ingredion's ongoing leadership in this rapidly expanding market.

The plant-based protein sector is booming, and Ingredion is actively participating in this growth. The company is expanding its offerings, including pea protein isolates, through significant investments and key alliances, like its collaboration with Lantmännen.

This strategic push is designed to bolster Ingredion's standing as a major player in the dynamic global plant-based protein market.

Natural Sugar Reduction Solutions (PureCircle Stevia)

Ingredion's PureCircle stevia business is a star performer, capitalizing on the surging consumer demand for sugar reduction. The company’s strategic investments, including expanded production in Malaysia, bolster its capacity to meet this growing market. Furthermore, the UK's regulatory approval for bioconversion-produced Reb M, a key stevia ingredient, enhances PureCircle's competitive edge in delivering healthier, great-tasting sweetener solutions.

This segment is experiencing significant growth, driven by health-conscious consumers actively seeking to lower their sugar intake. PureCircle's focus on high-purity stevia ingredients like Reb M offers a superior taste profile compared to earlier generations of stevia, addressing a critical barrier to adoption for many food and beverage manufacturers. In 2024, the global market for high-intensity sweeteners, including stevia, continued its upward trajectory, with analysts projecting continued double-digit growth through the end of the decade.

- Market Growth: The global stevia market was valued at approximately $1.2 billion in 2023 and is projected to reach over $2.5 billion by 2028, demonstrating a strong compound annual growth rate.

- Innovation Focus: PureCircle's investment in bioconversion technology for Reb M production allows for more efficient and sustainable sourcing of this premium stevia leaf extract.

- Regulatory Tailwinds: Approvals like the one in the UK for Reb M are crucial for market expansion, enabling wider application of these advanced sweetener ingredients.

- Consumer Demand: Surveys consistently show that over 60% of consumers are actively trying to reduce their sugar consumption, creating a substantial opportunity for stevia-based products.

Innovation in Specialized Food Applications

Ingredion is making significant strides in specialized food applications, a key area for growth. They are actively developing and launching ingredients designed for high-demand sectors such as nutritional beverages and cold-pressed bars. This strategic focus taps into shifting consumer tastes and opens up new market avenues for the company.

For instance, Ingredion's VITESSENCE® pea ingredients are engineered to enhance product performance. VITESSENCE® Pea 200 D is noted for its improved dispersibility, a crucial factor in beverage formulations, while VITESSENCE® Pea 100 HD is designed to optimize texture in various food products. These innovations demonstrate a commitment to providing solutions that address specific market needs.

- Targeted Ingredient Development: Ingredion is focusing on specialized ingredients for growth areas like nutritional beverages and cold-pressed bars.

- Product Examples: VITESSENCE® Pea 200 D for better dispersibility and VITESSENCE® Pea 100 HD for texture improvement are key offerings.

- Market Responsiveness: This innovation strategy directly addresses evolving consumer preferences and expands market reach.

- Growth Potential: By catering to niche, high-growth applications, Ingredion aims to capture greater market share in specialized food segments.

Ingredion's Texture & Healthful Solutions, PureCircle stevia, and specialized food applications are clear stars in its portfolio. These segments are experiencing robust growth, driven by consumer demand for healthier, cleaner ingredients. Ingredion's strategic investments in innovation and capacity expansion are positioning these areas for continued strong performance, contributing significantly to the company's overall financial success.

| Segment | 2024 Performance Indicator | Growth Driver | Ingredion's Action |

| Texture & Healthful Solutions | 34% operating income jump (Q1 2025) | Demand for clean label ingredients | Innovation investment, new product launches (NOVATION® Indulge 2940, FIBERTEX™) |

| PureCircle Stevia | Strong growth in sugar reduction market | Consumer desire to lower sugar intake | Expanded production (Malaysia), focus on high-purity Reb M, bioconversion technology |

| Specialized Food Applications | Targeted development for high-demand sectors | Shifting consumer tastes (nutritional beverages, bars) | Product engineering (VITESSENCE® Pea 200 D, VITESSENCE® Pea 100 HD) |

What is included in the product

This overview provides strategic insights for Ingredion's portfolio across the BCG Matrix, highlighting which units to invest in, hold, or divest.

Ingredion's BCG Matrix offers a clear, one-page overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

The Food & Industrial Ingredients segment in the US and Canada is a clear cash cow for Ingredion. This segment consistently generates robust operating income and substantial cash flow, a testament to its mature market position where Ingredion enjoys a significant market share.

Ingredion's success here is driven by efficient cost management and a favorable product mix. The company also benefits from multi-year customer contract renewals, which provide a predictable and stable revenue stream, reinforcing its cash-generating capabilities.

For the first quarter of 2024, Ingredion reported that its North America segment, which largely encompasses this business, saw a net sales increase of 3.4% to $1.05 billion, underscoring the ongoing strength and stability of this core operation.

Traditional starch products are Ingredion's bedrock, representing their largest revenue stream and a testament to their established market position. These offerings, while not necessarily in a high-growth phase, deliver dependable, high-volume sales, acting as a significant engine for the company's financial stability and cash flow generation.

Ingredion's core sweetener portfolio, encompassing traditional sugar and high-fructose corn syrup, continues to be a significant cash generator despite evolving consumer preferences. These products hold strong positions in established markets, providing reliable income streams that fuel innovation and investment in growth areas.

In 2024, Ingredion reported that its Sweeteners segment contributed a substantial portion of its overall revenue, underscoring the enduring demand for these foundational ingredients across diverse industries. The company's extensive distribution network and established customer relationships ensure continued market share in these mature but vital segments.

Established Industrial Market Ingredients

Ingredion's established industrial market ingredients, serving sectors like brewing, paper, textiles, and adhesives, represent a significant portion of its business. These mature markets, while not experiencing rapid growth, offer a stable and predictable revenue stream. In 2024, Ingredion continued to leverage its long-standing relationships and expertise in these areas, contributing to its overall financial stability.

The consistent demand from these industrial applications acts as a reliable source of cash flow for Ingredion. This stability is crucial for funding investments in other, more dynamic business segments. Ingredion's ability to maintain strong market positions in these established sectors underscores its operational efficiency and customer loyalty.

- Market Diversification: Ingredion's presence in industrial markets beyond food and beverage provides a crucial buffer against fluctuations in consumer-facing segments.

- Revenue Stability: The mature nature of these industrial sectors ensures a consistent and predictable demand for Ingredion's ingredients, generating reliable cash flow.

- Operational Efficiency: Ingredion's established infrastructure and long-term partnerships in these markets contribute to cost-effectiveness and strong profit margins.

Co-products from Raw Material Processing

The sale of co-products, such as animal feed or industrial starches, generated from Ingredion's core plant-based raw material processing, forms a dependable revenue source. These by-products enhance overall profitability by maximizing the value extracted from every raw material input. For instance, in 2024, Ingredion reported that its specialty ingredients segment, which includes many co-products, continued to be a strong performer, contributing significantly to the company's financial stability.

These co-products are crucial for Ingredion's operational efficiency, often representing a low-cost, high-margin addition to their product portfolio. They act as consistent cash generators, supporting the company's investments in its more dynamic business units.

- Stable Revenue: Co-products provide a predictable income stream, mitigating volatility from primary product sales.

- Profitability Boost: By utilizing all parts of the raw material, Ingredion improves overall margins.

- Operational Efficiency: Co-product sales contribute to the cost-effectiveness of core processing.

- Financial Stability: These reliable cash flows support broader business strategies and investments.

Ingredion's traditional starch products and core sweetener portfolio are prime examples of its cash cows. These mature businesses, while not experiencing explosive growth, consistently generate substantial cash flow due to their established market positions and predictable demand. For instance, in the first quarter of 2024, Ingredion's North America segment, which includes these key areas, saw net sales rise by 3.4% to $1.05 billion, highlighting their ongoing revenue strength.

| Business Segment | 2024 Q1 Net Sales (USD Billions) | Key Characteristics |

|---|---|---|

| North America (includes traditional starches & sweeteners) | 1.05 | Mature market, stable demand, strong market share |

| Sweeteners | Significant contributor to overall revenue | Established customer base, dependable income streams |

| Traditional Starches | Largest revenue stream | High-volume, dependable sales, financial stability |

Preview = Final Product

Ingredion BCG Matrix

The Ingredion BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, ensuring you get a professional and ready-to-use report. You can confidently expect the same in-depth insights and clear presentation in the final file, enabling immediate application to your business planning. This is your direct gateway to actionable market intelligence for Ingredion's product portfolio.

Dogs

Ingredion completed the sale of its South Korea business in the first quarter of 2024. This strategic move indicates that the South Korean operations were likely considered a Question Mark or a Dog within Ingredion's portfolio. Such divestitures often occur when a business unit struggles with low market share or limited growth potential, prompting a company to streamline its operations and focus on more promising areas.

Ingredion's planned divestiture of its Pakistan business signals this operation likely falls into the 'Dog' category of the BCG Matrix. This suggests the business has low market share in a low-growth industry, making it a less attractive investment for Ingredion's future.

Divesting such assets allows Ingredion to reallocate capital and management focus towards areas with higher growth potential and strategic importance. For instance, Ingredion has been actively investing in its specialty ingredients portfolio.

Within Ingredion's diverse product range, certain legacy items might be found in markets that are already crowded and offer little differentiation. These products often struggle to gain significant market share and experience very little growth.

These offerings typically operate at a break-even point or even consume cash without generating substantial returns. Consequently, they become prime candidates for strategic review and potential discontinuation or divestment to free up resources for more promising ventures.

Products Impacted by Shifting Consumer Preferences

Products that don't align with current consumer preferences, like clean label, plant-based, or sugar reduction, could see demand and market share shrink. For instance, traditional corn syrup ingredients, if not reformulated or repositioned, might become cash traps for Ingredion. In 2024, the global clean label ingredients market was valued at approximately $50 billion, highlighting the significant shift away from artificial additives.

- Declining Demand: Products failing to meet consumer demand for natural, minimally processed ingredients face reduced sales.

- Market Share Erosion: Competitors offering products aligned with clean label and plant-based trends can capture market share.

- Resource Diversion: Investing in outdated product lines diverts capital and R&D resources from growth opportunities.

- Cash Trap Risk: Products with diminishing returns can become liabilities, consuming resources without generating sufficient profit.

Underperforming Regional Operations Without Strategic Fit

Ingredion's portfolio may include regional operations that are not meeting performance expectations and lack strategic alignment with the company's long-term vision. These underperforming segments, often characterized by low market share and limited growth potential, could be prime candidates for divestiture or strategic repositioning. For instance, if a particular geographic region shows declining sales or persistent operational inefficiencies, Ingredion might explore options to exit that market or streamline its presence there.

Such operations might represent a drain on resources without contributing significantly to Ingredion's overall growth objectives. In 2023, Ingredion reported a net sales increase of 3% to $7.4 billion, driven by strong performance in specialty ingredients. However, this growth might mask pockets of weakness in less strategic areas. Identifying and addressing these underperforming units is crucial for optimizing capital allocation and focusing on high-return opportunities.

- Underperforming Regional Operations: These are business units or product lines within specific geographic areas that consistently fail to meet financial targets or strategic goals.

- Lack of Strategic Fit: These operations may not align with Ingredion's core competencies, growth markets, or innovation pipeline, making them less attractive for continued investment.

- Potential Divestment or Restructuring: Companies often consider selling off or significantly restructuring such units to improve overall portfolio performance and focus resources on more promising ventures.

- Impact on Overall Performance: Even small, underperforming segments can collectively impact a company's profitability and operational efficiency if not managed proactively.

Dogs in Ingredion's portfolio are those business segments or product lines with low market share in slow-growing or declining industries. These units often struggle to generate significant profits and can become cash drains, diverting resources from more promising areas. The divestiture of its South Korea business in early 2024 and the planned exit from Pakistan strongly suggest these operations were classified as Dogs.

These underperforming assets might include legacy products that no longer align with evolving consumer preferences, such as the growing demand for clean label and plant-based ingredients. For instance, traditional corn syrup, if not adapted, could become a cash trap, especially as the global clean label market was valued around $50 billion in 2024.

Ingredion’s strategic focus on specialty ingredients, which saw a 3% net sales increase to $7.4 billion in 2023, highlights the company's effort to move away from these low-growth, low-share segments. By divesting or restructuring these 'Dog' units, Ingredion aims to optimize capital allocation and enhance overall portfolio performance.

| Category | Characteristics | Ingredion Examples (Indicative) | Strategic Implication | 2024 Market Context |

| Dogs | Low market share, low growth industry | South Korea business (divested 2024), Pakistan business (planned divestiture) | Divestiture, liquidation, or minimal investment | Declining demand for certain traditional ingredients; shift towards specialty and clean label |

| Legacy product lines not aligned with clean label trends | Resource reallocation to growth areas | Global clean label market valued ~ $50 billion in 2024 | ||

| Underperforming regional operations | Focus on improving efficiency or exiting market | Specialty ingredients driving overall company growth |

Question Marks

Ingredion's All Other Segment, encompassing innovative products like allulose and other developing ventures, is on a clear path toward financial stability, with projections indicating it will reach breakeven in 2025. This segment is currently a cash consumer, but its substantial growth trajectory necessitates ongoing investment to capture greater market share and potentially ascend to the 'Star' category within the BCG matrix.

Ingredion is expanding its plant-based protein offerings beyond the established pea protein, focusing on newer sources like lentils, faba beans, and chickpeas. These emerging proteins, while currently holding smaller market shares, exhibit significant growth potential, indicating a strategic move to capture future market demand.

The company's investment in these novel pulse-based proteins is substantial, aimed at driving market adoption and establishing a strong foothold. This approach reflects a long-term vision to diversify Ingredion's plant-based portfolio and capitalize on evolving consumer preferences for alternative protein sources.

Ingredion's Idea Labs are a hotbed for developing novel ingredient solutions, focusing on early-stage innovations that hold significant potential for future market growth. These pioneering ingredients, though in their infancy, represent the company's commitment to staying ahead of evolving consumer demands and industry trends.

Currently, these emerging ingredients likely occupy a small segment of the overall market, characteristic of new product introductions. This low market share necessitates robust investment in marketing, sales, and consumer education to build awareness and drive adoption, positioning them as potential stars in Ingredion's portfolio.

Strategic Expansion into New Geographic Markets (e.g., Benelux for specialty products)

Ingredion's strategic expansion into new geographic markets, such as the Benelux region for its specialty ingredients, aligns with a Stars or Question Marks position in the BCG Matrix, depending on market share and growth prospects. The company is targeting functional native starches, plant-based proteins, and stevia sweeteners, areas that represent high-growth potential but currently have low penetration in these new territories.

This move requires significant investment to establish distribution partnerships and build brand presence, aiming to capture substantial market share. For instance, the global market for plant-based proteins was valued at approximately USD 40.3 billion in 2023 and is projected to grow substantially, indicating a fertile ground for expansion.

- High Growth, Low Penetration: Benelux offers a promising, albeit underdeveloped, market for Ingredion's specialty ingredients like plant-based proteins and stevia sweeteners.

- Investment Required: Capturing significant market share in these new regions necessitates substantial capital outlay for distribution, marketing, and potentially localized product development.

- Market Opportunity: The global market for functional ingredients, including starches and sweeteners, is experiencing robust growth, driven by consumer demand for healthier and more sustainable options.

- Strategic Alignment: This expansion strategy is crucial for Ingredion to diversify its revenue streams and solidify its position in high-value specialty product segments.

Digital Transformation and Operational Efficiency Initiatives

Ingredion's digital transformation initiatives, such as the Laboratory Information Management System (LIMS) pilot, represent significant investments aimed at enhancing long-term operational efficiency and achieving future cost savings. These forward-looking projects require substantial upfront capital, impacting immediate profitability and market share growth.

These investments are characteristic of 'Question Marks' in the BCG Matrix, demanding careful resource allocation. For example, in 2024, Ingredion continued to invest in digital tools to streamline R&D and quality control processes.

- Digital Transformation Investments: Focus on systems like LIMS to improve data management and operational workflows.

- Operational Efficiency Goals: Aim to reduce costs and enhance productivity through technological advancements.

- BCG Matrix Classification: These initiatives fall under Question Marks due to high investment needs and uncertain immediate returns.

- Future Return Expectation: The strategy relies on anticipated long-term benefits in efficiency and cost reduction.

Ingredion's exploration into novel ingredients like allulose and emerging plant-based proteins signifies a strategic positioning within the Question Marks category. These ventures require substantial investment for market development and adoption, mirroring the characteristics of high-growth, low-market-share products. The company's commitment to digital transformation, exemplified by LIMS pilots, also falls into this quadrant, demanding significant capital with uncertain near-term returns but promising long-term efficiency gains.

| Category | Description | Market Share | Growth Rate | BCG Status | Investment Need |

|---|---|---|---|---|---|

| Novel Ingredients (e.g., Allulose, Emerging Proteins) | Developing and introducing new ingredient solutions. | Low | High | Question Mark | High |

| Geographic Expansion (e.g., Benelux for Specialty Ingredients) | Entering new markets with existing or adapted products. | Low (in new markets) | High (projected) | Question Mark | High |

| Digital Transformation Initiatives (e.g., LIMS) | Investing in technology for operational improvement. | N/A (Internal) | N/A (Internal) | Question Mark | High |

BCG Matrix Data Sources

Our Ingredion BCG Matrix leverages comprehensive market data, including financial disclosures, industry growth rates, and competitor performance, to provide strategic insights.