Ingredion Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ingredion Bundle

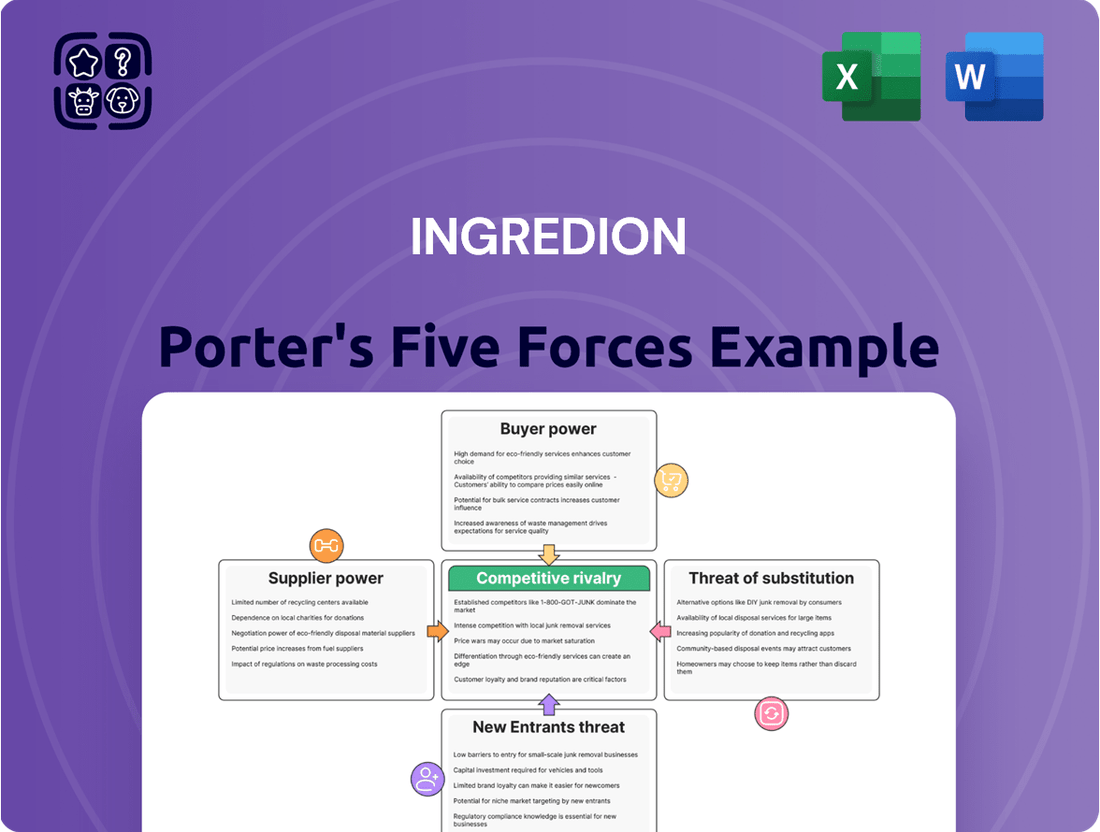

Ingredion operates within a dynamic food ingredients market, facing moderate threats from new entrants and the availability of substitutes. Buyer power is significant, particularly from large food manufacturers, while supplier power is relatively low due to the commodity nature of many raw materials. Intense rivalry among existing players further shapes the competitive landscape.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Ingredion’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Ingredion's reliance on key plant-based raw materials such as corn, tapioca, and potatoes means the concentration of agricultural suppliers significantly impacts their bargaining power. If a large portion of a critical crop is controlled by a small number of producers, these suppliers gain leverage, potentially driving up Ingredion's input costs.

This concentration isn't uniform; it fluctuates based on geographic location and the specific crop. For instance, in regions where corn production is highly consolidated, Ingredion faces a greater risk of supplier power. In 2024, global corn prices saw volatility, partly due to weather patterns affecting yields in major producing nations, highlighting how supplier concentration can amplify price swings.

The availability of substitute raw materials significantly impacts Ingredion's bargaining power with its suppliers. If Ingredion can easily switch between different plant-based inputs, like shifting from corn to tapioca for specific starch applications, it diminishes the leverage of any single supplier. This flexibility is crucial; when equally effective alternatives exist at comparable prices, Ingredion gains more negotiating strength.

Ingredion's strategic advantage lies in its diverse raw material sourcing, which includes corn, tapioca, and potatoes. This broad base provides a degree of resilience and allows for greater maneuverability in procurement. For instance, in 2023, Ingredion reported that corn remained its primary raw material, but its ability to process other starches provided a buffer against potential price hikes or supply disruptions from corn-centric suppliers.

The bargaining power of suppliers for Ingredion is significantly influenced by the switching costs involved in changing raw material sources. These costs can be substantial, encompassing expenses related to re-tooling manufacturing equipment to accommodate different raw material specifications, reformulating existing products to maintain quality and taste profiles, and the rigorous process of re-qualifying new suppliers to ensure consistent standards.

For instance, if Ingredion needs to switch from a corn-based starch supplier to a tapioca-based one, the entire production line might require adjustments, impacting operational efficiency and incurring capital expenditures. These inherent switching costs empower Ingredion's suppliers, as the effort and expense for Ingredion to change providers can be considerable, making it less likely for Ingredion to seek alternative suppliers frequently.

Importance of Ingredion to Suppliers

Ingredion's significance to its suppliers directly influences their bargaining power. If Ingredion accounts for a large percentage of a supplier's revenue, that supplier has less leverage because they depend heavily on Ingredion's continued business. Conversely, if Ingredion is just one of many clients for a supplier, the supplier can exert more influence over pricing and terms.

Ingredion's vast global footprint and diverse product portfolio mean it likely represents a substantial customer for many of its raw material providers. For instance, in 2023, Ingredion reported that its cost of goods sold was approximately $6.5 billion, indicating significant purchasing volume for agricultural commodities and other inputs.

- Supplier Reliance: A supplier whose business is predominantly with Ingredion has reduced bargaining power due to dependence on Ingredion's demand.

- Customer Diversification: Suppliers with a broad customer base, where Ingredion is a smaller client, possess greater leverage.

- Ingredion's Scale: Ingredion's extensive global operations and procurement needs suggest it is a key buyer for many of its raw material suppliers, potentially limiting supplier power.

- 2023 Procurement: With over $6.5 billion in cost of goods sold in 2023, Ingredion's purchasing scale is considerable, impacting the bargaining dynamic with its suppliers.

Threat of Forward Integration by Suppliers

The threat of forward integration by Ingredion's suppliers can significantly bolster their bargaining power. If suppliers can credibly move into ingredient processing, they can capture a larger portion of the value chain, potentially squeezing Ingredion's margins.

While direct agricultural producers typically face higher barriers to forward integration into complex processing, this remains a pertinent consideration, especially for suppliers of more specialized or value-added inputs. For instance, a supplier of a unique corn derivative might explore processing it further into a specialized sweetener, directly competing with Ingredion's offerings.

- Supplier Integration Risk: Suppliers of raw materials, particularly those with proprietary processing capabilities, may consider integrating forward to capture more value.

- Impact on Ingredion: If successful, this could lead to increased competition and potentially higher input costs for Ingredion.

- Industry Example: While less common for bulk agricultural commodities, specialized ingredient suppliers are more likely to pose this threat.

The bargaining power of Ingredion's suppliers is moderate, influenced by factors like raw material concentration and switching costs. While Ingredion's scale as a buyer ($6.5 billion in cost of goods sold in 2023) provides some leverage, the specialized nature of certain ingredients and the costs associated with changing suppliers can empower them.

The threat of forward integration by suppliers is relatively low for bulk commodities but could be a factor for specialized ingredient providers. Overall, Ingredion's diversified sourcing strategy helps to mitigate the potential for excessive supplier power.

| Factor | Impact on Ingredion | Mitigation Strategies |

|---|---|---|

| Supplier Concentration | Moderate to High (depending on crop/region) | Diversified sourcing, long-term contracts |

| Switching Costs | Moderate to High | Investment in flexible manufacturing, strong supplier relationships |

| Customer Diversification (Suppliers) | Suppliers with many clients have more power | Becoming a key customer for suppliers |

| Forward Integration Threat | Low for bulk, Moderate for specialized | Strategic partnerships, internal R&D |

What is included in the product

This analysis delves into the competitive forces impacting Ingredion, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the ingredient solutions market.

Instantly understand strategic pressure with a powerful spider/radar chart, simplifying Ingredion's competitive landscape for decisive action.

Customers Bargaining Power

Ingredion's customer base is diverse, spanning food, beverage, animal nutrition, brewing, and various industrial sectors worldwide. This broad reach generally dilutes individual customer power. However, the bargaining power of customers can significantly increase if a small number of major clients represent a substantial percentage of Ingredion's total revenue.

For instance, if a few key customers consistently purchase large volumes of Ingredion's starches, sweeteners, or biomaterials, they gain considerable leverage. This can translate into stronger negotiation positions regarding pricing, delivery schedules, and customized product specifications. In 2023, Ingredion reported net sales of $7.5 billion, highlighting the scale of operations where even a few percentage points concentrated with a handful of clients could represent hundreds of millions in revenue, granting them substantial influence.

Customers hold more sway when they can readily switch to alternative ingredient suppliers or use different ingredients to achieve comparable product qualities. This ease of substitution directly impacts Ingredion's pricing power and market share.

Ingredion's strategic emphasis on developing innovative solutions for texture, sweetness, nutrition, and sustainability is a direct response to this. By offering unique functionalities and performance benefits, Ingredion aims to make its ingredients less substitutable, thereby strengthening its position against customer bargaining power.

For instance, in 2024, the food and beverage industry continued to see a strong demand for clean label and plant-based ingredients, areas where Ingredion has invested heavily. Companies seeking these specific attributes may find Ingredion's specialized offerings harder to replace with generic alternatives.

The costs a customer faces when moving from Ingredion to another supplier significantly shape their power. High switching costs, like the expense of reformulating products, conducting new tests, and obtaining regulatory approvals for alternative ingredients, make customers hesitant to change. This hesitancy directly weakens their ability to demand lower prices or better terms from Ingredion.

Ingredion's emphasis on collaborative development and tailored ingredient solutions often embeds its products deeply within a customer's specific processes and formulations. This co-creation strategy can elevate the switching costs, as a customer would need to find not just a comparable ingredient but one that fits seamlessly into their existing, often complex, manufacturing and product development ecosystems.

Customer Price Sensitivity

Customer price sensitivity is a key factor influencing Ingredion's bargaining power of customers. In many of the industries Ingredion serves, particularly those reliant on commodity ingredients, customers can be highly attuned to price fluctuations. This sensitivity is amplified when the cost of ingredients forms a substantial part of their overall product expenses, giving them more leverage to negotiate favorable terms.

For instance, in the food and beverage sector, where Ingredion is a major supplier, ingredient costs can represent a significant portion of a finished product's cost of goods sold. If a customer's final product is also price-sensitive, they will naturally seek to minimize their input costs. This dynamic was evident in 2024, where inflationary pressures on raw materials like corn and sugar continued to impact pricing across the food industry, potentially increasing customer demands for lower ingredient prices from suppliers like Ingredion.

- Price Sensitivity in Key Markets: Customers in sectors like baking, beverages, and animal nutrition often face intense competition, making them highly sensitive to the cost of essential ingredients such as starches and sweeteners.

- Impact on Negotiation: When ingredient costs are a large percentage of a customer's total production cost, their ability to negotiate lower prices or seek alternative suppliers increases significantly.

- Ingredion's Mitigation Strategy: Ingredion's strategic focus on developing and marketing value-added and specialty ingredients, such as high-purity starches or functional sweeteners, aims to differentiate its offerings and reduce direct price comparisons with commodity products, thereby lessening customer price sensitivity.

Threat of Backward Integration by Customers

The threat of backward integration by customers can significantly bolster their bargaining power against Ingredion. If major food and beverage manufacturers possess the technical expertise and financial resources to produce their own starches, sweeteners, or other ingredients, they gain leverage in negotiations.

This is particularly relevant for very large players in the industry. For instance, a global beverage giant might consider developing proprietary ingredient solutions if the cost savings and control over supply chain outweigh the investment in R&D and manufacturing facilities. This capability directly challenges Ingredion's market position by offering an alternative to purchasing from Ingredion.

- Increased Customer Leverage: Customers capable of backward integration have greater power to negotiate lower prices or more favorable terms from Ingredion.

- Industry Examples: Large food conglomerates with substantial R&D budgets and existing manufacturing infrastructure are more likely to explore this option.

- Ingredion's Defense: Ingredion can mitigate this threat by offering highly specialized, proprietary ingredients and innovative solutions that are difficult for customers to replicate internally.

- Cost-Benefit Analysis for Customers: The decision for a customer to backward integrate hinges on a thorough cost-benefit analysis, weighing the capital expenditure and operational complexity against potential savings and strategic advantages.

Customers' bargaining power is a significant force influencing Ingredion's profitability. This power is amplified when customers can easily switch suppliers or when their purchasing volume is substantial enough to command better terms. Ingredion's ability to differentiate its offerings through innovation and specialized solutions is key to mitigating this pressure.

In 2023, Ingredion's net sales reached $7.5 billion, underscoring the importance of managing relationships with large volume buyers. Customers who represent a considerable portion of this revenue can exert considerable influence on pricing and product specifications. For instance, a major beverage manufacturer might leverage its scale to negotiate discounts on sweeteners or starches, impacting Ingredion's margins if not managed strategically.

The ease with which customers can find alternative ingredients or reformulate their products directly impacts Ingredion's pricing power. If Ingredion's products are perceived as commodities with readily available substitutes, customers gain leverage. This is particularly true in sectors where ingredient cost is a significant component of the final product, as seen in the competitive food and beverage market in 2024, where inflationary pressures continue to drive cost-consciousness among buyers.

Ingredion's strategy to counter this involves developing value-added ingredients that offer unique functional benefits, thereby increasing switching costs for customers. By embedding its products deeply into customer formulations through collaborative development, Ingredion aims to reduce the likelihood of customers seeking alternatives. This approach is crucial for maintaining pricing power and market share against a diverse and sometimes price-sensitive customer base.

| Factor | Impact on Ingredion | Mitigation Strategy |

|---|---|---|

| Customer Concentration | High concentration of revenue with a few large customers increases their bargaining power. | Diversify customer base, focus on value-added solutions for key accounts. |

| Ease of Substitution | Availability of alternative ingredients or reformulation capabilities weakens Ingredion's pricing power. | Develop proprietary, high-performance ingredients; focus on innovation and technical support. |

| Switching Costs | Low switching costs empower customers to demand better terms. | Increase integration into customer processes; offer tailored solutions that are difficult to replicate. |

| Price Sensitivity | Customers highly sensitive to ingredient costs will push for lower prices. | Emphasize total cost of ownership and the value proposition of Ingredion's ingredients. |

What You See Is What You Get

Ingredion Porter's Five Forces Analysis

This preview showcases the complete Ingredion Porter's Five Forces Analysis, providing a detailed examination of the competitive landscape within the ingredient solutions industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or missing sections. You can trust that the insights and strategic evaluations presented are what you will gain access to, ready for immediate application to your business planning.

Rivalry Among Competitors

The ingredient solutions market is intensely competitive, featuring numerous large and well-established companies. Ingredion contends with significant players like Cargill, Archer Daniels Midland (ADM), Tate & Lyle, Kerry Group, and Roquette Frères, all of whom offer a broad spectrum of similar and specialized ingredients, thereby heightening industry rivalry.

The overall expansion rate of the food ingredients sector significantly shapes how fiercely companies compete. When a market isn't growing rapidly, businesses often battle harder for existing customers, intensifying rivalry.

Projections indicate robust growth for the food ingredients market, with estimates suggesting a compound annual growth rate (CAGR) of approximately 6.1% from 2023 to 2028, reaching an estimated value of $264.7 billion by 2028. This upward trend, fueled by rising demand for convenient, ready-to-eat meals and a growing consumer focus on health and wellness, could potentially ease some of the competitive pressures as companies can expand by capturing new market opportunities rather than solely by taking share from rivals.

In the ingredient sector, competition extends beyond mere price points to encompass product differentiation and innovation. Companies actively strive to offer unique solutions that cater to evolving consumer demands.

Ingredion, for instance, distinguishes itself by developing novel functional ingredients focused on texture, sweetness, nutrition, and sustainability. This strategic emphasis on specialized solutions, supported by its global network of 'Idea Labs' innovation centers, aims to reduce the intensity of direct price-based competition.

Exit Barriers

Ingredion, like many in the ingredient manufacturing sector, faces significant exit barriers. These barriers can trap companies in the market, even when performance is weak, thereby increasing competitive intensity. For instance, specialized manufacturing equipment, often requiring substantial upfront investment, makes it difficult and costly to divest or repurpose assets. This capital intensity means companies are more likely to continue operating, even at reduced profitability, to avoid realizing substantial losses on their fixed assets.

The capital-intensive nature of ingredient production is a key driver of these high exit barriers. Companies like Ingredion invest heavily in plants and specialized machinery to process raw materials into various ingredients. In 2023, Ingredion reported capital expenditures of $428 million, reflecting ongoing investment in its operational infrastructure. Such large, specialized investments are not easily redeployed to other industries, meaning companies are reluctant to exit, even in challenging economic conditions, to avoid significant write-downs.

- High Capital Investment: The need for specialized processing equipment and facilities creates substantial sunk costs.

- Specialized Assets: Manufacturing plants and machinery are often tailored to specific ingredient production, limiting resale value or alternative uses.

- Long-Term Contracts: Ingredion may be bound by long-term supply agreements with customers, making early market exit financially punitive.

- Operational Scale: Achieving economies of scale in ingredient manufacturing requires significant operational capacity, making smaller-scale exits or divestitures less viable.

Market Share and Concentration

Ingredion operates in a highly competitive environment where its market share, while substantial in specific product categories, does not grant it a dominant position across the entire industry. This dynamic reflects the presence of several well-established players, each vying for market influence.

As of the first quarter of 2025, Ingredion's market share in key segments like sweeteners and starches indicates a landscape where significant competition exists, with multiple companies holding meaningful portions of the market. This suggests that no single entity has complete control, forcing continuous strategic maneuvering.

- Market Share Dynamics: Ingredion's market share in Q1 2025 shows it as a major player but not a sole leader, highlighting intense rivalry.

- Competitive Landscape: The presence of multiple competitors with considerable market positions intensifies the pressure on Ingredion to innovate and maintain efficiency.

- Segment-Specific Competition: While global market share might be consolidated, specific product segments reveal a more fragmented picture, indicating varied competitive intensity.

Ingredion faces intense competition from global giants like Cargill and ADM, who offer similar ingredient portfolios, intensifying rivalry. The ingredient market's growth, projected at 6.1% CAGR through 2028, offers opportunities for expansion but doesn't eliminate the need for differentiation. Ingredion's focus on innovation, particularly in functional ingredients, helps mitigate direct price competition.

High exit barriers, driven by specialized capital investments such as the $428 million Ingredion spent on capital expenditures in 2023, keep companies in the market, thus sustaining competitive pressure. This means even underperforming firms are less likely to leave, maintaining a crowded competitive landscape.

| Competitor | Key Product Overlap | Market Position |

|---|---|---|

| Cargill | Starches, sweeteners, texturizers | Major global player |

| Archer Daniels Midland (ADM) | Starches, sweeteners, proteins | Major global player |

| Tate & Lyle | Sweeteners, starches, fibers | Significant global player |

| Kerry Group | Flavors, texturizers, functional ingredients | Leading global ingredient solutions provider |

| Roquette Frères | Starches, sweeteners, plant-based proteins | Key European player with global reach |

SSubstitutes Threaten

The threat of substitutes for Ingredion's ingredients is amplified by the rapid development of alternative ingredient technologies. These innovations aim to replicate the functional or nutritional benefits Ingredion's products offer, but through entirely different raw materials or production methods. For instance, precision fermentation and cell cultivation are gaining traction, enabling the creation of proteins, fats, and other vital components without relying on traditional agricultural sources. This shift presents a significant, albeit often long-term, substitute threat.

The attractiveness of substitute ingredients for Ingredion hinges significantly on their price-performance ratio. If alternatives can deliver similar or better taste, texture, functionality, or nutritional value at a lower cost, the threat of substitution escalates.

For instance, in 2024, the cost of corn-based sweeteners, a key Ingredion product, can be influenced by agricultural commodity prices. If plant-based protein isolates, like pea or soy, offer comparable protein content and functionality at a more competitive price, food manufacturers might shift their sourcing, impacting Ingredion's market share.

This dynamic presents a continuous challenge for Ingredion as the food ingredient landscape evolves. The emergence of novel, cost-effective ingredient solutions, perhaps derived from fermentation or advanced processing techniques, could further amplify the threat of substitutes by offering enhanced performance or unique benefits at a compelling price point.

Customer willingness to switch to alternative ingredients is a significant factor. For instance, the surging demand for clean label products, meaning fewer artificial ingredients, and a preference for healthier, more natural options directly impacts this. In 2024, the global clean label ingredients market was valued at approximately $55 billion, showcasing a strong consumer pull towards these attributes.

The increasing consumer focus on plant-based diets and sustainability further amplifies the threat of substitutes. If Ingredion's ingredient portfolio doesn't align with these evolving preferences, such as offering more sustainable or plant-derived alternatives, customers may readily adopt offerings from competitors who do. This shift is evident in the plant-based food market, which saw substantial growth in 2024, with sales reaching new highs.

Regulatory and Health Trends

Shifting regulatory landscapes and heightened consumer focus on health are significant drivers for substitute ingredients. For instance, increasing global scrutiny on sugar content, as seen in various national health initiatives aimed at combating obesity and diabetes, directly encourages the demand for sugar alternatives. Ingredion's strategic investment and innovation in areas like stevia-based sweeteners, which saw the global stevia market valued at approximately $900 million in 2023 and projected to reach over $1.5 billion by 2028, exemplifies a proactive response to these evolving trends.

- Regulatory Pressure: Governments worldwide are implementing policies favoring healthier food options, impacting ingredient choices.

- Consumer Health Awareness: Growing consumer demand for reduced sugar, low-calorie, and natural ingredients fuels the adoption of substitutes.

- Ingredion's Response: The company's development of stevia and other high-intensity sweeteners directly addresses these market shifts.

- Market Growth: The market for sugar substitutes is expanding, driven by these health and regulatory tailwinds, creating opportunities and threats.

Innovation in Competing Industries

Innovation in industries that create substitute products, even if they aren't direct ingredient competitors, can indeed pose a significant threat. For instance, advancements in whole foods or minimally processed ingredients that lessen the demand for complex ingredient solutions could indirectly replace Ingredion's current offerings.

This dynamic pressures Ingredion to actively innovate, particularly in areas like natural and clean label solutions, to stay competitive. For example, by mid-2024, the global market for clean label ingredients was projected to reach over $50 billion, highlighting a substantial shift in consumer preference and a key area for Ingredion to address.

- Consumer preference for whole foods is growing.

- Minimally processed ingredients reduce reliance on complex solutions.

- Ingredion must innovate in natural and clean label offerings.

- The clean label ingredient market is a significant growth area.

The threat of substitutes for Ingredion's products is substantial, driven by evolving consumer preferences and technological advancements in food ingredients. The increasing demand for plant-based and clean-label options means manufacturers are actively seeking alternatives that align with these trends. For example, the global plant-based food market saw continued strong growth in 2024, indicating a clear shift in consumer purchasing habits that could reduce reliance on traditional ingredients.

Price and performance remain critical factors in the adoption of substitutes. If alternative ingredients can match or exceed the functionality and sensory attributes of Ingredion's offerings at a competitive cost, the substitution threat intensifies. For instance, advancements in fermentation technologies are creating novel protein sources that may offer a compelling value proposition compared to established ingredients in 2024.

Regulatory pressures and growing health consciousness further fuel the demand for substitutes, particularly sugar alternatives. With global health initiatives targeting sugar consumption, ingredients like stevia are gaining prominence. The market for stevia sweeteners, valued at approximately $900 million in 2023, underscores this trend and Ingredion's strategic focus on this area.

| Substitute Category | Key Drivers | Impact on Ingredion | 2024 Market Indicator |

|---|---|---|---|

| Plant-Based Proteins | Consumer demand for plant-based diets, sustainability concerns | Potential shift from traditional protein sources | Significant growth in the plant-based food sector |

| Sugar Alternatives (e.g., Stevia) | Health concerns (sugar reduction), regulatory initiatives | Increased demand for low-calorie sweeteners | Stevia market projected to exceed $1.5 billion by 2028 |

| Fermentation-Derived Ingredients | Technological innovation, novel ingredient creation | Potential to offer functional alternatives to existing ingredients | Emerging technologies gaining traction |

Entrants Threaten

Launching a business in the ingredient solutions sector, particularly on a global scale akin to Ingredion, demands considerable financial outlay. This includes building and equipping manufacturing plants, investing in cutting-edge research and development, and establishing robust supply chain networks.

These significant capital needs serve as a formidable hurdle for potential new competitors. For instance, the construction of a single, modern corn wet-milling facility, a core operation for companies like Ingredion, can easily run into hundreds of millions of dollars, deterring smaller players.

In 2024, the global food ingredients market is projected to reach over $650 billion, a testament to the scale of operations and the investment required to capture even a small share of this vast industry.

Established players like Ingredion leverage significant economies of scale in their operations, from bulk raw material purchasing to efficient manufacturing and widespread distribution networks. This cost advantage means they can produce ingredients at a lower per-unit cost than a new entrant could initially achieve.

For instance, Ingredion's global manufacturing footprint and strong supplier relationships in 2024 likely allow for more favorable pricing on corn and other key inputs compared to a startup. New companies entering the ingredient processing market would face immense difficulty matching these existing cost efficiencies, creating a substantial barrier to entry.

Ingredion's extensive product portfolio, featuring specialized ingredient solutions for texture, sweetness, and nutrition, is underpinned by proprietary technology and deep expertise. Their global network of 'Idea Labs' innovation centers fosters continuous development, making it difficult for new entrants to replicate this intellectual property and technical know-how. For instance, in 2024, Ingredion continued to invest heavily in R&D to maintain its competitive edge in developing novel ingredients.

Access to Distribution Channels and Raw Materials

New companies entering the ingredient solutions market would struggle to replicate Ingredion's established global distribution networks. Building these extensive relationships and logistics infrastructure takes significant time and capital investment, a hurdle for any potential entrant.

Securing reliable access to a diverse range of plant-based raw materials at competitive prices presents another formidable challenge. Ingredion's long-standing supplier relationships, forged over years, provide it with preferential terms and consistent supply, something new entrants would find difficult to match immediately.

For instance, Ingredion's 2024 fiscal year results highlight the scale of its operations, with net sales reaching $7.09 billion. This scale is underpinned by its robust supply chain and deep customer ties, which are critical barriers to entry.

The threat of new entrants is therefore mitigated by the high costs and complexity associated with establishing comparable global distribution and raw material sourcing capabilities.

- Global Distribution Networks: New entrants face significant capital and time investment to build comparable global reach to Ingredion's established network.

- Raw Material Access: Ingredion's long-standing supplier relationships offer preferential pricing and consistent supply, creating a barrier for new competitors.

- Scale Advantage: Ingredion's 2024 net sales of $7.09 billion underscore the economies of scale that new entrants would struggle to achieve quickly.

- Customer Relationships: Deep, established customer ties are difficult for new market participants to replicate, providing Ingredion with a competitive edge.

Brand Loyalty and Customer Relationships

Ingredion has spent years fostering deep customer relationships and a reputation as a reliable ingredient solutions partner. This established trust makes it difficult for new players to gain a foothold.

New entrants face a significant hurdle in replicating Ingredion's established customer loyalty and credibility. Building these essential connections requires substantial time and investment, acting as a barrier to entry.

- Brand Loyalty: Ingredion's long-standing presence has cultivated significant customer loyalty, making it challenging for new entrants to attract and retain clients.

- Customer Relationships: The company's focus on providing tailored ingredient solutions has resulted in strong, enduring relationships with its customer base.

- Credibility and Trust: New competitors must invest heavily in building their own brand reputation and demonstrating reliability to challenge Ingredion's established credibility.

The threat of new entrants in the ingredient solutions sector is relatively low for Ingredion. Significant capital requirements for manufacturing, R&D, and global distribution, estimated in the hundreds of millions for a single facility, act as a major deterrent. Furthermore, Ingredion's established economies of scale, proprietary technology, and deep customer relationships, evidenced by $7.09 billion in net sales in 2024, create substantial barriers that new companies find difficult to overcome.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High costs for plants, R&D, and supply chains. | Deters smaller players; a single corn wet-milling facility can cost hundreds of millions. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | New entrants struggle to match cost efficiencies in raw material purchasing and manufacturing. |

| Proprietary Technology & Expertise | Unique ingredient solutions and innovation centers. | Difficult for new entrants to replicate intellectual property and technical know-how. |

| Distribution Networks & Customer Relationships | Established global reach and strong client ties. | Requires significant time and investment for new players to build comparable networks and trust. |

Porter's Five Forces Analysis Data Sources

Our Ingredion Porter's Five Forces analysis leverages a comprehensive dataset including Ingredion's annual reports, SEC filings, and industry-specific market research from sources like IBISWorld and Statista. This approach ensures a robust understanding of competitive dynamics and market positioning.