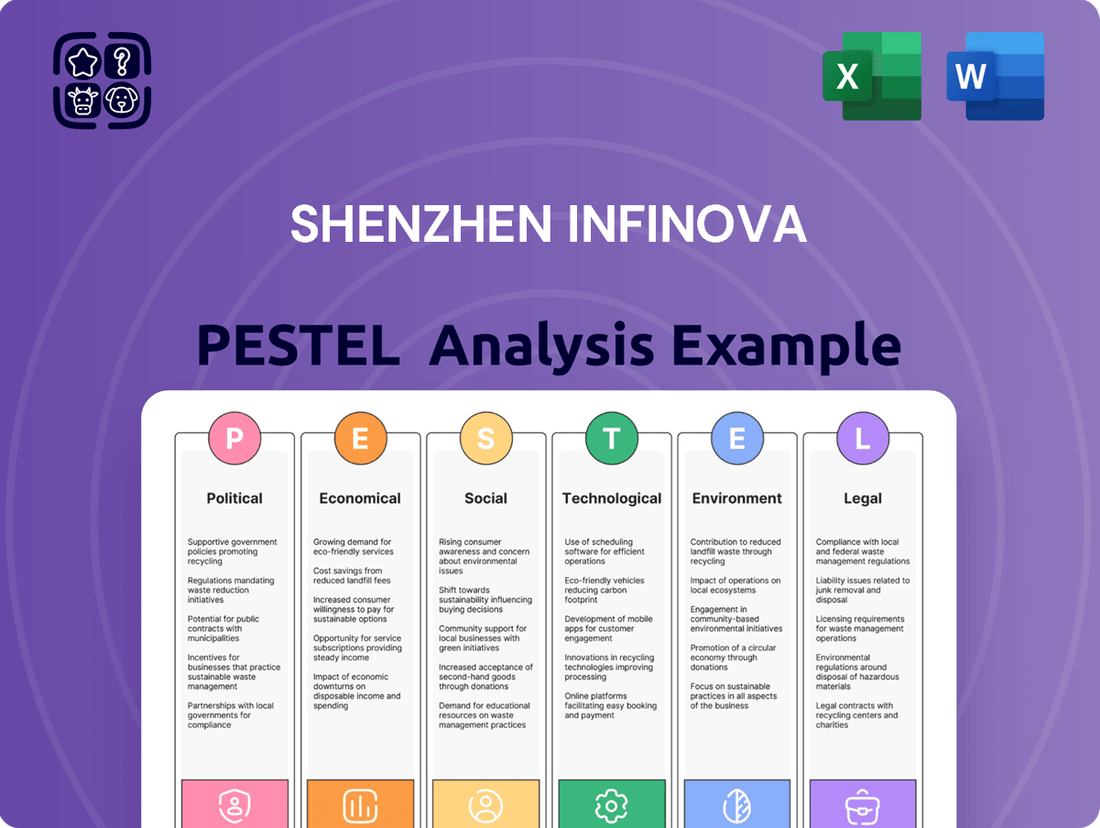

Shenzhen Infinova PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Infinova Bundle

Navigate the complex external environment impacting Shenzhen Infinova with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that are crucial for strategic planning. Gain a competitive edge by leveraging these actionable insights. Download the full report now to unlock Infinova's full market potential.

Political factors

The Chinese government's robust commitment to smart city development, particularly in enhancing public security infrastructure, presents a substantial market opportunity for companies like Infinova. This focus is evident in substantial government investment; for instance, by the end of 2023, China had already established over 1,000 smart city pilot projects nationwide, with significant allocations towards AI-powered surveillance and integrated security systems.

These national directives directly fuel demand for comprehensive security solutions, aligning perfectly with Infinova's core competencies in providing advanced video surveillance and integrated security platforms for critical infrastructure and government entities. Such policy backing often translates into preferential market access and potential funding avenues for domestic technology providers within these strategic sectors.

Escalating geopolitical tensions, particularly between China and Western nations, present a significant challenge for Shenzhen Infinova. These tensions can manifest as trade restrictions, sanctions, and export controls specifically targeting surveillance technology, directly impacting Infinova's ability to operate globally. For instance, the US Commerce Department's Entity List, which restricts exports to certain Chinese companies, could expand to include entities involved in advanced surveillance, potentially affecting Infinova's access to critical components or markets.

Such trade policies pose a direct risk to Infinova's international market access and supply chain resilience. The company might face limitations in acquiring specialized components manufactured in or reliant on Western supply chains, or find its products subject to tariffs or outright bans in key export regions. Navigating this complex web of international relations is crucial for Infinova to maintain its global business operations and secure its revenue streams.

Governments globally are tightening national security and data regulations, directly impacting companies like Infinova. For instance, the European Union's General Data Protection Regulation (GDPR) and similar frameworks in countries like the United States and China impose strict rules on data collection, processing, and storage for surveillance technologies. Failure to comply can result in substantial fines, with GDPR penalties reaching up to 4% of annual global turnover or €20 million, whichever is higher.

Domestic Policy Favoritism

Domestic policy favoritism can significantly shape Infinova's market position. In China, for instance, government procurement often prioritizes domestic technology firms, creating a more favorable environment for Infinova to secure substantial projects within the public sector. This can translate into a crucial competitive advantage within its home market.

However, this advantage is not without its international implications. Such nationalistic procurement strategies can prompt other nations to adopt similar reciprocal policies, potentially creating hurdles for Infinova's global expansion efforts. For example, the United States' Buy American Act, while not directly targeting Infinova, exemplifies the trend of governments favoring domestic suppliers, which could inspire similar measures elsewhere.

- Government procurement policies in China often favor domestic technology companies, bolstering Infinova's position in its home market.

- This domestic advantage can lead to reciprocal protectionist policies in other countries, potentially hindering Infinova's international growth.

- The global trend towards favoring domestic suppliers, as seen in initiatives like the US Buy American Act, highlights the potential for international market access challenges.

Political Stability and Public Order

The Chinese government's continued emphasis on maintaining social stability and preventing crime directly fuels demand for advanced security and surveillance technologies. This focus translates into significant government spending on public safety infrastructure. For instance, China's Ministry of Public Security has consistently allocated substantial budgets towards upgrading its surveillance networks and smart city initiatives, creating a robust domestic market for companies like Infinova. This commitment to public order underpins a predictable demand for Infinova's solutions.

Internationally, countries experiencing or anticipating political instability often increase their investment in security measures. As of early 2025, geopolitical tensions in various regions are driving a global uptick in defense and security spending. Many nations are prioritizing border security, counter-terrorism, and internal order maintenance, which directly benefits companies offering sophisticated surveillance and security systems. Infinova's ability to cater to these international needs is crucial for its growth.

- Government Investment: China's central government has prioritized smart city development and public security, with significant budget allocations for surveillance technology.

- Global Security Trends: Rising geopolitical instability in 2024-2025 has led to increased defense and security spending by nations worldwide.

- Demand Driver: A government's commitment to public order and crime prevention is a direct indicator of potential market size for security solutions.

Government policies in China strongly favor domestic technology firms, creating a significant advantage for Infinova within its home market. This nationalistic procurement approach, exemplified by initiatives like the US Buy American Act, can also lead to reciprocal protectionist measures in other countries, potentially challenging Infinova's international expansion.

The Chinese government's sustained focus on smart city development and public security directly fuels demand for Infinova's advanced surveillance solutions, with substantial national investment evident in over 1,000 smart city pilot projects by late 2023. Globally, increasing geopolitical tensions in 2024-2025 are driving heightened defense and security spending by nations, creating a favorable international market for such technologies.

Escalating geopolitical tensions present a considerable risk, potentially leading to trade restrictions and export controls on surveillance technology, impacting Infinova's global operations and supply chains. Furthermore, stricter data privacy regulations worldwide, like the EU's GDPR with penalties up to 4% of global turnover, necessitate careful compliance for companies in this sector.

| Factor | Impact on Infinova | Data/Example |

|---|---|---|

| Domestic Procurement Favoritism | Enhanced market access in China | China's government often prioritizes domestic tech firms. |

| Geopolitical Tensions | Risk of trade restrictions, supply chain disruption | US Entity List impacts Chinese tech companies. |

| Global Security Spending | Increased demand for surveillance solutions | Rising global instability in 2024-2025 drives security investment. |

| Data Privacy Regulations | Compliance burden, potential fines | GDPR fines up to 4% of global annual turnover. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Shenzhen Infinova across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, highlighting potential threats and opportunities within the company's operating landscape.

The Shenzhen Infinova PESTLE analysis acts as a pain point reliever by providing a structured framework to identify and address potential external challenges, enabling proactive strategy development and risk mitigation.

Economic factors

Global economic growth, especially in emerging markets where Infinova has a presence, directly correlates with infrastructure spending. For instance, the IMF projected global growth at 3.2% for 2024, a figure that influences municipal and corporate budgets for smart city initiatives and transportation upgrades. Stronger economic conditions typically translate to increased investment in these areas, boosting demand for advanced video surveillance and access control solutions like those provided by Infinova.

Global inflationary pressures, particularly evident in 2024 and projected into 2025, are significantly impacting manufacturing costs for companies like Shenzhen Infinova. For instance, the Producer Price Index (PPI) in many major economies saw substantial year-over-year increases throughout 2023 and early 2024, directly affecting the cost of electronic components and raw materials essential for Infinova's products.

These rising production expenses can compress Infinova's profit margins if not effectively managed. Alternatively, passing these costs onto consumers through price adjustments could diminish the company's competitive edge in a price-sensitive market. For example, a 5% increase in component costs could translate to a noticeable shift in final product pricing.

To counter these economic headwinds, Infinova must maintain and enhance its supply chain management strategies. This includes diversifying suppliers, securing long-term contracts for key materials, and exploring near-shoring or reshoring options to reduce transportation costs and lead times, thereby mitigating the impact of global supply chain disruptions.

Shenzhen Infinova, with its global reach, faces significant impacts from currency exchange rate fluctuations. For instance, if the Chinese Yuan strengthens against the US Dollar, Infinova's products priced in USD become more expensive for American buyers, potentially dampening sales. Conversely, a weaker Yuan would make imported components, often priced in foreign currencies, more costly for Infinova.

The company's financial performance is directly tied to these movements. In 2024, for example, the Yuan experienced periods of volatility against major currencies like the Euro and the US Dollar, creating an unpredictable revenue stream for companies with substantial international trade. Effective hedging strategies are therefore essential to buffer against these currency risks and ensure consistent profitability.

Investment in R&D and Technology Adoption

The economic climate directly impacts R&D and technology adoption. A robust economy, as seen in China's continued growth, encourages significant investment in advanced security solutions. For instance, China's State Council has emphasized boosting innovation, with plans to increase R&D spending as a percentage of GDP, aiming for 2.5% by 2025, which directly supports companies like Infinova focused on cutting-edge technology.

A strong economic outlook fuels demand for sophisticated security systems. As businesses and governments have more capital, they are more likely to invest in AI-powered analytics and integrated security platforms, aligning with Infinova's strategic direction. In 2024, global spending on AI in security is projected to reach over $20 billion, a testament to this trend.

- Government R&D Funding: China's commitment to increasing R&D investment supports technological advancement.

- Economic Growth & Security Spending: A healthy economy correlates with higher corporate and public expenditure on advanced security.

- AI Adoption in Security: The growing market for AI-driven security solutions presents a significant opportunity for Infinova.

- Project Scale: Favorable economic conditions enable larger, more complex security projects that leverage integrated systems.

Competition and Market Pricing

The competitive landscape in the security solutions sector significantly influences market pricing and Infinova's revenue. In 2024, the global video surveillance market was valued at approximately $55 billion, with projections indicating growth to over $100 billion by 2030, driven by increasing demand for smart city initiatives and enhanced security measures. This expansion attracts numerous players, intensifying competition and potentially leading to price wars, especially during economic slowdowns. For instance, in 2023, several competitors in the AI-powered surveillance segment engaged in aggressive discounting to gain market share, impacting average selling prices.

Infinova must navigate this environment by balancing competitive pricing with its need to maintain healthy profit margins and fund crucial research and development. The company's ability to differentiate its offerings through advanced features, superior quality, or unique service packages will be key. A study by Gartner in late 2024 highlighted that customers in the enterprise security market are increasingly willing to pay a premium for integrated solutions that offer robust cybersecurity and advanced analytics, suggesting a pathway for Infinova to move beyond pure price competition.

- Intense Competition: The security solutions market features a large number of domestic and international players, leading to price sensitivity.

- Economic Sensitivity: Economic downturns can trigger aggressive pricing strategies from competitors, pressuring Infinova's margins.

- Pricing Strategy: Infinova needs to adopt a strategy that aligns with market pricing while ensuring profitability and investment in innovation.

- Differentiation is Key: Focusing on product differentiation through advanced AI capabilities and integrated solutions can command higher price points.

Global economic growth directly impacts infrastructure spending, a key driver for Infinova's solutions. The IMF projected 3.2% global growth for 2024, influencing budgets for smart city and transportation projects. Stronger economies generally mean more investment in these areas, increasing demand for advanced security systems.

Inflationary pressures in 2024 and 2025 are increasing Infinova's manufacturing costs, particularly for electronic components. For example, producer price indices in major economies saw significant year-over-year increases in late 2023 and early 2024, directly affecting material expenses. This necessitates careful supply chain management and potentially price adjustments.

Currency fluctuations also pose a risk, as seen with the Yuan's volatility against the USD and Euro in 2024. A stronger Yuan makes exports pricier, while a weaker Yuan increases the cost of imported components. Effective hedging strategies are crucial for managing these risks and ensuring consistent profitability for Infinova.

The economic climate influences R&D investment; China's commitment to boosting innovation, with R&D spending targeted at 2.5% of GDP by 2025, benefits tech-focused companies like Infinova. Growing demand for AI in security, with global spending projected to exceed $20 billion in 2024, further supports Infinova's strategic focus on advanced solutions.

Full Version Awaits

Shenzhen Infinova PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Shenzhen Infinova covers all crucial political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain a deep understanding of its strategic landscape.

Sociological factors

The world is becoming more urbanized, with projections indicating that by 2050, 68% of the global population will live in cities. This rapid growth in urban centers intensifies public safety challenges, creating a substantial demand for advanced security solutions like those offered by Infinova.

As cities become more densely populated, the need for effective surveillance, crime prevention, and emergency response systems escalates. Infinova's integrated security platforms are well-positioned to address these growing concerns, offering cities the tools to manage complex urban environments and enhance citizen security.

Public awareness of data privacy is significantly impacting the surveillance technology market. Surveys in 2024 indicated that over 70% of consumers are concerned about how their personal data is collected and used by smart devices, including security cameras. This growing unease directly influences how readily consumers and governments will adopt and permit the widespread use of video security systems.

Infinova must proactively address these societal expectations by embedding robust privacy protections into its products. This includes transparent data handling policies and offering features like local data storage or anonymization capabilities. For instance, by emphasizing end-to-end encryption, a feature adopted by a growing number of security providers, Infinova can build crucial market trust and foster public acceptance, especially as regulations around data protection, like GDPR, continue to evolve and influence global markets.

Shenzhen's dynamic tech landscape means Infinova faces a highly competitive environment for skilled labor. The availability of engineers and software developers is crucial for their innovation in areas like AI and video analytics. As of early 2024, Shenzhen's tech sector continues to see high demand for specialized roles, with salaries for experienced AI engineers often exceeding 500,000 RMB annually.

Attracting and retaining top talent in cybersecurity and video analytics is paramount for Infinova's growth. The city's large university population, with over 1.5 million students in higher education institutions in 2023, provides a potential talent pool, but competition remains fierce, driving up recruitment costs and retention efforts.

Lifestyle Changes and Remote Monitoring

Modern lifestyles are increasingly shaped by remote work and a heightened awareness of personal security, directly fueling demand for accessible, integrated security solutions. This shift presents a significant opportunity for companies like Infinova, as the need for robust security extends beyond traditional business environments into consumer-focused applications such as smart homes and remote monitoring services.

The global smart home market, a key area for this trend, was valued at approximately $89.5 billion in 2023 and is projected to reach $240.8 billion by 2030, demonstrating a compound annual growth rate of 15.2%. This growth indicates a strong consumer appetite for connected security devices and remote management capabilities, areas where Infinova's expertise in video surveillance and communication technologies can be leveraged.

- Increased Demand for Remote Monitoring: A growing number of households are seeking remote access and control over their security systems, driven by convenience and peace of mind.

- Integration with Smart Home Ecosystems: Consumers expect security solutions to seamlessly integrate with other smart devices, creating a unified and intelligent home environment.

- Personal Security Concerns: Heightened public awareness of security issues, coupled with the rise of remote work, encourages individuals to invest in advanced personal and property protection measures.

Corporate Social Responsibility (CSR) Demands

Societal expectations for corporate social responsibility (CSR) are on the rise, pushing companies like Infinova to prioritize ethical manufacturing, robust data privacy, and environmental stewardship. This growing demand directly impacts how consumers and stakeholders perceive businesses. For instance, a 2024 Deloitte survey indicated that 70% of consumers consider a company's social and environmental impact when making purchasing decisions.

Infinova's dedication to CSR can significantly shape its brand image, fostering stronger customer loyalty and making it more appealing to investors. Markets that place a high value on ethical practices, such as the European Union and parts of North America, are particularly responsive to strong CSR initiatives. Companies demonstrating clear commitments to sustainability and ethical operations often see improved financial performance; a 2025 report by the Global Sustainable Investment Alliance highlighted that sustainable investments grew by 15% in 2024, reaching over $37 trillion globally.

- Growing consumer preference for ethically sourced products.

- Increased investor focus on Environmental, Social, and Governance (ESG) factors.

- Potential for enhanced brand reputation and market differentiation through CSR.

- Regulatory bodies are increasingly scrutinizing corporate social and environmental impacts.

Societal shifts towards urbanization and increased public safety concerns are driving demand for advanced security solutions like those offered by Infinova. Growing consumer awareness around data privacy is also a significant factor, influencing the adoption of surveillance technologies. Furthermore, evolving modern lifestyles, including the rise of remote work, are creating new opportunities for integrated home security systems.

| Societal Trend | Impact on Infinova | Supporting Data (2023-2025) |

|---|---|---|

| Urbanization & Public Safety | Increased demand for surveillance and crime prevention systems. | Global urban population projected to reach 68% by 2050. |

| Data Privacy Concerns | Need for transparent data handling and privacy-focused features. | Over 70% of consumers concerned about personal data use (2024 survey). |

| Remote Work & Smart Homes | Growth in demand for integrated home security and remote monitoring. | Global smart home market valued at $89.5 billion (2023), projected CAGR of 15.2% to 2030. |

Technological factors

The rapid evolution of Artificial Intelligence (AI) and machine learning is significantly transforming video surveillance. These technologies enable advanced analytics such as facial recognition, object detection, and sophisticated behavioral analysis, moving beyond simple recording to proactive threat identification.

Infinova must continuously integrate these AI capabilities into its IP cameras, Network Video Recorders (NVRs), and Video Management Systems (VMS). This integration is crucial for offering intelligent and proactive security solutions, thereby enhancing their value proposition, particularly for large-scale projects where efficiency and advanced insights are paramount.

By Q1 2024, the global AI in video analytics market was projected to reach approximately $12.5 billion, with a compound annual growth rate (CAGR) expected to exceed 20% through 2028, highlighting the immense market opportunity driven by these technological advancements.

The expanding universe of Internet of Things (IoT) devices, coupled with the growing reliance on cloud computing, is fundamentally reshaping the security landscape by fostering more interconnected and adaptable systems. Infinova's strategic advantage hinges on its capacity to harness cloud infrastructure for streamlined video management, convenient remote access, and secure data storage.

By seamlessly integrating with a wide array of IoT sensors, Infinova can deliver security solutions that are not only comprehensive and flexible but also built to evolve with future technological advancements. For instance, the global IoT market was projected to reach over $1.1 trillion by 2024, indicating a massive opportunity for security providers to embed their solutions within this expanding network.

As surveillance systems become increasingly interconnected, the risk of cyberattacks escalates significantly, making robust cybersecurity a critical imperative for companies like Infinova. The expansion of IoT devices in surveillance networks, for instance, presents a larger attack surface. In 2024, the global cybersecurity market was valued at over $270 billion, highlighting the substantial investment required in this area.

Infinova must prioritize substantial investments in secure hardware and software development, alongside implementing advanced measures like end-to-end encryption. Adherence to stringent data protection regulations, such as GDPR and CCPA, is crucial for safeguarding sensitive surveillance data and preserving customer confidence. Failure to do so could lead to significant financial penalties and reputational damage.

5G Technology and Edge Computing

The widespread rollout of 5G networks is a significant technological factor for Shenzhen Infinova. These networks provide dramatically increased speeds and reduced latency, which are crucial for efficiently transmitting large volumes of high-resolution video data. This enhanced capability directly supports more sophisticated, distributed security architectures that rely on real-time data flow.

Edge computing, powered by 5G, allows for the processing of video data much closer to where it's generated. This means Infinova's surveillance systems can analyze footage in real-time without needing to send all data back to a central server. This not only reduces the strain on bandwidth but also significantly improves the responsiveness and analytical capabilities of their solutions.

- 5G Deployment: Global 5G subscriptions are projected to reach over 1.5 billion by the end of 2024, with continued strong growth through 2025, indicating widespread network availability.

- Edge Computing Growth: The edge computing market is expected to grow at a compound annual growth rate (CAGR) of over 30% from 2024 to 2028, highlighting its increasing adoption.

- Data Processing: Real-time video analytics at the edge can reduce data transmission costs by up to 80% compared to cloud-based processing for certain applications.

- Latency Reduction: 5G offers latency as low as 1 millisecond, a substantial improvement over 4G's 50-100 milliseconds, enabling near-instantaneous decision-making in security scenarios.

Emerging Sensor Technologies and Biometrics

Innovations in sensor technologies, including thermal imaging and radar, are significantly broadening the scope of security systems beyond standard visual cameras. Infinova can leverage these advancements by integrating new sensor types and sophisticated biometric solutions, such as iris and fingerprint scanning. This integration allows for more adaptable and potent security measures across a variety of use cases.

The global biometric system market was valued at approximately $31.5 billion in 2023 and is projected to reach over $100 billion by 2030, demonstrating substantial growth. Infinova's strategic incorporation of advanced biometrics could tap into this expanding market by offering enhanced security and access control solutions.

- Thermal Imaging: Detects heat signatures, enabling surveillance in low-light or obscured conditions.

- Radar Technology: Provides object detection and tracking through various environmental barriers.

- Advanced Biometrics: Iris and advanced fingerprint scanning offer high-accuracy identity verification.

- Market Potential: The biometric market's rapid expansion presents a significant opportunity for Infinova to diversify its security offerings.

The integration of AI and IoT is revolutionizing surveillance, enabling intelligent analytics and interconnected systems. By Q1 2024, the AI in video analytics market was valued at around $12.5 billion, with growth expected to exceed 20% annually. The global IoT market is also expanding rapidly, projected to surpass $1.1 trillion by 2024, offering Infinova ample opportunities for integration.

5G deployment and edge computing are critical for real-time data processing and reduced latency. Global 5G subscriptions are anticipated to exceed 1.5 billion by the end of 2024. Edge computing's CAGR is projected to be over 30% from 2024 to 2028, allowing for faster, more efficient video analysis.

Advancements in sensor technology, such as thermal imaging and radar, along with biometrics, are expanding security capabilities. The global biometric system market, valued at approximately $31.5 billion in 2023, is expected to grow significantly, presenting a strong market for Infinova's advanced security solutions.

| Technology Trend | Market Value (2024 Est.) | Projected Growth (CAGR) | Impact on Infinova |

| AI in Video Analytics | ~$12.5 Billion (Q1 2024) | >20% (through 2028) | Enhanced analytics, proactive security |

| IoT Devices | >$1.1 Trillion | N/A (Broad market) | Interconnected, adaptable systems |

| 5G Subscriptions | >1.5 Billion (End of 2024) | N/A (Network rollout) | High-speed, low-latency data transmission |

| Edge Computing | N/A (Market segment) | >30% (2024-2028) | Real-time, localized data processing |

| Biometric Systems | ~$31.5 Billion (2023) | N/A (to 2030) | High-accuracy identity verification |

Legal factors

Strict data privacy laws like China's Personal Information Protection Law (PIPL) and Europe's GDPR significantly affect how Infinova handles personal data from video surveillance. These regulations mandate careful collection, processing, storage, and transmission of sensitive information, directly impacting product development and data management strategies.

Infinova's video management systems (VMS) and software must incorporate privacy-by-design principles. This includes features for data anonymization, obtaining user consent, and ensuring robust data security to meet global compliance requirements. Failure to comply can result in substantial fines; for instance, GDPR violations can reach up to 4% of annual global revenue or €20 million, whichever is higher.

Protecting its intellectual property, including patents for its camera technologies, VMS software, and unique algorithms, is crucial for Infinova's competitive advantage. For instance, the global patent application landscape saw over 3.4 million applications filed in 2023, highlighting the importance of robust IPR for tech companies.

Navigating international IPR laws and proactively defending against infringement, while also ensuring its products do not infringe on others' patents, is a constant legal challenge. The cost of patent litigation can be substantial, with average damages in U.S. patent infringement cases reaching millions of dollars, making proactive legal counsel essential for Infinova.

Infinova's professional video surveillance equipment must adhere to stringent product liability and safety standards, both domestically and internationally. This encompasses compliance with regulations for electrical safety, electromagnetic compatibility (EMC), and various environmental certifications, crucial for market access and consumer trust.

Failure to meet these standards, such as those outlined by the European Union's CE marking or the United States' FCC certification, can result in severe consequences. These include costly product recalls, significant legal liabilities, and substantial damage to Infinova's brand reputation, underscoring the need for robust quality assurance and thorough testing protocols.

Export Controls and Sanctions

Government export control regulations and international sanctions, particularly those targeting certain technologies or countries, can significantly impact Shenzhen Infinova's global sales of surveillance products. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, which can restrict exports of sensitive technologies to designated companies and countries. Infinova must navigate these evolving trade laws to avoid substantial penalties, such as fines and reputational damage, and to maintain its ability to operate in key international markets.

Compliance with these intricate trade regulations is paramount for Infinova. Failure to adhere to sanctions imposed by bodies like the United Nations or regional blocs can lead to severe legal repercussions and disrupt supply chains. For example, in 2023, several companies faced significant fines for inadvertently violating export control laws related to dual-use technologies. Infinova's proactive approach to understanding and implementing these controls is crucial for ensuring legal market access and preserving its global business relationships.

- Export Control Compliance: Infinova must stay abreast of regulations from agencies like BIS, which govern the export of advanced technologies.

- Sanctions Impact: International sanctions, particularly those affecting technology transfer to specific nations, can limit Infinova's market reach.

- Penalty Avoidance: Non-compliance can result in substantial fines, legal action, and damage to the company's international standing.

- Market Access: Meticulous adherence to these legal frameworks is essential for securing and maintaining access to global markets.

Government Procurement and Bidding Laws

Shenzhen Infinova’s engagement in government procurement and critical infrastructure projects necessitates strict adherence to public procurement laws and bidding regulations. These frameworks, often varying by region and project type, mandate transparency and competitive processes. For instance, in 2024, many governments worldwide increased scrutiny on supply chain integrity for national security projects, impacting how companies like Infinova must qualify and bid.

Navigating these legal landscapes requires robust compliance. Key aspects include:

- Rigorous Qualification: Meeting stringent technical and financial pre-qualification criteria, often detailed in tender documents.

- Competitive Bidding: Participating in open or restricted bidding processes, ensuring proposals meet all specified requirements.

- Contractual Obligations: Understanding and fulfilling complex contractual terms, including performance guarantees and payment schedules.

- Transparency Requirements: Adhering to disclosure norms and anti-corruption measures throughout the procurement lifecycle.

Shenzhen Infinova must navigate a complex web of international and domestic legal frameworks. Key areas include stringent data privacy laws like GDPR and China's PIPL, which demand careful handling of personal data collected by surveillance systems. Failure to comply can lead to severe penalties, with GDPR fines potentially reaching 4% of global annual revenue.

Intellectual property rights are critical; protecting patents for camera technology and software is vital in a competitive market where over 3.4 million patent applications were filed globally in 2023. Product liability and safety standards, such as CE marking and FCC certification, are also paramount for market access and avoiding costly recalls and legal liabilities.

Export controls and sanctions present significant challenges, requiring vigilance regarding regulations from bodies like the U.S. Bureau of Industry and Security (BIS). Non-compliance can result in substantial fines and reputational damage, underscoring the need for meticulous adherence to trade laws to maintain global operations.

Furthermore, participation in government procurement requires strict adherence to public bidding laws and transparency requirements, especially as governments increasingly scrutinize supply chains for national security projects in 2024.

| Legal Area | Key Regulations/Considerations | Potential Impact on Infinova | Example Data/Statistics |

|---|---|---|---|

| Data Privacy | GDPR, PIPL | Compliance costs, product design changes, data breach liabilities | GDPR fines up to 4% of global annual revenue |

| Intellectual Property | Patent Law, Trademark Law | Competitive advantage, litigation risks, licensing revenue | Over 3.4 million global patent applications in 2023 |

| Product Safety & Liability | CE Marking, FCC Certification | Market access, product recalls, warranty claims, reputational damage | Mandatory compliance for sales in EU and US markets |

| Export Controls & Sanctions | BIS Entity List, UN Sanctions | Market access restrictions, fines, supply chain disruptions | Regular updates to export control lists impact technology sales |

| Government Procurement | Public Procurement Laws, Bidding Regulations | Contract awards, compliance audits, transparency requirements | Increased scrutiny on supply chain integrity for national security projects in 2024 |

Environmental factors

The global push for sustainability is significantly boosting the demand for energy-efficient electronic products, a trend directly impacting the video surveillance market. As environmental consciousness grows and energy prices remain a concern, businesses and consumers alike are actively seeking solutions that minimize power consumption.

Infinova can leverage this trend by focusing on developing and marketing surveillance systems, such as cameras and Network Video Recorders (NVRs), that are designed for lower energy usage. This strategic alignment with green building standards and a reduced carbon footprint for security installations can provide a distinct competitive edge. For instance, the market for energy-efficient IT hardware, which includes surveillance components, saw substantial growth, with many manufacturers reporting double-digit percentage reductions in power draw for their latest product lines in 2024.

Stricter regulations around electronic waste (e-waste), like the EU's WEEE Directive, are increasingly holding manufacturers accountable for product disposal and recycling. In 2023, global e-waste generation reached an estimated 62 million metric tons, highlighting the growing environmental challenge and the need for robust compliance strategies.

Infinova must proactively integrate sustainable design principles and establish effective take-back and recycling programs to manage its environmental footprint and adhere to these evolving legal frameworks. Failure to comply can result in significant fines and reputational damage, impacting its market position.

Environmental scrutiny now scrutinizes the entire supply chain, pushing companies like Infinova to ensure ethical and sustainable sourcing of components and raw materials. This means Infinova must actively assess its suppliers for environmental compliance, aiming to reduce hazardous substances in its products and foster responsible manufacturing across its production network to satisfy stakeholder demands.

For instance, as of early 2024, global supply chain sustainability reporting has seen a significant uptick, with over 70% of large corporations now including some form of environmental impact assessment for their key suppliers, a trend Infinova is undoubtedly navigating.

Corporate Environmental Responsibility (CER)

Companies are increasingly judged not just by their profits, but by their environmental stewardship. Beyond simply meeting regulatory requirements, there's a growing expectation for proactive Corporate Environmental Responsibility (CER). This means actively working to reduce greenhouse gas emissions, conserve precious water resources, and diligently minimize waste across all operational facets. For a company like Infinova, a strong commitment to CER can significantly bolster its brand reputation, making it more appealing to clients who prioritize sustainability. Furthermore, such initiatives can often unlock operational efficiencies, leading to cost savings and a more streamlined business model.

Infinova's approach to CER is crucial in the current market landscape. For instance, the global push towards net-zero emissions, with many countries setting ambitious targets for 2050 and beyond, puts pressure on all industries to adapt. Companies that lead in environmental innovation often gain a competitive edge. In 2024, the renewable energy sector, where Infinova operates, saw significant investment, with global renewable energy capacity additions reaching record levels. This trend underscores the market's demand for environmentally sound solutions.

Key aspects of Infinova's potential CER strategy could include:

- Energy Efficiency: Implementing advanced technologies to reduce energy consumption in manufacturing and data centers.

- Waste Reduction and Recycling: Developing robust programs for material reuse and recycling, aiming for a circular economy model.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental track records and utilizing eco-friendly materials in product development.

- Carbon Footprint Measurement: Regularly assessing and reporting on greenhouse gas emissions to identify areas for improvement and track progress towards reduction goals.

Climate Change Impact on Infrastructure

Climate change is increasingly stressing infrastructure, with extreme weather events becoming more common and severe. This trend necessitates enhanced security and resilience in critical systems. For instance, a 2024 report indicated that global spending on climate adaptation infrastructure is projected to reach $1.7 trillion annually by 2025, highlighting the growing demand for robust solutions.

Infinova could capitalize on this by developing security products designed to withstand harsher environmental conditions, such as extreme temperatures or increased humidity. The company might also explore solutions that support disaster preparedness and response efforts, offering advanced surveillance and communication systems crucial during and after natural disasters.

- Rising Frequency of Extreme Weather: Globally, the number of weather-related disasters has more than doubled since the early 2000s, impacting infrastructure uptime and security.

- Infrastructure Resilience Investment: Governments and private sectors are increasing investments in climate-resilient infrastructure, with a significant portion allocated to advanced security and monitoring systems.

- Adaptation in Product Development: Infinova's product roadmap should consider materials and designs that offer enhanced durability against environmental stressors, aligning with market demands for long-term performance.

The growing global emphasis on environmental sustainability directly fuels demand for energy-efficient electronic products, influencing the video surveillance market. As environmental awareness increases and energy costs remain a concern, businesses and consumers are actively seeking solutions that minimize power consumption.

Infinova can capitalize on this trend by developing and marketing surveillance systems, like cameras and NVRs, designed for lower energy usage. Aligning with green building standards and reducing the carbon footprint of security installations offers a competitive advantage. The market for energy-efficient IT hardware, including surveillance components, saw significant growth, with many manufacturers reporting double-digit percentage reductions in power draw for their latest product lines in 2024.

Stricter regulations concerning electronic waste (e-waste), such as the EU's WEEE Directive, are increasingly holding manufacturers accountable for product disposal and recycling. Global e-waste generation reached an estimated 62 million metric tons in 2023, underscoring the growing environmental challenge and the necessity for robust compliance strategies.

Infinova must proactively integrate sustainable design principles and establish effective take-back and recycling programs to manage its environmental footprint and comply with evolving legal frameworks. Non-compliance can lead to substantial fines and reputational damage, negatively impacting its market position.

Environmental scrutiny now extends across the entire supply chain, compelling companies like Infinova to ensure ethical and sustainable sourcing of components and raw materials. This requires Infinova to actively assess its suppliers for environmental compliance, aiming to reduce hazardous substances in its products and promote responsible manufacturing throughout its production network to meet stakeholder expectations.

As of early 2024, global supply chain sustainability reporting has seen a notable increase, with over 70% of large corporations now incorporating some form of environmental impact assessment for their key suppliers, a trend Infinova is navigating.

Companies are increasingly evaluated not only on profits but also on their environmental stewardship, with a growing expectation for proactive Corporate Environmental Responsibility (CER). This involves actively reducing greenhouse gas emissions, conserving water resources, and minimizing waste across all operations. A strong commitment to CER can significantly enhance Infinova's brand reputation, making it more attractive to clients who prioritize sustainability, and can often lead to operational efficiencies and cost savings.

Infinova's approach to CER is critical in the current market. The global drive towards net-zero emissions, with many countries setting ambitious targets for 2050, pressures all industries to adapt. Companies leading in environmental innovation often gain a competitive edge. In 2024, the renewable energy sector, where Infinova operates, experienced substantial investment, with global renewable energy capacity additions reaching record levels, highlighting the market's demand for environmentally sound solutions.

Key aspects of Infinova's potential CER strategy could include:

- Energy Efficiency: Implementing advanced technologies to reduce energy consumption in manufacturing and data centers.

- Waste Reduction and Recycling: Developing robust programs for material reuse and recycling, aiming for a circular economy model.

- Sustainable Sourcing: Prioritizing suppliers with strong environmental track records and utilizing eco-friendly materials in product development.

- Carbon Footprint Measurement: Regularly assessing and reporting on greenhouse gas emissions to identify areas for improvement and track progress towards reduction goals.

Climate change is increasingly stressing infrastructure, with extreme weather events becoming more common and severe, necessitating enhanced security and resilience in critical systems. A 2024 report indicated that global spending on climate adaptation infrastructure is projected to reach $1.7 trillion annually by 2025, underscoring the growing demand for robust solutions.

Infinova could capitalize on this by developing security products designed to withstand harsher environmental conditions, such as extreme temperatures or increased humidity. The company might also explore solutions that support disaster preparedness and response efforts, offering advanced surveillance and communication systems crucial during and after natural disasters.

| Environmental Factor | Impact on Infinova | Key Trends (2024-2025) | Infinova's Strategic Response | Data Point |

|---|---|---|---|---|

| Energy Efficiency Demand | Increased market for low-power surveillance solutions | Growing consumer and business preference for sustainable electronics | Develop and market energy-efficient cameras and NVRs | Market for energy-efficient IT hardware saw double-digit power draw reductions in 2024 product lines. |

| E-Waste Regulations | Need for responsible product disposal and recycling compliance | Stricter global regulations like the EU's WEEE Directive | Integrate sustainable design, establish take-back programs | Global e-waste generation reached 62 million metric tons in 2023. |

| Supply Chain Sustainability | Pressure for ethical and eco-friendly component sourcing | Increased corporate focus on supplier environmental impact | Assess suppliers for environmental compliance, reduce hazardous substances | Over 70% of large corporations now include supplier environmental impact assessments (early 2024). |

| Climate Change & Infrastructure | Demand for resilient security systems against extreme weather | Rising frequency of extreme weather events | Develop durable products, offer disaster preparedness solutions | Global spending on climate adaptation infrastructure projected to reach $1.7 trillion annually by 2025. |

PESTLE Analysis Data Sources

Our PESTLE analysis for Shenzhen Infinova is built upon a comprehensive review of official government publications, economic data from reputable international organizations, and industry-specific market research reports. This ensures that each aspect of the analysis is grounded in verifiable and current information.