Shenzhen Infinova Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Infinova Bundle

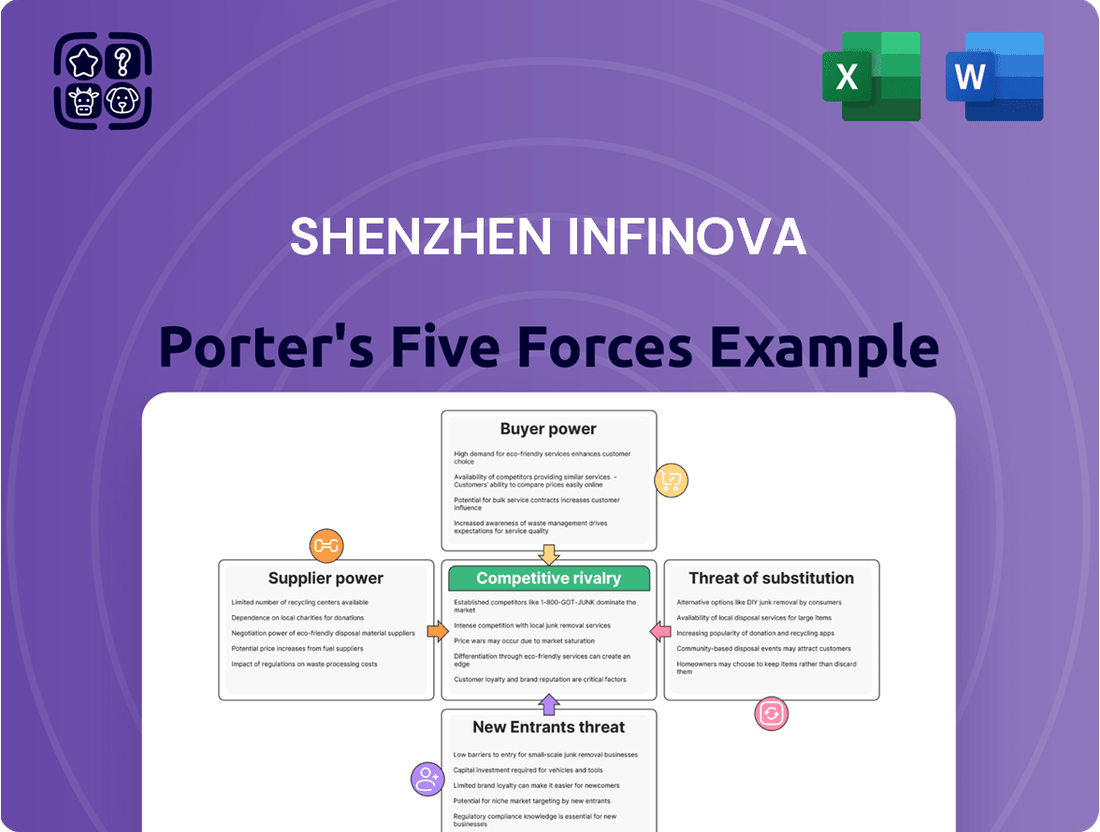

Shenzhen Infinova faces significant competitive pressures, with moderate bargaining power from both buyers and suppliers, and a notable threat from substitute products within its market. Understanding these dynamics is crucial for navigating its strategic landscape.

The complete report reveals the real forces shaping Shenzhen Infinova’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Infinova, a key player in video surveillance, depends on specialized suppliers for crucial components like advanced camera sensors and AI-enabling chipsets. When these suppliers are few, or possess proprietary technology, their leverage grows significantly. For instance, in 2024, the global semiconductor shortage highlighted how concentrated chipset suppliers can dictate terms, potentially raising costs for manufacturers like Infinova and squeezing their profitability.

Switching suppliers for highly specialized components, particularly those integrated into complex security systems like those Infinova produces, can be a significant undertaking. This often involves substantial costs related to re-designing products, rigorous re-testing, and obtaining new certifications, all of which can add considerable time and expense to Infinova's operations.

These high switching costs effectively bolster the bargaining power of Infinova's suppliers. When a vendor provides unique or proprietary parts crucial to Infinova's product functionality, the supplier knows that changing vendors would incur substantial financial penalties and operational disruptions for Infinova, making them less likely to concede on pricing or terms.

Suppliers possessing robust technological prowess, particularly in burgeoning fields like artificial intelligence or sophisticated sensor production, could indeed pose a forward integration threat. This means they might leverage their expertise to develop and market their own finished video surveillance solutions, directly challenging Infinova's market position.

While component suppliers typically focus on their core manufacturing, a strategic shift towards producing end-user products would significantly alter the competitive landscape. Such a move would directly pit them against Infinova, thereby amplifying their bargaining power in existing supply negotiations and potentially dictating terms for raw materials or components.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts Shenzhen Infinova's bargaining power with its suppliers. If Infinova can readily source comparable raw materials or components from alternative vendors, even with minor product adjustments, the power of existing suppliers is naturally reduced. For instance, if a key semiconductor component has multiple manufacturers offering similar specifications, Infinova can leverage this competition to negotiate better terms.

However, the landscape for specialized technologies, such as advanced AI chips or unique optical sensors crucial for Infinova's advanced surveillance systems, presents a different scenario. In such cases, the scarcity of viable substitutes can dramatically increase supplier leverage. For example, in 2024, the global shortage of high-performance AI processors, driven by increased demand from various tech sectors, led to extended lead times and price hikes from the few dominant suppliers, directly impacting companies like Infinova that rely on these cutting-edge components.

- Limited Substitutes for Specialized AI Hardware: Companies like Infinova often require highly specific, cutting-edge components for their AI-powered solutions. The market for these specialized inputs is frequently dominated by a small number of manufacturers, limiting Infinova's ability to switch suppliers without significant product redesign or performance compromise.

- Impact of Component Shortages: Global supply chain disruptions, as seen with semiconductor shortages in 2024, can severely limit the availability of substitute inputs. This scarcity empowers the few available suppliers, allowing them to dictate terms and pricing, thus increasing their bargaining power.

- Cost-Benefit of Redesign: While substitute inputs might exist, the cost and time associated with product redesign to accommodate them can be prohibitive. Infinova must weigh the potential savings from switching suppliers against the R&D expenses and market delay, which often favors sticking with established, albeit powerful, suppliers.

- Technological Obsolescence Risk: Relying on a single or limited set of suppliers for highly specialized technology also carries the risk of obsolescence if those suppliers do not innovate or if their technology is superseded. This dynamic can shift bargaining power towards suppliers who are perceived as more innovative and reliable.

Impact of Supplier's Industry Health

The overall health of the component manufacturing industry significantly influences supplier bargaining power. For instance, if the industry is consolidating, as seen in some specialized electronics components where major players acquire smaller ones, suppliers gain leverage. This consolidation can lead to fewer suppliers, increasing demand for their limited output and allowing them to command higher prices. In 2024, the semiconductor industry, a key supplier to many tech firms, continued to experience robust demand, particularly for advanced chips, strengthening the bargaining position of leading manufacturers.

Conversely, a fragmented supplier market with numerous competitors and excess capacity weakens supplier influence. In such scenarios, suppliers are often eager to secure business, leading to more competitive pricing and favorable terms for buyers like Infinova. If the market for a particular component is oversupplied, suppliers have less ability to dictate terms, as buyers can easily switch to alternatives. This dynamic can result in lower input costs for companies that source from these markets.

- Industry Consolidation: Increased mergers and acquisitions in supplier industries can reduce competition, empowering remaining suppliers.

- Demand Fluctuations: High demand for supplier products, like advanced semiconductors in 2024, grants suppliers greater pricing power.

- Supplier Fragmentation: A highly competitive supplier landscape with many small players typically limits individual supplier bargaining strength.

- Capacity Utilization: When suppliers operate at high capacity, they are less inclined to offer discounts, strengthening their negotiating position.

Suppliers of specialized components for Infinova, such as advanced AI chips, hold significant bargaining power due to limited alternatives and high switching costs. The global semiconductor shortage in 2024 exemplified this, where concentrated chipset suppliers dictated terms, increasing costs for manufacturers like Infinova.

The ability to switch suppliers for critical, integrated components is often hindered by substantial costs related to product redesign, re-testing, and certifications. This makes Infinova less likely to change vendors, thereby strengthening the supplier's negotiating position.

The scarcity of substitutes for cutting-edge technologies, like high-performance AI processors, amplifies supplier leverage. In 2024, demand surges for these components led to extended lead times and price hikes from dominant manufacturers, directly impacting companies reliant on them.

Industry consolidation within component manufacturing further empowers suppliers. For instance, the robust demand for advanced chips in 2024 strengthened the bargaining position of leading semiconductor manufacturers, allowing them to command higher prices.

| Factor | Impact on Infinova | 2024 Data/Example |

|---|---|---|

| Supplier Concentration | High | Limited number of AI chip manufacturers |

| Switching Costs | High | Product redesign, re-testing, certifications |

| Availability of Substitutes | Low for specialized components | Scarcity of high-performance AI processors |

| Industry Consolidation | Increases supplier power | Semiconductor industry demand and consolidation |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Shenzhen Infinova's position in the security and surveillance industry.

Instantly identify and neutralize competitive threats with a dynamic, visual breakdown of Shenzhen Infinova's Porter's Five Forces.

Customers Bargaining Power

Infinova's focus on large-scale security solutions for sectors like transportation and government means its clients often procure in substantial volumes. This sheer scale of purchase grants these customers significant leverage in price negotiations and contract terms. For instance, a single major infrastructure project could represent a substantial portion of Infinova's annual revenue, making customer retention paramount.

Furthermore, the highly customized nature of the security systems required by these major clients adds another layer to their bargaining power. Customers demanding bespoke integrations and specific functionalities are less likely to switch providers, but this also means Infinova invests heavily in tailoring solutions, which can be costly if not managed effectively through pricing and service level agreements.

In the highly competitive video surveillance market, particularly within China, customers exhibit significant price sensitivity. This is evident as numerous companies compete fiercely for contracts, often driving down prices. For instance, government and public sector projects frequently operate under strict budget limitations, empowering these clients to demand competitive pricing and advantageous terms from suppliers like Infinova.

This price sensitivity allows customers to easily compare proposals from various vendors. In 2024, the average project bid in China's public security sector saw a year-over-year decrease of approximately 8% due to intense competition, a trend that directly impacts Infinova's pricing strategies and profit margins.

Customers have a wealth of options from many well-known companies such as Hikvision, Dahua, Axis Communications, and Bosch, all of which provide comprehensive security solutions. This wide selection of alternatives allows customers to readily switch suppliers if Infinova's products or services don't align with their needs regarding cost, technology, or support.

The extensive competitive environment significantly strengthens the bargaining power of buyers. For instance, in the global video surveillance market, which was valued at approximately $60 billion in 2023 and is projected to reach over $100 billion by 2028, the sheer number of vendors means customers can often negotiate better terms or find more suitable offerings elsewhere.

Shift Towards Software-Defined and Cloud Solutions

The industry's move towards software-defined and cloud security solutions significantly boosts customer bargaining power. This shift allows clients to avoid large upfront hardware investments, opting instead for flexible, subscription-based services. For instance, by mid-2024, the global cloud security market was projected to reach over $40 billion, demonstrating a clear customer preference for scalable, adaptable solutions.

This trend empowers customers to switch providers more easily, as they are less tied to proprietary hardware. They can now cherry-pick services that offer greater adaptability and enhanced functionality, often at a more predictable cost. This flexibility means customers can negotiate better terms or move to competitors offering superior value propositions.

- Customers can leverage the abundance of cloud-based security options to compare features and pricing across multiple vendors.

- Reduced switching costs, due to less reliance on specialized hardware, amplify customer leverage in negotiations.

- The subscription model allows for easier evaluation and adoption of new technologies, further pressuring vendors to innovate and offer competitive pricing.

Customer's Access to Information and Expertise

Sophisticated customers, particularly in demanding sectors like critical infrastructure and government, often bring substantial internal expertise or leverage external consultants to thoroughly assess security solutions. This deep understanding of technology and the market empowers them to negotiate from a position of strength.

Awareness of prevailing market prices, the latest technological advancements, and the competitive landscape significantly bolsters their bargaining power. For instance, in 2024, government procurement processes for advanced security systems frequently involve detailed technical evaluations and price comparisons, giving agencies considerable leverage.

- Informed Decision-Making: Customers with access to detailed product specifications, performance benchmarks, and independent reviews can make more informed purchasing decisions.

- Price Sensitivity: High levels of information enable customers to identify and exploit price discrepancies between vendors, driving down costs.

- Demand for Customization: Sophisticated buyers often require tailored solutions, increasing the negotiation power they hold over suppliers who need to meet specific needs.

Infinova's customers, especially large government and transportation entities, wield considerable bargaining power due to their substantial order volumes and the customized nature of security solutions. This leverage is amplified by a highly competitive market where price sensitivity is a key factor, as evidenced by the 8% average bid decrease in China's public security sector in 2024.

| Factor | Impact on Infinova | Customer Leverage |

|---|---|---|

| Purchase Volume | High dependence on large contracts | Customers can negotiate bulk discounts and favorable terms. |

| Customization Needs | Increased R&D and production costs | Customers can demand tailored features, increasing switching costs for Infinova if not managed. |

| Price Sensitivity | Pressure on profit margins | Customers readily compare prices, forcing competitive bids. |

| Availability of Alternatives | Need for differentiation | Customers can easily switch to competitors like Hikvision or Dahua if Infinova's offerings are not cost-effective or technologically superior. |

Full Version Awaits

Shenzhen Infinova Porter's Five Forces Analysis

This preview showcases the comprehensive Shenzhen Infinova Porter's Five Forces Analysis you will receive immediately after purchase. You're looking at the actual, professionally formatted document, ensuring that what you see is exactly what you get, ready for your strategic planning needs.

Rivalry Among Competitors

The global video surveillance and security solutions market is a crowded arena, with giants like Hikvision and Dahua holding substantial sway. Infinova finds itself in direct competition with hundreds of other companies worldwide. This fierce competition means companies must continuously innovate and battle on both price and product features, directly influencing Infinova's profitability and its standing in the market.

The security industry is in a constant state of flux due to rapid technological advancements. Innovations in AI, machine learning, and cloud computing are reshaping how security solutions are developed and deployed. Companies like Infinova must pour significant resources into research and development to keep pace.

This relentless pursuit of innovation means integrating cutting-edge features such as advanced facial recognition and predictive analytics. Offering sophisticated, interconnected security systems is no longer optional but a necessity to remain competitive. The pressure to constantly upgrade and introduce new capabilities intensifies the rivalry among players in this dynamic market.

The global video surveillance market is projected to see continued expansion, with significant growth anticipated in regions outside of China. However, a notable shift occurred in 2024, as the Chinese market experienced a contraction. This downturn within Infinova's home market suggests that competitive pressures are likely intensifying among domestic players fighting for a smaller or stagnant market share.

This regional disparity creates a complex competitive landscape for Infinova. While opportunities may be emerging in international markets, these areas also present the challenge of facing established or new global competitors. The intensified competition within China, coupled with the need to navigate diverse international markets, directly impacts the intensity of rivalry.

High Fixed Costs and Pressure for Utilization

The security technology sector, where Shenzhen Infinova operates, is characterized by substantial fixed costs. Developing and manufacturing sophisticated security hardware and software demands significant investment in research and development, advanced production facilities, and highly skilled technical staff. For instance, the global video surveillance market, a key area for Infinova, was projected to reach approximately $114.5 billion by 2024, indicating the scale of investment required.

This high cost structure creates immense pressure for companies to maximize sales volumes and ensure high capacity utilization to spread these fixed expenses. Consequently, businesses like Infinova often engage in aggressive pricing tactics and compete fiercely to win large-scale projects that guarantee substantial revenue streams. This drive for utilization intensifies the competitive rivalry, particularly when market demand softens.

- High R&D Investment: Companies in this space invest heavily in innovation, with R&D often representing a significant percentage of revenue. For example, leading players in the broader cybersecurity market typically allocate between 15-20% of their revenue to R&D.

- Capital-Intensive Manufacturing: Setting up and maintaining advanced manufacturing lines for specialized security hardware requires substantial upfront capital expenditure.

- Pressure for Volume: To achieve economies of scale and cover fixed costs, companies must secure high sales volumes, leading to price competition.

- Impact of Market Slowdowns: During periods of reduced market growth, the pressure to maintain utilization can lead to price wars, further escalating competitive intensity.

Customer Switching Costs and Loyalty

While some switching costs exist in the integrated security solutions market, stemming from system integration complexities and user training, these are often manageable. The market's nature, with many providers offering comprehensive solutions, means customers can explore alternatives, thus maintaining a high level of competitive rivalry.

Companies actively work to cultivate customer loyalty through robust relationship management and by ensuring smooth system integrations. However, the inherent competitive pressure compels customers to continuously assess other available options.

- Customer Loyalty Drivers: Companies focus on seamless integrations and strong customer service to retain clients.

- Switching Cost Mitigation: The availability of comparable solutions from numerous vendors can reduce the perceived cost of switching.

- Competitive Intensity: Despite loyalty efforts, customers regularly evaluate alternative security solutions, fueling ongoing rivalry.

The competitive rivalry within the video surveillance sector is intense, driven by a large number of global and local players, including giants like Hikvision and Dahua. This crowded market necessitates continuous innovation and price competition, directly impacting Shenzhen Infinova's profitability and market position.

The industry's rapid technological evolution, particularly in AI and cloud computing, demands significant R&D investment, with leading companies often dedicating 15-20% of revenue to innovation. Furthermore, the capital-intensive nature of manufacturing sophisticated security hardware contributes to pressure for high sales volumes and capacity utilization, often leading to aggressive pricing strategies.

While customer loyalty can be fostered through integration and service, the availability of comparable solutions from numerous vendors means customers frequently evaluate alternatives, thereby sustaining high competitive rivalry. The Chinese market contraction in 2024 further intensifies domestic competition as players vie for market share.

| Factor | Description | Impact on Infinova |

|---|---|---|

| Number of Competitors | Hundreds globally, with major players like Hikvision and Dahua. | Requires constant innovation and competitive pricing. |

| R&D Investment | Leading firms invest 15-20% of revenue in R&D. | High pressure to keep pace with technological advancements. |

| Market Dynamics | Chinese market contracted in 2024; global market growth continues. | Intensified domestic competition, need to navigate diverse international markets. |

| Switching Costs | Manageable due to availability of comparable solutions. | Customers frequently evaluate alternatives, fueling rivalry. |

SSubstitutes Threaten

Traditional physical security measures like manned guarding, basic alarm systems, and physical barriers can indeed act as substitutes for advanced video surveillance and access control systems offered by companies like Infinova. For clients with simpler security requirements, these older methods might appear more cost-effective or adequate. For instance, a small retail store might opt for a manned guard and a simple alarm system rather than a sophisticated IP-based surveillance network, especially if their primary concern is deterring petty theft rather than comprehensive monitoring.

The threat of substitutes for Shenzhen Infinova's advanced surveillance systems comes from basic, standalone surveillance equipment. These can include simple, affordable security cameras or DIY home security systems that are easy for individuals to set up themselves. This poses a challenge as customers with less complex security needs might choose these more accessible and cost-effective alternatives over Infinova's integrated, professional solutions.

Non-video data analytics solutions pose a threat by offering alternative ways to achieve security objectives traditionally handled by video surveillance. For instance, anomaly detection can be managed by sophisticated sensor networks or behavioral analytics platforms that don't rely on visual feeds. The global data analytics market was projected to reach $300 billion in 2024, indicating a significant investment in these alternative technologies.

Access monitoring, another key security function, can be effectively handled by biometric systems or advanced network intrusion detection tools. These systems provide granular control and detailed logs without the need for video infrastructure. The market for identity and access management solutions alone was estimated to be over $17 billion in 2023, highlighting the substantial adoption of these non-video alternatives.

Cybersecurity Solutions as a Primary Focus

The threat of substitutes for Shenzhen Infinova's physical security solutions is growing, especially as organizations increasingly prioritize digital security. In our increasingly digital world, some companies might shift their focus to cybersecurity tools, encryption, and network security if their most critical assets are data. This could be seen as a substitute for extensive physical surveillance systems.

While Infinova offers integrated solutions, the rise of advanced cyber threats means that spending on digital defenses could divert resources from physical security investments. For instance, the global cybersecurity market was projected to reach over $200 billion in 2024, indicating a significant and growing investment area that could compete for budget allocation.

- Cybersecurity Spending Growth: The cybersecurity market is expanding rapidly, with projections indicating continued robust growth through 2025.

- Digital Asset Value: As more business operations and sensitive data reside in the digital realm, the perceived value and protection needs for these assets increase.

- Alternative Security Strategies: Organizations may opt for software-based security measures or cloud-based threat detection as substitutes for traditional hardware-centric physical security.

Internal Security Teams and Protocols

For large organizations, establishing strong internal security teams and implementing rigorous operational protocols can serve as a viable alternative to relying on outsourced integrated security solutions. These in-house capabilities, even when paired with more basic monitoring tools, can effectively substitute for comprehensive external systems, particularly for entities prioritizing direct control over their security infrastructure.

The investment in dedicated internal security personnel and the development of detailed operational procedures represent a significant threat of substitutes for companies like Shenzhen Infinova, which offers integrated security solutions. For instance, a large enterprise might allocate substantial budgets towards its own cybersecurity department, potentially reducing the need for third-party managed services.

- Internal Security Investment: Large corporations are increasingly building out internal cybersecurity teams. In 2024, the global average spend on internal IT security personnel and training saw a notable increase, with many organizations prioritizing in-house expertise.

- Protocol Development: The creation of stringent security protocols and standard operating procedures can mitigate the perceived need for external, all-encompassing security management systems.

- Control Preference: Organizations that value granular control over their data and security posture may find internal solutions more appealing, even if they require a higher upfront investment in talent and technology.

- Cost-Benefit Analysis: While outsourcing offers convenience, a thorough cost-benefit analysis might reveal that developing internal capabilities is more economical in the long run for certain large-scale operations.

The threat of substitutes for Shenzhen Infinova's advanced video surveillance and access control systems is multifaceted, encompassing traditional security measures, standalone equipment, and non-video data analytics. Basic alarm systems and manned guarding remain viable alternatives for clients with less complex security needs, offering a perceived cost-effectiveness. For instance, a small business might opt for a simple alarm and on-site personnel over a sophisticated IP-based network.

Furthermore, the rise of cybersecurity and digital asset protection presents a significant substitute. As businesses increasingly prioritize safeguarding data, investments in cybersecurity tools and encryption can divert budget from physical security infrastructure. The global cybersecurity market was projected to exceed $200 billion in 2024, highlighting this competing investment area.

| Substitute Category | Examples | Market Context/Data (2023-2024) |

|---|---|---|

| Traditional Physical Security | Manned guarding, basic alarm systems, physical barriers | Small businesses often prioritize cost-effectiveness; specific market size data varies but represents a persistent alternative. |

| Standalone Surveillance Equipment | DIY security cameras, basic home security systems | Accessible and affordable for individuals and small operations, bypassing integrated solutions. |

| Non-Video Data Analytics | Sensor networks, behavioral analytics platforms | Global data analytics market projected at $300 billion in 2024; offers alternative anomaly detection. |

| Access Monitoring Alternatives | Biometric systems, network intrusion detection | Identity and Access Management market exceeded $17 billion in 2023; provides granular control without video. |

| Digital Security Focus | Cybersecurity tools, encryption, network security | Global cybersecurity market projected over $200 billion in 2024; competes for budget allocation as digital assets gain value. |

| Internal Security Capabilities | In-house security teams, operational protocols | Large corporations increasing internal security investment; global average spend on IT security personnel and training saw a notable increase in 2024. |

Entrants Threaten

Entering the professional video surveillance and integrated security solutions market demands significant capital for research and development, particularly in areas like AI-powered analytics. For instance, companies like Hikvision and Dahua, major players in the industry, invest billions annually in R&D to stay ahead. This substantial financial commitment to innovation, coupled with the costs associated with specialized hardware manufacturing, creates a formidable barrier to entry for newcomers.

Developing and deploying sophisticated integrated security systems requires highly specialized technical skills. This includes expertise in video analytics, AI algorithms, network protocols, and the intricate art of system integration. New entrants often struggle to acquire this talent, which is both scarce and expensive to retain.

The high cost and difficulty in attracting and keeping professionals with these niche skills present a significant hurdle. Companies lacking established research and development infrastructure or prior industry experience will find it particularly challenging to compete.

Infinova, like other major players in the large-scale security solutions market, benefits significantly from its established brand reputation and deep-rooted customer relationships. For instance, securing contracts for government facilities or critical infrastructure often hinges on trust built over years, something new entrants find extremely challenging to replicate quickly. This makes it difficult for newcomers to penetrate the market and compete for these high-value projects.

Regulatory Compliance and Certifications

The security industry, particularly when serving critical infrastructure and government clients, faces a formidable hurdle in the form of extensive regulatory compliance and certifications. For instance, adherence to standards like the National Defense Authorization Act (NDAA) or specific safety protocols demands significant investment in time and capital. New entrants often struggle to meet these rigorous requirements, which can cost millions of dollars and take years to implement, effectively deterring those without established resources and deep expertise in navigating this complex environment.

These regulatory burdens create a substantial barrier to entry. Consider that achieving certifications like ISO 27001 for information security management can involve extensive audits and process overhauls, a process that smaller or newer companies may find prohibitively expensive and time-consuming. This complexity shields incumbent players who have already invested in compliance infrastructure.

- Stringent Regulations: The security sector is heavily regulated, especially for government and critical infrastructure contracts.

- High Compliance Costs: Meeting standards like NDAA or specific safety certifications requires substantial financial and human resources.

- Time and Expertise: Navigating the complex regulatory landscape demands specialized knowledge and considerable time investment.

- Barrier to New Entrants: These factors create a significant barrier, making it difficult for new companies to compete effectively.

Evolving Technology Landscape (AI, Cloud) as a Double-Edged Sword

The rapid evolution of technology, particularly in AI and cloud computing, presents a nuanced threat of new entrants for Shenzhen Infinova. While these advancements can reduce some traditional hardware-centric barriers, allowing software-focused startups to emerge with lower initial capital investment, they simultaneously raise the bar for innovation and competitive intensity.

New players must not only develop cutting-edge AI and cloud solutions but also contend with established companies like Infinova, which are already heavily investing in and integrating these technologies. For instance, by mid-2024, major cloud providers reported substantial growth in AI-related services, indicating significant ongoing investment by incumbents.

- Lowered Hardware Barriers: Cloud infrastructure reduces the need for new entrants to invest heavily in physical data centers and servers, democratizing access to computing power.

- Increased Software Sophistication: The complexity of AI and cloud integration demands high levels of technical expertise, creating a barrier for less sophisticated entrants.

- Incumbent Advantage: Established firms like Infinova leverage existing customer bases and R&D budgets to quickly adopt and scale new technologies, outmaneuvering smaller, less-resourced startups.

- Rapid Obsolescence: The fast pace of technological change means new entrants must constantly innovate to avoid their solutions becoming outdated, a challenge that requires sustained investment and agility.

The threat of new entrants in the professional video surveillance market remains moderate, primarily due to high capital requirements for R&D and manufacturing, alongside the need for specialized technical expertise. Established players like Infinova benefit from brand recognition and existing customer relationships, particularly in high-value government and critical infrastructure sectors. Navigating stringent regulatory compliance and certifications further erects significant barriers, demanding substantial investment and time.

| Factor | Impact on New Entrants | Example/Data Point (2024) |

| Capital Requirements (R&D & Manufacturing) | High | Major players invest billions annually in R&D; Hikvision's R&D spending in 2023 was approximately $2.5 billion USD. |

| Technical Expertise | High Barrier | Demand for AI, video analytics, and system integration specialists remains intense. |

| Brand Reputation & Customer Relationships | Significant Barrier | Securing government contracts often relies on trust built over years. |

| Regulatory Compliance & Certifications | High Barrier | NDAA compliance and ISO 27001 certification can cost millions and take years. |

| Technological Advancements (AI/Cloud) | Mixed Impact | Lowers some hardware barriers but increases demand for sophisticated software integration. |

Porter's Five Forces Analysis Data Sources

Our Shenzhen Infinova Porter's Five Forces analysis is built upon a foundation of comprehensive data, including Infinova's annual reports, industry-specific market research from firms like IDC and Gartner, and publicly available financial filings.