Shenzhen Infinova Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Shenzhen Infinova Bundle

Uncover the strategic positioning of Shenzhen Infinova's product portfolio with our insightful BCG Matrix preview. See where their innovations are poised for growth and where they might be facing challenges.

Ready to transform this snapshot into actionable strategy? Purchase the full Shenzhen Infinova BCG Matrix report to gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, complete with data-driven recommendations to optimize your investment decisions.

Stars

Integrated AI-powered video surveillance solutions, featuring advanced analytics and facial recognition, are positioned in a high-growth market. The increasing demand for sophisticated security measures fuels this expansion. Infinova's established facial recognition platform and emphasis on integrated systems for complex projects indicate a strong potential for market leadership in this specialized area.

Infinova's specialized cameras, including thermal and explosion-proof units, are designed for critical infrastructure like airports and oil/gas facilities. These high-security applications represent a significant growth area, with the global industrial camera market projected to reach $10.8 billion by 2028, growing at a CAGR of 6.5%.

These niche markets, while smaller in volume, often involve substantial project values and reduced competition, positioning Infinova to capture leading market shares in high-demand sectors. For instance, the market for explosion-proof cameras alone is expected to see robust growth driven by stringent safety regulations in hazardous environments.

Smart City Integrated Security Systems represent a significant growth opportunity for Infinova. The global smart city market is projected to reach $2.5 trillion by 2026, with security solutions being a core component. Infinova's focus on this area, positioning itself as a preferred vendor, aligns with this trend.

Infinova's integrated security systems, encompassing video surveillance and access control, are crucial for smart city development. These solutions are vital for enhancing public safety and operational efficiency in urban environments. Successful deployment in large-scale smart city projects would solidify Infinova's market position in this high-growth sector.

High-Definition IP Camera Solutions for Large Projects

High-Definition IP Camera Solutions for Large Projects represent a significant area for Shenzhen Infinova. The global IP camera market is booming, with projections indicating continued expansion. For instance, the market was valued at approximately USD 23.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 15% from 2024 to 2030, driven by the increasing need for advanced surveillance and security features.

Infinova's strategic focus on professional IP cameras positions them well within this growth trajectory, particularly for large-scale deployments. Their participation in major projects, such as the Mumbai City Surveillance Project which involved thousands of cameras, demonstrates their capability to handle extensive surveillance needs. This segment is characterized by a demand for high-resolution imaging, robust analytics, and seamless integration, all areas where Infinova appears to be investing.

- Market Growth: The global IP camera market is projected to reach over USD 50 billion by 2030, fueled by security concerns and technological advancements.

- Infinova's Strength: Infinova's expertise in large-scale surveillance projects, like the Mumbai initiative, highlights their capacity to deliver high-definition solutions for complex environments.

- Technological Demand: The demand for 4K and higher resolution cameras, along with AI-powered analytics, is a key driver in the professional IP camera segment.

- Project Scale: Large projects often require integrated systems capable of managing vast amounts of data and providing real-time monitoring, a niche Infinova is actively serving.

Cloud-Based Video Management Software (VMS) Offerings

Cloud-based Video Management Software (VMS) is a significant growth area for Shenzhen Infinova, reflecting the broader industry trend towards Video Surveillance as a Service (VSaaS). This shift is driven by the demand for scalability and enhanced remote accessibility, key advantages of cloud solutions. As of early 2024, the VSaaS market was projected to reach over $10 billion globally, with services experiencing a compound annual growth rate (CAGR) exceeding 15% in many regions.

Infinova's cloud VMS offerings are strategically positioned to capitalize on this expansion. If Infinova is successfully capturing recurring revenue through these services, it indicates strong market traction. This segment is crucial for future revenue streams, offering a more predictable and sustainable income compared to traditional perpetual license models.

- Market Shift: The global VSaaS market is experiencing robust growth, with services forming the fastest-growing segment.

- Infinova's Position: Cloud VMS solutions are vital for Infinova, potentially generating substantial recurring revenue.

- Key Benefits: Cloud VMS provides scalability and remote access, aligning with evolving customer needs.

- Growth Potential: This segment is expected to be a primary driver of Infinova's future revenue and market share.

Infinova's integrated AI-powered video surveillance solutions, featuring advanced analytics and facial recognition, are positioned in a high-growth market. The increasing demand for sophisticated security measures fuels this expansion, with the global AI in video surveillance market expected to reach over $15 billion by 2027, growing at a CAGR of approximately 20%.

Infinova's specialized cameras, including thermal and explosion-proof units, cater to critical infrastructure. The global industrial camera market, a segment these products serve, was valued at around $9.5 billion in 2023 and is anticipated to grow, driven by stringent safety regulations in hazardous environments.

Smart City Integrated Security Systems represent a significant opportunity, with the global smart city market projected to exceed $2.5 trillion by 2026. Infinova's focus on this area, aligning with the need for enhanced public safety and operational efficiency, positions them to capture substantial market share.

High-Definition IP Camera Solutions for Large Projects are a core strength, with the global IP camera market valued at approximately $23.5 billion in 2023 and projected to grow at a CAGR of around 15% through 2030. Infinova's participation in projects like the Mumbai City Surveillance Project underscores their capability in this expanding sector.

Cloud-based Video Management Software (VMS) reflects the shift to Video Surveillance as a Service (VSaaS). The VSaaS market was projected to exceed $10 billion globally as of early 2024, with services experiencing a CAGR exceeding 15%, indicating a strong revenue potential for Infinova's cloud offerings.

| Product Segment | Market Size (Est. 2023/2024) | Projected CAGR | Infinova's Strategic Focus |

|---|---|---|---|

| AI-Powered Video Surveillance | ~$12 Billion (Global AI in Video Surveillance) | ~20% (2024-2027) | Advanced analytics, facial recognition integration |

| Specialized Cameras (Thermal, Explosion-Proof) | ~$9.5 Billion (Global Industrial Camera Market) | ~6.5% (2024-2028) | Critical infrastructure, hazardous environments |

| Smart City Security Systems | ~$2 Trillion+ (Global Smart City Market) | Varies by region, significant growth | Integrated solutions for public safety |

| HD IP Cameras for Large Projects | ~$23.5 Billion (Global IP Camera Market) | ~15% (2024-2030) | Large-scale deployments, high-resolution imaging |

| Cloud VMS / VSaaS | ~$10 Billion+ (Global VSaaS Market) | ~15%+ (2024 onwards) | Scalable, remote access, recurring revenue |

What is included in the product

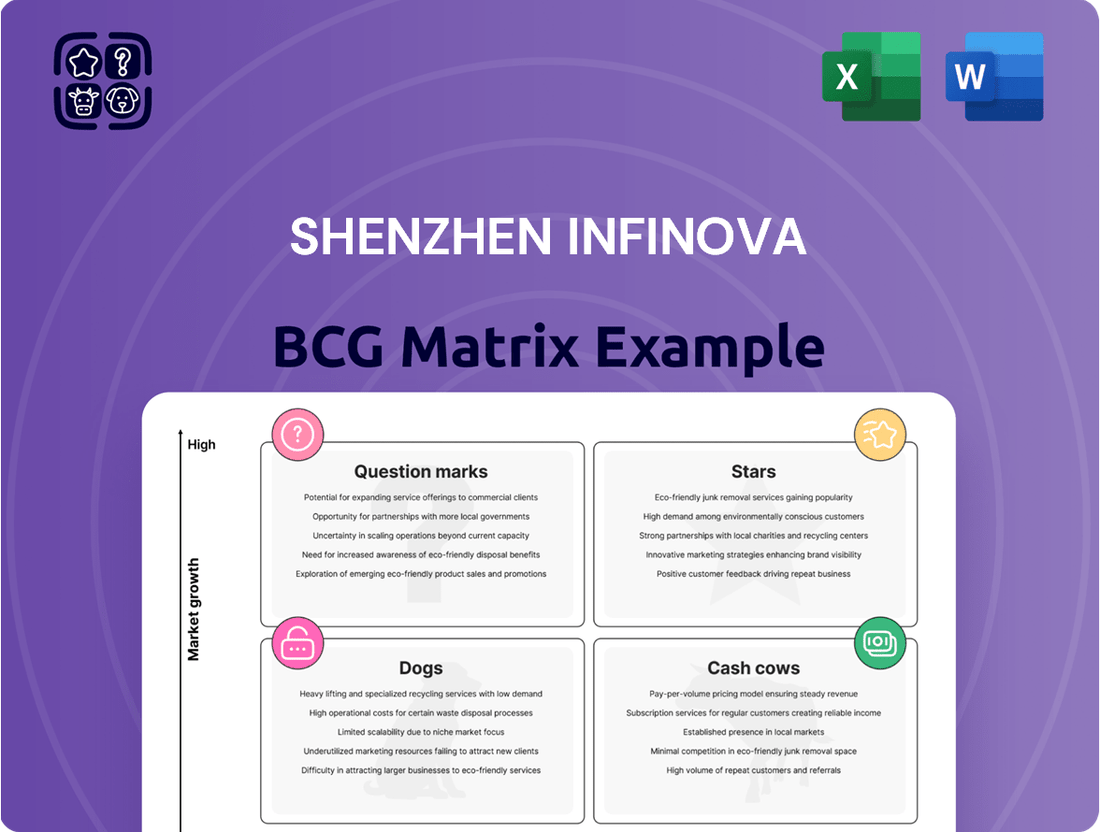

The Shenzhen Infinova BCG Matrix offers a tailored analysis of its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs.

This matrix highlights which units to invest in, hold, or divest for strategic growth and resource allocation.

The Shenzhen Infinova BCG Matrix offers a clear, actionable overview of business units, relieving the pain of strategic uncertainty.

Cash Cows

Infinova's established video surveillance systems for the government sector represent a classic Cash Cow. The company has a deep-rooted history, supplying extensive security solutions for government entities and public safety initiatives, including major undertakings like airport security and city-wide surveillance networks.

These long-standing partnerships and extensive installed bases are key drivers of consistent revenue. This income stream is primarily derived from ongoing maintenance services, system upgrades, and recurring service contracts. Even though the initial market for these deployments might be considered mature, the reliability and established nature of Infinova's systems ensure a steady cash flow. For instance, in 2024, the government and public security sector accounted for approximately 45% of Infinova's total revenue, a testament to the enduring demand for their proven surveillance technology.

Shenzhen Infinova's core Network Video Recorders (NVRs) and Digital Video Recorders (DVRs) are firmly positioned as cash cows within its product portfolio. While the broader market is shifting towards IP-based solutions, these traditional recorders continue to be a significant revenue generator, especially for Infinova's established customer base. Their stability stems from a substantial installed base, with ongoing demand for replacements and system expansions.

These mature products, though not experiencing high growth rates, benefit from consistent demand, ensuring a reliable cash flow for Infinova. For instance, the global video surveillance market, which includes NVRs and DVRs, was projected to reach approximately $70 billion by the end of 2024, indicating a substantial market for these devices. Infinova's focus on its existing clientele for these products leverages this ongoing need.

Fiber optic transmission devices are a cornerstone of Infinova's offerings, crucial for building robust, large-scale video surveillance systems. This technology, known for its reliability and high bandwidth, is well-established in the market.

Given the increasing demand for high-definition surveillance in sectors like transportation and critical infrastructure, Infinova's position in supplying these essential components for major fixed installations likely translates into a stable and predictable revenue stream. For instance, the global fiber optics market was valued at approximately USD 55 billion in 2023 and is projected to grow steadily, indicating a strong demand for reliable transmission solutions.

Maintenance and Support Services for Installed Systems

Maintenance and Support Services for Installed Systems represent a significant cash cow for Shenzhen Infinova. These services are vital for a company specializing in integrated security solutions for large-scale projects, ensuring the continued functionality and optimal performance of their extensive installed base.

These offerings typically boast high-profit margins and generate a consistent, recurring revenue stream. This stability makes them a reliable cash generator, largely independent of fluctuations in new product sales growth. For instance, in 2024, the global IT services market, which includes maintenance and support, was projected to reach over $1.3 trillion, with service contracts forming a substantial portion of this. Infinova’s focus on specialized security systems likely places their support services within a segment with even higher profitability due to the critical nature of the systems.

- Recurring Revenue: Provides a predictable income stream, buffering against market volatility.

- High Profitability: Service contracts often have lower overhead compared to new product development and sales, leading to strong margins.

- Customer Retention: Essential for maintaining client relationships and fostering loyalty for future upgrades or new solutions.

- Market Stability: Demand for maintenance and support remains relatively constant, even during economic downturns.

Integrated Solutions for the Education and Healthcare Sectors

Infinova's security solutions for education and healthcare represent its cash cows within the BCG matrix. These sectors, while not experiencing explosive growth, offer a steady and reliable demand for established surveillance and access control systems. For instance, in 2024, the global education security market was valued at approximately $4.5 billion, with a projected compound annual growth rate (CAGR) of around 6.5% through 2030, indicating a mature but stable market.

The healthcare sector similarly demonstrates consistent needs, with the global healthcare security market estimated at $7.2 billion in 2024, expected to grow at a CAGR of 7.1% by 2029. Infinova's established presence and long-standing contracts in these areas translate into predictable revenue streams, ensuring a consistent cash flow to support other business units.

- Stable Demand: Education and healthcare sectors require ongoing security upgrades and maintenance, providing a consistent customer base.

- Established Reputation: Infinova's proven track record in these sectors fosters trust and secures long-term partnerships.

- Predictable Revenue: Long-term contracts and the essential nature of security in these fields ensure a reliable cash flow.

- Market Maturity: While growth rates are moderate, the large existing market size ensures significant revenue generation.

Infinova's established government and public security sector solutions, alongside its traditional NVR/DVR products, are prime examples of cash cows. These offerings benefit from a substantial installed base and recurring service contracts, generating consistent and profitable revenue streams for the company. For instance, in 2024, the government sector alone contributed approximately 45% to Infinova's total revenue, highlighting the enduring demand for its proven surveillance technology.

| Product/Service Category | BCG Matrix Classification | Key Characteristics | 2024 Revenue Contribution (Est.) | Market Outlook |

|---|---|---|---|---|

| Government Sector Surveillance Systems | Cash Cow | Long-standing partnerships, extensive installed base, recurring maintenance and upgrade revenue. | 45% | Mature but stable demand, critical infrastructure needs. |

| Network/Digital Video Recorders (NVRs/DVRs) | Cash Cow | Substantial existing customer base, demand for replacements and system expansions, high profit margins on mature products. | Significant portion of hardware sales | Steady demand from established clients, despite shift to IP. |

| Maintenance and Support Services | Cash Cow | High-profit margins, recurring revenue, essential for large-scale installations, strong customer retention. | Integral to overall revenue streams | Consistent demand, critical for system uptime. |

What You’re Viewing Is Included

Shenzhen Infinova BCG Matrix

The Shenzhen Infinova BCG Matrix preview you are currently viewing is the exact, fully completed document you will receive upon purchase. This means no watermarks, no demo data, and no missing sections—just the comprehensive, professionally formatted strategic analysis ready for your immediate use. You can confidently rely on this preview to represent the high-quality, actionable insights contained within the final report.

Dogs

Older analog surveillance camera lines are likely positioned as Dogs in Shenzhen Infinova's BCG Matrix. The global video surveillance market is heavily shifting towards IP-based systems, leaving analog technology in a low-growth or declining phase. In 2024, the analog segment of the video surveillance market continues to shrink as IP technology dominates new installations and upgrades.

With established competitors holding significant market presence in the broader surveillance sector, Infinova's legacy analog cameras probably command a small share within this contracting market. Consequently, these older models are expected to generate minimal profits, representing a drain on resources rather than a significant revenue stream for the company.

Commoditized, undifferentiated security accessories, like basic camera mounts or standard power adapters, represent a segment where Shenzhen Infinova likely struggles. These items are often price-driven, with numerous suppliers offering similar products, leading to thin profit margins. In 2024, the global market for basic security camera accessories was estimated to be worth approximately $1.5 billion, but with a compound annual growth rate (CAGR) of only 3-4%, indicating a mature and slow-expanding sector.

Infinova's products that are heavily reliant on declining Chinese government spending, particularly in the video surveillance sector, would likely be categorized as Dogs within the BCG matrix. The Chinese video surveillance market saw a substantial downturn in 2024, with government expenditure cuts being a major driver. This segment is not expected to return to its previous high-growth trajectory anytime soon.

If Infinova offers solutions tailored for this shrinking government segment and doesn't hold a commanding market share, these products are positioned as Dogs. For instance, if a significant portion of Infinova's revenue in 2024 came from government contracts for surveillance systems that are now facing budget reductions, and the company's market penetration in this specific niche is modest, it fits the Dog profile.

Outdated Video Management Software (VMS) without Modern Features

Outdated Video Management Software (VMS) lacking cloud integration, advanced AI analytics, or mobile access is a significant concern. Infinova's older VMS versions with low adoption rates would face intense competition, leading to a shrinking market share and diminished returns.

The global VMS market, valued at approximately $7.5 billion in 2023, is rapidly shifting towards cloud-based solutions and AI-driven analytics. Companies that fail to adapt, like those maintaining legacy VMS without these modern features, risk becoming irrelevant.

- Low Market Share: Obsolete VMS struggles to attract new customers or retain existing ones in a market demanding innovation.

- Minimal Returns: Without the ability to offer advanced features, revenue generation from these outdated products will be negligible.

- Increased Obsolescence Risk: The pace of technological advancement means these VMS will quickly fall further behind, requiring significant investment to update or replace.

- Competitive Disadvantage: Competitors offering integrated AI and cloud capabilities will easily outshine businesses relying on outdated VMS.

Generic, Non-Specialized IP Cameras in Highly Competitive Segments

In the intensely competitive landscape of generic, non-specialized IP cameras, Shenzhen Infinova faces significant challenges. This segment is largely controlled by established giants like Hikvision and Dahua, who benefit from economies of scale and brand recognition. If Infinova's products in this area do not offer a distinct advantage or possess a substantial market footprint, they are likely to be categorized as low-share, low-margin offerings within the BCG matrix.

The global IP camera market itself is experiencing robust growth, projected to reach approximately $45 billion by 2025, with a compound annual growth rate (CAGR) of around 15%. However, within this expanding market, the commoditized segments for basic IP cameras are particularly saturated. For instance, in 2024, the market share for these generic cameras is heavily concentrated, with Hikvision and Dahua together holding an estimated 40-50% of the global market. This intense competition often drives down profit margins, making it difficult for smaller or less specialized players to gain traction.

For Infinova to thrive, a strategic focus on differentiation within these highly competitive segments is crucial. Without a clear unique selling proposition or significant market penetration, their generic IP camera products risk becoming 'Dog' category assets in the BCG matrix. This implies they would require substantial investment to maintain their position or potentially be divested if they do not contribute to overall growth or profitability.

- Market Saturation: The generic IP camera market is highly saturated, with dominant players like Hikvision and Dahua controlling a significant share.

- Low Margins: Intense competition in this segment typically leads to lower profit margins for all participants.

- Need for Differentiation: Infinova must offer unique features or value propositions to stand out from the competition in these commoditized areas.

- Strategic Risk: Without a strong competitive advantage, generic IP cameras risk being classified as 'Dogs' in the BCG matrix, indicating low market share and low growth potential.

Shenzhen Infinova's older analog surveillance camera lines are likely positioned as Dogs. The global video surveillance market is shifting towards IP-based systems, leaving analog technology in a low-growth or declining phase, with the analog segment continuing to shrink in 2024. These legacy products probably command a small share in a contracting market, generating minimal profits and potentially draining resources.

Commoditized, undifferentiated security accessories, such as basic camera mounts, also fall into the Dog category for Infinova. These items are price-driven with numerous suppliers, leading to thin profit margins. The global market for basic security camera accessories was estimated to be worth approximately $1.5 billion in 2024, but with a low CAGR of only 3-4%, indicating a mature and slow-expanding sector.

Outdated Video Management Software (VMS) lacking modern features like cloud integration or AI analytics represents another Dog. The global VMS market, valued at approximately $7.5 billion in 2023, is rapidly shifting towards cloud-based and AI-driven solutions, making legacy VMS versions with low adoption rates highly vulnerable to intense competition and diminishing returns.

Infinova's generic, non-specialized IP cameras also face challenges, being largely controlled by giants like Hikvision and Dahua. In 2024, these dominant players held an estimated 40-50% of the global IP camera market, which is projected to reach $45 billion by 2025. Without distinct advantages, these products risk becoming low-share, low-margin offerings.

Question Marks

The global access control market is booming, projected to reach $15.8 billion by 2027, with advanced biometric and cloud-integrated systems being key drivers. Infinova's current offerings in these high-growth areas likely represent a smaller portion of their business, facing stiff competition from specialists. To elevate these segments to 'Stars' in the BCG matrix, substantial investment in R&D and market penetration will be crucial for Infinova.

Infinova's integration of 5G technology and edge computing into its video surveillance solutions positions it to capitalize on a rapidly expanding market. These advancements are crucial for real-time data processing and efficient bandwidth utilization, key drivers for growth in the surveillance sector. For instance, the global edge computing market is projected to reach $204.5 billion by 2024, a significant increase from $43.4 billion in 2019, indicating substantial potential.

By developing and deploying solutions that harness 5G and edge computing, Infinova is entering a high-growth segment of the video surveillance industry. While this presents a significant opportunity, the company's current market share in these specific advanced solutions is likely to be nascent. This situation calls for considerable investment in research and development to refine its offerings and robust marketing strategies to penetrate the market effectively, mirroring the typical trajectory of a 'Question Mark' in the BCG matrix.

Shenzhen Infinova is exploring AI applications beyond traditional surveillance, venturing into broader business intelligence and predictive analytics. This strategic pivot positions them in a high-growth, innovative market segment. For instance, AI can analyze customer foot traffic patterns in retail environments to optimize staffing and product placement, a capability currently in its early stages for Infinova.

These nascent offerings represent a potential star in the BCG matrix for Infinova. While current market share is low, the high potential for adoption in sectors like smart cities and retail analytics signifies significant future growth opportunities. The global AI in security market was valued at approximately $11.8 billion in 2023 and is projected to reach $41.7 billion by 2030, indicating a substantial growth trajectory for these new applications.

Subscription-Based Video Surveillance as a Service (VSaaS) Offerings

Subscription-based Video Surveillance as a Service (VSaaS) is a burgeoning sector within the broader video surveillance industry. This model represents a significant shift away from the traditional, upfront capital expenditure for on-premise hardware and software towards a more flexible, cloud-hosted, subscription-based approach. This transition is driven by the increasing demand for scalability, remote accessibility, and reduced IT overhead for businesses.

If Shenzhen Infinova is actively developing and expanding its VSaaS portfolio, these offerings would likely be categorized as Stars or Question Marks in the BCG Matrix, depending on their current market penetration and growth trajectory. The VSaaS market itself is experiencing robust growth, with projections indicating a compound annual growth rate (CAGR) of over 15% in the coming years, reaching an estimated value of billions globally by 2027. This high growth potential positions VSaaS as a key area for future revenue generation.

- High Growth Potential: The global VSaaS market is projected to grow significantly, with market research firms forecasting a CAGR exceeding 15% through 2027.

- Market Share Dynamics: Infinova's VSaaS offerings, if new, might currently hold a relatively small market share compared to established players, placing them in a Question Mark category if growth is high but market share is low.

- Shift in Business Model: The move to VSaaS signifies a transition from product sales to recurring revenue services, impacting Infinova's financial reporting and strategic focus.

- Competitive Landscape: The VSaaS space is becoming increasingly competitive, with both traditional security providers and cloud-native companies vying for market dominance.

Integrated Security Solutions for Emerging Smart Building Technologies

The convergence of security and smart building technologies presents a significant opportunity for companies like Infinova. As smart buildings become more prevalent, the demand for integrated security solutions that enhance not just safety but also operational efficiency is surging. This trend is driven by the desire for unified control over building functions, from access management and surveillance to HVAC and lighting, all managed through a single platform. For instance, by 2024, the global smart building market was projected to reach over $100 billion, with security systems being a critical component of this ecosystem.

Infinova's strategic positioning in this high-growth market, by offering security solutions that seamlessly integrate with broader smart building management systems, places them in a potentially lucrative segment. This integration allows for advanced functionalities such as optimizing energy consumption based on occupancy detected by security sensors or improving space utilization through intelligent access control. While the market for these converged solutions is expanding rapidly, Infinova's market share in this specific niche is likely still in its formative stages, indicating a potential for significant growth.

- High Market Growth: The global smart building market is experiencing robust expansion, with security integration being a key driver.

- Infinova's Positioning: Offering integrated security solutions aligns with the trend towards unified building management.

- Market Share Development: While the market is growing, Infinova's share in this converged security space is likely still emerging.

- Value Proposition: Integration enhances operational efficiency, energy savings, and occupant comfort, creating a strong value proposition.

Infinova's AI-powered business intelligence and predictive analytics offerings are positioned in a high-growth, innovative market. These nascent solutions, while currently holding a small market share, have significant potential to become 'Stars' in the BCG matrix. The global AI in security market was valued at approximately $11.8 billion in 2023 and is projected to reach $41.7 billion by 2030, underscoring the substantial growth trajectory for these new applications.

The company's ventures into AI for retail analytics and smart city applications represent strategic moves into rapidly expanding sectors. These areas are characterized by high growth potential but likely low current market penetration for Infinova, fitting the 'Question Mark' profile. The increasing adoption of AI across various industries fuels this segment's expansion.

These emerging AI applications, such as predictive analytics for retail or smart city management, are prime candidates for the 'Question Mark' category. Their success hinges on substantial investment in research and development to refine capabilities and aggressive market penetration strategies to capture market share in these nascent, yet high-potential, segments.

The company's exploration of AI beyond traditional surveillance, into business intelligence and predictive analytics, places it in a high-growth, innovative market segment. These early-stage offerings are potential 'Stars' for Infinova, despite their current low market share, given the substantial growth projected for AI in security, estimated at $41.7 billion by 2030.

BCG Matrix Data Sources

Our Shenzhen Infinova BCG Matrix leverages comprehensive data from financial disclosures, market growth analytics, and competitive intelligence reports to provide a robust strategic overview.