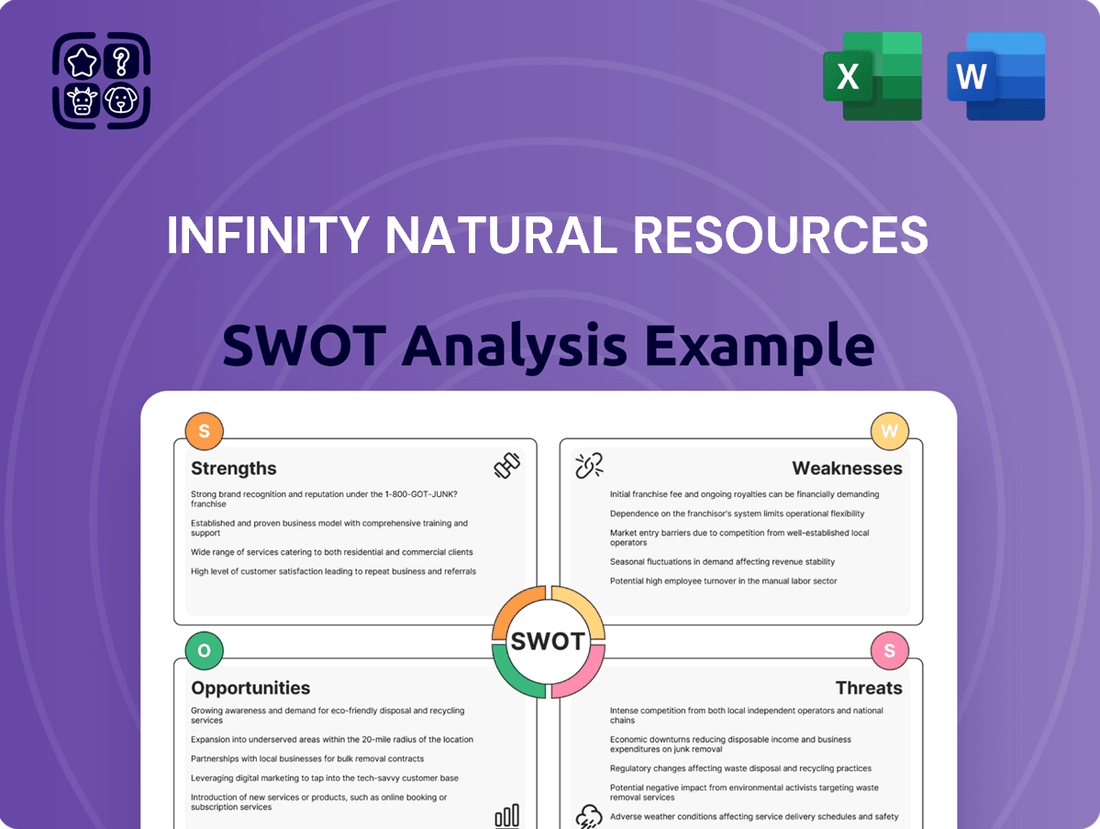

Infinity Natural Resources SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infinity Natural Resources Bundle

Infinity Natural Resources possesses significant strengths in its operational efficiency and a dedicated management team. However, understanding the full scope of its market opportunities and potential threats is crucial for informed decision-making. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Infinity Natural Resources, LLC's strength lies in its dedicated focus on the Appalachian Basin, a region boasting some of the most significant and economically attractive natural gas reserves in the U.S. This specialization allows the company to deeply leverage existing infrastructure and gain invaluable geological insights unique to this prolific area, forming a robust base for its operations.

Infinity Natural Resources leverages advanced drilling and completion technologies to significantly boost output from its resource base. These sophisticated methods, including extended horizontal drilling combined with multi-stage hydraulic fracturing and intensified completion designs, are key to unlocking greater recovery from challenging unconventional formations.

By embracing these cutting-edge techniques, the company aims to not only maximize the amount of oil and gas extracted but also to improve the overall efficiency of its operations. This commitment to technological advancement directly translates into reduced operational costs and enhanced production volumes, a critical factor in today's competitive energy market.

Infinity Natural Resources leverages its efficient operations and strategic asset management to create significant stakeholder value. This focus on disciplined capital allocation and operational excellence underpins its financial performance.

Strong Financial Position Post-IPO

Infinity Natural Resources solidified its financial standing significantly following its February 2025 Initial Public Offering (IPO). The company raised substantial net proceeds, which directly translated into a robust liquidity position.

This strategic capital infusion allowed Infinity Natural Resources to conclude 2024 with a zero-debt status on its revolving credit facility. Furthermore, the company reported a strong combination of cash reserves and available borrowing capacity, estimated at over $250 million as of the IPO completion.

- Robust Liquidity: The IPO generated approximately $180 million in net proceeds, enhancing the company's cash position.

- Debt-Free Operations: Infinity Natural Resources achieved a zero-debt status on its credit facility by the end of 2024.

- Financial Flexibility: The combined cash and available credit provide substantial capital for growth and strategic investments.

- Market Confidence: A successful IPO signals strong investor confidence in the company's future prospects.

Balanced Portfolio of Oil and Natural Gas Assets

Infinity Natural Resources boasts a well-balanced portfolio of oil and natural gas assets. For 2024, the company's production is a blend of oil, natural gas, and natural gas liquids, providing a diversified revenue stream. This mix allows Infinity to capitalize on different commodity price movements.

Looking ahead to 2025, Infinity plans to strategically shift its development focus. The company intends to create a more even split between natural gas-weighted and oil-weighted wells. This adjustment demonstrates a keen awareness of evolving market fundamentals and a commitment to optimizing resource allocation.

The company's diversified asset base is a significant strength, offering substantial flexibility. Infinity can readily adapt to fluctuating commodity prices and adjust its operational strategy to maximize returns. This agility is crucial in the dynamic energy sector.

- 2024 Production Mix: Balanced exposure to oil, natural gas, and natural gas liquids.

- 2025 Development Strategy: Planned shift towards a more even balance between natural gas and oil-weighted wells.

- Market Responsiveness: Strategy reflects adaptation to current and anticipated market fundamentals.

- Operational Flexibility: Diversified assets enable adaptation to commodity price volatility and optimization of returns.

Infinity Natural Resources' strengths are deeply rooted in its strategic positioning within the prolific Appalachian Basin, coupled with its commitment to technological innovation. The company's successful February 2025 IPO generated approximately $180 million in net proceeds, bolstering its financial flexibility and allowing it to conclude 2024 with a zero-debt status on its revolving credit facility. This robust liquidity, estimated at over $250 million in cash reserves and available borrowing capacity post-IPO, provides a strong foundation for future growth and operational excellence.

| Strength Category | Key Attribute | Supporting Data/Fact |

|---|---|---|

| Geographic Focus | Appalachian Basin Specialization | Access to significant and economically attractive natural gas reserves. |

| Operational Efficiency | Advanced Drilling & Completion Technologies | Extended horizontal drilling, multi-stage hydraulic fracturing for enhanced recovery. |

| Financial Health | Post-IPO Liquidity | ~$180M net proceeds from Feb 2025 IPO; >$250M in cash & borrowing capacity (as of IPO). |

| Financial Health | Debt-Free Status | Zero-debt status on revolving credit facility by end of 2024. |

| Asset Portfolio | Diversified Production Mix (2024) | Balanced exposure to oil, natural gas, and natural gas liquids. |

| Asset Portfolio | Strategic Development Plan (2025) | Planned shift to a more even split between natural gas and oil-weighted wells. |

What is included in the product

Delivers a strategic overview of Infinity Natural Resources’s internal and external business factors, highlighting its competitive position and market challenges.

Offers a clear, actionable SWOT analysis that pinpoints key vulnerabilities and opportunities for Infinity Natural Resources to address strategic challenges.

Weaknesses

Infinity Natural Resources' operational footprint is heavily concentrated within the Appalachian Basin. This singular focus, while allowing for specialized expertise, creates a significant vulnerability to region-specific issues. For instance, changes in state-level environmental regulations or unexpected infrastructure disruptions in the Appalachian region could disproportionately impact the company's overall performance.

Infinity Natural Resources faces significant challenges due to the inherent volatility of oil and natural gas prices. While natural gas prices saw a recovery in early 2025, they endured historically low points throughout 2024, underscoring the persistent risk of future price swings.

These unpredictable market fluctuations directly impact the company's revenues and cash flow, potentially jeopardizing the economic feasibility of planned or ongoing projects. For instance, a sharp decline in commodity prices, similar to what was observed in 2024, could significantly reduce profitability and hinder capital expenditure plans.

Infinity Natural Resources, like others in the unconventional oil and gas sector, faces rising costs associated with environmental and regulatory compliance. For instance, the EPA's comprehensive methane emission standards, finalized in March 2024, mandate advanced leak detection and more rigorous reporting, directly increasing operational expenses.

These evolving regulations translate into significant investments in new monitoring technology and specialized personnel. Failure to comply can result in substantial penalties, further impacting the company's bottom line and diverting capital from growth initiatives. This creates a continuous challenge in balancing environmental stewardship with financial performance.

Competition within the Appalachian Basin

The Appalachian Basin is a crowded playing field, with many companies, both large and small, all looking for the same valuable resources. This means Infinity Natural Resources faces stiff competition for prime acreage, which can inflate the cost of acquiring new leases. For instance, in 2024, lease acquisition costs in core areas of the basin have seen an upward trend due to this high demand.

This intense competition directly impacts profitability. As more players chase limited opportunities, profit margins can get squeezed, making it harder to generate substantial returns. Furthermore, the crowded market can stifle organic growth, as opportunities to expand operations through new ventures or acquisitions become more challenging to secure at favorable terms.

To stay ahead, Infinity Natural Resources must focus on operational excellence and embracing new technologies. This includes optimizing drilling and completion techniques to reduce costs and increase recovery rates. For example, companies that have invested in advanced seismic imaging and data analytics in 2024 have reported improved well productivity and lower per-unit production costs.

Key competitive pressures include:

- High Lease Acquisition Costs: Bidding wars for desirable land parcels drive up upfront investment.

- Margin Compression: Intense competition can lead to lower prices for extracted resources.

- Limited Organic Growth Opportunities: Difficulty in securing new, profitable projects due to existing players.

- Need for Continuous Efficiency Gains: Constant pressure to innovate and reduce operational expenses to maintain profitability.

Potential for Production Declines in Unconventional Wells

Unconventional shale wells, the backbone of Infinity Natural Resources' production, are known for their impressive initial output that quickly diminishes. This means the company faces a constant challenge to drill new wells just to keep its overall production steady. For example, many shale plays see production drop by 50-70% in the first year alone.

This inherent characteristic of shale wells translates into a significant and continuous need for capital investment. Infinity must allocate substantial funds not for growth, but simply to counteract the natural decline of its existing wells and maintain current production levels. This ongoing capital intensity is a core weakness, as it limits funds available for other strategic initiatives or shareholder returns.

- Steep Decline Rates: Unconventional wells often experience rapid production declines, necessitating constant replacement.

- High Capital Intensity: Sustaining production requires significant, ongoing capital expenditures for drilling and completion.

- Operational Dependency: Reliance on continuous drilling makes operations vulnerable to drilling efficiency and cost fluctuations.

- Limited Growth from Existing Assets: A substantial portion of capital is used for maintenance rather than pure expansion.

Infinity Natural Resources' heavy reliance on the Appalachian Basin exposes it to significant regional risks, as demonstrated by the 2024 downturn in natural gas prices which disproportionately impacted companies operating solely within that area. Furthermore, the company's profitability is directly tied to volatile commodity prices, with 2024 experiencing historically low natural gas points, highlighting the challenge of maintaining consistent revenue streams. The increasing costs of environmental compliance, such as those mandated by the March 2024 EPA methane emission standards, add further pressure, requiring substantial investment in new technologies and potentially diverting capital from growth. Intense competition for acreage in the Appalachian Basin in 2024 drove up lease acquisition costs, squeezing profit margins and limiting expansion opportunities.

Preview Before You Purchase

Infinity Natural Resources SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine preview of the comprehensive Infinity Natural Resources SWOT analysis, which will be fully accessible after your purchase.

Opportunities

Global natural gas demand saw a strong rebound in 2024, with projections showing continued growth through 2025, especially in North America. This upward trend is primarily fueled by increased usage in power generation and industrial applications.

The outlook for Henry Hub natural gas prices in 2025 and beyond suggests a potential uptick. This anticipated price appreciation could significantly benefit Infinity Natural Resources, particularly its assets heavily weighted towards natural gas production, leading to enhanced profitability.

Infinity Natural Resources can capitalize on ongoing advancements in drilling and completion technologies. Innovations like extended reach horizontal drilling and sophisticated hydraulic fracturing techniques are making resource extraction more efficient. For instance, in 2024, the average horizontal lateral length in the Permian Basin reached over 10,000 feet, a significant increase from previous years, leading to improved well economics.

These technological leaps directly translate into lower per-well costs and higher ultimate recovery rates for Infinity. By adopting these cutting-edge methods, the company can unlock greater value from its existing acreage and new prospects. This operational enhancement is crucial for maintaining a competitive edge and boosting profitability in the dynamic energy market.

The oil and gas sector is seeing a significant push towards consolidation, as companies aim to achieve greater economies of scale and improve their cost competitiveness. Infinity Natural Resources, with its solid financial standing following its initial public offering, is well-positioned to capitalize on this trend.

This presents a prime opportunity for Infinity Natural Resources to explore strategic acquisitions within the Appalachian Basin, aiming to bolster its reserve base, boost production levels, and broaden its market reach. For instance, the industry saw significant M&A activity in 2023, with deals valued in the billions, indicating a strong appetite for consolidation.

Growing Demand for US LNG Exports

The United States has solidified its position as a top global exporter of Liquefied Natural Gas (LNG), with projections indicating continued strong growth in this sector through 2025 and beyond. This expanding international market offers a significant demand channel for natural gas produced in regions like the Appalachian Basin.

This robust export demand is a key opportunity for Infinity Natural Resources, as it can translate into higher domestic natural gas prices and encourage greater production volumes. For instance, US LNG export capacity is expected to reach approximately 17.2 billion cubic feet per day (Bcfd) by the end of 2024, a substantial increase from previous years.

- Increased Export Capacity: US LNG export terminals are expanding, with new facilities coming online, boosting the nation's ability to ship gas globally.

- Global Energy Demand: Growing global demand for cleaner energy sources, particularly in Asia and Europe, underpins the sustained need for LNG.

- Price Support: Strong export markets provide a floor for domestic natural gas prices, making production more economically viable.

- Appalachian Basin Advantage: Companies like Infinity, with access to abundant and cost-effective Appalachian natural gas, are well-positioned to capitalize on this export growth.

Potential for Reduced Regulatory Burden

A shift in the political climate, potentially influenced by changes in presidential administrations, could usher in a less stringent regulatory environment for the oil and gas sector. While such changes often have a lag in implementation, the prospect of reduced oversight on production activities presents an opportunity for Infinity Natural Resources. This could translate into lower compliance costs and a streamlined administrative process, ultimately fostering a more advantageous operational landscape.

Infinity Natural Resources is poised to benefit from the increasing global demand for natural gas, particularly with the expansion of US LNG export capacity, which is projected to reach 17.2 Bcfd by the end of 2024. This growing international market offers a significant avenue for increased production and potentially higher domestic prices. Furthermore, the company can leverage advancements in drilling technologies, such as longer horizontal laterals now exceeding 10,000 feet in key basins, to improve efficiency and reduce costs. The ongoing industry consolidation also presents an opportunity for strategic acquisitions, allowing Infinity to expand its reserve base and market presence, especially within the Appalachian Basin.

Threats

The oil and gas sector, including companies like Infinity Natural Resources, continues to wrestle with significant price volatility. Geopolitical events, shifts in global supply and demand, and broader economic trends all contribute to this instability. For instance, while Brent crude averaged around $82 per barrel in early 2024, forecasts for the latter half of 2024 and into 2025 suggest potential swings based on OPEC+ decisions and global economic growth outlooks.

A sharp downturn in crude oil or natural gas prices poses a direct threat to Infinity Natural Resources' financial health. Such declines can substantially reduce the company's revenues and profitability, impacting its cash flow generation. This could, in turn, limit the capital available for crucial future development projects and exploration activities, potentially stalling growth initiatives.

The oil and gas sector is grappling with increasingly stringent environmental regulations, such as new methane emission standards and evolving water management protocols. While the EPA has granted some compliance deadline extensions, the trajectory clearly indicates a tightening regulatory landscape. These evolving rules could force Infinity Natural Resources to allocate more capital towards environmental controls, thereby increasing operational expenses.

The Appalachian Basin, while abundant in resources, is a mature and intensely competitive unconventional energy region. This maturity means many players are already active, increasing the pressure on any single company.

Continuous drilling by numerous operators, especially in natural gas production, risks creating regional oversupply. For instance, in early 2024, the Henry Hub natural gas spot price has seen volatility, sometimes dipping below $2.00 per MMBtu, demonstrating how oversupply can depress local commodity prices.

This fierce competition and potential for oversupply directly challenge the economic viability of new well developments for Infinity Natural Resources. It puts downward pressure on profit margins as companies vie for market share and struggle to achieve favorable pricing for their extracted commodities.

Energy Transition and Shift Towards Renewables

The accelerating global shift towards renewable energy sources presents a significant long-term threat to traditional fossil fuel demand. Investments in solar, wind, and electric vehicles are rapidly increasing, projected to reach trillions of dollars by 2030, which could gradually erode the market share of oil and gas. This transition, while not eliminating the need for hydrocarbons for decades, directly impacts the industry's long-term growth trajectory and can dampen investor sentiment towards fossil fuel companies.

The International Energy Agency (IEA) reported in its 2024 outlook that renewable energy capacity additions are expected to grow by over 10% in 2024 compared to the previous year, reaching record levels. This expansion directly competes with the energy needs traditionally met by fossil fuels. Furthermore, policy support and technological advancements are making renewables increasingly cost-competitive, potentially accelerating the decline in fossil fuel consumption in key sectors like transportation and power generation.

- Decreasing Demand: The rise of renewables and EVs directly reduces the need for oil and gas.

- Investor Confidence: Growing focus on ESG (Environmental, Social, and Governance) factors can deter investment in fossil fuel assets.

- Policy Risk: Government regulations and incentives favoring clean energy can negatively impact fossil fuel producers.

- Technological Obsolescence: Rapid advancements in renewable technologies could make existing fossil fuel infrastructure less viable over time.

Geopolitical Instability and Global Market Disruptions

Geopolitical instability, particularly ongoing conflicts in regions like Ukraine and the Middle East, continues to pose a significant threat to global energy markets. These tensions can trigger volatile price fluctuations and create substantial supply chain vulnerabilities for companies like Infinity Natural Resources.

The direct impact of these global disruptions on Infinity Natural Resources includes:

- Increased Operational Risk: Geopolitical events can escalate the risk of disruptions to exploration, production, and transportation activities, potentially leading to project delays or increased security costs.

- Price Volatility: For example, in early 2024, Brent crude oil prices experienced significant swings, often exceeding $80 per barrel, directly influenced by Middle Eastern tensions, impacting revenue predictability.

- Supply Chain Disruptions: Access to critical equipment, technology, and even personnel can be hampered by international sanctions or trade restrictions stemming from geopolitical rivalries, affecting project timelines and costs.

The accelerating global shift towards renewable energy sources, driven by policy support and technological advancements, presents a significant long-term threat to traditional fossil fuel demand. IEA data shows renewable capacity additions are projected to grow over 10% in 2024, directly competing with oil and gas needs.

Intense competition within the Appalachian Basin, coupled with the risk of regional oversupply, puts downward pressure on commodity prices. For instance, Henry Hub natural gas prices have dipped below $2.00 per MMBtu in early 2024, impacting profit margins for producers like Infinity Natural Resources.

Increasingly stringent environmental regulations, such as methane emission standards, necessitate higher capital allocation for compliance, thereby increasing operational expenses. Geopolitical instability also poses a threat through price volatility and supply chain disruptions, with Brent crude prices exceeding $80 per barrel in early 2024 due to Middle Eastern tensions.

| Threat Category | Specific Threat | Impact on Infinity Natural Resources | Supporting Data/Trend |

| Market Demand | Shift to Renewables | Reduced long-term demand for oil and gas | Renewable capacity additions up >10% in 2024 (IEA) |

| Market Pricing | Regional Oversupply | Depressed commodity prices, lower profit margins | Henry Hub natural gas < $2.00/MMBtu (early 2024) |

| Regulatory Environment | Stricter Environmental Rules | Increased operational costs, capital expenditure | New methane emission standards |

| Geopolitical Factors | Global Instability | Price volatility, supply chain disruptions | Brent crude > $80/barrel (early 2024) due to Middle East tensions |

SWOT Analysis Data Sources

This Infinity Natural Resources SWOT analysis is built upon a robust foundation of reliable data, including comprehensive financial statements, in-depth market research reports, and expert industry forecasts.