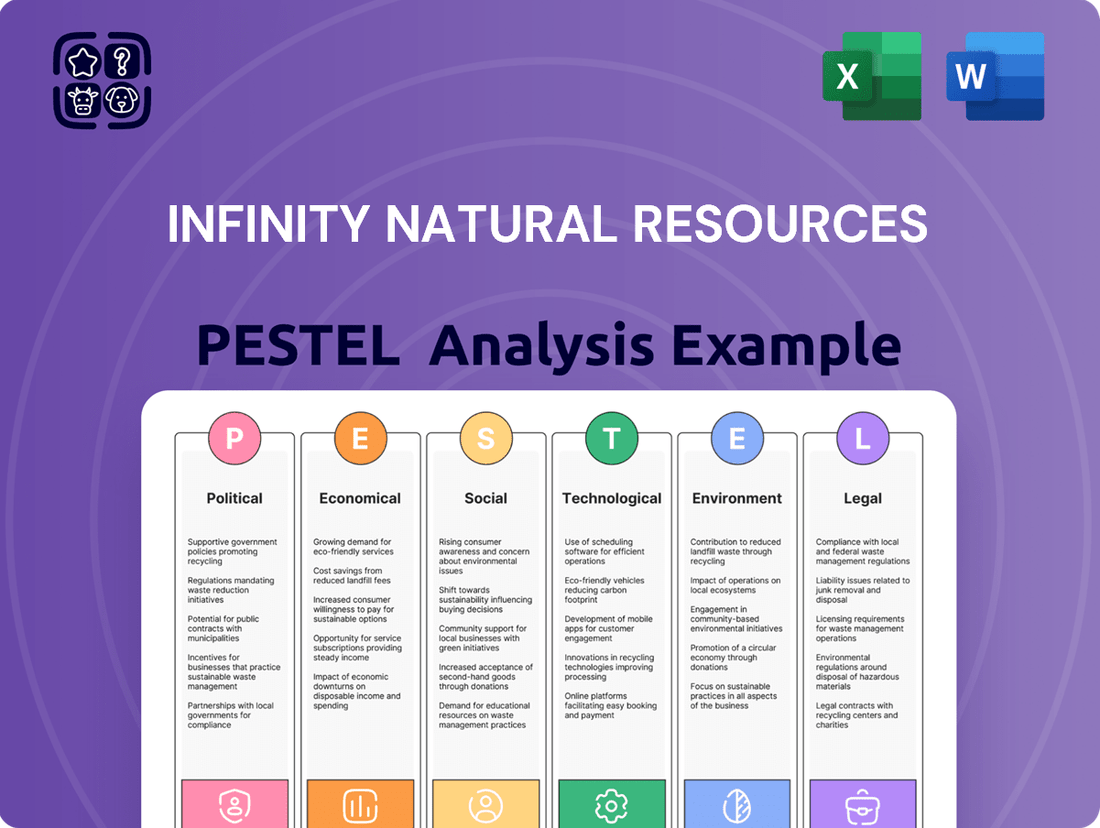

Infinity Natural Resources PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Infinity Natural Resources Bundle

Navigate the complex external forces impacting Infinity Natural Resources with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping the company's operational landscape and future growth. Gain a strategic advantage by uncovering critical insights into social trends and regulatory shifts. Download the full PESTLE analysis now to unlock actionable intelligence and refine your market strategy.

Political factors

The political landscape, especially with the anticipated shift under a potential second Trump administration, signals a robust endorsement of fossil fuel expansion. Executive actions are expected to expedite oil and gas leasing on federal territories and simplify approvals for pipeline projects.

This policy direction could foster a more accommodating regulatory framework for companies like Infinity Natural Resources. Such an environment might streamline permitting procedures and stimulate capital infusion into infrastructure crucial for Appalachian Basin activities.

For instance, during the previous Trump administration, there was a notable increase in oil and gas lease sales on federal lands, with the Bureau of Land Management reporting a significant rise in the number of leases offered and awarded. This trend is likely to be mirrored or even amplified, potentially reducing operational hurdles for Infinity Natural Resources.

While federal policy in the United States has, at times, leaned towards supporting fossil fuels, the patchwork of regulations across different states creates significant uncertainty for companies like Infinity Natural Resources. This regulatory fragmentation can complicate long-term strategic planning, especially for projects with extended lifecycles.

The Appalachian Basin, a key operational area for many energy firms, exemplifies this. Some states within the region actively promote fossil fuel development, offering incentives, while others impose stringent environmental protections and permitting hurdles. This divergence means Infinity Natural Resources must meticulously track and comply with a complex web of varying state-level rules.

Navigating these disparate regulatory environments presents a substantial challenge, potentially leading to project delays and increased legal expenses. For instance, a project might face opposition or require extensive environmental impact assessments in one state, while a similar venture in a neighboring state proceeds with fewer complications. This reality underscores the need for robust legal and compliance teams to manage the risks inherent in such a varied landscape.

Global geopolitical instability, particularly conflicts in Eastern Europe and the Middle East, has significantly heightened concerns about energy security. This has led many nations to re-evaluate their energy strategies, recognizing the ongoing necessity of oil and gas for economic stability and national security. For instance, in 2024, many European nations continued to diversify away from Russian energy supplies, increasing demand for alternative sources.

This renewed focus on energy security translates into a more favorable policy environment for domestic hydrocarbon production. Governments are increasingly likely to support and incentivize exploration and production activities within their borders to ensure reliable energy access. This shift could mean regulatory tailwinds and potential financial support for companies like Infinity Natural Resources, especially given their operations in the strategically important Appalachian Basin.

The strategic importance of regions like the Appalachian Basin for reliable energy supply is being underscored by these geopolitical developments. Companies operating here, such as Infinity Natural Resources, may find their operations viewed as critical national assets. This could lead to policies that protect and promote domestic production, potentially offering a degree of insulation from global market volatility and enhancing the long-term viability of their investments.

International Climate Agreements and Domestic Policy

The global drive towards decarbonization, underscored by agreements like the Paris Agreement, continues to influence energy policy. While the immediate disruption to traditional oil and gas operations might be tempered by geopolitical considerations, the long-term trajectory points towards stricter climate-related regulations. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully operational in 2026, will impose costs on carbon-intensive imports, indirectly affecting global energy trade and potentially pressuring companies like Infinity Natural Resources to adapt their operational footprints and emissions reporting.

Domestic policies are also increasingly aligning with international climate goals. Many nations are setting ambitious emissions reduction targets and implementing mandates for climate risk disclosures, similar to the SEC's proposed climate disclosure rules in the United States, which, despite legal challenges, signal a clear trend. Infinity Natural Resources must proactively engage with these evolving regulatory landscapes, demonstrating robust climate risk mitigation strategies to ensure its continued social license to operate and access to capital markets.

- Global Decarbonization Push: International agreements are accelerating the shift away from fossil fuels.

- Mandatory Climate Disclosures: Regulatory bodies worldwide are increasing requirements for companies to report on climate-related risks and emissions.

- Geopolitical Mitigation: Immediate impacts on traditional business models may be softened by current geopolitical realities, but the long-term trend is clear.

- Strategic Adaptation: Companies like Infinity Natural Resources need to invest in climate risk mitigation to maintain operational viability and stakeholder trust.

Public Opinion on Hydraulic Fracturing

Public opinion on hydraulic fracturing, or fracking, remains a complex issue. While overall support has seen a modest uptick in recent years, especially within certain political circles, significant environmental concerns continue to shape public perception. For instance, a 2024 Gallup poll indicated that while a majority still express some level of concern about fracking's environmental impact, the percentage of those who believe it is essential for meeting the nation's energy needs has grown.

Key concerns frequently cited by the public include the potential for groundwater contamination and the risk of induced seismicity, or earthquakes, linked to wastewater injection. These issues are often highlighted in local media and can directly influence regulatory decisions and community acceptance of new projects. For Infinity Natural Resources, navigating these public sentiments is crucial for operational success.

- Environmental Concerns: Public apprehension often centers on water contamination and induced seismicity.

- Shifting Demographics: Support for fracking shows subtle growth, particularly among specific political groups.

- Community Relations: Transparent communication and addressing local concerns are vital for maintaining social license to operate.

The political landscape, particularly in the US, is leaning towards supporting fossil fuel expansion, with potential policy shifts aiming to streamline oil and gas leasing and pipeline approvals. This could significantly benefit companies like Infinity Natural Resources by reducing regulatory hurdles in key operational areas like the Appalachian Basin.

Geopolitical instability is also reinforcing the importance of domestic energy security, leading governments to favor reliable hydrocarbon production and potentially offering incentives for companies operating in strategic regions. However, the global push for decarbonization, driven by international agreements, continues to signal a long-term trend towards stricter climate regulations, necessitating proactive adaptation from energy firms.

Public opinion on hydraulic fracturing remains mixed, with ongoing environmental concerns about water contamination and seismicity. While some support has grown, companies must actively engage with communities and address these issues to maintain their social license to operate.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Infinity Natural Resources across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into how these forces shape the company's operating landscape, identifying potential threats and opportunities for strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex external factors into actionable insights for Infinity Natural Resources.

Helps support discussions on external risk and market positioning during planning sessions, offering a clear understanding of the PESTLE landscape to proactively address challenges and capitalize on opportunities.

Economic factors

Natural gas prices in the Appalachian Basin have been on a rollercoaster, hitting rock bottom in early 2024 before bouncing back due to higher demand. This price swing is crucial for Infinity Natural Resources to consider.

Looking ahead to 2025, experts predict a rise in natural gas prices. This is largely due to more liquefied natural gas (LNG) being exported and a growing need for electricity to power data centers, which are becoming increasingly common.

This inherent price volatility means Infinity Natural Resources must employ strong financial hedging techniques and maintain tight control over operational expenses to navigate these market fluctuations effectively.

The United States is poised for significant growth in Liquefied Natural Gas (LNG) exports, with projections showing a substantial increase in capacity coming online. This expansion, coupled with the rapidly growing energy requirements of artificial intelligence (AI) driven data centers, is creating a powerful demand pull for natural gas. For instance, U.S. LNG export capacity is expected to reach approximately 17.3 billion cubic feet per day (Bcf/d) by the end of 2024, a notable increase from previous years.

The Appalachian Basin, a key natural gas-producing region, is strategically positioned to capitalize on this burgeoning demand. Forecasts suggest a considerable uplift in production from the basin to meet these escalating needs, potentially adding hundreds of millions of cubic feet per day of new supply. This regional advantage directly translates into a robust market opportunity for companies like Infinity Natural Resources, whose operations are concentrated within this vital supply area.

In 2025, the U.S. oil and gas sector is strongly emphasizing capital discipline, a trend that Infinity Natural Resources will likely mirror. This focus means prioritizing shareholder returns through dividends and buybacks over ambitious expansion projects. For instance, many major oil companies have committed to returning a significant portion of their free cash flow to investors, a strategy expected to continue.

This industry-wide shift toward efficiency and shareholder returns suggests Infinity Natural Resources will concentrate on optimizing its current asset base. Rather than pursuing growth at all costs, the company's strategy will likely center on maximizing profitability from existing operations and making judicious investments in high-return projects. This approach aligns with investor demands for stable, predictable returns in a mature market.

Infrastructure Constraints and Takeaway Capacity

Infrastructure constraints, particularly limited pipeline takeaway capacity, have been a persistent challenge for the Appalachian Basin, impacting production growth and natural gas pricing. While significant investments are being made, such as the Mountain Valley Pipeline, which began full service in June 2024, ensuring sufficient capacity remains crucial. Infinity Natural Resources' success hinges on the continued expansion and reliability of this vital transportation network to access broader markets.

The ongoing development of infrastructure is directly linked to Infinity Natural Resources' ability to capitalize on its reserves. For instance, the completion of the Mountain Valley Pipeline is expected to add approximately 2 billion cubic feet per day of natural gas transport capacity. However, potential legal challenges or construction delays for future projects could still create bottlenecks, affecting the efficient delivery of resources and potentially dampening realized prices for Infinity Natural Resources.

- Appalachian Basin Natural Gas Production: In the first quarter of 2024, production in the Appalachian Basin reached approximately 33.7 billion cubic feet per day.

- Mountain Valley Pipeline Capacity: The MVP project, upon reaching full service, provides 2.0 billion cubic feet per day of transportation capacity.

- Infrastructure Investment: Over $10 billion has been invested in Appalachian Basin pipeline expansions in recent years, with ongoing projects aiming to increase takeaway capacity.

Cost Optimization and Operational Efficiency

U.S. oil and gas producers have significantly boosted efficiency and profitability through years of cost optimization and digital advancements, allowing them to thrive even with fluctuating commodity prices. This resilience is a key economic factor influencing companies like Infinity Natural Resources.

Infinity Natural Resources' commitment to advanced drilling and completion technologies directly supports this trend, enabling them to extract more value from their operations. This strategic focus on efficiency enhances their ability to generate profits and withstand economic pressures.

- Industry Efficiency Gains: U.S. oil and gas producers have seen substantial improvements in operational efficiency, with some companies reporting a 15-20% reduction in lifting costs per barrel over the past five years due to technological adoption.

- Technological Investment: Infinity Natural Resources' investment in advanced drilling techniques, such as multi-lateral wells and enhanced oil recovery (EOR) methods, directly contributes to lower per-unit production costs.

- Economic Resilience: By prioritizing operational efficiency, Infinity Natural Resources can maintain profitability and competitiveness even when crude oil prices are below the industry average break-even point, which for many shale producers was around $50-$60 per barrel in early 2024.

The economic landscape for natural gas, particularly in the Appalachian Basin, is shaped by fluctuating prices and increasing demand. Predictions for 2025 indicate rising prices driven by robust LNG exports and the energy needs of data centers.

Infinity Natural Resources must navigate this volatility through effective hedging and cost management. The company's strategic focus on operational efficiency, as seen industry-wide, is key to maximizing returns from its existing assets.

Infrastructure development, such as the Mountain Valley Pipeline, is critical for market access, but potential bottlenecks remain a concern. The industry's overall efficiency gains, bolstered by technological investment, provide a foundation for resilience.

| Metric | Value | Period | Source/Note |

|---|---|---|---|

| Appalachian Basin Production | 33.7 Bcf/d | Q1 2024 | Industry Data |

| U.S. LNG Export Capacity | ~17.3 Bcf/d | End of 2024 | Projected |

| Mountain Valley Pipeline Capacity | 2.0 Bcf/d | Full Service (June 2024) | Project Completion |

| Industry Lifting Cost Reduction | 15-20% | Past 5 Years | Average for efficient producers |

Preview Before You Purchase

Infinity Natural Resources PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Infinity Natural Resources delves into the Political, Economic, Social, Technological, Legal, and Environmental factors shaping its operational landscape. Understand the critical external forces impacting the company's strategy and future growth.

Sociological factors

Public sentiment towards the oil and gas sector, especially regarding hydraulic fracturing, significantly shapes Infinity Natural Resources' operational environment. Negative perceptions, often fueled by concerns over water contamination and seismic events, can translate into tangible hurdles.

For instance, in 2024, several regions saw intensified local protests against new drilling permits, with community groups citing potential impacts on groundwater as a primary concern. This public scrutiny directly affects the company's ability to secure and maintain its social license to operate, potentially delaying projects and increasing compliance costs.

To navigate this, Infinity Natural Resources is focusing on proactive community engagement. Initiatives in 2025 include increased investment in local environmental monitoring programs and transparent communication channels to address public anxieties, aiming to build trust and mitigate opposition.

The oil and gas sector, including companies like Infinity Natural Resources, is grappling with significant workforce shifts. An aging demographic in the industry means a substantial portion of experienced workers are nearing retirement, creating a knowledge gap. For instance, projections indicate that by 2030, over 40% of the oil and gas workforce in some regions could be eligible for retirement, exacerbating existing shortages.

This demographic challenge is compounded by an increasing demand for specialized skills. Beyond traditional roles, there's a critical need for professionals adept in digital technologies such as artificial intelligence, machine learning, and advanced data analytics. The International Energy Agency (IEA) highlighted in its 2024 outlook that the energy transition will require a significant upskilling of the existing workforce and the recruitment of new talent with digital competencies to drive efficiency and innovation in operations.

Infinity Natural Resources must therefore prioritize strategies for talent acquisition and development. This includes robust training programs focused on emerging technologies in areas like enhanced oil recovery and digital oilfield management. Attracting and retaining individuals with expertise in these advanced fields is paramount for maintaining competitive operational efficiency and fostering innovation in a rapidly changing energy landscape.

The health and safety of communities and workers surrounding oil and gas operations remain critical sociological factors for Infinity Natural Resources. Public concern over potential well-site emissions and water contamination is a constant consideration, as evidenced by increased activism and regulatory attention following environmental incidents. For instance, in 2024, several regions saw heightened public pressure on energy companies to adopt stricter emission controls, with some local governments proposing new ordinances to protect resident well-being.

Energy Transition and Public Acceptance

Public sentiment is increasingly favoring a shift away from fossil fuels, impacting the social license for traditional energy projects. For instance, in 2024, surveys indicated that over 60% of consumers in developed nations expressed a desire for increased investment in renewable energy sources.

This growing emphasis on sustainability means Infinity Natural Resources must clearly communicate its contribution to a balanced energy future. Demonstrating how current operations can support or transition towards broader environmental, social, and governance (ESG) objectives is crucial for maintaining public acceptance and stakeholder trust.

The company's strategy needs to address public concerns about climate change and environmental impact. By 2025, it's anticipated that regulatory bodies and investment funds will place even greater scrutiny on companies' carbon footprints and transition plans, making proactive engagement on these issues paramount.

- Growing Public Demand for Renewables: Global surveys in 2024 showed a significant majority favoring renewable energy investment.

- ESG Scrutiny: By 2025, expect heightened focus on corporate carbon footprints and transition strategies from regulators and investors.

- Social License to Operate: Public acceptance is directly tied to a company's perceived role in a sustainable energy future.

- Communication Strategy: Infinity Natural Resources must articulate its alignment with broader sustainability goals to maintain public trust.

Regional Economic Impact and Employment

The oil and gas industry significantly bolsters the Appalachian Basin's economy, primarily through job creation and local investment. For instance, in 2023, the energy sector in Pennsylvania directly and indirectly supported an estimated 100,000 jobs, contributing billions to the state's GDP. This economic engine, however, is not immune to the volatility of commodity prices and the rapid pace of technological change, which can influence job availability.

Infinity Natural Resources' ongoing commitment to investment and operational efficiency plays a crucial role in fostering regional employment and economic stability. A strong operational presence can translate to consistent job opportunities and a more predictable economic environment for communities in the basin.

- Job Creation: The energy sector in the Appalachian Basin is a major employer, with direct and indirect job numbers often in the tens of thousands, varying with market conditions.

- Economic Multiplier Effect: Investments in oil and gas operations stimulate local economies through spending on goods, services, and infrastructure, benefiting a wide range of businesses.

- Sensitivity to Market Fluctuations: Employment levels can be directly impacted by global oil and gas prices; a downturn can lead to job losses, while high prices can spur hiring.

- Technological Impact on Employment: Advancements in extraction and automation technologies can alter the types and numbers of jobs available, potentially requiring a more skilled workforce.

Public sentiment strongly influences Infinity Natural Resources' operations, with concerns about environmental impacts like water contamination and seismic activity leading to protests and increased regulatory scrutiny, as seen in 2024. The company is responding with enhanced community engagement and transparency initiatives for 2025 to maintain its social license to operate.

Demographic shifts, including an aging workforce and a growing need for digital skills, present challenges for Infinity Natural Resources. Projections indicate a significant portion of experienced workers retiring by 2030, necessitating robust talent development and recruitment strategies focusing on areas like AI and data analytics, as emphasized by the IEA in 2024.

The company must address public concerns regarding climate change and environmental impact, as ESG scrutiny intensifies. By 2025, regulatory bodies and investors will demand clearer carbon footprint data and transition plans, making proactive communication on sustainability crucial for maintaining public trust and acceptance.

Technological factors

Infinity Natural Resources heavily relies on advanced drilling and completion technologies like horizontal drilling and hydraulic fracturing to boost output from challenging unconventional plays. These methods are key to unlocking previously inaccessible reserves.

The sector is seeing continuous innovation, with a 2024 focus on improving efficiency and precision. For instance, advancements in multi-stage fracturing are allowing for more targeted stimulation, leading to higher initial production rates.

Infinity's competitive edge is amplified by its adoption of real-time data analytics and automation in its operations. This technological integration, seen across the industry, aims to optimize well performance and reduce downtime, a critical factor in maximizing resource recovery.

The oil and gas industry is rapidly embracing digital innovation and automation. For instance, AI is now being used to optimize drilling processes, with some companies reporting efficiency gains of up to 15% through predictive maintenance and real-time data analysis. Remote monitoring systems are also becoming standard, allowing for greater oversight and faster response times to operational issues, which can significantly reduce costly downtime.

For Infinity Natural Resources, this technological shift presents a significant opportunity to enhance operational efficiency and safety. By integrating advanced data analytics for reservoir management and employing AI for predictive maintenance on equipment, the company can expect to improve resource extraction yields and minimize unexpected equipment failures. This digital transformation is crucial for maintaining competitiveness and ensuring resilience in a dynamic market.

Technological advancements are increasingly focused on minimizing the environmental footprint of oil and gas operations. Innovations in greener fracturing fluids, for example, aim to reduce the toxicity and environmental persistence of chemicals used in hydraulic fracturing. By 2024, the industry saw a continued push towards these less impactful alternatives, with several companies reporting successful trials of bio-based or more easily degradable fluid compositions.

Improved water recycling techniques are also crucial, allowing companies to reuse a significant portion of the water produced during drilling and completion. Data from 2025 indicates that advanced water treatment technologies can achieve recycling rates exceeding 90% for some operations, drastically reducing the demand for freshwater and the volume of wastewater requiring disposal. Precision drilling technologies further enhance efficiency, enabling more targeted extraction and minimizing the surface disturbance and overall water consumption.

Infinity Natural Resources can bolster its sustainability credentials and proactively address environmental concerns by integrating these cutting-edge technologies. Adopting these advancements not only mitigates pollution risks but also aligns the company with growing investor and regulatory expectations for environmentally responsible practices, potentially leading to improved access to capital and enhanced brand reputation.

Carbon Capture, Utilization, and Storage (CCUS)

The advancement of Carbon Capture, Utilization, and Storage (CCUS) technologies presents a significant technological factor for Infinity Natural Resources. As the energy sector increasingly targets net-zero emissions, integrating CCUS could become crucial for natural gas producers aiming to decarbonize their operations.

Opportunities exist for Infinity Natural Resources to explore CCUS, particularly leveraging CO2 sources from their gas processing activities. Furthermore, the growing demand for CO2 from sectors like data centers, which require cooling solutions that can be integrated with CCUS, offers a potential avenue for utilization.

- CCUS Market Growth: The global CCUS market is projected to reach $50.2 billion by 2030, indicating substantial technological development and investment.

- CO2 Utilization Potential: Companies are exploring CO2 utilization for enhanced oil recovery, building materials, and synthetic fuels, creating new revenue streams.

- Technological Advancements: Innovations in capture efficiency and storage security are making CCUS more economically viable and scalable for industrial applications.

Enhanced Oil Recovery (EOR) Techniques

Technological advancements in Enhanced Oil Recovery (EOR) are becoming increasingly important, especially for companies like Infinity Natural Resources operating in unconventional plays. These techniques go beyond the initial extraction phase, aiming to wring more oil from existing reservoirs. For instance, the experimental application of CO2 flooding in unconventional fields shows promise in boosting production, a crucial area for maximizing asset value.

Staying ahead of EOR innovations can unlock significant opportunities. By adopting or adapting these technologies, Infinity Natural Resources could extend the productive life of its fields and improve overall recovery rates. This proactive approach is vital in a market where efficient resource utilization directly impacts profitability and long-term sustainability.

Key EOR technologies influencing the sector include:

- Thermal EOR: Techniques like steam injection, which reduce oil viscosity, remain a dominant EOR method, particularly in heavy oil fields.

- Gas Injection EOR: Including CO2, nitrogen, and natural gas injection, which can improve sweep efficiency and potentially store captured carbon. The global EOR market, driven by these technologies, was projected to reach over $40 billion by 2024.

- Chemical EOR: Methods like polymer flooding and surfactant flooding are being refined to enhance oil displacement in various reservoir conditions.

- Advanced EOR: Research into microbial EOR and novel chemical formulations continues, aiming for more cost-effective and environmentally friendly recovery solutions.

Technological factors are paramount for Infinity Natural Resources, driving efficiency and unlocking new reserves through advanced drilling like horizontal drilling and hydraulic fracturing. The industry's 2024 focus on precision, exemplified by multi-stage fracturing improvements, directly boosts initial production rates.

Automation and real-time data analytics are key competitive advantages, optimizing well performance and minimizing downtime, crucial for maximizing resource recovery. AI's role in predictive maintenance and operational optimization, with reported efficiency gains up to 15% by 2024, highlights this trend.

Sustainability is also technologically driven, with innovations in greener fracturing fluids and advanced water recycling achieving over 90% reuse rates by 2025, reducing environmental impact and operational costs.

Carbon Capture, Utilization, and Storage (CCUS) is a growing technological frontier, with the global market projected to reach $50.2 billion by 2030, offering Infinity opportunities to decarbonize and potentially create new revenue streams.

Legal factors

The oil and gas sector in the Appalachian Basin faces a dense regulatory landscape, encompassing federal and state permitting. Navigating these rules, especially with varying policies across different states, can cause significant project delays and inflate costs for companies like Infinity Natural Resources.

Infinity Natural Resources must maintain strict adherence to legal requirements and be prepared for changes in regulations. This includes staying current with federal methane emission standards, which saw proposed updates in 2024, and adapting to any state-specific permitting adjustments that may arise in 2025.

Environmental litigation, especially concerning water quality and contamination linked to hydraulic fracturing, presents a significant legal risk for oil and gas firms. These cases can result in substantial financial penalties and harm a company's public image. For instance, in 2023, the Environmental Protection Agency (EPA) continued to enforce stricter regulations on wastewater discharge from oil and gas operations, with fines potentially reaching tens of thousands of dollars per day for non-compliance.

Infinity Natural Resources must maintain rigorous water stewardship and environmental protection adherence to lessen these legal exposures. Failure to comply with updated water quality standards, such as those potentially revised by the EPA in late 2024 or early 2025, could lead to costly legal battles and operational disruptions, impacting the company's bottom line and investor confidence.

Pipeline infrastructure development, crucial for transporting natural gas from regions like the Appalachian Basin, frequently encounters legal hurdles and extended approval timelines. For instance, the Mountain Valley Pipeline faced considerable delays stemming from legal actions initiated by environmental organizations and local residents, impacting its projected completion date and cost. This legal environment directly influences Infinity Natural Resources' ability to efficiently transport its products to market.

Land Use and Property Rights

Operating in the Appalachian Basin, Infinity Natural Resources faces significant legal hurdles related to land use and property rights. Securing and maintaining access to acreage hinges on navigating complex leasing agreements with landowners, which can vary widely across the region. Potential disputes over subsurface mineral rights and surface access are a constant consideration.

The legal framework surrounding these rights is paramount. In 2024, the average oil and gas lease bonus payment in the Appalachian Basin ranged from $500 to $2,500 per acre, depending on the specific play and prevailing market conditions. Infinity Natural Resources must meticulously manage these agreements to avoid costly litigation and ensure operational continuity.

Key legal considerations include:

- Lease Agreement Compliance: Ensuring all terms and conditions within landowner leases are met to prevent breaches and maintain access.

- Mineral Rights Ownership: Verifying clear title to subsurface mineral rights, as ownership can be fragmented or subject to complex historical conveyances.

- Surface Use Regulations: Adhering to state and local regulations governing surface activities, including drilling, pipelines, and infrastructure development, to minimize environmental impact and landowner conflict.

- Dispute Resolution: Establishing clear protocols for addressing and resolving any disputes that may arise with landowners or other stakeholders regarding property rights.

ESG Reporting and Disclosure Requirements

Infinity Natural Resources must navigate a landscape of increasingly stringent ESG reporting mandates. For instance, by 2024, many jurisdictions are implementing mandatory climate-related financial disclosures, moving beyond voluntary emissions tracking. This means Infinity Natural Resources needs robust systems to accurately report Scope 1, 2, and potentially Scope 3 emissions, aligning with frameworks like the Task Force on Climate-related Financial Disclosures (TCFD) or emerging ISSB standards.

The shift towards mandatory reporting means that simply disclosing emissions is no longer sufficient; the depth and assurance of that data are paramount. Investors and regulators in 2024 and 2025 are demanding greater transparency and reliability in ESG data, often requiring third-party assurance for reported metrics. Infinity Natural Resources should prepare for audits and verification processes to validate its ESG disclosures, ensuring compliance and building stakeholder trust.

Key legal and regulatory factors impacting ESG reporting for Infinity Natural Resources include:

- Mandatory Climate Disclosures: Expecting regulations similar to those proposed by the SEC in the US or the CSRD in the EU, which mandate detailed reporting on climate risks and emissions starting in 2024 and 2025 for many companies.

- Standardization of Frameworks: The growing adoption of global standards like those from the International Sustainability Standards Board (ISSB) will create a more harmonized reporting environment, requiring companies to adapt their data collection and disclosure processes.

- Increased Scrutiny and Enforcement: Regulators are enhancing their oversight of ESG claims, meaning Infinity Natural Resources must ensure its disclosures are not only compliant but also accurate and free from greenwashing, with potential penalties for non-compliance.

Infinity Natural Resources must navigate a complex web of environmental regulations, including federal methane emission standards, which saw proposed updates in 2024, and state-specific permitting in 2025. Failure to comply with water quality standards, potentially revised by the EPA in late 2024 or early 2025, could lead to significant penalties, impacting operational continuity and investor confidence.

Environmental factors

Hydraulic fracturing, a core activity for companies like Infinity Natural Resources in the Appalachian Basin, demands significant water volumes, placing water usage and sustainable management at the forefront of environmental considerations. The region's water resources are vital for local communities and ecosystems, making responsible stewardship paramount.

Infinity Natural Resources must prioritize efficient water recycling and reuse strategies. In 2024, the energy sector's water intensity in shale plays remained a focus, with industry reports highlighting that a single fracking operation can utilize millions of gallons of water. Implementing advanced treatment technologies can significantly reduce the need for fresh water withdrawal, mitigating impacts on local water availability and addressing potential conflicts with other water users.

The oil and gas sector is under intense scrutiny to curb greenhouse gas (GHG) emissions, with a particular focus on methane. In 2023, the U.S. Environmental Protection Agency (EPA) finalized rules targeting methane emissions from existing oil and natural gas facilities, aiming to cut them by 75% by 2030 compared to 2019 levels.

Companies like EQT, a major producer in the Appalachian Basin, have demonstrated tangible progress, reporting a 60% reduction in Scope 1 and Scope 2 methane intensity from 2019 to 2023. This proactive approach sets a benchmark for operational efficiency and environmental stewardship within the industry.

For Infinity Natural Resources, adopting advanced leak detection and repair (LDAR) technologies and investing in infrastructure upgrades will be crucial. These measures are essential to minimize methane leakage and other operational emissions, ensuring compliance with evolving regulations and meeting stakeholder expectations for sustainability.

Hydraulic fracturing, a key technique in unconventional resource extraction, carries the risk of induced seismicity, a growing public and environmental concern. While most seismic events linked to fracking are minor, the potential for even small tremors necessitates stringent monitoring protocols and a commitment to best practices. This proactive approach is crucial for Infinity Natural Resources to effectively manage risks and uphold public confidence in its operations.

In 2023, the U.S. Geological Survey reported an increase in seismic activity in regions with significant oil and gas development, highlighting the ongoing relevance of this issue. For instance, Oklahoma has seen a notable rise in earthquakes attributed to wastewater injection, a related but distinct practice. Infinity Natural Resources must therefore integrate robust seismic monitoring systems and adapt its drilling and completion strategies to minimize any potential for induced seismicity, ensuring responsible resource development.

Land Disturbance and Habitat Impact

Oil and gas exploration by companies like Infinity Natural Resources inherently involves land disturbance. The construction of well pads, access roads, and pipelines can fragment habitats, impacting local wildlife. For instance, in 2024, the U.S. Bureau of Land Management reported that oil and gas activities impacted over 1.5 million acres of public land, highlighting the scale of potential habitat disruption.

Infinity Natural Resources must prioritize minimizing its operational footprint. This includes employing advanced drilling techniques that reduce surface disturbance and implementing comprehensive land reclamation plans post-operation. By 2025, many energy companies are expected to adopt stricter environmental standards, driven by regulatory pressures and investor demand for sustainable practices.

- Habitat Fragmentation: Development of infrastructure can break up continuous natural areas, isolating wildlife populations.

- Biodiversity Loss: Direct impacts from construction and indirect effects like noise and light pollution can harm species diversity.

- Reclamation Efforts: Successful restoration of disturbed land is crucial for mitigating long-term ecological damage.

- Regulatory Compliance: Adherence to environmental regulations, such as those concerning endangered species and protected habitats, is paramount.

Waste Management and Spill Prevention

Infinity Natural Resources faces significant environmental challenges related to waste management and spill prevention in its oil and gas operations. The generation of waste fluids, such as produced water and drilling muds, requires meticulous handling and disposal to mitigate environmental impact. In 2023, the US oil and gas industry generated an estimated 20 billion barrels of produced water, highlighting the scale of this challenge.

Effective waste management protocols are paramount for Infinity Natural Resources. This includes the proper treatment and disposal of these fluids, often involving advanced separation technologies and compliant disposal methods to prevent groundwater contamination. The company must also adhere to stringent regulations governing the handling of hazardous materials used in exploration and production.

Furthermore, the risk of surface spills, whether from pipelines, storage tanks, or operational equipment, necessitates robust spill prevention and response plans. The Environmental Protection Agency (EPA) reported over 1,000 significant oil spills in US waters between 2010 and 2020, underscoring the persistent threat. Infinity Natural Resources must invest in preventative measures, containment systems, and rapid response capabilities to safeguard environmental quality and minimize ecological damage.

- Waste Fluid Generation: Oil and gas operations inherently produce substantial volumes of wastewater and drilling fluids, demanding careful management.

- Regulatory Compliance: Adherence to environmental regulations for waste treatment and disposal is critical for Infinity Natural Resources.

- Spill Prevention: Implementing advanced technologies and operational procedures to prevent spills is a key environmental responsibility.

- Emergency Response: Maintaining comprehensive spill response plans and resources is essential to mitigate the impact of any accidental releases.

Infinity Natural Resources must address water usage, with fracking operations consuming millions of gallons, necessitating efficient recycling and reuse strategies. The company also faces pressure to reduce greenhouse gas emissions, particularly methane, with new EPA regulations aiming for significant cuts by 2030, a goal companies like EQT have already made strides towards.

The risk of induced seismicity requires stringent monitoring, as seismic activity in oil and gas development regions has been noted to increase. Furthermore, land disturbance from infrastructure development can fragment habitats and impact biodiversity, making minimized operational footprints and effective reclamation crucial for companies like Infinity Natural Resources by 2025.

Waste management, including the handling of produced water and drilling fluids, is a significant environmental challenge, with the industry generating billions of barrels of wastewater annually. Robust spill prevention and response plans are also vital, given the persistent threat of accidental releases, requiring investment in preventative measures and rapid response capabilities.

| Environmental Factor | Key Considerations for Infinity Natural Resources | Relevant Data/Trends (2023-2025) |

|---|---|---|

| Water Management | Efficient water recycling, reuse, and responsible withdrawal. | Shale plays' water intensity remains a focus; millions of gallons used per fracking operation. |

| Greenhouse Gas Emissions | Methane emission reduction, leak detection and repair (LDAR). | EPA aims for 75% methane reduction by 2030 (vs. 2019); EQT reported 60% reduction by 2023. |

| Induced Seismicity | Robust seismic monitoring and adaptive drilling practices. | Increased seismic activity noted in oil and gas development regions. |

| Land Use & Habitat | Minimizing operational footprint, effective land reclamation. | Oil and gas activities impacted over 1.5 million acres of US public land in 2024. |

| Waste & Spill Management | Proper treatment/disposal of waste fluids, spill prevention and response. | US oil/gas industry generated ~20 billion barrels of produced water in 2023; over 1,000 significant spills in US waters (2010-2020). |

PESTLE Analysis Data Sources

Our Infinity Natural Resources PESTLE Analysis is built on a robust foundation of data from leading financial institutions, government agencies, and respected industry research firms. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.