Indus Towers PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

Navigate the complex external landscape impacting Indus Towers with our detailed PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are shaping the telecom infrastructure sector. Gain a competitive edge by leveraging these insights for robust strategic planning. Download the full PESTLE analysis now to unlock actionable intelligence and make informed decisions.

Political factors

The Indian government's commitment to digital transformation, exemplified by the Digital India initiative, is a major catalyst for telecom infrastructure growth. This policy framework directly fuels the demand for robust tower networks, essential for expanding digital services nationwide.

The National Telecom Policy 2025, with its ambitious targets of achieving 100% 4G and 90% 5G coverage by 2030, presents a significant opportunity for tower companies. Indus Towers, as a key player, stands to benefit directly from this policy push, as it necessitates substantial expansion and densification of existing tower infrastructure.

The Telecommunications Act 2023, coupled with new Right of Way (RoW) Rules effective January 1, 2025, is set to significantly streamline tower installation approvals. This aims to reduce project delays and associated costs, a critical factor for infrastructure development.

A stable and predictable regulatory landscape is paramount for attracting and retaining the substantial long-term investments required in telecom infrastructure. This stability provides the confidence needed for companies like Indus Towers to plan and execute expansion strategies.

Government decisions on spectrum allocation, particularly for 5G and emerging satellite services, are crucial for mobile operators' growth strategies. These decisions directly influence the demand for tower infrastructure, as operators expand their networks to cover new frequencies. For instance, the administrative allocation of satellite spectrum by governments is anticipated to spur greater investment and accelerate deployment timelines, creating new opportunities for tower companies.

Foreign Direct Investment (FDI) Policies

India's foreign direct investment (FDI) policies in the telecommunications sector have been consistently liberalized, creating a fertile ground for infrastructure development. For instance, by 2023, India had attracted significant FDI inflows into its telecom sector, with the government actively encouraging foreign participation to bolster network capabilities and technological adoption.

These favorable policies directly benefit companies like Indus Towers by facilitating access to crucial foreign capital. This capital infusion is vital for the continuous upgrade and expansion of telecom infrastructure, including the deployment of 5G technology, which Indus Towers is heavily involved in.

The government's commitment to attracting FDI is evident in policy updates aimed at simplifying investment procedures and enhancing ease of doing business. This proactive approach ensures that companies like Indus Towers can readily leverage international investment to drive innovation and meet the growing demand for robust mobile connectivity across India.

- FDI Inflows: India's telecom sector has seen substantial FDI, with the government actively promoting foreign investment to drive infrastructure growth.

- Policy Liberalization: Continuous easing of FDI regulations in telecom aims to attract foreign capital for technological advancements and network expansion.

- Infrastructure Development: Favorable FDI policies enable companies like Indus Towers to secure capital for critical infrastructure upgrades, including 5G deployment.

- Technological Advancement: Attracting foreign investment supports the adoption of cutting-edge technologies, enhancing network quality and capacity.

Geopolitical Landscape and National Security

The Indian government's increasing focus on building secure and trusted telecom networks is a significant political factor. This is evident in initiatives like the Draft National Telecom Policy 2025, which specifically highlights the need to secure critical telecom infrastructure. Such a policy direction could strongly encourage domestic manufacturing of telecom equipment, thereby impacting Indus Towers' supply chain and potentially its sourcing strategies.

This push for indigenous manufacturing aims to reduce India's reliance on foreign equipment suppliers. For infrastructure providers like Indus Towers, this could translate into new opportunities for partnerships with local players or increased investment in domestic capabilities. The government's stance on national security within the telecom sector is a key driver shaping the operational and strategic landscape for tower companies.

- Government Emphasis on Trusted Networks: The Draft National Telecom Policy 2025 underscores the importance of securing India's telecom infrastructure.

- Promotion of Indigenous Manufacturing: Policies are likely to favor domestic production of telecom equipment, influencing supply chain dynamics.

- Reduced Reliance on Foreign Vendors: A strategic objective is to decrease dependence on international suppliers for critical network components.

- Impact on Infrastructure Providers: This geopolitical focus directly affects companies like Indus Towers through potential shifts in sourcing and operational strategies.

The Indian government's proactive stance on digital infrastructure, including the National Digital Communications Policy 2018 and the upcoming National Telecom Policy 2025, directly supports tower companies like Indus Towers. These policies aim to expand broadband access and 5G coverage, creating a sustained demand for tower infrastructure. For example, the government's target of 100% 4G and 90% 5G coverage by 2030 necessitates significant tower deployment and upgrades.

The liberalization of Foreign Direct Investment (FDI) norms in the telecom sector, with a 100% FDI allowed, has been a key enabler. By 2023, India continued to attract substantial FDI into its telecom sector, bolstering network expansion. This influx of capital is crucial for companies like Indus Towers to fund the capital-intensive deployment of new technologies.

The Telecommunications Act 2023 and the associated Right of Way (RoW) Rules, effective January 1, 2025, are designed to expedite tower deployment by simplifying approval processes. This regulatory streamlining is expected to reduce project execution timelines and costs, a critical factor for infrastructure growth.

Government initiatives promoting indigenous manufacturing of telecom equipment, driven by national security concerns, could influence supply chains. This focus on trusted networks and reduced reliance on foreign vendors may create new partnership opportunities or necessitate shifts in sourcing strategies for tower providers.

What is included in the product

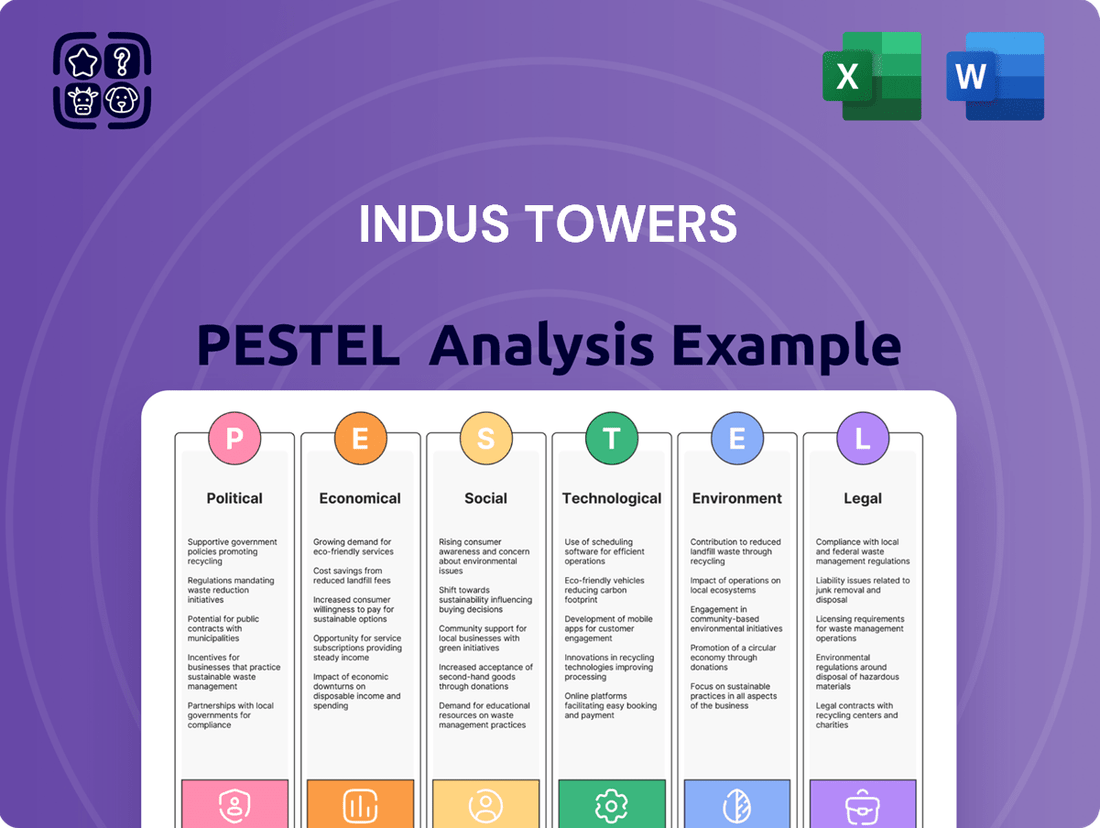

This PESTLE analysis meticulously examines the external macro-environmental forces impacting Indus Towers, dissecting its operational landscape across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, enabling stakeholders to identify and leverage emerging opportunities while mitigating potential threats within the telecom infrastructure sector.

This PESTLE analysis for Indus Towers acts as a pain point reliever by providing a clean, summarized version of the full analysis for easy referencing during meetings or presentations, streamlining strategic discussions.

Economic factors

The Indian telecom market is on a robust growth trajectory, with forecasts indicating it will reach USD 83.34 billion by 2030. This expansion is fueled by a surge in smartphone adoption and escalating data usage, creating a substantial demand for passive infrastructure solutions like those offered by Indus Towers.

India's 5G rollout is accelerating, with over 395,000 5G base stations deployed by early 2024, significantly boosting demand for tower infrastructure. This expansion necessitates denser networks and increased fiber optic connectivity, creating substantial opportunities for tower companies like Indus Towers.

Indus Towers is strategically positioned to capitalize on this trend, actively upgrading its existing network and investing in new infrastructure to support 5G. The company's collaborations with major telecom operators are crucial for meeting the escalating demand for 5G services, which promise faster speeds and lower latency for consumers and businesses alike.

Improvements in Average Revenue Per User (ARPU) for mobile operators directly benefit tower companies like Indus Towers. As operators earn more per subscriber, their financial health improves, allowing for greater investment in network infrastructure, including 5G rollouts and capacity upgrades. This, in turn, drives demand for tower services.

The surge in active mobile subscribers to 980 million by March 2024, as reported by TRAI, is a positive indicator for ARPU growth. Higher subscriber numbers, coupled with increasing data consumption and the adoption of higher-value plans, are expected to push ARPU upwards, creating a more robust revenue stream for telecom players and consequently for tower infrastructure providers.

Infrastructure Sharing Trends

The telecom industry is increasingly embracing infrastructure sharing, a move actively supported by regulators like India's TRAI. This trend allows operators to pool resources, leading to better use of existing assets and potentially higher tenancy ratios for tower companies like Indus Towers. For instance, in 2023, the Indian telecom sector saw continued focus on network expansion through shared infrastructure, aiming to reduce capital expenditure for individual players.

This sharing model can significantly boost the efficiency of tower companies by increasing the number of tenants on each tower. Higher tenancy ratios directly translate to improved revenue streams and operational leverage. As of early 2024, the drive for 5G rollout continues to be a major catalyst for such sharing agreements, as it requires substantial investment in new sites and fiber deployment.

- Increased Tenancy: Infrastructure sharing directly improves tower company revenue by allowing multiple operators to use a single tower.

- Cost Efficiency: Operators reduce their capital expenditure on new site builds and fiber deployment, making their business models more sustainable.

- Regulatory Support: Bodies like TRAI actively encourage sharing to promote competition and efficient resource allocation in the telecom market.

- 5G Rollout Impact: The demand for denser networks for 5G services is a key driver for more infrastructure sharing agreements.

Capital Expenditure and Investment in Digital Infrastructure

The Indian government's commitment to boosting infrastructure investment, particularly in the telecom sector, presents significant tailwinds for Indus Towers. The Draft National Telecom Policy 2025, for instance, aims to channel an impressive ₹1,00,000 crore annually into infrastructure development. This substantial government push, coupled with private sector capital expenditure focused on modernizing existing networks and expanding 5G capabilities, directly translates into increased demand for tower infrastructure services, benefiting companies like Indus Towers.

This robust investment climate is further underscored by recent trends. For the fiscal year 2023-24, India's telecom sector saw significant capital expenditure, with operators investing heavily in network upgrades and deployment. This ongoing investment cycle is crucial for meeting the growing data consumption needs and enabling new digital services, creating a sustained demand for passive infrastructure providers.

- Government Target: Draft National Telecom Policy 2025 aims for ₹1,00,000 crore annual infrastructure investment in the telecom sector.

- Private Sector Drive: Continued capital expenditure by telecom operators on network modernization and 5G rollout fuels demand for tower infrastructure.

- Digital India Push: The broader government agenda to enhance digital connectivity and services necessitates expanded and upgraded telecom infrastructure.

- Market Growth: Increased data consumption and the proliferation of IoT devices will require more extensive and efficient network coverage, driving tower deployment.

The Indian economic landscape offers significant advantages for tower infrastructure providers like Indus Towers. A rapidly growing digital economy, coupled with government initiatives promoting digital inclusion, fuels demand for enhanced telecom infrastructure. The burgeoning middle class and increasing disposable incomes also contribute to higher mobile data consumption, directly benefiting tower companies.

The Indian economy is projected to grow substantially, with GDP expected to reach $5 trillion by 2027, creating a favorable environment for investment in infrastructure. This economic expansion translates into increased spending power for consumers and businesses, driving demand for data-intensive services and, consequently, more robust telecom networks.

Inflationary pressures, while a consideration, are often managed through long-term contracts and the essential nature of telecom services. The Reserve Bank of India's monetary policy, aimed at maintaining price stability, supports a predictable economic environment conducive to long-term infrastructure investments.

Interest rate trends are crucial for capital-intensive businesses like Indus Towers. While rising rates can increase borrowing costs, the strong demand for telecom services and the government's focus on infrastructure development can offset these challenges, ensuring continued investment and growth opportunities.

What You See Is What You Get

Indus Towers PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Indus Towers.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, offering a comprehensive PESTLE analysis for Indus Towers.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the strategic landscape for Indus Towers.

Sociological factors

India's digital landscape is rapidly evolving, with a significant surge in digital literacy and adoption, especially in previously underserved rural areas. This trend directly fuels the demand for enhanced mobile connectivity, as more people embrace digital services. For instance, as of early 2024, internet penetration in rural India has seen substantial growth, with government initiatives like Digital India actively working to close the urban-rural digital divide.

The increasing comfort and reliance on digital platforms for communication, education, and commerce necessitate a strong and expansive mobile network infrastructure. This growing user base, empowered by greater digital skills, translates into higher data consumption and a greater need for reliable network coverage across the nation, directly benefiting tower companies like Indus Towers.

Rapid urbanization is creating a significant demand for robust mobile network infrastructure in India's burgeoning cities, requiring denser coverage solutions. Concurrently, government programs like BharatNet are actively working to bridge the digital divide by extending internet access to rural and remote regions.

Indus Towers is strategically positioned to address these dual demands. In fiscal year 2024, the company demonstrated this commitment by deploying over 60% of its new towers in rural India, directly supporting the expansion of connectivity to previously underserved populations and aligning with national digital inclusion goals.

Consumers are increasingly relying on data-heavy applications like video streaming and online gaming, which dramatically boosts data usage. This escalating demand for bandwidth directly translates into a greater need for robust network infrastructure, benefiting tower companies.

In 2024, the average global mobile data traffic per smartphone was projected to reach around 13.8 GB per month, a figure expected to climb substantially by 2025. This surge in data consumption necessitates continuous expansion and densification of mobile networks, directly supporting the business model of infrastructure providers like Indus Towers.

Employment and Skill Development

The expanding telecom sector, driven by increased infrastructure deployment, is a significant job creator, necessitating continuous workforce upskilling. This trend is underscored by the Draft National Telecom Policy 2025, which targets the creation of one million new jobs and the upskilling or reskilling of another million workers, highlighting the critical role of human capital development in the industry's growth trajectory.

This focus on employment and skill development directly impacts companies like Indus Towers by ensuring a pipeline of qualified talent for network operations and maintenance. The policy's emphasis on digital literacy and specialized technical skills will be crucial for adapting to evolving technologies such as 5G and beyond.

- Job Creation: The telecom sector's growth is a key driver of employment.

- Upskilling Mandate: The Draft National Telecom Policy 2025 aims to upskill and reskill a substantial portion of the workforce.

- Talent Demand: Increased infrastructure requires a skilled labor force for deployment and ongoing management.

- Technological Adaptation: The need for expertise in new technologies like 5G is paramount.

Public Perception and Acceptance of Tower Infrastructure

Public perception surrounding the safety and visual impact of telecom towers significantly affects how quickly new infrastructure can be built and where sites can be secured. In 2024, ongoing discussions about radiation levels and the visual clutter of towers in urban and rural landscapes continue to shape public opinion and regulatory approaches.

For companies like Indus Towers, fostering positive community relations is crucial for seamless operations and expansion, particularly in densely populated regions. Addressing local concerns proactively can mitigate delays and ensure continued access to essential sites for network growth.

- Community Engagement: Initiatives to educate the public on tower safety standards and the benefits of improved connectivity are vital.

- Aesthetic Considerations: Exploring innovative tower designs and camouflaging techniques can improve acceptance in sensitive areas.

- Regulatory Impact: Public sentiment can influence local zoning laws and permitting processes, directly impacting deployment timelines.

- Digital Divide: Positive public perception is indirectly linked to bridging the digital divide by enabling wider network coverage.

The increasing digital literacy across India, especially in rural areas, fuels demand for better mobile connectivity, a trend supported by government initiatives like Digital India aiming to bridge the urban-rural digital divide by early 2024. This growing reliance on digital platforms necessitates robust network infrastructure, directly benefiting tower companies. Indus Towers' deployment strategy in fiscal year 2024, with over 60% of new towers in rural India, aligns with these societal shifts towards greater digital inclusion.

Technological factors

The ongoing rollout of 5G and the anticipation of 6G, coupled with the explosive growth of the Internet of Things (IoT) and Artificial Intelligence (AI), are fundamentally reshaping telecommunications infrastructure demands. These advancements require more robust and densified tower networks to handle increased data traffic and lower latency.

Indus Towers is strategically positioned to capitalize on these trends, actively investing in upgrading its existing infrastructure to be 5G-ready and future-proof. This includes deploying new equipment and optimizing sites to support the higher frequencies and increased capacity needed for these next-generation technologies.

For example, the global 5G connections were projected to surpass 1.5 billion by the end of 2024, a significant jump from previous years, highlighting the urgent need for expanded tower capacity. Indus Towers' proactive approach ensures it can meet the evolving needs of telecom operators as they expand their 5G services and prepare for the integration of AI and IoT applications.

The increasing fiberization of telecom towers is a key technological driver for 5G deployment, enabling the high-speed data and increased capacity essential for next-generation mobile services. This trend is directly supported by government initiatives, with a national target to boost tower fiberization from 46% to 80% by 2030.

This push for fiber connectivity is critical for operators like Indus Towers to leverage the full potential of 5G, ensuring robust backhaul and efficient data transfer across their extensive network infrastructure.

Technological advancements in energy-efficient solutions are reshaping the telecom tower industry. Innovations like solar power and advanced lithium-ion batteries are becoming crucial for lowering operational expenses and minimizing environmental footprints. These technologies offer a pathway to more sustainable and cost-effective tower operations.

Indus Towers is actively integrating these green technologies into its infrastructure. The company has set an ambitious target of achieving net-zero emissions by 2050, underscoring its commitment to environmental stewardship. This strategic adoption of renewables is key to their long-term operational strategy and corporate responsibility.

For instance, Indus Towers reported in its FY24 results that it had deployed over 100,000 towers with solar power, significantly reducing its reliance on diesel. This move not only cuts down on carbon emissions but also provides substantial savings on fuel costs, demonstrating the tangible financial benefits of these technological shifts.

Development of Small Cells and In-Building Solutions (IBS)

The increasing demand for seamless connectivity in dense urban environments and large indoor venues is driving the adoption of small cells and in-building solutions (IBS). These technologies are crucial for augmenting the capacity and coverage of traditional macro towers, especially in areas with high user concentration. Indus Towers has recognized this trend and is actively deploying IBS to address the connectivity needs within buildings, ensuring a consistent user experience.

Indus Towers' investment in IBS is a strategic move to capture a larger share of the indoor connectivity market. As of late 2024, the telecommunications industry is witnessing a significant push towards densification, with small cells projected to form a substantial portion of new base station deployments. This focus on IBS allows Indus Towers to offer comprehensive network solutions that extend beyond outdoor macro sites.

- Small cells complement macro towers by providing localized capacity and coverage in high-traffic areas.

- Indus Towers' IBS deployment targets indoor spaces like malls, airports, and office buildings.

- Industry projections indicate strong growth in small cell deployments through 2025, highlighting the strategic importance of IBS.

Network Virtualization and Software-Defined Networking (SDN)

The increasing adoption of network virtualization and Software-Defined Networking (SDN) is fundamentally reshaping how telecommunications infrastructure is managed. These advancements allow for greater flexibility and scalability in network operations, potentially influencing the demand for and the very design of physical tower infrastructure. For instance, by enabling dynamic resource allocation and automated network management, SDN can optimize the utilization of existing tower assets.

These technologies significantly boost overall network performance. SDN, in particular, centralizes network control, allowing for quicker deployment of new services and more efficient traffic management. This efficiency can translate into cost savings for telecom operators, who are key clients for tower companies like Indus Towers. The global SDN market was valued at approximately USD 20.5 billion in 2023 and is projected to reach USD 88.3 billion by 2030, growing at a CAGR of 23.5% during the forecast period, highlighting a strong trend towards these solutions.

- Enhanced Network Agility: SDN and network virtualization allow for on-demand provisioning and modification of network resources, reducing the need for extensive physical upgrades.

- Improved Resource Utilization: These technologies enable operators to better utilize existing tower space and capacity by dynamically allocating bandwidth and services.

- Cost Efficiencies for Clients: By optimizing network operations, telecom operators can achieve significant cost savings, which may influence their infrastructure investment decisions.

- Focus on Digital Infrastructure: The shift towards software-defined networks emphasizes the importance of robust digital infrastructure, potentially driving demand for advanced connectivity solutions at tower sites.

The continued expansion of 5G and the emerging 6G networks necessitate a densification of tower infrastructure, requiring more advanced capabilities to manage increased data traffic and lower latency. Indus Towers is actively upgrading its sites to support these next-generation technologies, ensuring it can meet the evolving demands of telecom operators as they roll out enhanced services.

The integration of energy-efficient solutions, such as solar power, is crucial for reducing operational costs and environmental impact. Indus Towers is committed to sustainability, aiming for net-zero emissions by 2050, and has already deployed solar power on over 100,000 towers as of FY24, significantly lowering its reliance on diesel and cutting fuel expenses.

The increasing adoption of small cells and in-building solutions (IBS) is vital for improving connectivity in dense urban areas and indoor venues. Indus Towers is investing in IBS to enhance capacity and coverage, addressing the growing demand for seamless connectivity within buildings and capturing a larger share of this expanding market.

Network virtualization and Software-Defined Networking (SDN) are transforming telecom infrastructure management, offering greater flexibility and efficiency. These technologies enable dynamic resource allocation and automated network control, optimizing the use of existing tower assets and potentially leading to cost savings for clients. The global SDN market's projected growth to USD 88.3 billion by 2030 underscores this technological shift.

Legal factors

The Telecommunications Act 2023, alongside the new Right of Way (RoW) Rules effective January 1, 2025, establishes a crucial legal foundation for telecom infrastructure development. These regulations are designed to streamline the approval process and significantly cut down on project timelines, which is vital for companies like Indus Towers.

Indus Towers must adhere to these new legal mandates to ensure compliant and efficient deployment of its telecom infrastructure. The aim is to foster a more conducive environment for network expansion and upgrades, potentially impacting the speed at which new towers can be erected or existing ones modified.

The Telecom Regulatory Authority of India (TRAI) significantly shapes the telecommunications landscape, directly influencing Indus Towers. TRAI's recommendations and regulations on crucial areas like infrastructure sharing, spectrum allocation, and quality of service standards are paramount. These directives can impact operational costs and revenue streams for tower companies.

TRAI's proactive approach, such as introducing a property rating framework for digital connectivity, aims to enhance the quality and availability of telecom infrastructure. This initiative could potentially create new opportunities for tower providers like Indus Towers to improve their service offerings and expand their market reach by adhering to these updated standards.

Indus Towers must meticulously comply with environmental regulations and local building codes for all tower installations and ongoing operations. This includes strict adherence to electromagnetic field (EMF) radiation limits, which are set by regulatory bodies to protect public health, and obtaining specific clearances for towers situated near sensitive areas like schools or hospitals.

Failure to meet these stringent requirements can lead to significant penalties, project delays, and reputational damage. For instance, in 2023, India's Department of Telecommunications (DoT) continued to enforce EMF emission norms, with telecom operators and tower companies like Indus Towers needing to ensure compliance across their extensive network of over 400,000 sites.

Contractual Agreements with Mobile Network Operators

The legal framework surrounding contracts with mobile network operators (MNOs) is fundamental to Indus Towers' business model, directly impacting revenue streams and operational continuity. These agreements for passive infrastructure services are legally binding and dictate terms of lease, payment, and service level agreements.

Ensuring robust contractual terms and efficient dispute resolution mechanisms is paramount. For instance, Indus Towers' ability to manage and recover doubtful receivables, a common challenge in this sector, hinges on the legal enforceability of its contracts and the clarity of payment terms. As of Q3 FY24, Indus Towers reported a trade receivable of INR 11,189 crore, highlighting the importance of strong contractual management.

- Contractual Stability: Legal enforceability of long-term contracts with MNOs provides revenue predictability.

- Receivables Management: Clear payment terms and dispute resolution clauses in contracts are vital for managing doubtful receivables, which stood at INR 11,189 crore in Q3 FY24.

- Regulatory Compliance: Adherence to telecom licensing and infrastructure sharing regulations ensures legal operational standing.

- Dispute Resolution: Effective legal recourse for contract breaches safeguards financial interests and operational uptime.

Data Privacy and Security Laws

Indus Towers, as a critical component of digital infrastructure, must navigate a complex landscape of data privacy and security laws. Ensuring the integrity and confidentiality of its vast network is paramount, especially with increasing data volumes and evolving cyber threats. The Indian government's focus on this area is evident, with the Draft National Telecom Policy 2025 highlighting the importance of secure and trusted telecom networks. This policy aims to foster an environment where data protection is a cornerstone, directly impacting how tower companies manage sensitive information and operational data.

Adherence to these regulations means implementing robust security measures and transparent data handling practices. For Indus Towers, this translates to significant investments in cybersecurity infrastructure and compliance frameworks. The company's commitment to safeguarding user data and network integrity is not just a legal obligation but a crucial factor in maintaining trust with telecom operators and end-users. The evolving regulatory environment necessitates continuous adaptation and proactive risk management.

Key legal considerations for Indus Towers include:

- Data Protection Compliance: Adhering to India's Digital Personal Data Protection Act, 2023, which mandates consent-based data processing and imposes penalties for breaches.

- Telecom Security Mandates: Complying with directives from the Department of Telecommunications (DoT) concerning the security of telecom infrastructure, potentially including restrictions on equipment from certain vendors.

- Network Integrity Standards: Meeting the requirements outlined in the Draft National Telecom Policy 2025, which aims to establish secure and trusted telecom networks through stringent security audits and certifications.

The Telecommunications Act 2023 and the new Right of Way (RoW) Rules effective January 1, 2025, streamline approvals for tower infrastructure. Indus Towers must comply with these to ensure efficient network expansion. The Telecom Regulatory Authority of India (TRAI) also significantly influences operations through directives on infrastructure sharing and spectrum allocation, impacting costs and revenue.

Environmental regulations and local building codes, including EMF radiation limits, are critical for tower installations. Non-compliance can result in penalties and delays, as seen with DoT's continued enforcement of EMF norms in 2023 across India's vast tower network.

Contractual stability with mobile network operators is fundamental to Indus Towers' revenue, with strong contract management crucial for receivables, which stood at INR 11,189 crore in Q3 FY24. Data privacy laws, like the Digital Personal Data Protection Act, 2023, and security mandates from the DoT, also require significant compliance efforts.

Environmental factors

The telecom industry faces growing scrutiny to shrink its environmental impact. Indus Towers is actively working towards a net-zero greenhouse gas emission goal by 2050, a commitment that involves significant operational changes.

Key strategies include reducing reliance on diesel generators, a major source of emissions in tower operations, and investing in more energy-efficient technologies for its infrastructure. These initiatives are crucial for aligning with global climate targets and demonstrating corporate responsibility.

In 2023, Indus Towers reported a reduction in its Scope 1 and Scope 2 emissions, driven by these efforts. The company's focus on renewable energy sources and optimized power management is central to achieving its ambitious 2050 net-zero target.

Telecom towers are substantial energy consumers, and the industry's environmental footprint is a growing concern. Indus Towers is proactively addressing this by investing heavily in renewable energy solutions. As of early 2024, the company was on track to deploy renewable energy capacity equivalent to 500 megawatts, with ambitious plans to reach gigawatt scale by 2025 through strategic partnerships and direct investments in solar power.

The responsible management of electronic waste (e-waste) from telecom equipment is a significant environmental challenge. Indus Towers, like others in the sector, faces increasing scrutiny regarding its environmental footprint. The growing emphasis on a circular economy means a greater focus on recycling and reusing telecom hardware.

India's Draft National Telecom Policy 2025 actively champions circular economy principles. This policy aims to encourage the recycling of telecom hardware and equipment, reducing waste and promoting sustainability. This aligns with global trends where companies are expected to demonstrate robust e-waste management strategies.

Impact of Natural Disasters and Extreme Weather

Telecom infrastructure, including cell towers, is inherently susceptible to damage from natural disasters and extreme weather. Events like cyclones, floods, and heavy snowfall can lead to widespread service disruptions and necessitate costly repairs and rebuilding efforts. For instance, in 2023, India experienced numerous extreme weather events, impacting various sectors, including telecommunications, with potential for significant downtime and capital expenditure for restoration.

Recognizing this vulnerability, there's a growing emphasis on integrating telecom infrastructure resilience into national disaster recovery and preparedness frameworks. This involves developing strategies to minimize downtime and expedite service restoration following such events.

- Infrastructure Hardening: Investments in making towers more resistant to high winds, seismic activity, and flooding.

- Redundancy and Backup: Ensuring backup power sources and alternative network paths to maintain connectivity during outages.

- Early Warning Systems: Utilizing advanced weather forecasting to anticipate and mitigate potential damage to critical infrastructure.

- Rapid Restoration Plans: Pre-established protocols and resources for swift repair and re-establishment of services post-disaster.

Site Aesthetics and Community Concerns

The visual impact of telecom towers and community concerns about their environmental effects can pose challenges for new deployments by Indus Towers. For instance, in 2024, several Indian states saw protests against tower installations due to perceived health risks and aesthetic objections, leading to temporary project delays. Addressing these concerns proactively through community engagement and promoting sustainable, aesthetically pleasing designs are crucial for smooth operations and future expansion.

Indus Towers is increasingly focusing on mitigating the visual footprint of its infrastructure. Initiatives include exploring camouflaged towers designed to blend with surroundings and investing in green energy solutions to reduce the environmental impact. By prioritizing these aspects, the company aims to foster better community relations and ensure compliance with evolving environmental regulations, a key consideration for their expansion plans in 2025.

The company's approach to site aesthetics and community concerns directly influences its ability to secure permits and maintain social license to operate. For example, a 2024 report highlighted that projects in areas with strong community opposition faced an average delay of 6-9 months. Indus Towers' commitment to transparent communication and incorporating feedback on tower design and placement is therefore vital for efficient rollout and maintaining a positive brand image.

Indus Towers is actively reducing its carbon footprint, aiming for net-zero emissions by 2050. This involves transitioning away from diesel generators and embracing energy-efficient technologies. In 2023, the company reported a reduction in Scope 1 and Scope 2 emissions, underscoring its commitment to sustainability.

The company is making significant investments in renewable energy, with plans to deploy 500 megawatts of renewable capacity by early 2024 and reach gigawatt scale by 2025. This focus on green energy is crucial for meeting climate goals and managing operational costs.

Environmental regulations and community concerns about tower aesthetics and potential health impacts are key considerations. India's Draft National Telecom Policy 2025, promoting circular economy principles for e-waste, further shapes the company's operational strategies. Protests against tower installations in 2024 led to project delays, highlighting the need for proactive community engagement and sustainable design.

| Environmental Initiative | Target/Status | Key Actions |

|---|---|---|

| Net-Zero Emissions | By 2050 | Reducing diesel generator use, investing in energy-efficient tech |

| Renewable Energy Deployment | 500 MW (early 2024), GW scale (2025) | Direct investment in solar power, strategic partnerships |

| E-waste Management | Circular economy principles | Promoting recycling and reuse of telecom hardware |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Indus Towers is informed by a comprehensive review of official government publications, telecom industry reports, and economic data from reputable international organizations. This ensures a robust understanding of the political, economic, social, technological, legal, and environmental factors influencing the tower infrastructure sector.