Indus Towers Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

Indus Towers operates in a dynamic telecom tower industry where buyer power from major telecom operators is significant, influencing pricing and contract terms. The threat of new entrants, while moderated by high capital costs, remains a consideration, especially with potential infrastructure sharing models.

The complete report reveals the real forces shaping Indus Towers’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Indus Towers benefits from a wide array of suppliers for its equipment and services. This broad supplier base generally dilutes the bargaining power of any single supplier, preventing any one entity from dictating terms. For instance, in 2024, Indus Towers continued to engage with numerous vendors for passive infrastructure components like towers, power systems, and cooling solutions, ensuring competitive sourcing.

This diversification significantly reduces Indus Towers' dependence on any particular supplier. It allows the company to negotiate favorable pricing and contract terms, thereby supporting cost efficiency in its operations. The ability to switch between multiple qualified suppliers provides a crucial buffer against price hikes or supply disruptions.

For many essential components like basic tower materials, power solutions, and routine maintenance, Indus Towers benefits from a market with numerous qualified suppliers. This wide availability of options means that the company doesn't heavily rely on any single provider.

The standardization of these components further diminishes supplier leverage. Because these parts are largely interchangeable, Indus Towers faces relatively low costs and complexities when switching from one supplier to another. This flexibility is a key factor in managing input costs and ensuring supply chain resilience.

In 2023, the Indian tower infrastructure market saw significant activity, with companies like Indus Towers playing a crucial role. The competitive landscape among suppliers for raw materials and basic services remained robust, preventing any single supplier from dictating terms. For instance, the cost of steel, a primary input for towers, is influenced by global commodity prices and domestic production capacity, with multiple steel manufacturers serving the sector.

Indus Towers' relationships with suppliers are a mixed bag. While long-term contracts and strategic alliances can sometimes tip the scales in favor of suppliers, especially for highly specialized components, Indus Towers' sheer size and significance in the Indian telecom infrastructure sector often grant it considerable bargaining power. As a major customer, the company's substantial order volumes make it a highly desirable client for many suppliers.

Technological Advancements in Supply

Suppliers providing cutting-edge technologies, like energy-efficient solutions such as solar power and lithium-ion batteries, or sophisticated smart tower management systems, can wield significant bargaining power. This power stems from the unique value these innovations bring, potentially leading to substantial cost reductions and enhanced operational performance for Indus Towers.

Indus Towers' strategic integration of these advanced technologies underscores their critical role. For instance, the company has actively implemented solar power solutions across its sites, aiming to reduce reliance on conventional energy sources and lower operational expenditures. In 2023, Indus Towers reported a significant increase in its renewable energy usage, with approximately 30% of its energy consumption coming from green sources, a testament to the impact of these technologically advanced suppliers.

- Suppliers of specialized energy-efficient equipment, such as solar panels and lithium-ion batteries, can command higher prices due to the unique benefits they offer.

- Indus Towers' investment in AI-powered energy management systems demonstrates a reliance on suppliers with advanced technological capabilities.

- The adoption of green energy solutions by Indus Towers, which reached around 30% of total energy consumption in 2023, highlights the growing bargaining power of suppliers in this sector.

- Suppliers offering proprietary smart tower technologies that improve network efficiency and reduce downtime represent a key area where bargaining power can be concentrated.

Impact of Raw Material Costs

Fluctuations in the cost of essential raw materials like steel directly impact supplier pricing power. For instance, a surge in global steel prices, which can be influenced by geopolitical events or increased demand, would necessitate higher payments for tower construction components, thereby strengthening suppliers' position. Indus Towers' reliance on these materials means that significant upward price movements can directly increase its operational expenditures.

While Indus Towers likely has long-term agreements in place, these contracts are not immune to substantial commodity price volatility. If raw material costs escalate dramatically, suppliers may leverage these agreements to seek price adjustments, increasing their bargaining power. This dynamic can put pressure on Indus Towers' margins if it cannot pass these increased costs onto its customers.

The company's strategic pivot towards green energy solutions, such as solar power for its tower sites, is a key initiative to mitigate the impact of volatile fossil fuel prices. By reducing reliance on traditional energy sources, Indus Towers can potentially insulate itself from the price swings associated with oil and gas, thereby weakening the bargaining power of energy suppliers.

- Steel Price Volatility: Global steel prices have seen significant fluctuations, with benchmarks like the S&P Global Platts average for rebar in India experiencing periods of sharp increases, impacting construction costs.

- Long-Term Contracts: While specific terms are confidential, telecommunication infrastructure contracts often include clauses for material cost pass-throughs, which can be triggered by significant commodity price movements.

- Green Energy Investment: Indus Towers has been actively investing in renewable energy sources, aiming to power a substantial portion of its sites through solar energy, reducing dependence on grid electricity and its associated price volatility.

Suppliers of specialized, high-tech components, such as advanced energy-efficient systems or proprietary network management software, hold considerable bargaining power. This is due to the unique value and potential cost savings these innovations offer. For example, suppliers of AI-driven energy optimization solutions can negotiate from a position of strength. Indus Towers' increasing reliance on these advanced solutions, as evidenced by its 2023 green energy adoption reaching approximately 30% of its total energy consumption, underscores this trend.

Conversely, suppliers of standardized, commoditized equipment and raw materials face limited bargaining power. The availability of multiple vendors for basic tower materials like steel, coupled with the interchangeability of these components, allows Indus Towers to negotiate favorable terms. In 2024, the competitive sourcing of passive infrastructure components remained robust, ensuring cost efficiency.

The bargaining power of suppliers is also influenced by raw material price volatility. Significant increases in commodity prices, such as steel, can empower suppliers to seek price adjustments, even within long-term contracts, potentially impacting Indus Towers' operational expenditures.

What is included in the product

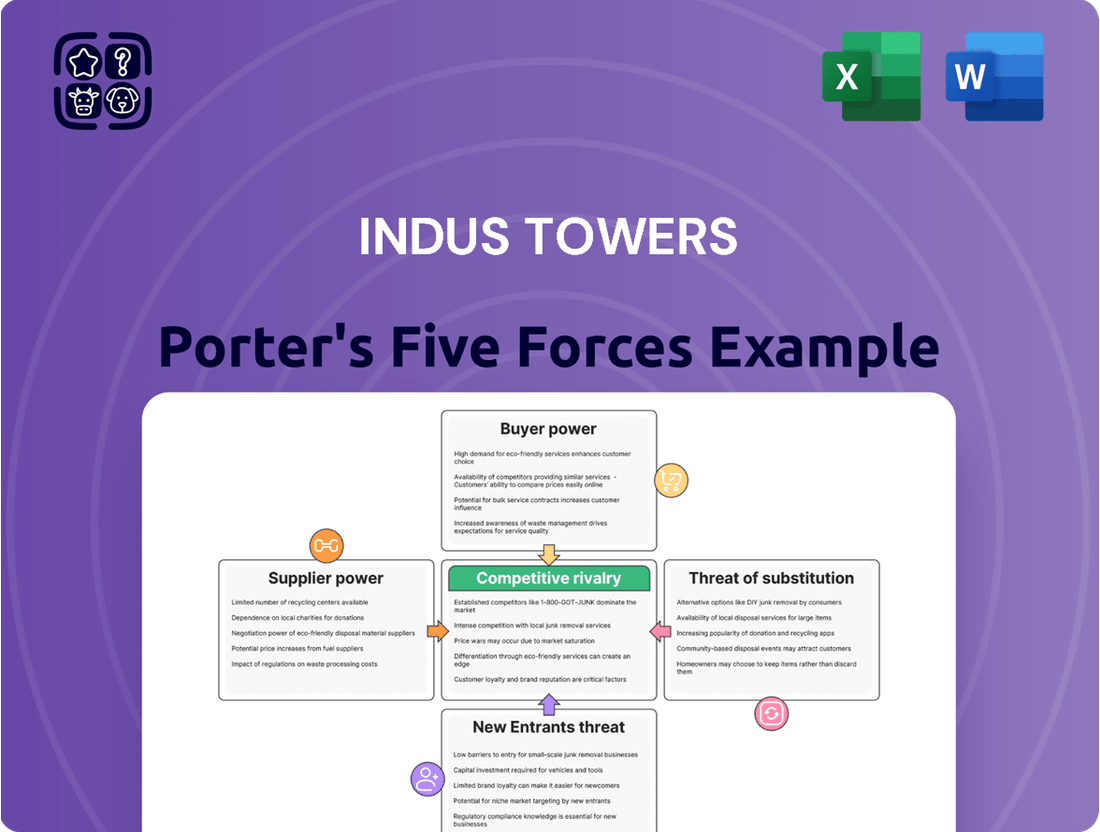

This analysis unpacks the competitive forces impacting Indus Towers, detailing the threat of new entrants, the bargaining power of buyers and suppliers, the intensity of rivalry, and the threat of substitutes.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces for Indus Towers.

Gain actionable insights into market dynamics, enabling strategic adjustments to address potential disruptions and capitalize on opportunities.

Customers Bargaining Power

Indus Towers' customer base is highly concentrated, with a few major wireless carriers like Bharti Airtel, Vodafone Idea, and Reliance Jio Infocomm being its primary clients. This limited number of large customers grants them substantial bargaining power.

For instance, in the fiscal year ending March 31, 2023, Vodafone Idea and Bharti Airtel were significant revenue contributors for Indus Towers. Their ability to negotiate pricing and contract terms is amplified due to their large market share and the essential nature of tower infrastructure for their operations.

Indus Towers' reliance on co-location, where multiple telecom operators share a single tower, means customers can exert pressure. For instance, in 2023, Indus Towers reported a tenancy ratio of approximately 1.76, indicating that, on average, each tower hosted less than two operators. This presents an opportunity for larger customers to negotiate more favorable terms, especially when considering new co-locations or lease renewals, as they represent a significant portion of potential revenue for each tower.

The financial health of Indus Towers' major clients, especially Vodafone Idea, is a critical factor influencing its revenue streams and the timeliness of payments. Vodafone Idea's ongoing financial challenges directly translate into increased bargaining power for them, as they represent a significant portion of Indus Towers' customer base.

As of early 2024, Vodafone Idea has been actively seeking funding to address its financial obligations and invest in network upgrades. Delays in payments from such a large customer can strain Indus Towers' liquidity and provide leverage for renegotiating terms, thus amplifying customer power.

Long-Term Contracts and Renewals

Indus Towers’ reliance on long-term contracts, while ensuring revenue predictability, also positions customers to wield significant bargaining power during renewal periods. This leverage is amplified if clients perceive viable alternative infrastructure providers or hold dominant market shares, enabling them to negotiate for more favorable terms. For instance, during the fiscal year ending March 31, 2024, Indus Towers continued its focus on supporting the network expansion needs of its major telecom operators.

The company’s strategic imperative to capitalize on these customer network expansions means that maintaining strong relationships and offering competitive renewal terms are crucial. Customers, particularly larger ones like Bharti Airtel and Vodafone Idea, can leverage their substantial business volume to influence pricing and service level agreements. This dynamic is a key factor in managing customer loyalty and mitigating churn risk.

- Customer Leverage: Long-term contracts grant customers negotiation power at renewal, especially if alternatives exist or they hold strong market positions.

- Strategic Focus: Indus Towers aims to benefit from customer network expansions, necessitating favorable renewal terms.

- Market Influence: Major clients can exert pressure on pricing and service agreements due to their significant business volume.

- Renewal Negotiations: The renewal process is a critical juncture where customer bargaining power is most evident.

Customer's Own Infrastructure Development

While Indus Towers operates on a shared infrastructure model, major telecom operators retain the option to develop or enhance their own passive infrastructure in select regions. This is often driven by strategic imperatives or a desire to lessen reliance on third-party tower providers. This capability acts as a significant bargaining lever for these customers.

However, the prevailing industry trend strongly leans towards outsourcing passive infrastructure. This strategy is primarily adopted to mitigate substantial capital expenditure, making the development of in-house infrastructure a less common, though still present, consideration for large operators.

- Customer's Own Infrastructure Development: Telecom operators can invest in their own passive infrastructure, reducing reliance on tower companies.

- Strategic Considerations: Building in-house infrastructure can be a strategic move to gain control or reduce costs in specific high-demand areas.

- Trend Towards Outsourcing: Despite the potential for in-house development, the industry generally favors outsourcing to conserve capital.

- Bargaining Power: The mere possibility of developing their own infrastructure enhances the bargaining power of large telecom customers with tower providers like Indus Towers.

Indus Towers' customer bargaining power is significant due to the concentrated nature of its client base, primarily consisting of major wireless carriers. These large operators, like Bharti Airtel and Vodafone Idea, hold substantial leverage given their considerable market share and the essential nature of tower infrastructure for their operations.

The tenancy ratio, which indicates how many operators share a tower, also plays a role. For instance, in 2023, Indus Towers had a tenancy ratio of approximately 1.76. A lower ratio means fewer operators per tower, potentially giving larger clients more negotiation power, especially during renewals or when new co-locations are considered.

The financial health of key customers, particularly Vodafone Idea, directly impacts their bargaining position. Financial challenges can lead to delayed payments, which in turn can provide these large clients with leverage to renegotiate contract terms.

| Customer | Significance to Indus Towers (FY23) | Potential Bargaining Factor |

|---|---|---|

| Bharti Airtel | Major Revenue Contributor | Large Market Share, Network Expansion Needs |

| Vodafone Idea | Significant Revenue Contributor, Financial Challenges | Financial Health, Potential for Payment Delays |

| Reliance Jio Infocomm | Key Client | Market Dominance, Strategic Infrastructure Needs |

Full Version Awaits

Indus Towers Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. The comprehensive Indus Towers Porter's Five Forces Analysis presented here details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the telecommunications tower industry. This ready-to-use analysis will equip you with critical insights for strategic decision-making.

Rivalry Among Competitors

The Indian telecom tower landscape is characterized by a limited number of major players following significant consolidation. Indus Towers, a key entity, commands a substantial market share, typically above 30%, making it a dominant force. This oligopolistic structure intensifies rivalry as these few large companies vie for new tower deployments and co-location opportunities to expand their infrastructure and service offerings.

Competitive rivalry in the telecom tower industry, including Indus Towers, is intensely focused on maximizing tenancy ratios on existing infrastructure and securing new co-location agreements from mobile network operators. This battle for customers drives competition on pricing, the quality of services offered, and the speed at which new sites can be deployed. Indus Towers' strategic imperative for growth directly involves aggressively pursuing both increased tower additions and a higher number of co-locations on its existing base.

Competitors are actively pursuing strategic acquisitions and organic growth to bolster their market share and expand their tower infrastructure. This includes acquiring existing tower portfolios, which directly increases their operational footprint and competitive leverage.

Indus Towers, for example, has strategically acquired significant tower assets to solidify its market standing. In fiscal year 2024, the company continued to focus on operational efficiency and growth, though specific acquisition figures for new portfolios in that year are part of ongoing market consolidation discussions.

This aggressive expansion strategy, driven by both organic development and mergers and acquisitions, directly fuels the intensity of competitive rivalry within the telecom tower industry.

Impact of 5G Rollout and Rural Connectivity

The accelerated 5G rollout and the government's focus on enhancing rural connectivity are creating a highly competitive environment among tower companies. These firms are aggressively seeking contracts to build out new 5G infrastructure and upgrade existing tower sites to support denser network requirements. This competition intensifies as operators aim to expand coverage and capacity, driving demand for more strategically located and technologically advanced tower solutions.

Companies are investing heavily in deploying the necessary infrastructure to support these denser networks. For instance, by the end of 2024, India's 5G network had already covered a significant portion of urban areas, with ongoing efforts to penetrate rural markets. This expansion necessitates more tower sites and upgrades, directly fueling the competitive rivalry as players like Indus Towers, American Tower Corporation, and Adani Towers compete for these lucrative deployment opportunities.

- Increased Demand: The 5G rollout is driving demand for more tower sites to accommodate denser network requirements, creating a competitive race for deployment contracts.

- Infrastructure Upgrades: Tower companies are competing to upgrade existing infrastructure to support new technologies and higher capacities, a key factor in securing operator business.

- Rural Connectivity Push: Government initiatives to expand connectivity to rural areas are opening new markets, intensifying competition as companies vie for these expansion projects.

Technological Differentiation and Service Offerings

Competitive rivalry in the passive telecom infrastructure sector, while centered on core tower space, intensifies through technological differentiation and advanced service offerings. Companies are actively moving beyond simply providing physical locations for antennas.

Indus Towers, for instance, competes by offering value-added services that enhance operational efficiency and sustainability for telecom operators. These include energy-efficient solutions, such as advanced power management systems and renewable energy integration, and the deployment of smart tower technologies that enable remote monitoring and predictive maintenance.

The competition is not just about securing tower sites but about delivering holistic infrastructure solutions that demonstrably reduce the operational expenditure for clients. For example, in 2023, the focus on energy efficiency was critical, with telecom operators aiming to cut power costs, which can represent a significant portion of their operating expenses.

- Technological Differentiation: Companies compete on the sophistication of their tower infrastructure, including features like advanced cooling systems, integrated battery backup, and IoT-enabled monitoring.

- Value-Added Services: Beyond passive hosting, services like managed energy solutions, site acquisition support, and fiber connectivity integration are key competitive factors.

- Operational Efficiency Focus: The drive to reduce telecom operators' operating costs through smarter energy usage and streamlined site management is a major battleground.

- Market Trends: The increasing demand for 5G deployment necessitates more robust and technologically advanced infrastructure, pushing providers to innovate and differentiate their offerings.

Competitive rivalry in India's telecom tower sector is fierce, driven by a concentrated market of a few dominant players, including Indus Towers. This intense competition centers on securing new co-location agreements and maximizing tenancy ratios on existing infrastructure. The ongoing 5G rollout and government initiatives for rural connectivity further fuel this rivalry, pushing companies to invest heavily in infrastructure upgrades and new deployments.

Companies compete not only on providing physical tower space but also on offering value-added services like energy-efficient solutions and smart tower technologies. This focus on operational efficiency and technological differentiation is crucial for reducing telecom operators' costs and securing lucrative contracts in a rapidly evolving market.

| Key Competitor | Estimated Market Share (FY24) | Key Competitive Focus |

|---|---|---|

| Indus Towers | 30-35% | Tenancy ratios, 5G deployment, energy efficiency |

| American Tower Corporation (ATC) India | 20-25% | Infrastructure upgrades, rural expansion, new site acquisition |

| Adani Towers | 10-15% | Aggressive expansion, strategic partnerships, fiber integration |

SSubstitutes Threaten

The increasing adoption of small cells, micro-towers, and Distributed Antenna Systems (DAS) presents a significant threat to traditional tower companies like Indus Towers. These alternative solutions are particularly effective for localized network coverage, especially in densely populated urban environments and for the ongoing 5G densification efforts. For instance, the global small cell market was valued at approximately $6.5 billion in 2023 and is projected to grow substantially, demonstrating a clear shift in infrastructure deployment strategies.

These technologies can diminish the dependency on large, macro towers for specific connectivity requirements, thereby impacting the revenue streams of tower operators. As mobile network operators focus on optimizing coverage and capacity, especially in high-traffic areas, they may opt for these more granular deployment models. This trend suggests a potential reduction in demand for traditional tower leasing, especially for new deployments aimed at urban micro-coverage.

Emerging satellite communication technologies, like Starlink and OneWeb, while currently more niche and expensive for widespread mobile connectivity, could become a viable substitute for traditional tower infrastructure in the long term, particularly in remote or underserved regions. These services offer the potential to bypass terrestrial networks entirely.

By 2024, the satellite internet market is projected to reach over $6 billion, indicating significant growth and investment in this area. This expansion suggests a growing capability for satellite services to offer alternative connectivity solutions, potentially impacting the demand for traditional mobile tower services in specific use cases.

The increasing prevalence of Wi-Fi and public hotspots presents a notable threat of substitutes for cellular data services, impacting demand for tower infrastructure. In 2024, the global public Wi-Fi user base continued to expand, with millions accessing these networks daily, particularly in urban centers. This readily available, often free, alternative for internet access can diminish the reliance on mobile data plans, especially for activities like browsing, social media, and even video streaming in areas with strong Wi-Fi coverage.

This substitution effect is most pronounced in densely populated urban environments where public Wi-Fi availability is high. As more locations, from cafes to public transport, offer Wi-Fi, consumers may opt for these connections over their cellular data, thereby reducing the perceived necessity for constant, high-capacity cellular service. This trend could indirectly affect the growth trajectory for new tower deployments, as the demand for ubiquitous cellular coverage might be partially sated by alternative connectivity solutions.

In-building Solutions (IBS)

Dedicated In-Building Solutions (IBS) pose a significant threat to traditional macro tower businesses like Indus Towers. These IBS can be deployed directly by telecom operators or third-party providers to ensure robust indoor mobile coverage, thereby diminishing reliance on external macro towers for building penetration. This trend is particularly relevant in urban areas and large commercial spaces where indoor connectivity is paramount.

Indus Towers has acknowledged this threat and is actively working to bolster its own IBS offerings. This strategic move aims to mitigate the impact of substitute solutions by capturing a share of the indoor coverage market. The company’s focus on IBS demonstrates an understanding that the future of mobile infrastructure will likely involve a hybrid approach, integrating both macro and micro-level solutions.

The increasing demand for seamless indoor connectivity, especially in high-traffic venues like airports, shopping malls, and office complexes, drives the adoption of IBS. For instance, the global in-building wireless solutions market was valued at approximately USD 10.5 billion in 2023 and is projected to grow significantly in the coming years, highlighting the competitive pressure from these alternatives.

- IBS reduce reliance on external macro towers for indoor coverage.

- Telecom operators and third parties can deploy dedicated IBS.

- Indus Towers is strengthening its IBS portfolio to counter this threat.

- The global IBS market is experiencing substantial growth, indicating increasing competition.

Fiber Optic Networks (Direct Connectivity)

While fiber optic cables are essential for the backhaul that connects towers to the broader internet, direct fiber connections to homes and businesses can bypass the need for wireless last-mile delivery. This means consumers might opt for high-speed internet directly through fiber, reducing their reliance on mobile network operators and, by extension, tower infrastructure. For instance, in 2024, the global fiber optic market continued its robust expansion, driven by increasing demand for high-speed broadband and 5G deployment which itself requires fiber backhaul, yet the direct-to-premise segment represents a distinct competitive pressure.

This trend poses a threat because it offers an alternative pathway to high-speed data services. As more end-users gain access to direct fiber, the demand for wireless connectivity for fixed broadband purposes could diminish. This could impact tower companies like Indus Towers if a significant portion of their revenue is tied to providing wireless access to residential or business customers who could alternatively be served by direct fiber. The ongoing investment in fiber infrastructure by telecom operators globally, including significant rollouts in North America and Europe in 2024, underscores this potential shift.

- Direct Fiber Competition: Fiber-to-the-home (FTTH) and fiber-to-the-business (FTTB) offer a high-speed alternative that bypasses wireless last-mile connectivity.

- Reduced Reliance on Towers: Consumers and businesses may choose direct fiber for internet access, lessening their dependence on mobile network operators and tower infrastructure.

- Market Trends: The continued global expansion of fiber optic networks in 2024, driven by broadband and 5G needs, highlights the growing availability of this substitute.

- Revenue Impact: A significant shift to direct fiber could reduce demand for wireless services provided by tower tenants, potentially affecting tower company revenues.

The threat of substitutes for traditional tower infrastructure is multifaceted, encompassing alternative wireless technologies and direct wired connections. Small cells, DAS, and emerging satellite services offer localized or alternative connectivity, potentially reducing reliance on macro towers, especially in urban and remote areas. By 2024, the satellite internet market was projected to exceed $6 billion, indicating significant growth in this substitute area.

Furthermore, the widespread availability of public Wi-Fi and dedicated in-building solutions (IBS) directly competes with cellular services, particularly for indoor coverage and urban data consumption. The global IBS market was valued at around $10.5 billion in 2023, highlighting the scale of this alternative. Finally, direct fiber-to-the-home/business connections bypass wireless last-mile delivery, presenting a substitute for mobile operators' fixed wireless access services, with the global fiber optic market continuing its robust expansion in 2024.

| Substitute Technology | Key Impact on Towers | 2023/2024 Data Point |

|---|---|---|

| Small Cells/DAS | Localized coverage, reduces macro tower need in dense areas | Small cell market ~$6.5 billion (2023) |

| Satellite Internet | Alternative for remote/underserved regions | Satellite internet market projected >$6 billion (2024) |

| Public Wi-Fi | Reduces reliance on cellular data in high-coverage zones | Growing global user base |

| In-Building Solutions (IBS) | Provides dedicated indoor coverage, lessening external tower dependence | IBS market ~$10.5 billion (2023) |

| Direct Fiber Optic | Bypasses wireless last-mile for fixed broadband | Global fiber optic market expanding robustly (2024) |

Entrants Threaten

The sheer scale of investment needed to build a robust telecom tower infrastructure across India presents a formidable barrier to new entrants. Companies must secure vast tracts of land, erect numerous towers, and equip them with sophisticated technology, demanding billions of dollars upfront. For instance, the capital expenditure for establishing a new tower company can easily run into hundreds of millions, if not billions, of dollars, making it a prohibitive cost for many aspiring players.

The Indian telecom sector presents significant regulatory hurdles for potential new entrants. Obtaining the necessary licenses and permits is a complex and often lengthy process, demanding substantial investment in time and resources. For instance, the Department of Telecommunications (DoT) has stringent licensing requirements that can deter smaller players.

Adherence to intricate right-of-way (RoW) rules across various states and municipalities further complicates market entry. These regulations govern the installation and maintenance of telecom infrastructure, adding layers of bureaucratic complexity. Navigating these diverse and sometimes conflicting rules requires specialized expertise and considerable effort, acting as a substantial barrier.

Indus Towers, alongside a handful of other major players, commands a significant portion of the Indian telecom tower market. This established dominance, characterized by an extensive nationwide network and deep operational expertise, creates a formidable barrier for any potential new entrants aiming to replicate their scale and efficiency. For instance, as of the first quarter of 2024, Indus Towers reported managing over 400,000 towers, highlighting the sheer magnitude of infrastructure new companies would need to match.

Access to Key Customers

New entrants face a significant hurdle in gaining access to key customers, primarily the major telecom operators. These operators typically have deep-rooted, long-term contractual relationships with established tower companies, making it difficult for newcomers to break in and secure substantial business. For instance, in 2024, the top three telecom operators in India, who are the primary clients for tower companies like Indus Towers, continued to consolidate their infrastructure sharing agreements with incumbent providers.

This established customer loyalty and the complexity of switching providers create a high barrier. New entities would need to offer exceptionally compelling value propositions or innovative solutions to entice these major players away from their existing partners. The cost and effort associated with renegotiating contracts and integrating new infrastructure can be prohibitive for both the customer and the new entrant.

The existing customer base is a critical asset for incumbent tower companies. In 2023, Indus Towers reported a significant portion of its revenue was derived from long-term contracts with major telecom operators, highlighting the stickiness of these relationships. This concentration of key clients means that securing even a small percentage of their business would require substantial investment and strategic maneuvering by any new competitor entering the market.

- Established Relationships: Major telecom operators have long-standing contracts and partnerships with existing tower companies.

- Customer Loyalty: Switching providers involves significant costs and complexities, fostering customer loyalty towards incumbents.

- Market Concentration: A few dominant telecom operators represent the primary customer base, making access a concentrated challenge.

- Contractual Obligations: Existing long-term agreements lock in customers, presenting a formidable barrier for new entrants seeking market share.

Technological Expertise and Infrastructure Sharing Model

Operating a large-scale, shared telecom infrastructure network, like that of Indus Towers, demands significant technological expertise. This includes mastery of passive infrastructure management, advanced energy solutions to power numerous sites efficiently, and sophisticated operational strategies to ensure network uptime and performance. New entrants would face a steep climb in acquiring or developing this specialized knowledge.

The capital expenditure required for building a comparable network from scratch is substantial, making it difficult for new players to enter. For instance, the rollout of 5G technology necessitates significant investment in new towers and upgraded equipment, a barrier that established players with existing infrastructure are better positioned to overcome. In 2024, telecom infrastructure investment globally continued to be robust, with a significant portion dedicated to network densification and modernization, underscoring the high entry costs.

- Specialized Knowledge: Expertise in passive infrastructure, energy management, and operational efficiency is critical.

- High Capital Investment: Building a new, extensive tower network requires billions in upfront capital.

- Technological Obsolescence Risk: New entrants must invest in future-proof technologies to avoid rapid obsolescence.

- Regulatory Hurdles: Obtaining permits and licenses for tower construction can be a lengthy and complex process.

The threat of new entrants in the Indian telecom tower market is currently low, primarily due to the immense capital required and the established dominance of incumbents like Indus Towers. New players would need to overcome significant financial barriers, regulatory complexities, and the challenge of securing long-term contracts with major telecom operators.

The high upfront investment for infrastructure development, coupled with stringent licensing and right-of-way regulations, makes market entry exceptionally difficult. Furthermore, existing customer loyalty and the operational expertise of established companies like Indus Towers, which managed over 400,000 towers as of Q1 2024, create substantial hurdles for any aspiring competitor.

| Barrier Type | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | Building a nationwide tower network requires billions in investment. | Very High |

| Regulatory Hurdles | Complex licensing and right-of-way processes. | High |

| Customer Relationships | Long-term contracts with major telecom operators. | High |

| Economies of Scale | Incumbents benefit from existing, extensive infrastructure. | High |

Porter's Five Forces Analysis Data Sources

Our Indus Towers Porter's Five Forces analysis is built upon a foundation of diverse and reliable data sources, including the company's annual reports, investor presentations, and filings with regulatory bodies like the Securities and Exchange Board of India (SEBI).

We supplement this internal data with insights from industry-specific market research reports, telecommunications sector publications, and macroeconomic data from reputable financial information providers to offer a comprehensive view of the competitive landscape.