Indus Towers Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indus Towers Bundle

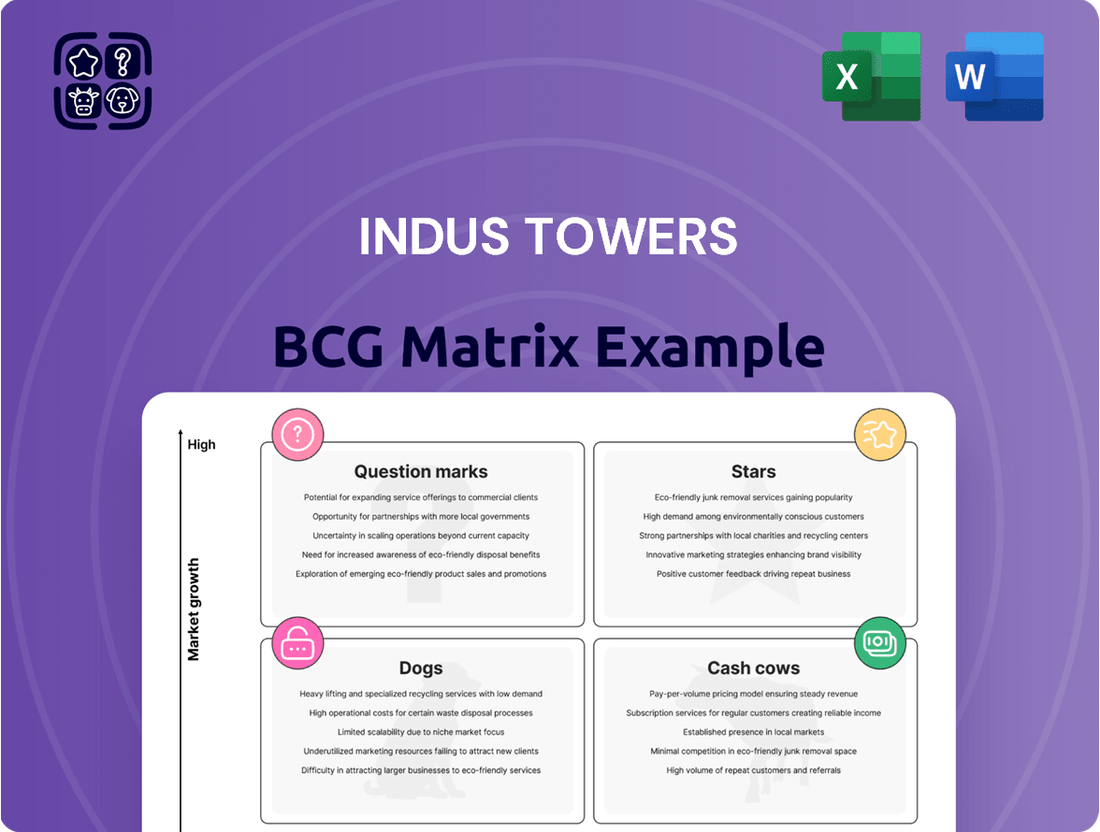

Unlock the strategic potential of Indus Towers with a comprehensive BCG Matrix analysis. Understand which of their business units are market leaders (Stars), reliable income generators (Cash Cows), underperforming assets (Dogs), or emerging opportunities (Question Marks).

This preview offers a glimpse into Indus Towers' market position. For a complete, actionable understanding of their portfolio and to make informed investment decisions, purchase the full BCG Matrix report today.

Don't miss out on crucial insights that can shape your investment strategy. The full report provides detailed quadrant placements, data-driven recommendations, and a clear roadmap for maximizing returns and mitigating risks within the telecom infrastructure sector.

Stars

Indus Towers is a major player benefiting from India's aggressive 5G expansion. As telecom giants like Jio and Airtel rapidly deploy their 5G services, there's a significant uptick in demand for new tower sites and sharing existing infrastructure. This surge, driven by the need for denser network coverage, makes 5G infrastructure a star in Indus Towers' portfolio, offering substantial growth prospects and market share opportunities.

Indus Towers boasts an industry-leading tenancy ratio, a key indicator of its operational efficiency and market strength. This high ratio, meaning multiple telecom operators utilize a single tower, directly contributes to its 'Star' status within the BCG Matrix.

As telecom firms increasingly focus on network expansion and cost optimization, the appeal of co-location on existing, well-established towers like those managed by Indus Towers grows significantly. For instance, in the financial year 2023-24, Indus Towers reported a tenancy ratio of approximately 1.76, demonstrating the effective utilization of its infrastructure.

This trend of co-location translates into enhanced revenue per tower for Indus Towers, reinforcing its dominant market position. The ability to attract and retain multiple tenants on a single tower solidifies its existing tower infrastructure as a star asset, generating consistent and growing cash flows.

Indus Towers boasts a comprehensive pan-India tower portfolio, spanning all 18 telecommunication circles. This expansive network ensures it can serve the infrastructure demands of all major wireless operators, reaching both urban centers and expanding into rural regions. This widespread presence is a key differentiator in the dynamic Indian telecom market.

Digital India and Rural Connectivity Initiatives

Government initiatives such as Digital India and BharatNet are actively pushing for improved internet access and digital skills, particularly in rural India. These programs create a significant demand for more robust telecom infrastructure, including the deployment of new towers and extensive fiber optic networks. By 2023, the Indian government had invested over ₹70,000 crore in BharatNet to connect over 1.5 lakh gram panchayats, a number expected to grow significantly.

Indus Towers, with its strategic emphasis on extending its network into less-served areas, is ideally positioned to benefit from these government-driven connectivity efforts. The company's expansion into these emerging rural markets aligns perfectly with the national agenda for digital inclusion. This strategic alignment is a key factor supporting its potential for high growth and increased market share.

- Digital India aims to transform India into a digitally empowered society and knowledge economy.

- BharatNet targets to provide broadband connectivity to all Gram Panchayats by 2025.

- Indus Towers' rural expansion strategy directly supports these national connectivity goals.

- The demand for telecom infrastructure is projected to rise by an estimated 15-20% annually in rural segments due to these initiatives.

Growing Data Consumption and Smartphone Penetration

India's digital landscape is booming, with mobile data consumption soaring. By the end of 2023, average monthly data consumption per user in India reached approximately 25 GB, a significant jump from previous years. This surge is fueled by increasing smartphone penetration, which crossed 70% in early 2024, making digital services accessible to a wider population.

This sustained growth in data usage directly translates to a higher demand for robust and efficient network infrastructure. As the backbone of mobile connectivity, Indus Towers' services are in high demand to support this increasing data traffic. The need for more towers and upgraded infrastructure to handle 5G deployment further strengthens Indus Towers' position in this expanding market.

- Data Consumption Growth: Indian mobile users consumed over 130 Exabytes of data in 2023.

- Smartphone Penetration: Over 70% of the Indian population owned smartphones by early 2024.

- Network Demand: Increased data usage necessitates more cell sites and advanced network capabilities.

- Indus Towers' Role: The company is crucial in providing the infrastructure to meet this escalating demand.

Indus Towers' existing, well-utilized tower infrastructure is a clear 'Star' in the BCG matrix. Its industry-leading tenancy ratio, around 1.76 in FY23-24, signifies efficient asset deployment as multiple operators share towers, boosting revenue per site. This strong performance is further bolstered by India's rapid 5G rollout, which drives demand for new and existing tower sites. The company's extensive pan-India network, covering all 18 telecom circles, positions it to capitalize on this growth.

| Metric | Value (as of FY23-24) | Significance |

| Tenancy Ratio | ~1.76 | Indicates efficient infrastructure utilization and revenue generation per tower. |

| 5G Rollout Impact | High | Drives demand for new tower sites and infrastructure upgrades. |

| Network Coverage | Pan-India (18 circles) | Ensures broad market reach and ability to serve diverse operator needs. |

What is included in the product

Indus Towers' BCG Matrix analyzes its tower portfolio, identifying growth opportunities and areas for strategic resource allocation.

The Indus Towers BCG Matrix provides a clear, one-page overview of each business unit's market position, alleviating the pain of complex strategic analysis.

Cash Cows

Indus Towers' core business of leasing and maintaining telecom towers is a classic cash cow, providing a stable and predictable revenue stream. This segment is characterized by long-term contracts with major mobile operators, ensuring consistent cash flow and a mature market position. The essential nature of this infrastructure, coupled with sustained demand, solidifies its role as a significant cash generator for the company.

Indus Towers benefits from deeply entrenched relationships with key Indian telecom giants like Bharti Airtel and Vodafone Idea. These established partnerships are the bedrock of its consistent business flow, offering significant revenue predictability.

The ongoing dependence of these major players on Indus Towers' extensive network infrastructure translates directly into a stable and substantial cash generation capability. This is a hallmark of a strong Cash Cow.

Indus Towers exhibits remarkable operational efficiency and cost management, evidenced by its consistently robust EBITDA margins. For instance, in the fiscal year ending March 2024, the company reported an EBITDA of ₹10,791 crore, showcasing its ability to generate substantial profits from its core operations.

The company actively pursues optimization strategies, such as reducing diesel consumption and integrating renewable energy sources into its operations. These initiatives not only enhance environmental sustainability but also directly contribute to maximizing profit margins and generating significant free cash flow, reinforcing its position as a cash cow.

This diligent management of its vast tower infrastructure, which comprises over 2.2 lakh towers as of March 2024, is a key driver of its cash cow status. The efficient operation of this extensive network translates directly into stable and predictable cash generation for the company.

Stable Revenue from Existing 4G/3G Networks

Even as the industry buzzes about 5G, Indus Towers continues to benefit from a strong revenue stream generated by its existing 4G and 3G network infrastructure. These mature technologies still underpin a significant portion of India's mobile communication needs, providing a reliable and consistent income source for the company.

The stability of these established networks, coupled with their large and entrenched user base, translates into predictable cash flows for Indus Towers. This steady revenue generation is a hallmark of its Cash Cow business units within the BCG Matrix framework.

- Substantial 4G/3G Tenancy: Indus Towers maintains a significant number of tenancies on its towers for 4G and 3G services, ensuring consistent rental income.

- Mature Market Demand: Despite the advent of 5G, a large segment of the Indian population still relies on 4G and 3G, maintaining demand for network coverage.

- Operational Efficiency: The company's focus on efficient operations for these mature networks helps maintain healthy profit margins.

- Financial Year 2023-24 Performance: Indus Towers reported robust operational performance, with its tower infrastructure continuing to be a critical asset for telecom operators leveraging 4G and 3G technologies.

Infrastructure Sharing Model

Indus Towers' infrastructure sharing model is a prime example of a Cash Cow. By allowing multiple telecom operators to co-locate their equipment on a single tower, Indus Towers significantly reduces the capital expenditure and operational costs for each operator. This is crucial in a market where tower deployment is expensive and often involves navigating complex regulations.

This shared model directly translates into higher tower utilization for Indus Towers, boosting its revenue per tower. For instance, in the fiscal year ending March 2024, Indus Towers reported a robust EBITDA margin, a testament to the efficiency of its asset utilization. The mature Indian telecom market, with its high penetration, provides a stable demand for these shared infrastructure services.

- Cost Efficiency: Operators save on site acquisition, construction, and maintenance by sharing towers.

- Revenue Maximization: Indus Towers maximizes revenue from each physical asset by leasing space to multiple tenants.

- Profitability: High occupancy rates in a mature market lead to strong profit margins and predictable cash flows for Indus Towers.

- Market Position: As one of the largest tower companies in India, Indus Towers benefits from economies of scale in its sharing operations.

Indus Towers' established tower infrastructure, particularly for 4G and 3G services, represents a significant cash cow. The company's ability to generate consistent revenue from these mature technologies, supported by strong operator relationships and high tower utilization through infrastructure sharing, solidifies its cash cow status. Its operational efficiency, demonstrated by robust EBITDA margins like the ₹10,791 crore reported for FY24, further underscores its strength in this segment.

| Metric | FY24 (₹ Crore) | FY23 (₹ Crore) |

|---|---|---|

| EBITDA | 10,791 | 11,011 |

| Number of Towers | 223,317 | 222,852 |

| Tenancy Ratio | 1.75 | 1.74 |

Preview = Final Product

Indus Towers BCG Matrix

The Indus Towers BCG Matrix preview you are viewing is the identical, fully unlocked document you will receive immediately after purchase. This means you are seeing the complete, unwatermarked analysis, ready for immediate integration into your strategic planning processes. No additional steps or hidden content will be revealed; what you see is precisely what you get to leverage for informed decision-making.

Dogs

While not explicitly labeled as a 'dog' within the BCG Matrix framework for Indus Towers, older infrastructure primarily supporting declining technologies like 2G or legacy 3G networks can be viewed in this category. These assets are characterized by minimal future growth potential and may incur ongoing maintenance costs without generating substantial new revenue streams.

Such infrastructure could represent a cash trap if significant capital is still allocated to their upkeep without a clear path to modernization or divestment. For instance, if a significant portion of Indus Towers' tower sites are heavily reliant on 2G technology, which is seeing a global decline in subscriber numbers, these sites would fit the 'dog' profile.

In 2024, the continued global shift towards 4G and 5G technologies means that investments in maintaining 2G or older 3G infrastructure are unlikely to yield attractive returns. Companies like Indus Towers must strategically manage these assets, potentially through offloading or repurposing, to avoid them becoming a drain on resources.

Towers in extremely remote locations with consistently low tenant numbers and high operating expenses, often due to heavy reliance on diesel generators, fit the 'dog' category. These sites might incur more in upkeep than they generate in revenue.

For instance, in early 2024, the Indian telecom sector continued to grapple with the economic viability of towers in Tier 3 and Tier 4 cities, where tenancy ratios can be as low as 1.2x, compared to 2.5x or higher in urban centers. The cost of maintaining these remote sites, including fuel for generators and security, can significantly erode profitability.

Companies like Indus Towers, which operate a vast network, must regularly assess these underperforming assets. If there's no clear path to increased tenancy or improved operational efficiency, these towers may be considered for divestment or consolidation to free up capital for more promising investments.

Non-core, sub-scale business ventures within Indus Towers, if they exist, would represent potential 'dogs' in the BCG matrix. These are typically smaller, experimental initiatives that haven't achieved significant market traction or a clear path to profitability. For instance, a new, unproven managed services offering or a niche technology pilot that hasn't attracted substantial clients would fall into this category.

These ventures often consume resources, including capital and management attention, without contributing meaningfully to revenue or market share. As of early 2024, Indus Towers' primary focus remains on its core tower infrastructure business, which is a market leader. Any smaller, ancillary services that are not scaling effectively would be candidates for re-evaluation or divestment to optimize resource allocation.

Inefficient Energy Solutions at Select Sites

Inefficient Energy Solutions at Select Sites represent a potential 'dog' within Indus Towers' portfolio. These are sites still primarily reliant on older, less efficient, and more expensive energy sources, such as solely diesel generators, without readily available renewable alternatives. Such locations can become significant cash drains due to elevated operating expenses.

These sites are characterized by high fuel costs and maintenance requirements, directly impacting profitability. For instance, in 2024, the cost of diesel power for telecom towers can be substantially higher per unit of energy compared to solar or hybrid solutions. This disparity means that while these sites contribute to network coverage, their operational expenditure disproportionately outweighs their revenue-generating capacity.

- High Operating Expenses: Sites relying solely on diesel power incur significant costs for fuel procurement, transportation, and generator maintenance.

- Low Return on Investment: The high operational costs at these inefficient sites limit their ability to generate a strong return, especially when compared to sites utilizing greener, more cost-effective energy solutions.

- Environmental Impact: Continued reliance on diesel also presents environmental concerns, which can affect corporate sustainability ratings and long-term operational viability.

Outdated Ancillary Services or Equipment

Within Indus Towers' portfolio, ancillary services or older equipment that are not keeping pace with technological evolution or shifting market needs could be classified as dogs. If these assets are not being upgraded or strategically retired, they might become a drain on resources. For instance, older generation passive equipment that is no longer compatible with newer network technologies or is too costly to maintain could fall into this category.

These outdated components can represent a significant challenge. They might continue to incur operational and maintenance expenses, such as power consumption and physical upkeep, without generating substantial revenue or contributing to future growth prospects. This situation could negatively impact overall profitability and resource allocation efficiency for Indus Towers.

- Obsolescence Risk: Older equipment, like 2G or early 3G passive components, faces a high risk of becoming obsolete as the industry transitions to 5G and beyond.

- Maintenance Costs: Continued maintenance of non-essential or outdated ancillary services can divert capital and human resources away from more strategic investments.

- Low Market Demand: Services or equipment that are no longer in demand by telecom operators due to technological advancements will have minimal growth potential.

- Resource Drain: In 2024, a focus on efficient operations means that any asset requiring significant upkeep without commensurate returns is a candidate for divestment or phase-out.

Older infrastructure, particularly that supporting declining technologies like 2G and legacy 3G, can be considered 'dogs' for Indus Towers. These assets have limited growth potential and may incur ongoing maintenance costs without significant new revenue. For example, in early 2024, the global shift to 4G and 5G made investments in 2G infrastructure less attractive.

Towers in remote locations with low tenancy and high operating expenses, often due to diesel reliance, also fit the 'dog' profile. In 2024, sites in Tier 3 and Tier 4 cities with tenancy ratios as low as 1.2x, compared to 2.5x in urban areas, exemplify this challenge.

Inefficient energy solutions, such as sites solely reliant on diesel generators, represent another 'dog' category due to high operating expenses. In 2024, diesel power costs were substantially higher per unit of energy than renewable alternatives, impacting profitability.

Outdated passive equipment and ancillary services not aligned with market needs or technological evolution are also potential 'dogs'. These assets may continue to incur costs without contributing to growth, highlighting a resource drain that requires strategic re-evaluation or divestment.

| Asset Category | BCG Classification | Rationale | 2024 Context | Potential Action |

|---|---|---|---|---|

| 2G/Legacy 3G Infrastructure | Dog | Minimal growth, ongoing maintenance costs | Global shift to 4G/5G | Divestment/Consolidation |

| Low Tenancy Remote Towers | Dog | High operating expenses, low revenue | Tenancy ratios < 1.5x in Tier 3/4 cities | Repurposing/Offloading |

| Diesel-Reliant Sites | Dog | High energy costs, environmental concerns | Diesel costs significantly higher than renewables | Transition to renewable energy |

| Outdated Passive Equipment | Dog | Obsolescence risk, maintenance costs | Incompatibility with new network technologies | Upgrade/Retire |

Question Marks

As 5G networks demand increased density, especially indoors, small cells and in-building solutions represent a significant growth avenue. Indus Towers is actively investigating these opportunities, recognizing their potential to complement their existing macro tower infrastructure.

While Indus Towers holds a dominant position in the macro tower market, its share in the specialized small cell and in-building solutions segment is likely still developing. This area requires substantial investment to build out the necessary infrastructure and secure key placements, positioning these offerings as potential question marks within the BCG matrix.

Indus Towers is venturing into new territories by offering infrastructure for the burgeoning Internet of Things (IoT) and smart city initiatives. This strategic pivot aims to diversify revenue beyond traditional mobile tower leasing.

These new ventures are positioned as question marks within the BCG matrix. While the IoT and smart city markets are experiencing rapid expansion, with global IoT spending projected to reach $1.1 trillion in 2024 according to IDC, Indus Towers is entering these as a nascent player with a currently small market share.

The scalability and ultimate success of these new revenue streams remain uncertain, making them classic question mark investments. Indus Towers will need to invest significantly to build market presence and prove the viability of its offerings in these competitive, evolving landscapes.

Indus Towers is exploring the deployment of EV charging stations at its extensive tower sites, a move that capitalizes on their existing infrastructure. This initiative taps into India's burgeoning electric vehicle market, a sector poised for significant expansion.

While this venture represents a promising avenue for growth, its current stage is marked by uncertainty. The actual market adoption rate and the financial viability of EV charging services for Indus Towers remain to be fully established, placing it firmly in the question mark category of the BCG Matrix.

Expansion into Untapped Deep Rural and Remote Areas

Expanding into untamed deep rural and remote areas for Indus Towers presents a classic question mark scenario within the BCG Matrix. While these regions offer significant untapped market potential, driven by government initiatives aimed at boosting rural connectivity, the immediate reality is challenging.

The high cost of infrastructure development in these terrains, coupled with lower population densities, means Indus Towers likely holds a low initial market share. This combination of high growth potential and low market share is the hallmark of a question mark. For instance, while India's BharatNet project aims to connect all Gram Panchayats with optical fiber, the last-mile connectivity in extremely remote locations remains a significant hurdle, impacting initial uptake and revenue generation.

Investing heavily in these areas could indeed transform them into stars if successful, but the substantial upfront capital expenditure and the uncertainty of immediate returns place them firmly in the question mark category. The potential for future growth is undeniable, as digital inclusion becomes a national priority, but the path to profitability is fraught with logistical and financial complexities.

- High Growth Potential: Government push for universal connectivity in rural India, with initiatives like BharatNet targeting over 600,000 villages, signifies a vast, underserved market.

- Low Initial Market Share: The logistical difficulties and high capital expenditure required to establish towers in remote, difficult terrains limit early market penetration for Indus Towers.

- Investment Dilemma: Significant investment is needed to unlock this growth, but the uncertain immediate returns make it a high-risk, high-reward proposition, characteristic of question marks.

- Future Star Potential: Successful penetration could lead to these areas becoming future stars as digital adoption increases and infrastructure costs potentially decrease over time.

Future-Proofing for 6G and Beyond

India's commitment to 6G research, with significant government backing, positions the nation for leadership in future telecom. Indus Towers' engagement in early-stage 6G development, while not yet yielding direct revenue, represents a strategic investment in a high-potential, albeit uncertain, future market.

The question mark in Indus Towers' BCG Matrix for 6G stems from its nascent stage; the technology promises substantial growth but lacks current market presence or defined revenue streams. This aligns with the characteristics of a question mark in the matrix, requiring careful resource allocation and strategic evaluation.

- India's Telecom Vision: The Indian government has allocated significant funds towards 6G research and development, aiming to establish India as a global pioneer in the next wave of wireless technology.

- Indus Towers' Strategic Position: While specific pilot projects or R&D investments by Indus Towers in 6G are not publicly detailed, preparing for future network demands is crucial for infrastructure providers.

- Market Uncertainty: 6G technology is still in its infancy, with no established market share or clear monetization strategies, making its future revenue potential a significant question mark for any player.

- High Growth, High Risk: The potential for exponential growth in 6G applications necessitates early exploration, but the inherent risks associated with unproven technologies require cautious investment.

Indus Towers' exploration into small cells and in-building solutions, alongside its ventures into IoT and smart city infrastructure, are positioned as question marks. These areas exhibit high growth potential, driven by evolving technological demands and government initiatives, yet Indus Towers currently holds a nascent market share in these segments.

The expansion into deep rural and remote areas also falls into the question mark category. While these regions offer substantial untapped market potential, the high costs associated with infrastructure development and lower population densities present significant challenges, limiting immediate market penetration and revenue generation.

Similarly, early-stage engagement with 6G technology represents a strategic bet on future growth. The technology's infancy means no established market share or clear monetization strategies exist, making its revenue potential a significant question mark, despite the Indian government's strong push for 6G research.

The company's foray into EV charging stations at its tower sites is another question mark. While capitalizing on India's growing EV market, the actual adoption rates and financial viability of these services for Indus Towers are yet to be fully established.

| BCG Category | Indus Towers Segment | Market Growth | Market Share | Strategic Implication |

|---|---|---|---|---|

| Question Mark | Small Cells & In-Building Solutions | High (5G densification) | Developing/Low | Requires significant investment to capture growth; potential to become a Star. |

| Question Mark | IoT & Smart City Infrastructure | High (Global IoT spending projected $1.1T in 2024) | Nascent/Low | Needs investment to build presence; uncertain immediate returns. |

| Question Mark | Deep Rural & Remote Connectivity | High (Govt. initiatives like BharatNet) | Low (High infra cost, low density) | High upfront capital, uncertain immediate returns; potential for future Star. |

| Question Mark | EV Charging Stations | High (India's EV market expansion) | Uncertain/Low | Market adoption and financial viability still to be proven; requires strategic evaluation. |

| Question Mark | 6G Technology Development | Very High (Future telecom evolution) | None/Zero | Early-stage investment in unproven technology; high risk, high potential reward. |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.