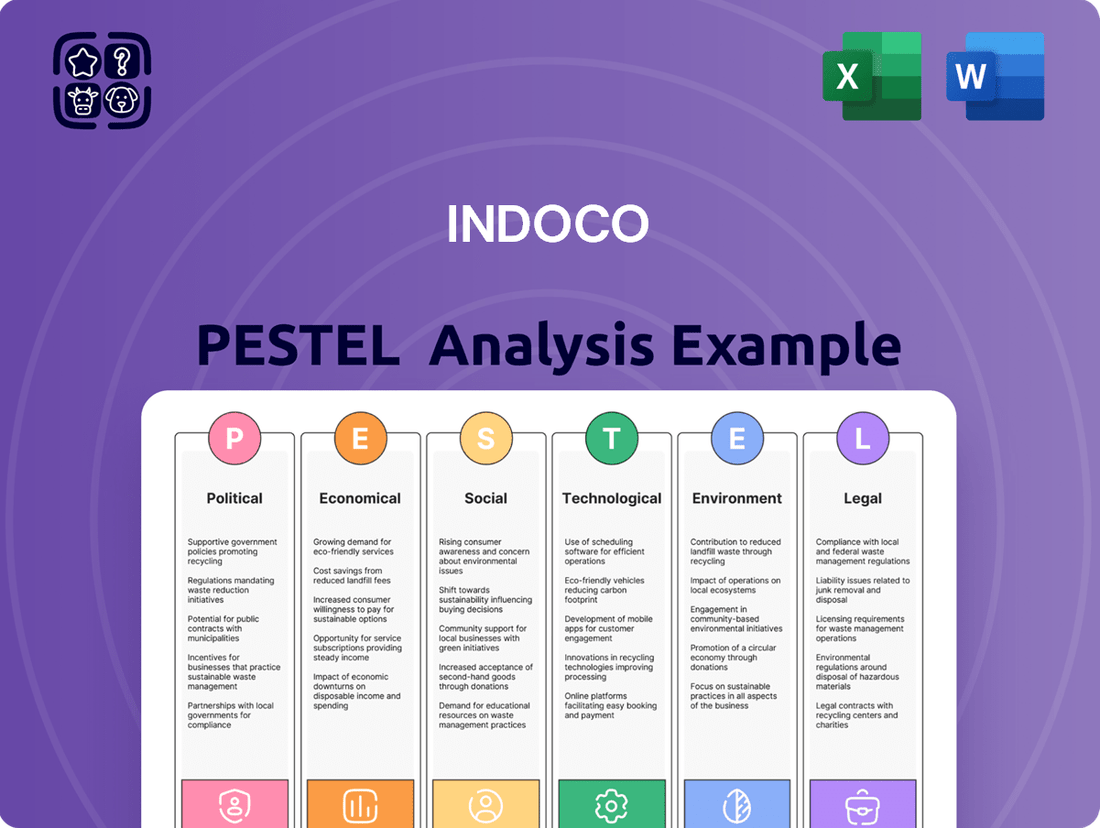

Indoco PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

Gain a strategic advantage with our comprehensive PESTLE analysis of Indoco. Uncover the critical political, economic, social, technological, legal, and environmental factors shaping the company's trajectory. This in-depth report is your key to understanding market dynamics and identifying future opportunities.

Don't be caught off guard by external shifts. Our expertly crafted PESTLE analysis provides actionable intelligence to inform your investment decisions and business strategies concerning Indoco. Ready to unlock deeper market insights?

Equip yourself with the knowledge to navigate Indoco's operating environment. This analysis goes beyond surface-level observations, delivering a thorough examination of the forces impacting the pharmaceutical sector. Secure your copy now for immediate access to vital market intelligence.

Political factors

The Indian government is a significant driver of pharmaceutical sector growth, particularly through its Production Linked Incentive (PLI) schemes. These schemes, launched to boost domestic manufacturing of Active Pharmaceutical Ingredients (APIs) and bulk drugs, aim to decrease reliance on imports. For Indoco Remedies, this translates into potential financial benefits and a more stable supply chain, especially as the government targets a 10% increase in API production by 2025-26.

Beyond just manufacturing, the government's strategic vision, encapsulated in the 'Discover in India for the world' initiative, is pushing for greater innovation. This focus extends beyond traditional generics, encouraging research and development into novel therapies. This shift could provide Indoco Remedies with opportunities to expand its portfolio and move up the value chain, capitalizing on government support for R&D investments.

India's proactive approach to aligning its pharmaceutical regulations with international standards, such as those set by the USFDA, EMA, and WHO-GMP, is a significant political factor. This harmonization is particularly beneficial for companies like Indoco Remedies, facilitating smoother market access and boosting confidence in Indian pharmaceutical products globally.

The country's commitment to these global benchmarks is evidenced by the substantial number of USFDA-approved manufacturing facilities in India, exceeding 650 and ranking highest outside the United States. This growing number directly supports enhanced export capabilities for Indian pharmaceutical manufacturers.

Government policies, particularly those dictating drug pricing, significantly influence pharmaceutical companies like Indoco Remedies. For instance, the inclusion of drugs under the National List of Essential Medicines (NLEM) often restricts the extent to which prices can be increased. This directly impacts revenue realization for specific products within the domestic market.

In 2024, the NLEM framework continues to be a key determinant for a substantial portion of the Indian pharmaceutical market. Companies must navigate these price controls, as minimal permitted increases can affect overall financial performance. This necessitates strategic adjustments in product portfolio management and market penetration to offset potential revenue limitations.

Trade policies and international relations

Global trade policies, including potential tariffs, can indirectly impact Indoco Remedies by affecting the cost of raw materials or finished goods, even if pharmaceuticals themselves are often exempt from direct tariffs. Shifts in trade relationships, particularly with key markets like the United States and European Union, could significantly influence Indoco’s international sales and the stability of its global supply chain. For instance, the imposition of new trade barriers or changes in existing agreements could lead to increased operational costs or reduced market access, impacting overall profitability.

Changes in international relations can create both opportunities and challenges. For example, evolving trade agreements might open new markets for Indoco's products, or conversely, geopolitical tensions could disrupt established supply routes. The pharmaceutical industry relies heavily on a smooth flow of materials and finished products across borders, making it particularly sensitive to shifts in trade policy and diplomatic relations. Indoco Remedies, with its significant international presence, must remain agile and adaptable to these evolving global dynamics to maintain its competitive edge.

- Trade Policy Impact: While pharmaceuticals are often shielded from direct tariffs, indirect cost increases on inputs due to broader trade disputes remain a concern for companies like Indoco Remedies.

- Market Access: Fluctuations in trade relations with major economic blocs such as the US and EU can directly affect Indoco's export revenues and market penetration strategies.

- Supply Chain Resilience: Geopolitical shifts and altered trade pacts necessitate robust supply chain management to mitigate disruptions in sourcing active pharmaceutical ingredients (APIs) and distributing finished products.

- Regulatory Alignment: Harmonization or divergence in pharmaceutical regulations between trading partners can also influence Indoco's product development and market entry plans.

Ease of doing business and investment climate

The Indian government's commitment to improving the ease of doing business significantly bolsters the investment climate. Streamlining regulatory processes and shortening approval timelines are key initiatives. For instance, the pharmaceutical sector benefits from policies allowing 100% Foreign Direct Investment (FDI) under automatic approval for greenfield projects. This proactive approach fosters a more conducive environment for companies like Indoco Remedies, supporting their expansion strategies and attracting crucial foreign capital.

This focus on regulatory efficiency directly impacts operational agility and cost-effectiveness. By reducing bureaucratic hurdles, the government empowers businesses to scale more rapidly and efficiently. Such improvements are vital for attracting and retaining foreign investment, which is critical for technological advancement and market competitiveness in the pharmaceutical industry.

- 100% FDI in Greenfield Pharma: Facilitates foreign investment in new manufacturing facilities.

- Streamlined Approvals: Reduces time and complexity for business operations.

- Favorable Investment Climate: Encourages both domestic and international capital inflow.

- Support for Expansion: Directly aids companies like Indoco Remedies in growth initiatives.

Government incentives like the Production Linked Incentive (PLI) schemes are actively boosting India's pharmaceutical manufacturing, aiming for a significant increase in API production by 2025-26. This focus on domestic production and innovation, coupled with the 'Discover in India' initiative, presents opportunities for Indoco Remedies to expand its portfolio and R&D capabilities. India's commitment to aligning its pharmaceutical regulations with international standards, such as USFDA and EMA, is a key political factor that enhances global market access for companies like Indoco, supported by over 650 USFDA-approved facilities in India.

Drug pricing policies, particularly the National List of Essential Medicines (NLEM), continue to influence revenue realization for companies like Indoco Remedies within the domestic market. Global trade policies and international relations also play a crucial role, impacting raw material costs, export revenues, and supply chain resilience for Indoco's international operations. The government's push for improved ease of doing business, including 100% FDI in greenfield pharmaceutical projects, further strengthens the investment climate and supports Indoco's expansion strategies.

What is included in the product

This Indoco PESTLE analysis dissects the critical external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that influence the company's operations and strategic landscape.

Provides a concise and actionable PESTLE analysis that helps Indoco identify and mitigate external risks, thereby relieving the pain point of navigating complex market dynamics.

Economic factors

India's domestic pharmaceutical market is projected to grow at a compound annual growth rate (CAGR) of around 10-12% through 2025. This robust expansion is fueled by increasing healthcare expenditure, a burgeoning middle class with greater disposable income, and a higher incidence of lifestyle-related illnesses.

Government programs such as Ayushman Bharat, the Pradhan Mantri Jan Arogya Yojana, are significantly boosting drug demand, particularly in underserved rural and semi-urban regions. This expansion of healthcare access directly translates into opportunities for pharmaceutical players like Indoco Remedies, especially within the branded generics and chronic disease management segments.

The global pharmaceutical market is on a strong growth trajectory, with projections indicating a significant expansion in the coming years. Analysts forecast the market to reach approximately $2.15 trillion by 2027, up from an estimated $1.6 trillion in 2023, showcasing robust compound annual growth rates.

Emerging markets are increasingly contributing to this expansion, gradually capturing a larger share of the global pharmaceutical sales. This shift is fueled by rising healthcare spending, improving access to medical services, and a growing middle class in these regions.

Key drivers for this market growth include the escalating demand for vaccines, novel therapeutics, and the burgeoning field of personalized medicine. These advancements are leading to new treatment options and a greater focus on patient-specific care.

This expanding global pharmaceutical landscape presents considerable opportunities for companies like Indoco Remedies, particularly for their international operations and export-oriented business segments. The increasing demand for quality pharmaceuticals worldwide can translate into substantial growth in their overseas sales and market penetration.

Fluctuations in raw material prices significantly influence the operating profit margins of pharmaceutical firms like Indoco Remedies. For instance, a surge in the cost of key active pharmaceutical ingredients (APIs) or excipients directly increases production expenses.

Inflationary pressures in 2024 and projected into 2025 present a notable challenge. If Indoco Remedies cannot fully pass these increased production costs onto consumers or find cost efficiencies, its profitability will likely be squeezed. For example, while specific 2024-2025 raw material price indices for pharmaceutical inputs are proprietary, general inflation rates in India, where Indoco is based, were around 5-6% in late 2023 and are expected to remain a factor in 2024.

Currency fluctuations

Currency fluctuations are a significant factor for Indoco Remedies, given its international presence. Changes in exchange rates directly affect the value of its foreign earnings when converted back to Indian Rupees. For instance, a stronger US Dollar or Euro against the INR can boost revenue reported in its financial statements from sales in these regions.

Conversely, unfavorable currency movements can erode profitability. Companies like Indoco often hedge their currency exposure to mitigate these risks, but the effectiveness of these strategies can vary. The volatility of exchange rates, particularly in emerging markets where Indoco has a growing footprint, adds another layer of complexity to financial planning and forecasting.

For the fiscal year 2023-24, the Indian Rupee experienced periods of depreciation against major currencies like the US Dollar and Euro. This trend, while potentially beneficial for export revenues, also impacts the cost of imported raw materials or intermediates. Understanding these dynamics is crucial for assessing Indoco's financial performance.

- Impact on Revenue: Favorable currency movements can inflate reported revenue from international sales. For example, if Indoco's sales in the US grow by 10% in USD terms, but the USD strengthens by 5% against the INR, its revenue in INR terms would see a higher percentage increase.

- Profitability Margins: Currency fluctuations can compress or expand profit margins depending on whether costs or revenues are more exposed to foreign exchange volatility.

- Hedging Strategies: Companies like Indoco utilize financial instruments to hedge against adverse currency movements, aiming to stabilize earnings.

- Emerging Market Exposure: Indoco's expansion into emerging markets means it's increasingly exposed to the currency risks associated with those economies, which can be more pronounced.

Access to financing and investment trends

Access to bank financing and the general investment climate significantly shape a company's ability to fund capital expenditures and pursue expansion. For Indoco Remedies, a robust investment climate translates directly into their capacity for growth. In recent years, the company has actively utilized debt financing to support its ambitious plans, including significant capital expenditure for plant refurbishment and the establishment of new facilities. This reliance on financial markets underscores the importance of favorable lending conditions and investor confidence for their ongoing development strategies.

The overall investment trends in the pharmaceutical sector, particularly in India, play a vital role. As of late 2024, the Indian pharmaceutical market continues to attract significant domestic and foreign investment, driven by increasing healthcare demand and government support for manufacturing. This positive trend suggests that companies like Indoco Remedies are likely to find continued access to capital, albeit with careful consideration of interest rates and economic stability. The ability to secure financing at reasonable costs remains a key determinant of their project viability and future expansion.

- Indoco Remedies' significant debt-funded capital expenditure highlights its reliance on external financing for plant upgrades and new facilities.

- The overall investment climate directly impacts Indoco's ability to fund capital expenditure and expansion plans through access to bank financing.

- Positive investment trends in the Indian pharmaceutical sector, as observed in late 2024, generally support companies like Indoco in securing necessary capital.

- The cost and availability of financing are critical factors influencing the success and execution of Indoco's growth strategies.

Economic factors significantly shape Indoco Remedies' operating environment. Inflationary pressures, particularly in raw material costs, directly impact profit margins, with general inflation in India hovering around 5-6% in late 2023, a trend expected to persist into 2024. Currency fluctuations also play a crucial role, with the Indian Rupee experiencing depreciation against major currencies like the US Dollar and Euro in fiscal year 2023-24, affecting both export revenues and the cost of imported inputs.

Access to financing is a key economic consideration, with Indoco Remedies relying on debt to fund capital expenditures for plant upgrades and new facilities. The investment climate in India's pharmaceutical sector, attracting substantial domestic and foreign capital as of late 2024, generally supports access to capital, though interest rates and economic stability remain critical factors.

Preview Before You Purchase

Indoco PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Indoco PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain a clear understanding of the external forces shaping Indoco's business landscape. This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises.

Sociological factors

Growing health consciousness significantly boosts the demand for pharmaceutical products. This heightened awareness, particularly after the pandemic, has led to increased consumption of medicines and a greater emphasis on self-care practices. For instance, global healthcare spending reached an estimated $10 trillion in 2023, reflecting this trend and benefiting companies like Indoco Remedies that cater to these evolving consumer needs.

The aging global population is a substantial tailwind for Indoco Remedies. For instance, in 2024, over 1 in 5 people in Europe were projected to be 65 or older, a trend mirrored in many of Indoco's key markets. This demographic shift directly fuels demand for chronic care medications, a core area for the company.

Lifestyle diseases like cardiovascular issues, diabetes, and gastrointestinal disorders are also on the rise, further bolstering the market for Indoco's therapeutic offerings. Reports from 2023 indicated a concerning increase in obesity and related conditions in several developing economies, presenting sustained long-term growth opportunities for the pharmaceutical sector.

The increasing demand for affordable healthcare solutions, especially generic medicines, is a significant sociological driver for companies like Indoco Remedies. In 2023, the Indian pharmaceutical market saw robust growth in the generics segment, driven by price-sensitive consumers and a growing awareness of cost-effective treatment options.

Government initiatives further bolster this trend. For instance, India's Jan Aushadhi Kendras, which provide generic medicines at substantially lower prices, have expanded their reach, indicating a societal preference for affordability. By focusing on generic drug production, Indoco Remedies is well-positioned to meet this widespread demand, enhancing accessibility to essential medicines for a larger population.

Urbanization and healthcare access in Tier II/III cities

The increasing migration of populations to Tier II and Tier III cities in India is a major driver for expanded healthcare access. This trend directly fuels domestic pharmaceutical sales as more people gain proximity to medical facilities and treatments. For companies like Indoco Remedies, this demographic shift presents a substantial opportunity to tap into previously underserved markets, necessitating tailored distribution networks and marketing approaches.

By 2024, it's estimated that over 40% of India's population will reside in urban areas, with a significant portion of this growth occurring in smaller cities. This urbanization directly translates into increased demand for pharmaceuticals. Indoco can leverage this by strengthening its presence in these rapidly developing regions.

- Urban Growth: India's urban population is projected to reach over 600 million by 2030, with Tier II/III cities accounting for a substantial share of this expansion.

- Healthcare Spending: Per capita healthcare expenditure in Tier II cities is rising, indicating greater affordability and willingness to spend on health services and medicines.

- Market Penetration: Pharmaceutical companies focusing on these areas can achieve higher market penetration, as seen by the growth in sales of chronic and acute care medications in these regions.

- Distribution Networks: The need for efficient last-mile delivery in these expanding urban centers is crucial, with investments in logistics expected to grow to meet demand.

Changing consumer preferences and digital health adoption

Consumer preferences are significantly shifting towards a more personalized and accessible healthcare experience, often referred to as the consumerization of healthcare. This means patients are increasingly acting like consumers, actively seeking out information and demanding convenience in how they receive care and purchase health products. The rapid adoption of digital tools, such as telemedicine and a growing array of digital health solutions, directly impacts how people access and consume healthcare. For instance, a 2024 report indicated that over 60% of consumers prefer to interact with healthcare providers digitally, highlighting a clear demand for online consultations and health management apps.

This evolving landscape compels pharmaceutical companies, like Indoco Remedies, to rethink their engagement strategies. Integrating digital channels is no longer optional but essential for better patient engagement and expanding market reach. Companies are investing in digital platforms to provide educational content, support patient adherence to medication, and offer virtual assistance. By 2025, it's projected that the global digital health market will exceed $600 billion, underscoring the immense opportunity and necessity for companies to have a robust digital presence to connect with patients effectively.

The embrace of digital health tools translates into tangible business opportunities and challenges:

- Increased Demand for Telehealth: Patients are increasingly utilizing virtual consultations, leading to a greater need for digital-first patient support and prescription fulfillment services.

- Personalized Health Management: The rise of wearable technology and health apps means consumers expect tailored health advice and support, pushing companies to develop data-driven patient programs.

- Digital Engagement in Pharma Marketing: Pharmaceutical companies are leveraging social media and digital platforms to educate consumers and healthcare professionals, moving beyond traditional marketing methods.

- Data Privacy and Security Concerns: As more health data is digitized, ensuring robust data privacy and security becomes paramount for maintaining consumer trust and regulatory compliance.

Societal shifts towards preventative healthcare and self-management are increasing demand for pharmaceuticals, aligning with Indoco Remedies' focus on chronic and acute care. The growing preference for affordable generics, supported by government initiatives like Jan Aushadhi Kendras, also presents a significant market advantage for the company.

Technological factors

Technological advancements are revolutionizing drug discovery and R&D. Pharmaceutical companies, including Indoco Remedies, are increasingly leveraging digital tools, artificial intelligence (AI), and machine learning to streamline their research processes.

These technologies are crucial for enhancing R&D efficiency and significantly shortening the time it takes to bring new drugs to market. For instance, investments in AI and advanced analytics are projected to reduce drug discovery timelines by an estimated 30-40% in the coming years.

By adopting these innovations, Indoco Remedies can accelerate the development of novel drugs and therapies, thereby improving patient outcomes and strengthening its competitive position in the global pharmaceutical landscape. The ability to predict drug efficacy and identify potential candidates more rapidly is a key benefit.

Indoco Remedies is actively upgrading and expanding its production facilities to align with global quality benchmarks, a critical step for meeting international demand. This includes significant investment in advanced manufacturing processes, particularly for complex products like biosimilars and specialized pharmaceuticals, aiming to boost scalability and efficiency. For instance, in the fiscal year ending March 31, 2024, Indoco reported capital expenditure of INR 139.2 crore, a substantial portion of which is directed towards enhancing manufacturing capabilities and capacity expansion.

The company's focus on contract manufacturing services is also bolstered by these technological advancements. By adopting cutting-edge production techniques, Indoco can offer more competitive and sophisticated services to its global partners. This strategic enhancement of manufacturing processes directly supports Indoco's competitive edge in the pharmaceutical sector, ensuring they can deliver high-quality products at scale. The ongoing modernization of their plants, including those in India, is designed to meet stringent regulatory requirements across major markets.

Digital transformation is profoundly reshaping how pharmaceutical companies like Indoco operate, particularly in sales and supply chain management. The ongoing digitization of sales processes, marketing outreach, and intricate supply chains promises significant improvements in efficiency and compliance. For instance, by the end of 2024, the global pharmaceutical supply chain management market is projected to reach approximately $2.5 billion, highlighting the scale of this digital shift.

This digital overhaul directly benefits companies such as Indoco Remedies by enabling more robust inventory management, ensuring products are available when and where needed. Furthermore, it facilitates faster and more reliable distribution networks, a critical factor in the timely delivery of medicines. The ability to conduct more targeted marketing efforts, driven by data analytics from digitized sales interactions, allows for more effective patient engagement strategies.

Focus on high-value segments and complex generics

Indian pharmaceutical companies are strategically targeting high-value segments like biosimilars and specialized medicines, a move necessitating significant investments in advanced technologies. This pivot towards complex generics and novel therapies is driven by the pursuit of higher profit margins and global market competitiveness. For instance, the biosimilars market in India was projected to reach USD 5.5 billion by 2026, indicating a strong growth trajectory and the underlying technological demand.

To excel in these sophisticated areas, continuous technological upgrades are paramount. This includes adopting cutting-edge R&D platforms, advanced manufacturing processes, and robust quality control systems. Companies are channeling more resources into developing complex generics that often face less competition and offer better returns, demanding sophisticated synthesis and formulation expertise.

- Focus on Biosimilars: Indian firms are increasing R&D in biosimilars, aiming to capture a larger share of this rapidly growing global market, estimated to be worth over USD 20 billion by 2027.

- Specialty Drugs Investment: Significant capital is being allocated to developing and manufacturing specialty drugs for chronic diseases, requiring advanced chemical synthesis and delivery systems.

- Complex Generics Development: There's a trend towards creating generics with complex active pharmaceutical ingredients (APIs) and challenging formulations, such as injectables and controlled-release dosage forms.

- R&D Expenditure: Leading Indian pharma companies are boosting their R&D spending, with some allocating over 8-10% of their revenue towards innovation and technological advancement in 2024-2025.

Automation and data analytics

The increasing integration of automation and data analytics in manufacturing and operations is a significant technological driver for companies like Indoco. This adoption directly translates to improved product quality and a noticeable reduction in operational errors, ultimately boosting overall productivity. For instance, in 2024, the global industrial automation market was valued at approximately USD 225 billion, with advanced analytics playing a crucial role in its growth, projected to reach over USD 350 billion by 2029.

This technological advancement is not just about efficiency; it's fundamental for maintaining a competitive edge in the market. Furthermore, it's essential for adhering to increasingly strict regulatory standards prevalent across various industries. Companies leveraging these technologies are better positioned to meet compliance requirements and innovate faster.

- Increased Productivity: Automation can speed up production cycles significantly.

- Enhanced Quality Control: Data analytics identifies deviations from quality standards in real-time.

- Cost Reduction: Lower error rates and optimized resource allocation lead to cost savings.

- Regulatory Compliance: Advanced systems help track and report data for regulatory adherence.

Technological advancements are transforming Indoco's R&D, with AI and machine learning set to cut drug discovery times by up to 40%. The company is also investing heavily in advanced manufacturing, with capital expenditure of INR 139.2 crore in FY24, to boost scalability for complex products like biosimilars. Digital transformation is improving Indoco's sales and supply chain management, with the global market for these services expected to reach $2.5 billion by the end of 2024.

| Technological Factor | Impact on Indoco | Supporting Data/Examples |

| AI & Machine Learning in R&D | Accelerated drug discovery and development | Potential 30-40% reduction in drug discovery timelines. |

| Advanced Manufacturing | Increased scalability and efficiency for complex products | INR 139.2 crore capital expenditure in FY24; focus on biosimilars and specialty drugs. |

| Digital Transformation (Sales & Supply Chain) | Enhanced operational efficiency and compliance | Global pharmaceutical supply chain management market projected at $2.5 billion by end of 2024. |

| Automation & Data Analytics | Improved product quality and productivity | Global industrial automation market valued at approx. $225 billion in 2024. |

Legal factors

The pharmaceutical and medical device sectors in India are heavily regulated, with key legislation like the Drugs and Cosmetics Act and the Medical Device Rules dictating stringent standards for manufacturing, import, sales, and product labeling. For Indoco Remedies, staying compliant with these evolving legal frameworks is paramount, particularly as new regulations are introduced for areas like in-vitro diagnostics and broader medical devices.

Indoco Remedies must navigate evolving legal landscapes, particularly concerning Good Manufacturing Practices (GMP). Recent updates to India's Schedule M of the Drugs and Cosmetics Rules 1945 significantly elevate regulatory benchmarks for drug manufacturing. These changes necessitate substantial investments in premises, plant infrastructure, and equipment to comply with the new stringent requirements.

The company's commitment to quality is tested as it must ensure all its manufacturing sites, including its recently commissioned solid dosage facility and its active pharmaceutical ingredient (API) plants, adhere to these enhanced domestic regulations. Furthermore, Indoco must maintain compliance with rigorous international quality standards, such as those set by the US Food and Drug Administration (USFDA) and the UK Medicines and Healthcare products Regulatory Agency (UKMHRA), to continue accessing key global markets.

Amendments to patent rules are tightening deadlines, for instance, the 'Request for Examination' must be filed within 31 months from the priority date in India, requiring Indoco to streamline its patent application process to ensure timely protection of its innovations.

The impending expiration of patents on several blockbuster biologics by 2025 is a significant development. This opens up substantial avenues for generic and biosimilar manufacturers, including Indoco Remedies, to introduce their own versions, potentially capturing a considerable market share in the pharmaceutical sector.

Marketing and ethical conduct regulations

Marketing and ethical conduct regulations significantly shape how pharmaceutical companies like Indoco operate. The Uniform Code for Pharmaceutical Marketing Practices (UCPMP) is a key example, strictly prohibiting gifts or financial inducements to healthcare professionals. This focus on ethical engagement is crucial; failing to comply can lead to severe reputational damage and financial penalties, impacting Indoco's market standing.

Adherence to these ethical standards is not just about avoiding trouble; it's about building trust. For instance, in 2024, regulatory bodies worldwide continued to scrutinize marketing practices closely, leading to several significant fines for non-compliance across the industry. Indoco's commitment to transparent and ethical marketing is therefore vital for sustained growth and maintaining its license to operate.

The implications for Indoco are clear: developing marketing strategies that align with the UCPMP and similar global regulations is a necessity. This involves focusing on providing accurate product information and educational resources rather than promotional incentives.

- Regulatory Scrutiny: Increased enforcement of marketing regulations by bodies like the US FDA and EMA in 2024 led to substantial penalties for breaches of ethical conduct.

- Reputational Risk: Ethical lapses in marketing can erode public and professional trust, impacting prescription rates and brand loyalty for companies like Indoco.

- Compliance Costs: Investing in robust compliance programs and training for sales and marketing teams is essential to navigate complex ethical marketing landscapes.

- Market Access: Demonstrating a commitment to ethical practices can positively influence market access and formulary decisions by healthcare providers and payers.

Data privacy laws

India's new draft Digital Personal Data Protection Rules are set to streamline the Digital Personal Data Protection Act, 2023, strengthening the protection of digital personal data within the country. This evolving legal landscape directly impacts pharmaceutical companies, particularly those involved in digital health services or managing sensitive patient information, requiring robust compliance measures.

Adherence to these data privacy regulations is paramount for pharmaceutical entities to maintain trust and avoid potential legal repercussions. For instance, the Act mandates clear consent for data processing and outlines significant penalties for non-compliance, which could affect a company's financial performance and reputation.

- Enhanced Data Protection: The Digital Personal Data Protection Act, 2023, and its accompanying rules establish a comprehensive framework for safeguarding digital personal data in India.

- Compliance Imperative: Pharmaceutical companies leveraging digital health platforms or handling patient data must ensure strict adherence to these regulations.

- Consent and Transparency: Key provisions emphasize obtaining explicit consent for data processing and maintaining transparency with data subjects.

- Penalties for Non-Compliance: The Act introduces significant financial penalties for breaches, underscoring the importance of a robust data privacy strategy.

Indoco Remedies must navigate a complex web of legal and regulatory requirements in India and globally. The Drugs and Cosmetics Act and Medical Device Rules set stringent standards, while evolving GMP regulations, like the updated Schedule M, demand significant investment in infrastructure to maintain compliance. Furthermore, patent law amendments, such as the 31-month deadline for Request for Examination, necessitate agile patent application management.

The company's adherence to ethical marketing practices, guided by the Uniform Code for Pharmaceutical Marketing Practices (UCPMP), is crucial. Global scrutiny on marketing in 2024 resulted in substantial penalties for industry non-compliance, highlighting the risk of reputational damage and financial penalties for Indoco if ethical standards are breached. This also impacts market access and requires a focus on accurate product information over promotional incentives.

Additionally, India's Digital Personal Data Protection Act, 2023, and its upcoming rules mandate robust data privacy measures for companies handling sensitive patient information, with significant penalties for non-compliance. Maintaining transparency and obtaining explicit consent for data processing are key requirements that Indoco must prioritize.

Environmental factors

Pharmaceutical manufacturing, including operations like Indoco Remedies, inherently produces chemical waste that can significantly impact water and air quality. In 2023, the Indian pharmaceutical industry faced increased scrutiny regarding its environmental practices, with reports highlighting concerns over effluent discharge and air emissions from manufacturing units.

Consequently, Indoco Remedies must navigate a landscape of increasingly strict environmental regulations. For instance, India's Central Pollution Control Board (CPCB) has been tightening emission standards for various industrial sectors, including pharmaceuticals, pushing companies to invest in advanced pollution control technologies.

Effective waste management systems are crucial for compliance and sustainability. This involves not only treating wastewater to meet discharge norms but also safely disposing of solid and hazardous chemical byproducts generated during drug synthesis and production, a challenge many Indian pharma companies are actively addressing.

Minimizing its ecological footprint requires Indoco to implement robust emission control measures, such as scrubbers and filters, to reduce air pollutants. The company’s commitment to environmental stewardship will be increasingly measured by its success in managing these waste streams and controlling its overall environmental impact, a trend expected to intensify through 2025.

Indoco’s commitment to sustainable manufacturing is crucial for navigating the evolving environmental landscape. Reducing energy consumption and waste is a key focus, with many companies aiming for significant cuts in their carbon footprint.

For instance, the global manufacturing sector's greenhouse gas emissions were substantial in recent years, highlighting the urgent need for change. Companies like Indoco are investing in eco-friendly technologies, such as renewable energy sources and zero-waste production methods, to meet stringent global environmental standards and maintain competitiveness.

Embracing these greener practices not only addresses regulatory pressures but also appeals to an increasingly environmentally conscious consumer base. The push towards circular economy principles within manufacturing is gaining momentum, with a growing emphasis on product lifecycle management and resource efficiency.

Companies like Indoco must navigate stringent environmental regulations, often requiring clearances from authorities such as the Ministry of Environment, Forest and Climate Change (MoEFCC). Compliance with acts like the Environmental Protection Act, 1986, is non-negotiable.

Mandatory environmental audits are a crucial part of ensuring adherence to these regulations. In 2023, for instance, India saw a significant increase in environmental penalties, with some companies facing substantial fines for non-compliance, underscoring the financial risks involved.

Failure to meet environmental standards can lead to severe consequences, including hefty fines and even the temporary or permanent halt of operations. This regulatory landscape directly impacts operational costs and strategic planning for businesses operating within India.

Water usage and management

Pharmaceutical manufacturing is inherently water-intensive, with processes like cleaning, synthesis, and cooling requiring significant volumes. For instance, in 2023, the global pharmaceutical market's water consumption was estimated to be in the billions of gallons annually, a figure projected to grow with increased production demands. The potential for aquatic pollution from the discharge of wastewater containing active pharmaceutical ingredients (APIs) and other chemical residues presents a substantial environmental challenge.

Effective water management and robust wastewater treatment are therefore not just best practices but necessities for companies like Indoco. These measures are critical for ensuring compliance with increasingly stringent environmental regulations, such as those enforced by the Central Pollution Control Board (CPCB) in India, which sets discharge limits for various pollutants. Companies failing to meet these standards face hefty fines and reputational damage.

Looking ahead to 2024 and 2025, the focus on water stewardship will intensify.

- Increased Scrutiny: Regulatory bodies worldwide are expected to tighten wastewater discharge standards for pharmaceutical facilities.

- Technological Investment: Companies will likely invest more in advanced water treatment technologies, such as reverse osmosis and advanced oxidation processes, to meet these stricter requirements.

- Resource Efficiency: A drive towards water recycling and reuse within manufacturing processes will become more prominent to reduce overall consumption and operational costs.

- ESG Reporting: Water usage and management metrics are becoming key components of Environmental, Social, and Governance (ESG) reporting, influencing investor sentiment and corporate valuation.

Supply chain sustainability

Ensuring environmental sustainability across Indoco's supply chain, from sourcing Active Pharmaceutical Ingredients (APIs) to final distribution, is becoming a critical imperative. This focus extends to evaluating and reducing environmental risks posed by suppliers, and actively encouraging sustainable procurement strategies.

The pharmaceutical industry, including companies like Indoco, faces growing pressure to adopt greener logistics and reduce carbon footprints. For instance, a 2024 report highlighted that pharmaceutical logistics account for a significant portion of the sector's emissions, with a push for greater use of electric vehicles and optimized routing.

- Supplier Environmental Audits: Indoco can implement rigorous environmental audits for its key API suppliers to assess their waste management, water usage, and emissions.

- Sustainable Packaging Initiatives: Exploring and adopting biodegradable or recyclable packaging materials for finished products can significantly reduce environmental impact.

- Green Logistics Partnerships: Collaborating with logistics providers committed to reducing emissions, such as those utilizing alternative fuels or electric fleets, is crucial.

- Circular Economy Principles: Investigating opportunities for product lifecycle management, including responsible disposal and potential recycling of manufacturing by-products, aligns with sustainability goals.

The Indian government, through bodies like the Central Pollution Control Board (CPCB), is consistently strengthening environmental regulations for industries, including pharmaceuticals. This means companies like Indoco Remedies must invest in advanced pollution control technologies to meet stricter discharge and emission standards, a trend expected to continue through 2025.

Water usage is a significant environmental consideration for pharmaceutical manufacturing, with billions of gallons consumed globally each year. Indoco must prioritize robust wastewater treatment and water recycling initiatives to comply with regulations and minimize aquatic pollution, especially given the potential presence of APIs in discharged water.

As of 2024, there's a growing emphasis on sustainable supply chains within the pharmaceutical sector. This includes pressure on companies to conduct environmental audits of their suppliers and adopt greener logistics, such as electric vehicles for distribution, to reduce the industry's overall carbon footprint.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Indoco is built upon a robust foundation of data sourced from official regulatory bodies, reputable market research firms, and leading economic institutions. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in credible, up-to-date information.