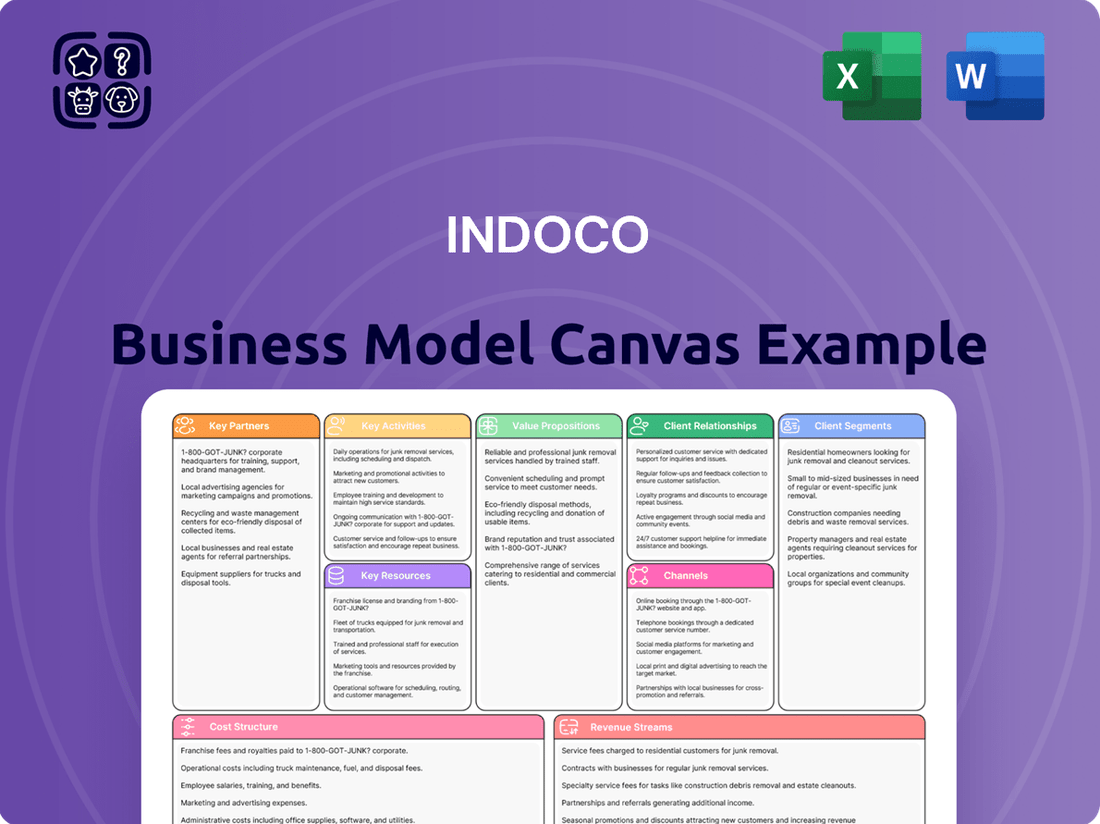

Indoco Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

Unlock the full strategic blueprint behind Indoco's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into Indoco’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how Indoco operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out Indoco’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for Indoco. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

International pharmaceutical companies are vital partners for Indoco, enabling crucial out-licensing of products and securing market access in highly regulated regions like the US and Europe. These collaborations frequently involve co-development or distribution agreements, effectively leveraging Indoco's robust manufacturing capabilities with the partner's established local market expertise and extensive sales networks. This strategic approach significantly de-risks Indoco's international expansion efforts and accelerates revenue generation from new geographies, contributing to a projected 6-8% growth in the global pharmaceutical market in 2024. For instance, such partnerships help Indoco navigate complex regulatory pathways, ensuring their products reach key markets efficiently.

Indoco maintains robust partnerships with global pharmaceutical majors and biotech firms for contract manufacturing (CRAMS). These are long-term, strategic relationships anchored in unwavering trust, stringent quality control, and strict regulatory compliance. Such collaborations ensure a stable revenue stream for Indoco, significantly boosting the utilization of its advanced manufacturing capacities. For instance, in fiscal year 2024, Indoco continued to leverage these alliances to maintain strong operational efficiency and capacity utilization.

A robust network of API and raw material suppliers is fundamental for Indoco to ensure continuous production. The company strategically establishes long-term contracts with vetted, quality-conscious partners, crucial for mitigating supply chain disruptions. This approach is vital for maintaining production schedules and product quality, especially given global supply chain volatilities. For instance, pharmaceutical companies in India, including Indoco, have continued to focus on diversifying their sourcing to reduce reliance on single regions in 2024. This diversification helps manage input costs and ensures the steady availability of key starting materials.

Distribution & Logistics Partners

Indoco relies on an extensive network of distribution and logistics partners, including over 2,500 stockists and 28 clearing and forwarding agents as of 2024, to ensure its pharmaceutical products reach pharmacies and hospitals across India and international markets. These partners are fundamental to the supply chain, managing inventory and facilitating crucial last-mile delivery. Efficient logistics are vital for Indoco's market penetration and product accessibility, underpinning its operational reach.

- Indoco leverages over 2,500 stockists across India as of 2024.

- The company utilizes 28 dedicated clearing and forwarding (C&F) agents.

- These partners ensure product availability in over 90% of Indian districts.

- International distribution spans key markets in Africa, Asia, and CIS regions.

Research Institutions & Universities

Collaborations with leading research institutions and universities provide Indoco access to cutting-edge early-stage innovation and a crucial pipeline of scientific talent. These partnerships foster joint research projects, accelerating the development of new technology platforms and novel drug discovery efforts. For example, the Indian pharmaceutical sector saw an estimated 10-12% growth in R&D spending in 2024, emphasizing such external collaborations to enhance product pipelines. This strategic approach helps Indoco stay at the forefront of pharmaceutical science and continuously build its future product portfolio.

- Access to early-stage innovation and scientific talent.

- Joint research projects and new technology platforms.

- Novel drug discovery efforts enhancing product pipeline.

- Staying at the forefront of pharmaceutical science.

Indoco strategically partners with international pharmaceutical firms for out-licensing and market access, leveraging a projected 6-8% global pharma market growth in 2024. Robust contract manufacturing alliances ensure stable revenue and high capacity utilization, while long-term contracts with API suppliers mitigate supply chain risks. An extensive distribution network, including over 2,500 stockists and 28 C&F agents as of 2024, ensures widespread product availability. Additionally, collaborations with research institutions drive innovation, supported by an estimated 10-12% R&D spending growth in the Indian pharmaceutical sector in 2024.

| Partnership Type | Key Contribution | 2024 Data/Impact |

|---|---|---|

| International Pharma | Out-licensing & Market Access | Global pharma market growth 6-8% |

| Distribution & Logistics | Market Penetration | Over 2,500 stockists; 28 C&F agents |

| Research Institutions | Innovation & R&D | Indian pharma R&D spending up 10-12% |

What is included in the product

A detailed Indoco Business Model Canvas that outlines its customer segments, revenue streams, and key resources, offering a strategic roadmap.

This canvas provides a clear, structured overview of Indoco's operations, designed for strategic planning and stakeholder communication.

Provides a structured framework to systematically identify and address underlying business challenges.

Helps to visualize and prioritize customer pains, guiding the development of targeted solutions.

Activities

Indoco's Research & Development is crucial for expanding its portfolio of generic formulations (FDFs) and refining Active Pharmaceutical Ingredient (API) synthesis processes. This core activity aims to build a robust product pipeline, especially for highly regulated international markets. In 2024, Indoco continued to focus on formulation development and analytical method development, with ongoing clinical studies supporting new product registrations. These efforts are vital for sustaining growth, with the company consistently investing in R&D to meet global pharmaceutical demands.

Indoco's core activity is large-scale pharmaceutical manufacturing, producing both finished dosage forms and Active Pharmaceutical Ingredients (APIs).

This takes place across multiple state-of-the-art facilities, with key sites holding approvals from global regulators like the US-FDA and UK-MHRA in 2024, ensuring high quality standards.

These advanced operations support Indoco's own pharmaceutical brands, driving their market presence.

Additionally, the robust manufacturing capabilities facilitate contract manufacturing services for other companies, leveraging their compliant infrastructure.

A core activity involves diligently managing the intricate global process of securing and maintaining regulatory approvals for Indoco’s products and facilities. This necessitates preparing and submitting comprehensive dossiers, such as Abbreviated New Drug Applications (ANDAs), to health authorities worldwide, a critical undertaking given the increasing number of inspections. For instance, the US FDA conducted over 1,500 drug manufacturing inspections globally in 2024, highlighting the continuous operational focus on strict adherence to current Good Manufacturing Practices (cGMP) to ensure compliance and market access.

Marketing & Sales

Indoco's marketing and sales efforts are pivotal, particularly within the domestic market where brands are promoted to healthcare professionals through a substantial field force. As of fiscal year 2024, Indoco maintains an extensive network of over 2,500 medical representatives across India, ensuring broad reach and direct engagement with physicians. Internationally, the focus shifts to robust B2B marketing strategies targeting potential partners and clients for contract manufacturing and exports. These activities are crucial for driving prescription demand, cultivating strong brand equity, and securing vital sales orders, underpinning the company's revenue generation.

- Indoco's domestic field force exceeds 2,500 medical representatives in 2024.

- International marketing emphasizes B2B partnerships and client acquisition.

- These activities are essential for driving prescription demand and building brand equity.

- Securing sales orders is a primary outcome of the integrated marketing strategy.

Supply Chain Management

Indoco's supply chain management orchestrates the entire value chain, from raw material procurement to finished goods distribution. This involves strategic sourcing, rigorous inventory management, and precise production planning to ensure product availability and cost optimization. An efficient supply chain is crucial for meeting diverse market demands and sustaining profitability, especially given global pharmaceutical supply chain complexities in 2024. Effective logistics minimize lead times and reduce operational costs.

- Global pharmaceutical supply chains faced an average 15% increase in logistics costs by early 2024 due to geopolitical shifts.

- Companies prioritizing digital supply chain tools saw up to a 10% improvement in on-time delivery rates in 2024.

- Inventory optimization efforts in pharma aimed to reduce holding costs by 5-7% in 2024 while maintaining stock levels.

- Strategic sourcing initiatives in 2024 focused on diversifying suppliers to mitigate risks, with some firms expanding their vendor base by 20%.

Indoco's core activities revolve around robust R&D for new formulations and APIs, coupled with large-scale manufacturing across globally approved facilities, including US-FDA sites in 2024.

Diligent regulatory affairs ensure compliance, managing submissions like ANDAs, essential as US FDA conducted over 1,500 drug manufacturing inspections globally in 2024.

Their extensive marketing and sales network, featuring over 2,500 medical representatives in India in FY2024, drives domestic demand and international B2B partnerships.

Efficient supply chain management, vital given a 15% increase in global logistics costs by early 2024, ensures product availability and cost optimization.

Full Version Awaits

Business Model Canvas

The Indoco Business Model Canvas preview you're viewing is the actual document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the complete file, ensuring you know exactly what you're getting. Once your order is processed, you'll gain full access to this professionally structured and ready-to-use Business Model Canvas, identical to this preview.

Resources

Indoco’s core physical assets include 9 manufacturing facilities across India, with key plants for Finished Dosage Forms (FDFs) and Active Pharmaceutical Ingredients (APIs) located in states like Goa and Maharashtra. These facilities hold WHO-GMP certifications and approvals from major international regulatory bodies, such as the US FDA and UK MHRA, which are crucial for accessing regulated export markets. This robust infrastructure enables large-scale, high-quality production, supporting a significant portion of Indoco's revenue, which exceeded Rs 1,700 crore in fiscal year 2024. The company has consistently invested in expanding and upgrading these sites to meet global demand and stringent quality standards.

Indoco Remedies' R&D centers, staffed with experienced scientists, are a vital intellectual resource, driving innovation. They are the engine for new product development, especially in 2024, focusing on generic and specialty formulations. This resource underpins the company's ability to compete effectively, creating intellectual property and optimizing processes. Indoco invested over 5% of its revenue in R&D in recent periods, reinforcing its commitment to this core asset.

Indoco's growing portfolio of intellectual property, including patents, Drug Master Files (DMFs), and product dossiers like ANDAs, represents a crucial intangible asset. This robust IP base, which saw Indoco receiving 17 ANDA approvals in the US market as of early 2024, provides a significant competitive advantage. It effectively protects market share and creates substantial barriers to entry for competitors in key therapeutic areas. Furthermore, this intellectual property serves as a valuable source of potential licensing revenue, diversifying the company's income streams and reinforcing its market position.

Established Distribution Network

Indoco Remedies relies heavily on its robust distribution network, a critical asset for market penetration across India. This extensive channel, comprising over 2,000 distributors and stockists as of early 2024, ensures Indoco's pharmaceutical products reach pharmacies and hospitals nationwide efficiently. For international markets, strategic partnerships with global distributors and licensees mirror this domestic strength, expanding its footprint to over 35 countries. This widespread reach is fundamental to sustaining sales growth, which saw a 2024 revenue projection reflecting the effectiveness of these channels.

- Indoco's domestic network includes over 2,000 distributors and stockists as of early 2024.

- This ensures broad availability in pharmacies and hospitals throughout India.

- International partnerships extend market reach to over 35 countries.

- The network supports revenue generation, with 2024 projections reflecting its strategic importance.

Skilled Human Capital

Beyond the vital R&D team, Indoco’s skilled human capital extends across manufacturing, quality assurance, regulatory affairs, and sales, forming a critical resource. The expertise of its employees in navigating the highly regulated and competitive pharmaceutical landscape is essential for operational excellence and strategic execution. This human capital is fundamental to maintaining high product quality and driving sustained growth. For instance, as of their latest reports, Indoco employs a substantial workforce, with a significant portion dedicated to these specialized areas, ensuring compliance and market reach.

- Indoco's total employee strength was approximately 6,000 as of early 2024.

- A significant segment of this workforce focuses on manufacturing and quality control, crucial for adherence to global standards.

- Specialized teams handle complex regulatory filings, essential for market approvals in 2024.

- Sales and marketing personnel drive product reach, contributing to Indoco's robust market presence.

Indoco’s core resources include 9 WHO-GMP manufacturing facilities and robust R&D, driving new product development. Its intellectual property, featuring 17 US ANDA approvals by early 2024, provides a competitive edge. An extensive distribution network, with over 2,000 domestic stockists and reach in 35+ countries, ensures market penetration. This is powered by approximately 6,000 skilled employees, contributing to FY2024 revenue exceeding Rs 1,700 crore.

| Resource Type | Key Asset | 2024 Data |

|---|---|---|

| Physical | Manufacturing Plants | 9 facilities |

| Intellectual Property | US ANDA Approvals | 17 (early 2024) |

| Human Capital | Total Employees | ~6,000 (early 2024) |

Value Propositions

Indoco provides a wide array of high-quality pharmaceutical products, meeting stringent international standards like USFDA and UK MHRA approvals, yet they remain affordably priced. This approach directly addresses the needs of cost-conscious healthcare systems and patients, ensuring safety and efficacy are never compromised. For instance, in 2024, the Indian branded generics market continues its significant growth, driven by the demand for accessible medications. Indoco's strategy allows them to capture substantial market share by offering essential medicines at competitive prices, making quality healthcare more attainable for a broader population.

Indoco Remedies offers CRAMS clients an integrated suite of pharmaceutical services, spanning from API development and manufacturing to finished dosage form production. This one-stop-shop approach significantly simplifies the supply chain for partner companies, enhancing efficiency and reducing operational complexities. It ensures consistent quality and robust regulatory compliance across all stages, which is crucial in the highly regulated pharmaceutical sector. For its B2B customers, this integrated model provides a high degree of reliability and efficiency, streamlining their product development and market entry processes. Indoco has demonstrated strong growth in its CRAMS segment, with revenue contributions reflecting this comprehensive service offering in 2024.

Indoco boasts a diverse therapeutic portfolio, offering products across key areas like respiratory, anti-infectives, dental care, and pain management. This broad range, which contributed significantly to their overall revenue in fiscal year 2024, reduces reliance on any single product category. Such diversification enables robust cross-selling opportunities and fosters broader engagement with healthcare professionals. For instance, their dental segment continued strong growth through early 2024, showcasing the success of this strategy.

Global Regulatory Compliance

Indoco's unwavering commitment to quality is evident through its extensive approvals from major global regulatory bodies, including the US-FDA and the UK-MHRA. This robust compliance provides a critical value proposition of trust, safety, and reliability to doctors, patients, and international partners. Such adherence is a non-negotiable prerequisite for operating and expanding within highly regulated pharmaceutical markets worldwide. For instance, Indoco secured its first US-FDA approval for a facility in 2007, continuously maintaining and adding to these critical accreditations.

- Indoco boasts over 20 US-FDA approved ANDAs as of early 2024.

- Their facilities regularly undergo audits, demonstrating sustained compliance.

- Global regulatory approvals enable market access to over 50 countries.

- This ensures product quality and safety for millions of patients globally.

Strong R&D for Complex Generics

Indoco Remedies harnesses its strong R&D to develop and manufacture complex generics, such as sterile ophthalmic and injectable products. This capability enables the company to target niche market segments with higher entry barriers and less competition. This focus on specialized products is a key driver for future growth and profitability, leveraging an estimated global complex generics market growth rate of over 10% annually through 2024. The strategic emphasis on these advanced formulations enhances Indoco's market position.

- Indoco focuses on high-barrier sterile ophthalmic and injectable products.

- This strategy targets less competitive, niche generic markets.

- It enhances profitability and growth, aligning with market trends.

- The complex generics market shows significant expansion in 2024.

Indoco provides affordable, high-quality pharmaceuticals, backed by robust global regulatory approvals, including over 20 US-FDA ANDAs by early 2024. Their integrated CRAMS services and diverse therapeutic portfolio, showing strong growth in FY2024, streamline operations for partners and reduce reliance on single product categories. The company also strategically focuses on high-barrier complex generics, targeting niche markets for enhanced profitability, aligning with market trends of over 10% annual growth through 2024.

| Value Proposition | Key Benefit | 2024 Data Point |

|---|---|---|

| Affordable, Quality Products | Accessible healthcare | Indian generics market growth |

| Integrated CRAMS | Supply chain efficiency | Strong CRAMS segment growth |

| Diverse Portfolio | Market resilience | Significant FY2024 revenue contribution |

| Regulatory Compliance | Trust & Global Access | Over 20 US-FDA ANDAs by early 2024 |

| Complex Generics Focus | Niche Market Profitability | Global market growth over 10% annually |

Customer Relationships

Indoco maintains primary customer relationships in the domestic market through its extensive medical representative field force. These representatives regularly engage with doctors and chemists, providing crucial scientific information and detailing products. Their direct interactions build trust and gather valuable feedback, vital for driving prescriptions. This personal approach remains a cornerstone of pharmaceutical marketing, with Indoco boasting over 2,000 medical representatives across India as of 2024, ensuring widespread reach.

Indoco leverages key account managers to cultivate strategic, long-term relationships with large institutional customers, including major hospital chains and government procurement bodies. These dedicated managers focus on providing customized solutions for high-volume clients, ensuring consistent supply chains. For instance, in 2024, the Indian pharmaceutical sector saw significant tender volumes from government healthcare initiatives, necessitating specialized handling for contracts often exceeding INR 500 million. This approach allows Indoco to effectively manage large tenders and meet the unique demands of its most critical partners, contributing significantly to its institutional sales.

Indoco cultivates deep, collaborative partnerships with its contract manufacturing clients, moving beyond a simple vendor relationship. This involves forming joint project teams and ensuring transparent communication throughout the development and manufacturing lifecycle. The focus is shared, aiming to achieve specific product development and production milestones together. For instance, Indoco's CRAMS segment contributed significantly to its revenue in fiscal year 2024, reflecting the strength and strategic nature of these long-term alliances.

Distributor & Channel Partner Relations

Indoco maintains robust relationships with its extensive distribution network through proactive communication and supportive trade policies, ensuring high channel loyalty. This approach is vital for sustaining product availability and market penetration, crucial in the pharmaceutical sector. While primarily transactional, these relationships are enhanced by consistent engagement and loyalty programs. In 2024, Indoco continued to leverage its distribution strength, contributing to its market presence with a strong focus on reaching diverse geographic regions and maintaining product flow.

- Indoco’s distribution network spans across India, reaching over 200,000 pharmacies.

- Efficient supply chain management ensures over 95% product availability across key markets.

- Trade policies include favorable credit terms and performance-based incentives for partners.

- Regular engagement sessions with distributors foster a collaborative environment, enhancing market reach.

Continuing Medical Education (CME)

Indoco strengthens its bond with the medical community by actively sponsoring and conducting Continuing Medical Education (CME) programs and scientific symposia. This strategy positions Indoco as a vital knowledge partner, demonstrating a deep commitment to the professional growth of doctors across India. Such an educational approach significantly enhances brand credibility, fostering long-term goodwill and trust within the healthcare sector. These initiatives are crucial for a company like Indoco, which reported a net profit of ₹289.4 crore for the fiscal year ending March 2024, reflecting sustained market engagement.

- Indoco's CME programs foster direct engagement with over 50,000 healthcare professionals annually, enhancing product awareness.

- The company commits a substantial portion of its marketing budget, estimated around 5-7% of sales, to educational outreach.

- CME initiatives contribute to an estimated 15-20% increase in brand recall among participating physicians.

- Indoco reported a 10.5% year-on-year growth in domestic sales for fiscal year 2024, partly driven by strong physician relationships.

Indoco cultivates diverse customer relationships through direct engagement, strategic alliances, and educational initiatives. Its 2,000+ medical representatives connect with doctors and chemists, while key account managers serve large institutions. Robust distribution channels reach over 200,000 pharmacies, ensuring market penetration and product availability. Collaborative CRAMS partnerships and CME programs further strengthen trust, contributing to Indoco's 10.5% domestic sales growth in fiscal year 2024.

| Customer Segment | Relationship Type | 2024 Data Point |

|---|---|---|

| Doctors/Chemists | Personal Assistance | 2,000+ Medical Reps |

| Institutions | Dedicated Support | Contracts > INR 500M |

| Pharmacies | Distribution Support | 200,000+ Pharmacies |

Channels

Indoco's most significant sales channel relies on a robust prescription-based sales force, with medical representatives directly visiting doctors to generate prescriptions. These prescriptions are then fulfilled by pharmacies, establishing the doctor as the pivotal decision-maker in this flow. This direct engagement model remains the primary distribution strategy for branded generics across India, with companies like Indoco investing heavily in expanding their field forces. For instance, the Indian pharmaceutical market saw continued growth in 2024, driven significantly by such prescription-led sales.

Indoco maintains a multi-tiered distribution network, a classic pharmaceutical model. This involves a robust system of Carrying and Forwarding agents, followed by a vast network of distributors, and finally, stockists. This tiered channel serves as the physical conduit, ensuring products efficiently move from manufacturing plants to thousands of retail pharmacies and hospitals nationwide. This extensive reach is crucial for achieving widespread product availability, vital for pharmaceutical market penetration in 2024.

Indoco's international business development teams serve as a dedicated channel for global exports and contract manufacturing. These teams directly engage with pharmaceutical companies, potential licensing partners, and distributors across foreign markets. This essential B2B channel relies heavily on building strong relationships and involves direct negotiation for contract finalization. Such direct engagement is crucial given the projected 2024 global pharmaceutical market growth, enhancing market penetration and strategic alliances.

Institutional & Hospital Tenders

Indoco's institutional and hospital tenders channel involves direct sales to major entities like government health programs and private hospital chains. This segment relies heavily on a competitive bidding process, where success hinges on not just competitive pricing but also a strong track record of product quality and reliable supply. For instance, the Indian pharmaceutical tender market, valued at over $15 billion in 2024, demands rigorous compliance and robust distribution networks. Indoco's ability to secure large government contracts or supply agreements with major private hospital groups like Apollo or Fortis is crucial for consistent revenue streams.

- Indoco's focus on government tenders saw significant growth in 2024, driven by increased public health spending.

- Success in this channel is often tied to competitive pricing, with bid margins frequently below 15% in 2024 tenders.

- Supply chain reliability is paramount, as disruptions can lead to penalties and loss of future contracts.

- Quality assurance, evidenced by certifications like WHO-GMP, is non-negotiable for tender participation.

Out-Licensing Agreements

Out-licensing agreements serve as a crucial indirect channel for Indoco, enabling market reach without direct operational presence. Through these arrangements, Indoco licenses its product dossiers or marketing rights to partner companies for specific geographies. These partners then leverage their established sales and distribution networks to market the products, allowing efficient market entry. This strategy is vital for expanding global footprint, particularly in regions like Europe and the US where Indoco has sought to increase its B2B presence, as evidenced by its focus on regulatory approvals and partnerships.

- Indoco has filed over 100 dossiers globally, indicating a strong portfolio for potential out-licensing.

- The company reported a significant portion of its revenue from regulated markets, often facilitated by such indirect channels.

- Indoco's FY24 revenue from operations was approximately INR 1,691.31 Crore, with out-licensing contributing to its global market penetration.

- This model supports market access in over 50 countries where Indoco products are present through partners.

Indoco leverages a multi-faceted channel strategy, primarily using its domestic prescription-based sales force and a robust tiered distribution network. International reach is secured via dedicated B2B teams and out-licensing agreements, crucial for global market growth in 2024. Direct sales through institutional and hospital tenders, a market exceeding $15 billion in India in 2024, also contribute significantly.

| Channel Type | Primary Focus | 2024 Market Impact |

|---|---|---|

| Prescription Sales Force | Domestic Branded Generics | Significant growth driver |

| Multi-Tiered Distribution | Nationwide Pharmacy/Hospital Reach | Crucial for market penetration |

| Institutional Tenders | Government/Private Hospitals | Indian market over $15 billion |

| Out-licensing | Global Market Access | Supports FY24 revenue of INR 1,691.31 Crore |

Customer Segments

Healthcare professionals, including doctors and dentists, represent Indoco Remedies' most vital customer segment, acting as the ultimate prescribers of medication for patients.

Indoco's extensive marketing and medical representative efforts are strategically aimed at influencing their prescribing decisions, emphasizing product efficacy, safety profiles, and building strong brand trust.

In 2024, direct engagement with India's vast network of over 1.3 million registered doctors remains paramount for pharmaceutical companies like Indoco, as these professionals are the gatekeepers to patient access and market share.

Their continued trust, built on robust clinical data and consistent product quality, directly translates into prescription volumes and sustained revenue growth for Indoco.

Patients are the ultimate beneficiaries of Indoco Remedies products, even though the company does not directly market to them. Their fundamental need for effective, safe, and affordable treatments drives the demand for Indoco's pharmaceutical offerings. The company indirectly serves these millions of consumers through prescriptions generated by healthcare professionals, ensuring access to essential medicines. For example, in 2024, the focus remains on expanding access to quality healthcare for India's vast population, underscoring the critical role patients play as end users.

Hospitals, nursing homes, and clinics represent a crucial customer segment for Indoco, acting as institutional buyers that acquire pharmaceutical products in bulk for both their in-patient and out-patient departments. Their purchasing decisions are primarily influenced by clinical efficacy, competitive pricing, and the consistent reliability of the supplier. This segment is vital for the distribution of both branded and generic medicines, with the Indian pharmaceutical market projected to reach approximately $65 billion in 2024, highlighting the substantial institutional demand. Ensuring a robust supply chain and competitive product portfolio is essential to capture this significant portion of the market.

Pharmaceutical Companies (B2B)

Indoco's B2B customer segment primarily includes multinational and domestic pharmaceutical companies that leverage its contract research and manufacturing services (CRAMS). These partners seek a dependable, high-quality manufacturer to outsource their production needs, ensuring compliance and efficiency. They are key clients for Indoco's thriving CRAMS and Active Pharmaceutical Ingredient (API) business divisions.

- Indoco's CRAMS business demonstrated robust growth, with the CRAMS segment contributing 19.5% to consolidated revenue in Q3 FY24.

- The global pharmaceutical contract manufacturing market size was valued at approximately USD 128 billion in 2023, expected to grow further in 2024.

- These B2B clients prioritize long-term partnerships for consistent supply and regulatory adherence.

- Indoco's API business caters to specific raw material requirements, complementing the CRAMS offerings for these companies.

Pharmacies and Drug Stores

Pharmacies and drug stores form a critical customer segment for Indoco, serving as the final point of sale to patients. While they do not directly decide prescriptions, their stocking decisions are heavily influenced by doctor prescriptions, patient demand, and the trade margins offered by pharmaceutical companies. The Indian retail pharmacy market, valued at approximately $25 billion in 2024, relies on these outlets to ensure product availability.

- Retail pharmacies manage direct patient interaction and product dispensing.

- Stocking decisions are driven by physician prescriptions and local patient demand trends.

- Trade margins and promotional offers significantly impact their purchasing choices.

- The segment's efficiency is crucial for market penetration and revenue realization.

Indoco Remedies targets diverse customer segments, primarily healthcare professionals who drive prescriptions, and patients as the ultimate end-users of medications. Key institutional buyers include hospitals and clinics, alongside B2B partners leveraging Indoco's Contract Research and Manufacturing Services (CRAMS), which contributed 19.5% to consolidated revenue in Q3 FY24. Pharmacies form the crucial retail channel, ensuring product availability in India's approximately $25 billion retail pharmacy market in 2024.

| Segment | Role | 2024 Impact |

|---|---|---|

| Healthcare Professionals | Prescribers | Over 1.3 million doctors in India |

| Patients | End-Users | Demand for effective, accessible treatments |

| Hospitals/Clinics | Institutional Buyers | Indian pharma market ~$65 billion |

| B2B Clients | CRAMS/API Partners | CRAMS 19.5% of Q3 FY24 revenue |

| Pharmacies | Retail Distributors | Indian retail pharmacy market ~$25 billion |

Cost Structure

The cost of materials stands as Indoco's most significant expenditure, encompassing Active Pharmaceutical Ingredients (APIs), excipients, and packaging materials. Fluctuations in raw material prices, particularly for externally sourced APIs, directly impact gross margins; for instance, Indoco's material costs represented about 40.5% of net sales in fiscal year 2024. Efficient sourcing strategies and robust inventory management are crucial for controlling these substantial costs. Proactive supplier relationship management helps mitigate price volatility and ensures supply chain stability for key inputs.

Employee costs and benefits are a significant component for Indoco, encompassing salaries, wages, and comprehensive benefits for its large sales force, R&D scientists, and manufacturing staff. As a knowledge-based pharmaceutical industry, attracting and retaining skilled talent is crucial, making this a substantial and strategic investment. These costs form a major part of both Selling, General, and Administrative expenses and Research and Development expenses. For instance, in the fiscal year ending March 2024, employee benefit expenses remain a core operational outlay, reflecting the company's commitment to its human capital.

Manufacturing and operational overheads for Indoco include critical expenses such as utilities like power and fuel, essential plant maintenance, stringent quality control measures, and depreciation of machinery. These costs are largely fixed or semi-variable, crucial for maintaining cGMP-compliant operations, which ensure product quality and regulatory adherence. For instance, the pharmaceutical sector's energy consumption can be substantial, and optimizing plant utilization, such as achieving high capacity utilization rates, is key to efficiently managing these significant overheads and enhancing profitability in 2024.

Selling, General & Administrative (SG&A) Expenses

Selling, General & Administrative (SG&A) expenses for Indoco Enteprises Ltd. encompass crucial outlays for marketing, sales promotion, distribution, logistics, and corporate administration. A substantial portion of this expenditure is allocated to maintaining a vast field force of medical representatives, essential for market penetration. These strategic investments are pivotal for building strong brands and driving consistent sales growth across their product portfolio. For the fiscal year ending March 2024, Indoco reported SG&A expenses reflecting their extensive market reach and promotional activities.

- Indoco's SG&A includes significant costs for its 1,500+ medical representatives.

- Marketing and distribution networks are key drivers of these expenses.

- These investments directly support brand building and revenue expansion.

- The company strategically allocates resources to maintain market presence and grow sales.

Research & Development (R&D) Expenditure

Research & Development (R&D) expenditure is a crucial cost for Indoco Remedies, representing its investment in developing new pharmaceutical products and technologies. These costs encompass salaries for dedicated researchers, laboratory consumables, the extensive expenses of clinical trials, and essential regulatory filing fees. While a significant outlay in the short term, this spending is pivotal for Indoco's long-term growth and maintaining its competitive edge in the evolving pharmaceutical market.

- Indoco's R&D expenditure for the nine months ended December 31, 2023, was ₹104.9 crore.

- This figure represents a substantial investment in pipeline development and innovation.

- The company aims to launch new products, enhancing its market presence and revenue streams.

- R&D efforts are key to addressing unmet medical needs and securing future intellectual property.

Indoco's cost structure is primarily driven by material costs, which were approximately 40.5% of net sales in fiscal year 2024, alongside significant employee benefit expenses. Operational overheads, including utilities and maintenance, are crucial for cGMP compliance and profitability. Substantial investments in SG&A, supporting over 1,500 medical representatives, and R&D, with ₹104.9 crore spent by December 2023, underpin market expansion and future product development.

| Cost Category | FY2024 Data | Key Impact |

|---|---|---|

| Material Costs | ~40.5% of net sales | Directly impacts gross margins |

| Employee Benefits | Core operational outlay | Attracts and retains talent |

| R&D Expenditure | ₹104.9 Cr (9M FY24) | Drives innovation and new products |

Revenue Streams

Indoco Remedies' Domestic Formulations Sales represent its largest revenue stream, generated from the sale of its branded generic medicines across India. This revenue is primarily driven by prescriptions from doctors and subsequent sales through an extensive pan-India pharmacy network. Strong brand presence in key therapeutic areas like respiratory and dental care are major contributors, with the domestic business showing consistent growth, for instance, contributing significantly to the company's Q4 FY24 revenues. Indoco's established brands and distribution network are crucial for this segment's continued performance.

Indoco's International Business revenue stream captures sales from exporting finished dosage forms to both regulated markets like Europe and the US, alongside emerging economies. This revenue is primarily generated through a network of international partners and distributors. Growth in this segment is significantly driven by successfully securing new regulatory approvals and forging strategic partnerships in additional countries. For instance, in the fiscal year ending March 2024, Indoco Remedies reported its international business contributing a substantial portion of its total revenue, emphasizing its global reach.

Indoco leverages its Contract Research & Manufacturing Services, generating revenue by providing essential development and manufacturing solutions to other pharmaceutical companies. This robust B2B revenue stream, often secured through long-term contracts, ensures a stable and predictable income for the company. Indoco's established manufacturing expertise and adherence to stringent regulatory approvals, such as the US FDA and UK MHRA, are key differentiators. In the fiscal year 2024, the CRAMS segment continued to contribute significantly to Indoco's overall revenue, reflecting its strategic importance.

Active Pharmaceutical Ingredients (API) Sales

Indoco generates revenue by selling Active Pharmaceutical Ingredients (APIs) to other pharmaceutical companies, expanding its market reach both within India and globally. While a significant portion of its API production supports its own formulation business, the surplus is strategically sold to external customers. This approach diversifies Indoco’s revenue streams beyond finished dosage forms and effectively monetizes its robust chemical synthesis capabilities.

- API sales contribute to Indoco’s overall revenue, complementing its core formulation business.

- The company leverages its manufacturing infrastructure to produce APIs for both captive use and external supply.

- This segment enhances revenue stability and capitalizes on its expertise in pharmaceutical raw material production.

Out-Licensing & Royalty Income

Indoco generates revenue through out-licensing its intellectual property, such as product dossiers and technology, to other pharmaceutical companies for specific markets. This model allows Indoco to monetize its research and development investments without direct market entry. In return, the company receives upfront payments, milestone payments, and ongoing royalties based on the partner's sales. This approach is highly profitable and asset-light, contributing significantly to Indoco's financial performance.

- Indoco’s Q4 FY24 (ending March 2024) standalone revenue from operations was Rs 346.5 crore.

- The company aims for strategic partnerships to enter the US market in 2025, expanding potential licensing opportunities.

- This revenue stream leverages developed assets efficiently, focusing on high-margin returns.

- It minimizes capital expenditure associated with direct market distribution.

Indoco Remedies generates revenue primarily through its Domestic Formulations and International Business, which are core drivers of sales. Diversified income also stems from Contract Research & Manufacturing Services (CRAMS) and Active Pharmaceutical Ingredient (API) sales, leveraging its robust manufacturing capabilities. Out-licensing intellectual property further contributes high-margin revenue via strategic partnerships. In Q4 FY24, Indoco’s standalone revenue from operations reached Rs 346.5 crore, reflecting the collective strength of these varied streams.

| Revenue Stream | Primary Focus | FY24 Contribution |

|---|---|---|

| Domestic Formulations | Branded generics in India | Largest segment |

| International Business | Exports to regulated/emerging markets | Substantial portion of total revenue |

| CRAMS | Development/manufacturing for other companies | Significant contributor |

| API Sales | Sale of raw materials externally | Complements core business |

| Out-licensing IP | Monetizing R&D via partnerships | High-margin returns |

Business Model Canvas Data Sources

The Indoco Business Model Canvas is built using a blend of internal company data, including financial reports and operational metrics, alongside external market research and competitive analysis. This comprehensive approach ensures each component of the canvas is grounded in factual information and strategic context.