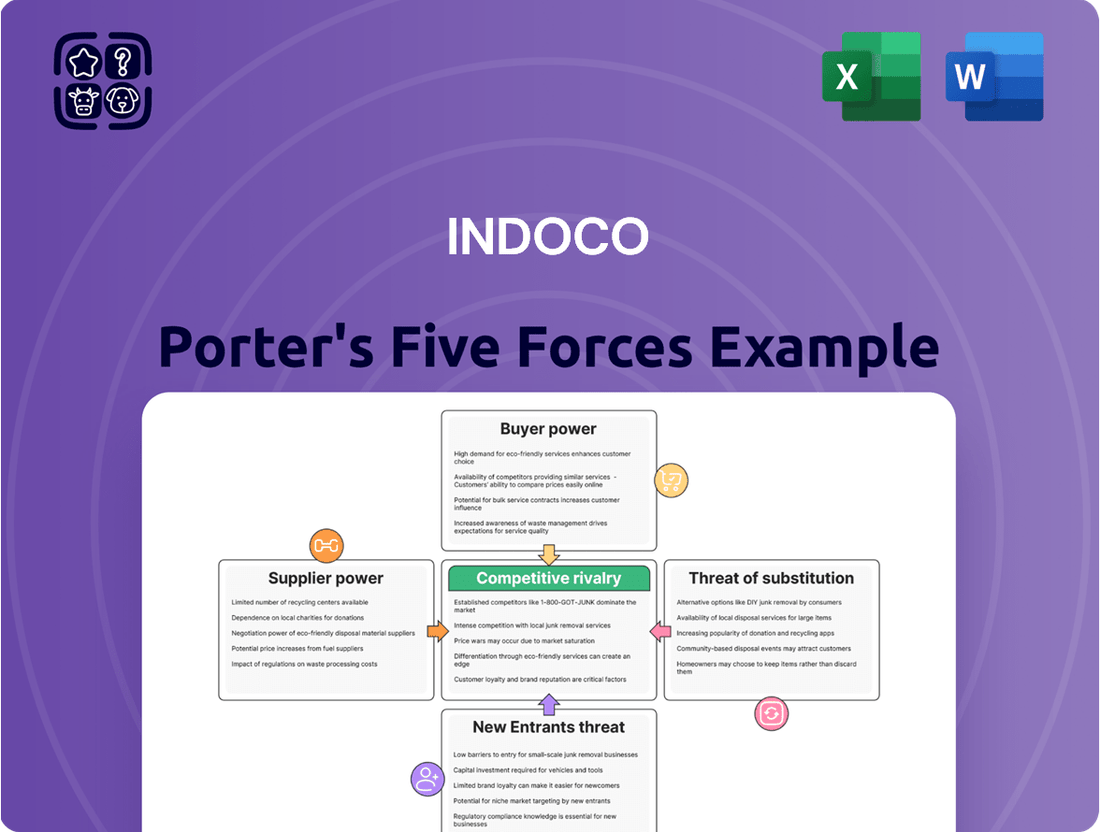

Indoco Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Indoco Bundle

Indoco’s competitive landscape is shaped by powerful forces, from the bargaining power of its buyers to the intense rivalry among existing players. Understanding these dynamics is crucial for navigating its market effectively.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Indoco’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Indoco Remedies faces moderate bargaining power from its suppliers, particularly for Active Pharmaceutical Ingredients (APIs) and key raw materials. The pharmaceutical industry often relies on specialized manufacturers for these critical inputs, and while Indoco aims for a diversified supplier base, certain niche APIs might originate from a more concentrated group of producers. This concentration can empower those suppliers to negotiate higher prices or more favorable terms, directly impacting Indoco's cost of goods sold. For instance, in 2023, the global API market saw price fluctuations due to supply chain disruptions, a factor that directly affects companies like Indoco.

Indoco Remedies faces moderate bargaining power from its suppliers. The company relies on a diverse range of raw materials and intermediates for its pharmaceutical formulations. While some specialized active pharmaceutical ingredients (APIs) might have limited suppliers, Indoco's ability to source globally for many common chemicals and excipients helps to mitigate supplier leverage.

Switching costs for Indoco can be significant, particularly for APIs requiring rigorous quality control and regulatory re-approval. For example, changing a key intermediate supplier in a regulated market like the US or Europe could involve substantial time and expense for requalification, potentially impacting production timelines and costs. This inertia grants established suppliers a degree of power.

However, Indoco's purchasing volume and long-term supplier relationships can provide counterbalancing leverage. By consolidating purchases and engaging in strategic partnerships, Indoco can negotiate more favorable terms. The company's commitment to quality and reliability also makes it an attractive customer, further strengthening its position with key suppliers.

Indoco Remedies faces moderate bargaining power from its suppliers, particularly for Active Pharmaceutical Ingredients (APIs) and key intermediates. While some basic chemicals are commoditized, the supply of specialized APIs can be concentrated among a few manufacturers, giving those suppliers more leverage. For instance, in 2024, the global API market saw price fluctuations driven by supply chain disruptions and increasing demand for complex molecules, potentially impacting Indoco's input costs.

Supplier Power 4

The bargaining power of suppliers for Indoco Remedies is influenced by the threat of forward integration. If suppliers, particularly those providing Active Pharmaceutical Ingredients (APIs), were to establish their own finished dosage form manufacturing capabilities, their leverage over Indoco would significantly increase. This scenario is generally less prevalent in the highly regulated pharmaceutical industry due to high entry barriers and capital requirements, but it remains a potential concern for specialized API providers.

For instance, while many API manufacturers focus on bulk production, a few could possess the expertise and capital to move into contract manufacturing of finished formulations. This would allow them to capture more of the value chain. In 2024, the global pharmaceutical contract manufacturing market was valued at an estimated USD 145 billion, indicating substantial revenue potential for integrated players.

The key factors influencing this threat for Indoco include:

- Specialization of API Suppliers: Suppliers with unique or highly sought-after APIs might have a stronger incentive and capability to integrate forward.

- Regulatory Hurdles: The stringent regulatory approvals needed for finished dosage forms act as a significant deterrent to suppliers considering forward integration.

- Capital Investment: Setting up and maintaining finished dosage manufacturing facilities requires substantial capital, which not all API suppliers may have readily available.

- Market Access: Suppliers would need to build their own sales, marketing, and distribution networks to compete effectively in the finished dosage market, a complex undertaking.

Supplier Power 5

The bargaining power of suppliers for Indoco Remedies is influenced by Indoco's significance as a customer. If Indoco constitutes a substantial portion of a supplier's overall sales, that supplier's leverage is weakened, as they rely more heavily on Indoco's business. Conversely, if Indoco is a minor client to its suppliers, those suppliers can potentially dictate terms more effectively.

For instance, in 2023, the global pharmaceutical excipients market, a key input for companies like Indoco, was valued at approximately USD 10.5 billion, with an expected compound annual growth rate of 6.2% through 2030. This indicates a competitive landscape with numerous suppliers for essential raw materials.

- Indoco's Revenue Share: Analyzing Indoco's purchasing volume relative to a supplier's total revenue is crucial. A larger share implies greater supplier dependency on Indoco, reducing their bargaining power.

- Supplier Concentration: The number of available suppliers for critical raw materials or active pharmaceutical ingredients (APIs) impacts Indoco's options. A concentrated supplier base can increase supplier power.

- Switching Costs: The difficulty and expense Indoco would incur in changing suppliers for its key inputs can also influence supplier power. High switching costs benefit suppliers.

- Input Differentiation: If the inputs Indoco requires are highly specialized and not readily available from multiple sources, suppliers of these unique inputs will possess greater bargaining power.

Indoco Remedies faces a moderate level of bargaining power from its suppliers, particularly for specialized Active Pharmaceutical Ingredients (APIs) and certain key intermediates. While the company benefits from a diverse global supplier base for many raw materials, the concentration among manufacturers of niche APIs can grant those suppliers leverage. This is exacerbated by significant switching costs for Indoco, as requalifying suppliers for regulatory compliance can be time-consuming and expensive, potentially impacting production. For instance, in 2024, the global pharmaceutical intermediates market experienced price volatility due to geopolitical factors, directly influencing input costs for companies like Indoco.

| Factor | Assessment | Impact on Indoco |

| Supplier Concentration (APIs) | Moderate to High for niche APIs | Increased supplier pricing power |

| Switching Costs | High for regulated inputs | Limits Indoco's flexibility, benefits suppliers |

| Indoco's Purchase Volume | Significant for many inputs | Provides some counter-leveraging power |

| Forward Integration Threat | Low but present for specialized suppliers | Potential future increase in supplier power |

What is included in the product

This analysis delves into the competitive forces shaping Indoco's industry, examining buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly identify and mitigate competitive threats with a visual breakdown of bargaining power, rivalry, and substitution risks.

Customers Bargaining Power

Indoco Remedies faces considerable buyer power due to its diverse customer segments, ranging from large hospitals and pharmacy chains to smaller distributors and government health programs. Customers, particularly those focused on generics, are highly price-sensitive. For instance, in 2023, the Indian pharmaceutical market saw intense competition in the generics segment, with price erosion being a significant factor for manufacturers like Indoco.

Indoco Remedies faces significant buyer power due to the availability of numerous alternative pharmaceutical products. The market for finished dosage forms is characterized by a wide array of generic versions, offering consumers and healthcare providers readily accessible and often lower-cost substitutes for Indoco's offerings. This abundance of choice directly empowers customers to negotiate for better pricing, putting pressure on Indoco to remain competitive.

The bargaining power of customers for Indoco Remedies is a significant factor. Large institutional buyers, such as major pharmaceutical distributors or government health organizations, wield considerable influence due to the sheer volume of their purchases. These large-scale orders enable them to negotiate favorable pricing and terms, potentially impacting Indoco's profit margins.

In 2024, Indoco's revenue from key export markets, which often involve large distributors, continued to be a substantial portion of its overall sales. For instance, its exports to regulated markets like the US and Europe, where large pharmacy chains and distributors are dominant, represented a significant revenue stream. This scale of purchasing power allows these entities to demand competitive pricing, putting pressure on Indoco to maintain cost efficiency.

While individual retail customers have minimal bargaining power, the collective purchasing power of large B2B clients is a key consideration for Indoco. The company's ability to secure long-term supply agreements with these major players is crucial for stable revenue. However, these agreements often come with stringent pricing clauses, reflecting the customers' leverage.

Buyer Power 4

Indoco Remedies, like many pharmaceutical companies, faces significant buyer power from its customers, particularly large distributors and institutional buyers. Information asymmetry is a key factor; customers who actively track market pricing, competitor offerings, and regulatory changes are better positioned to negotiate favorable terms. For instance, if a major hospital network or a large generic drug distributor has data showing lower prices for similar active pharmaceutical ingredients (APIs) from other suppliers, they can use this leverage to push Indoco for discounts. This is especially true for commoditized products where differentiation is minimal.

The availability of alternative suppliers directly impacts Indoco's customer bargaining power. When there are numerous other manufacturers capable of producing the same drugs or APIs, customers can easily switch, increasing their negotiating leverage. In the pharmaceutical sector, particularly for off-patent drugs, the supply chain often has multiple players. This intensifies the pressure on Indoco to maintain competitive pricing and efficient operations to retain its customer base. For example, in 2024, the generic drug market continued to be highly competitive, with many suppliers vying for contracts, thereby empowering buyers.

The bargaining power of Indoco's customers is also influenced by the volume of their purchases and the importance of Indoco's products to their overall business. Large-scale buyers, such as major pharmacy chains or government health programs, represent a substantial portion of Indoco's revenue. Their ability to consolidate purchasing power or threaten to shift significant volumes to competitors gives them considerable influence over pricing and contract terms. This is a constant consideration for Indoco's sales and marketing teams.

- Customer Information Advantage: Well-informed customers, armed with market data and competitive bids, can effectively negotiate lower prices for Indoco's products.

- Availability of Alternatives: The presence of numerous alternative suppliers for APIs and finished formulations significantly amplifies customer bargaining power.

- Volume and Importance of Purchases: Large institutional buyers, representing substantial revenue streams, wield considerable influence due to their purchasing volume and the critical nature of the supplied products.

- Price Sensitivity: In markets where price is a primary driver, such as generics, customers are more inclined to leverage any available information or alternatives to secure the best deals.

Buyer Power 5

The bargaining power of customers for Indoco Remedies is a significant factor, particularly concerning generic drug manufacturing. Large distributors or pharmacy chains possess the potential to engage in backward integration, meaning they could consider manufacturing their own generic drugs rather than purchasing from companies like Indoco. This threat, while generally mitigated by the high regulatory hurdles and substantial capital investment required in pharmaceutical production, can still influence pricing negotiations and the dynamics of customer relationships.

While direct backward integration by major retail pharmacy chains into complex generic drug manufacturing is uncommon due to these barriers, the *potential* itself can exert pressure. For instance, if a large chain perceives Indoco's pricing as too high, they might explore partnerships or smaller-scale manufacturing ventures, especially for simpler, high-volume generics. This leverage impacts Indoco's strategy in maintaining competitive pricing and strong supplier agreements.

- Potential for Backward Integration: Large distributors and pharmacy chains can exert pressure by considering manufacturing their own generic drugs, particularly for high-volume, simpler formulations.

- Regulatory and Capital Barriers: The pharmaceutical industry's stringent regulations and significant capital requirements generally make backward integration challenging for most buyers.

- Influence on Pricing: The mere threat of backward integration can empower customers to negotiate more favorable pricing terms with Indoco.

- Customer Relationship Impact: Indoco must balance competitive pricing with the need to maintain robust relationships, as customer power can affect long-term partnerships.

Indoco Remedies faces substantial customer bargaining power, especially from large distributors and institutional buyers who represent significant purchase volumes. These large clients leverage their buying power to negotiate favorable pricing, impacting Indoco's profit margins. For instance, in 2024, exports to regulated markets, dominated by large pharmacy chains, remained a crucial revenue driver, highlighting the influence of these major customers.

| Customer Segment | Impact on Bargaining Power | Example/Data Point (2024 Focus) |

|---|---|---|

| Large Distributors/Pharmacy Chains | High | Significant revenue contribution from regulated markets (e.g., US, Europe) necessitates competitive pricing to retain these clients. |

| Government Health Programs | High | Bulk purchasing and tender-based pricing amplify their negotiation leverage. |

| Smaller Distributors/Retailers | Low | Individual orders have minimal impact; collective power is limited. |

Preview Before You Purchase

Indoco Porter's Five Forces Analysis

The preview you see is the exact Indoco Porter's Five Forces Analysis document you will receive immediately after purchase, offering a comprehensive examination of competitive forces within the pharmaceutical industry. This detailed report analyzes the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry among existing competitors. You'll gain strategic insights into Indoco's market position and potential challenges. What you're previewing is precisely the same professionally formatted and ready-to-use analysis that will be available to you instantly upon completing your purchase, ensuring no surprises.

Rivalry Among Competitors

Indoco Remedies operates in highly competitive therapeutic areas like anti-infectives, pain management, and respiratory medicine. The company faces a significant number of direct rivals, with close to 295 active competitors vying for market share in both India and international markets. This crowded landscape, featuring numerous players of varying sizes, inherently fuels intense competition.

The competitive rivalry within the pharmaceutical sectors where Indoco operates is influenced by the industry's growth trajectory. For instance, India's pharmaceutical market demonstrated robust growth, expanding by 8.4% in the fiscal year 2025, indicating a dynamic environment. This healthy expansion generally allows for more players to coexist with less intense direct confrontation, as there is room for market share expansion for many.

Indoco Remedies faces significant competitive rivalry, particularly in its domestic formulations business. The market for branded generics and unbranded generics shows varying degrees of differentiation. While some branded products may command a premium, the presence of numerous players and mature molecules in the unbranded segment intensifies price-based competition, potentially limiting Indoco's pricing power.

In 2024, the Indian pharmaceutical market, a key focus for Indoco, continued to be characterized by a large number of domestic and international players. This crowded landscape means that for many of Indoco's products, especially those based on off-patent molecules, rivalry is fierce. For instance, the respiratory and anti-infective segments often see multiple companies offering similar formulations, driving down margins.

Competitive Rivalry 4

The pharmaceutical industry, including players like Indoco Remedies, faces intense competitive rivalry. High exit barriers significantly contribute to this. Companies often have substantial investments in specialized manufacturing facilities and research and development, making it costly to simply shut down operations or pivot to other sectors. For instance, the development of a single drug can cost hundreds of millions of dollars and take over a decade, locking in capital and expertise.

These high fixed costs, coupled with the specialized nature of assets, mean that pharmaceutical firms are reluctant to exit the market even when facing profitability challenges. This can lead to prolonged periods of aggressive competition as companies fight to maintain market share and recoup their investments. Long-term contracts with suppliers and distributors further entrench companies, increasing the difficulty of exiting gracefully.

The intense rivalry is evident in the market dynamics. For example, in 2023, the Indian pharmaceutical market grew by approximately 7-8%, but this growth was accompanied by significant pricing pressures across various therapeutic segments. Companies are constantly vying for market leadership through new product launches, strategic partnerships, and aggressive marketing efforts.

- High R&D Investment: Pharmaceutical companies invest heavily in research and development, with average R&D spending often exceeding 15% of revenue, creating substantial sunk costs.

- Specialized Assets: Manufacturing plants and equipment are often highly specialized for specific drug production, making them difficult to repurpose or sell.

- Regulatory Hurdles: The complex and lengthy regulatory approval processes for drugs create significant barriers to entry and exit, as companies must comply with strict guidelines throughout their lifecycle.

- Brand Loyalty and Patents: Established brands and patent protection can create strong customer loyalty, but also mean that companies are highly motivated to defend their market position, intensifying rivalry.

Competitive Rivalry 5

Competitive rivalry within Indoco's contract manufacturing services is quite intense. Companies vie for business by emphasizing quality, strict adherence to regulations, cost efficiency, and quick turnaround times. This competition comes from both Indian and global contract manufacturers in a sector anticipating considerable growth.

The pharmaceutical contract manufacturing market is dynamic, with many players striving for market share. Indoco faces rivals who can offer similar or even more specialized services. For instance, the global pharmaceutical contract manufacturing market was valued at approximately USD 135.8 billion in 2023 and is projected to reach USD 230.5 billion by 2030, indicating a strong compound annual growth rate (CAGR) of 7.9%. This growth fuels competition as more firms enter or expand their contract manufacturing capabilities.

- Key Competitive Factors: Quality assurance, regulatory compliance (e.g., US FDA, EMA), cost-effectiveness, and speed of delivery are paramount.

- Player Landscape: Indoco competes with a mix of large multinational contract development and manufacturing organizations (CDMOs) and smaller, specialized domestic players.

- Pricing Pressures: The drive for cost efficiency can lead to significant pricing pressures, impacting profit margins for all participants.

- Innovation and Technology: Companies that invest in advanced manufacturing technologies and R&D for novel drug delivery systems gain a competitive edge.

Indoco Remedies operates in a highly competitive pharmaceutical landscape, facing close to 295 active rivals in therapeutic areas like anti-infectives and pain management. This intense rivalry is fueled by a growing Indian pharmaceutical market, which expanded by 8.4% in fiscal year 2025, creating opportunities but also intensifying competition for market share.

In its domestic formulations business, particularly in branded and unbranded generics, Indoco experiences significant price-based competition due to the presence of numerous players and mature molecules. This dynamic limits pricing power for companies like Indoco, especially in segments like respiratory and anti-infectives where multiple companies offer similar products, compressing margins.

The pharmaceutical industry, including Indoco, is characterized by high exit barriers, such as substantial R&D investments and specialized manufacturing assets, which lock in capital and expertise. This makes it difficult for firms to leave the market, leading to sustained aggressive competition as companies strive to maintain market share and recoup their significant investments.

In the contract manufacturing services sector, Indoco faces fierce competition from both domestic and global CDMOs, emphasizing quality, regulatory compliance, cost-efficiency, and speed. The global contract manufacturing market, valued at approximately USD 135.8 billion in 2023 and projected to reach USD 230.5 billion by 2030, reflects this dynamic growth and the resulting competitive pressures.

SSubstitutes Threaten

The threat of substitutes for Indoco Remedies' products is relatively low, particularly within the pharmaceutical sector. While non-pharmacological interventions and lifestyle changes can address certain health conditions, they rarely offer a direct replacement for the efficacy of prescribed medications. For instance, in areas like chronic pain management or infectious diseases, pharmacological solutions remain the primary and often most effective treatment.

However, it's important to acknowledge that some therapeutic areas might see a rise in alternative therapies. For example, a growing interest in wellness and natural remedies could offer substitutes in less critical health segments. Despite this, the core business of Indoco, focused on essential and often life-saving medications, is less susceptible to direct substitution by these less potent alternatives.

The threat of substitutes for Indoco Remedies is significant, particularly from emerging drug delivery systems. For instance, advancements in oral disintegrating tablets or long-acting injectable formulations can offer greater patient convenience and compliance, potentially making traditional tablet or capsule forms less appealing. This shift could impact Indoco's established product lines.

Innovation in drug delivery technology presents a potent substitute. If competitors introduce novel formulations that boast enhanced bioavailability or reduced dosing frequency, Indoco's existing products could face diminished market share. Consider the rise of transdermal patches for pain management, offering a continuous release mechanism that bypasses the digestive system, a clear substitute for oral pain relievers.

The pharmaceutical market in 2024 continues to see a surge in research and development focused on patient-centric delivery methods. Companies investing heavily in these areas, such as microsphere technology for sustained drug release or inhalable therapies for respiratory conditions, are creating viable alternatives. Indoco must monitor these advancements closely to avoid being outpaced.

Furthermore, advancements in biosimilars and novel therapeutic modalities like gene therapy represent indirect substitutes, especially in specialized therapeutic areas. While not direct replacements for all of Indoco's offerings, they can capture market share in specific segments, forcing a re-evaluation of competitive strategies and product portfolios.

Preventive healthcare and public health initiatives pose a significant threat to Indoco. For instance, advancements in vaccination programs and lifestyle-focused wellness can reduce the prevalence of conditions like diabetes or cardiovascular disease, directly impacting the demand for Indoco's diabetes and cardiovascular medications. In 2023, global health spending on preventative care saw a notable increase, indicating a growing trend that could erode the market for treatment-focused pharmaceuticals.

Threat of Substitutes 4

The threat of substitutes for Indoco Remedies' products is a significant consideration, especially in markets like India where over-the-counter (OTC) alternatives and traditional or herbal medicines are widely accessible and often preferred. These substitutes can offer a lower price point and a perception of natural efficacy, potentially drawing consumers away from Indoco's prescription pharmaceuticals. For instance, in therapeutic areas like pain management or digestive health, readily available OTC options or Ayurvedic remedies can be seen as viable alternatives by a segment of the population.

Consumer preference and accessibility are key drivers of this threat. In 2023, the Indian OTC market was valued at approximately USD 6.8 billion and is projected to grow, indicating a strong consumer inclination towards self-medication for common ailments. This trend directly impacts the market share for prescription drugs that have accessible OTC counterparts.

Indoco's response to this threat involves focusing on prescription-only medications with strong clinical backing and developing differentiated product portfolios. However, the pervasive availability and cultural acceptance of traditional remedies mean that even highly effective prescription drugs can face pressure from these alternatives. The company must continuously innovate and emphasize the superior efficacy and safety profiles of its prescription offerings to mitigate this persistent threat.

The impact of substitutes can be particularly pronounced in specific therapeutic segments:

- Gastrointestinal products: Many common digestive issues can be addressed with OTC antacids or herbal remedies, posing a threat to Indoco's prescription-based gastrointestinal medications.

- Pain management: The widespread availability of OTC pain relievers like paracetamol and ibuprofen, alongside topical analgesics and traditional balms, offers a significant substitute for prescription pain management drugs.

- Dermatological conditions: For mild skin irritations or common dermatological issues, consumers may opt for readily available OTC creams or traditional herbal treatments over prescription-strength formulations.

Threat of Substitutes 5

The threat of substitutes for Indoco Remedies is present, particularly with the emergence of advanced biotechnological treatments and novel drug delivery systems. While traditional small-molecule drugs remain prevalent, innovative therapies could potentially displace them in certain therapeutic segments. For instance, the increasing success of biologics in treating chronic diseases, a market Indoco participates in, presents a clear substitution risk.

While the pharmaceutical industry generally exhibits a low threat of substitution due to high R&D costs and regulatory hurdles, specific niches can be more vulnerable. Consider the oncology sector, where personalized medicine and gene therapies are rapidly advancing, potentially offering alternatives to conventional chemotherapy agents. Indoco's focus on generic formulations, while cost-effective, can be challenged by these cutting-edge alternatives if they offer superior efficacy or fewer side effects.

The company's product portfolio, which includes a range of therapeutic areas, faces varying levels of substitution threats.

- Biologics: The growing market for biologic drugs, especially in areas like autoimmune diseases and oncology, poses a significant substitution threat to Indoco's small-molecule offerings in these therapeutic classes.

- Gene Therapy and Cell Therapy: Advances in these cutting-edge fields offer potentially curative solutions that could make traditional drug treatments obsolete for certain genetic disorders and cancers.

- Advanced Drug Delivery Systems: Innovations in how drugs are administered, such as long-acting injectables or targeted delivery mechanisms, can enhance efficacy and patient compliance, potentially substituting for more frequent oral or simpler injectable formulations.

- Digital Therapeutics: While still nascent, digital solutions integrated with or replacing traditional pharmaceuticals are emerging as a complementary or alternative approach to managing certain chronic conditions.

The threat of substitutes for Indoco Remedies' products is moderate, with advancements in drug delivery systems and alternative therapies posing the most significant challenges. While prescription drugs are generally less prone to substitution than consumer goods, innovations that offer improved patient outcomes or convenience can erode market share. For instance, in 2024, the pharmaceutical industry continued to see substantial investment in novel delivery methods like implantable devices and inhaled therapies, which could offer advantages over traditional oral or injectable medications for certain chronic conditions.

The rise of biosimilars and advancements in gene therapy also present a growing substitution risk, particularly in specialized therapeutic areas. These cutting-edge treatments can offer alternative mechanisms of action or more targeted approaches, potentially displacing established pharmaceutical products. The global biosimilar market, valued at over USD 20 billion in 2023 and projected for continued growth, underscores this trend.

Furthermore, in markets like India, over-the-counter (OTC) medications and traditional remedies remain accessible substitutes for common ailments, impacting Indoco's offerings in segments like gastrointestinal health and pain management. The Indian OTC market's growth, reaching an estimated USD 7 billion in 2023, highlights the persistent consumer preference for accessible self-medication options.

| Therapeutic Area | Potential Substitutes | Impact on Indoco |

|---|---|---|

| Gastrointestinal | OTC antacids, herbal remedies | Moderate; accessible alternatives for common issues. |

| Pain Management | OTC analgesics, topical treatments, traditional balms | High; wide availability of effective OTC and traditional options. |

| Dermatology (mild) | OTC creams, herbal treatments | Moderate; consumer preference for readily available solutions. |

| Chronic Diseases (e.g., Oncology, Autoimmune) | Biologics, gene therapy, advanced drug delivery systems | Increasing; potential displacement of small-molecule drugs by novel therapies. |

Entrants Threaten

The pharmaceutical industry, including companies like Indoco Remedies, presents a formidable barrier to new entrants due to immense capital requirements. Establishing a state-of-the-art pharmaceutical manufacturing facility demands substantial investment, often running into hundreds of millions of dollars, for research and development infrastructure, advanced production plants, and rigorous quality control systems. For instance, setting up a new API (Active Pharmaceutical Ingredient) manufacturing unit in India, compliant with global regulatory standards like US FDA or EMA, can easily cost upwards of $50 million to $100 million in 2024. These significant upfront costs create a steeplechase for potential new players, making it difficult to compete with established firms that have already amortized these initial expenditures.

The pharmaceutical industry, including companies like Indoco Remedies, faces significant threats from new entrants due to the formidable regulatory landscape. Health authorities such as the FDA in the United States, the EMA in Europe, and India's CDSCO impose complex and stringent approval processes for manufacturing, clinical trials, and ultimately, drug registration.

These hurdles are incredibly time-consuming and resource-intensive, often requiring billions of dollars and years of development. For instance, the average cost to bring a new drug to market is estimated to be over $2 billion. This substantial financial and temporal commitment acts as a powerful deterrent, effectively raising the entry barriers for potential new competitors.

Furthermore, the need for extensive intellectual property protection, including patents, adds another layer of difficulty. New entrants must navigate existing patent protections or invest heavily in developing novel compounds, further increasing the cost and risk associated with market entry.

In 2024, the ongoing focus on drug safety and efficacy, coupled with evolving regulatory requirements, means these barriers are unlikely to diminish, thereby continuing to limit the threat of new entrants in the pharmaceutical sector.

The threat of new entrants into the Indian pharmaceutical market, particularly for companies like Indoco Remedies, is moderate. Established players benefit significantly from economies of scale in procurement, manufacturing, and distribution. For instance, in 2023, Indoco Remedies reported a revenue of INR 1,475 crore, indicating a substantial operational footprint that allows for cost advantages.

New companies entering this space would find it challenging to match these cost efficiencies from the outset. The capital required for setting up compliant manufacturing facilities and building robust distribution networks is considerable. Without achieving similar scale, new entrants would face higher per-unit costs, making it difficult to compete on price with established firms.

Furthermore, regulatory hurdles and the need for product approvals add to the barriers. Navigating these complex processes takes time and resources, which can be a deterrent for potential new market participants. This complexity, coupled with the established brand recognition and customer loyalty enjoyed by companies like Indoco, further solidifies the position of existing players.

Threat of New Entrants 4

The pharmaceutical industry presents a significant hurdle for new entrants due to the immense difficulty in establishing robust distribution networks and securing access to established sales channels. Companies need strong relationships with doctors, pharmacists, and hospitals, which are built over many years.

Building trust and brand recognition in this highly regulated and competitive market demands considerable time and substantial investment. For example, launching a new drug requires extensive clinical trials and regulatory approvals, a process that can take over a decade and cost billions of dollars before a single product reaches the market.

- High Capital Requirements: Significant upfront investment is needed for research, development, clinical trials, manufacturing facilities, and marketing.

- Regulatory Hurdles: Stringent government regulations and lengthy approval processes for new drugs act as substantial barriers.

- Established Brand Loyalty: Doctors and patients often exhibit loyalty to established pharmaceutical brands, making it challenging for newcomers to gain market share.

- Distribution Network Access: Gaining access to established distribution channels and pharmacy networks requires significant effort and negotiation.

Threat of New Entrants 5

The threat of new entrants into the Indian pharmaceutical market, particularly for generics like those produced by Indoco Remedies, is influenced by several factors. While the generic market generally has lower barriers to entry compared to innovative drug development, specific segments can still present challenges.

The intellectual property landscape, encompassing patents and trade secrets, plays a crucial role. Though Indoco operates primarily in the generics space, existing patents on innovator drugs can restrict new players from entering specific, high-value therapeutic areas. In 2023, India's patent filings continued to grow, indicating an active IP environment that can deter newcomers without their own robust IP or licensing agreements.

Key barriers to entry for new pharmaceutical companies in India include:

- Regulatory Hurdles: Obtaining approvals from bodies like the Central Drugs Standard Control Organisation (CDSCO) requires significant time, investment, and adherence to stringent quality standards.

- Capital Investment: Establishing manufacturing facilities that meet Good Manufacturing Practices (GMP) and R&D capabilities demands substantial capital outlay.

- Economies of Scale: Established players benefit from existing production capacities and supply chain efficiencies, making it difficult for smaller new entrants to compete on cost.

- Brand Reputation and Distribution Networks: Building trust with healthcare professionals and patients, alongside establishing wide-reaching distribution channels, takes considerable time and effort.

The threat of new entrants in the pharmaceutical sector, impacting companies like Indoco Remedies, remains moderate due to substantial barriers. High capital requirements for research, development, and compliant manufacturing facilities, often exceeding $50 million to $100 million for API units in 2024, deter many. Complex and lengthy regulatory approval processes, costing billions and taking years, further elevate entry barriers.

Established players like Indoco Remedies benefit from economies of scale, with 2023 revenues of INR 1,475 crore, providing cost advantages that new entrants struggle to match. Additionally, intellectual property protection and the need to build trust and distribution networks over time solidify the position of existing firms, limiting the immediate threat from newcomers.

| Barrier Category | Description | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High investment for R&D, manufacturing, and compliance. | Significant financial hurdle; discourages smaller players. |

| Regulatory Hurdles | Stringent and time-consuming approval processes. | Increases cost and time-to-market, demanding expertise. |

| Intellectual Property | Existing patents and need for novel development. | Restricts access to certain therapeutic areas; requires innovation investment. |

| Economies of Scale | Cost advantages for established players due to volume. | New entrants face higher per-unit costs, impacting price competitiveness. |

| Brand & Distribution | Established trust and networks with healthcare professionals. | Challenging for newcomers to gain market access and customer loyalty. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Indoco leverages data from annual reports, industry-specific market research, and competitor financial disclosures. We also incorporate insights from regulatory filings and macroeconomic indicators to provide a comprehensive understanding of the competitive landscape.