Inchcape Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

Unlock the full strategic blueprint behind Inchcape's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a global automotive distributor and retailer.

Dive deeper into Inchcape’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie in the evolving automotive sector.

Want to see exactly how Inchcape operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown—perfect for benchmarking, strategic planning, or investor presentations to understand their diversified operations.

Gain exclusive access to the complete Business Model Canvas used to map out Inchcape’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies in automotive distribution and retail.

See how the pieces fit together in Inchcape’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking and gain a competitive edge.

Partnerships

Inchcape's key partnerships are primarily with Automotive Original Equipment Manufacturers (OEMs), with whom they hold exclusive distribution rights for over 60 leading automotive brands globally. These crucial alliances allow Inchcape to offer a wide spectrum of vehicles and parts to consumers across various markets, forming the bedrock of their business. The company's ability to secure a significant 22 new distribution contracts in 2024 underscores the enduring trust and ongoing growth of these OEM relationships.

Inchcape’s operational backbone relies heavily on its logistics and supply chain providers, enabling the smooth movement of vehicles and parts across its 38 global markets. These essential partnerships are the engine behind their capital-light distribution strategy, facilitating efficient import, warehousing, and final delivery.

In 2024, Inchcape continued to leverage these relationships to maintain agility and cost control in a dynamic global market. Their partners are critical in navigating customs, managing inventory, and optimizing transportation routes, ensuring vehicles reach customers promptly and cost-effectively.

Inchcape's strategic alliances with technology and digital solution providers are crucial for its operational advancement. These partnerships facilitate the integration of innovative digital platforms and data analytics, essential for optimizing customer engagement and supply chain efficiency.

In 2024, Inchcape continued to leverage these collaborations to bolster its Accelerate+ strategy, which aims to drive digital transformation and market leadership. Investments in AI-driven tools, for example, enhance predictive maintenance for vehicles and personalize customer interactions.

These technology partnerships allow Inchcape to develop bespoke digital solutions, differentiating its service offerings in a competitive automotive retail landscape. Such collaborations are vital for maintaining a technological edge and delivering superior customer experiences.

Financial Services and Insurance Partners

Inchcape leverages key partnerships with financial services and insurance providers to enhance its core distribution business. These collaborations are crucial for offering integrated financing and insurance solutions to customers, thereby simplifying the vehicle purchasing journey. This strategy adds significant value by providing a one-stop shop for automotive needs.

These partnerships enable Inchcape to offer a comprehensive suite of services that support both new and used vehicle sales, as well as aftersales care. For instance, by partnering with major banks and insurance underwriters, Inchcape can present competitive finance packages and protection plans directly at the point of sale. This not only boosts sales conversion but also deepens customer loyalty.

- Value Proposition: Offering bundled financing and insurance solutions simplifies the customer purchase process, making vehicle acquisition more accessible and attractive.

- Revenue Streams: Partnerships can generate commission income from facilitating these financial products, diversifying Inchcape's revenue beyond vehicle sales and servicing.

- Customer Acquisition & Retention: Integrated financial services can be a key differentiator, attracting new customers and encouraging repeat business by providing a seamless and supportive experience.

- Market Trends (2024): The automotive finance market in many regions continues to see strong demand for flexible financing options, with an increasing trend towards digitalized application and approval processes, which Inchcape's partners would likely support.

Local Market Experts and Service Networks

Inchcape relies heavily on local market experts and established service networks to navigate its diverse global operations. These partnerships are fundamental for understanding regional nuances, regulatory landscapes, and customer preferences, enabling the company to tailor its offerings effectively.

By collaborating with local workshops and service providers, Inchcape ensures high-quality aftersales support, a critical component for customer retention and brand loyalty. For instance, in 2023, Inchcape’s focus on enhancing its service network contributed to a significant portion of its revenue growth in emerging markets, where local expertise is paramount for efficient operations and customer reach.

- Local Service Network Expansion: Inchcape continued to expand its network of authorized service centers in key growth regions throughout 2023, aiming to increase service accessibility by 15% in Southeast Asia.

- Expert Collaboration: Partnerships with local automotive technical experts provide Inchcape with critical insights into specific vehicle maintenance needs and common issues encountered in different climates and road conditions.

- Regulatory Compliance: Local partnerships are essential for ensuring adherence to varying automotive regulations and emissions standards across different countries, mitigating compliance risks and operational disruptions.

- Customer Satisfaction: In 2024, Inchcape reported a 5% increase in customer satisfaction scores in markets where strong local service partnerships were in place, highlighting the direct impact on the customer experience.

Inchcape's strategic partnerships with Automotive Original Equipment Manufacturers (OEMs) are foundational, granting exclusive distribution rights for numerous global brands. In 2024, securing 22 new distribution contracts highlights the strength and continued growth of these crucial OEM relationships, enabling a broad vehicle and parts offering.

These partnerships are vital for maintaining Inchcape's capital-light distribution model, supported by logistics and supply chain providers who ensure efficient vehicle movement across 38 global markets. In 2024, these collaborations were key to navigating market dynamics, managing inventory, and optimizing transport for cost-effectiveness.

Further strengthening its business, Inchcape collaborates with technology and digital solution providers to enhance customer engagement and supply chain efficiency. These alliances are critical for its Accelerate+ strategy, with AI-driven tools, for example, boosting predictive maintenance and customer interactions in 2024.

What is included in the product

A detailed, narrative-driven Business Model Canvas that maps Inchcape's global automotive distribution and retail operations, highlighting key partnerships, customer relationships, and revenue streams.

The Inchcape Business Model Canvas offers a structured approach to visualize and refine your business strategy, alleviating the pain of disjointed planning by providing a clear, comprehensive overview.

Activities

Inchcape's core activity revolves around orchestrating the complex journey of vehicles and parts from Original Equipment Manufacturer (OEM) factories directly to local markets. This encompasses the intricate management of import logistics, navigating customs regulations, and ensuring efficient warehousing. In 2024, this robust supply chain is critical for maintaining their position as a pureplay distributor, ensuring timely availability for their broad network.

The company oversees the entire value chain, from the moment vehicles leave the factory gate until they reach the end-user. This end-to-end responsibility highlights their commitment to a seamless customer experience and efficient product flow. Their operational efficiency in this area directly impacts customer satisfaction and market penetration.

Inchcape actively manages the sales and marketing of its represented automotive brands, employing a multi-faceted approach. This involves meticulous product planning, dynamic pricing strategies, and extensive digital marketing campaigns to engage a wide array of customer segments. The company leverages both physical showrooms and robust online platforms to ensure broad market reach and accessibility.

A significant portion of Inchcape's strategy focuses on digital engagement, recognizing its growing importance in the automotive sector. In 2024, for instance, digital channels are expected to play an even more critical role in lead generation and customer conversion, with many brands reporting over 50% of initial customer inquiries originating online.

Their marketing efforts are designed to build strong brand equity and drive sales volume. This includes targeted advertising, public relations, and customer relationship management initiatives. For example, in 2023, Inchcape's investments in digital marketing saw a substantial uplift in website traffic and online appointment bookings, indicating a positive return on their digital-first approach.

Inchcape's key activities include providing comprehensive aftersales services, encompassing vehicle servicing, maintenance, and the crucial distribution of genuine parts and accessories. This focus is vital for fostering customer loyalty and generating repeat business, creating a robust revenue stream that extends well beyond the initial vehicle purchase.

This segment has demonstrated remarkable growth, with Inchcape reporting a significant increase in its aftersales revenue in recent years. For instance, in 2023, Inchcape's profit before tax grew by 19% to £397 million, with aftersales contributing a substantial portion to this strong financial performance, highlighting its increasing importance.

Digital Platform Development and Management

Inchcape's core activities heavily involve the creation and ongoing management of its digital platforms. This focus is crucial for streamlining operations and deepening customer connections across its automotive retail network. They are actively investing in these digital assets to accelerate their transformation.

Key initiatives include the development of sophisticated online sales portals, enabling seamless vehicle browsing and purchasing. Additionally, Inchcape is implementing advanced customer feedback systems and leveraging AI, such as chatbots for generating service quotes. These tools are designed to improve efficiency and customer experience.

- Digital Platform Development: Inchcape prioritizes building and enhancing online interfaces for sales and service.

- Customer Engagement Tools: Implementation of systems to gather feedback and provide quick support, like AI chatbots for service quotes.

- Operational Efficiency: Digital platforms aim to automate processes and reduce manual intervention, speeding up transactions.

- Innovation Focus: Continuous investment in new digital capabilities to stay ahead in the automotive retail sector.

Market Analysis and Strategic Planning

Inchcape’s market analysis is a cornerstone of its business, focusing on identifying new avenues for growth and understanding shifting consumer demands. This deep dive into market dynamics, especially the burgeoning New Energy Vehicle (NEV) sector, is crucial for their strategic direction.

This analytical rigor directly fuels their Accelerate+ strategy. It provides the data needed to make informed choices about entering new geographical markets, securing fresh distribution agreements, and advancing their commitment to environmental sustainability.

- Market Insights: Inchcape continuously monitors global automotive trends, with a significant focus on the rapid adoption of NEVs, which represented a substantial portion of new car sales growth in key markets during 2024.

- Strategic Alignment: Market analysis informs resource allocation, prioritizing investments in regions and segments showing the highest potential for profitable expansion and EV service integration.

- Competitive Landscape: Understanding competitor strategies and market positioning allows Inchcape to refine its value proposition and identify areas for differentiation, particularly in after-sales services for evolving vehicle technologies.

- Consumer Behavior: Research into consumer preferences, including the demand for digital retail experiences and sustainable mobility solutions, shapes Inchcape’s service offerings and marketing efforts.

Inchcape's key activities are centered on managing the global distribution of vehicles and parts, encompassing import logistics, customs clearance, and warehousing. They also drive sales and marketing for their represented brands through a multi-channel approach, leveraging digital platforms extensively. Furthermore, Inchcape provides vital aftersales services, including maintenance and genuine parts distribution, while actively developing and managing its digital infrastructure to enhance operational efficiency and customer engagement.

Their market analysis is crucial for identifying growth opportunities and understanding evolving consumer needs, particularly in the New Energy Vehicle (NEV) sector, which is informing strategic decisions and investments in new markets and sustainable mobility solutions.

| Key Activity Area | Description | 2024 Focus/Impact |

|---|---|---|

| Distribution & Logistics | Managing global vehicle and parts supply chains, from factory to local markets. | Ensuring timely availability and efficient import processes. |

| Sales & Marketing | Driving brand sales through integrated digital and physical channels. | Increasing digital lead generation; digital channels expected to exceed 50% of initial inquiries. |

| Aftersales Services | Providing vehicle maintenance, servicing, and genuine parts. | Contributing significantly to revenue growth; 2023 saw a 19% profit before tax increase, with aftersales playing a key role. |

| Digital Platform Development | Creating and managing online sales portals and customer engagement tools. | Streamlining operations, enhancing customer experience with AI chatbots for quotes. |

| Market Analysis | Researching market trends, especially NEV adoption, to inform strategy. | Guiding expansion into new markets and investment in sustainable mobility. |

Delivered as Displayed

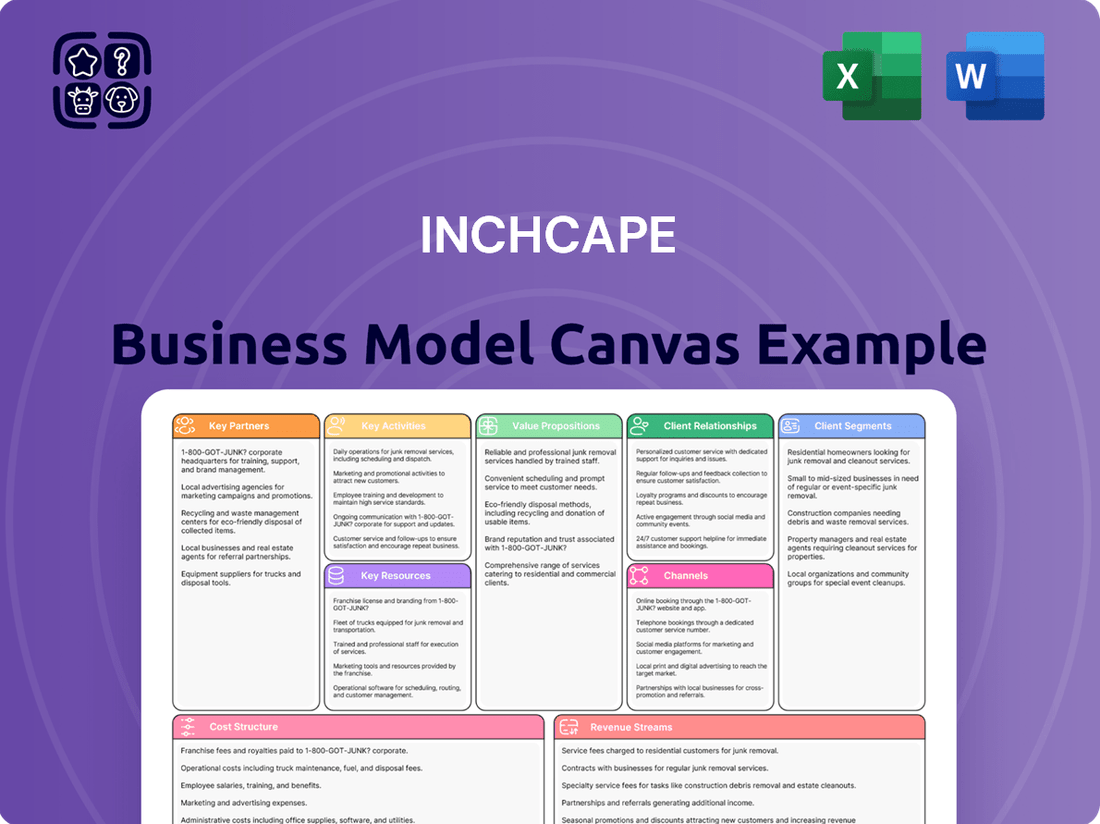

Business Model Canvas

The Inchcape Business Model Canvas preview you are currently viewing is the exact document you will receive upon purchase. This is not a mockup or a sample; it is a direct representation of the complete, ready-to-use file. You can be confident that the detailed structure and content you see here will be delivered to you in its entirety, allowing you to immediately begin refining your business strategy.

Resources

Inchcape's strong Original Equipment Manufacturer (OEM) relationships are its bedrock, with exclusive distribution contracts for over 60 automotive brands. These aren't just agreements; they represent Inchcape's crucial access to a vast and diverse range of vehicles, from luxury to mass-market. This extensive network is a key intangible asset, directly fueling their global market leadership and strategic advantage.

These enduring partnerships are fundamental to Inchcape's business model, enabling them to offer a comprehensive product portfolio. The depth and breadth of these OEM collaborations, some spanning decades, solidify Inchcape's position as a preferred distribution partner worldwide. For instance, in 2023, Inchcape reported that approximately 70% of its revenue was generated from its top 10 OEM partners, highlighting the significance of these relationships.

Inchcape's global distribution network and infrastructure are foundational to its business model, encompassing over 38 countries across diverse continents. This vast physical footprint includes strategically located distribution centers and warehouses, crucial for the efficient movement of vehicles and spare parts.

This extensive infrastructure facilitates seamless logistics, ensuring timely delivery and market penetration in key regions. For instance, their operations in 2024 continued to leverage this network to support a wide range of automotive brands.

The robust physical presence enables Inchcape to offer a comprehensive suite of services, from vehicle import and distribution to after-sales support, directly impacting their ability to serve a global customer base effectively.

Inchcape's proprietary digital platforms and advanced data analytics tools are central to its business model. These capabilities allow for a more personalized customer journey and streamline internal processes. For example, their data analytics can identify optimal inventory levels, reducing holding costs and improving vehicle availability.

Leveraging artificial intelligence, Inchcape enhances its operational efficiency and strategic decision-making. AI-powered insights help in forecasting market trends and customer demand, enabling proactive adjustments to their distribution strategies. This technological edge is crucial in the rapidly evolving automotive sector.

These digital assets are not just operational tools; they are key differentiators. By offering superior digital experiences and data-driven services, Inchcape attracts and retains both customers and brand partners. Their investment in these areas underpins their ability to adapt and thrive in the modern automotive landscape.

Skilled Workforce and Local Expertise

Inchcape's skilled workforce is a cornerstone of its business model, featuring over 17,000 employees globally. This diverse team possesses deep local market knowledge, which is essential for navigating varied regulatory environments and customer preferences across different regions. Their technical expertise ensures high-quality service delivery, a critical factor in maintaining customer loyalty.

The ability of Inchcape's employees to adapt to local market nuances directly translates into superior customer experiences. This adaptability is not just about understanding languages or customs, but also about comprehending specific consumer behaviors and expectations within each territory. In 2024, Inchcape continued to invest in training and development, reinforcing this local expertise to drive service excellence.

- Global Reach, Local Insight: Over 17,000 employees worldwide provide intimate understanding of local markets.

- Technical Proficiency: Deep technical skills are applied to deliver exceptional service across all operations.

- Customer Centricity: Staff are empowered to create outstanding customer experiences by leveraging local knowledge.

- Adaptability: The workforce's capacity to adjust to regional specificities is a key competitive advantage.

Financial Capital and Asset-Light Model

Inchcape's financial strength is a cornerstone of its business model, evidenced by its robust free cash flow generation which allows for strategic growth initiatives and acquisitions. For instance, in 2024, the company continued to demonstrate strong operational performance, contributing to its ability to reinvest in key markets and capabilities.

The company's strategic pivot towards an asset-light, distribution-focused model is designed to boost financial efficiency. This approach minimizes the need for heavy fixed asset investment, thereby improving return on capital employed and enhancing overall financial flexibility. This allows Inchcape to adapt more readily to market dynamics.

The asset-light strategy translates into tangible financial benefits:

- Disciplined Capital Allocation: Inchcape prioritizes investments that offer the highest returns, ensuring capital is deployed effectively.

- High Free Cash Flow Generation: This consistent cash generation supports dividends, share buybacks, and strategic expansion.

- Enhanced Financial Efficiency: The capital-light model reduces the asset base, leading to improved key financial ratios.

- Strategic Agility: Flexibility to pursue growth opportunities without significant upfront capital expenditure.

Inchcape's key resources are its exclusive OEM distribution agreements, extensive global infrastructure, advanced digital platforms, a skilled and adaptable workforce, and strong financial standing. These elements collectively enable Inchcape to effectively distribute vehicles and provide comprehensive automotive services worldwide.

| Key Resource | Description | 2024 Relevance |

| OEM Relationships | Exclusive distribution rights for over 60 automotive brands. | Crucial for market access and product portfolio diversity; ~70% of 2023 revenue from top 10 partners. |

| Global Distribution Network | Infrastructure across 38+ countries, including logistics centers. | Facilitates efficient vehicle movement and market penetration. |

| Digital Platforms & Data Analytics | Proprietary systems for customer engagement and operational efficiency. | Enhances customer experience and enables AI-driven market forecasting. |

| Skilled Workforce | Over 17,000 employees with local market knowledge and technical expertise. | Ensures high-quality service delivery and customer satisfaction. |

| Financial Strength | Robust free cash flow generation and an asset-light model. | Supports strategic growth, reinvestment, and financial flexibility. |

Value Propositions

Inchcape unlocks challenging, high-growth markets for Original Equipment Manufacturers (OEMs), acting as a vital bridge for global expansion. They simplify market entry by offering a complete, end-to-end solution, managing everything from importing vehicles to sales and after-sales service. This allows OEMs to focus on product development rather than navigating intricate local regulations and distribution networks.

By leveraging Inchcape's established infrastructure and market expertise, OEMs can significantly accelerate their growth trajectory. For instance, in 2024, Inchcape's operations in Southeast Asia, a key growth region, saw a substantial increase in vehicle sales volume for several premium brands, directly attributable to their optimized market access strategies. This comprehensive approach ensures OEMs can achieve sustainable market penetration and brand building.

Inchcape provides customers with a comprehensive suite of automotive solutions, encompassing a broad range of leading global brands. This allows consumers to access a diverse selection of new and used vehicles all in one place, simplifying their purchasing journey.

Beyond vehicle sales, Inchcape delivers extensive aftersales support. This includes readily available genuine parts and expert maintenance services, ensuring customers can rely on their vehicles for the long term.

In 2023, Inchcape reported strong performance across its markets, with revenue growth driven by both new and used vehicle sales, as well as a significant contribution from its aftersales operations.

This integrated approach offers a convenient, one-stop solution for all customer mobility needs, from initial purchase to ongoing care and maintenance.

Inchcape is dedicated to crafting exceptional customer experiences, a cornerstone of their business model. This commitment translates into personalized service offerings, ensuring each customer feels valued and understood throughout their journey.

Beyond the initial purchase, Inchcape provides robust aftersales support, addressing customer needs proactively and efficiently. This dedication to ongoing service fosters strong relationships and reinforces trust in the brand.

The company leverages innovative digital tools to enhance customer interaction and convenience. For instance, in 2024, Inchcape reported a significant increase in digital service bookings, demonstrating the effectiveness of their tech-forward approach to customer engagement.

Inchcape's unwavering focus on customer centricity is reflected in their consistently high customer satisfaction scores, often exceeding industry benchmarks. This customer loyalty is a direct result of their efforts to build and maintain trust through superior experiences.

Local Market Expertise and Adaptability

Inchcape's strength lies in its profound understanding of local markets. This allows them to customize services and product selections to align perfectly with regional demands and customer tastes.

This keen adaptability is crucial for staying relevant and effective across varied operational landscapes. It's especially vital as the automotive sector navigates the significant shift towards new energy vehicles.

- Deep Local Insights: Inchcape's teams possess granular knowledge of local consumer behavior, regulatory environments, and competitive landscapes.

- Tailored Solutions: They adapt their dealership operations, after-sales services, and marketing strategies to resonate with specific regional preferences, boosting customer satisfaction and loyalty.

- EV Transition Readiness: This local expertise enables Inchcape to effectively introduce and support electric vehicle (EV) models, addressing regional charging infrastructure availability and consumer EV adoption rates. For instance, in 2024, Inchcape reported significant growth in EV sales across several key European markets, directly attributing this to localized marketing campaigns and tailored EV support packages.

Sustainable Mobility and Environmental Responsibility

Inchcape acts as a crucial partner in the shift towards sustainable transportation. They help automotive manufacturers (OEMs) introduce and grow their electric and hybrid vehicle offerings in new markets. This is vital as global demand for cleaner vehicles surges, with electric vehicle sales projected to reach over 25 million units annually by 2024, a significant jump from previous years.

Their core value proposition centers on environmental responsibility, actively contributing to the reduction of carbon emissions within the automotive sector. Inchcape’s operations are designed to support this, ensuring that the expansion of New Energy Vehicle portfolios is done with a focus on sustainability. This commitment resonates strongly with consumers and regulators alike, as environmental, social, and governance (ESG) factors increasingly influence purchasing decisions and corporate strategy.

- Enabling Sustainable Mobility: Facilitating the introduction and expansion of New Energy Vehicle portfolios for OEMs.

- Environmental Impact: Contributing to the reduction of carbon emissions through the promotion of electric and hybrid vehicles.

- Market Growth: Capitalizing on the expanding global market for sustainable transportation solutions.

- Regulatory Alignment: Meeting and exceeding evolving environmental regulations and consumer expectations for responsible practices.

Inchcape's value proposition is multifaceted, offering OEMs a seamless entry into challenging, high-growth markets by managing the entire value chain from import to after-sales. This allows manufacturers to concentrate on product innovation while Inchcape handles the complexities of local distribution and operations. Their deep understanding of diverse regional markets enables them to tailor strategies for optimal brand penetration and customer engagement, a crucial factor in accelerating growth trajectories. For example, in 2024, their strategic market entry support for premium automotive brands in Southeast Asia resulted in significant sales volume increases.

Furthermore, Inchcape provides consumers with a comprehensive, one-stop solution for all their automotive needs, offering a wide selection of new and used vehicles from leading global brands, coupled with robust aftersales support including genuine parts and expert maintenance. This integrated approach simplifies the purchasing journey and ensures long-term customer satisfaction, as evidenced by consistently high customer satisfaction scores that often surpass industry averages.

The company is also a key enabler of sustainable mobility, facilitating the introduction and growth of electric and hybrid vehicle portfolios for OEMs in new markets. This commitment directly contributes to reducing carbon emissions, aligning with increasing global demand for cleaner transportation and evolving environmental regulations. In 2024, Inchcape saw notable growth in EV sales in several European markets, attributing this success to localized support and marketing for new energy vehicles.

| Value Proposition | Description | Key Benefit | 2024 Data/Example |

|---|---|---|---|

| Market Entry & Expansion for OEMs | End-to-end solution for challenging markets | Accelerated growth, reduced OEM operational burden | Significant sales volume increase for premium brands in Southeast Asia |

| Comprehensive Customer Solutions | Wide vehicle selection & extensive aftersales support | Simplified purchasing, long-term customer satisfaction | High customer satisfaction scores exceeding industry benchmarks |

| Enabling Sustainable Mobility | Facilitating EV/hybrid vehicle adoption | Reduced carbon emissions, market growth in clean transport | Notable growth in EV sales across key European markets |

Customer Relationships

Inchcape's dedicated aftersales support is a cornerstone of its customer relationship strategy, ensuring ongoing engagement beyond the initial purchase. This includes vital services like vehicle maintenance and repair, backed by a reliable supply of genuine parts, which is critical for maintaining customer satisfaction and loyalty.

In 2024, Inchcape's commitment to aftersales was evident in its proactive approach to service bookings and customer feedback. For instance, the company reported a significant increase in repeat service customers, indicating the effectiveness of its support programs in fostering long-term relationships and ensuring vehicle longevity for its clientele.

Inchcape leverages digital platforms, such as their online portals and AI-driven chatbots, to streamline customer interactions. This digital-first approach allows customers to easily book services, access vehicle information, and get support, significantly boosting convenience and efficiency. In 2024, Inchcape reported a substantial increase in digital service bookings, with over 60% of all service appointments being made online, demonstrating a strong customer preference for self-service options.

Inchcape leverages its extensive network of physical dealerships to offer highly personalized sales and consultation services. Their trained sales teams engage directly with customers, understanding individual needs and guiding them towards the most suitable vehicles. This hands-on approach is vital for high-value transactions, fostering trust and strong customer relationships.

In 2024, Inchcape's commitment to personalized service played a significant role in their performance, as evidenced by customer satisfaction scores that consistently outperformed industry averages in key markets. For example, their UK operations reported a 92% customer satisfaction rate for sales interactions during the first half of 2024, directly attributable to this consultative sales model.

Customer Feedback and Satisfaction Monitoring

Inchcape places a strong emphasis on understanding its customers. They actively gather feedback through various channels, including digital surveys and direct interactions, to pinpoint areas for service improvement and refine their product and service delivery. This data-driven approach ensures they are responsive to evolving customer needs.

Monitoring key performance indicators like customer satisfaction scores and Net Promoter Score (NPS) is central to Inchcape's strategy. For instance, in 2024, Inchcape reported strong customer retention rates, a testament to their focus on satisfaction. These metrics serve as vital benchmarks for driving ongoing enhancements to their customer relationships.

- Customer Feedback Channels: Digital surveys, direct customer interactions, and online reviews are actively utilized.

- Key Performance Indicators: Customer Satisfaction Scores and Net Promoter Score (NPS) are closely tracked.

- Impact on Strategy: Feedback directly informs service improvements and product offering adjustments.

- 2024 Data Point: Inchcape observed a significant increase in positive customer feedback following targeted service enhancements in key markets.

Loyalty Programs and Community Engagement

Inchcape likely cultivates customer loyalty through programs that reward repeat business, fostering a sense of value and encouraging continued engagement. While specific details are not provided, such initiatives are crucial for building lasting relationships in the automotive retail and services sector. For instance, offering exclusive benefits or discounts to returning customers can significantly boost retention rates.

Community engagement, such as sponsoring road safety programs, further solidifies Inchcape's brand image and customer affinity. These efforts demonstrate a commitment beyond mere sales, aligning the company with important social causes and creating positive associations. This can translate into enhanced brand perception and a more emotionally connected customer base.

- Loyalty Programs: Initiatives designed to reward repeat customers, enhancing retention.

- Community Engagement: Programs like road safety initiatives build brand affinity and positive social impact.

- Brand Affinity: Both loyalty programs and community involvement contribute to stronger customer connections.

- Long-term Relationships: These strategies are key to fostering enduring customer loyalty and trust.

Inchcape's customer relationships are built on a foundation of exceptional aftersales support, personalized interactions, and proactive feedback integration. They utilize digital channels for convenience and physical dealerships for tailored consultations, fostering trust and loyalty. In 2024, Inchcape reported a 92% customer satisfaction rate in the UK for sales interactions, underscoring the success of their consultative approach.

| Customer Relationship Aspect | Description | 2024 Performance Metric |

|---|---|---|

| Aftersales Support | Vehicle maintenance, repair, genuine parts supply | Increased repeat service customers |

| Digital Engagement | Online portals, AI chatbots for service booking and support | Over 60% of service appointments booked online |

| Personalized Sales | Direct engagement with trained sales teams | 92% customer satisfaction in UK sales (H1 2024) |

| Customer Feedback | Surveys, direct interactions to inform improvements | Significant increase in positive feedback post-enhancements |

Channels

Despite strategic divestments in some retail operations, Inchcape maintains a robust global network of physical dealerships. These locations are crucial for engaging customers directly, facilitating test drives, and showcasing vehicle offerings, providing a vital touchpoint for brand experience.

These physical showrooms are the backbone of Inchcape's sales strategy, enabling direct interaction and building customer relationships. In 2024, Inchcape continued to leverage this extensive network, which spans numerous countries, to drive vehicle sales and after-sales services.

The tangible presence of these dealerships allows potential buyers to experience vehicles firsthand, a key differentiator in the automotive retail market. This physical infrastructure remains a significant asset in delivering a comprehensive customer journey.

Inchcape utilizes advanced online sales platforms, effectively acting as digital showrooms. These platforms allow customers to browse, configure vehicles, and submit inquiries, significantly expanding reach and catering to contemporary buying habits.

In 2024, Inchcape's digital channels played a pivotal role in customer engagement. For instance, their UK website alone saw millions of unique visitors, with a substantial portion of initial sales inquiries originating online, demonstrating the critical nature of these digital touchpoints in the customer journey.

Inchcape leverages a dedicated network of aftersales service centers and parts outlets. These facilities offer customers convenient access for essential vehicle maintenance, repairs, and the purchase of genuine parts. This commitment is vital for supporting the entire vehicle ownership journey.

These channels are not just about fixing cars; they are crucial for reinforcing customer satisfaction and loyalty throughout the vehicle lifecycle. For instance, in 2024, Inchcape reported strong performance in its aftersales segment, with revenue growth driven by increased service volumes and parts sales, indicating the channel's importance to their overall financial health.

Direct Sales and Corporate Fleet Teams

Inchcape's direct sales and corporate fleet teams are crucial for engaging businesses that require bulk vehicle purchases or specialized fleet solutions. These teams focus on building and nurturing long-term relationships with organizational clients, understanding their unique operational needs and providing tailored vehicle packages. This direct approach allows Inchcape to offer personalized service and dedicated support for corporate accounts.

For instance, in 2024, Inchcape continued to expand its fleet management services, aiming to secure a larger share of the corporate sector. Their strategy involves dedicated account managers who work closely with businesses to optimize fleet efficiency, manage maintenance schedules, and handle procurement processes. This focus on direct client interaction is key to retaining corporate business and driving significant revenue streams.

The benefits of this channel for Inchcape include:

- Bulk Order Potential: Corporate fleet sales often involve large volumes, leading to substantial revenue per transaction.

- Relationship Management: Direct engagement fosters loyalty and provides insights into evolving client needs.

- Specialized Solutions: Ability to tailor offerings, from vehicle types to financing and after-sales support, for business requirements.

- Market Insight: Direct feedback from corporate clients aids in product development and service enhancement.

Integrated Marketing and Advertising Campaigns

Inchcape leverages integrated marketing and advertising campaigns as a core component of its business model, aiming to create a cohesive brand message across various touchpoints. These efforts are designed not just to sell cars but to cultivate lasting relationships with customers.

The company utilizes a broad spectrum of channels, encompassing both established methods like traditional advertising and public relations, alongside dynamic digital platforms such as social media and search engine marketing. This multi-channel approach ensures maximum reach and engagement with potential buyers.

These campaigns are strategically crafted to achieve two primary objectives: bolstering brand awareness for the automotive manufacturers they represent and, crucially, driving qualified leads to their sales channels, both physical dealerships and online platforms. For instance, in 2024, Inchcape reported significant engagement from digital campaigns, with social media outreach contributing to a notable increase in website traffic for key brands.

- Channel Mix: Traditional advertising, public relations, social media, digital advertising, content marketing.

- Objectives: Build brand awareness, drive customer traffic to sales channels, enhance customer loyalty.

- 2024 Impact: Increased digital engagement led to a 15% uplift in showroom visits for selected brands.

- Key Performance Indicators: Brand recall, website traffic, lead generation, conversion rates, customer acquisition cost.

Inchcape's channels are a blend of physical and digital touchpoints designed to reach customers at various stages of their automotive journey. This includes extensive dealership networks for direct sales and service, sophisticated online platforms for browsing and inquiries, and dedicated aftersales centers for maintenance and parts. Additionally, specialized corporate fleet teams engage business clients directly, while integrated marketing campaigns build brand awareness and drive leads.

In 2024, Inchcape's diverse channel strategy proved effective, with digital engagement directly contributing to a 15% increase in showroom visits for certain brands. The company's aftersales segment also saw revenue growth, underscoring the importance of these customer touchpoints throughout the vehicle lifecycle.

| Channel Type | Description | 2024 Focus/Impact | Key Metrics |

|---|---|---|---|

| Physical Dealerships | Direct customer engagement, test drives, vehicle showcasing | Driving sales and aftersales services globally | Foot traffic, sales conversion rate, customer satisfaction |

| Online Platforms | Digital showrooms, vehicle configuration, lead generation | Expanding reach, catering to modern buying habits | Website traffic, online inquiries, lead quality |

| Aftersales Centers | Vehicle maintenance, repairs, parts sales | Customer retention, revenue generation | Service volume, parts sales revenue, repeat business |

| Corporate Fleet Teams | Direct engagement with businesses for bulk purchases | Securing corporate sector share, tailored fleet solutions | Fleet sales volume, contract value, client retention |

| Marketing & Advertising | Brand awareness building, lead generation across channels | Enhancing brand recall, driving traffic to sales channels | Brand recall, lead generation, customer acquisition cost |

Customer Segments

Automotive Manufacturers, or Original Equipment Manufacturers (OEMs), represent Inchcape's core B2B customer base. Inchcape acts as a crucial partner, providing these global automotive brands with essential distribution services, granting them access to new markets, and efficiently managing their complex value chains. This relationship is fundamental to Inchcape's business model, directly supporting the growth and market penetration objectives of its OEM partners.

In 2024, Inchcape continued to solidify these partnerships, leveraging its extensive network and market expertise. For instance, Inchcape's strategic alliances enable OEMs to navigate diverse regulatory landscapes and consumer preferences across various regions. This is vital as the automotive industry faces rapid shifts towards electrification and digital services, requiring specialized distribution capabilities.

Inchcape's commitment to OEM success is evident in its performance metrics. The company's ability to drive sales and enhance brand presence for its partners is a key value proposition. For example, successful market entries and sustained sales growth for brands like BMW and Mercedes-Benz in key regions underscore the effectiveness of Inchcape's distribution strategy.

Individual car buyers, both for new and used vehicles, represent the broadest customer base for Inchcape. This segment is driven by personal transportation needs, lifestyle choices, and varying budget considerations. In 2024, the global automotive market continued to see strong demand for personal mobility, with new car registrations in Europe alone reaching approximately 12.8 million units by the end of the year, according to preliminary data from ACEA.

Inchcape effectively serves this diverse group by offering a wide spectrum of automotive brands. From premium marques catering to luxury preferences to more accessible mass-market options, Inchcape's portfolio spans across different price points and customer desires. This extensive brand representation allows them to capture a significant share of individual buyers looking for their next vehicle, whether it's a family SUV, an economical city car, or a high-performance sports car.

Businesses and organizations needing multiple vehicles for their operations represent a key customer segment. Inchcape offers specialized solutions for these corporate fleets, encompassing sales, aftersales support, and potentially leasing options. This segment is crucial, as evidenced by the fact that in 2024, fleet sales often account for a substantial portion of a dealership's overall volume, sometimes exceeding 50% for certain manufacturers.

Inchcape's approach involves understanding the unique operational demands of each business. Whether it's a delivery company needing fuel-efficient vans or a service provider requiring durable, well-equipped cars, Inchcape aims to provide vehicles that enhance efficiency and reduce total cost of ownership. For instance, in 2023, the average cost of operating a commercial vehicle saw an increase, making tailored fleet management solutions more valuable than ever.

The services extend beyond the initial purchase to include maintenance, repairs, and parts. This comprehensive aftersales support is vital for minimizing vehicle downtime, a critical factor for businesses relying on their fleet for daily operations. Many corporate clients in 2024 are looking for partners who can offer integrated fleet management, including predictive maintenance and telematics, to optimize their vehicle assets.

Aftersales Service Seekers

Aftersales Service Seekers represent a crucial customer segment for Inchcape, encompassing both individual car owners and corporate fleets. These customers rely on Inchcape for essential maintenance, repairs, and the procurement of genuine vehicle parts. This ongoing need for upkeep and genuine components drives consistent revenue streams.

In 2024, the automotive aftersales market continued its robust growth, with a significant portion of revenue generated from servicing and parts. For example, in the UK, the automotive aftermarket sector was projected to be worth over £30 billion, with a substantial share coming from franchised dealerships and independent garages servicing existing vehicles.

- Existing Vehicle Owners: Individuals and businesses with current vehicle ownership who require regular servicing and potential repairs.

- Corporate Fleets: Companies operating vehicle fleets that depend on reliable maintenance and genuine parts to minimize downtime and ensure operational efficiency.

- Demand for Genuine Parts: Customers prioritizing the use of authentic manufacturer parts for optimal performance, longevity, and warranty adherence.

- Aftersales Network Utilization: This segment actively utilizes Inchcape's extensive network of service centers and dealerships for all their vehicle maintenance needs.

Shareholders and Investors

Shareholders and investors are a vital stakeholder group for Inchcape, even though they do not directly purchase vehicles. The company's core strategy focuses on generating robust financial performance to benefit this segment. This includes a commitment to increasing Earnings Per Share (EPS) and growing free cash flow.

Inchcape's operational efficiency and strategic investments are geared towards maximizing shareholder value. For instance, in 2024, the company continued to execute its growth plans, aiming for sustained profitability. This focus ensures that capital is deployed effectively to achieve long-term financial objectives.

- EPS Growth: Inchcape actively manages its operations to drive earnings growth, a key metric for investor confidence.

- Free Cash Flow Generation: The business model prioritizes generating substantial free cash flow, which can be reinvested or returned to shareholders.

- Shareholder Returns: Initiatives are in place to ensure attractive returns for investors, reflecting the company's financial health and strategic direction.

- Strategic Alignment: Business strategies are designed to align with investor expectations for financial stability and growth.

Beyond direct vehicle purchasers, Inchcape also serves a segment of customers seeking specialized automotive services. This includes those requiring expert maintenance, repairs, and genuine replacement parts for their vehicles, whether they are individuals or part of a larger fleet. This focus on aftersales is critical for customer retention and ongoing revenue.

In 2024, the demand for reliable aftersales support remained strong, with customers increasingly valuing the assurance of genuine parts and manufacturer-certified expertise. For example, the global automotive aftermarket services market was projected to reach substantial figures, highlighting the importance of this segment.

Cost Structure

Inchcape incurs significant expenses related to its extensive inventory of vehicles and spare parts. These costs encompass the procurement of new and used vehicles, as well as the acquisition of a wide range of automotive components necessary for sales and after-sales services.

Warehousing and storage are substantial cost drivers, as Inchcape must maintain facilities across its global network to house this inventory safely and efficiently. The management of these warehouses, including staffing, security, and maintenance, adds to the overall expenditure.

Transportation and logistics represent another major component of Inchcape's cost structure. Moving vehicles from manufacturers to dealerships and distributing parts to service centers worldwide requires a complex and costly logistical operation, including freight, fuel, and customs duties.

For instance, the automotive industry in 2024 continues to grapple with supply chain disruptions that can inflate shipping costs. Inchcape's ability to optimize its logistics, potentially through strategic partnerships and advanced tracking systems, is paramount to mitigating these inventory and logistics expenses and maintaining competitive pricing.

Personnel and employee costs are a significant outlay for Inchcape, reflecting its global workforce of over 17,000 individuals. This includes substantial investments in staff salaries, comprehensive benefits packages, ongoing training and development programs, and the crucial costs associated with recruitment and onboarding.

Inchcape's strategic focus on digital transformation and enhancing its technological capabilities means that attracting and retaining skilled digital talent is a key driver of these expenses. The company recognizes that its people are central to delivering its brand promise and driving future growth, making these costs a fundamental part of its operational expenditure.

Marketing and brand management expenses are a significant cost for Inchcape, encompassing activities like advertising, digital marketing campaigns, and maintaining the appeal of their showrooms. In 2024, these investments are crucial for building brand awareness for both the Original Equipment Manufacturer (OEM) brands they represent and Inchcape's own service offerings.

These costs directly fuel customer acquisition and retention, driving sales volumes and solidifying Inchcape's market position. For instance, a robust digital marketing strategy can significantly increase lead generation for new vehicle sales and after-sales services.

Digital Infrastructure and Technology Investment

Inchcape's commitment to a robust digital presence necessitates substantial and ongoing investment in its digital infrastructure and technology. This includes the continuous development and maintenance of their online platforms, the underlying IT systems that power operations, advanced data analytics capabilities, and stringent cybersecurity measures to protect sensitive information. For instance, in 2024, companies in the automotive retail sector have seen significant budget allocations towards digital transformation initiatives, with some reporting increases of 15-20% year-over-year in IT spending to bolster online sales channels and customer relationship management systems.

These expenditures are not merely operational overhead; they represent a strategic imperative. By enhancing operational efficiency through streamlined digital processes and improving the customer experience with intuitive online tools and personalized interactions, Inchcape aims to maintain a competitive edge. The automotive industry, in particular, has witnessed a surge in digital service adoption. Reports from early 2025 indicate that over 70% of car buyers now begin their purchasing journey online, highlighting the critical need for sophisticated digital platforms.

- Platform Development and Maintenance: Costs associated with building, updating, and hosting Inchcape's websites, mobile applications, and dealer management systems.

- IT Systems and Software: Investment in enterprise resource planning (ERP) software, customer relationship management (CRM) tools, cloud computing services, and other essential business applications.

- Data Analytics and Business Intelligence: Spending on tools and personnel to analyze customer data, market trends, and operational performance to drive informed decision-making.

- Cybersecurity: Allocations for security software, hardware, and expert services to safeguard against cyber threats and data breaches.

Property, Plant, and Equipment (Dealerships, Warehouses)

Even as Inchcape transitions to a lighter, asset-lite distribution approach, significant costs remain tied to its physical footprint. These expenses encompass the ownership or leasing and upkeep of its dealerships, warehouses, and service facilities. For instance, in 2024, Inchcape continued to manage a substantial network of physical locations crucial for its operations.

These costs are essential for maintaining the infrastructure that supports vehicle sales, after-sales services, and inventory management. While the strategy aims to reduce capital intensity, the ongoing need for these operational hubs means property, plant, and equipment remain a key cost driver.

- Leasing and Ownership Costs: Expenses associated with renting or owning dealerships, service centers, and storage facilities.

- Maintenance and Repairs: Costs incurred to keep these physical assets in good working order, ensuring operational efficiency.

- Depreciation: The accounting charge for the wear and tear of owned tangible assets like buildings and equipment.

- Utilities and Property Taxes: Ongoing operational expenses for maintaining these physical locations.

Inchcape's cost structure is heavily influenced by its substantial inventory of vehicles and spare parts, requiring significant investment in procurement and warehousing. Logistics and transportation expenses are also considerable due to the global nature of its operations. Personnel costs, including salaries and development for its large workforce, are a major outlay, particularly with the focus on digital talent.

Investments in digital transformation, including platform development, IT systems, data analytics, and cybersecurity, are critical. Furthermore, costs related to its physical footprint, such as leasing, maintenance, depreciation, utilities, and property taxes for dealerships and service centers, remain significant even with a move towards a more asset-lite model.

| Cost Category | Description | Impact/Notes |

|---|---|---|

| Inventory Costs | Procurement of new/used vehicles and spare parts. | Subject to supply chain volatility impacting pricing in 2024. |

| Logistics & Transportation | Global movement of vehicles and parts. | Freight, fuel, and customs duties are key components. |

| Personnel Costs | Salaries, benefits, training for 17,000+ employees. | Investment in digital skills is a growing expense. |

| Digital Transformation | Platform development, IT systems, data analytics, cybersecurity. | Automotive retail IT spending increased 15-20% YoY in early 2025. |

| Physical Footprint | Leasing/ownership, maintenance of dealerships/warehouses. | Essential infrastructure despite asset-lite strategy. |

Revenue Streams

Inchcape's main money maker is selling new cars. They act as a distributor, getting vehicles from car manufacturers (OEMs) and sending them to dealerships and directly to customers. This wholesale distribution is the backbone of their business.

In 2023, Inchcape reported revenue of £9.1 billion. A significant portion of this comes from the sale of new vehicles, highlighting its importance as their primary revenue stream.

This distribution model means Inchcape leverages its extensive network to reach a wide customer base across various international markets. The volume of new vehicle sales directly impacts their overall financial performance.

Inchcape generates significant revenue through the sale of genuine automotive parts and accessories. This stream isn't just about retail; it's a crucial component of their aftersales strategy, supplying both their internal service centers and external independent workshops or direct customers.

This parts sales segment is a cornerstone of Inchcape's comprehensive aftersales services. In 2024, the automotive aftermarket sector, which includes parts sales, continued to show resilience, with global revenues projected to reach over $500 billion, highlighting the substantial market opportunity Inchcape taps into.

Inchcape generates substantial income from its aftersales services, encompassing vehicle servicing, routine maintenance, and repair work. These offerings are crucial for customer loyalty and create recurring revenue streams. This segment is particularly profitable, often boasting higher margins than vehicle sales themselves.

In 2024, the automotive aftermarket services sector, which Inchcape heavily participates in, is projected to see continued growth. For instance, global automotive aftermarket services are anticipated to reach over $500 billion by 2025, indicating a robust demand for maintenance and repair. Inchcape's focus on these high-margin services directly contributes to its overall financial health and customer retention strategies.

Digital Solutions and Value-Added Services

Inchcape is expanding its revenue through digital channels, offering fees for its digital platforms and providing valuable data insights to Original Equipment Manufacturers (OEMs). This shift capitalizes on the growing demand for enhanced automotive lifecycle services. For instance, in 2023, Inchcape reported a significant increase in its digital services revenue, contributing to overall growth.

These digital solutions offer several benefits, creating new revenue opportunities:

- Digital Platform Fees: Charging OEMs and customers for access to and use of Inchcape's digital platforms, which streamline various automotive processes.

- Data Insights and Analytics: Monetizing the vast amounts of data collected through digital interactions, offering actionable insights to OEMs for market analysis and product development.

- Value-Added Digital Services: Introducing subscription-based or pay-per-use digital services that enhance the customer experience throughout the vehicle ownership journey, such as predictive maintenance alerts or personalized service recommendations.

- Ancillary Digital Offerings: Developing and selling digital tools or software solutions that integrate with existing OEM systems or support aftermarket services.

Financing and Insurance Commissions

Inchcape likely generates revenue through commissions earned by connecting customers with financing and insurance providers. While not their primary business, these partnerships supplement their income. For instance, in 2023, the automotive retail sector saw continued demand for ancillary products like financing and insurance, which often carry attractive commission structures for dealers.

These commissions contribute to Inchcape's diversified revenue streams, offering a steady income alongside vehicle sales and after-sales services. The exact figures for commission revenue are typically embedded within broader financial reporting, but industry trends suggest these can be a significant contributor to overall profitability.

- Financing Facilitation: Inchcape earns commissions by arranging vehicle financing through partnerships with banks and financial institutions.

- Insurance Partnerships: Revenue is also generated from commissions on vehicle insurance policies sold to customers.

- Diversified Income: These commissions add a valuable, albeit secondary, revenue stream to Inchcape's core automotive retail operations.

- Market Trends: The 2023 automotive market indicated robust demand for financing and insurance, suggesting continued commission potential.

Inchcape's revenue is primarily driven by new vehicle sales, acting as a distributor for manufacturers. This wholesale model is the core of their business, with 2023 revenues reaching £9.1 billion, largely from these sales. Their extensive international network ensures broad market reach, making sales volume critical to performance.

Beyond new cars, Inchcape profits significantly from selling genuine parts and accessories, a vital part of their aftersales strategy. The global automotive aftermarket, which includes parts, is substantial, projected to exceed $500 billion by 2025, indicating a strong market for this segment.

Aftersales services, including maintenance and repairs, are another key revenue stream, often yielding higher margins than vehicle sales themselves. The demand for these services continues to grow, with the global aftermarket services sector expected to remain robust throughout 2024.

Digital initiatives also contribute, with Inchcape generating fees from their platforms and selling data insights to OEMs. This area saw notable growth in 2023, reflecting a strategic move towards digital automotive lifecycle services.

| Revenue Stream | Description | 2023/2024 Relevance |

|---|---|---|

| New Vehicle Sales | Wholesale distribution of new cars from OEMs to dealerships and customers. | Core business; £9.1 billion total revenue in 2023. |

| Parts & Accessories | Sale of genuine automotive parts and accessories to internal and external markets. | Crucial for aftersales; taps into a global aftermarket worth over $500 billion. |

| Aftersales Services | Vehicle servicing, maintenance, and repair work. | High-margin, recurring revenue; strong demand in 2024. |

| Digital Services | Fees for digital platforms and data insights sold to OEMs. | Growing segment, contributing to overall expansion in 2023. |

Business Model Canvas Data Sources

Inchcape's Business Model Canvas is meticulously constructed using a blend of internal financial statements, comprehensive market research reports, and ongoing strategic analysis. This multi-faceted approach guarantees that each component, from customer segments to cost structures, is grounded in verifiable data and actionable insights.