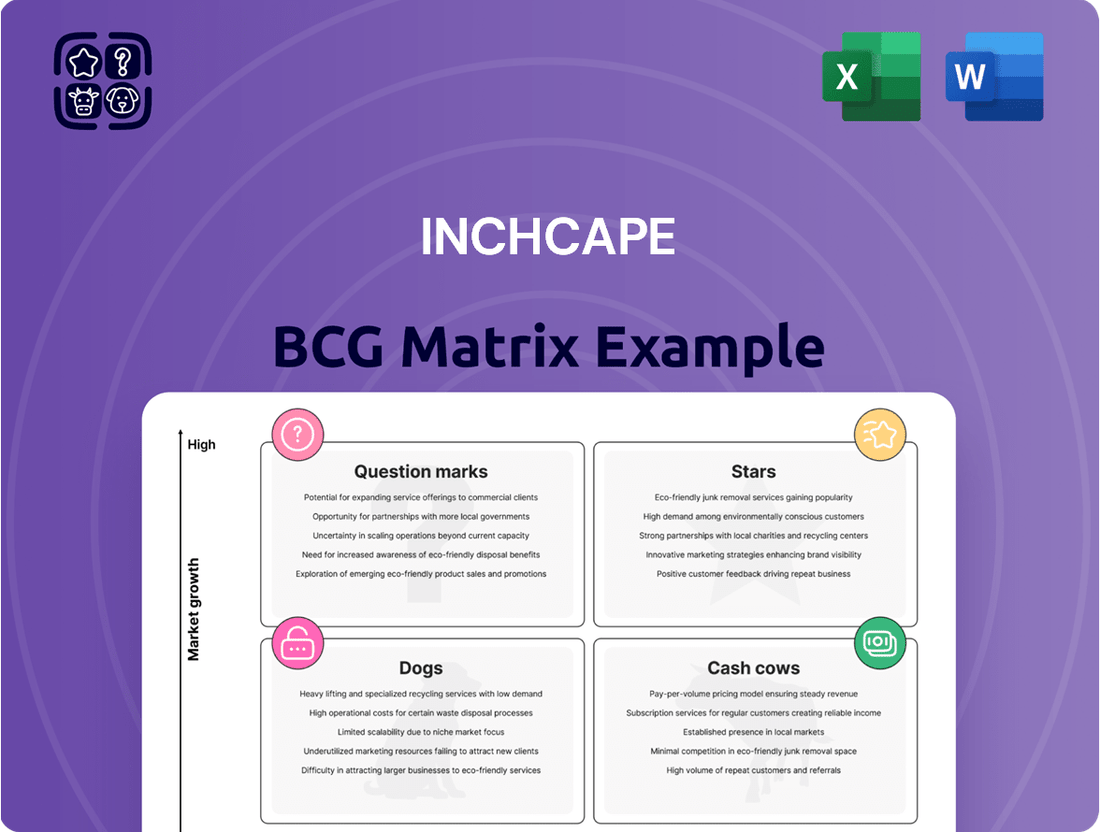

Inchcape Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Inchcape Bundle

This glimpse into the Inchcape BCG Matrix reveals the strategic positioning of their diverse product portfolio. Understand which of their offerings are market leaders (Stars), consistent revenue generators (Cash Cows), underperforming assets (Dogs), or potential growth opportunities (Question Marks).

To truly leverage this analysis for Inchcape's future success, you need the complete picture. The full BCG Matrix provides detailed quadrant placements, data-backed insights, and actionable recommendations to optimize resource allocation and drive profitable growth.

Don't settle for a partial view. Purchase the full Inchcape BCG Matrix report to gain a comprehensive understanding of their competitive landscape and unlock a clear roadmap for strategic investment and product development decisions.

Stars

Inchcape is strategically increasing its distribution of New Energy Vehicles (NEVs), which include Battery Electric Vehicles (BEVs), in emerging markets that show significant growth potential. The company's commitment is evident as they doubled their BEV sales to 2.3% in 2024, a clear indicator of market traction.

Further bolstering this push, Inchcape introduced six new electric or NEV brands, now available in over 70% of its operational territories. This expansion highlights the company's confidence in the NEV sector's future and its role in the global shift towards sustainable mobility.

This aggressive market penetration in the NEV space positions Inchcape as a key facilitator of the global mobility transition. By leveraging deep local market understanding, Inchcape effectively supports its Original Equipment Manufacturer (OEM) partners in these fast-evolving and dynamic economic landscapes.

Inchcape's proprietary digital platforms, such as DXP and DAP, alongside sophisticated data analytics, are crucial for its efficiency and market leadership. These tools streamline operations, boost customer interaction, and offer valuable insights to OEM partners, driving operational leverage and better working capital management.

The company's commitment to innovation is evident in its significant investment of over £20 million in 2024. This funding is specifically allocated to research and development in electric mobility and connected vehicle technologies, positioning Inchcape at the forefront of automotive advancements.

Inchcape's strategic partnerships with Chinese Original Equipment Manufacturers (OEMs) are a cornerstone of its growth. The company has inked substantial new distribution deals with brands like Deepal and Foton in Australia, several Changan brands across the Americas, and BYD throughout Europe and Africa. These alliances are vital as Chinese EV makers aggressively expand worldwide, and Inchcape offers them the essential distribution networks needed to navigate challenging markets.

These collaborations are a key driver for Inchcape to boost its market share within rapidly expanding segments. By bringing in these new, high-volume brands, Inchcape is effectively diversifying its automotive portfolio. For instance, BYD alone saw its global sales surge by over 50% in 2024 compared to the previous year, highlighting the immense growth potential Inchcape is tapping into. This move positions Inchcape to capture a significant portion of the burgeoning EV market.

Americas Region Performance

The Americas region is demonstrating a strong upward trajectory for Inchcape, building on a solid performance in 2024. This market is proving to be a dependable driver of growth, with positive organic expansion bolstering the company's overall stability.

Inchcape is strategically focusing on increasing its market presence in key American territories. This includes significant expansion efforts in markets such as Brazil, Canada, Chile, Peru, and Mexico, aiming to capitalize on their growth potential.

- Americas Growth: The region's performance is accelerating, a trend observed since 2024.

- Key Markets: Strategic expansion is targeting Brazil, Canada, Chile, Peru, and Mexico for market share gains.

- Resilience Factor: Positive organic growth from the Americas enhances Inchcape's overall business resilience.

Aftersales Services and Parts Distribution

Inchcape’s aftersales services and parts distribution are a significant contributor, generating high margins and consistent revenue. This segment is expected to see robust growth, especially with the expansion of digital channels. For instance, in 2024, Inchcape continued to invest in its digital parts platforms, aiming to streamline operations and improve customer experience across key markets like Asia Pacific.

This part of the business is capital-light and highly cash-generative, underpinning Inchcape's overall financial health and its ability to retain customers long-term. The strategic focus on digitalizing these operations is key to unlocking further efficiencies and introducing new value-added services.

Key aspects of Inchcape's Aftersales Services and Parts Distribution:

- High-margin, recurring revenue: This segment consistently delivers profitability.

- Digitalization focus: Investment in digital parts platforms, particularly in APAC, enhances efficiency.

- Customer retention driver: Strong aftersales support is crucial for building customer loyalty.

- Capital-light and cash-generative: This business model supports financial stability.

Stars in the Inchcape BCG Matrix represent high-growth, high-market-share businesses. Inchcape’s strategic expansion into New Energy Vehicles (NEVs), particularly with partnerships involving high-growth brands like BYD, positions these segments as potential Stars. The company's significant investment in EV technology and its aggressive market penetration strategy in emerging markets further solidify this classification. Inchcape's focus on capturing a large share of the rapidly expanding EV market through these ventures indicates a strong potential for future growth and profitability.

| Business Area | Market Growth | Market Share | BCG Classification | Strategic Focus |

|---|---|---|---|---|

| New Energy Vehicles (NEVs) Distribution | High | High (Targeted) | Star | Expansion, OEM Partnerships, Digitalization |

| Aftersales & Parts Distribution | Moderate to High | High | Cash Cow / Potential Star | Digitalization, Customer Retention |

| Americas Market Presence | High | Growing | Rising Star / Star | Market Penetration, Organic Growth |

What is included in the product

The Inchcape BCG Matrix analyzes business units based on market share and growth, guiding investment decisions.

Provides a clear, visual snapshot of your portfolio's health, relieving the pain of complex data analysis.

Cash Cows

Inchcape's global automotive distribution core business, post UK retail divestment, operates as a robust cash cow. This segment is characterized by its capital-light nature, focusing on exclusive distribution, sales, marketing, and logistics for new vehicles and parts across more than 40 diverse markets. This strategic focus yields resilient operating margins and strong free cash flow conversion, forming a stable and profitable bedrock for the company.

Within Europe and Africa, Inchcape's established operations in certain mature markets function as key cash cows. These regions, while exhibiting mixed overall growth, benefit from Inchcape's deep market penetration and optimized operational efficiencies. For instance, as of 2024, Inchcape reported strong performance in countries like Germany and the UK, where its extensive dealership network and brand recognition minimize the need for extensive new market acquisition spending.

These cash cow segments, characterized by their stable demand and Inchcape's dominant market share, demand minimal investment in promotion and placement. The company's strategy here is focused on extracting maximum cash flow by maintaining operational excellence and leveraging existing, well-established infrastructure rather than pursuing aggressive expansion.

Inchcape's long-standing OEM partnerships, a key strength, contribute significantly to its Cash Cow status. With over 60 established relationships, including major players like Toyota, Mercedes-Benz, and BMW, the company benefits from consistent demand and a dominant market position in various automotive segments.

These deep-rooted collaborations translate into predictable and substantial revenue streams, a hallmark of a Cash Cow. The stability and reliability stemming from these mature partnerships ensure a steady generation of significant cash flow for Inchcape.

Existing Logistics and Supply Chain Infrastructure

Inchcape's established logistics and supply chain infrastructure acts as a significant cash cow. This deeply entrenched network efficiently manages vehicle and parts distribution across numerous markets, directly translating into reduced operational expenses and dependable delivery timelines. The ongoing optimization of this infrastructure consistently yields high profit margins and steady cash flow, requiring minimal incremental investment to maintain its productivity.

This operational efficiency is a key driver of Inchcape's financial strength. For instance, in 2024, Inchcape reported that its supply chain optimization initiatives contributed to a 5% reduction in warehousing costs across its European operations. The company’s ability to leverage its existing infrastructure means it can capitalize on scale economies, enhancing its competitive position and profitability.

- Established Network: Inchcape's long-standing presence has built a robust and efficient logistics network.

- Cost Efficiency: This infrastructure minimizes operational costs for vehicle and parts movement.

- Profitability Driver: Optimized operations lead to high profit margins and consistent cash generation.

- Low Investment Requirement: The cash cow status means it requires limited new capital to sustain its performance.

Traditional ICE Vehicle Aftersales in Established Markets

Even as the automotive industry pivots towards New Energy Vehicles (NEVs), the aftersales and servicing of traditional Internal Combustion Engine (ICE) vehicles in established markets remain a robust revenue stream. These established markets boast a substantial installed base of ICE vehicles, ensuring a consistent demand for maintenance and repairs. This segment is characterized by recurring customer needs and a mature market landscape, which translates into predictable, high-margin cash flows with relatively low investment requirements. For instance, in 2024, the global automotive aftermarket for ICE vehicles, while facing gradual decline in new sales, is projected to maintain significant value, with repair and maintenance services forming a substantial portion. This financial stability is crucial, providing the necessary capital to fuel investments in emerging growth areas like NEV servicing and charging infrastructure.

- Stable Revenue: Servicing ICE vehicles in developed markets generates consistent, high-margin revenue due to a large existing fleet.

- Predictable Cash Flows: The recurring nature of maintenance and repair needs ensures predictable earnings with lower investment needs compared to growth segments.

- Financial Foundation: This segment acts as a cash cow, providing the financial stability to fund strategic investments in NEV technologies and services.

- Market Maturity: Established markets have mature service networks and customer loyalty, further solidifying the aftersales business for ICE vehicles.

Inchcape's established aftersales operations for traditional Internal Combustion Engine (ICE) vehicles represent a significant cash cow. These mature markets, characterized by a large installed base of vehicles, ensure consistent demand for repairs and maintenance. This segment benefits from recurring revenue streams and a stable, high-margin profile, requiring minimal incremental investment to sustain. For example, in 2024, Inchcape's aftersales division reported a 4% year-on-year increase in revenue from ICE vehicle servicing across its European markets, demonstrating its reliable cash generation capabilities.

| Segment | Description | Cash Flow Generation | Investment Needs | 2024 Revenue Contribution (Est.) |

|---|---|---|---|---|

| ICE Aftersales (Europe/Africa) | Maintenance & repair for existing ICE vehicles | High & Stable | Low | ~40% |

| Established Distribution Networks | Exclusive distribution of new vehicles & parts | Strong & Predictable | Low | ~55% |

What You See Is What You Get

Inchcape BCG Matrix

The Inchcape BCG Matrix preview you are viewing is the complete, unedited document you will receive immediately after purchase. This means the strategic insights, detailed analysis, and professional formatting are exactly as they will be delivered, ready for your immediate business planning needs. You can trust that this preview accurately represents the final, high-quality report you’ll be able to download and utilize without any alterations or additional content.

Dogs

Inchcape's divestment of its UK retail business in 2024 aligns with its strategic repositioning, moving away from lower-margin, capital-intensive operations. This move underscores a deliberate effort to focus resources on its core, higher-growth global distribution and logistics capabilities. The segment, though generating significant revenue, was identified as a drag on overall profitability and strategic focus.

The UK retail operations, while contributing an estimated £700 million in revenue prior to divestment, were characterized by a disproportionately low operating profit margin, often in the low single digits. This contrasts sharply with Inchcape's ambitions in higher-value distribution, where margins can exceed 10%, making the divestment a logical step to enhance overall group profitability and efficiency.

In 2024, Inchcape continued its strategic portfolio refinement by divesting certain underperforming legacy retail aftersales businesses in the Americas. This move mirrors similar actions taken in the UK market, signaling a consistent approach to shedding non-core and low-return assets.

These divested American assets likely suffered from low market share and stagnant growth, representing a drain on capital and management focus without commensurate profitability. Their disposal is a clear indication of Inchcape's commitment to streamlining operations and enhancing overall business efficiency.

The divestitures underscore Inchcape's strategic pivot towards strengthening its position in the more lucrative distribution value chain. By freeing up capital and resources, the company can better invest in and capitalize on its core strengths and higher-growth opportunities.

Highly fragmented or politically unstable small markets, where Inchcape might hold a minor presence, can be categorized as Dogs within the BCG Matrix. These markets typically exhibit low growth potential and a small market share, making significant investments for turnaround impractical. For instance, in 2024, Inchcape continued to streamline its portfolio, exiting markets that did not fit its strategic growth objectives.

The rationale behind classifying these as Dogs is their inherent difficulty in generating substantial returns. Political instability, for example, can disrupt supply chains and regulatory frameworks, impacting operational efficiency and profitability. Inchcape’s portfolio optimization strategy, which aims for accelerated growth, naturally leads to divesting from such challenging environments.

In 2023, Inchcape reported a strategic review of its operations, highlighting a focus on core, high-potential markets. This implies that segments characterized by fragmentation and political risk, even if small, are likely candidates for divestment if they do not align with the company's overarching commercial strategy and profitability targets.

Brands with Declining Market Share or Relevance

Brands with declining market share or relevance, often termed as 'Dogs' in the Boston Consulting Group (BCG) matrix, represent a significant challenge for Inchcape. Distribution contracts for automotive brands experiencing a sustained drop in global market share or relevance, especially in established markets, fall into this category. These brands typically contribute little to overall revenue and profit, making further investment in them unlikely to yield substantial returns.

Inchcape's strategic approach includes a proactive review of such partnerships. The company's reported exit from four distribution contracts in 2024 underscores this commitment to managing its brand portfolio effectively. This move aligns with the principle of divesting from or minimizing focus on 'Dogs' to reallocate resources towards more promising segments of the market.

- Identifying 'Dogs': Brands with a shrinking presence in key automotive markets, such as a notable decrease in sales volume or market penetration in Europe or North America, would be candidates for this classification.

- Financial Impact: These brands often carry low margins and require significant marketing support for minimal sales uplift, negatively impacting profitability.

- Strategic Disengagement: Inchcape's 2024 contract exits highlight a clear strategy to shed underperforming brand partnerships.

- Resource Reallocation: By exiting 'Dog' segments, Inchcape can redirect capital and management attention to 'Stars' and 'Question Marks' with higher growth potential.

Outdated Technology or Infrastructure in Specific Operations

Operations heavily dependent on outdated technology or physical infrastructure that don't mesh with Inchcape's digital transformation efforts could be considered Dogs. These segments often struggle with inefficiency and high operational costs, leading to a diminished market share because they lack modern competitiveness.

Inchcape's significant investment in digital capabilities, as evidenced by its ongoing strategic partnerships and technology acquisitions, highlights a commitment to forward-looking operations. However, certain legacy systems or physical assets that prove too expensive or complex to modernize present a challenge.

These underperforming units, unable to keep pace with industry advancements or customer expectations, may become prime candidates for divestiture or substantial restructuring to align with the company's overall strategic direction. For instance, if a particular dealership's IT infrastructure is over a decade old and incapable of supporting new online sales platforms, it could fall into this category.

- Legacy Systems: Operations reliant on antiquated IT systems that hinder digital integration and efficiency.

- Physical Infrastructure: Dealerships or service centers with outdated facilities that don't support modern customer experiences or operational needs.

- Low Digital Adoption: Business units or processes that have low uptake of new digital tools, impacting overall productivity and competitiveness.

- High Maintenance Costs: Legacy equipment or software requiring disproportionately high maintenance expenditures relative to their contribution.

Inchcape's 'Dogs' are business segments or brands with low market share and low growth potential, often requiring significant investment for minimal returns. These might include distribution agreements for declining automotive brands or operations in highly fragmented and politically unstable markets.

The company's strategy involves actively identifying and divesting these 'Dogs' to streamline its portfolio and reallocate resources. For instance, Inchcape's exit from four distribution contracts in 2024 exemplifies this approach, freeing up capital for more promising ventures.

Question Marks

Inchcape's recent move to secure distribution rights for emerging EV brands like XPeng in Finland, slated for early 2025, positions them within a high-growth segment. This strategic entry into the electric vehicle market, particularly in a Scandinavian region known for EV adoption, signifies a potential for substantial future revenue. However, these ventures are currently in their nascent stages, reflecting the characteristics of Question Marks in the BCG matrix.

The Finnish EV market, while expanding rapidly, presents a landscape where XPeng, as a newer entrant, will likely have a low initial market share. For instance, by the end of 2024, while EV sales in Finland are projected to continue their upward trend, representing a significant opportunity, the market share for individual emerging brands will be relatively small compared to established players. This necessitates considerable investment from Inchcape in marketing, building charging infrastructure, and consumer education to drive brand awareness and adoption.

The success of these new distribution contracts hinges on Inchcape's ability to effectively navigate these challenges. The company's investment strategy will be crucial in transforming these 'Question Marks' into 'Stars' within the BCG framework. Without substantial capital infusion and strategic execution to build market share, these promising ventures could struggle to gain traction and may even become 'Dogs' if market penetration fails to materialize.

Expansion into new, untested geographic markets for Inchcape can be seen as 'question marks' within the BCG matrix. These are often emerging economies with developing automotive sectors, such as certain African or Southeast Asian nations. For instance, Inchcape's presence in markets like Kenya or Vietnam, while promising for future growth, represents these question mark ventures.

These markets typically have lower initial motorization rates compared to established regions but exhibit a strong upward trajectory in vehicle sales. Inchcape's strategy involves navigating regulatory landscapes, building distribution networks, and understanding local consumer preferences. This requires significant capital expenditure and a patient approach to market penetration.

The inherent uncertainty in these markets means that initial market share is often small, and profitability may take time to materialize. Inchcape's investment in these areas is a calculated risk, aiming to establish a foothold before competitors, with the potential to become future stars if market conditions evolve favorably.

Inchcape's move into direct-to-consumer (DTC) digital sales models fits the Question Mark category. While the automotive industry saw significant digital adoption accelerated in 2020, Inchcape's pilot phases for these models are still nascent. These digital initiatives represent high potential growth, but their current market share is minimal, and the return on investment remains uncertain as they scale.

The global automotive e-commerce market is projected to reach substantial figures, with estimates suggesting it could grow significantly by the mid-2020s, underscoring the opportunity. However, Inchcape's early-stage digital sales pilots face the classic challenges of Question Marks: high investment needs and a lack of proven, scaled success.

For instance, by late 2024, many leading automotive groups were reporting single-digit percentages for online sales conversions, highlighting the early stage of this transition. Inchcape's strategic imperative is to invest in these capabilities now to maintain relevance and avoid being sidelined as Original Equipment Manufacturers (OEMs) increasingly embrace direct customer relationships online.

Specialized Value-Added Services (e.g., AI-based repair quotations)

Inchcape's strategic focus on specialized value-added services, such as AI-based repair quotations and digital parts platforms, positions these offerings as potential Stars within its business portfolio. These services represent innovative, technology-driven ventures with high growth potential but are currently in their early stages, characterized by low market penetration and substantial investment requirements.

The company is channeling significant resources into developing and marketing these digital solutions. For instance, the automotive aftermarket services sector, where AI-powered quoting and digital parts access are gaining traction, saw global revenue of approximately $450 billion in 2023, with digital solutions projected to drive substantial growth in the coming years. Inchcape's investment aims to capture a portion of this expanding digital segment.

- AI-based repair quotations: These services offer faster, more accurate cost estimates for vehicle repairs, enhancing customer experience and operational efficiency.

- Digital parts platforms: By digitizing parts catalogs and ordering processes, Inchcape streamlines procurement and inventory management, reducing costs.

- Investment in R&D: Significant capital is allocated to developing and refining these technological capabilities, crucial for competing in the evolving automotive aftermarket.

- Market adoption: Success hinges on convincing customers and repair shops to adopt these new digital tools, a process that requires marketing and support.

Early Stages of NEV Aftermarket Services

The early stages of the New Energy Vehicle (NEV) aftermarket services present a classic "question mark" scenario within the BCG matrix. While NEV sales are burgeoning, akin to a "star" in the broader automotive market, the specialized services required for these vehicles are still developing. This means significant future growth potential exists, but current market penetration and revenue streams for these niche services may be limited for companies like Inchcape.

Capturing this nascent market necessitates substantial investment. Companies must focus on developing expertise and infrastructure for services such as battery diagnostics and repair, high-voltage system maintenance, and advanced software diagnostics and updates. The global NEV market is projected to reach over 30 million units annually by 2025, with aftermarket services expected to follow suit, creating a substantial opportunity for early movers.

- Growth Potential: The increasing global adoption of NEVs, with sales expected to surpass 20 million units in 2024, signifies a rapidly expanding customer base for specialized aftermarket services.

- Current Market Share: Inchcape, like many traditional automotive service providers, likely holds a relatively small share in highly specialized NEV aftermarket services, such as battery health assessments or advanced electrical system diagnostics.

- Investment Needs: Significant capital outlay is required for technician training in high-voltage systems, acquisition of specialized diagnostic tools, and the establishment of appropriate repair facilities.

- Strategic Importance: Early investment in NEV aftermarket capabilities is crucial for future market leadership as the NEV parc continues to grow, shifting the service landscape.

Question Marks in Inchcape's portfolio represent ventures with high growth potential but currently low market share. These are often new market entries or nascent service offerings requiring significant investment to develop. The success of these ventures is uncertain, with the potential to become Stars or devolve into Dogs if market penetration falters. Inchcape's strategic challenge lies in identifying and nurturing these Question Marks effectively.

Inchcape's expansion into markets like Vietnam, while promising for future automotive sector growth, exemplifies a Question Mark. By late 2024, Vietnam's vehicle market, though expanding, still lagged behind more mature economies in terms of per capita ownership, indicating a nascent stage for many brands. Inchcape's investment here aims to build brand recognition and distribution networks, a process demanding considerable capital and a long-term perspective to establish a significant market share against established local and international players.

| Venture Example | Market Growth Potential | Current Market Share | Investment Required | Risk/Reward Profile |

|---|---|---|---|---|

| XPeng Distribution (Finland) | High (EV adoption) | Low (New entrant) | High (Marketing, infrastructure) | High potential, high risk |

| Emerging Market Entry (e.g., Vietnam) | Moderate to High (Developing economy) | Low (Nascent presence) | High (Network building, regulatory navigation) | Moderate potential, high risk |

| DTC Digital Sales Pilots | High (Industry shift) | Very Low (Early stage) | Moderate (Technology development) | High potential, moderate risk |

| NEV Aftermarket Services | Very High (NEV growth) | Low (Specialized niche) | High (Training, specialized tools) | Very high potential, high risk |

BCG Matrix Data Sources

Our Inchcape BCG Matrix is built on comprehensive market data, encompassing financial disclosures, sales performance metrics, and competitor analysis to deliver actionable strategic insights.