IMCD PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

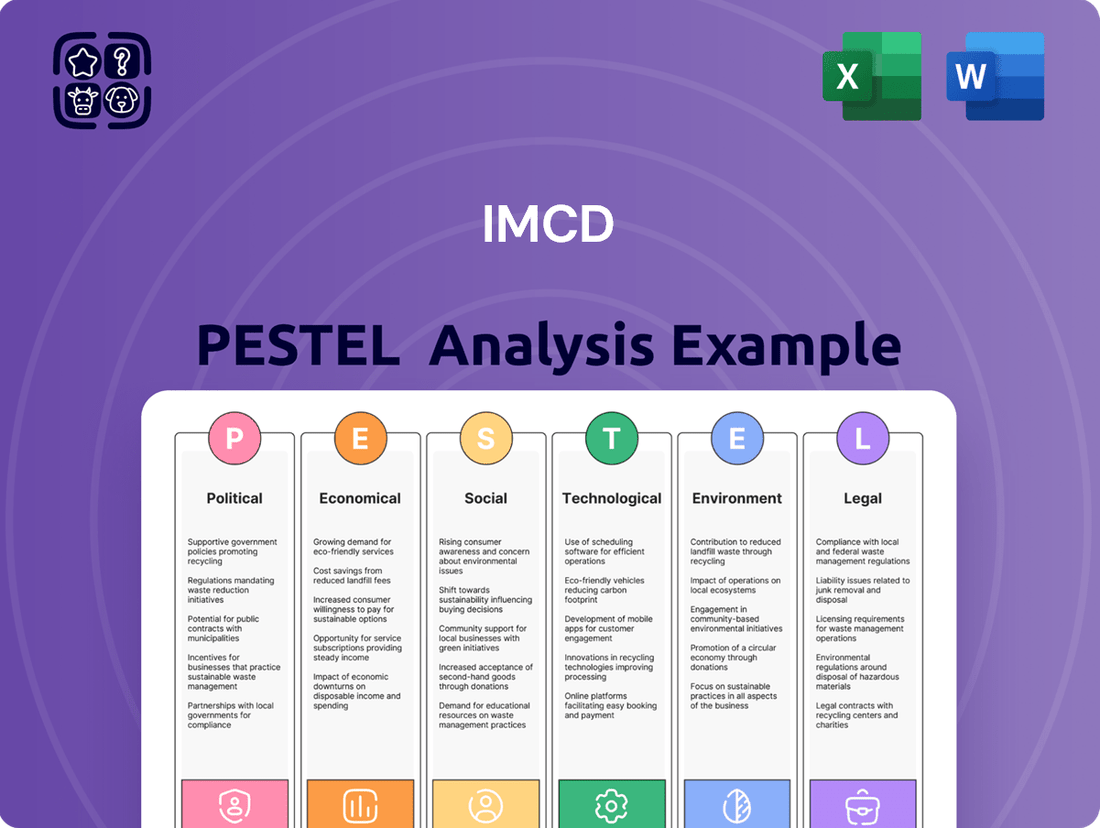

Navigate the complex external forces shaping IMCD's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that create both opportunities and challenges for the company. Equip yourself with the strategic intelligence needed to make informed decisions and gain a competitive advantage. Download the full PESTLE analysis now and unlock actionable insights.

Political factors

IMCD's global reach means it's highly sensitive to shifts in international trade policies and tariffs. For instance, the European Union's ongoing trade negotiations, including those with Mercosur, could significantly alter import/export costs for specialty chemicals.

Protectionist policies enacted by major economies, such as potential tariffs on chemical intermediates in the United States or increased import duties in China, could directly impact IMCD's cost of goods and supply chain reliability. The company's ability to navigate these changes, perhaps by diversifying sourcing or localizing production, is key to maintaining market access and competitive pricing in 2024 and beyond.

Geopolitical instability presents a significant challenge for IMCD. Ongoing conflicts and rising global tensions, such as those in Eastern Europe and the Middle East, directly impact supply chains for specialty chemicals and ingredients. For instance, disruptions in key shipping routes or production hubs can lead to increased freight costs and material shortages, as seen in the volatility of logistics prices throughout 2024.

IMCD's extensive global presence, operating in over 50 countries, necessitates careful management of these risks. Regional conflicts can affect market demand for specific products and influence the feasibility of new investments. The company's ability to adapt its sourcing and distribution strategies in response to events like trade disputes or localized unrest is crucial for maintaining operational continuity and regional profitability.

Governments globally are tightening rules on chemical production and distribution, with a notable focus on specialty chemicals. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, demanding significant investment in data generation and compliance for companies like IMCD. This trend necessitates ongoing adaptation to new safety and environmental standards, potentially impacting operational expenses and the range of chemicals IMCD can offer.

Political Stability in Key Markets

The political stability of countries where IMCD operates or plans to grow is a critical factor affecting business predictability. For instance, in 2023, IMCD continued its expansion in regions like Asia-Pacific, a market that can experience varying degrees of political stability which could impact investment security and operational continuity.

Unstable political situations can trigger abrupt policy shifts, economic volatility, or even expropriation risks, directly challenging IMCD's ability to execute long-term strategies and penetrate new markets effectively. For example, geopolitical tensions in Eastern Europe in 2024 continue to pose challenges for businesses with regional exposure, requiring robust risk management frameworks.

- Geopolitical Risk Assessment: IMCD's strategic planning must incorporate thorough assessments of geopolitical risks in its key operational and target markets.

- Regulatory Environment Monitoring: Continuous monitoring of political developments and potential regulatory changes is essential to adapt business strategies proactively.

- Market Diversification: A diversified geographic footprint can mitigate the impact of political instability in any single region.

- Government Relations: Maintaining strong relationships with governmental bodies and stakeholders in operating countries is crucial for navigating political landscapes.

Government Support for Green Chemistry Initiatives

Governments worldwide are increasingly channeling resources into green chemistry, recognizing its role in achieving sustainability goals. For IMCD, this translates into significant opportunities as policies favoring eco-friendly chemicals and circular economy principles gain traction. For instance, the European Union’s Green Deal, with its ambitious targets for reducing chemical pollution and promoting sustainable products, directly supports the market for IMCD’s specialized, sustainable chemical solutions.

These governmental pushes are not just about regulation; they often come with tangible incentives. Many nations are offering grants, tax breaks, and subsidies for companies investing in research and development of sustainable materials and processes. In 2024, the US government announced over $2 billion in funding for clean energy and sustainable manufacturing technologies, a move that could bolster demand for IMCD’s expertise in formulating with bio-based and recycled feedstocks.

- EU Green Deal: Aims to make the EU climate-neutral by 2050, with a significant focus on a zero-pollution ambition for a toxic-free environment, directly benefiting green chemistry sectors.

- US Inflation Reduction Act (IRA): Provides substantial tax credits and incentives for clean energy and sustainable manufacturing, encouraging the adoption of greener chemical processes.

- Global Sustainability Investments: Projections indicate global investment in sustainable chemistry could reach hundreds of billions by 2030, driven by policy support and market demand.

Political stability and government regulations significantly shape IMCD's operational landscape. Trade policies, such as the EU's evolving trade agreements, directly influence import/export costs for specialty chemicals, impacting IMCD's supply chain and pricing strategies throughout 2024. Protectionist measures by major economies could also affect the cost of goods and sourcing reliability.

Geopolitical tensions and regional conflicts, like those in Eastern Europe, disrupt global supply chains, leading to increased freight costs and material shortages, as observed in 2024's logistics market volatility. IMCD's extensive global presence requires careful management of these risks to ensure operational continuity and profitability across its operations in over 50 countries.

Governmental focus on sustainability and green chemistry presents opportunities for IMCD, driven by initiatives like the EU's Green Deal and the US Inflation Reduction Act. These policies encourage the adoption of eco-friendly chemicals and sustainable manufacturing, aligning with IMCD's portfolio and potential for growth in these sectors.

What is included in the product

This IMCD PESTLE analysis delves into the critical external forces shaping the company's operating environment across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these macro-environmental factors.

The IMCD PESTLE analysis offers a clear, summarized version of the full analysis, making it easy to reference during meetings or presentations and alleviating the pain of sifting through extensive data.

Economic factors

IMCD's fortunes are intrinsically linked to the pulse of the global economy. When industrial production ramps up and consumers are spending freely, demand for the specialty chemicals and ingredients IMCD distributes tends to follow suit. For instance, in 2023, global GDP growth was estimated to be around 3.1%, a moderation from the previous year, reflecting a mixed economic picture across key regions.

However, the specter of recession looms, and its impact could be significant. Should major economies like the US, Eurozone, or China experience a downturn, we could see a noticeable dip in demand for IMCD's products. This would translate into lower sales volumes and potentially force price adjustments, squeezing both revenue and profit margins. For example, the IMF projected global growth to slow to 2.9% in 2024, indicating ongoing economic headwinds.

Rising inflation and fluctuating raw material costs present a significant challenge for IMCD, directly impacting its cost of goods sold and profit margins. For instance, the global Producer Price Index (PPI) for chemicals saw substantial increases throughout 2023 and into early 2024, with some categories experiencing double-digit percentage rises year-over-year. This upward pressure on input costs necessitates agile procurement and pricing strategies for IMCD, a key distributor of specialty chemicals.

IMCD's ability to navigate these economic headwinds hinges on its effective management of procurement and pricing across its broad portfolio. As of the first quarter of 2024, many commodity chemical prices, which form the base for many specialty formulations, remained elevated compared to pre-pandemic levels, driven by supply chain disruptions and energy costs. Successfully passing on these increased costs while maintaining competitive pricing is crucial for preserving IMCD's profitability.

IMCD's global operations mean currency exchange rate fluctuations are a constant factor. For instance, in the first half of 2024, the company noted that while reported revenue growth was strong, a portion of this was attributable to favorable currency movements. This highlights the sensitivity of their financial reporting to the relative strength of currencies like the Euro against others.

Significant swings in exchange rates directly affect IMCD's reported financial performance. When converting earnings from foreign subsidiaries back to their reporting currency, a stronger local currency can inflate reported revenues and profits, while a weaker one can depress them. This was evident in their 2023 annual report, where currency impacts were explicitly mentioned as a driver for certain year-over-year variances in gross profit and operating EBITA.

The company's strategy involves managing this exposure through natural hedging and, where necessary, financial instruments. However, the inherent volatility means that investors must look beyond headline growth figures to understand the underlying operational performance, considering the impact of currency translation on key metrics like operating EBITA.

Interest Rate Environment and Access to Capital

The prevailing interest rate environment directly impacts IMCD's cost of borrowing, a significant factor given its consistent pursuit of strategic acquisitions often financed through debt. For instance, if central banks maintain higher rates through 2024 and into 2025, IMCD's financial expenses associated with new debt or refinancing existing obligations will likely rise.

Access to capital remains paramount for IMCD's growth trajectory, enabling both the funding of its acquisitive strategy and the support of organic expansion initiatives across its diverse markets.

For example, the European Central Bank's key interest rates, which influence borrowing costs for companies like IMCD operating within the Eurozone, have seen significant increases in the period leading up to and including 2024. This tightening monetary policy can make debt financing more expensive, potentially affecting the profitability of acquisitions.

- Increased Borrowing Costs: Higher interest rates directly translate to greater interest payments on any debt-financed acquisitions or operational funding, potentially reducing net income.

- Capital Availability: While capital may still be available, its cost will be higher, requiring more rigorous financial modeling to ensure acquisition targets meet return hurdles.

- Impact on Acquisition Valuation: Rising interest rates can lead to higher discount rates used in valuation models, potentially lowering the perceived value of acquisition targets and influencing deal terms.

- Financing Organic Growth: Similar to acquisitions, the cost of financing internal expansion projects, such as new facilities or R&D, will also be influenced by the prevailing interest rate environment.

Supply Chain Disruptions and Logistics Costs

Supply chain disruptions, like those seen in 2021-2022 due to port congestion and labor shortages, significantly inflated shipping costs. For instance, the cost to ship a 40-foot container from Asia to Europe more than doubled in some periods. These events directly impact IMCD's operations by increasing the cost of acquiring and distributing specialty chemicals and ingredients, potentially leading to delivery delays and ingredient scarcity for their customers.

To mitigate these risks, IMCD's strategy emphasizes robust risk management and diversified sourcing. This approach aims to ensure business continuity even when specific regions or suppliers face challenges. For example, by maintaining relationships with multiple suppliers across different geographies, IMCD can pivot sourcing strategies when disruptions occur, thereby safeguarding its supply lines and customer commitments.

- Increased Logistics Costs: Global shipping rates saw unprecedented spikes in 2021, with some routes experiencing increases of over 100% year-over-year, impacting the landed cost of raw materials.

- Delivery Delays: Port backlogs, such as the significant congestion at major US ports in late 2021, led to average container dwell times extending by several days or even weeks.

- Ingredient Shortages: Events like the Suez Canal blockage in March 2021 highlighted the fragility of global trade routes, causing temporary shortages of various commodities.

- Diversified Sourcing: IMCD's commitment to a broad supplier base across different regions helps buffer against localized disruptions, ensuring a more resilient supply chain.

Economic factors significantly influence IMCD's performance, with global GDP growth and inflation directly impacting demand and costs. For instance, while global GDP growth was around 3.1% in 2023, projections for 2024 indicated a slowdown to 2.9%, signaling potential headwinds. Rising inflation, evidenced by chemical producer price index increases in early 2024, pressures IMCD's margins, necessitating careful procurement and pricing strategies.

Currency fluctuations also play a crucial role, as seen in the first half of 2024 where favorable exchange rates boosted reported revenues. However, this volatility requires investors to scrutinize underlying operational performance. Furthermore, higher interest rates, as maintained by bodies like the European Central Bank through 2024, increase borrowing costs for IMCD's acquisition-driven growth strategy, potentially impacting deal valuations and financing expenses.

Supply chain disruptions, such as those causing shipping cost spikes in 2021-2022, directly affect IMCD's logistics expenses and can lead to delivery delays. For example, container shipping costs from Asia to Europe more than doubled during certain periods. IMCD mitigates these risks through diversified sourcing and robust risk management to ensure supply chain resilience.

| Economic Factor | Impact on IMCD | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Global GDP Growth | Influences demand for specialty chemicals and ingredients. | Estimated 3.1% in 2023; projected 2.9% for 2024 (IMF). |

| Inflation & Input Costs | Affects cost of goods sold and profit margins. | Chemical PPI saw significant increases in late 2023/early 2024. |

| Interest Rates | Impacts cost of borrowing for acquisitions and operations. | ECB key rates remained elevated through 2024, increasing financing costs. |

| Currency Exchange Rates | Affects reported financial performance and profitability. | Favorable currency movements contributed to reported revenue growth in H1 2024. |

| Supply Chain Disruptions | Increases logistics costs and can cause delivery delays. | Container shipping costs from Asia to Europe more than doubled in certain periods (2021-2022). |

Same Document Delivered

IMCD PESTLE Analysis

The preview shown here is the exact IMCD PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing comprehensive insights into IMCD's operating environment.

The content and structure shown in the preview is the same IMCD PESTLE Analysis document you’ll download after payment, offering a detailed breakdown of political, economic, social, technological, legal, and environmental factors.

Sociological factors

Global consumers are increasingly prioritizing environmentally friendly and sustainable products, driving a significant shift in ingredient and chemical sourcing for manufacturers. This trend directly impacts the demand for bio-based materials and biodegradable components.

IMCD, a key player in the chemical distribution and solutions sector, is well-positioned to leverage this growing consumer consciousness. By actively offering and developing sustainable alternatives, IMCD can meet this evolving market need. For instance, the market for sustainable chemicals is projected to reach $100 billion by 2027, demonstrating substantial growth potential.

Shifting consumer lifestyles and dietary trends are profoundly impacting demand for specialty ingredients, particularly within the food & nutrition and personal care sectors. For instance, the burgeoning plant-based movement, which saw global plant-based food sales reach an estimated $7.4 billion in 2023, directly fuels demand for ingredients like pea protein and oat milk derivatives. Similarly, the growing preference for natural and clean-label cosmetic products, with the global natural cosmetics market projected to grow at a CAGR of 8.5% from 2024 to 2030, creates significant opportunities for ingredient suppliers like IMCD to offer sustainable and ethically sourced components.

Demographic shifts, particularly the global trend of aging populations, are significantly boosting demand in the pharmaceutical and healthcare sectors. For instance, the United Nations projects that by 2050, one in six people worldwide will be 65 years or older, a substantial increase from one in eleven in 2019. This demographic evolution directly translates into a greater need for specialized pharmaceutical excipients and active pharmaceutical ingredients, which are core to IMCD's business operations.

This increasing demand for healthcare services and products, driven by an aging global populace, creates substantial opportunities for companies like IMCD that supply essential components for drug manufacturing. As more individuals require ongoing medical treatment and preventative care, the market for high-quality excipients and APIs is set to expand. IMCD's ability to provide innovative solutions in these areas positions it well to capitalize on these evolving healthcare needs.

Workforce Demographics and Talent Acquisition

Attracting and retaining a skilled workforce, particularly technical experts and sales professionals, is paramount for IMCD's success. The company's business model relies heavily on the specialized knowledge and client relationships these individuals bring. In 2023, IMCD reported having over 4,000 employees globally, highlighting the scale of its talent needs.

Demographic shifts and the evolving expectations of today's workforce demand agile talent management. This includes robust training and development initiatives to keep employees' skills current and foster career growth. For instance, IMCD's commitment to continuous learning is evident in its various development programs aimed at enhancing both technical and commercial expertise.

- Talent Retention: IMCD focuses on creating an engaging work environment to retain its specialized workforce, a key differentiator in the chemical distribution sector.

- Skill Gaps: Addressing potential skill gaps in areas like digital marketing and data analytics is crucial for future growth.

- Global Workforce: Managing a diverse, global workforce requires tailored approaches to recruitment and employee engagement.

- Employee Development: Investments in training and development programs are essential to meet the evolving technical and commercial demands of the industry.

Health and Safety Consciousness

There's a growing emphasis on health and safety, especially concerning chemicals. This societal shift directly impacts how industries operate and what consumers expect. Companies that prioritize safe chemical handling and develop safer products are better positioned in the market.

IMCD's dedication to these principles is a significant advantage. By ensuring the safe and reliable management of chemicals and championing the development of safer formulations, IMCD resonates with this societal trend. This commitment not only strengthens its brand image but also improves its standing with customers and regulators.

For instance, in 2024, the global chemical safety market was valued at approximately $10.5 billion, with projections indicating continued growth driven by stricter regulations and increased awareness. IMCD's proactive approach in areas like REACH compliance and responsible product stewardship directly addresses these market demands.

- Increased regulatory scrutiny: Governments worldwide are implementing more stringent regulations for chemical safety, influencing product development and supply chain management.

- Consumer demand for safer products: End-users are increasingly seeking products with transparent ingredient lists and proven safety profiles, pushing manufacturers towards safer alternatives.

- Industry best practices: Adherence to international safety standards and certifications, such as ISO 45001 for occupational health and safety, is becoming a competitive differentiator.

- IMCD's role in promoting safety: The company actively supports its partners in navigating complex safety regulations and developing innovative, safer chemical solutions, contributing to a healthier environment and workplace.

Societal trends like the increasing demand for sustainable and ethically sourced ingredients significantly influence IMCD's market. Consumers are prioritizing health and safety, driving a need for transparent product information and safer chemical alternatives. This shift impacts demand across sectors like food, personal care, and pharmaceuticals.

The aging global population is a key demographic driver, boosting demand for pharmaceutical excipients and healthcare-related ingredients. IMCD's focus on these sectors aligns with this trend, as the UN projects a substantial increase in the 65+ population by 2050.

The workforce is also evolving, with a greater emphasis on employee development and retention. IMCD's success hinges on its ability to attract and keep skilled talent, particularly technical experts, as demonstrated by its global workforce of over 4,000 employees in 2023.

| Sociological Factor | Impact on IMCD | Relevant Data (2023-2025) |

|---|---|---|

| Consumer Demand for Sustainability | Increases demand for bio-based and biodegradable ingredients; drives need for sustainable sourcing. | Global sustainable chemicals market projected to reach $100 billion by 2027. Plant-based food sales reached $7.4 billion in 2023. |

| Health and Safety Consciousness | Drives demand for safer chemical formulations and transparent ingredient lists. | Global chemical safety market valued at ~$10.5 billion in 2024. |

| Demographic Shifts (Aging Population) | Boosts demand for pharmaceutical excipients and healthcare ingredients. | UN projects 1 in 6 people globally will be 65+ by 2050. |

| Workforce Expectations and Talent Management | Requires investment in employee development, retention, and addressing skill gaps. | IMCD employed over 4,000 people globally in 2023. |

Technological factors

IMCD is significantly advancing its technological capabilities, with a strong focus on digital transformation and AI integration. The company is investing in a unified global IT platform, alongside integrated ERP and CRM systems, to create a more cohesive operational backbone. This strategic move is designed to boost efficiency across the board.

AI-enabled tools are being deployed to enhance customer experience, notably through platforms like MyIMCD, which provides a streamlined digital interface for clients. These technological adoptions are crucial for improving internal processes and driving overall operational excellence. By the end of 2024, IMCD reported that over 80% of its customer interactions were digitally enabled, showcasing a substantial leap in their digital strategy.

Continuous advancements in chemical formulation technologies are a key technological factor empowering IMCD. These innovations allow the company to develop and offer highly customized and effective solutions across various industries, from pharmaceuticals to coatings.

IMCD's commitment to research and development, evidenced by its investment in technical centers, ensures it remains a leader in new product development. For instance, their focus on sustainable formulations is a direct response to evolving market demands, further solidifying their value-added services and market position.

Technological advancements in logistics, like real-time tracking and AI-powered predictive analytics, are revolutionizing chemical distribution. These innovations enhance efficiency and bolster reliability, directly benefiting companies like IMCD that prioritize robust supply chain solutions. For instance, in 2024, the global supply chain management market was valued at over $25 billion, with digital solutions driving significant growth.

IMCD's strategic investment in digitalizing its supply chain allows for quicker, more dependable deliveries of specialty chemicals. By leveraging these technologies, IMCD can better manage inventory, optimize routes, and anticipate potential disruptions. This focus on advanced tracking and data analytics is crucial in the fast-paced chemical industry, where timely delivery is paramount for customer satisfaction and operational success.

Emergence of New Chemical Products and Applications

The chemical industry is constantly evolving with new products and applications, offering significant growth potential. IMCD's strategic advantage lies in its capability to pinpoint and distribute these cutting-edge specialty chemicals. For instance, the demand for advanced materials in electronics and sustainable solutions is surging, with the global specialty chemicals market projected to reach approximately $875 billion by 2025, according to some industry forecasts.

IMCD's success hinges on its agility in adapting to these technological shifts. By focusing on high-growth areas, the company can capitalize on emerging trends.

- Electronics: The increasing sophistication of electronic devices drives demand for specialized chemicals used in semiconductors, displays, and batteries.

- Sustainable Materials: Growing environmental consciousness fuels the need for bio-based and recyclable chemical solutions, a market segment experiencing rapid expansion.

- Innovation Pipeline: IMCD's partnerships with leading chemical manufacturers ensure access to a steady stream of novel products and formulations.

Automation in Warehousing and Distribution

The increasing adoption of automation in warehousing and distribution is a significant technological factor. Technologies like robotic process automation (RPA) and automated guided vehicles (AGVs) are transforming logistics operations. For instance, warehouse automation is projected to reach a market size of $30 billion by 2026, a substantial increase from previous years, highlighting its growing importance.

While IMCD operates with an asset-light model, focusing on its distribution network's efficiency is crucial. Automating key processes within this network can lead to substantial improvements. Studies show that warehouse automation can reduce labor costs by up to 70% and increase throughput by 300% in certain operations.

- Increased Efficiency: Automation streamlines inventory management, order picking, and shipping, reducing processing times.

- Cost Reduction: Lower labor expenses and minimized errors contribute to significant operational cost savings.

- Enhanced Safety: Automating hazardous tasks in warehouses improves workplace safety for employees.

- Competitive Edge: Optimizing distribution through technology further strengthens IMCD's position in the market by ensuring faster and more reliable deliveries.

IMCD is heavily investing in digital transformation, aiming to enhance operational efficiency and customer engagement through AI and unified IT platforms. By the close of 2024, over 80% of their customer interactions were digitally enabled, reflecting a significant shift in their strategy.

The company leverages advancements in chemical formulation technologies to provide tailored solutions, supported by ongoing R&D investments in technical centers. This focus on innovation, particularly in sustainable materials, is crucial for staying competitive in a market projected to reach approximately $875 billion by 2025.

Technological upgrades in logistics, including real-time tracking and predictive analytics, are vital for IMCD's asset-light distribution model. Warehouse automation, with a projected market size of $30 billion by 2026, offers substantial gains in efficiency and cost reduction, further solidifying their market position.

| Technological Area | IMCD Focus/Impact | Relevant Data/Projection |

| Digital Transformation & AI | Unified IT, AI for customer experience (MyIMCD) | 80%+ digitally enabled customer interactions (end of 2024) |

| Chemical Formulation | Customized solutions, R&D investment | Specialty chemicals market projected at ~$875 billion by 2025 |

| Logistics & Automation | Real-time tracking, predictive analytics, warehouse automation | Warehouse automation market projected at $30 billion by 2026 |

Legal factors

IMCD navigates a dense regulatory landscape, with compliance for chemical registration like REACH being critical. Failure to meet these standards can result in significant fines and restricted market access, impacting their ability to distribute products across various regions.

The company must also adhere to strict rules governing the handling of hazardous materials and ensuring product safety. For instance, in 2024, the European Chemicals Agency (ECHA) continued to enforce stringent controls on substances, with ongoing evaluations impacting chemical formulations and supply chains.

Environmental Protection Laws are becoming more stringent globally, impacting chemical distributors like IMCD. For instance, the European Union's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) regulation continues to evolve, requiring extensive data and potential restrictions on substances, directly affecting IMCD's product sourcing and sales. Failure to comply can lead to significant fines and reputational damage.

IMCD must navigate a complex web of environmental regulations concerning emissions, waste management, and chemical handling. In 2024, many regions are focusing on reducing plastic waste and promoting circular economy principles, which could influence the types of products IMCD can distribute and the services it offers. Proactive engagement in sustainable practices, such as responsible sourcing and efficient logistics, is crucial for mitigating legal risks and enhancing corporate image.

As a distributor of specialty chemicals and ingredients, IMCD faces significant product liability risks. Failure to meet stringent safety standards can lead to costly lawsuits and damage to its brand. For instance, in 2023, the chemical industry saw regulatory bodies worldwide, including the European Chemicals Agency (ECHA), enhance scrutiny on ingredient safety and traceability, impacting distributors like IMCD.

Anti-Trust and Competition Laws

IMCD's active acquisition strategy, which sees multiple companies integrated into the group each year, means they must navigate anti-trust and competition laws across many different countries. For instance, in 2023, IMCD completed 16 acquisitions, a significant number that requires thorough regulatory review in each market to ensure no undue market concentration occurs.

Adhering to these regulations is crucial for IMCD to maintain fair market practices and sidestep potential legal hurdles that could hinder their expansion plans. For example, merger control regulations in regions like the European Union or the United States can impose conditions or even block deals if they are deemed to substantially lessen competition.

Failure to comply can result in substantial fines and reputational damage. The European Commission, for example, can impose fines up to 10% of a company's total worldwide annual turnover for competition law infringements.

Key considerations for IMCD include:

- Merger Notification Thresholds: Understanding and complying with the thresholds that trigger mandatory notification to competition authorities in various jurisdictions before completing an acquisition.

- Market Definition and Share Analysis: Accurately assessing the relevant product and geographic markets to determine IMCD's market share post-acquisition and its potential impact on competition.

- Regulatory Approvals: Securing clearance from relevant competition authorities, which may involve providing remedies or commitments to address competition concerns.

- Compliance Programs: Implementing robust internal compliance programs to educate employees on anti-trust laws and ensure adherence throughout the acquisition and integration processes.

Intellectual Property Rights

Intellectual property (IP) rights are crucial in the specialty chemicals and ingredients sector, particularly concerning proprietary formulations and unique applications. IMCD's ability to navigate and leverage these rights directly impacts its competitive positioning and potential for innovation.

Protecting its own formulation expertise and technical advancements is vital for IMCD to maintain its edge and prevent legal entanglements. For instance, the global chemical industry saw significant patent activity in 2024, with filings related to sustainable chemical processes and novel material compositions increasing by an estimated 8% year-over-year, highlighting the importance of IP in driving new market opportunities and defending existing ones.

- Respect for existing IP: IMCD must conduct thorough due diligence to ensure its product offerings and services do not infringe on patents held by competitors.

- Protection of own IP: Securing patents and trade secrets for IMCD's proprietary formulations and application technologies is essential for long-term value creation.

- Licensing and partnerships: Strategic licensing agreements can provide access to new technologies or markets, while protecting IMCD's core innovations.

- Global IP landscape: Understanding and complying with varying IP laws across different operating regions is critical for risk mitigation.

Legal compliance is paramount for IMCD, impacting every facet of its operations from chemical registration to mergers. The company must navigate evolving regulations like REACH, with ECHA's continued scrutiny in 2024 impacting chemical formulations and supply chains. Product liability, especially concerning ingredient safety and traceability, remains a key risk, as highlighted by increased regulatory attention in 2023.

IMCD's aggressive acquisition strategy, which saw 16 acquisitions in 2023, necessitates strict adherence to anti-trust laws to avoid market concentration issues. Failure to comply with competition regulations, such as merger notification thresholds and market share analysis, can lead to substantial fines, potentially up to 10% of global turnover.

Protecting intellectual property is also critical, with patent filings in sustainable chemical processes rising by an estimated 8% in 2024. IMCD must ensure its product offerings do not infringe on existing patents while securing its own proprietary formulations and application technologies.

Environmental factors

Growing concerns about climate change are pushing industries, including the chemical sector, to significantly reduce their carbon emissions. This global push for decarbonization is reshaping operational strategies and supply chain management.

IMCD is proactively addressing these pressures by focusing on optimizing its own operations to lower greenhouse gas emissions. For instance, in 2023, the company reported a reduction in its Scope 1 and 2 emissions intensity. They are also working closely with their logistics partners to decarbonize the supply chain, aiming to minimize their overall environmental impact.

Growing global awareness of resource scarcity, especially concerning non-renewable raw materials, is compelling industries to adopt more sustainable sourcing methods. This trend is particularly relevant for chemical distributors like IMCD, which rely on a consistent supply of diverse raw materials.

IMCD's strategic emphasis on championing cleaner and safer ingredients, such as bio-based chemicals and renewable feedstocks, directly responds to this environmental pressure. For instance, the global bio-based chemicals market was valued at approximately USD 105.4 billion in 2023 and is projected to grow significantly, indicating a strong market pull for such sustainable alternatives.

The chemical industry, including distributors like IMCD, is under growing pressure to manage its waste effectively. Globally, the chemical sector generates millions of tons of waste annually, with regulations like the EU's Waste Framework Directive pushing for stricter handling and disposal practices. IMCD's focus on adhering to stringent waste management protocols and actively participating in circular economy initiatives, such as chemical recycling and product lifecycle management, directly addresses these environmental concerns and ensures regulatory compliance.

Water Scarcity and Pollution

Water scarcity and pollution represent significant environmental challenges that can disrupt chemical production and supply chains. While IMCD's asset-light business model insulates it from direct operational impacts, the company's position within the chemical distribution network means it indirectly influences water usage and pollution across its supplier and customer relationships. For instance, increasing regulations around wastewater discharge in major chemical manufacturing hubs could affect the availability and cost of certain raw materials distributed by IMCD. Globally, the World Bank reported in 2023 that over 2 billion people live in countries experiencing high water stress, a figure projected to rise, potentially impacting chemical production capacity in affected regions.

IMCD's indirect influence means it must monitor the water management practices of its partners. Suppliers with poor water stewardship could face operational disruptions or reputational damage, which in turn could affect IMCD's product availability. Conversely, IMCD can encourage its partners to adopt more sustainable water practices. The chemical industry, as a whole, is a significant user of water, and initiatives aimed at reducing water intensity or improving water quality in manufacturing processes are becoming increasingly important. For example, the European Chemical Industry Council (Cefic) has highlighted water efficiency as a key sustainability priority for its members.

Considering the interconnectedness of the supply chain:

- Water scarcity can lead to increased operational costs for chemical manufacturers, potentially impacting the pricing of products distributed by IMCD.

- Stricter regulations on water pollution may necessitate costly upgrades for suppliers, affecting their ability to meet demand or increasing their product costs.

- IMCD's sustainability reporting, increasingly scrutinized by investors and stakeholders, may need to address its indirect water footprint.

Biodiversity Loss and Ecosystem Impact

The chemical industry, including companies like IMCD, faces scrutiny regarding its impact on biodiversity and ecosystems. Chemical production processes and the lifecycle of chemical products can affect natural habitats and species. For instance, the United Nations Environment Programme (UNEP) reported in 2024 that chemical pollution remains a significant threat to freshwater biodiversity, impacting over 60% of assessed river ecosystems globally.

IMCD is actively addressing these concerns by prioritizing sustainable solutions and responsible sourcing. This commitment is crucial for minimizing the company's ecological footprint. In 2023, IMCD reported an increase in its portfolio of sustainable products, aiming to align with global environmental protection goals and meet growing stakeholder demands for environmentally conscious business practices.

- Ecosystem Impact: Chemical manufacturing can lead to habitat disruption and water contamination, affecting local flora and fauna.

- Biodiversity Threat: Over 60% of assessed river ecosystems globally are threatened by chemical pollution, according to UNEP reports in 2024.

- Sustainable Solutions: IMCD's strategy focuses on offering and developing chemical solutions with reduced environmental impact.

- Responsible Sourcing: The company emphasizes ethical and environmentally sound procurement of raw materials to mitigate upstream ecological risks.

Environmental pressures are driving a significant shift towards decarbonization and sustainable sourcing within the chemical industry. IMCD is actively responding by reducing its operational emissions, with a reported decrease in Scope 1 and 2 emissions intensity in 2023, and by championing bio-based chemicals, a market valued at approximately USD 105.4 billion in 2023.

The company also prioritizes effective waste management and circular economy initiatives, aligning with stricter global regulations. Furthermore, IMCD indirectly addresses water scarcity and pollution by encouraging sustainable practices among its partners, recognizing that over 2 billion people lived in high water-stress countries in 2023. Finally, IMCD is committed to minimizing its ecological footprint by offering sustainable product portfolios and emphasizing responsible sourcing, a critical step given that over 60% of assessed river ecosystems are threatened by chemical pollution.

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using a blend of official government publications, reputable financial institutions like the IMF and World Bank, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors.