IMCD Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

IMCD's competitive landscape is shaped by powerful forces, from the bargaining power of its suppliers and customers to the threat of new entrants and substitutes. Understanding these dynamics is crucial for navigating its specialty chemicals and ingredients distribution market. This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore IMCD’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

IMCD's expansive global network, reaching across EMEA, Asia-Pacific, and the Americas, significantly dilutes the bargaining power of individual suppliers. By serving a multitude of customers, IMCD reduces reliance on any single buyer, thereby strengthening its own negotiating position.

Suppliers find IMCD to be an indispensable partner for market penetration. The company offers specialty chemical producers a vital conduit to diverse markets, making IMCD an attractive and often necessary channel for reaching a broad customer base efficiently.

This extensive reach means suppliers often depend on IMCD to access various end-use industries and geographical regions. Without IMCD's established distribution infrastructure, many suppliers would face considerable challenges and costs in achieving similar market penetration on their own.

IMCD's profound technical expertise, encompassing formulation know-how and the operation of dedicated laboratories, elevates its role far beyond simple product distribution for suppliers. This deep knowledge allows IMCD to assist suppliers in tailoring their offerings to meet precise customer needs and evolving market demands, positioning IMCD as a crucial strategic ally rather than a mere intermediary.

By offering comprehensive services, including specialized technical sales and targeted marketing initiatives, IMCD significantly strengthens its value proposition to suppliers. This integrated approach makes it challenging for suppliers to circumvent IMCD's role and directly reach end customers, thereby solidifying IMCD's bargaining power.

The specialty chemicals market, while featuring some large players, is largely characterized by a fragmented landscape of smaller, highly specialized manufacturers. This means IMCD can often source ingredients from numerous providers, weakening the individual bargaining power of any single supplier. For instance, in 2024, the specialty chemicals sector saw continued growth, with many niche producers contributing to the overall supply chain.

IMCD actively leverages this fragmentation by maintaining a diverse supplier network across various product categories and geographical regions. This strategy is crucial for mitigating the risk of dependency on any one supplier. The company's ongoing efforts to cultivate new supplier partnerships and deepen existing ones in new markets and business segments underscore its commitment to maintaining this advantageous position.

Supplier reliance on distributors for market penetration

Many specialty chemical producers, particularly smaller entities, lack the necessary infrastructure and market knowledge to effectively penetrate diverse global markets. They often depend on specialized distributors like IMCD to bridge this gap, reaching a broad customer base, including many small and medium-sized businesses that are difficult to access directly. This reliance grants distributors significant bargaining power.

This dynamic is further amplified as manufacturers increasingly outsource sales, marketing, and logistics functions to pure-play distribution specialists. For instance, in 2024, the global chemical distribution market was valued at approximately $230 billion, with a significant portion attributed to specialty chemicals where such partnerships are crucial. This outsourcing trend solidifies the distributor's role as an indispensable intermediary, enhancing their leverage over suppliers.

- Supplier Dependence: Smaller specialty chemical manufacturers often lack direct sales channels and market reach, making them dependent on distributors for customer access.

- Distribution Expertise: Distributors like IMCD possess the specialized knowledge and networks required to navigate complex end-user industries effectively.

- Outsourcing Trend: The growing practice of manufacturers outsourcing sales and distribution functions to specialized firms strengthens the bargaining power of these distributors.

- Market Value: The global chemical distribution market, estimated at around $230 billion in 2024, underscores the significant economic role and influence of these intermediaries.

IMCD's ongoing acquisition strategy

IMCD's aggressive acquisition strategy significantly bolsters its bargaining power with suppliers. In 2024 alone, the company completed 12 acquisitions, with an additional six in the first half of 2025. This rapid expansion allows IMCD to consolidate smaller distributors, thereby gaining access to a wider array of product portfolios and securing more favorable regional supplier agreements.

By increasing its scale through these strategic tuck-in acquisitions, IMCD enhances its overall market presence and negotiating leverage. The company's ability to offer a more diversified and comprehensive product range across all its business segments strengthens its position when dealing with suppliers, as it becomes a more valuable and integrated partner.

- Acquisition Pace: 12 businesses acquired in 2024, 6 in H1 2025.

- Supplier Leverage: Consolidation of distributors increases negotiating power.

- Market Presence: Expanded product portfolios and regional agreements.

- Diversification: Reinforced presence across all segments, offering broader customer solutions.

IMCD's extensive global reach and deep technical expertise significantly diminish supplier bargaining power. Suppliers often rely on IMCD for market access, especially smaller manufacturers lacking their own distribution networks. This reliance, coupled with IMCD's role in tailoring products and its comprehensive service offering, makes it difficult for suppliers to bypass IMCD and reach end customers directly.

The fragmented nature of the specialty chemicals market, with numerous niche producers, further weakens individual supplier leverage. IMCD actively manages this by cultivating a diverse supplier base. In 2024, the global chemical distribution market reached approximately $230 billion, highlighting the substantial influence of distributors like IMCD in facilitating these supplier-customer relationships.

IMCD's aggressive acquisition strategy, with 12 acquisitions in 2024 and 6 in the first half of 2025, consolidates its market position. This expansion increases its negotiating leverage by broadening product portfolios and securing more favorable regional supplier agreements, making IMCD a more indispensable partner for suppliers.

| Factor | IMCD's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Global Network & Market Access | Extensive reach across EMEA, Asia-Pacific, Americas | Lowers supplier power by reducing reliance on single buyers and providing suppliers with crucial market penetration. |

| Technical Expertise & Value-Added Services | Formulation know-how, dedicated labs, tailored solutions | Reduces supplier power by positioning IMCD as a strategic partner, essential for product customization and market adaptation. |

| Supplier Fragmentation | Access to numerous niche manufacturers | Lowers supplier power as IMCD can source from multiple providers, mitigating dependence on any single supplier. |

| Outsourcing Trend | Specialized sales, marketing, and logistics | Lowers supplier power as manufacturers increasingly outsource these functions, making distributors like IMCD indispensable intermediaries. |

| Acquisition Strategy | 12 acquisitions in 2024, 6 in H1 2025 | Lowers supplier power by consolidating market share, expanding product portfolios, and strengthening negotiating leverage. |

What is included in the product

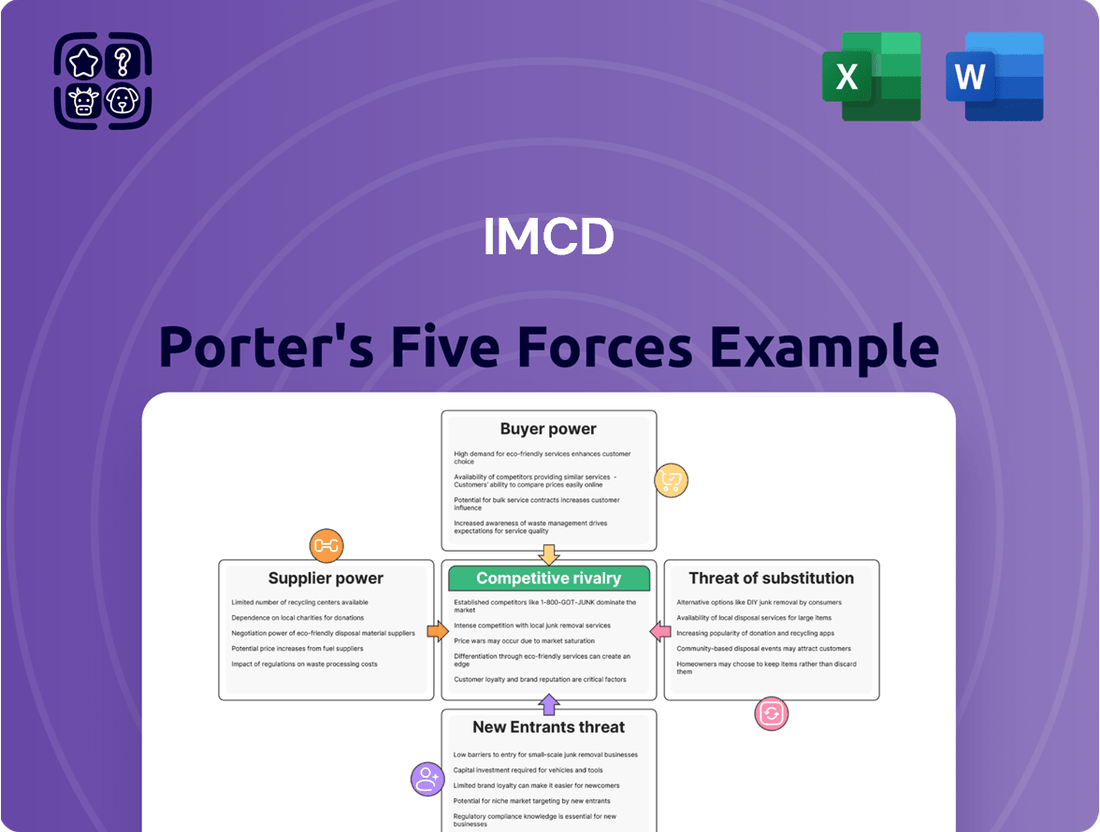

This analysis dissects IMCD's competitive environment by examining the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes.

Instantly identify and mitigate competitive threats with a visual breakdown of supplier power, buyer leverage, and substitute risks.

Customers Bargaining Power

IMCD's strength lies in its extensive customer network, serving around 49,000 clients globally. This vast and varied customer base spans numerous industries like food, pharmaceuticals, personal care, and coatings, making it difficult for any single customer or a small group to exert significant influence over pricing or terms.

The sheer diversity and fragmentation of IMCD's clientele inherently dilute the bargaining power of individual customers. While some larger clients might possess a degree of leverage, their ability to dictate terms is counterbalanced by the broad spectrum and global reach of IMCD's customer relationships.

IMCD's bargaining power of customers is mitigated by its extensive value-added services. Rather than simply distributing chemicals, IMCD provides crucial formulation expertise and technical support, making it a partner in product development. This deep technical knowledge, evidenced by their state-of-the-art application labs, creates significant customer loyalty.

Customers in the specialty chemicals sector frequently seek customized formulations and unique solutions for their specific product needs. IMCD's dedicated technical teams and advanced laboratories collaborate directly with clients to craft these bespoke offerings, fostering robust, enduring partnerships and diminishing the allure of switching distributors.

This commitment to personalized solutions directly addresses the escalating market demand for high-performance chemicals that precisely meet the stringent requirements of diverse industrial and consumer applications. For instance, in 2024, the demand for advanced materials in the automotive sector, requiring specialized coatings and adhesives, saw significant growth, highlighting the value of IMCD's customization capabilities.

Switching costs for customers

Switching distributors can impose significant indirect costs on customers, even if not directly financial. These costs include the time and resources needed to re-qualify new suppliers, adapt existing product formulations to new ingredients, and manage the potential disruption to established supply chains. For instance, a food manufacturer switching from IMCD to another distributor might need to conduct extensive testing on new ingredient sources to ensure consistent product quality and regulatory compliance.

IMCD's integrated technical and supply chain solutions often create a degree of customer lock-in, effectively raising switching costs. When customers rely on IMCD's specialized expertise for complex formulations or for managing intricate logistics, disentangling these services becomes a more involved process. This deep integration means that moving to a competitor would require not just a change in supplier but also a replication or re-development of the technical support and supply chain efficiencies previously provided by IMCD.

The bargaining power of customers is influenced by switching costs, and for IMCD, these costs are elevated due to the nature of its services.

- Re-qualification: Customers must invest in testing and approving new suppliers and their product offerings.

- Formulation Adaptation: Changes in ingredient sourcing may necessitate adjustments to product recipes and performance characteristics.

- Supply Chain Disruption: Transitioning distributors can interrupt delivery schedules and inventory management.

- Technical Integration: Deep reliance on IMCD's specialized formulation support creates a barrier to switching.

Market trends favoring technical partners over simple distributors

The specialty chemicals market is increasingly demanding innovative, sustainable, and high-performance solutions, shifting customer focus from mere product supply to comprehensive partnership. This trend strengthens the bargaining power of technically adept partners over simple distributors.

Customers now seek more than just chemical products; they require deep technical insights, robust regulatory compliance assistance, and forward-thinking sustainability solutions. This elevates the value proposition of partners who can deliver these integrated services.

IMCD's strategic investments in areas like its sustainable solutions program and digital transformation initiatives are designed to meet these evolving customer needs. By offering advanced technical support and sustainability expertise, IMCD enhances its role as a crucial partner, thereby mitigating the bargaining power that customers might otherwise exert based solely on price.

- Market Shift: From price-driven transactions to value-added technical partnerships in specialty chemicals.

- Customer Demand: Growing need for innovation, sustainability, and regulatory support alongside chemical supply.

- IMCD's Strategy: Focus on technical expertise and sustainable solutions to become a preferred partner.

- Impact on Bargaining Power: Reduced customer leverage when partners offer indispensable technical and sustainability services.

IMCD's vast and diverse customer base, numbering around 49,000 clients globally across numerous sectors, inherently dilutes the bargaining power of any single customer. This fragmentation means that while larger clients may have some leverage, their influence is tempered by IMCD's broad market reach and varied relationships.

Furthermore, IMCD's provision of value-added services, such as formulation expertise and technical support through its application labs, significantly reduces customer bargaining power. These services create customer loyalty and increase switching costs, as clients rely on IMCD's specialized knowledge for product development and innovation.

The increasing market demand for customized, high-performance, and sustainable chemical solutions further shifts the dynamic. Customers now seek partners offering integrated technical and sustainability expertise, rather than just suppliers, diminishing their ability to dictate terms based solely on price. For example, growth in advanced materials for the automotive sector in 2024 underscored the need for such specialized partnerships.

Switching costs, including re-qualification, formulation adaptation, and supply chain disruption, are considerable for IMCD's clients, further limiting their leverage. This deep integration of services makes it difficult and resource-intensive for customers to transition to alternative distributors.

| Factor | Impact on Customer Bargaining Power | IMCD's Mitigation Strategy |

| Customer Base Size and Diversity | Low, due to fragmentation | Extensive global network across diverse industries |

| Value-Added Services | Low, due to technical dependency | Formulation expertise, application labs, technical support |

| Switching Costs | Low, due to high re-qualification and integration | Integrated technical and supply chain solutions |

| Market Trends | Low, due to demand for partnership over supply | Focus on innovation, sustainability, and regulatory support |

What You See Is What You Get

IMCD Porter's Five Forces Analysis

This preview showcases the complete IMCD Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape for the company. The document you see here is precisely what you will receive immediately after purchase, ensuring full transparency and immediate utility. This professionally formatted analysis is ready for your strategic review, providing actionable insights into IMCD's market position and future outlook.

Rivalry Among Competitors

The global chemical distribution market, especially for specialty chemicals, is quite fragmented, meaning there are numerous companies operating. However, this landscape is changing as major players actively acquire smaller ones. For instance, in 2023, IMCD itself completed several strategic acquisitions, bolstering its presence in key regions and sectors.

This ongoing consolidation, driven by giants like IMCD, Brenntag, and Azelis, intensifies competition. These larger distributors are not just buying smaller firms; they are also expanding their service offerings and geographical reach, creating a more challenging environment for all participants as they battle for market dominance and a broader customer base.

IMCD operates in a highly competitive landscape, facing formidable rivals like Brenntag SE, Univar Solutions Inc., Azelis Holdings SA, and HELM AG. These established global players boast vast distribution networks and comprehensive product portfolios, intensifying the battle for supplier partnerships and customer loyalty.

The rivalry extends beyond mere pricing; competitors vie for market share by offering superior technical expertise, a wider array of specialized products, and more robust logistical solutions. For instance, Brenntag, a major player, reported revenues of approximately €21.2 billion in 2023, highlighting its significant scale and market presence, which directly impacts IMCD's competitive positioning.

Competition in specialty chemicals distribution is shifting from pure price wars to a battleground of value-added services and deep technical expertise. Distributors are increasingly judged on their ability to provide sophisticated technical sales support, offer formulation assistance, leverage advanced laboratory capabilities, and ensure seamless supply chain operations. This focus on specialized knowledge and customer support is becoming the key differentiator in the market.

IMCD's strategic emphasis on its extensive network of over 80 technical centers and laboratories worldwide, coupled with its development of digital customer engagement tools, directly addresses this evolving competitive landscape. These investments highlight the company's commitment to providing tangible technical value, moving beyond basic product distribution to become an integral partner in their customers' innovation and product development processes.

IMCD's active acquisition strategy as a competitive differentiator

IMCD's competitive edge is significantly bolstered by its relentless acquisition strategy. In 2024 alone, the company completed 12 acquisitions, with an additional 6 in the first half of 2025. This consistent inorganic growth allows IMCD to rapidly expand its product portfolio and market reach.

These strategic acquisitions are not random; they focus on complementary businesses that enhance IMCD's existing offerings and diversify its revenue streams. This proactive approach strengthens its position as a market leader by quickly integrating new capabilities and customer bases.

By aggressively pursuing inorganic growth, IMCD can outmaneuver competitors who might be slower to adapt or primarily focused on organic expansion. This allows IMCD to efficiently enter new market segments and geographies, solidifying its competitive advantage.

- Acquisition Pace: 12 acquisitions in 2024 and 6 in H1 2025.

- Strategic Focus: Acquiring complementary businesses to enhance portfolio and diversification.

- Competitive Impact: Rapid market entry and segment expansion, outpacing organic growth strategies.

- Market Position: Strengthening market leadership through accelerated inorganic growth.

Focus on digital transformation and sustainability

Competitive rivalry within the chemical distribution sector is intensifying, driven by a dual focus on digital transformation and sustainability. Companies are investing heavily in advanced digital platforms, integrated ERP and CRM systems, and AI-powered tools to streamline operations and improve customer interactions. For instance, IMCD is actively enhancing its global IT infrastructure to achieve greater efficiency and a superior customer experience.

This digital push is directly linked to the growing market demand for sustainable and eco-friendly chemical solutions. Distributors are increasingly competing on their ability to offer green alternatives and provide expert guidance on their use. This trend is becoming a significant differentiator, pushing the industry towards a more environmentally conscious competitive landscape. In 2024, the market for sustainable chemicals is projected to see significant growth, further fueling this competitive dynamic.

- Digital Platforms: IMCD's investment in a unified global IT platform, including integrated ERP and CRM, aims to boost operational efficiency and customer engagement.

- AI Integration: The adoption of AI-enabled tools is a key strategy for enhancing service delivery and gaining a competitive edge in the market.

- Sustainability Demand: A rising consumer and industrial preference for green chemicals creates a battleground for distributors to showcase their eco-friendly product portfolios and expertise.

- Market Trends: The increasing emphasis on sustainability is reshaping competitive strategies, pushing companies to innovate in offering environmentally responsible solutions.

Competitive rivalry in the chemical distribution sector is characterized by aggressive inorganic growth and a focus on value-added services. IMCD's strategy of acquiring complementary businesses, with 12 acquisitions in 2024 and 6 in H1 2025, allows it to rapidly expand its portfolio and market reach, outmaneuvering slower competitors.

This intense competition is further fueled by digital transformation and sustainability demands. Companies are investing in advanced digital platforms and AI to enhance efficiency and customer engagement, while also competing on their ability to offer green chemical solutions. For instance, Brenntag’s 2023 revenue of €21.2 billion underscores the scale of major players.

| Competitor | 2023 Revenue (approx.) | Key Competitive Strategy |

|---|---|---|

| IMCD | €4.5 billion (2023) | Inorganic growth (acquisitions), technical expertise, digital enhancement |

| Brenntag SE | €21.2 billion (2023) | Scale, broad portfolio, global network |

| Univar Solutions Inc. | $11.7 billion (2023) | Value-added services, technical support, digital solutions |

| Azelis Holdings SA | €6.1 billion (2023) | Specialty focus, innovation, sustainability solutions |

SSubstitutes Threaten

Chemical manufacturers selling directly to end customers represent a significant substitute threat to chemical distributors. Large producers, leveraging their existing sales forces and logistics networks, may opt for direct sales, particularly with their high-volume clients. This allows them to capture the full margin and maintain direct customer relationships.

However, this direct sales model isn't universally adopted. Many manufacturers, especially those with a broad product portfolio or serving a fragmented customer base, find it more efficient to partner with specialized distributors. For instance, in 2024, many mid-sized chemical producers continued to rely on distributors to reach niche markets and manage smaller orders, a trend that has been growing as companies focus on core competencies.

The outsourcing trend is notable. Manufacturers increasingly delegate sales, marketing, and distribution responsibilities to specialized distributors, especially when entering new or complex markets or serving smaller, less strategic customers. This allows manufacturers to reduce their operational overhead and focus on research and development, a strategy adopted by a growing number of specialty chemical companies seeking market penetration.

Very large customers, especially those with substantial chemical needs, may consider developing in-house formulation capabilities and managing their own supply chains. This strategic shift aims to reduce dependence on intermediaries like IMCD, potentially offering cost savings and greater control. For instance, a major automotive manufacturer might invest in its own paint formulation labs and logistics network to streamline operations.

However, the undertaking of in-house operations is considerable, demanding significant capital for research and development, sophisticated logistics infrastructure, and navigating complex regulatory landscapes. For example, establishing a compliant chemical storage and distribution facility can easily run into millions of dollars in initial investment.

For the vast majority of customers, particularly small and medium-sized enterprises (SMEs), the cost and complexity of replicating IMCD's integrated services are prohibitive. These businesses benefit immensely from IMCD's expertise in sourcing, formulation support, and regulatory guidance, which would be prohibitively expensive to develop internally.

The increasing global demand for sustainability is a significant driver for the development of new bio-based and green chemical alternatives. These innovations directly challenge traditional fossil-based specialty chemicals, creating a potent substitute threat for companies like IMCD.

For instance, the market for bio-based chemicals is projected to reach over $100 billion by 2027, highlighting the rapid growth and adoption of these greener options. This necessitates that chemical distributors, including IMCD, proactively adapt their product portfolios and technical expertise to cater to this evolving market need.

IMCD's strategic emphasis on sustainable solutions and the promotion of cleaner ingredients positions them to effectively navigate and even capitalize on this threat. By aligning with the shift towards environmentally friendly chemistry, IMCD can mitigate the risk of substitution and foster new growth opportunities.

Alternative technologies or processes reducing chemical demand

Technological shifts can introduce alternative solutions that bypass the need for certain specialty chemicals, thereby diminishing demand. For example, advancements in materials science or manufacturing processes might enable the use of fewer or entirely different chemical inputs in product creation.

IMCD actively manages this threat by maintaining a broad and diversified product portfolio across numerous end-use industries. This strategic diversification ensures that a downturn in demand for specific chemicals due to technological substitution in one sector has a limited impact on the company's overall financial performance. For instance, in 2023, IMCD reported revenue growth across its key segments, demonstrating resilience despite varying market dynamics in different chemical applications.

- Technological advancements can lead to the development of new materials or processes that require fewer or no specialty chemicals.

- Process innovations in manufacturing, such as additive manufacturing, may reduce the reliance on traditional chemical formulations.

- IMCD's mitigation strategy involves a diversified business model, spreading risk across various industrial sectors and chemical applications.

- Portfolio diversification helps cushion the impact of substitution threats in any single market segment.

Shift to commodity chemicals for cost savings

The threat of substitutes for IMCD's specialty chemicals is present, particularly when customers prioritize cost savings. In certain applications, especially during economic slowdowns, businesses might switch to more basic, commodity chemicals if the price difference becomes significant. This is a notable concern for companies like IMCD, whose core business is in higher-value specialty chemicals that typically command better margins but also require more technical expertise and support.

For example, if a manufacturing process can achieve acceptable results with a less specialized, cheaper chemical, the incentive to substitute can be high. This is particularly relevant in sectors sensitive to input costs. For instance, in 2024, many industries faced inflationary pressures, potentially increasing the appeal of commodity alternatives. However, IMCD's strategy often involves providing tailored solutions and technical support, which can mitigate this risk by demonstrating the long-term value and performance benefits of their specialty offerings over cheaper, less capable substitutes.

- Cost Sensitivity: Customers may switch to lower-priced commodity chemicals when economic conditions tighten, impacting demand for specialty products.

- Performance vs. Price: While specialty chemicals offer distinct advantages, significant cost differentials can drive substitution, especially if performance requirements are not stringent.

- IMCD's Focus: IMCD's emphasis on specialty chemicals with higher margins and technical support requirements generally positions them as less vulnerable to direct commodity substitution compared to pure commodity players.

The threat of substitutes for IMCD arises from alternative products or services that can fulfill the same customer need. This includes manufacturers selling directly to end-users, which allows them to capture full margins and maintain direct customer relationships. However, many manufacturers, particularly those with diverse product lines or fragmented customer bases, find it more efficient to partner with specialized distributors like IMCD, especially when targeting niche markets or handling smaller orders, a trend observed in 2024.

Large customers may also develop in-house formulation capabilities to reduce reliance on intermediaries, though this requires substantial capital investment and expertise. For smaller businesses, replicating IMCD's integrated services is often cost-prohibitive, making IMCD's sourcing, formulation, and regulatory support invaluable. The growing demand for bio-based and green chemical alternatives, with the bio-based chemical market projected to exceed $100 billion by 2027, presents another significant substitute threat, requiring distributors to adapt their portfolios.

Technological shifts can also introduce alternative solutions that bypass the need for certain specialty chemicals. IMCD mitigates this by maintaining a diversified product portfolio across various end-use industries, as evidenced by its revenue growth across key segments in 2023. Cost sensitivity can also drive customers towards commodity chemicals during economic slowdowns, though IMCD's focus on value-added services and technical support helps counter this by highlighting the long-term benefits of specialty offerings.

| Substitute Threat | Description | IMCD's Mitigation Strategy | Example/Data Point (2024 focus) |

|---|---|---|---|

| Direct Manufacturer Sales | Manufacturers selling directly to end customers. | Focus on value-added services, technical support, and niche market access. | Many mid-sized chemical producers continued to rely on distributors in 2024 to reach niche markets. |

| In-house Capabilities | Large customers developing their own formulation and supply chain management. | Offer superior expertise, efficiency, and a broader product range than typically achievable in-house. | Establishing compliant chemical storage facilities can cost millions, a barrier for most. |

| Bio-based/Green Alternatives | Development of environmentally friendly chemical options. | Proactive adaptation of product portfolios and technical expertise to sustainable solutions. | The bio-based chemical market is projected to reach over $100 billion by 2027. |

| Technological Advancements | New materials or processes reducing chemical reliance. | Diversified business model across various industrial sectors and chemical applications. | IMCD reported revenue growth across key segments in 2023, showing resilience. |

| Commodity Chemicals | Switching to lower-priced, less specialized chemicals. | Emphasize the performance, technical support, and long-term value of specialty chemicals. | Inflationary pressures in 2024 may increase the appeal of commodity alternatives for some. |

Entrants Threaten

Establishing a global chemical distribution network demands substantial capital. Think significant investments in warehouses, sophisticated logistics, advanced IT systems, and specialized technical labs. For instance, building out a comparable infrastructure to IMCD's would likely run into hundreds of millions, if not billions, of dollars.

While IMCD leverages an asset-light approach, emphasizing relationships and technical know-how, the sheer scale of its global operations and service offerings presents a formidable barrier for newcomers. Replicating this extensive reach and depth of service requires not just capital but also years of operational experience and network development.

Creating a resilient and widespread supply chain is a complex and expensive undertaking. New entrants would face considerable challenges in securing reliable suppliers, managing international shipping complexities, and ensuring compliance across diverse regulatory environments, all of which add to the initial cost and time to market.

The specialty chemicals distribution sector is heavily regulated, demanding extensive knowledge of safety, environmental, and transportation laws, both domestically and internationally. New companies entering this market must make substantial investments to build this expertise and ensure compliance across various regions, creating a significant hurdle.

For instance, in 2024, the global chemical industry faced increasing scrutiny regarding sustainability and supply chain transparency, with new regulations like the EU's REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) continuing to evolve, requiring ongoing adaptation and investment in compliance infrastructure.

IMCD benefits from its long-standing, robust compliance systems and seasoned regulatory affairs teams. This established infrastructure and human capital represent a crucial competitive advantage, making it difficult for new entrants to match their level of operational integrity and market access.

The threat of new entrants is significantly lowered by IMCD's deeply entrenched supplier and customer relationships. These aren't just transactional links; they're built on years of trust, technical support, and consistent value delivery. For instance, in 2023, IMCD reported continued growth driven by these partnerships, highlighting their crucial role in market penetration and retention.

Newcomers would struggle immensely to replicate the loyalty IMCD commands. Suppliers prioritize distributors like IMCD who offer market access and technical expertise, while customers rely on IMCD's proven track record and comprehensive solutions. This established network acts as a formidable barrier, making it exceedingly difficult for new players to gain a foothold and compete effectively.

Requirement for deep technical and formulation expertise

The specialty chemical distribution landscape requires deep technical and formulation expertise, posing a significant barrier to new entrants. It’s not just about moving products; it involves providing sophisticated advice and creating tailored solutions for customers. This necessitates a substantial investment in highly skilled personnel, including chemists and technical specialists, which is a considerable hurdle for newcomers looking to establish themselves.

New companies face the daunting task of building a team with the caliber of expertise that established players like IMCD already possess. IMCD’s commitment to research and development, evident in its numerous technical centers, further solidifies this barrier. For instance, IMCD’s focus on innovation and technical support is a core part of its value proposition, making it difficult for less experienced entrants to compete on this crucial front.

- Technical Acumen: Specialty chemical distribution demands more than logistics; it requires profound technical and formulation knowledge to guide clients and engineer unique solutions.

- Talent Acquisition Challenge: New entrants must invest heavily and spend significant time cultivating a team of highly skilled chemists and technical experts, mirroring IMCD’s established capabilities.

- R&D Investment Barrier: IMCD’s substantial investments in research and development and its network of technical centers create a high entry barrier, making it challenging for new companies to match its innovative capacity.

Challenges in achieving global scale and diverse portfolio quickly

New entrants face a significant hurdle in replicating IMCD's global reach and extensive product diversity. Building a comparable portfolio across numerous industries requires substantial upfront investment in sourcing, logistics, and market development, a process that cannot be easily accelerated.

Achieving global scale quickly is a formidable challenge for any new player aiming to compete with established giants like IMCD. This necessitates navigating complex regulatory environments and establishing robust supply chains across diverse geographies, a task that demands considerable time and resources.

IMCD's strategic approach, which includes continuous acquisitions, further complicates entry for newcomers. These acquisitions allow IMCD to rapidly expand its product offerings and market penetration, creating a moving target for any business attempting to establish a similar breadth of services. For instance, IMCD's acquisition strategy in 2023 and early 2024 has consistently added new capabilities and geographical presence, making it harder for competitors to match their comprehensive market coverage.

- Global Scale: Reaching the operational footprint of IMCD, which spans over 50 countries, requires immense capital and time.

- Portfolio Diversity: Matching IMCD's offering across sectors like pharmaceuticals, food, coatings, and advanced materials is a complex integration challenge.

- Acquisition Strategy: IMCD's ongoing M&A activity, such as its acquisition of a specialty chemicals distributor in Southeast Asia in Q1 2024, strengthens its market position and makes it harder for new entrants to gain traction.

- Investment Requirements: The sheer volume of investment needed to establish comparable sourcing networks, technical expertise, and distribution channels acts as a significant barrier.

The threat of new entrants into the specialty chemical distribution market is significantly mitigated by the substantial capital requirements for establishing a global operational footprint. Building out the necessary infrastructure, including warehouses, advanced logistics, and IT systems, demands hundreds of millions, if not billions, of dollars, making it a daunting prospect for newcomers.

Furthermore, the sector's heavy regulation, covering safety, environmental, and transportation laws, necessitates considerable investment in expertise and compliance infrastructure. For example, evolving regulations like the EU's REACH framework in 2024 require continuous adaptation and financial commitment, creating a substantial hurdle for any new player.

IMCD's deeply entrenched supplier and customer relationships, built on years of trust and value delivery, also act as a formidable barrier. In 2023, IMCD's continued growth underscored the importance of these partnerships, making it difficult for new entrants to replicate the loyalty and market access IMCD commands.

The need for deep technical and formulation expertise further raises the entry barrier. New companies must invest heavily in skilled personnel and R&D, mirroring IMCD's capabilities and technical centers, which is a significant challenge for less experienced entrants aiming to compete on innovation and customer solutions.

| Factor | IMCD's Position | Impact on New Entrants |

| Capital Investment | Extensive global infrastructure (warehouses, logistics, IT) | Extremely high barrier; requires billions in investment. |

| Regulatory Compliance | Robust, long-standing compliance systems and teams | Significant investment in expertise and infrastructure needed; high ongoing cost. |

| Supplier & Customer Relationships | Years of trust, technical support, and consistent value | Difficult to replicate; loyalty is a major competitive advantage. |

| Technical & Formulation Expertise | Strong R&D, technical centers, skilled personnel | Requires substantial investment in talent and innovation capabilities. |

Porter's Five Forces Analysis Data Sources

Our IMCD Porter's Five Forces analysis is built upon a robust foundation of data, integrating financial reports, industry expert interviews, and proprietary market intelligence. This multi-faceted approach ensures a comprehensive understanding of competitive pressures.