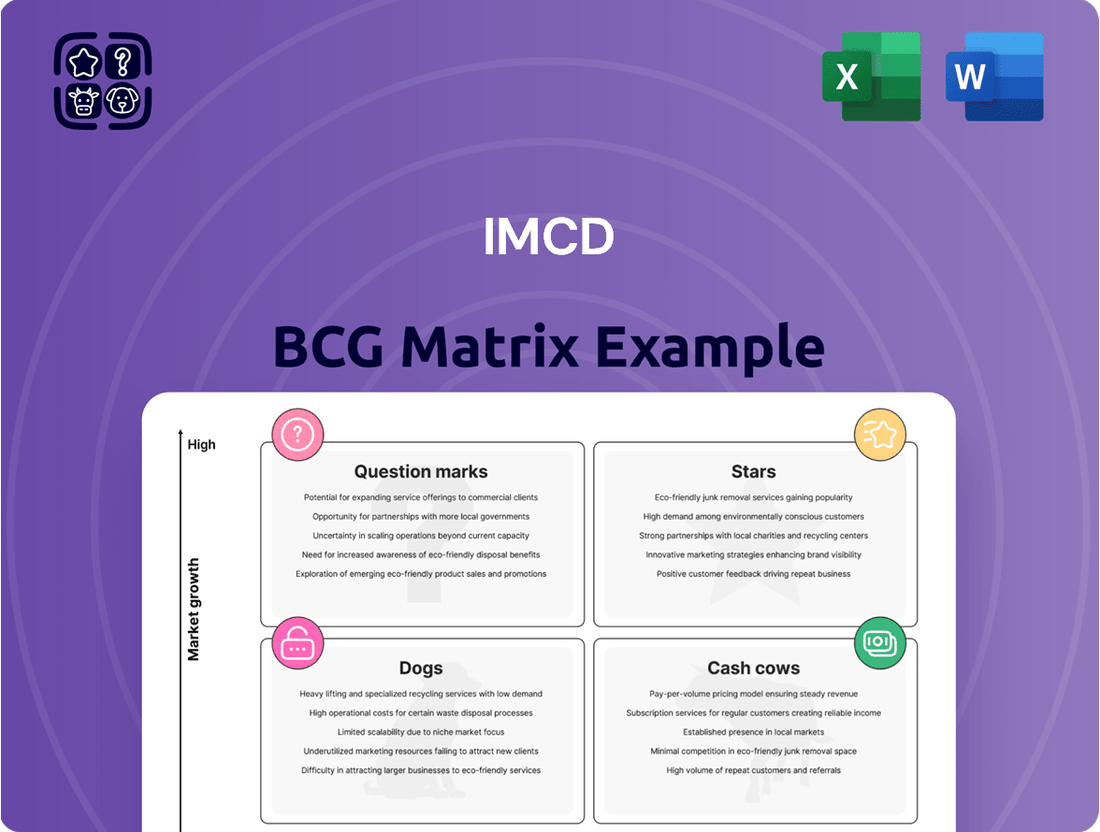

IMCD Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IMCD Bundle

The IMCD BCG Matrix offers a powerful framework to understand your product portfolio's health and potential. By categorizing products into Stars, Cash Cows, Dogs, and Question Marks, you gain clarity on where to invest and divest. Ready to transform your strategic planning?

Unlock the full strategic potential of the IMCD BCG Matrix. Our comprehensive report provides detailed quadrant analysis, actionable insights, and tailored recommendations to optimize your product mix and drive profitable growth. Purchase the complete version today for a clear roadmap to market leadership.

Stars

IMCD's strategic emphasis on high-growth specialty segments like food & nutrition and pharmaceuticals is a key driver of its market position. These sectors are experiencing robust expansion, with the global specialty chemicals market anticipated to see substantial growth in the coming years.

For instance, the global food ingredients market was valued at approximately $200 billion in 2023 and is projected to grow at a CAGR of over 6% through 2030. Similarly, the pharmaceutical excipients market, a critical component of drug formulation, is expected to reach over $12 billion by 2027, growing at a CAGR of around 5.5%.

IMCD's proactive approach, including strategic acquisitions and investments in these areas, has allowed it to capture and maintain a significant market share within these rapidly expanding verticals, reinforcing their status as stars in the IMCD BCG Matrix.

The Americas region is a shining example of strong performance within IMCD's portfolio, exhibiting robust organic growth. Its gross profit saw a significant uptick in the first half of 2025, underscoring its position as a market leader.

This sustained growth, coupled with a high market share in a dynamic regional market, firmly places the Americas segment in the Star category of the BCG Matrix. Strategic moves, like the acquisition of Apus Química in Chile, further solidify IMCD's dominance and future expansion prospects.

IMCD's commitment to digital transformation, including a unified global IT platform and integrated ERP/CRM systems, provides a substantial competitive edge. This strategic move enhances their ability to serve clients efficiently in the booming digital sector of chemical distribution.

While specific market share for digital tools isn't tracked, IMCD's investment in AI-enabled solutions and advanced platforms directly translates to improved operational efficiency and service delivery. These capabilities are crucial for maintaining leadership in a fast-paced, technology-driven market.

Strategic Acquisitions in Emerging Markets

IMCD's strategic acquisitions in emerging markets are a key component of its growth strategy, particularly within the context of a BCG Matrix analysis where these ventures are positioned as potential Stars. By acquiring companies like Trichem in India and Daoqin in China, IMCD is actively pursuing market share in rapidly expanding territories. These moves are designed to solidify its presence in high-growth sectors, such as pharmaceuticals and nutraceuticals, in these dynamic regions.

These targeted acquisitions allow IMCD to quickly build and enhance its leadership position in emerging economies. For instance, in 2023, IMCD reported significant revenue growth in its Asia-Pacific segment, partly driven by successful integrations of acquired businesses. This proactive approach in emerging markets is crucial for capturing future growth opportunities and diversifying its global footprint.

- Focus on High-Growth Emerging Markets: IMCD's strategy targets regions with substantial economic expansion and increasing demand for specialty chemicals and ingredients.

- Strategic Acquisitions: Examples like Trichem (India) and Daoqin (China) demonstrate a pattern of acquiring established players to accelerate market entry and expansion.

- Targeting High-Growth Categories: Acquisitions often focus on sectors like pharmaceuticals and nutraceuticals, which exhibit strong growth trajectories in emerging economies.

- Market Leadership Aspiration: The aim is to quickly establish or strengthen IMCD's market position in these dynamic and expanding territories.

Sustainable Solutions Portfolio

The Sustainable Solutions Portfolio, representing a significant growth opportunity for IMCD, is driven by the escalating global demand for environmentally friendly chemicals. This segment aligns with the company's strategic focus on green chemistry and sustainable formulations.

IMCD's proactive development and promotion of these solutions position them to capitalize on a market trend that is rapidly gaining momentum. Their commitment to offering greener alternatives is a key differentiator.

- Market Growth: The global market for sustainable chemicals is projected to reach $107.9 billion by 2027, growing at a CAGR of 8.5% from 2020.

- IMCD's Strategy: IMCD is actively expanding its portfolio of bio-based and sustainable ingredients, catering to industries seeking to reduce their environmental footprint.

- Competitive Advantage: By investing in green chemistry, IMCD aims to secure a leading position in this high-value, rapidly expanding market segment.

Stars in the IMCD BCG Matrix represent business units or market segments with high growth and high market share. IMCD's specialty chemicals distribution in high-growth sectors like food & nutrition and pharmaceuticals exemplifies this. These segments, driven by increasing global demand and IMCD's strategic investments and acquisitions, are key growth engines.

The Americas region, with its robust organic growth and market leadership, is a prime example of a Star. Similarly, IMCD's focus on emerging markets through strategic acquisitions like Trichem in India and Daoqin in China positions these ventures as Stars, aiming for rapid market share gains in high-growth economies.

The Sustainable Solutions Portfolio also shines as a Star, capitalizing on the escalating demand for environmentally friendly chemicals. IMCD's proactive expansion of its bio-based and sustainable ingredients portfolio offers a significant competitive advantage in this rapidly expanding market.

| Segment | Growth Rate | Market Share | BCG Category |

|---|---|---|---|

| Food & Nutrition | High | High | Star |

| Pharmaceuticals | High | High | Star |

| Americas Region | High | High | Star |

| Emerging Markets (e.g., India, China) | High | Growing | Star (Potential) |

| Sustainable Solutions | High | Growing | Star (Potential) |

What is included in the product

Strategic guidance on investing in Stars, milking Cash Cows, developing Question Marks, and divesting Dogs.

Quickly visualize your portfolio's strategic positioning, easing the pain of complex market analysis.

Cash Cows

IMCD's core specialty chemicals distribution business is a classic Cash Cow within the BCG Matrix. Its position as a global leader in this mature market ensures steady, substantial cash flow. This stability is driven by IMCD's significant market share and long-standing relationships with both suppliers and customers.

In 2024, IMCD continued to demonstrate the strength of this segment. The company reported robust performance in its distribution arm, reflecting the consistent demand for specialty chemicals across various industries. This mature market, while not seeing rapid expansion, offers predictable revenue streams, a hallmark of a Cash Cow.

The EMEA region, a cornerstone for IMCD, consistently delivers robust gross profit and operating EBITA. In 2024, this mature market demonstrated its enduring strength, underpinning the company's financial stability.

While growth in EMEA may be more measured than in rapidly developing areas, IMCD's deep-rooted presence and operational efficiency ensure sustained market share and profitability. This segment remains a reliable source of financial contributions for the company.

IMCD's dedication to operational excellence and robust supply chain solutions fuels its position as a Cash Cow. This focus ensures efficient management of its extensive distribution network, directly contributing to high profit margins and consistent cash flow generation. These honed capabilities guarantee that established product lines and distribution channels operate at peak efficiency, a definitive characteristic of a Cash Cow.

Long-Standing Supplier Partnerships

IMCD's success is significantly bolstered by its deeply entrenched, long-standing relationships with its principal suppliers. These enduring partnerships are crucial, providing a consistent and reliable flow of products, particularly within mature market segments. This stability allows IMCD to maintain a strong competitive edge without needing to constantly invest heavily in aggressive promotions, thereby generating predictable and robust cash flows.

These stable supplier relationships are the bedrock of IMCD's Cash Cow business units. They translate into dependable revenue streams and a reduced need for significant capital expenditure on marketing or product development for these established product lines. For instance, in 2024, IMCD reported continued strength in its specialty chemicals distribution, a sector often characterized by mature product portfolios and long-term supplier agreements.

- Supplier Stability: Long-term contracts with key principals ensure consistent product availability.

- Reduced Promotional Spend: Mature product categories benefit from established market presence, lowering marketing costs.

- Predictable Cash Flows: Stable supplier and customer relationships in core markets generate reliable earnings.

- Competitive Advantage: Enduring partnerships provide a distinct edge in sourcing and supply chain reliability.

Diversified Industry Portfolio (Mature Sub-segments)

Within its broad range of specialty chemical and ingredient distribution, IMCD likely possesses mature sub-segments, particularly in coatings and specific industrial manufacturing applications. These segments, characterized by stable demand and IMCD's established market leadership, function as cash cows.

These mature areas generate consistent, reliable profits with minimal need for further strategic investment, contributing significantly to IMCD's overall financial stability. For instance, in 2024, the coatings and industrial sectors continued to represent substantial portions of IMCD's revenue, with reported growth in these established markets underscoring their cash-generating capacity.

- Mature Segments: Coatings and certain industrial applications exhibit stable, predictable demand.

- Dominant Market Share: IMCD holds strong positions, ensuring consistent revenue streams.

- Profit Generation: These areas are key contributors to profitability with low reinvestment needs.

- Financial Stability: They provide the financial bedrock for other strategic initiatives.

IMCD's specialty chemicals distribution, especially in mature markets like coatings and certain industrial applications, functions as a prime Cash Cow. These segments benefit from IMCD's significant market share and deep supplier relationships, leading to predictable and substantial cash flows with limited need for aggressive reinvestment.

In 2024, IMCD's performance in established markets like EMEA highlighted the stability of its Cash Cow segments. The company's operational efficiency and strong principal partnerships in these areas ensured consistent profitability, contributing significantly to overall financial health.

| Segment | 2024 Revenue Contribution (Illustrative) | Profitability Driver | BCG Classification |

|---|---|---|---|

| Specialty Chemicals Distribution (EMEA) | High | Stable Demand, Operational Efficiency | Cash Cow |

| Coatings & Industrial Applications | Significant | Market Leadership, Long-term Contracts | Cash Cow |

What You See Is What You Get

IMCD BCG Matrix

The IMCD BCG Matrix document you are previewing is the complete, unwatermarked final version you will receive immediately after purchase. This meticulously crafted report provides a clear, actionable framework for analyzing IMCD's business portfolio, enabling strategic decision-making. You'll gain access to the same professional-grade analysis and formatting that will empower your strategic planning and competitive insights.

Dogs

Underperforming niche industrial chemical lines, characterized by specific, highly specialized products within stagnant or declining markets, represent the Dogs in IMCD's portfolio. These segments typically exhibit low market share and minimal growth prospects, potentially hindering overall profitability and tying up valuable capital. For instance, if IMCD's specialty coatings additives for a specific legacy manufacturing process are facing obsolescence due to new material technologies, this would exemplify a Dog.

Such lines offer little strategic advantage and contribute minimally to IMCD's revenue streams, often requiring disproportionate management attention relative to their financial contribution. Imagine a scenario where a particular line of industrial solvents, used in an outdated electronics manufacturing technique, sees its demand plummet as newer, eco-friendlier alternatives gain traction. This would be a classic Dog, with declining sales and limited potential for recovery.

In 2024, IMCD's focus would be on identifying and divesting or rationalizing these underperforming segments to reallocate resources towards higher-growth opportunities. While specific figures for these niche segments are proprietary, IMCD's overall strategy involves continuous portfolio optimization to ensure capital is deployed where it can generate the most significant returns.

Ineffectively integrated legacy acquisitions represent a potential challenge for IMCD, particularly those that haven't meshed well with the company's existing structure or failed to hit their financial goals. These could be smaller, older deals that now hold a minor market share and exhibit sluggish growth, potentially draining resources without delivering expected returns. For example, if a past acquisition in a niche chemical distribution segment, acquired in 2022 for €15 million, only generated €2 million in revenue in 2023 and showed a net loss, it might be classified here.

Within the vast chemical distribution landscape, certain product categories have devolved into highly commoditized arenas. Here, price becomes the primary battleground, and differentiation is minimal. For IMCD, these segments represent areas where they may not possess a distinct competitive advantage or hold a significant market position. Think of basic industrial chemicals or widely available solvents where numerous distributors offer similar products.

These low-margin, low-growth environments are often characterized by intense price wars. For instance, in 2024, the global market for commodity chemicals, while substantial, often saw profit margins shrink to single digits due to oversupply and intense competition among distributors. This makes it challenging for any player, including IMCD, to achieve substantial returns or gain meaningful market share without significant scale or cost efficiencies.

Consequently, IMCD would likely view these segments as less attractive for strategic investment or resource allocation. The limited profit potential and subdued growth prospects mean that focusing on these commoditized areas would not align with a strategy aimed at maximizing long-term value or driving innovation.

Geographical Pockets with Limited Market Penetration and Stagnant Growth

Geographical pockets with limited market penetration and stagnant growth are classic examples of Dogs in the IMCD BCG Matrix. These are typically smaller regions where IMCD's presence is minimal, and the local specialty chemicals market isn't growing, or may even be shrinking. For instance, a remote island nation with a nascent industrial base and limited demand for advanced chemical solutions would fit this description.

Such areas present significant challenges for achieving market share and generating profitable returns. The lack of market expansion means that even with increased effort, the potential for sales is inherently capped. This makes substantial investment in these regions unlikely to yield the desired results, as the overall market size is simply too small and unsupportive of growth.

Consider these characteristics for identifying Dogs:

- Low Market Share: IMCD's operational footprint is minimal, indicating a very small percentage of the local specialty chemicals market is captured.

- Stagnant or Declining Market Growth: The overall demand for specialty chemicals in these regions is not increasing, or is actively decreasing, limiting revenue potential. For example, if a region's GDP growth is below 1% and its industrial output is declining, it signals a weak market.

- Limited Investment Potential: The combination of low penetration and poor market growth makes these areas unattractive for significant capital allocation, as the return on investment is likely to be minimal.

- High Operational Costs Relative to Revenue: In 2024, operating in such markets often means disproportionately high logistical and administrative costs for the low revenue generated, further eroding profitability.

Obsolete or Low-Demand Product Formulations

Obsolete or low-demand product formulations within IMCD's portfolio, particularly those that are technologically surpassed, would be classified as Dogs in the BCG Matrix. These items, while potentially still distributed, face significantly reduced market demand.

These products typically exhibit both low market share and minimal growth prospects, meaning they contribute very little to IMCD's overall revenue or strategic expansion. For instance, if IMCD continues to distribute a specific legacy chemical formulation for a manufacturing process that has largely been replaced by newer, more efficient methods, this formulation would likely fall into the Dog category. As of 2024, the trend towards sustainability and advanced materials continues to accelerate, making older formulations even more susceptible to becoming obsolete.

- Low Market Share: Products with a negligible presence in their respective markets.

- Negligible Growth: Formulations that are not experiencing any significant increase in demand.

- Candidates for Divestment: These products represent potential opportunities for divestment or discontinuation to free up resources.

- Resource Drain: Maintaining distribution for such products can consume valuable resources without generating substantial returns.

Dogs in IMCD's portfolio represent underperforming niche industrial chemical lines or legacy acquisitions that haven't integrated well. These segments typically have low market share and minimal growth prospects, such as specialty coatings additives for obsolete manufacturing processes. In 2024, IMCD's strategy involves identifying and divesting these segments to reallocate capital to higher-growth areas.

Commoditized product categories with intense price competition and limited differentiation also fall into the Dog classification. These low-margin, low-growth areas, like basic industrial chemicals, make it difficult for IMCD to achieve substantial returns. For example, the global commodity chemicals market in 2024 saw profit margins shrink due to oversupply.

Geographical pockets with limited market penetration and stagnant growth, like a remote island nation with a nascent industrial base, are also considered Dogs. These areas offer minimal potential for market share expansion or profitable returns, making significant investment unattractive due to small market size and weak growth.

Obsolete or low-demand product formulations, technologically surpassed and facing reduced market demand, are further examples of Dogs. As of 2024, the trend towards sustainability accelerates obsolescence, making older formulations susceptible to becoming candidates for divestment or discontinuation to free up resources.

Question Marks

IMCD's aggressive acquisition strategy, particularly in the first half of 2025 with six new companies, signals a strong focus on high-growth markets. These acquisitions, including TECOM Ingredients in Spain's Food & Nutrition sector and Ferrer Alimentación in Iberia's Food & Beverage space, highlight IMCD's ambition to expand its footprint in lucrative regions.

The integration of businesses like Apus Química in Chile's Advanced Materials and Trichem in India's Pharmaceuticals requires substantial investment to bolster market share and achieve full operational synergy. Similarly, the acquisitions of YCAM in South Korea's Personal Care/Pharmaceuticals and Daoqin in China's Food & Nutraceuticals present opportunities for growth, but also necessitate significant capital allocation for market penetration and integration.

When IMCD ventures into entirely new countries or regions, these initial expansions are considered Question Marks in the BCG Matrix. These markets often present significant growth opportunities, but IMCD begins with a negligible market share, necessitating considerable investment in building its presence.

For instance, IMCD’s strategic expansion into Southeast Asia in recent years, including establishing operations in Vietnam and Indonesia, exemplifies this. While these markets hold substantial long-term growth potential, IMCD’s initial market share was minimal, requiring significant capital outlay for infrastructure development, local talent acquisition, and aggressive market penetration strategies to gain traction.

Pioneering innovative formulations, particularly in sustainable chemicals, places a company squarely in the question mark quadrant of the BCG Matrix. These ventures involve substantial investments in cutting-edge solutions addressing critical issues like circularity and resource efficiency, but their market adoption is still nascent.

Companies in this space are betting on high future growth, as evidenced by the increasing global demand for sustainable materials. For instance, the market for bio-based chemicals alone was projected to reach $117.7 billion by 2027, according to a 2024 report, highlighting the growth runway for such innovations.

However, these pioneering efforts are characterized by low current market share, necessitating significant outlays in research and development, alongside robust marketing campaigns, to cultivate demand and achieve widespread adoption.

Emerging Digital Service Offerings

Emerging digital service offerings, such as an AI-driven product recommendation tool like IMCD's SalesAssistant, often begin as Question Marks in the BCG matrix. This is because they are entering a rapidly expanding digital market with high growth potential, but their initial market share is typically very low.

These new services require significant investment to refine their capabilities, build customer trust, and demonstrate tangible value. For instance, IMCD's investment in digital tools aims to enhance customer experience and operational efficiency, aligning with the broader trend of digital adoption in the chemical distribution sector.

- High Growth Market: Entering a market with increasing digital adoption, projected to see continued expansion in B2B e-commerce platforms for specialty chemicals.

- Low Market Share: Initial customer uptake of new digital tools is often limited, necessitating marketing and sales efforts to drive penetration.

- Investment Required: Significant capital expenditure is needed for development, integration, and ongoing support to ensure the digital offering's success.

- Potential for Star: Successful adoption and scaling can transform these offerings into Stars, generating substantial revenue and market leadership.

Segments with Low Initial Market Share Post-Acquisition

Even within a growing market, if IMCD's consolidated market share in a particular segment after an acquisition is still small, it's categorized as a Question Mark. This indicates a need for careful evaluation and strategic resource allocation.

These segments, despite being in expanding markets, represent potential growth opportunities that require significant investment and focused integration to improve IMCD's competitive standing. Without such efforts, they risk remaining underdeveloped.

- Low Market Share: Despite market growth, IMCD's combined share in the acquired segment remains minimal.

- Strategic Investment Needed: Requires targeted capital and resources to boost market penetration.

- Integration Focus: Successful integration is crucial to leverage synergies and improve competitiveness.

- Potential for Growth: If managed effectively, these segments can evolve into Stars or Cash Cows.

Question Marks represent new ventures or markets where IMCD has a low market share but operates in a high-growth environment. These require significant investment to build market presence and can potentially become Stars if successful. For example, IMCD's expansion into new geographic territories or pioneering new sustainable product lines often starts as a Question Mark.

These ventures are characterized by substantial capital outlays for research, development, marketing, and infrastructure. The success hinges on IMCD's ability to effectively penetrate these markets and gain traction against established competitors. The global specialty chemicals market, for instance, is projected to grow, offering fertile ground for such expansions.

The challenge for Question Marks lies in converting potential into market dominance. IMCD's 2024 strategic acquisitions, such as those in emerging markets, exemplify this. These moves, while promising high future returns, demand careful management and resource allocation to shift them from Question Marks to more stable positions in the BCG Matrix.

IMCD's investment in digital transformation, like its AI-driven SalesAssistant, also fits this category. While the digital market for chemical distribution is expanding rapidly, initial adoption rates for new tools are typically low, necessitating ongoing investment to drive customer uptake and prove value.

| BCG Category | Market Growth | IMCD Market Share | Investment Needs | Potential Outcome |

|---|---|---|---|---|

| Question Mark | High | Low | High | Star or Dog |

| Example: New Geographic Expansion (e.g., Vietnam operations) | High (Emerging Market Growth) | Low (Initial Presence) | High (Infrastructure, Talent, Marketing) | Potential Market Leader (Star) or Stagnant (Dog) |

| Example: Sustainable Product Innovations | High (Increasing Demand for Eco-friendly solutions) | Low (Nascent Market Adoption) | High (R&D, Market Education) | Market Leader (Star) or Obsolete (Dog) |

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing sales figures, growth rates, and competitive landscape analysis from industry reports and financial disclosures.