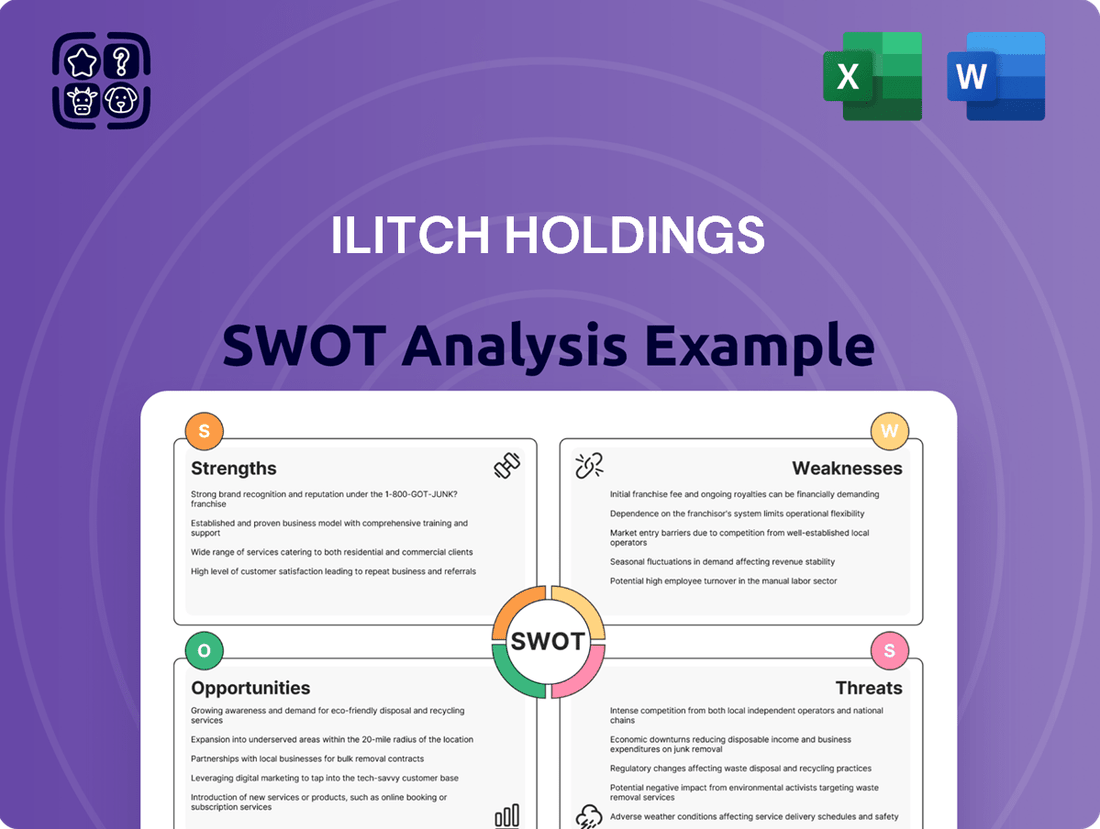

Ilitch Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ilitch Holdings Bundle

Ilitch Holdings boasts significant strengths in its diversified portfolio, including sports franchises and real estate development, but faces challenges like intense competition and evolving consumer preferences. Understanding these dynamics is crucial for any strategic player in the market.

Want the full story behind Ilitch Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Ilitch Holdings boasts a remarkably diverse portfolio, encompassing key sectors like food with Little Caesars Pizza, professional sports through the Detroit Red Wings and Detroit Tigers, and entertainment via Olympia Entertainment. This broad business model acts as a significant strength, effectively spreading risk across different industries.

This diversification translates into multiple, stable revenue streams, insulating the company from the volatility that might impact a single industry. For instance, in 2023, Little Caesars continued its global expansion, opening over 300 new locations, while the Detroit Red Wings saw increased attendance and merchandise sales, showcasing the resilience of their varied assets.

Ilitch Holdings benefits from exceptionally strong brand recognition, particularly through its Little Caesars pizza chain, which stands as the third-largest globally. This widespread recognition is directly linked to its successful 'Hot-N-Ready' business model, a familiar and convenient offering for millions of consumers.

Beyond its food service operations, the company's ownership of iconic sports franchises like the Detroit Red Wings and Detroit Tigers cultivates deep brand loyalty and a substantial market presence. These teams boast dedicated fan bases, contributing significantly to the overall market position and brand equity of Ilitch Holdings.

Ilitch Holdings' significant real estate holdings, primarily managed by Olympia Development, represent a core strength. The company is heavily invested in urban revitalization, most notably through The District Detroit project. This initiative aims to create a vibrant mixed-use district, fostering economic growth and long-term asset appreciation.

The District Detroit development is projected to generate substantial economic impact, with estimates suggesting billions in economic activity and the creation of thousands of jobs. This focus on real estate not only diversifies Ilitch Holdings' revenue streams but also positions it as a key player in Detroit's ongoing urban renewal, enhancing its community standing and brand value.

Financial Strength and Stability

Ilitch Holdings exhibits remarkable financial strength, evidenced by revenue growth exceeding 600% since 2004, a performance that significantly outpaced the S&P 500 during the same period. This robust financial trajectory underscores the company's resilience and effective management.

The substantial financial backing of Ilitch Holdings is further highlighted by its owner, Marian Ilitch, whose net worth reached an estimated $6.9 billion as of July 2025. This wealth is largely derived from her successful ventures in the pizza industry with Little Caesars and her ownership stakes in major sports franchises, providing a deep well of capital for continued investment and expansion.

- Consistent Revenue Growth: Over 600% revenue increase since 2004, surpassing S&P 500 performance.

- Owner's Net Worth: Marian Ilitch's estimated $6.9 billion net worth (July 2025) provides strong financial backing.

- Diversified Revenue Streams: Success in both consumer goods (Little Caesars) and sports entertainment contributes to stability.

- Strong Capital Position: The company's financial health allows for significant investments in its various business units.

Community Engagement and Philanthropy

Ilitch Holdings demonstrates a robust commitment to community engagement and philanthropy. Through its various foundations and affiliates, the company has made substantial contributions, exceeding $275 million to charitable causes. This dedication extends to practical support, including serving meals and contributing thousands of volunteer hours, underscoring a deep-seated connection with the communities it serves.

This extensive community involvement significantly bolsters Ilitch Holdings' public image and cultivates invaluable goodwill. Such positive perception is a strategic asset, fostering local support and contributing to the company's long-term business sustainability and resilience. It creates a favorable environment for its diverse business operations.

- $275 Million+ Contributed: Total donations to community causes.

- Thousands of Volunteer Hours: Demonstrating direct employee commitment.

- Enhanced Public Image: Building goodwill and local trust.

- Long-Term Sustainability: Fostering community support for business operations.

Ilitch Holdings' diversified business model, spanning food, sports, and entertainment, provides significant stability. This broad reach ensures multiple revenue streams, mitigating risks associated with any single sector. For example, Little Caesars' global expansion in 2023, with over 300 new locations, complemented the Detroit Red Wings' increased attendance and merchandise sales, showcasing the strength of this varied approach.

| Business Segment | 2023 Performance Highlight | Revenue Contribution Factor |

|---|---|---|

| Food (Little Caesars) | 300+ new global locations opened | Consistent consumer demand, global brand recognition |

| Sports (Detroit Red Wings) | Increased attendance and merchandise sales | Dedicated fan base, strong brand loyalty |

| Sports (Detroit Tigers) | Continued fan engagement and media rights | Established team history, regional popularity |

| Entertainment (The District Detroit) | Ongoing development and event hosting | Real estate asset appreciation, economic impact |

What is included in the product

Analyzes Ilitch Holdings’s competitive position through key internal and external factors, highlighting its diverse portfolio and market presence.

Ilitch Holdings' SWOT analysis acts as a pain point reliever by offering a clear, actionable roadmap to navigate complex market dynamics and capitalize on emerging opportunities.

Weaknesses

Ilitch Holdings' significant investment in Detroit, particularly through The District Detroit, creates a notable weakness. This concentration makes the company highly vulnerable to localized economic downturns or shifts in the city's appeal. For instance, a slowdown in Detroit's job growth or a decrease in tourism directly impacts attendance at events and the occupancy of their real estate holdings.

The success of Ilitch Holdings' entertainment and real estate portfolio is intrinsically linked to the continued economic vitality and attractiveness of the Detroit metropolitan area. In 2024, while Detroit's economic indicators showed positive trends, any reversal could disproportionately affect Ilitch Holdings compared to more diversified conglomerates. The reliance on a single geographic market limits their ability to offset regional weaknesses with strengths elsewhere.

The performance of sports franchises within Ilitch Holdings, such as the Detroit Red Wings and Detroit Tigers, is inherently volatile. Fluctuations in team success, player availability due to injuries, and the overall level of fan engagement directly impact revenue streams from ticket sales, concessions, and merchandise. For example, the Red Wings' continued absence from the playoffs in the 2024-25 season likely affected their financial performance, while the Tigers' mid-season surge followed by a significant downturn in 2025 underscores the unpredictable nature of sports outcomes.

The 'District Detroit' project, a cornerstone of Ilitch Holdings' urban revitalization strategy, has faced significant hurdles in its development timeline. Stalled progress and repeatedly adjusted construction schedules have generated frustration within the local community, casting a shadow over the project's momentum and raising concerns about its overall pace.

These prolonged delays in major undertakings like District Detroit can be a substantial drain on capital, as investments remain tied up without generating returns. Furthermore, such setbacks can erode public trust and foster negative perceptions, even as the company emphasizes its commitment to community benefits and engagement.

Private Company Secrecy

As a privately held entity, Ilitch Holdings operates without the stringent public disclosure mandates faced by publicly traded corporations. This inherent secrecy means a lack of readily available detailed financial statements and operational data, making it challenging for external parties like potential investors or market analysts to fully assess the company's financial standing and strategic direction.

This opacity can create hurdles in valuation and due diligence processes. For instance, while Ilitch Holdings' revenue streams from its diverse portfolio, including sports franchises like the Detroit Red Wings and Detroit Tigers, and significant real estate holdings, are substantial, specific profit margins or debt levels are not publicly disclosed. This lack of transparency makes it difficult to benchmark performance against industry peers, a common practice for publicly traded companies.

- Limited Public Scrutiny: Less pressure from public shareholders regarding performance and strategy.

- Information Asymmetry: External stakeholders have less insight into financial health and decision-making compared to public companies.

- Valuation Challenges: Difficulty in precisely valuing the company due to unavailable detailed financial disclosures.

- Investor Access: Potential investors may find it harder to conduct thorough due diligence without access to comprehensive financial reports.

Potential for Negative Public Perception in Real Estate

Ilitch Holdings has faced criticism regarding its approach to certain Detroit properties. Reports indicate instances where buildings were left vacant or lots were utilized for parking instead of active development. This has fueled concerns about the pace and effectiveness of revitalization efforts within the city.

This situation can foster negative public perception and potentially lead to community backlash. Such sentiment could hinder future development approvals and diminish public support for Ilitch Holdings' broader initiatives in Detroit.

- Vacant Properties: Specific examples of Ilitch-owned properties remaining untenanted have been cited in local media, impacting neighborhood aesthetics.

- Parking Lot Usage: The use of prime development land for surface parking lots, rather than new construction, has drawn criticism.

- Community Concerns: Residents and community groups have voiced concerns about the visual impact and missed economic opportunities these practices represent.

Ilitch Holdings' significant investment in Detroit, particularly through The District Detroit, creates a notable weakness. This concentration makes the company highly vulnerable to localized economic downturns or shifts in the city's appeal. For instance, a slowdown in Detroit's job growth or a decrease in tourism directly impacts attendance at events and the occupancy of their real estate holdings.

The success of Ilitch Holdings' entertainment and real estate portfolio is intrinsically linked to the continued economic vitality and attractiveness of the Detroit metropolitan area. In 2024, while Detroit's economic indicators showed positive trends, any reversal could disproportionately affect Ilitch Holdings compared to more diversified conglomerates. The reliance on a single geographic market limits their ability to offset regional weaknesses with strengths elsewhere.

The performance of sports franchises within Ilitch Holdings, such as the Detroit Red Wings and Detroit Tigers, is inherently volatile. Fluctuations in team success, player availability due to injuries, and the overall level of fan engagement directly impact revenue streams from ticket sales, concessions, and merchandise. For example, the Red Wings' continued absence from the playoffs in the 2024-25 season likely affected their financial performance, while the Tigers' mid-season surge followed by a significant downturn in 2025 underscores the unpredictable nature of sports outcomes.

The 'District Detroit' project, a cornerstone of Ilitch Holdings' urban revitalization strategy, has faced significant hurdles in its development timeline. Stalled progress and repeatedly adjusted construction schedules have generated frustration within the local community, casting a shadow over the project's momentum and raising concerns about its overall pace.

These prolonged delays in major undertakings like District Detroit can be a substantial drain on capital, as investments remain tied up without generating returns. Furthermore, such setbacks can erode public trust and foster negative perceptions, even as the company emphasizes its commitment to community benefits and engagement.

As a privately held entity, Ilitch Holdings operates without the stringent public disclosure mandates faced by publicly traded corporations. This inherent secrecy means a lack of readily available detailed financial statements and operational data, making it challenging for external parties like potential investors or market analysts to fully assess the company's financial standing and strategic direction.

This opacity can create hurdles in valuation and due diligence processes. For instance, while Ilitch Holdings' revenue streams from its diverse portfolio, including sports franchises like the Detroit Red Wings and Detroit Tigers, and significant real estate holdings, are substantial, specific profit margins or debt levels are not publicly disclosed. This lack of transparency makes it difficult to benchmark performance against industry peers, a common practice for publicly traded companies.

- Limited Public Scrutiny: Less pressure from public shareholders regarding performance and strategy.

- Information Asymmetry: External stakeholders have less insight into financial health and decision-making compared to public companies.

- Valuation Challenges: Difficulty in precisely valuing the company due to unavailable detailed financial disclosures.

- Investor Access: Potential investors may find it harder to conduct thorough due diligence without access to comprehensive financial reports.

Ilitch Holdings has faced criticism regarding its approach to certain Detroit properties. Reports indicate instances where buildings were left vacant or lots were utilized for parking instead of active development. This has fueled concerns about the pace and effectiveness of revitalization efforts within the city.

This situation can foster negative public perception and potentially lead to community backlash. Such sentiment could hinder future development approvals and diminish public support for Ilitch Holdings' broader initiatives in Detroit.

- Vacant Properties: Specific examples of Ilitch-owned properties remaining untenanted have been cited in local media, impacting neighborhood aesthetics.

- Parking Lot Usage: The use of prime development land for surface parking lots, rather than new construction, has drawn criticism.

- Community Concerns: Residents and community groups have voiced concerns about the visual impact and missed economic opportunities these practices represent.

The company's substantial debt load, particularly related to the financing of large-scale projects like Little Caesars Arena and The District Detroit, presents a significant financial vulnerability. High interest payments can strain cash flow, especially if revenue generation from these developments falls short of projections. For example, the $250 million bond issuance in 2023 for District Detroit projects highlights the scale of their financial commitments.

Furthermore, the reliance on debt financing makes Ilitch Holdings susceptible to rising interest rates, which could increase the cost of servicing their obligations. This financial leverage, while potentially amplifying returns in a strong market, also magnifies risk during economic downturns or periods of underperformance in their portfolio assets.

The concentration of Ilitch Holdings' assets and operations within the city of Detroit exposes the company to significant geographic risk. While their commitment to the city is a core part of their identity, any localized economic downturn, natural disaster, or major event impacting Detroit could have a disproportionately negative effect on the company's overall financial health. This lack of geographic diversification is a critical weakness compared to more broadly spread conglomerates.

For example, if Detroit experiences a significant decline in tourism or a major employer leaves the region, it could directly impact attendance at sporting events, hotel occupancy, and retail sales across Ilitch Holdings' properties. The economic forecast for Detroit in 2024 and 2025, while showing signs of recovery, still carries inherent volatility that directly translates into risk for Ilitch Holdings.

| Weakness Category | Description | Impact/Example |

|---|---|---|

| Geographic Concentration | Heavy reliance on the economic health and appeal of Detroit. | Vulnerability to localized downturns; a slowdown in Detroit's job growth directly impacts revenue. |

| Sports Franchise Volatility | Performance of sports teams is unpredictable and impacts revenue. | The Red Wings' playoff absence in 2024-25 likely reduced ticket and merchandise sales. |

| Development Delays | Hurdles and extended timelines in major projects like The District Detroit. | Ties up capital; can erode public trust and create negative perceptions. |

| Lack of Transparency | As a private company, detailed financial data is not publicly disclosed. | Makes valuation and benchmarking against peers difficult for external parties. |

| Property Management Criticism | Instances of vacant buildings and parking lots instead of active development. | Fosters negative public perception and could hinder future development approvals. |

| Debt Load | Significant debt financing for major projects. | Susceptible to rising interest rates; strains cash flow if revenue projections aren't met. |

Full Version Awaits

Ilitch Holdings SWOT Analysis

You’re previewing the actual analysis document. Buy now to access the full, detailed report on Ilitch Holdings' Strengths, Weaknesses, Opportunities, and Threats.

This preview reflects the real document you'll receive—professional, structured, and ready to use, providing a comprehensive overview of Ilitch Holdings' strategic position.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase to gain actionable insights into Ilitch Holdings' competitive landscape.

Opportunities

Little Caesars is actively pursuing aggressive expansion, with plans to launch many new multi-unit restaurants throughout the U.S. and internationally in 2024 and 2025. This strategic growth, including entry into non-traditional locations like university campuses and airports, offers substantial potential for gaining market share and boosting revenue within the quick-service restaurant industry.

The ongoing revitalization of Detroit presents significant opportunities for Ilitch Holdings. Developments within 'The District Detroit,' such as new housing, hotels, and commercial spaces, are projected to drive substantial growth. For instance, the expansion of residential units and mixed-use developments in this area continues to attract both residents and businesses, fostering a vibrant urban core.

Ilitch Holdings' dedication to job creation and economic development in Detroit is a key opportunity. Projects like the restoration of Henry Street and the Co-Developer Program not only enhance the city's infrastructure but also bolster its tax base. This commitment to community integration and business attraction positions the company for sustained growth and positive impact.

Olympia Entertainment's stewardship of key venues like Little Caesars Arena, Comerica Park, and the Fox Theatre presents a significant opportunity to diversify beyond sports. These facilities are ideally positioned to host a broad spectrum of events, from major concerts to family entertainment, thereby maximizing utilization and revenue potential.

The ongoing development and enhancement of District Detroit, coupled with these premier venues, create a powerful draw for increased visitor traffic. This strategic focus on diverse programming and integrated hospitality services is projected to unlock substantial new revenue streams, further solidifying Ilitch Holdings' market presence.

Technological Innovation and Digital Transformation

Ilitch Holdings has a significant opportunity to leverage technological innovation and digital transformation to bolster its various businesses. Their investment in cutting-edge technology, especially within Little Caesars, aims to refine the customer experience and boost operational effectiveness. This focus on innovation across the Ilitch Companies can translate into more engaging customer interactions and a stronger market position.

The company's strategic embrace of technology presents several key opportunities:

- Enhanced Operational Efficiencies: Implementing advanced tech solutions can streamline processes, reduce costs, and improve speed of service, particularly in food service operations like Little Caesars.

- New Revenue Streams: Digital transformation opens doors for innovative service models, such as advanced online ordering platforms, loyalty programs, and personalized marketing campaigns.

- Improved Customer Engagement: Leveraging data analytics and digital touchpoints allows for deeper understanding of customer preferences, leading to more targeted promotions and a superior overall experience.

- Competitive Differentiation: Early adoption and effective implementation of new technologies can set Ilitch Holdings apart from competitors, attracting and retaining a broader customer base.

Strategic Partnerships and Collaborations

Ilitch Holdings actively pursues strategic partnerships, exemplified by its co-development program with Detroit-based businesses for properties within The District Detroit. This approach not only fuels local economic growth but also cultivates essential community support. Such collaborations can unlock novel development avenues and foster innovative solutions across their diverse business portfolios.

These alliances are crucial for Ilitch Holdings' expansion and community integration. For instance, the company's investment in The District Detroit, a massive urban revitalization project, relies heavily on synergistic relationships with local entities. These partnerships can lead to shared resources, expanded market reach, and a more robust local ecosystem.

- Local Economic Impact: Partnerships within The District Detroit are designed to create jobs and stimulate business for Detroit-based companies.

- Community Buy-in: Collaborations foster goodwill and ensure that development aligns with the needs and aspirations of the local community.

- Innovation and Growth: Working with diverse partners can introduce new technologies, business models, and creative approaches to existing Ilitch Holdings ventures.

- Risk Mitigation: Shared development and operational responsibilities can help distribute financial risk and leverage complementary expertise.

Ilitch Holdings is well-positioned to capitalize on the continued growth and development within The District Detroit. The ongoing influx of residents and businesses into this revitalized urban core, with new residential and mixed-use projects, directly translates to increased foot traffic and demand for the company's entertainment and dining offerings.

The company's strategic focus on leveraging its premier venues, including Little Caesars Arena and Comerica Park, for a diverse range of events beyond sports presents a significant revenue expansion opportunity. By attracting major concerts, family shows, and other large-scale events, Ilitch Holdings can maximize venue utilization and tap into new customer segments throughout 2024 and 2025.

Ilitch Holdings has a clear opportunity to enhance its market position through technological innovation, particularly in streamlining operations and improving customer experience at Little Caesars. Investments in digital platforms and data analytics can drive new revenue streams and foster stronger customer loyalty.

The company's commitment to strategic partnerships, especially within Detroit's revitalization efforts, offers a pathway to shared growth and innovation. Collaborating with local businesses on projects within The District Detroit not only strengthens community ties but also unlocks new development possibilities and operational efficiencies.

Threats

Ilitch Holdings navigates a fiercely competitive environment across its diverse portfolio. In the fast-food industry, Little Caesars contends with established giants like Pizza Hut and Domino's, a market characterized by aggressive pricing and rapid innovation. For instance, the global pizza market was valued at over $140 billion in 2023, highlighting the sheer scale of competition.

Beyond pizza, Ilitch Holdings' ventures in professional sports and entertainment face intense rivalry for consumer attention and spending. The Detroit Red Wings and Detroit Tigers compete not only with other professional sports teams but also with a vast array of leisure activities, from concerts to streaming services, all vying for a share of discretionary income. This broad competitive pressure necessitates continuous strategic adaptation to maintain market relevance and profitability.

Economic downturns pose a significant threat to Ilitch Holdings. A recession, for instance, could drastically reduce consumer discretionary spending, impacting attendance at Little Caesars Arena and Comerica Park, as well as sales at its restaurant chains. For example, during the COVID-19 pandemic, which triggered an economic slowdown, live events and dining faced severe restrictions and reduced consumer willingness to spend on non-essentials.

Persistent underperformance by the Detroit Red Wings and Detroit Tigers poses a significant threat, potentially eroding fan engagement, attendance, and merchandise revenue. The Red Wings’ prolonged absence from the playoffs and the Tigers’ recent performance dips, such as their faltering after a promising start in 2025, underscore the difficulty in consistently fielding winning teams that capture and retain fan loyalty.

Real Estate Development Risks and Public Scrutiny

Large-scale urban development projects, such as Ilitch Holdings' District Detroit initiative, inherently face significant risks. These include potential construction delays and escalating costs, which can impact the project's financial viability. For example, major urban regeneration projects often experience budget increases of 10-20% due to unforeseen circumstances.

Public scrutiny is a constant threat, particularly regarding the delivery of promised community benefits and the overall pace of development. Activist groups and local residents may voice concerns or opposition, potentially leading to policy changes or project slowdowns. In 2024, several high-profile urban development projects across the US faced public backlash and regulatory hurdles impacting their timelines and scope.

- Construction Cost Escalation: Building material costs saw an average increase of 8% in 2024, impacting large-scale development budgets.

- Public Opposition: Community benefit agreements in urban projects often become points of contention, with delays common if these are not met to satisfaction.

- Regulatory Changes: Evolving urban planning policies or zoning laws can introduce new compliance requirements, adding complexity and cost.

Labor and Supply Chain Disruptions

Ilitch Holdings, operating in diverse sectors like food, sports, and entertainment, faces significant threats from labor and supply chain disruptions. Labor shortages and rising wage pressures, a trend highlighted by the U.S. Bureau of Labor Statistics reporting unemployment rates below 4% for much of 2024, can directly impact operational costs and efficiency. For instance, Little Caesars might experience higher ingredient costs or challenges in maintaining adequate staffing levels, affecting service speed and customer experience.

Furthermore, the sports and entertainment divisions are not immune. Labor disputes within leagues or unions, or broader disruptions affecting event staff and logistics, could lead to postponed games or cancellations, directly impacting revenue streams and fan engagement. Supply chain volatility, a persistent issue in recent years, can also affect everything from the availability of pizza ingredients to the merchandise sold at sporting events.

- Labor Shortages: Persistent low unemployment rates in 2024 continue to create competition for workers, potentially increasing labor costs for Ilitch Holdings' businesses.

- Wage Pressures: To attract and retain staff, companies may face upward pressure on wages, impacting profitability, especially in labor-intensive sectors like food service.

- Supply Chain Volatility: Disruptions in global or domestic supply chains can lead to increased costs for raw materials and finished goods, affecting margins for Little Caesars and merchandise availability for sports teams.

- Event Disruption Risk: Labor disputes or widespread operational disruptions could impact the scheduling and execution of live events, leading to lost revenue and reputational damage.

Ilitch Holdings faces significant threats from evolving consumer preferences and technological advancements. The rise of streaming services and alternative entertainment options continues to challenge traditional live sports attendance. Furthermore, the quick-service restaurant sector is seeing increased competition from ghost kitchens and delivery-only brands, requiring adaptation to maintain market share.

The company's reliance on physical venues like Little Caesars Arena and Comerica Park makes it vulnerable to shifts in consumer behavior towards digital experiences. For instance, while live sports viewership remains strong, the overall entertainment spending landscape is diversifying, with digital content consumption growing rapidly. This necessitates ongoing investment in unique fan experiences and robust digital engagement strategies.

Ilitch Holdings operates under the constant threat of economic downturns and shifts in consumer spending habits. A recessionary environment, as seen during the COVID-19 pandemic in 2020-2021, can severely impact discretionary spending on entertainment and dining. For example, consumer confidence indices often dip during economic contractions, directly affecting ticket sales and restaurant traffic.

The competitive landscape for both sports franchises and quick-service restaurants is intense and dynamic. Little Caesars faces pressure from major players like Domino's and Pizza Hut, who often engage in aggressive promotional pricing. In the sports sector, the Detroit Red Wings and Detroit Tigers must contend with increasing entertainment alternatives for consumer dollars, making fan engagement and consistent performance critical.

| Threat Category | Specific Threat | Impact on Ilitch Holdings | Supporting Data/Trend |

|---|---|---|---|

| Market Competition | Intense rivalry in QSR | Pressure on pricing, market share erosion | Global pizza market valued at over $140 billion in 2023. |

| Market Competition | Competition for entertainment spending | Reduced attendance, lower revenue | Growth in streaming services and alternative leisure activities. |

| Economic Factors | Consumer discretionary spending reduction | Lower sales for restaurants and sports tickets | Consumer confidence indices often decline during economic slowdowns. |

| Operational Risks | Labor shortages and wage pressures | Increased operating costs, service disruption | U.S. unemployment rates below 4% in much of 2024. |

| Project Development Risks | Construction cost escalation | Budget overruns, project delays | Average increase of 8% in building material costs in 2024. |

SWOT Analysis Data Sources

This Ilitch Holdings SWOT analysis is built upon a foundation of verified financial reports, comprehensive market intelligence, and expert industry evaluations. These sources provide robust data for an accurate assessment of the company's strategic position.