Ilitch Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ilitch Holdings Bundle

Ilitch Holdings operates in a dynamic landscape shaped by intense rivalry, powerful suppliers, and discerning buyers. Understanding these forces is crucial for navigating its diverse business portfolio, from sports and entertainment to food and real estate.

The complete report reveals the real forces shaping Ilitch Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of professional athletes and their unions, such as the NHLPA for the Detroit Red Wings and the MLBPA for the Detroit Tigers, is exceptionally strong. Elite talent is a finite and essential asset for any sports franchise, giving players significant leverage.

This influence is evident in collective bargaining agreements, salary caps, and free agency rules, which directly shape team payrolls and overall financial performance. For instance, in the 2023-2024 NHL season, the average NHL salary cap was $83.5 million, a figure heavily influenced by player union negotiations.

For Little Caesars, the bargaining power of food ingredient suppliers, such as those providing flour, cheese, and tomato sauce, is generally moderate. This is particularly true when sourcing specialized or premium-quality ingredients.

However, Little Caesars significantly counters this supplier power through its substantial operational scale. Its ability to purchase ingredients in large volumes allows for favorable pricing negotiations.

Furthermore, the company's in-house distribution network, Blue Line Distribution, plays a crucial role. This integrated supply chain enhances Little Caesars' purchasing leverage and streamlines logistics, further reducing the impact of individual supplier power.

Suppliers of specialized technology for sports venues, such as advanced scoreboards and sophisticated sound systems, and for quick-service restaurants (QSR), like AI-driven drive-thru technology and self-service kiosks, generally possess moderate bargaining power. This is because the development and implementation of such technology often require significant capital investment and possess a specialized nature, making it difficult for companies like Ilitch Holdings to switch suppliers easily.

Ilitch Holdings' commitment to modernizing its venues, evident in recent upgrades to Little Caesars Arena, underscores its reliance on these technology providers. For example, the arena features state-of-the-art LED lighting and display systems, indicating a dependence on suppliers capable of delivering such complex technological solutions.

Real Estate Construction and Labor

In the real estate construction sector, suppliers such as general contractors, specialized subcontractors, and material vendors wield considerable influence, especially in dynamic markets. For Olympia Development, a key player in Detroit's resurgence, this translates to potential impacts on project execution. The bargaining power of these suppliers is amplified by factors like the availability of skilled labor and the cost of essential building materials.

Labor shortages in skilled trades, a persistent issue in many construction markets, can drive up wages and extend project schedules. Similarly, fluctuations in the price of concrete, steel, and lumber directly affect construction budgets. For instance, the Producer Price Index for construction materials saw a notable increase in early 2024, impacting project costs across the industry.

- Skilled Labor Availability: Shortages in trades like electricians and plumbers can lead to higher labor costs and project delays.

- Material Cost Volatility: Rising prices for key materials like steel and lumber directly increase construction expenses for developers.

- Contractor Concentration: In markets with fewer large, reputable construction firms, their bargaining power increases.

- Demand Dynamics: High demand for construction services, as seen in Detroit's ongoing development boom, strengthens supplier leverage.

Broadcasting and Media Rights

The bargaining power of suppliers in the broadcasting and media rights sector significantly impacts Ilitch Holdings. While Ilitch owns venues for the Detroit Red Wings (NHL) and Detroit Tigers (MLB), the crucial broadcasting rights are negotiated at the league level, not by individual teams. This means major media conglomerates, acting as buyers of this content, wield considerable power. For instance, in 2023, the NFL's media rights deals alone were valued at over $110 billion through 2033, demonstrating the immense scale and the consolidated buying power of broadcasters. This league-wide negotiation structure limits the direct leverage Ilitch Holdings has over the terms of these lucrative content deals, influencing the revenue streams available to its sports franchises.

- League-wide Negotiation: Broadcasting rights for NHL and MLB are typically negotiated by the leagues, concentrating buying power with major media companies.

- Media Company Leverage: Large media conglomerates, as buyers of sports content, possess substantial bargaining power due to the high demand and consolidated purchasing.

- Revenue Impact: These league-level agreements directly affect the revenue generated by Ilitch Holdings' sports teams, the Red Wings and Tigers, by dictating the terms of media rights sales.

For Ilitch Holdings' diverse operations, the bargaining power of suppliers varies. For Little Caesars, the scale of operations generally moderates supplier power for common ingredients, though specialized items can command higher leverage. Technology suppliers for venues and restaurants hold moderate power due to specialized needs and capital investment requirements.

Construction suppliers, including contractors and material vendors, can exert significant influence, particularly given potential labor shortages and material cost volatility, as seen with rising construction material prices in early 2024. In sports, league-level negotiations for broadcasting rights concentrate power with media companies, limiting team-specific leverage.

| Industry Segment | Supplier Type | Bargaining Power Level | Key Influencing Factors |

|---|---|---|---|

| Quick Service Restaurants (Little Caesars) | Food Ingredients (common) | Moderate | High volume purchasing, operational scale |

| Sports Venues & QSR | Specialized Technology | Moderate | Capital investment, specialized nature |

| Real Estate Development | Construction Contractors & Material Vendors | Considerable | Skilled labor availability, material cost volatility (e.g., PPI for construction materials up in early 2024) |

| Sports Franchises (Red Wings, Tigers) | Broadcasting & Media Rights | Low (for Ilitch Holdings) | League-wide negotiation, consolidated media company buying power (e.g., NFL media rights over $110B through 2033) |

What is included in the product

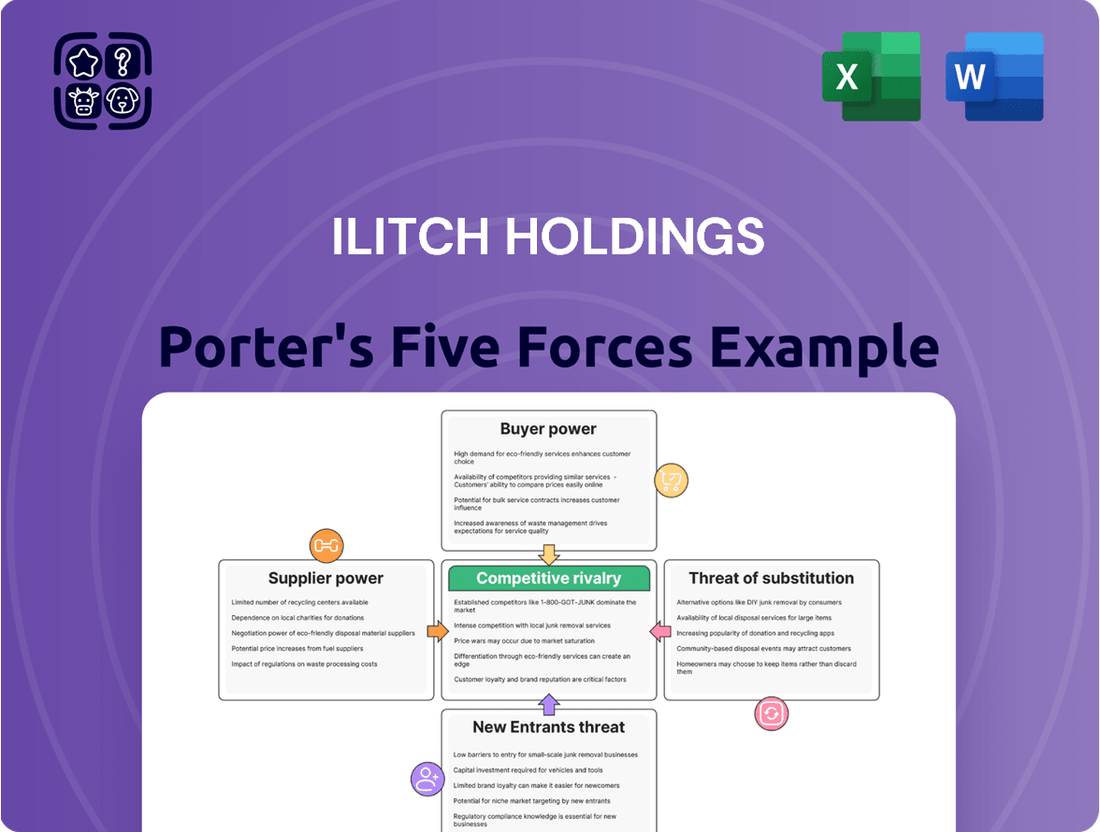

Tailored exclusively for Ilitch Holdings, analyzing its position within its competitive landscape by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry.

Instantly visualize the competitive landscape for Ilitch Holdings' diverse portfolio, from sports teams to real estate, with a clear, one-sheet summary of all five forces—perfect for quick strategic decision-making.

Customers Bargaining Power

The bargaining power of individual Little Caesars consumers is quite strong. This is because the quick-service restaurant and pizza market is packed with competitors, giving customers plenty of choices. For instance, in 2024, the U.S. pizza delivery market alone was valued at over $45 billion, showcasing the intense competition Little Caesars faces.

Consumers are often swayed by price, making them highly sensitive to deals and discounts. Little Caesars has built its brand around affordability, with its Hot-N-Ready pizzas often priced competitively. This strategy directly addresses customer price sensitivity, as evidenced by their continued focus on value propositions to draw in and keep customers in a crowded marketplace.

Sports fans, particularly those of the Detroit Red Wings and Detroit Tigers, wield moderate bargaining power. This influence stems from several factors, including the teams' on-field performance, the availability of alternative entertainment choices, and the pricing of tickets and merchandise. For instance, a losing season can diminish fan enthusiasm and their willingness to pay premium prices, forcing teams to offer discounts or promotions to maintain attendance.

Team success is a significant driver of fan loyalty and spending. In 2023, the Detroit Tigers, despite a challenging season, saw an average attendance of around 16,000 per game. However, sustained winning seasons, like those experienced by the Red Wings in past decades, typically correlate with higher ticket demand and less price sensitivity among the fanbase. This dynamic means that while a core group of dedicated fans will always support the teams, the broader fan base's purchasing decisions are often tied to the perceived value and excitement of the game day experience.

Event organizers and promoters hold considerable sway over Olympia Entertainment. Their ability to select from a multitude of venues means Ilitch Holdings must continually offer competitive advantages. For instance, in 2024, the live entertainment industry saw a robust recovery, with major tours and festivals driving significant demand for venue bookings.

The diverse and attractive portfolio of Ilitch Holdings' venues, including the state-of-the-art Little Caesars Arena and the historic Fox Theatre, serves as a crucial counterweight to this customer power. These premier facilities, coupled with comprehensive event services, make them desirable locations, thereby strengthening Olympia Entertainment's negotiating position.

Corporate Sponsors and Advertisers

Corporate sponsors and advertisers, especially those aligned with Ilitch Holdings' sports teams like the Detroit Red Wings and Detroit Tigers, wield significant bargaining power. Their substantial financial commitments are contingent on demonstrable brand visibility and access to Ilitch's engaged fan bases. For instance, in 2024, major sponsorship deals often involve multi-year commitments, with companies expecting guaranteed impressions and specific marketing activations.

This power dynamic necessitates Ilitch Holdings to consistently deliver tangible value, such as extensive media coverage and direct consumer engagement opportunities, to retain these vital revenue streams. The ability of sponsors to easily shift their advertising budgets to competing entertainment properties or digital platforms means Ilitch must continually prove its unique selling proposition.

- Sponsor Value Proposition: Ilitch Holdings must highlight audience demographics and reach to justify sponsorship investments.

- Negotiation Leverage: Sponsors can leverage alternative marketing channels to negotiate better terms.

- Long-Term Partnerships: The renewal of sponsorship agreements in 2024 often depends on demonstrated ROI from previous campaigns.

- Brand Association: Sponsors seek strong brand alignment with Ilitch's popular sports and entertainment properties.

Real Estate Tenants and Buyers

Customers in Ilitch Holdings' real estate ventures, such as residential and commercial tenants or property buyers in Detroit, generally possess moderate to high bargaining power. This power is shaped by prevailing local market conditions, including rental vacancy rates and the availability of alternative properties. As Detroit's real estate market continues its transformation, the options available to tenants and buyers can significantly influence their negotiating leverage.

For instance, in 2024, Detroit's residential rental vacancy rate hovered around 5-7%, offering tenants a reasonable selection and thus some bargaining power. Similarly, the availability of comparable commercial spaces in areas undergoing development, like the District Detroit, can empower potential lessees to negotiate terms more favorably.

- Tenant Leverage: As of early 2024, with a moderate vacancy rate in Detroit's rental market, tenants can often negotiate lease terms, especially for multi-year commitments or larger commercial spaces.

- Buyer Options: The number of available properties for sale in key Detroit neighborhoods influences buyer negotiation power; a higher inventory generally means buyers can push for better pricing or concessions.

- Market Sensitivity: Ilitch Holdings' real estate segment's power is directly tied to the economic health and growth trajectory of Detroit, impacting demand and tenant retention.

- Competitive Landscape: The presence of other developers and landlords offering similar properties or amenities in proximity can increase the bargaining power of potential customers.

The bargaining power of customers for Ilitch Holdings is multifaceted, varying across its diverse business segments. For Little Caesars, individual consumers hold significant power due to the highly competitive pizza market, where price sensitivity is a key driver. In 2024, the sheer volume of pizza options available meant that value and affordability remained paramount for attracting and retaining customers.

Sports fans, while loyal, also exhibit moderate bargaining power, their willingness to spend influenced by team performance and the availability of alternative entertainment. For instance, while the Detroit Red Wings have a dedicated fanbase, sustained on-ice success directly impacts ticket demand and price elasticity, as seen in past decades of strong performance correlating with higher fan spending.

Event organizers and corporate sponsors possess considerable leverage, able to pivot to competing venues or marketing channels. This necessitates Ilitch Holdings to consistently offer compelling value propositions, such as access to premium facilities like Little Caesars Arena and strong fan engagement metrics, to secure and maintain these crucial partnerships. The live entertainment sector's recovery in 2024 underscored the demand for quality venues, amplifying this negotiating power.

Real estate tenants and buyers in Detroit also wield moderate to high bargaining power, particularly in 2024, influenced by local market dynamics like vacancy rates. As Detroit's urban core continues to develop, the availability of comparable properties can empower customers to negotiate more favorable lease or purchase terms, making Ilitch Holdings' property offerings competitive within the broader market.

| Ilitch Holdings Segment | Customer Group | Bargaining Power Level | Key Influencing Factors (2024) |

|---|---|---|---|

| Little Caesars | Individual Consumers | High | Intense market competition, price sensitivity, availability of alternatives. |

| Sports Teams (Red Wings, Tigers) | Sports Fans | Moderate | Team performance, ticket pricing, alternative entertainment options, fan loyalty. |

| Olympia Entertainment | Event Organizers | Considerable | Venue availability, event demand, competitive venue offerings, industry trends. |

| Olympia Entertainment | Corporate Sponsors | Considerable | Brand visibility needs, ROI expectations, alternative marketing channels, sponsorship alignment. |

| Real Estate Ventures | Residential/Commercial Tenants | Moderate to High | Local market conditions, rental vacancy rates, availability of comparable properties, lease terms. |

| Real Estate Ventures | Property Buyers | Moderate to High | Real estate market conditions, property availability, pricing, economic outlook for Detroit. |

Preview the Actual Deliverable

Ilitch Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces Analysis of Ilitch Holdings, detailing the competitive landscape across its diverse portfolio. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, offering actionable insights into industry rivalry, buyer and supplier power, the threat of new entrants, and the bargaining power of substitutes.

Rivalry Among Competitors

Little Caesars navigates a hyper-competitive quick-service restaurant (QSR) and pizza landscape. Major players like Domino's, Pizza Hut, and Papa John's constantly vie for market share, alongside a multitude of regional and local pizzerias. This intense rivalry necessitates ongoing innovation in everything from new menu items to aggressive pricing and efficient service models to stand out.

Ilitch Holdings' professional sports teams, like the Detroit Red Wings (NHL) and Detroit Tigers (MLB), face intense rivalry from other franchises within their leagues. This competition isn't just about wins and losses; it's a battle for fan engagement, media coverage, and crucial sponsorship revenue, both locally and nationally.

For instance, in the 2023 MLB season, the Detroit Tigers ranked 29th in attendance among all 30 teams, drawing an average of 16,408 fans per game. This highlights the challenge of capturing fan interest when competing against more successful or popular franchises, impacting revenue streams vital for team operations and growth.

Olympia Entertainment faces intense competition from a vast spectrum of entertainment choices. This includes not only other live venues and concert promoters but also the growing dominance of streaming services, traditional movie theaters, and a multitude of leisure activities vying for consumer attention and disposable income. For instance, the global streaming market alone was projected to reach over $200 billion in 2024, highlighting the significant alternative entertainment options available.

Detroit Real Estate Development Scramble

Olympia Development, a key player in Detroit's real estate scene, navigates a highly competitive environment. Numerous other developers and property owners actively seek prime development sites and lucrative tenant agreements across the city.

The intensity of this rivalry is directly influenced by factors such as the availability of developable land, the attractiveness of investment opportunities, and the overall momentum of Detroit's urban revitalization. For instance, in 2024, the surge in interest in downtown Detroit projects meant more developers were competing for limited parcels.

This scramble for projects and tenants means that developers like Olympia must constantly innovate and offer compelling value propositions to secure and retain business. The competition is not just about acquiring land, but also about attracting and keeping the businesses that will occupy the developed spaces.

- Increased Competition for Prime Detroit Land: Developers are actively bidding on available parcels, driving up acquisition costs.

- Tenant Attraction and Retention Challenges: Securing and keeping desirable tenants requires competitive leasing terms and attractive development offerings.

- Impact of Urban Revitalization Pace: The speed of Detroit's renewal directly fuels competition as more opportunities arise, attracting a wider range of developers.

- Diversification of Development Projects: Competition spans various real estate sectors, including residential, commercial, and mixed-use developments.

Cross-Sector Entertainment Competition

Ilitch Holdings' broad range of businesses means its different ventures often compete for the same discretionary spending by consumers. For instance, a family might opt for a quick and affordable meal from Little Caesars, decide to attend a Detroit Red Wings hockey game, or choose to experience a live concert at one of Olympia Entertainment's venues. This creates a dynamic where the company's own brands are vying for the same consumer dollar, influencing purchasing decisions within the household.

This cross-sector competition is particularly evident in the entertainment and food sectors. In 2024, consumer spending on entertainment and dining out remains a significant portion of household budgets. For example, average annual spending on entertainment per consumer unit in the U.S. was projected to be around $3,000-$3,500, while food away from home also represents a substantial expenditure. Ilitch Holdings' ability to capture a share of this spending across its diverse offerings is key.

- Diversified Offerings: Ilitch Holdings operates in sectors like pizza (Little Caesars), professional sports (Detroit Red Wings, Detroit Tigers), and live entertainment venues (Olympia Entertainment).

- Consumer Choice: Consumers face choices between a casual meal, a sporting event, or a concert, directly impacting which Ilitch Holdings entity receives revenue.

- Market Dynamics: In 2024, the entertainment and food service industries continue to be highly competitive, with consumers prioritizing value and experience.

Ilitch Holdings faces intense competitive rivalry across its diverse business segments. Little Caesars competes fiercely in the crowded fast-casual pizza market against giants like Domino's and Pizza Hut, necessitating constant innovation in product and pricing. The sports franchises, Detroit Red Wings and Detroit Tigers, battle for fan attention and revenue against numerous other professional teams, a challenge underscored by the Tigers' 2023 attendance ranking of 29th in MLB.

Olympia Entertainment contends with a vast array of entertainment options, from other live venues to the ever-growing streaming services, which captured over $200 billion globally in 2024. Similarly, Olympia Development navigates a competitive real estate market in Detroit, where increased interest in urban revitalization in 2024 intensified competition for prime land and tenants.

| Ilitch Holdings Segment | Key Competitors | Competitive Pressure Factor |

|---|---|---|

| Little Caesars | Domino's, Pizza Hut, Papa John's, local pizzerias | Price, menu innovation, delivery efficiency |

| Detroit Red Wings (NHL) | Other NHL franchises, local sports teams | Fan engagement, media rights, sponsorship |

| Detroit Tigers (MLB) | Other MLB franchises, local sports teams | Fan engagement, media rights, sponsorship |

| Olympia Entertainment | Concert promoters, other live venues, streaming services | Consumer spending on leisure, alternative entertainment options |

| Olympia Development | Other real estate developers, property owners | Land availability, investment attractiveness, tenant demand |

SSubstitutes Threaten

The threat of substitute food choices for Little Caesars is substantial. Consumers have a wide array of alternatives, from other quick-service restaurants and casual dining establishments to the convenience of grocery store prepared meals or even cooking at home. This broad accessibility to different food options means customers can readily switch if they perceive better value, quality, or a different dining experience elsewhere.

Furthermore, evolving consumer preferences are amplifying this threat. The increasing demand for healthier and plant-based meal options presents a direct challenge. As consumers prioritize wellness and dietary variety, quick-service restaurants like Little Caesars face pressure to adapt their menus and offerings to remain competitive against these growing substitute trends.

The increasing sophistication of home entertainment systems and the proliferation of digital media platforms present a significant threat of substitution for Ilitch Holdings' sports teams and entertainment venues. Consumers can now access a vast array of live sports, concerts, and movies through streaming services and on-demand platforms, often at a lower price point and with greater convenience than attending in person.

For instance, in 2024, the global streaming market continued its robust growth, with major players reporting substantial subscriber increases. This trend directly impacts attendance at live events, as fans increasingly opt for the comfort and cost-effectiveness of watching content at home. The availability of high-definition broadcasts and immersive viewing experiences further diminishes the perceived need to attend physical venues.

Ilitch Holdings' sports and entertainment ventures, including the Detroit Red Wings and Detroit Tigers, contend with a wide array of alternative leisure activities. These substitutes range from digital entertainment like video gaming, which saw global revenues exceed $180 billion in 2023, to outdoor pursuits and personal hobbies. Consumers must allocate their finite discretionary time and money, making choices between attending a live game, playing a sport, or engaging in other forms of recreation.

DIY and Local Alternatives for Events

For smaller events, DIY planning and local community venues present a viable alternative to large-scale professional event management. This means Ilitch Holdings, through Olympia Entertainment, must continually differentiate its offerings by providing premium, unique experiences that justify the higher cost and scale.

The rise of accessible event technology and the growing trend of personalized, intimate gatherings further empower individuals to orchestrate their own events. This directly challenges the market share of larger venues that cater to more traditional, larger-scale productions.

- DIY Event Planning: Lower overhead and greater customization appeal to budget-conscious organizers.

- Community Venues: Offer intimate settings and local charm as an alternative to large arenas.

- Impact on Olympia Entertainment: Necessitates a focus on high-value, unique programming to remain competitive.

- Market Trend: Growing demand for personalized and smaller-scale event experiences.

Shifting Lifestyles and Urban Mobility

The threat of substitutes for urban living and working spaces is amplified by shifting lifestyles and evolving mobility patterns. For instance, the rise of remote work, accelerated by the pandemic, allows individuals to choose locations beyond traditional urban centers. In 2024, a significant portion of the workforce continues to embrace hybrid or fully remote arrangements, reducing the necessity of proximity to a central business district. This trend presents a direct substitute for occupying office space or residing within expensive urban cores.

Olympia Development faces this threat by needing to demonstrate unique value. Consider the appeal of suburban living, which often offers more space and potentially lower costs, directly competing with downtown residential offerings. Furthermore, the increasing affordability and efficiency of public transportation and personal mobility solutions in various cities can make commuting from more distant, less expensive areas a viable substitute for living downtown. For example, advancements in electric vehicle infrastructure and the expansion of ride-sharing services can broaden the acceptable commuting radius for many professionals.

- Remote Work Adoption: By early 2024, surveys indicated that over 60% of U.S. workers were in hybrid or fully remote roles, a substantial increase from pre-pandemic levels.

- Suburban Appeal: Data from 2023 showed continued strong demand for single-family homes in suburban areas, often driven by affordability and lifestyle preferences.

- Commuting Trends: While commuting patterns are still normalizing, the average one-way commute time for those who do commute remains a critical factor in location decisions.

The threat of substitutes for Ilitch Holdings' food offerings, primarily Little Caesars, is significant due to the vast array of dining choices available. Consumers can easily opt for other fast-casual restaurants, delivery services, or even prepare meals at home, especially with the growing popularity of meal kits. In 2024, the quick-service restaurant sector continued to see intense competition, with value and convenience remaining key drivers for consumer choices.

For Ilitch Holdings' sports and entertainment segments, the substitution threat is robust. Digital entertainment, including streaming services and online gaming, offers compelling alternatives to live events. In 2023, global video game revenue alone surpassed $180 billion, highlighting the significant portion of leisure spending captured by these digital substitutes.

The urban development arm of Ilitch Holdings also faces substitutes. The increasing adoption of remote and hybrid work models, with over 60% of U.S. workers in such arrangements by early 2024, reduces the necessity for traditional urban office spaces and residences. This trend makes suburban living, often offering more space and affordability, a strong substitute.

| Industry Segment | Primary Substitute Threats | Key Factors Driving Substitution | 2023/2024 Data Point |

|---|---|---|---|

| Food (Little Caesars) | Other QSRs, Delivery Services, Home Cooking, Meal Kits | Value, Convenience, Health Trends | Continued QSR market growth and competition |

| Sports & Entertainment | Streaming Services, Online Gaming, Home Entertainment | Cost, Convenience, Content Variety | Global Video Game Revenue: >$180 Billion (2023) |

| Urban Development | Suburban Living, Remote Work Locations | Affordability, Space, Lifestyle Preferences | >60% US Workers in Hybrid/Remote Roles (Early 2024) |

Entrants Threaten

The threat of new entrants into the pizza and quick-service restaurant (QSR) sector is a mixed bag. For small, local pizza shops, the barriers to entry are relatively low. Think about it: you don't need a massive amount of capital to open a single neighborhood spot. This means more independent players can pop up, adding to the competition.

However, when we look at a company like Ilitch Holdings, specifically with its Little Caesars brand, the landscape shifts dramatically. Building a national or international chain requires substantial investment in branding, marketing, and, crucially, a robust supply chain. Little Caesars’ Blue Line Distribution, for instance, represents a significant capital expenditure and operational complexity that deters many potential competitors from scaling up to that level.

The sheer scale of infrastructure needed to compete nationally, from securing prime real estate to managing a vast network of suppliers and franchisees, creates a formidable barrier. In 2024, the cost of establishing a significant QSR presence, including technology integration and labor, continues to rise, making it increasingly difficult for new, large-scale entrants to challenge established players like Little Caesars without considerable financial backing.

The threat of new entrants into professional sports leagues like the NHL and MLB is practically non-existent. The sheer capital needed to acquire or even start a franchise is astronomical, often running into hundreds of millions, if not billions, of dollars. For instance, the average NHL team valuation in 2024 was reported to be around $1.05 billion, with some exceeding $2 billion, presenting a formidable financial hurdle.

Beyond the immense cost, leagues strictly limit the number of teams allowed, creating an exclusive club. Existing teams also benefit from deeply entrenched fan bases, established infrastructure, and lucrative media deals, all of which are incredibly difficult for newcomers to replicate or overcome. League ownership approval processes are rigorous, further solidifying these high barriers to entry.

Entering the large-scale entertainment venue market, such as that operated by Olympia Entertainment, demands immense capital for construction or acquisition, often running into hundreds of millions of dollars. For instance, the development of a new major arena or stadium can easily exceed $500 million, a figure that deters many potential entrants.

Furthermore, securing established relationships with major promoters, artists, and sports leagues is crucial for consistent event booking. Without these pre-existing networks, new venues struggle to attract high-profile events, which are vital for revenue generation and building a brand presence.

The operational complexity, encompassing everything from ticketing and security to concessions and marketing, requires significant expertise and a proven track record. This steep learning curve and the need for specialized staff further elevate the barriers to entry, protecting existing players like Olympia Entertainment from immediate competitive threats.

Significant Investment and Regulatory Hurdles in Real Estate

New entrants aiming for large-scale urban real estate development, especially in a city like Detroit undergoing revitalization, encounter formidable barriers. These include immense capital requirements, intricate zoning laws and lengthy regulatory approval processes, and the necessity of profound local market understanding and robust community relationships.

For instance, a major mixed-use development project in a prime Detroit location could easily require hundreds of millions of dollars in upfront investment. In 2024, the average cost of construction materials saw an increase, further escalating these initial capital needs. Navigating Detroit's specific zoning ordinances and securing permits can add months, if not years, to project timelines, demanding specialized expertise and significant time commitment.

- High Capital Outlay: Projects often demand hundreds of millions of dollars, a substantial barrier for new players.

- Regulatory Complexity: Navigating zoning, permits, and environmental reviews in urban settings is time-consuming and costly.

- Local Expertise and Relationships: Success hinges on understanding local market dynamics, community needs, and building trust with stakeholders, which takes time and effort to establish.

Brand Recognition and Established Supply Chains

Ilitch Holdings faces a moderate threat from new entrants due to its deeply entrenched brand recognition and highly efficient, established supply chains. For instance, Little Caesars, a flagship brand, consistently ranks among the top pizza chains in the U.S. by sales, demonstrating significant customer loyalty. Newcomers would find it exceedingly difficult and costly to build comparable brand awareness and secure reliable, cost-effective distribution networks like Ilitch’s Blue Line Distribution or Champion Foods, which are critical for competitive pricing and product availability.

The significant capital investment required to match Ilitch’s brand equity and operational infrastructure acts as a substantial barrier. Developing the kind of widespread recognition that Little Caesars or the Detroit Red Wings command takes years and substantial marketing expenditure. Furthermore, replicating Ilitch’s integrated supply chain capabilities, which ensure quality control and cost savings, presents a formidable challenge for any new competitor seeking to enter these markets.

- Brand Loyalty: Ilitch Holdings brands, such as Little Caesars and the Detroit Red Wings, enjoy substantial customer loyalty built over decades, making it hard for new entrants to capture market share.

- Supply Chain Efficiency: Established networks like Blue Line Distribution and Champion Foods provide Ilitch with significant operational advantages and cost efficiencies that new competitors would struggle to replicate.

- Capital Investment: Entering markets dominated by Ilitch requires immense capital for branding, marketing, and building a comparable supply chain infrastructure, posing a high barrier to entry.

The threat of new entrants for Ilitch Holdings is generally low across its diverse business segments, largely due to the substantial capital requirements and established market positions. For its QSR division, while smaller independent pizza shops face lower barriers, replicating the scale and efficiency of Little Caesars’ national supply chain and brand recognition is a significant hurdle. Similarly, entering professional sports leagues or developing large-scale entertainment venues demands hundreds of millions, if not billions, of dollars, coupled with rigorous league approvals and established fan bases.

| Business Segment | Barriers to Entry | Ilitch Holdings Advantage | New Entrant Challenge |

| Quick Service Restaurants (Little Caesars) | High (Brand, Supply Chain, Scale) | Established brand loyalty, efficient Blue Line Distribution, national franchise network. | Replicating brand equity and supply chain efficiency requires massive capital and time. |

| Professional Sports (NHL, MLB) | Extremely High (Capital, League Approval, Fan Base) | Deeply entrenched fan bases, lucrative media deals, league ownership. | Astronomical franchise acquisition costs (e.g., avg. NHL team valuation ~ $1.05 billion in 2024), limited team slots. |

| Entertainment Venues (Olympia Entertainment) | Very High (Capital, Promoter Relationships, Operational Expertise) | Existing infrastructure, established relationships with promoters and artists. | High construction costs (>$500 million for new arenas), difficulty securing high-profile events without networks. |

| Real Estate Development | High (Capital, Regulatory, Local Relationships) | Profound local market understanding, established community relationships. | Significant upfront investment (hundreds of millions), complex zoning and permitting, rising construction costs (2024). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Ilitch Holdings is built upon a foundation of publicly available financial reports, investor relations materials, and industry-specific market research. We also leverage data from reputable business news outlets and trade publications to capture current market dynamics and competitive actions.