Ilitch Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ilitch Holdings Bundle

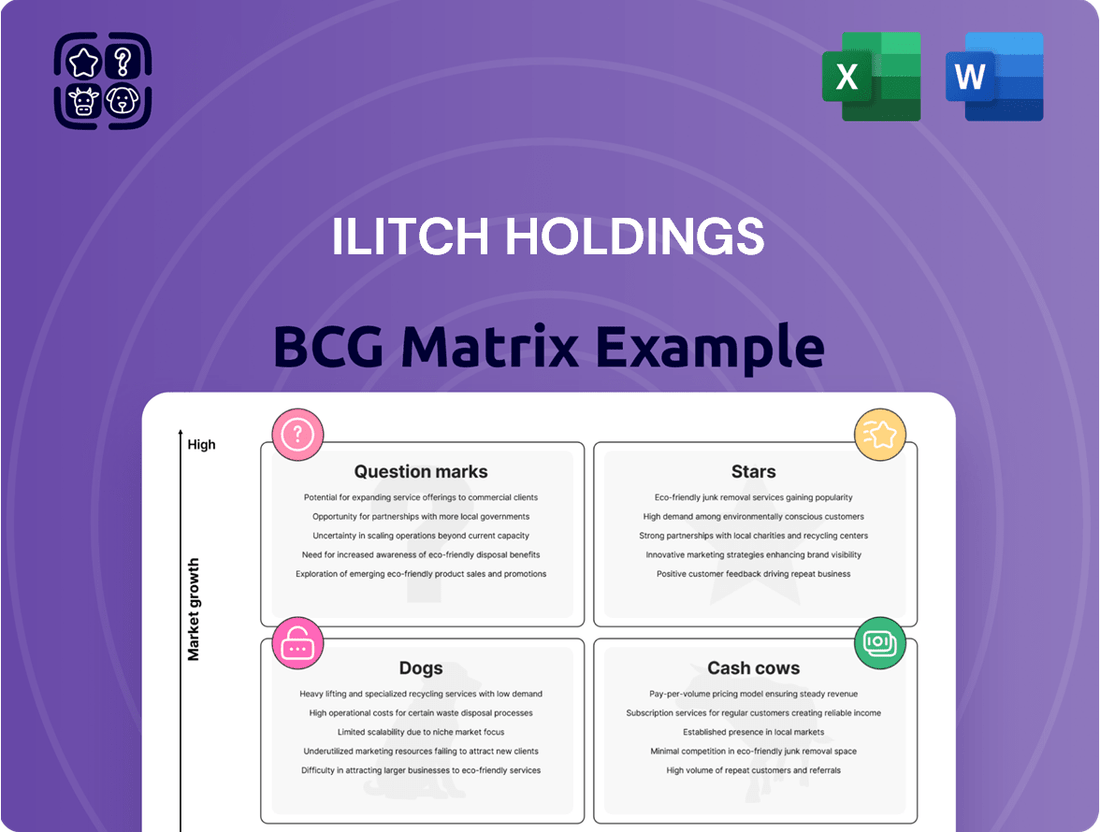

Curious about Ilitch Holdings' strategic product portfolio? This preview offers a glimpse into how their diverse ventures might be categorized within the BCG Matrix. Understand the potential Stars, Cash Cows, Dogs, and Question Marks that shape their business. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategic recommendations to navigate their market landscape.

Stars

Little Caesars, the third-largest pizza chain globally, is a prime example of a star within Ilitch Holdings' portfolio. Its impressive market presence is further amplified by aggressive franchise growth and expansion initiatives throughout 2024.

The company is projecting a 5% network expansion in 2025, with over 23 new restaurants slated to open in major U.S. markets such as Dallas, Los Angeles, and New York City. This rapid domestic development, coupled with strategic international ventures into markets like Dubai and India, underscores a high-growth industry and Little Caesars' strong position to capture increasing market share.

Little Caesars is making significant strides in technology to improve customer experience and streamline operations. Their proprietary Pizza Portal pickup system is a prime example, allowing for easy digital ordering and quick collection. This focus on convenience addresses the growing demand for on-the-go food solutions in the quick-service restaurant sector.

Olympia Entertainment Venues, encompassing iconic locations such as Little Caesars Arena, the Fox Theatre, and Comerica Park, are pivotal to Detroit's urban renewal efforts. These premier venues are experiencing substantial growth, fueled by increasing demand for live entertainment and experiences within the revitalized city center.

The ambitious expansion of The District Detroit is projected to further elevate activity and visitor numbers to these entertainment hubs, solidifying their position in a rapidly expanding market. Their robust market standing, coupled with the growing appetite for live events, firmly places them in the Star category of the Ilitch Holdings BCG Matrix.

Ilitch Sports + Entertainment Brand Value

Ilitch Sports + Entertainment, encompassing the Detroit Red Wings and Detroit Tigers, occupies the 'Star' quadrant in the BCG Matrix. This classification stems from their strong brand equity and increasing market share within a high-growth sector, fueled by strategic investments in fan engagement and stadium modernization.

The Detroit Red Wings, a historic NHL franchise, consistently demonstrates high market share due to its deep-rooted fan base and ongoing efforts to revitalize the team's performance. Similarly, the Detroit Tigers experienced a notable upswing in late 2024, securing a playoff berth and showing promising momentum into the 2025 season. These positive trends, coupled with significant capital infusion into the surrounding entertainment district, solidify their 'Star' status.

- Brand Recognition: The Red Wings and Tigers boast iconic status, translating to high fan loyalty and consistent attendance.

- Performance Trajectory: The Tigers' late 2024 playoff appearance and strong start to 2025 indicate a positive growth trend.

- Strategic Investments: Ongoing enhancements to fan experience and the development of the entertainment district are key drivers of their 'Star' classification.

- Market Share: Both franchises maintain significant market share within their respective sports leagues and the broader Detroit entertainment landscape.

Strategic Real Estate Development in Key Growth Areas

Olympia Development's strategic push into mixed-use projects within The District Detroit, including new apartment buildings and hotels, targets Detroit's burgeoning real estate market. With groundbreakings scheduled for 2025, these developments are positioned to capture high demand for urban living, hospitality, and commercial spaces.

- Targeted Growth: Focus on high-demand sectors in a revitalized urban core.

- Future Potential: Significant investment in projects expected to become Stars.

- 2025 Milestones: Groundbreakings for key residential and hospitality components.

- Market Alignment: Addressing the increasing need for integrated urban amenities.

Little Caesars, Olympia Entertainment Venues, and Ilitch Sports + Entertainment are all classified as Stars within Ilitch Holdings' BCG Matrix. These entities operate in high-growth markets and possess strong market shares, indicating significant potential for continued expansion and profitability. Their strategic initiatives, including aggressive franchise growth, venue development, and team performance improvements, further solidify their Star status, suggesting they require substantial investment to maintain their growth trajectory and capitalize on market opportunities.

| Ilitch Holdings Business Unit | BCG Matrix Category | Market Growth Rate | Relative Market Share | Key Performance Indicators (2024-2025) |

|---|---|---|---|---|

| Little Caesars | Star | High | High | Projected 5% network expansion in 2025; 23+ new U.S. restaurants; International expansion into Dubai and India. |

| Olympia Entertainment Venues | Star | High | High | Increasing demand for live entertainment; Expansion of The District Detroit driving visitor numbers. |

| Ilitch Sports + Entertainment (Red Wings & Tigers) | Star | High | High | Detroit Tigers playoff berth (late 2024); Red Wings strong fan base and ongoing performance efforts; Capital infusion into entertainment district. |

What is included in the product

This BCG Matrix analysis highlights Ilitch Holdings' business units, categorizing them by market share and growth to guide strategic decisions.

A clear BCG Matrix visualizes Ilitch Holdings' portfolio, easing strategic decision-making and resource allocation.

Cash Cows

Little Caesars Pizza, a significant player in the global pizza market, operates as a Cash Cow within Ilitch Holdings' portfolio. As of 2024, its extensive network of over 4,000 locations worldwide, coupled with its well-established 'Hot-N-Ready' model, ensures a robust and steady stream of revenue.

This business benefits from a mature market where its strong value proposition and convenience allow it to maintain a considerable market share. The operational efficiency of its core model means it requires less investment for promotion relative to the substantial cash it generates.

The Detroit Red Wings, a cornerstone of Ilitch Holdings' sports division, represent a classic Cash Cow. Their established NHL presence, coupled with a dedicated fanbase, ensures consistent revenue from ticket sales, merchandise, and media deals.

In the 2023-2024 NHL season, the Red Wings generated approximately $80 million in gate receipts, a testament to their enduring popularity. This stable income stream, despite potential on-ice variability, solidifies their position as a reliable cash generator for the parent company.

The Detroit Tigers, much like their hockey counterparts, represent a cornerstone of Ilitch Holdings' sports portfolio. This Major League Baseball franchise boasts a rich heritage and a passionate fanbase, which translates into a reliable and substantial revenue stream. Even with fluctuating on-field success, the inherent stability of the baseball market means the Tigers consistently pull in significant cash from ticket sales, lucrative sponsorships, and broadcasting agreements.

MotorCity Casino Hotel

MotorCity Casino Hotel is a prime example of a cash cow within Ilitch Holdings' portfolio. Its established presence in the Detroit gaming and hospitality market means it consistently generates substantial profits with relatively low reinvestment needs.

This mature business operates in a regulated environment, allowing for predictable revenue streams. In 2024, the Michigan Gaming Control Board reported that Detroit's three casinos, including MotorCity, generated over $1.2 billion in revenue, highlighting the sector's stability and profitability.

- Strong Market Position: MotorCity Casino Hotel benefits from a well-recognized brand and a loyal customer base in Detroit.

- Consistent Profitability: The business reliably generates significant cash flow, contributing steadily to Ilitch Holdings' overall financial health.

- Low Growth Investment Needs: As a mature entity, it requires less capital for expansion compared to its substantial cash generation capabilities.

- Reliable Cash Flow: Its consistent profits make it a dependable source of funds for the parent company, supporting other ventures or investments.

Blue Line Distribution and Champion Foods

Blue Line Distribution and Champion Foods are considered cash cows within the Ilitch Holdings portfolio, primarily supporting the Little Caesars pizza chain. These businesses operate in mature, stable markets, generating consistent cash flow. Their role is crucial in ensuring the efficient supply chain and operational backbone for Ilitch's core food service operations.

In 2024, the food distribution and manufacturing sectors, where these companies operate, continued to demonstrate resilience. While specific financial figures for these subsidiaries are not publicly disclosed, the overall growth of the quick-service restaurant industry, driven by value and convenience, directly benefits their performance. For instance, the U.S. quick-service restaurant market was projected to reach over $300 billion in 2024, indicating a robust demand environment.

- Stable Cash Generation: Blue Line Distribution and Champion Foods are designed to generate predictable, high cash flow with minimal investment needs, characteristic of cash cow businesses.

- Supportive Role: Their primary function is to support the larger Ilitch Holdings entities, particularly Little Caesars, by providing essential goods and services.

- Mature Market Operations: Operating in established food service and supply chain markets, they benefit from steady demand and economies of scale.

- Profitability Contribution: These subsidiaries contribute significantly to the overall profitability and cash flow of the Ilitch Holdings group, enabling investments in other business areas.

The Detroit Red Wings and Detroit Tigers, as established sports franchises, consistently generate substantial revenue streams for Ilitch Holdings. Their strong brand recognition and dedicated fan bases translate into reliable income from ticket sales, concessions, merchandise, and media rights, even with fluctuating on-field performance.

MotorCity Casino Hotel also functions as a cash cow, leveraging its established presence in the Detroit market to produce predictable profits with limited reinvestment requirements. The gaming sector's stability, as evidenced by the over $1.2 billion in revenue generated by Detroit casinos in 2024, underscores its role as a dependable cash generator.

Little Caesars Pizza, with its vast global footprint and efficient operational model, remains a core cash cow. Its value proposition ensures consistent demand, allowing it to generate significant cash with minimal need for further investment in expansion or marketing relative to its earnings.

Blue Line Distribution and Champion Foods, while less visible, are critical cash cows supporting Little Caesars. Operating in stable food service markets, they provide essential supply chain functions and generate consistent cash flow, benefiting from the overall strength of the quick-service restaurant industry, which was projected to exceed $300 billion in the U.S. in 2024.

| Business Unit | BCG Category | Key Characteristics | 2024 Data/Context |

| Detroit Red Wings | Cash Cow | Established NHL team, dedicated fanbase, consistent revenue from tickets, merchandise, media. | Gate receipts of approx. $80 million in 2023-2024 season. |

| Detroit Tigers | Cash Cow | Major League Baseball franchise, strong heritage, passionate fanbase, stable revenue from tickets, sponsorships, broadcasting. | Consistent revenue generation despite on-field variability. |

| Little Caesars Pizza | Cash Cow | Global pizza chain, mature market, strong value proposition, efficient operations, steady revenue. | Over 4,000 locations worldwide; U.S. QSR market projected over $300 billion in 2024. |

| MotorCity Casino Hotel | Cash Cow | Established gaming and hospitality, predictable revenue, low reinvestment needs. | Part of Detroit casinos generating over $1.2 billion in revenue in 2024. |

| Blue Line Distribution & Champion Foods | Cash Cow | Support Little Caesars, mature markets, stable demand, efficient supply chain. | Benefit from robust demand in the resilient food service sector. |

Preview = Final Product

Ilitch Holdings BCG Matrix

The Ilitch Holdings BCG Matrix preview you're currently viewing is the complete, unwatermarked document you'll receive immediately after purchase. This means the strategic insights and detailed analysis presented here are precisely what you'll be able to utilize for your business planning without any alterations or limitations.

Dogs

Undeveloped real estate parcels within Ilitch Holdings' portfolio likely fall into the Dogs quadrant of the BCG Matrix. These properties, often vacant lots or untenanted buildings in Detroit, represent a low market share of active development and revenue generation. Their low-growth state, if left as is, ties up significant capital without yielding substantial returns.

Certain older properties within the Ilitch Holdings portfolio, especially those not directly involved in the significant District Detroit development, could be experiencing underperformance. These assets might be characterized by low revenue generation and high maintenance costs, presenting a drag on overall profitability.

For instance, if a venue built in the late 1990s, like the original Joe Louis Arena (which closed in 2017), were still part of the active portfolio without significant reinvestment, it would likely fall into this category. Such properties often have limited market appeal and struggle to attract new revenue streams in the current economic climate.

Within Ilitch Holdings' expansive portfolio, certain minor or acquired ventures have struggled to find their footing. These "Dogs" represent businesses that haven't achieved significant market traction or profitability since their launch. For example, a hypothetical acquired tech startup in 2022, focused on a niche software solution, might have seen its user base stagnate at under 5,000 active users by early 2024, failing to generate substantial revenue.

Such ventures, while potentially holding strategic value for a time, ultimately become resource drains. They consume capital and management attention without delivering the expected returns or contributing to the group's overall growth. If these stagnant ventures continue to operate at a loss, perhaps reporting a net loss of $2 million in 2023, they fit the classic 'Dog' profile in the BCG Matrix, needing careful evaluation for divestiture or turnaround.

Outdated Retail or Office Spaces

Outdated retail or office spaces owned by Ilitch Holdings, particularly those outside the revitalized District Detroit zones, could be classified as Dogs in the BCG Matrix. These properties might face challenges attracting tenants due to evolving consumer preferences and the rise of remote work, leading to low occupancy rates.

For instance, a 2024 report on commercial real estate indicated a national office vacancy rate of approximately 19.6%, a figure that could be higher for older, less desirable properties. Similarly, retail spaces not benefiting from significant foot traffic or unique experiential offerings are struggling, with some analysts predicting further consolidation in the brick-and-mortar sector throughout 2024 and into 2025.

- Low Occupancy: Properties with sustained vacancies, indicating a lack of demand.

- Declining Market Share: Spaces that are not keeping pace with modern design or amenity expectations.

- Limited Growth Potential: Areas where economic or demographic trends do not support significant future increases in property value or rental income.

- High Maintenance Costs: Older buildings often incur higher operational and repair expenses, further eroding profitability.

Marginalized Operational Support Units

Marginalized operational support units within Ilitch Holdings, while not the primary focus like their cash cow counterparts, can represent areas of potential inefficiency. These units, often characterized by low market share or diminishing internal demand, might consume resources without generating significant returns. For instance, a legacy IT support system that is no longer widely used internally could fall into this category.

Consider a scenario where a smaller, specialized logistics division, originally set up for a now-discontinued product line, continues to operate. While core distribution networks are robust, this niche unit might struggle to find external clients or justify its operational costs. In 2024, such units could be identified through detailed internal audits focusing on resource allocation versus output metrics.

- Low Market Share: These units typically serve a very small segment of the market, either internally or externally.

- Declining Internal Need: The services or products offered are becoming less relevant to the conglomerate's core operations.

- Resource Drain: Despite minimal contribution, they continue to incur operational expenses, potentially impacting overall profitability.

- Strategic Review: Companies like Ilitch Holdings would likely conduct reviews in 2024 to assess the viability and potential divestment or restructuring of such units.

Properties with low occupancy and minimal revenue, such as older, less desirable retail or office spaces outside of prime development areas, are likely classified as Dogs. These assets often face challenges attracting tenants due to changing market demands and may have high maintenance costs, hindering profitability. For example, national office vacancy rates hovered around 19.6% in early 2024, a figure likely higher for properties lacking modern amenities or prime locations.

| Asset Type | Market Share | Growth Potential | Profitability | BCG Classification |

|---|---|---|---|---|

| Undeveloped Real Estate Parcels | Low | Low | Low | Dog |

| Older, Underperforming Venues (e.g., non-District Detroit) | Low | Low | Low | Dog |

| Niche Acquired Ventures (e.g., struggling tech startup) | Low | Low | Low | Dog |

| Outdated Retail/Office Spaces (non-District Detroit) | Low | Low | Low | Dog |

Question Marks

The District Detroit is introducing significant new developments, including a 261-unit apartment building at 2205 Cass and a 290-room hotel near Little Caesars Arena, both scheduled to begin construction in 2025. These projects are positioned within Detroit's ongoing revitalization, a market experiencing high growth.

However, as new ventures, these developments currently represent low market share. They necessitate substantial capital outlay before they can generate significant returns, placing them in a position that requires careful management and strategic investment.

The University of Michigan Center for Innovation (UMCI) in The District Detroit, which began construction in December 2023, is a key element of Ilitch Holdings' strategic expansion. This ambitious educational and research hub is positioned as a potential high-growth venture, aiming to revitalize the surrounding area.

While the UMCI anticipates significant long-term economic benefits and innovation, its current phase involves substantial upfront investment from Ilitch Holdings, primarily through land contributions. This means the project is currently a cash consumer, reflecting its status as a question mark in the BCG matrix, with its future success contingent on realizing its high-growth potential.

Olympia Development's Co-Developer Program is a strategic move to leverage local expertise for growth, targeting specific projects like 81 W. Columbia Street and 475 Peterboro. This program positions these ventures as potential stars within the BCG matrix, requiring continued investment to solidify market share.

These initiatives represent Olympia's commitment to fostering Detroit's development landscape, aiming to cultivate high-growth opportunities. However, their current market penetration is still developing, necessitating ongoing capital infusion and strategic oversight to ensure they move beyond the question mark stage.

Exploratory Ventures in Emerging Technologies/Markets

Ilitch Holdings, with its significant presence in the food service industry via Little Caesars, actively invests in technological advancements. Beyond its established Pizza Portal, the company explores new frontiers in emerging technologies and digital markets.

These exploratory ventures, while potentially high-growth, carry significant risk due to their unproven nature. They demand substantial research and development, alongside dedicated efforts to foster market adoption, to ensure future expansion and competitiveness.

- Venture Capital Investments: Ilitch Holdings could allocate a portion of its capital to emerging tech startups, mirroring the 2024 trend where venture capital funding for AI and biotech saw renewed interest despite overall market caution.

- Digital Marketplace Development: Exploring new digital platforms or services that leverage data analytics or AI for enhanced customer engagement and operational efficiency, similar to how major retailers expanded their e-commerce capabilities in 2024.

- Blockchain and Web3 Applications: Investigating the potential of decentralized technologies for supply chain management, loyalty programs, or new customer interaction models, building on the growing enterprise adoption of blockchain seen in early 2024.

- Metaverse and AR/VR Integration: Experimenting with immersive technologies for marketing, customer experience, or employee training, reflecting the increasing corporate exploration of these virtual environments throughout 2024.

Future Diversification Efforts

Ilitch Holdings' future diversification efforts will likely focus on strategic expansion beyond its established food, sports, and entertainment pillars. This involves a dual approach of nurturing organic growth within existing ventures while actively seeking new market entries and potential business acquisitions.

Any ventures into nascent industries, outside their core competencies, would initially be classified as question marks. These new endeavors, such as emerging technology sectors or sustainable energy, would demand substantial capital investment and intensive strategic analysis to assess their potential for long-term viability and market penetration. For instance, if Ilitch Holdings were to explore the burgeoning drone delivery market, a significant upfront investment in research, development, and regulatory compliance would be necessary, with uncertain returns in the initial phases.

- Organic Growth: Continued investment in existing brands like Little Caesars and the Detroit Red Wings to maintain and expand market share.

- Strategic Investments: Targeted acquisitions or partnerships in complementary sectors that leverage existing infrastructure or customer bases.

- Nascent Industry Exploration: Cautious entry into new, high-growth potential markets, requiring significant R&D and market validation.

- Capital Allocation: Prioritizing resources for diversification initiatives that show promising long-term return potential, balancing risk and reward.

The District Detroit's new apartment and hotel projects, along with the University of Michigan Center for Innovation, are current question marks. These ventures require significant upfront capital and have low initial market share, mirroring the high investment and uncertain returns characteristic of this BCG matrix category.

Similarly, Olympia Development's Co-Developer Program initiatives are also in the question mark phase. These projects need ongoing investment to build market presence, facing the challenge of converting potential into established market share.

Ilitch Holdings' exploration into emerging technologies and digital markets, such as AI and blockchain applications, also falls under question marks. These areas demand substantial R&D and market validation to determine their future growth trajectory and profitability.

Future diversification into nascent industries like drone delivery or sustainable energy would also represent question marks, necessitating considerable investment and strategic analysis to gauge their long-term viability and market penetration potential.

BCG Matrix Data Sources

Our Ilitch Holdings BCG Matrix is informed by comprehensive financial disclosures, detailed market research, and internal performance metrics to provide strategic clarity.