IIFL Finance PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IIFL Finance Bundle

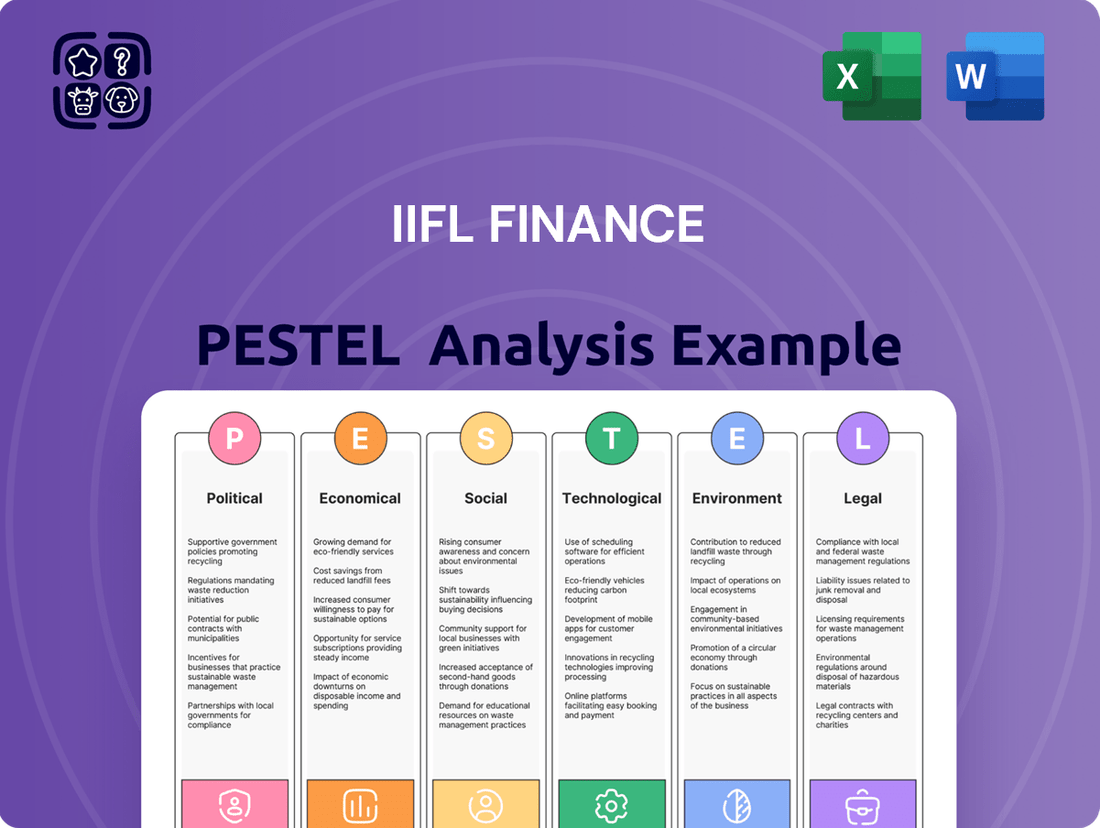

Navigate the complex external environment impacting IIFL Finance with our comprehensive PESTLE Analysis. Understand how political stability, economic fluctuations, and technological advancements are shaping its trajectory. Gain critical insights into social trends, environmental regulations, and legal frameworks that influence its operations.

This meticulously researched PESTLE Analysis provides actionable intelligence, empowering you to anticipate market shifts and identify strategic opportunities for IIFL Finance. Elevate your decision-making by understanding the full spectrum of external forces at play.

Don't miss out on this essential tool for investors, analysts, and strategists. Purchase the complete PESTLE Analysis of IIFL Finance today for a deeper understanding and a significant competitive advantage.

Political factors

The stability of the Indian government and continuity of its economic policies are pivotal for IIFL Finance. Following the Lok Sabha elections in June 2024, the incumbent government secured a third term, indicating a commitment to existing economic frameworks. This continuity fosters a predictable environment for the Non-Banking Financial Company sector, which has seen consistent regulatory support from the Reserve Bank of India. For instance, the RBI's recent scale-based regulations for NBFCs provide clear operational guidelines. Any significant shifts in political priorities could introduce uncertainty, but the current outlook suggests stability, supporting IIFL's long-term strategic planning.

The Reserve Bank of India (RBI) is the primary regulator for NBFCs in India, significantly shaping IIFL Finance's operations. A notable example is the temporary embargo placed on IIFL's gold loan business in March 2024, underscoring the stringent regulatory environment. Adherence to the RBI's evolving norms, including those for capital adequacy and risk management, is crucial for IIFL's sustained business continuity and growth. This oversight ensures financial stability and consumer protection within the sector.

Government initiatives strongly emphasize financial inclusion, creating significant opportunities for IIFL Finance. Policies promoting credit access for Micro, Small, and Medium Enterprises (MSMEs), affordable housing, and rural areas directly align with IIFL's core business. For instance, the Indian government's focus on MSME lending, with credit growth projected around 12-15% in FY2025, directly boosts IIFL's secured and unsecured loan portfolios. These strategic alignments can drive substantial growth in key loan segments for the company, supporting their expansion into underserved markets and improving asset quality as formal credit penetration increases. This sustained push for broader financial access enhances IIFL's market reach.

Taxation Policies

Changes in India's corporate tax rates directly influence IIFL Finance's profitability. For instance, the effective corporate tax rate for many Indian companies, including financial institutions, often hovers around 25.17% under the new regime for FY 2024-25. The Goods and Services Tax (GST) on financial services, typically 18%, also impacts the cost of IIFL's offerings to customers. A stable or favorable tax environment, potentially including incentives, could significantly enhance the company's net income. Conversely, any increase in the tax burden would challenge its financial performance and competitiveness in the market.

- India's corporate tax regime, with rates like 25.17% for some, directly impacts IIFL's bottom line.

- The 18% GST on financial services affects product pricing and consumer affordability.

- Fiscal policy shifts can either boost or constrain IIFL Finance's profit margins.

- A predictable tax framework is crucial for IIFL's long-term financial planning.

International Relations and Foreign Investment Policies

India's foreign policy and evolving regulations on foreign direct investment (FDI) and external commercial borrowings (ECB) directly impact IIFL Finance's access to global capital. A more liberalized investment environment, exemplified by the Reserve Bank of India's (RBI) recent adjustments to ECB frameworks in 2024, can offer the company cheaper funding avenues. Conversely, escalating geopolitical tensions, such as ongoing trade disputes affecting global capital flows, can restrict international funding opportunities. Such factors influence IIFL's fundraising costs and its capacity for expansion, particularly given the projected increase in India's FDI inflows to over $100 billion by FY2025.

- India's FDI policy shifts, like the 2024 relaxation in certain sectors, enhance capital accessibility.

- ECB framework updates by RBI in 2024 aim to streamline foreign borrowing for Indian entities.

- Geopolitical instability could temper foreign investor appetite, impacting IIFL's international funding costs.

The re-elected Indian government in June 2024 ensures policy stability, vital for IIFL Finance. RBI's stringent oversight, exemplified by the March 2024 gold loan embargo, shapes operations. Government pushes for financial inclusion, like projected 12-15% MSME credit growth in FY2025, offer IIFL significant growth avenues. Furthermore, a 25.17% corporate tax rate and evolving FDI policies (FDI inflows projected over $100 billion by FY2025) directly impact profitability and capital access.

| Factor | Relevance to IIFL Finance | 2024/2025 Data Point |

|---|---|---|

| Government Stability | Policy continuity, predictable environment | Lok Sabha elections: June 2024 (Incumbent re-elected) |

| Regulatory Oversight | Operational compliance, risk management | RBI Gold Loan Embargo: March 2024 |

| Financial Inclusion | Growth opportunities in key loan segments | MSME Credit Growth: ~12-15% (FY2025 Projection) |

| Corporate Taxation | Direct impact on profitability | Corporate Tax Rate: ~25.17% (FY2024-25) |

| FDI/ECB Policies | Access to global capital, funding costs | India FDI Inflows: >$100 Billion (FY2025 Projection) |

What is included in the product

This PESTLE analysis thoroughly examines the external macro-environmental factors impacting IIFL Finance, offering a nuanced understanding of the Political, Economic, Social, Technological, Environmental, and Legal landscapes.

It provides actionable insights by connecting these global trends to specific opportunities and threats relevant to IIFL Finance's operations and strategic planning.

Provides a concise version of the IIFL Finance PESTLE analysis that can be dropped into PowerPoints or used in group planning sessions, effectively addressing the pain point of time-consuming information synthesis.

Helps support discussions on external risks and market positioning during planning sessions by offering a clear, summarized view of the PESTLE factors impacting IIFL Finance, thus relieving the pain of uncertainty.

Economic factors

India's robust economic health directly fuels demand for financial products, benefiting IIFL Finance. A projected GDP growth rate of approximately 6.5% for the 2025-26 fiscal year indicates a very favorable climate for credit expansion. This optimistic economic outlook is largely propelled by strong domestic consumption, significant government capital expenditure, and the continued resilience of the services sector. Such growth underpins increased lending opportunities and improved asset quality for financial institutions.

The Reserve Bank of India's monetary policy, particularly its repo rate decisions, directly influences IIFL Finance's cost of borrowing and lending margins. With the repo rate held at 6.50% through early 2024, funding costs for NBFCs like IIFL remain stable, yet any future hikes could pressure profitability. Conversely, a stable or declining interest rate environment would significantly enhance IIFL's net interest margins, benefiting its financial performance. This sensitivity to RBI's stance is a key economic factor for the company's outlook.

Inflationary pressures significantly influence IIFL Finance's operating environment by impacting consumer purchasing power and the cost of capital. While India's Consumer Price Index (CPI) inflation moderated to approximately 4.8% by early 2025, a resurgence could dampen loan demand. Such a scenario would also increase operational expenses for IIFL Finance, affecting its profitability. Effectively managing the impact of fluctuating inflation is crucial for maintaining healthy net interest margins and overall financial stability.

Credit Demand in Key Sectors

IIFL Finance's growth trajectory is inherently tied to credit demand across its primary segments: home loans, gold loans, and business loans, particularly for MSMEs. The substantial unmet credit demand within India's MSME sector, estimated at over $300 billion annually, represents a significant market opportunity for IIFL. Furthermore, a rebound in the gold loan business, especially following the anticipated lifting of the RBI embargo by mid-2025, is crucial for future revenue expansion.

- MSME credit gap in India exceeds $300 billion annually, offering substantial growth for lenders like IIFL.

- IIFL's gold loan portfolio, which contributed 32% to its AUM as of December 2024, is poised for recovery post-embargo.

- Home loans and MSME business loans remain key drivers, with robust demand expected through 2025.

Foreign Exchange and Global Economic Trends

Fluctuations in foreign exchange rates directly impact IIFL Finance’s foreign borrowing costs, especially as global interest rate differentials shift. For instance, a stronger US Dollar in late 2024 could increase the servicing cost of dollar-denominated debt. Global economic trends, such as a projected slowdown in major economies like Europe, can indirectly affect India’s growth trajectory, although the International Monetary Fund forecasts India’s GDP growth at 6.8% for 2024-25, driven by robust domestic demand. Despite this internal resilience, persistent global trade tensions or commodity price volatility remain potential headwinds for the financial sector.

- US Dollar strength can elevate foreign debt servicing costs for Indian NBFCs.

- India's 2024-25 GDP growth is projected around 6.8%, largely domestically driven.

- Global economic slowdowns, while indirect, pose risks to India's financial stability.

- Trade tensions or commodity price volatility are ongoing external risk factors.

India's robust economic growth, projected at 6.8% for 2024-25, directly fuels credit demand for IIFL Finance. Stable RBI repo rates, held at 6.50% through early 2024, support lending margins. The substantial $300 billion MSME credit gap and anticipated mid-2025 lifting of the gold loan embargo offer significant growth avenues. Managing inflation at 4.8% (early 2025) and foreign exchange volatility remains crucial for profitability.

| Economic Factor | Key Data (2024/2025) | Impact on IIFL |

|---|---|---|

| GDP Growth | 6.8% (2024-25) | Increased credit demand |

| Repo Rate | 6.50% (Early 2024) | Stable funding costs |

| MSME Credit Gap | >$300 billion annually | Significant growth opportunity |

Full Version Awaits

IIFL Finance PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of IIFL Finance offers critical insights into the Political, Economic, Social, Technological, Legal, and Environmental factors influencing its operations. Understanding these external forces is paramount for strategic decision-making within the Indian financial services sector.

Sociological factors

Increasing financial literacy across India drives a higher demand for formal credit and investment products from institutions like IIFL Finance. As of early 2025, more individuals actively monitor their credit health, with reports indicating a significant rise in credit report inquiries, creating opportunities for NBFCs to offer diverse services. This trend is particularly evident among younger demographics and women, who are increasingly engaging with digital financial platforms and seeking structured financial solutions.

The expanding Indian middle class, projected to reach over 600 million by 2025, exhibits rising aspirations for significant purchases like homes and vehicles. This demographic shift fuels robust demand for retail loans, with the Indian retail credit market expected to grow at a CAGR of 15% through 2024-2025. IIFL Finance, with its diverse product portfolio including home loans and business financing, is strategically positioned to cater to these evolving financial needs. This societal trend represents a powerful, long-term growth driver for the company, aligning with their focus on accessible credit solutions.

The increasing acceptance of digital financial services marks a significant shift in consumer behavior, with a strong preference for online transactions and mobile banking. India's smartphone penetration is projected to exceed 75% by late 2024, enabling widespread access to digital platforms, even in many rural areas. This trend allows IIFL Finance to enhance its digital infrastructure for efficient loan origination, servicing, and customer engagement. Such digitization is crucial, as it helps reduce operational costs, with some financial institutions reporting up to a 30% saving on transaction processing, while significantly improving the overall customer experience.

Increasing Participation of Women in the Economy

The increasing participation of women in India's economy presents a significant sociological shift, directly impacting the financial sector. The number of women borrowers is growing, reflecting their enhanced role in financial decision-making and economic contribution. They are increasingly seeking loans for both personal needs and entrepreneurial ventures, contributing a larger portion of their income to household welfare.

This demographic trend opens up a substantial and expanding customer base for financial institutions like IIFL Finance. As of early 2024, data indicates a robust increase in credit uptake by women, with their share in microfinance loans reaching new highs. This empowers women while simultaneously boosting the financial inclusion landscape.

- Women's share in microfinance portfolios in India exceeded 90% in fiscal year 2024.

- Their overall credit outstanding growth has consistently outpaced men's in recent years.

- The average loan ticket size for women borrowers has shown a steady increase.

- This segment offers IIFL Finance a high-growth opportunity with strong repayment trends.

Focus on Underserved and Rural Markets

IIFL Finance strategically targets the significant financial needs of semi-urban and rural populations, a demographic largely overlooked by conventional banks. This focus allows IIFL to leverage a substantial growth opportunity, driving financial inclusion across India. By expanding its presence in these regions, the company taps into a high-growth segment, evidenced by the fact that rural credit off-take is projected to grow by 15-18% through 2025. This approach enhances market penetration and addresses critical gaps in access to credit.

- Rural credit growth anticipated at 15-18% by 2025.

- Over 60% of India's population resides in rural areas, offering vast untapped potential.

- Traditional banks often have limited branch networks in remote areas.

- NBFCs like IIFL are crucial in bridging the financial inclusion gap.

India's digital financial services adoption, with smartphone penetration nearing 75% by late 2024, enables IIFL's efficient digital outreach. Women's economic empowerment drives increased credit demand; their share in microfinance exceeded 90% in FY2024. The focus on semi-urban/rural populations, with rural credit growth projected at 15-18% through 2025, expands IIFL's market significantly.

| Factor | Trend | 2024/2025 Impact |

|---|---|---|

| Digital Adoption | Rising | Smartphone penetration ~75% |

| Women's Inclusion | Growing | Microfinance share >90% (FY24) |

| Rural Outreach | Expanding | Credit growth 15-18% (2025) |

Technological factors

The NBFC sector is rapidly embracing digital transformation, enhancing customer experience and streamlining operations. IIFL Finance is heavily investing in digital technologies, including e-KYC solutions and platforms for faster loan processing, significantly reducing turnaround times. Strategic partnerships with fintech innovators are crucial, helping IIFL leverage advanced analytics and AI for improved credit assessment and broader digital lending reach. This focus aligns with the projected 30% annual growth in India's digital lending market through 2025.

The increasing adoption of Artificial Intelligence (AI) and Machine Learning (ML) is transforming financial services, with NBFCs like IIFL Finance leveraging these tools for enhanced operations. AI algorithms are crucial for sophisticated credit scoring and precise risk assessment, enabling IIFL to serve a broader customer base, including previously underserved segments. By 2025, over 70% of Indian financial institutions are projected to utilize AI for fraud detection, significantly improving security. Furthermore, AI-powered chatbots are streamlining customer service, improving response times and engagement.

The proliferation of digital lending platforms has fundamentally reshaped how customers access credit, with digital loan disbursals in India projected to grow significantly through 2025. IIFL Finance is actively leveraging its proprietary digital platforms, like the IIFL Loans app, and forging partnerships to facilitate seamless and rapid loan disbursal. This strategic 'phygital' model, integrating its extensive physical branch network with robust digital capabilities, is pivotal to its market penetration and operational efficiency. Approximately 70% of IIFL's new customer acquisitions are now driven through digital channels, highlighting this shift.

Cybersecurity and Data Privacy

As financial services digitize, robust cybersecurity and data privacy are paramount for IIFL Finance. Protecting sensitive customer data and maintaining trust necessitates significant investment in securing its digital infrastructure, with global financial sector cybersecurity spending projected to exceed $150 billion in 2025. Regulatory scrutiny is increasing, making compliance a critical factor, especially with India's Digital Personal Data Protection Act 2023 impacting data handling.

- Global financial sector cybersecurity spending is projected to exceed $150 billion in 2025.

- The average cost of a data breach in the financial industry globally was approximately $5.97 million in 2024.

- India's Digital Personal Data Protection Act 2023 mandates stringent data privacy and security measures.

Blockchain Technology and its Applications

Blockchain technology, though still in its early stages within the Indian financial sector, presents significant potential for IIFL Finance to enhance security, transparency, and efficiency in core processes like loan disbursement and claims settlement. Several Indian NBFCs are already conducting pilot programs or exploring blockchain for various use cases, aiming to streamline operations and reduce fraud. Embracing this technology could offer IIFL a crucial competitive advantage by 2025, as the market matures and adoption grows.

- The Indian blockchain market is projected to grow substantially, with financial services being a key driver.

- Pilot projects by some NBFCs focus on secure digital identities and efficient cross-border payments.

- Potential for reduced reconciliation efforts and faster transaction speeds in lending operations.

IIFL Finance is rapidly leveraging digital transformation, with a 30% projected annual growth in India's digital lending market through 2025. AI and ML are crucial for credit assessment and fraud detection, with 70% of Indian financial institutions expected to use AI for fraud detection by 2025. Robust cybersecurity is paramount, as global financial sector spending on it is projected to exceed $150 billion in 2025. This focus enhances efficiency and broadens market reach.

| Tech Factor | Impact on IIFL | 2025 Projection |

|---|---|---|

| Digital Lending | Faster disbursals | 30% market growth |

| AI/ML | Enhanced risk assessment | 70% FI adoption for fraud |

| Cybersecurity | Data protection | >$150B sector spend |

Legal factors

The Reserve Bank of India's Scale-Based Regulatory (SBR) framework, effective October 2022, classifies NBFCs into four layers based on asset size and systemic importance, with tighter regulations for higher layers. IIFL Finance, given its substantial asset base exceeding Rs. 77,000 crore as of December 2024, falls under the Upper Layer, requiring enhanced governance and capital adequacy norms. This mandates stricter compliance, impacting operational flexibility and capital allocation strategies. The framework aims to bolster financial stability, but it increases the regulatory burden and compliance costs for large NBFCs like IIFL.

Strict adherence to Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations is mandatory for IIFL Finance and all financial institutions. The Reserve Bank of India (RBI) periodically updates these norms, with significant clarifications issued in late 2024 regarding digital KYC protocols. Non-compliance can result in severe penalties; for instance, the RBI imposed over INR 5 crore in fines on several NBFCs in early 2025 for AML rule breaches. This underscores the critical need for IIFL to maintain robust compliance frameworks to avoid substantial financial penalties and reputational damage.

With IIFL Finance's extensive digital presence and customer data handling, compliance with evolving data protection laws is paramount. India's Digital Personal Data Protection Act (DPDP Act) 2023, with its upcoming implementation phases in 2024-2025, significantly strengthens the legal framework. IIFL must ensure its data processing and storage practices strictly adhere to these regulations, particularly concerning sensitive financial information. Non-compliance could lead to substantial penalties, potentially up to INR 250 crore for significant data breaches, impacting financial stability and customer trust.

Consumer Protection Regulations

Consumer protection regulations significantly shape IIFL Finance's operations, with the RBI tightening norms. The mandate for a Key Fact Statement, effective October 2024 for retail loans, ensures transparency on charges like the annualized percentage rate (APR) and other fees. New RBI guidelines from January 2025 cap penal charges at 2% on overdue amounts, aiming for fairer lending practices. The focus is on robust grievance redressal, with the RBI pushing for Self-Regulatory Organizations (SROs) to enhance customer protection frameworks by mid-2025.

- RBI mandates Key Fact Statement for retail loans by October 2024.

- New RBI rules effective January 2025 limit penal charges to 2% of overdue amounts.

- IIFL Finance must align with RBI's enhanced transparency and fair practice directives.

- Self-Regulatory Organizations (SROs) are expected to strengthen customer protection by mid-2025.

Regulations on Gold Loan Disbursement and Auction

The Reserve Bank of India (RBI) enforces stringent regulations on gold loan disbursement and auction processes, including a 75% loan-to-value (LTV) ratio for NBFCs. IIFL Finance faced a temporary ban on its gold loan business in March 2024 due to significant supervisory concerns regarding non-compliance with these rules. Sustained adherence to RBI guidelines, particularly concerning gold assaying and transparent auction procedures, is crucial for the company's operational stability. This regulatory compliance directly impacts IIFL Finance's ability to operate its key gold loan segment, which contributed substantially to its AUM in fiscal year 2024.

- RBI mandates a 75% LTV cap for gold loans by NBFCs.

- IIFL Finance received a temporary ban on gold loan disbursements in March 2024.

- Strict adherence to assaying and auction norms is essential for business continuity.

- Regulatory compliance directly impacts the significant gold loan AUM segment.

RBI regulations critically impact IIFL Finance's gold loan segment, enforcing a 75% loan-to-value cap. The company faced a temporary ban on new gold loan disbursements in March 2024 due to supervisory non-compliance. Strict adherence to RBI guidelines on gold assaying and transparent auction procedures is crucial for operational stability. This compliance directly affects the significant contribution of gold loans to IIFL's AUM in fiscal year 2024.

| Regulatory Aspect | Details | Impact on IIFL Finance |

|---|---|---|

| Gold Loan LTV Cap | 75% (RBI Mandate) | Limits loan size, affects revenue potential |

| Gold Loan Ban | Temporary, March 2024 | Disrupted a key business segment, revenue loss |

| Compliance Focus | Assaying, Auction Norms | Essential for operational continuity and regulatory standing |

Environmental factors

The increasing focus on Environmental, Social, and Governance (ESG) criteria presents a significant factor for IIFL Finance. Regulators like the Securities and Exchange Board of India (SEBI) have mandated ESG disclosure requirements, with the Business Responsibility and Sustainability Report (BRSR) now compulsory for the top 1000 listed entities by market capitalization from FY2023 onwards. This regulatory push, alongside investor demand for sustainable practices, necessitates IIFL's deep integration of ESG considerations into its core business strategy and public reporting. Such proactive integration is crucial for maintaining investor confidence and ensuring long-term financial resilience in the evolving market landscape.

The Reserve Bank of India (RBI) has introduced a draft framework requiring financial institutions, including large NBFCs like IIFL Finance, to disclose climate-related financial risks and opportunities. This mandates comprehensive reporting on governance, strategy, risk management, and specific metrics tied to climate change. IIFL Finance will need to develop sophisticated capabilities to assess and accurately report on these evolving environmental exposures, impacting its operational and lending strategies through 2024 and 2025. This regulatory push aims to build a more resilient financial sector by integrating climate considerations into core business practices.

India's ambitious sustainability goals present a significant opportunity for IIFL Finance to expand its green finance portfolio, particularly as the nation targets 500 GW of renewable energy capacity by 2030. This includes crucial financing for electric vehicles, solar projects, and energy-efficient green buildings, aligning with the growing demand for sustainable infrastructure. Furthermore, securing funding from international bodies like the Asian Infrastructure Investment Bank (AIIB) for affordable and green housing projects, such as the USD 200 million loan for India's housing sector in late 2024, strongly supports this strategic direction.

Physical and Transition Risks of Climate Change

Climate change presents significant physical and transition risks impacting IIFL Finance's loan portfolio. Physical risks, like increased extreme weather events, could damage assets securing loans, potentially increasing non-performing assets (NPAs). Transition risks, stemming from the global shift towards a low-carbon economy, may affect sectors heavily reliant on fossil fuels or carbon-intensive operations. IIFL must assess its exposure to these vulnerabilities, as sectors such as real estate and infrastructure, which comprise a substantial portion of Indian financial sector lending (e.g., over 30% of bank credit as of 2024), face heightened climate-related challenges.

- Physical risks include property damage from floods or droughts, impacting collateral values.

- Transition risks involve policy changes and market shifts affecting high-carbon industries.

- IIFL's loan book could see rising NPAs if exposed to climate-vulnerable real estate or energy sectors.

- Assessing portfolio resilience to climate scenarios is crucial for 2024-2025 financial stability.

Disclosure of Greenhouse Gas (GHG) Emissions

Evolving ESG regulations increasingly mandate companies, including financial institutions like IIFL Finance, to disclose their greenhouse gas (GHG) emissions. This includes Scope 1 (direct), Scope 2 (indirect from purchased energy), and crucially, Scope 3 (indirect value chain) emissions. For IIFL, this means assessing not just operational emissions but also financed emissions from its loan portfolios, a significant challenge for 2024-2025 compliance. Robust data collection and transparent reporting mechanisms are essential to meet these new environmental disclosure standards.

- Scope 1, 2, and 3 GHG emissions disclosure is becoming a regulatory norm for financial entities.

- IIFL Finance must measure emissions from its own direct operations and energy consumption.

- Assessing financed emissions from its diverse loan portfolio presents a complex data challenge for 2024.

- Compliance by 2025 necessitates advanced data collection and reporting systems for transparency.

IIFL Finance faces increasing regulatory pressure to integrate ESG criteria, with SEBI’s BRSR now mandatory for top 1000 entities from FY2023, and RBI pushing for climate-related financial disclosures by 2024-2025. This necessitates robust reporting on governance, strategy, and climate metrics, including Scope 1, 2, and 3 GHG emissions, especially financed emissions from its loan portfolio. Physical risks like extreme weather impacting collateral and transition risks from decarbonization strategies pose significant challenges to loan book quality, requiring assessment of climate vulnerabilities in sectors like real estate (over 30% of bank credit as of 2024). Conversely, India's target of 500 GW renewable energy by 2030 offers opportunities for green finance, supported by international funding, such as a USD 200 million AIIB loan for housing in late 2024.

| Environmental Factor | Impact on IIFL Finance (2024-2025) | Key Data/Metrics |

|---|---|---|

| ESG Regulatory Compliance | Increased disclosure burden; BRSR mandatory for top 1000 listed entities from FY2023. | SEBI BRSR, RBI climate disclosure framework (draft for 2024-2025). |

| Climate Risks (Physical & Transition) | Potential for rising NPAs; need for portfolio climate stress testing. | Real estate/infrastructure >30% of Indian bank credit (2024); increased extreme weather events. |

| Green Finance Opportunities | Expansion in renewable energy, EV, green building financing. | India's 500 GW renewable energy target by 2030; USD 200M AIIB loan (late 2024). |

PESTLE Analysis Data Sources

Our IIFL Finance PESTLE Analysis is constructed using a comprehensive blend of primary and secondary data sources. We leverage official reports from regulatory bodies, economic data from international financial institutions, and market research from reputable industry analysts.

The insights presented are grounded in current economic indicators, legislative updates from financial authorities, technological advancements in fintech, and socio-cultural trends impacting consumer behavior. This ensures a robust and up-to-date assessment of the macro-environment for IIFL Finance.