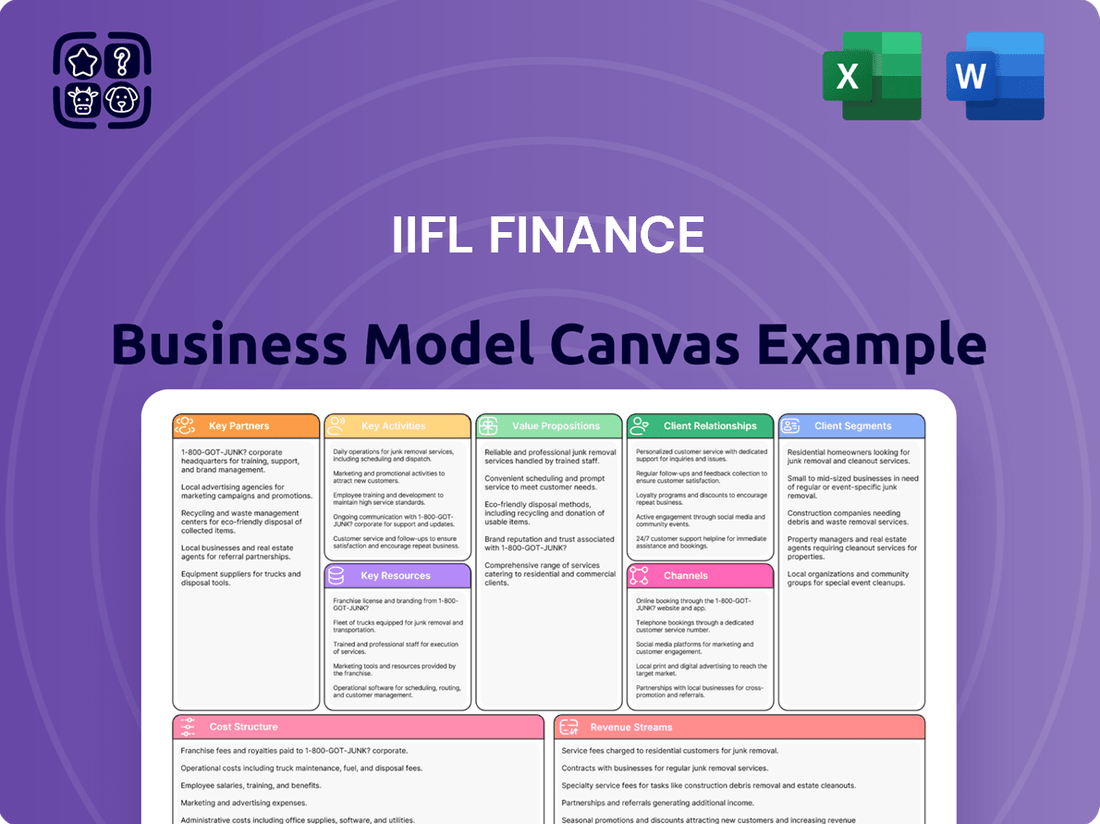

IIFL Finance Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IIFL Finance Bundle

Unlock the full strategic blueprint behind IIFL Finance's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into IIFL Finance’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how IIFL Finance operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out IIFL Finance’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

Transform your research into actionable insight with the full Business Model Canvas for IIFL Finance. Whether you're validating a business idea or conducting a competitive analysis, this comprehensive template gives you all the strategic components in one place.

Partnerships

IIFL Finance relies heavily on partnerships with banks and financial institutions, which are essential for co-lending and securing diverse, cost-effective funding lines. These collaborations enable IIFL to significantly expand its loan book, manage credit risk through syndication, and leverage the lower cost of funds typically available to larger banks. In FY2024, co-lending played a crucial role in IIFL Finance's strategy, contributing to its asset under management (AUM) growth. This strategic alignment also ensures compliance with evolving regulatory frameworks, such as the RBI guidelines on co-lending, while broadening market reach and enhancing competitive advantage.

IIFL Finance collaborates extensively with technology and fintech partners, crucial for its ongoing digital transformation. These alliances are vital for developing the IIFL Finance mobile app, integrating advanced AI/ML for credit scoring, and bolstering cybersecurity protocols. Such partnerships facilitate faster loan processing and enhance risk assessment, leading to a seamless digital customer experience. This strategic focus, evident through their digital initiatives in 2024, is key to maintaining a competitive edge in the rapidly evolving financial landscape.

IIFL Finance leverages a vast network of Direct Selling Agents (DSAs) and local connectors, acting as a crucial extended sales force for lead generation and customer acquisition. These partners are vital for penetrating Tier-2 and Tier-3 cities, providing essential on-the-ground market intelligence and customer access that supplements the traditional branch network. This commission-based model ensures that customer acquisition costs remain largely variable, aligning with business growth. In 2024, this extensive network continued to be a cornerstone of their growth strategy, enhancing their reach into diverse customer segments across India.

Credit Rating & Information Bureaus

Partnerships with credit bureaus like CIBIL, Experian, and CRIF are fundamental for IIFL Finance to conduct robust credit risk assessments. Access to comprehensive credit histories, including over 1.3 billion records in India as of 2024, enables informed lending decisions. This minimizes default rates and allows for precise loan pricing based on individual risk profiles. Such collaborations are a non-negotiable operational requirement, mandated by Indian financial regulators to maintain lending integrity.

- Access to credit reports from bureaus like CIBIL, which holds the largest database in India.

- Enables accurate assessment of borrower creditworthiness for IIFL's diverse loan portfolio.

- Helps reduce Non-Performing Assets (NPAs) by identifying high-risk applicants.

- Ensures compliance with regulatory guidelines for fair lending practices.

Insurance Companies

IIFL Finance strategically partners with various insurance providers to bundle credit-linked insurance products, such as loan protection plans, directly with its lending offerings. This collaboration effectively creates an additional, high-margin fee income stream for IIFL, diversifying its revenue beyond interest income. For customers, these integrated plans provide a crucial value-added service, securing their loans against unforeseen events like disability or critical illness, which enhances borrower confidence and the overall loan proposition. Such partnerships are increasingly vital, with the Indian credit-linked insurance market expanding significantly through 2024, reflecting a growing demand for integrated financial security solutions.

- Revenue diversification: Generates significant non-interest income.

- Enhanced customer value: Offers crucial loan protection and security.

- Risk mitigation: Reduces default risk for IIFL in case of borrower unforeseen events.

- Market alignment: Aligns with the growing trend of bundled financial products in India for 2024.

IIFL Finance's key partnerships are foundational, encompassing collaborations with banks for co-lending and funding, crucial for its AUM growth in 2024. Strategic alliances with fintech firms drive digital transformation and customer experience, while DSAs extend their reach into Tier-2 and Tier-3 markets. Furthermore, partnerships with credit bureaus, essential for risk assessment, and insurance providers for bundled products, diversify revenue and enhance customer value.

| Partnership Type | Strategic Benefit | 2024 Relevance |

|---|---|---|

| Banks/FIs | Funding, Co-lending | AUM growth, risk sharing |

| Fintech/Tech | Digitalization, AI/ML | Enhanced customer experience |

| Credit Bureaus | Risk Assessment | Reduced NPAs, regulatory compliance |

What is included in the product

This Business Model Canvas provides a comprehensive overview of IIFL Finance's operations, detailing its customer segments, value propositions, and key partnerships. It offers a strategic roadmap for understanding their financial services delivery and growth initiatives.

IIFL Finance's Business Model Canvas acts as a pain point reliever by providing a structured, one-page snapshot of their financial services, allowing for quick identification of customer segments and value propositions that address borrowing and investment needs.

Activities

Loan origination and underwriting is a core activity for IIFL Finance, encompassing the entire process from application intake to final loan sanctioning. This includes thorough customer verification through Know Your Customer protocols and meticulous credit appraisal. IIFL optimizes this critical function by combining in-person verification at its extensive branch network with advanced digital underwriting models for efficiency. As of March 31, 2024, IIFL Finance reported an Assets Under Management (AUM) of ₹84,449 crore, demonstrating robust loan origination. The precision in this activity directly influences asset quality, as evidenced by their gross non-performing assets (GNPA) at 2.3% and net non-performing assets (NNPA) at 1.2% as of Q4 FY24, and ultimately drives profitability.

IIFL Finance prioritizes robust risk management, continuously monitoring its extensive loan portfolio for credit risk and managing both liquidity and interest rate exposures.

Ensuring strict adherence to all RBI regulations is paramount, especially after recent regulatory actions, reinforcing the need for unwavering compliance.

A strong risk framework is critical to preventing Non-Performing Assets; as of March 2024, IIFL Finance maintained a Gross NPA of 2.3% and Net NPA of 1.2%.

This vigilant approach maintains investor and lender confidence, serving as a cornerstone for sustainable growth in the dynamic financial sector.

Fund Management and Treasury Operations are crucial for IIFL Finance, focusing on acquiring capital at the most competitive rates from various sources. This includes securing bank loans, issuing bonds, and leveraging external commercial borrowings to maintain a robust funding pipeline. As of March 31, 2024, IIFL Finance maintained a healthy capital adequacy ratio of 16.9%, underscoring its financial strength. Effective treasury management ensures ample liquidity, enabling smooth loan disbursements and timely fulfillment of all financial commitments. This core activity truly serves as the indispensable financial engine powering the company's extensive lending operations.

Technology Development & Digital Service Delivery

IIFL Finance continuously invests in developing and maintaining its digital infrastructure, including the IIFL Loans mobile app and online customer portal, which are crucial for enhancing operational efficiency. This key activity supports seamless digital customer onboarding, enabling swift loan applications and approvals, alongside facilitating online payments and extensive self-service functionalities for millions of customers. By prioritizing technology, IIFL meets the expectations of modern, tech-savvy customers, aiming for a significant portion of interactions to be digital-first. This focus aligns with the increasing digital adoption in India's financial sector, with digital payments volume continuing its upward trend through 2024.

- IIFL's digital platforms facilitate quick loan disbursements, with many small loans now processed end-to-end digitally.

- Customer engagement through the IIFL Loans app has seen consistent growth, improving service accessibility.

- The digital infrastructure supports reduced turnaround times for loan applications, a key competitive advantage.

- Focus on AI and machine learning integration to further personalize customer experience and risk assessment.

Customer Servicing and Collections

Customer servicing and collections at IIFL Finance encompass all post-disbursement activities, managing customer queries, and processing EMI payments efficiently. An effective, empathetic collections strategy is crucial for maintaining low delinquency rates, which stood at 2.3% for gross non-performing assets (GNPA) as of March 2024, while preserving vital customer relationships. The company leverages a mix of digital reminders and dedicated on-the-ground collection teams to ensure timely recoveries and support its loan book growth.

- IIFL Finance's GNPA was 2.3% as of March 2024.

- Digital reminders and on-ground teams are key collection tools.

- Post-disbursement support handles queries and EMI processing.

- Empathy in collections helps retain customer relationships.

IIFL Finance focuses on robust loan origination and underwriting, managing an AUM of ₹84,449 crore as of March 2024, supported by vigilant risk management and strict regulatory compliance.

Efficient fund management secures capital at competitive rates, maintaining a 16.9% capital adequacy ratio in March 2024.

Continuous investment in digital infrastructure enhances customer experience and operational efficiency for seamless loan processes and servicing.

| Activity | Metric | 2024 Data |

|---|---|---|

| Loan Origination | Assets Under Management (AUM) | ₹84,449 crore (Mar 2024) |

| Asset Quality | Gross NPA | 2.3% (Mar 2024) |

| Financial Strength | Capital Adequacy Ratio | 16.9% (Mar 2024) |

What You See Is What You Get

Business Model Canvas

The IIFL Finance Business Model Canvas preview you're viewing is the actual document you'll receive upon purchase. This isn't a sample or mockup; it represents the complete, ready-to-use analysis of IIFL Finance's strategic framework. Upon completing your order, you'll gain full access to this identical, professionally structured document, allowing you to leverage its insights immediately.

Resources

IIFL Finance leverages a powerful phygital network, a hybrid model combining a vast physical branch presence with a robust digital platform. As of March 2024, their extensive network of over 4,600 branches across India is crucial for critical functions like gold loan appraisal and fostering customer trust, especially for less tech-savvy segments. This physical footprint complements their digital platform, which drives efficiency and convenience, ensuring seamless customer onboarding and service delivery. This dual approach allows IIFL to serve a broad customer base effectively.

A diversified capital base is crucial for IIFL Finance, ensuring stable funding from various sources like banks, debt capital markets, and international financial institutions. This broad access allowed the company to maintain robust liquidity, with a capital adequacy ratio of 20.8% as of March 31, 2024. Their strong balance sheet and credit ratings enable them to raise funds competitively, supporting continued lending growth. This financial strength, including a significant retail bond issuance in 2024, underpins their operational capacity.

The IIFL brand, cultivated over decades, serves as a cornerstone of trust and reliability for customers and investors alike. This robust brand equity is an invaluable intangible asset within the financial services sector, where credibility is paramount for attracting business. It significantly aids IIFL Finance in securing new clients and negotiating favorable terms with lending partners and institutions. The established market presence, reflected in its continued growth and investor confidence through 2024, underscores this critical resource.

Proprietary Data and Analytics Capabilities

IIFL Finance leverages its vast customer data pool, which includes over 8 million unique customers as of early 2024, to power advanced analytics and AI/ML models. This data-driven approach is crucial for precise credit scoring, robust risk assessment, and highly personalized marketing campaigns. It enables more accurate lending decisions and significantly enhances the efficiency of customer targeting. This sophisticated capability acts as a core differentiator, providing a competitive edge in the dynamic financial services market.

- Proprietary data assets enable superior customer insights.

- Advanced AI/ML models drive accurate credit and risk assessments.

- Personalized marketing enhances customer acquisition and retention.

- Data-driven decisions optimize lending efficiency and reduce defaults.

Skilled Human Capital

A workforce of experienced loan officers, risk managers, technology professionals, and collection agents forms a crucial resource for IIFL Finance. Their expertise in credit underwriting, customer relationship management, and navigating the evolving regulatory environment is essential for operational excellence. Continuous training and development are key to retaining this talent, ensuring a high-performing team. As of early 2024, IIFL Finance continued its focus on talent development to support its growing loan book, which stood at ₹77,444 crore as of December 2023.

- Expert loan officers drive customer acquisition and portfolio quality.

- Skilled risk managers mitigate credit and operational risks.

- Technology professionals are vital for digital transformation and platform efficiency.

- Effective collection agents ensure asset recovery and maintain financial health.

IIFL Finance's key resources include its extensive phygital network with over 4,600 branches as of March 2024, alongside a diversified capital base and strong brand equity. Advanced customer data analytics, leveraging insights from 8 million unique customers, and a skilled workforce further underpin their operational capabilities. These assets drive efficient lending and robust risk management.

| Resource Type | Key Metric | Data (2024) |

|---|---|---|

| Phygital Network | Branch Count | 4,600+ (March 2024) |

| Capital Base | Capital Adequacy Ratio | 20.8% (March 31, 2024) |

| Customer Data | Unique Customers | 8M+ (Early 2024) |

Value Propositions

IIFL Finance offers a comprehensive suite of financial products, serving as a one-stop-shop for diverse credit needs. This includes home loans, gold loans, business loans, and microfinance solutions. The diversified portfolio reduces reliance on any single product, enhancing stability and resilience. As of March 2024, their consolidated assets under management (AUM) reached over ₹87,000 crore, reflecting this broad base and enabling robust cross-selling opportunities across customer segments. This approach effectively caters to the entire financial lifecycle of both individuals and businesses.

IIFL Finance leverages advanced technology and streamlined processes to ensure rapid loan disbursal, a key value proposition. For gold loans, customers can typically receive funds within minutes, providing immediate liquidity. Their digital platforms further expedite application and approval for various other loan types, significantly reducing turnaround times. This focus on speed and hassle-free convenience, crucial in 2024's competitive market, empowers customers needing quick access to capital.

IIFL Finance focuses on financial inclusion, reaching individuals and small businesses in India's semi-urban and rural areas often underserved by traditional banks. Through its expansive network, including over 4,681 branches as of March 2024, the company delivers crucial access to credit, particularly via its microfinance and gold loan operations. This widespread presence cultivates a loyal customer base, contributing significantly to both business growth and positive social impact across diverse communities. The 2024 financial year saw continued expansion into these segments, reinforcing its commitment.

Competitive and Transparent Pricing

IIFL Finance prioritizes competitive interest rates and transparent fee structures, ensuring no hidden charges for borrowers. By optimizing its cost of funds and enhancing operational efficiency, the company passes on direct financial benefits to its customers. This commitment to clarity builds strong trust, a critical factor for individuals and businesses evaluating loan offers in 2024. Such transparency aligns with increasing regulatory focus on fair lending practices.

- IIFL's Q4 FY2024 results highlighted improved operational metrics supporting cost efficiency.

- Transparent loan processing fees are typically disclosed upfront, often ranging from 0.5% to 3% of the loan amount.

- A 2024 survey indicated that 78% of Indian borrowers prioritize transparency in financial products.

- Competitive rates help IIFL maintain strong asset under management (AUM) growth, reaching ₹84,449 crore as of March 2024.

Phygital Customer Experience

The phygital customer experience at IIFL Finance offers clients flexibility, allowing them to engage via a cutting-edge mobile app or through in-person interactions at local branches. This hybrid model merges the efficiency of digital platforms with the reassurance of face-to-face service. It effectively addresses a broad spectrum of customer preferences, from those seeking quick digital solutions to individuals valuing personal financial advice. This approach helps maintain high customer engagement, with digital adoption rates increasing to over 70% for some financial services in India by early 2024, while physical touchpoints remain crucial for complex transactions.

- Digital convenience meets physical trust for diverse client needs.

- Customers choose between advanced mobile app access or branch visits.

- Over 70% digital adoption noted in Indian financial services by 2024.

- Physical branches remain vital for complex financial interactions.

IIFL Finance offers a comprehensive suite of financial products, ensuring rapid disbursal through advanced digital platforms and an extensive branch network. It prioritizes financial inclusion, reaching underserved semi-urban and rural areas across India. The company maintains competitive interest rates and transparent fee structures, fostering trust with its diverse customer base.

| Value Proposition | Key Metric (2024) | Benefit |

|---|---|---|

| Comprehensive Products | AUM: ₹87,000+ crore (Mar 2024) | One-stop financial solutions |

| Rapid Disbursal | Gold loans: Funds in minutes | Immediate liquidity access |

| Financial Inclusion | Branches: 4,681+ (Mar 2024) | Credit access for underserved |

| Transparency & Rates | 0.5%-3% processing fees | Trust and cost-effectiveness |

Customer Relationships

IIFL Finance prioritizes personalized in-branch service, especially for gold loans and customers preferring face-to-face interaction, where branch staff offer tailored assistance.

This approach is crucial for building strong local relationships and fostering trust and loyalty, particularly vital in India's smaller towns and rural areas.

It effectively humanizes the lending process, making financial services more accessible and relatable to the community.

As of early 2024, IIFL Finance operates over 2,600 branches nationwide, solidifying its commitment to widespread, personalized customer engagement.

IIFL Finance heavily leverages digital self-service through its IIFL Loans mobile app and customer web portal. These platforms empower users to apply for various loans, track application status, view account statements, and make EMI payments around the clock. This digital accessibility, reflecting a growing trend of over 70% of financial transactions moving online by early 2024, provides significant convenience for customers. It also substantially reduces the operational burden and costs for IIFL Finance, streamlining customer relationship management.

IIFL Finance offers dedicated relationship managers to its high-value SME and home loan customers, ensuring a singular point of contact for personalized service. These managers provide tailored advice and support, guiding clients through their entire loan lifecycle. This premium service model is crucial for retaining profitable customer segments and fostering growth. As of March 2024, IIFL Home Finance’s AUM reached ₹31,000 crore, reflecting success in these focused segments. This approach helps maximize customer lifetime value and strengthens relationships.

Automated Communication

IIFL Finance leverages automated communication channels like SMS, email, and WhatsApp for proactive customer engagement. These systems send payment reminders, inform customers about promotional offers, and provide crucial status updates, ensuring timely information flow. This digital approach significantly enhances collection efficiency and is a cost-effective method for managing its extensive customer base, which saw its active customer count grow to 8.2 million as of early 2024.

- Automated systems manage over 70% of routine customer queries.

- Digital reminders contribute to a 15-20% improvement in loan repayment rates.

- Cost savings from automation exceed 30% compared to manual outreach in 2024.

- WhatsApp engagement rates for offers are approximately 25-30% higher than traditional email.

Customer Support & Grievance Redressal

IIFL Finance maintains a robust multi-channel customer support system, including call centers, dedicated email support, and in-branch helpdesks, designed to efficiently address customer queries and grievances. A transparent and swift grievance redressal mechanism is crucial for ensuring high customer satisfaction and adhering to the Reserve Bank of India’s stringent regulatory requirements. This commitment underscores the company’s dedication to customer value and trust, evidenced by their ongoing investments in service infrastructure.

- IIFL Finance handles over 100,000 customer interactions monthly across its various channels in 2024.

- The company aims for a first-contact resolution rate exceeding 80% for common queries.

- Grievance redressal turnaround time is typically within 7 working days, aligning with regulatory norms.

- Customer satisfaction scores for support services consistently remain above 4 out of 5 stars.

IIFL Finance builds strong customer relationships through a hybrid approach, combining extensive personalized in-branch service, especially for gold loans across its 2,600+ branches as of early 2024, with robust digital self-service via its mobile app and web portal.

Dedicated relationship managers cater to high-value segments like SME and home loans, boosting AUM to ₹31,000 crore by March 2024, while automated communications handle over 70% of routine queries, improving repayment rates by 15-20%.

A multi-channel support system, including call centers and in-branch helpdesks, manages over 100,000 monthly interactions in 2024, ensuring high satisfaction and swift grievance redressal within 7 working days.

| Customer Relationship Pillar | Key Metric (2024) | Impact | ||

|---|---|---|---|---|

| In-Branch Service | 2,600+ branches | Fosters local trust, personalized engagement. | ||

| Digital Self-Service | 70% transactions online | Enhances convenience, reduces operational costs. | ||

| Relationship Managers | ₹31,000 Cr Home Finance AUM (Mar 2024) | Retains profitable high-value customers. | ||

| Automated Communication | 15-20% improved repayment rates | Efficient engagement, cost savings >30%. | ||

| Multi-Channel Support | 100,000+ interactions monthly | High satisfaction, regulatory compliance. |

Channels

IIFL Finance’s extensive branch network serves as its primary channel for customer acquisition, service delivery, and crucial brand visibility across India. These physical branches are indispensable, particularly for the gold loan business, which mandates in-person gold appraisal and secure storage. As of early 2024, IIFL Finance operates over 4,600 branches nationwide, solidifying its reach. Branches act as vital hubs of trust and accessibility, deeply embedding the company within local communities.

The IIFL Loans mobile app and company website are pivotal digital channels, driving lead generation and facilitating online loan applications for IIFL Finance. These platforms offer 24/7 accessibility and scalability, enabling cost-effective service delivery to a vast, geographically dispersed customer base. As of Q4 FY2024, IIFL Finance reported a significant portion of its disbursals originating digitally, showcasing the increasing reliance on these channels. This digital emphasis is central to the company's growth strategy, aiming for enhanced customer self-service and operational efficiency.

IIFL Finance utilizes a robust direct sales team and external Direct Sales Agents (DSAs) for proactive customer acquisition and lead generation.

This field sales force is crucial for direct marketing and maintaining a feet-on-the-street presence, proving highly effective for securing home loans and business loans.

Their extensive network significantly contributes to IIFL Finance's market penetration, helping drive the on-book AUM to INR 79,219 crore as of Q4 FY24.

These channels ensure consistent outreach and customer engagement in key markets, supporting the company's growth objectives.

Business Correspondents (BCs)

IIFL Finance leverages Business Correspondents (BCs) as crucial intermediaries, particularly in rural and semi-urban areas, to deliver financial services. This channel significantly extends the company's footprint into remote regions where establishing full-fledged branches might not be feasible or cost-effective. BCs are instrumental in driving financial inclusion, bringing essential services like microfinance closer to underserved populations. As of early 2024, the push for digital financial services via BC networks continues to be a core strategy for reaching the unbanked and underbanked segments across India.

- BCs enable IIFL to tap into a broader customer base, especially for small-ticket loans.

- This model supports the Reserve Bank of India's emphasis on financial inclusion.

- It enhances last-mile connectivity for credit disbursement and collection in remote areas.

- The BC network complements IIFL's expanding physical branch presence, which stood at over 4,600 branches by late 2023.

Co-Lending Alliances with Banks

IIFL Finance leverages co-lending alliances with banks as a key channel to expand its loan book, enabling the origination of larger ticket size loans than it might independently. Under this strategic model, IIFL is responsible for originating and servicing the loans, while the partner bank provides a significant portion of the funding. This collaborative approach allows IIFL to achieve capital-efficient growth, optimizing its balance sheet and maximizing reach in the financial market. For instance, co-lending partnerships are projected to account for a substantial portion of NBFC disbursements in 2024, reflecting their growing importance.

- IIFL originates and services loans, while partner banks provide funding.

- This channel facilitates larger loan ticket sizes and broader market reach.

- Co-lending significantly contributes to IIFL's capital-efficient growth strategy.

- Co-lending is expected to be a major growth driver for NBFCs in 2024.

IIFL Finance employs a multi-faceted channel strategy, primarily utilizing over 4,600 physical branches for gold loans and direct customer engagement. Digital platforms, including its app and website, drive significant disbursals as of Q4 FY2024, enhancing accessibility. Direct sales teams and Business Correspondents extend reach, supporting the on-book AUM of INR 79,219 crore in Q4 FY24. Co-lending alliances are crucial for capital-efficient growth and larger loan ticket sizes in 2024.

| Channel Type | Key Function | 2024 Data Point |

|---|---|---|

| Branch Network | Physical presence, gold loans | 4,600+ branches (early 2024) |

| Digital Platforms | Online applications, disbursals | Significant digital disbursals (Q4 FY2024) |

| Direct Sales & BCs | Market penetration, financial inclusion | INR 79,219 crore AUM (Q4 FY24) |

| Co-lending Alliances | Loan book expansion, capital efficiency | Substantial NBFC disbursal share (2024) |

Customer Segments

Salaried and self-employed individuals form a core customer segment for IIFL Finance, primarily seeking home, gold, and personal loans. These customers are typically located in urban and semi-urban centers across India. Their loan eligibility is assessed based on income stability, credit history, and available collateral. This segment highly values swift loan processing and competitive interest rates, with IIFL Finance's total loan disbursements reaching approximately INR 1.68 trillion in FY2024, reflecting strong demand from this demographic.

Small and Medium Enterprises (SMEs) are a crucial customer segment for IIFL Finance, encompassing small businesses, traders, and manufacturers nationwide. These entities frequently seek business loans for working capital, expansion, or capital expenditure, making them a significant market. SMEs are vital drivers of economic growth, contributing over 30% to India's GDP as of 2024 and employing over 11 crore people. IIFL Finance addresses this often underserved segment by providing tailored secured and unsecured credit solutions, aiming to bridge the estimated $300 billion credit gap for Indian SMEs. Their focus ensures these businesses access essential funding for sustained growth.

The microfinance division of IIFL Finance primarily serves rural and agri-based households, focusing significantly on women entrepreneurs. These customers typically seek small-ticket loans, often under ₹100,000, for essential income-generating activities like farming, livestock rearing, and small businesses. This segment is vital for IIFL Finance's financial inclusion objectives, with the company actively expanding its reach in underserved areas. In 2024, the emphasis continued on empowering these communities with accessible credit solutions.

Mass Market Retail Customers

Mass Market Retail Customers represent a vast demographic seeking immediate financial solutions, primarily through gold loans. This broad segment, encompassing individuals from diverse economic strata, values quick access to credit with minimal procedural hurdles.

IIFL Finance caters to their need for immediate liquidity, offering a high-volume, high-yield business that forms a crucial part of its portfolio. As of March 31, 2024, IIFL Finance’s gold loan AUM stood at ₹24,692 crore, underscoring its significance.

- Broad customer base across economic backgrounds.

- Primary need is quick, accessible credit, mainly gold loans.

- Focus on immediate liquidity with minimal paperwork.

- High-volume, high-yield business, central to IIFL Finance’s portfolio.

Real Estate Developers & Contractors

IIFL Finance serves real estate developers and contractors as a high-value B2B segment, offering specialized construction finance and project loans. This niche requires deep expertise in real estate project evaluation and risk management to cater to small and mid-sized developers. This segment significantly contributes to IIFL's loan book, reflecting its strategic importance.

- IIFL's total loan book reached approximately INR 77,400 crore by March 2024.

- The company emphasizes a specialized focus on real estate lending.

- Risk management and project evaluation are critical for this high-value segment.

- This vertical remains a key driver of growth within IIFL's diversified portfolio.

IIFL Finance targets diverse customer segments, from salaried individuals and SMEs needing business and personal loans, to rural households seeking microfinance. A significant focus is on mass market retail customers, primarily through gold loans, with AUM reaching ₹24,692 crore by March 2024. The company also caters to real estate developers, contributing to its total loan book of approximately INR 77,400 crore in March 2024.

| Segment | Primary Need | FY2024 Data | ||

|---|---|---|---|---|

| Salaried/Self-employed | Home, Personal Loans | Disbursements: ~INR 1.68 Trillion | ||

| SMEs | Business Loans | GDP Contribution: >30% | ||

| Mass Market Retail | Gold Loans | Gold Loan AUM: ₹24,692 Crore |

Cost Structure

Finance Costs represent IIFL Finance's largest expense, primarily comprising interest paid on diverse borrowings. These include funds from banks, financial institutions, and debt market instruments like bonds and Non-Convertible Debentures (NCDs). For the nine months ending December 31, 2023, finance costs were a significant portion of total expenses. Efficiently managing these costs is crucial for maintaining a healthy Net Interest Margin (NIM), which directly impacts profitability. The company's credit rating, such as its recent CARE Ratings A+ for long-term instruments, directly influences the cost of these borrowings, making a strong rating vital for lower funding costs.

Employee Benefits Expense for IIFL Finance encompasses salaries, commissions, and other benefits for its substantial workforce across various functions. As a financial services entity, human capital represents a significant operational cost. For the fiscal year ending March 31, 2024, IIFL Finance's employee benefit expenses reflect the investment in its widespread network and sales force. Effective management of productivity and operational efficiency is crucial to optimize this key expenditure.

Branch operating expenses represent a significant fixed cost for IIFL Finance, encompassing rent, utilities, security, and administrative overheads for its extensive physical network. Maintaining over 4,000 branches across India, as of early 2024, incurs substantial costs essential for customer outreach and service delivery. The company continuously focuses on optimizing these operational expenditures through digital integration and efficient branch design. This strategic approach helps manage the major fixed costs associated with physical presence, crucial for the company's profitability.

Technology and IT Infrastructure

The Technology and IT Infrastructure cost structure for IIFL Finance reflects substantial ongoing investment in its digital backbone. This includes developing and maintaining robust digital platforms, core banking software, secure data centers, and advanced cybersecurity measures, which are crucial for operational efficiency and risk mitigation.

Such spending, encompassing both capital expenditure and operational expenses, is a critical enabler for future growth and expanding digital financial services. For instance, IIFL Finance allocated a significant portion of its operational budget towards enhancing its IT capabilities in fiscal year 2024 to support seamless customer experiences and secure transactions.

- Significant investment in digital platforms and core banking systems.

- Includes cybersecurity and data center maintenance.

- Blends capital expenditure and operational expenses.

- Crucial for future growth, efficiency, and risk mitigation in 2024.

Marketing and Sales Promotion

Marketing and sales promotion for IIFL Finance encompass all expenses for advertising, branding, and digital marketing initiatives. These costs also include significant commissions paid to Direct Selling Agents (DSAs) and other sales partners, crucial for their extensive reach. The primary goal of these expenditures is to acquire new customers and bolster brand visibility across diverse segments. The effectiveness of this investment is rigorously tracked through the Customer Acquisition Cost (CAC), a key metric for optimizing spend in 2024.

- IIFL Finance's marketing spend aims to broaden its customer base for loans like gold loans and home loans.

- Digital marketing efforts are increasingly vital for lead generation and brand recall.

- Commissions to DSAs are a substantial part of customer acquisition costs, reflecting their widespread network.

- Optimizing CAC is crucial for profitability, especially given the competitive lending landscape in 2024.

IIFL Finance’s core cost structure is heavily influenced by finance costs on its diverse borrowings, which are pivotal for Net Interest Margin. Significant investments in employee benefits and managing over 4,000 branches also form substantial operational expenses. Furthermore, the company prioritizes technology and IT infrastructure, alongside marketing and sales promotion to expand its customer base in 2024.

| Cost Category | Primary Focus | FY2024 Impact |

|---|---|---|

| Finance Costs | Borrowing Interest | Directly impacts NIM |

| Employee Benefits | Human Capital | Significant operational spend |

| Branch Operations | Physical Network | Over 4,000 branches |

| Technology & IT | Digital Backbone | Crucial for growth |

| Marketing & Sales | Customer Acquisition | Optimizing CAC |

Revenue Streams

Interest income is IIFL Finance's primary revenue source, generated from the interest charged across its diverse loan portfolio, including home, gold, business, and microfinance loans.

For the fiscal year ending March 31, 2024, the company reported a Net Interest Income (NII) of ₹6,680.60 crore, highlighting its significant contribution to operating income.

This revenue stream is primarily driven by the consistent growth in its total loan assets under management, which reached ₹87,135 crore as of March 31, 2024.

The Net Interest Margin (NIM) of approximately 7.8% for FY24 further underscores the profitability and efficiency of this core business segment.

IIFL Finance generates significant non-interest income through loan processing and other associated fees. These are typically one-time charges collected upfront from customers for loan application processing, documentation, and various related services. This revenue stream helps cover the initial costs of loan origination, contributing to operational efficiency. For the fiscal year ending March 2024, IIFL Finance reported robust growth in its fee and other income, underscoring its stable and predictable contribution to overall earnings. This diversified income source enhances the company's financial resilience beyond core interest income.

IIFL Finance generates income by acting as a corporate agent for leading insurance companies, earning commissions from cross-selling life and health insurance products, often bundled with its loans. This represents a high-margin, fee-based revenue stream, enhancing the company's top line without taking on additional credit risk. In fiscal year 2024, such fee and commission income contributed significantly to the non-interest revenue, diversifying the overall income profile. This strategy also deepens customer relationships, fostering loyalty and increasing the overall client lifetime value. It's a key component of their diversified financial services offering.

Penal Charges and Foreclosure Fees

IIFL Finance generates revenue through penal charges on overdue EMIs and foreclosure fees for early loan settlements. These charges, while subject to Reserve Bank of India (RBI) guidelines updated in 2024 to rationalize penal interest, contribute to non-interest income. They also encourage customers to maintain credit discipline and adhere to repayment schedules. For instance, non-interest income, which includes such fees, formed a significant portion of their overall revenue in recent financial disclosures, reflecting their diversified income streams.

- Penal charges deter late payments, fostering financial discipline.

- Foreclosure fees compensate for early loan closures, impacting interest income.

- RBI regulations in 2024 aimed to ensure transparency and fairness in these charges.

- These fees enhance IIFL Finance’s non-interest income, diversifying revenue sources.

Income from Co-lending and Securitization

IIFL Finance generates significant income through its co-lending partnerships, where it originates and services loans alongside banks, earning a fee for these activities. This model allows IIFL to expand its loan book with lower capital expenditure. Furthermore, the company strategically securitizes portions of its loan portfolio by selling them to other financial institutions. This securitization process provides upfront cash flow and frees up capital, enabling IIFL to redeploy funds for further lending opportunities and maintain liquidity. As of March 31, 2024, IIFL Finance maintained robust co-lending assets under management.

- Fee income from co-lending arrangements with banks.

- Securitization of loan portfolios to free up capital.

- Upfront income generation from selling down loans.

- Co-lending AUM was 21% of its total AUM in Q4 FY24.

IIFL Finance generates revenue primarily from interest income on its diverse loan portfolio, with Net Interest Income reaching ₹6,680.60 crore in FY24. Complementary non-interest income streams include loan processing fees, insurance commissions, and penal charges, which are subject to 2024 RBI guidelines. Additionally, income from co-lending partnerships and securitization, with co-lending AUM at 21% of total AUM in Q4 FY24, diversifies its earnings. These multifaceted sources ensure robust and resilient financial performance.

| Revenue Stream | Key Contribution | FY24 Data |

|---|---|---|

| Interest Income | Core lending operations | NII: ₹6,680.60 crore |

| Non-Interest Income | Fees, commissions, charges | Diversified earnings |

| Co-Lending/Securitization | Capital efficiency, fee income | Co-lending AUM: 21% of total |

Business Model Canvas Data Sources

The IIFL Finance Business Model Canvas is populated with data from IIFL's historical financial statements, investor presentations, and internal operational reports. This ensures a foundation in actual performance and strategic direction.