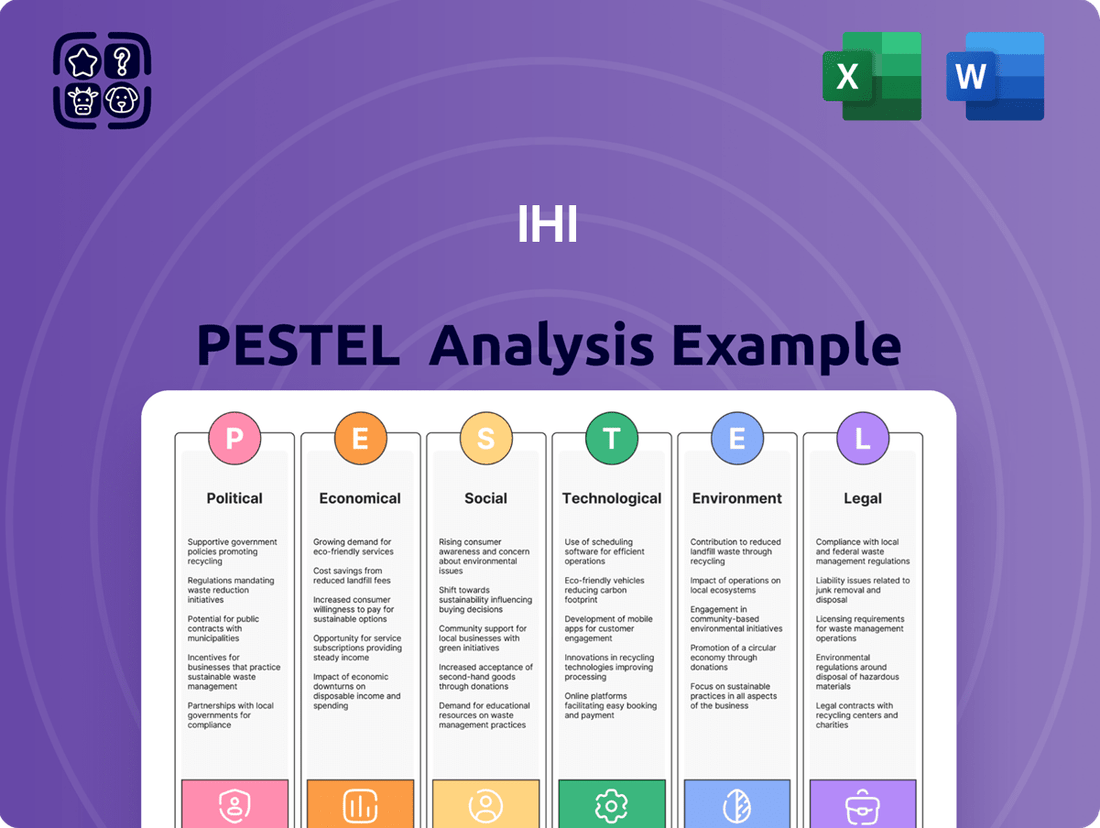

IHI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHI Bundle

Navigate the complex external environment impacting IHI with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors shaping its trajectory. Gain actionable intelligence to inform your strategic decisions and secure a competitive advantage. Download the full, expertly researched report today.

Political factors

Government policies and regulations significantly shape IHI Corporation's operational landscape, particularly in its core aerospace, defense, and energy sectors. For example, Japan's commitment to carbon neutrality by 2050, reinforced by policies promoting green energy, directly influences IHI's strategic investments in ammonia fuel and carbon capture technologies, areas where the company is actively developing solutions.

Changes in international trade agreements and environmental standards also present both challenges and opportunities. In 2024, evolving regulations around emissions in the aviation sector, for instance, necessitate continuous adaptation in IHI's aero-engine development to meet stricter environmental targets and maintain market access.

IHI's position in the aerospace and defense industry means its fortunes are directly linked to government defense expenditures and the broader geopolitical climate. For instance, Japan's Ministry of Defense announced a record budget of ¥7.7 trillion (approximately $53 billion USD) for fiscal year 2024, an increase of 16.5% from the previous year, signaling potential growth in demand for IHI's defense systems and support services.

Geopolitical tensions, such as those in the Indo-Pacific region, often drive increased defense spending among nations. This trend can translate into greater opportunities for IHI, particularly with its involvement in advanced platforms like the F-35 fighter jet, which requires ongoing maintenance and upgrades. The continued global emphasis on national security and military modernization, as seen in allied nations' defense budget increases, directly benefits companies like IHI that supply critical defense components and MRO services.

Fluctuations in international trade relations, including the imposition of tariffs or trade barriers, can significantly impact IHI's supply chain, export capabilities, and overall profitability. For example, the ongoing trade tensions between major economies in 2024 continued to create uncertainty, potentially increasing the cost of imported components for IHI's manufacturing processes and affecting the pricing of its exported goods.

Navigating these complex global trade dynamics is crucial for IHI to maintain its competitive edge and ensure smooth operations. Companies like IHI must closely monitor evolving trade policies and adapt their strategies to mitigate risks associated with protectionist measures or disruptions in key trading partnerships, especially as global trade volumes saw a projected modest growth of around 2.6% in 2024 according to some forecasts.

Public Procurement and Infrastructure Spending

Government investments in social infrastructure, like bridges and railway systems, directly impact IHI's business in these areas and their offshore facilities. Public procurement policies and the funding dedicated to major projects create substantial opportunities for the company.

For instance, the Japanese government's commitment to infrastructure renewal, including seismic retrofitting and upgrades to aging transport networks, is a key driver. In fiscal year 2023, Japan's total infrastructure spending was projected to be around ¥16.3 trillion (approximately $110 billion USD), with a significant portion allocated to transportation and disaster prevention, areas where IHI has strong capabilities.

- Government Infrastructure Investment: Japan's FY2023 infrastructure spending target highlights a consistent demand for large-scale projects.

- Procurement Policy Impact: Favorable public procurement policies can directly translate into secured contracts for IHI.

- Opportunity Alignment: IHI's expertise in bridges, railways, and offshore facilities aligns well with government spending priorities.

Political Stability in Key Markets

The political stability of nations where IHI Corporation holds substantial operations or ongoing projects is a critical consideration, especially within emerging markets. For instance, IHI's significant infrastructure development projects in Southeast Asia, a region often subject to political transitions, require careful monitoring. A report from the World Bank in late 2024 highlighted that political instability in several developing economies led to an average 15% increase in project execution costs due to delays and unforeseen security measures.

Sudden policy shifts or governmental changes can directly impede IHI's project timelines and affect its overall profitability. Consider the impact of unexpected regulatory changes on large-scale industrial projects, potentially increasing compliance burdens or altering market access. For example, a change in government in a key South American market in early 2025 led to a temporary halt on several major construction contracts, impacting companies like IHI that were involved.

These political dynamics pose tangible risks to IHI's investments and its long-term strategic growth plans. The unpredictability can deter future investment and necessitate contingency planning for potential disruptions. IHI's exposure to markets with fluctuating political landscapes means that risk mitigation strategies, including political risk insurance and diversified market presence, are paramount for safeguarding its financial performance and operational continuity.

Key considerations for IHI regarding political stability include:

- Monitoring political risk indicators in key operating regions, such as the Fragile States Index.

- Assessing the potential impact of upcoming elections or leadership changes on regulatory environments.

- Evaluating the consistency of government policies related to foreign investment and industrial development.

- Analyzing the historical precedent of policy reversals and their financial consequences for major projects.

Government policies and geopolitical shifts significantly influence IHI's operations, especially in defense and energy. Japan's increased defense budget for FY2024, reaching ¥7.7 trillion, directly benefits IHI's defense systems. Furthermore, global environmental regulations, like stricter aviation emissions standards in 2024, drive IHI's innovation in sustainable technologies such as ammonia fuel.

Trade agreements and political stability in operating regions also present challenges. In 2024, fluctuating trade relations and geopolitical tensions in the Indo-Pacific created uncertainty, potentially impacting IHI's supply chain and export costs. Political instability in emerging markets, as noted by the World Bank in late 2024, can increase project costs by an average of 15% due to delays and security needs.

Government investment in infrastructure, like Japan's projected ¥16.3 trillion in FY2023 for transport and disaster prevention, creates substantial opportunities for IHI in areas such as bridges and railways. However, sudden policy changes or governmental transitions, as seen in some South American markets in early 2025, can temporarily halt projects and impact profitability, necessitating robust risk mitigation strategies for IHI.

| Factor | Impact on IHI | 2024/2025 Data/Trend |

|---|---|---|

| Defense Spending | Increased demand for defense systems and services | Japan's FY2024 defense budget up 16.5% to ¥7.7 trillion ($53 billion USD) |

| Environmental Regulations | Drives investment in green technologies | Stricter aviation emissions targets in 2024 require adaptation |

| Trade Relations | Affects supply chain and export costs | Ongoing trade tensions create uncertainty; projected modest global trade growth of ~2.6% in 2024 |

| Political Stability | Impacts project execution and profitability | Instability in developing economies can increase project costs by ~15% (World Bank, late 2024) |

| Infrastructure Investment | Creates opportunities for construction and engineering | Japan's FY2023 infrastructure spending projected at ¥16.3 trillion ($110 billion USD) |

What is included in the product

The IHI PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the Institute for Healthcare Improvement, providing a comprehensive understanding of its external operating landscape.

Provides a clear, actionable framework that simplifies complex external factors, reducing the overwhelm of strategic planning and boosting confidence in decision-making.

Economic factors

IHI's extensive operations in heavy industry, from infrastructure to energy, make it exceptionally sensitive to the pulse of global economic growth. When the world economy is expanding, demand for IHI's core offerings, such as large-scale industrial machinery and power generation equipment, tends to surge. For instance, in 2023, global GDP growth was estimated at around 3.1%, a figure that directly influences the investment cycles in sectors IHI serves.

Industrial output is a critical barometer for IHI's performance. A healthy manufacturing sector worldwide means greater need for the advanced systems and components IHI provides. In the first quarter of 2024, industrial production in major economies like the United States and the Eurozone showed varied but generally positive trends, indicating a continued, albeit uneven, demand environment for heavy industrial goods.

As a Japanese company, IHI's financial performance is significantly influenced by currency exchange rate fluctuations, especially the yen's value. A weaker yen generally benefits IHI by making its overseas earnings more valuable when converted back into yen.

For instance, in the fiscal year ending March 2024, IHI reported that a depreciation of the yen against the US dollar and Euro provided a substantial boost to its operating profit. Specifically, a ¥10 depreciation against the dollar was estimated to add approximately ¥4 billion to operating profit, while a similar move against the Euro could add around ¥1.5 billion.

These favorable exchange rate movements have been a key factor in IHI's recent financial recovery and have contributed to upward revisions in profit forecasts. The company's ability to leverage these currency tailwinds is crucial for its continued growth and profitability in its global markets.

Volatility in raw material and energy prices presents a significant challenge for IHI. For instance, fluctuations in steel prices, a key component in IHI's heavy machinery and infrastructure projects, directly impact manufacturing costs. Similarly, soaring energy costs, particularly for natural gas and electricity, increase operational expenses across all of IHI's business segments, from shipbuilding to power systems.

To counter these pressures, IHI has been actively pursuing strategies like optimizing its supply chain and exploring long-term procurement contracts. In 2024, the global energy market experienced significant price swings, with Brent crude oil averaging around $80-$90 per barrel for much of the year, a factor IHI closely monitors for its impact on project feasibility and profitability.

Interest Rates and Access to Capital

Fluctuations in interest rates directly affect IHI's cost of capital, influencing the feasibility and profitability of its major projects and investments. For instance, if the Federal Reserve maintains its target range for the federal funds rate at 5.25%-5.50% through 2024 and potentially into early 2025, as indicated by projections, IHI's borrowing expenses for new ventures could remain elevated.

Maintaining access to robust and cost-effective capital markets is crucial for IHI's strategic growth. This includes securing funding for its ongoing research and development efforts, which are vital for innovation in the healthcare sector, and for expanding its operations into new international markets. Favorable market conditions in 2024 have seen corporate bond yields for investment-grade companies generally range between 4.5% and 6%, a factor IHI would consider.

- Interest Rate Impact: Higher interest rates increase IHI's debt servicing costs, potentially reducing net income and cash flow available for reinvestment.

- Capital Access: IHI's ability to issue new debt or equity at attractive rates is key to funding R&D and global expansion plans.

- Market Conditions: As of mid-2024, the average yield on 10-year U.S. Treasury notes has hovered around 4.25%, influencing broader borrowing costs for corporations like IHI.

- Strategic Funding: Access to capital markets allows IHI to pursue long-term growth strategies, such as acquiring new technologies or building manufacturing facilities.

Market Demand in Key Business Segments

Market demand within IHI's core business segments, particularly civil aero engines and clean energy, is a critical economic factor influencing its financial performance. The aerospace sector's recovery and expansion directly correlate with IHI's engine sales and services, while the global shift towards sustainability fuels demand for its clean energy solutions.

In 2024, the commercial aircraft market has shown robust recovery, with major manufacturers like Boeing and Airbus reporting significant order backlogs. For example, as of the first half of 2024, Airbus delivered 317 aircraft, indicating sustained demand for new planes, which translates to more engine orders for IHI.

The clean energy sector, driven by decarbonization efforts and government incentives worldwide, presents a substantial growth opportunity. IHI's investments in hydrogen and carbon capture technologies are positioned to benefit from this trend, with an increasing number of projects seeking advanced energy solutions.

- Civil Aero Engines: Sustained demand for new aircraft, evidenced by strong order backlogs from major manufacturers, directly boosts IHI's revenue from engine sales and maintenance services.

- Clean Energy: The global push for decarbonization and increasing adoption of renewable energy sources are creating significant market opportunities for IHI's clean energy technologies, including hydrogen and carbon capture.

- Economic Drivers: Growth in air travel post-pandemic and government policies supporting environmental initiatives are key economic drivers underpinning demand in IHI's strategic business areas.

Global economic growth directly impacts IHI's demand for heavy industrial machinery and infrastructure projects. As of early 2024, the International Monetary Fund projected global GDP growth to be around 3.2%, a figure that underpins investment in sectors IHI serves.

Industrial production trends are a key indicator for IHI. For instance, in Q1 2024, industrial output in major economies showed moderate growth, suggesting a steady, though varied, demand for heavy industrial goods.

Currency fluctuations, particularly the yen's strength, significantly affect IHI's profitability. A weaker yen generally boosts IHI's overseas earnings when converted back into Japanese currency.

For example, IHI's fiscal year 2023 results benefited from a weaker yen, with estimates suggesting a ¥10 depreciation against the US dollar could add approximately ¥4 billion to operating profit.

Volatility in raw material and energy prices, such as steel and natural gas, directly impacts IHI's manufacturing costs and operational expenses. In 2024, global energy prices, with Brent crude averaging around $80-$90 per barrel, remained a key factor for IHI's project cost management.

Interest rates influence IHI's cost of capital and project feasibility. Projections for 2024 indicated interest rates remaining relatively stable, with the US federal funds rate target range at 5.25%-5.50%, impacting borrowing costs for IHI's investments.

Market demand in IHI's key sectors, like civil aero engines and clean energy, is crucial. The aerospace sector's recovery, with Airbus delivering 317 aircraft in the first half of 2024, signals strong demand for IHI's engine components.

| Economic Factor | 2023/2024 Data/Trend | Impact on IHI |

|---|---|---|

| Global GDP Growth | Projected 3.2% for 2024 | Drives demand for infrastructure and industrial machinery |

| Industrial Production | Moderate growth in major economies (Q1 2024) | Indicates steady demand for heavy industrial goods |

| Yen Exchange Rate | Weaker yen beneficial for overseas earnings | Boosts reported profits from international operations |

| Raw Material/Energy Prices | Brent crude ~$80-$90/barrel (2024) | Affects manufacturing costs and project profitability |

| Interest Rates | US Fed Funds Rate 5.25%-5.50% (2024 target) | Influences cost of capital for investments |

| Aerospace Demand | Airbus deliveries: 317 aircraft (H1 2024) | Increases demand for aero engines and services |

Preview the Actual Deliverable

IHI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive IHI PESTLE Analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. You'll gain valuable insights into the external forces shaping IHI's strategic landscape.

Sociological factors

Japan's aging population, with a median age of 48.7 years in 2023 according to the World Bank, directly impacts IHI's workforce. This demographic shift means a shrinking pool of younger workers and a greater reliance on experienced, older employees, posing challenges for knowledge transfer and succession planning.

The global workforce is also evolving, with a growing demand for specialized skills in areas like advanced manufacturing and digital technologies. IHI's reliance on highly skilled engineers and technicians for its complex projects, such as aerospace and energy systems, makes the availability of this talent crucial for maintaining its operational edge and competitive advantage in 2024 and beyond.

Societal demands for corporations to act responsibly are growing, pushing companies like IHI to focus on ethical labor, human rights, and community involvement. These expectations directly impact IHI's public image and how it interacts with everyone invested in its success.

IHI’s proactive stance on diversity, equity, and inclusion (DE&I) and its commitment to human rights initiatives demonstrate an understanding of these shifting societal norms. For instance, in 2024, IHI reported that 45% of its global workforce identified as women, with 22% in leadership positions, signaling progress in its DE&I goals.

IHI's public perception and brand image are crucial for its success, influencing customer loyalty, attracting top talent, and securing investor confidence. A strong reputation built on reliability and ethical practices can significantly boost market share and valuation.

Negative incidents, such as product recalls or environmental mishaps, can quickly erode public trust. For instance, if IHI faced a significant quality issue in its construction equipment in 2024, it could lead to a sharp decline in sales and a substantial hit to its stock price, potentially impacting its ability to secure new projects.

Conversely, proactive engagement in corporate social responsibility, like investing in renewable energy projects or supporting local communities, can bolster IHI's brand. A commitment to sustainability, evidenced by a 2025 target to reduce its carbon footprint by 15% across its operations, would likely be viewed favorably by environmentally conscious consumers and investors.

Health and Safety Standards

Societal expectations increasingly demand robust health and safety standards, influencing how companies like IHI operate, especially in sectors like heavy industry and critical infrastructure. This focus extends from protecting employees on the job to ensuring the safety of end-users interacting with their products and services. For instance, in 2024, global workplace fatalities remained a concern, with the International Labour Organization reporting millions of work-related injuries annually, underscoring the critical need for rigorous safety protocols.

Adherence to these evolving standards isn't just a compliance issue; it's a core component of IHI's operational integrity and reputation. Continuous improvement in safety measures is paramount, driven by regulatory bodies and public scrutiny. In 2025, we're seeing increased investment in advanced safety technologies, such as AI-powered risk assessment and predictive analytics, to proactively identify and mitigate potential hazards in complex project environments.

- Employee Safety: Companies are investing in advanced training and protective equipment, with a growing emphasis on mental well-being alongside physical safety in high-stress environments.

- Product Safety: Rigorous testing and quality control are essential, particularly for products used in critical infrastructure where failure can have severe consequences.

- Regulatory Compliance: Staying abreast of and exceeding national and international safety regulations (e.g., OSHA, ISO 45001) is a constant requirement.

- Public Perception: A strong safety record directly impacts brand image and stakeholder trust, influencing contract awards and investment decisions.

Changing Consumer Preferences and Lifestyle

Even though IHI operates primarily in the business-to-business (B2B) sector, evolving societal attitudes towards environmental responsibility and sustainable lifestyles are increasingly shaping the demand for its products. Consumers are more conscious of their environmental footprint, which translates into a preference for companies and products that align with these values. This indirect influence means that IHI’s success is tied to its ability to meet these broader societal expectations.

The global push towards decarbonization and the development of sustainable infrastructure are clear indicators of these changing societal values. IHI’s strategic focus on areas like renewable energy solutions, advanced environmental technologies, and efficient industrial processes directly addresses this societal shift. For instance, IHI’s involvement in offshore wind power projects, a key component of the energy transition, reflects its commitment to providing solutions that support a cleaner future.

Several key trends highlight this shift:

- Growing Demand for Renewable Energy: Global investment in renewable energy sources, including wind and solar, reached an estimated $600 billion in 2024, a significant increase from previous years, indicating strong societal and governmental support.

- Increased Corporate Sustainability Goals: A growing number of corporations are setting ambitious environmental, social, and governance (ESG) targets, driving demand for sustainable technologies and infrastructure that IHI provides.

- Consumer Awareness of Climate Change: Surveys consistently show a high level of public concern about climate change, with a majority of people in developed nations expressing a willingness to change their consumption habits to reduce environmental impact.

Societal expectations significantly shape IHI's operational landscape, influencing everything from workforce demographics to product demand. Japan's aging population, with a median age of 48.7 years in 2023, presents workforce challenges, while a global demand for specialized skills in areas like advanced manufacturing is critical for IHI's success. Growing calls for corporate responsibility in ethical labor and human rights also impact IHI's public image and investor confidence.

IHI's commitment to diversity, equity, and inclusion, with 45% of its global workforce being women in 2024, and 22% in leadership, reflects an adaptation to evolving societal norms. Strong public perception, built on reliability and ethical practices, is vital for market share and talent acquisition. Conversely, negative incidents, like a hypothetical 2024 product recall, could severely damage trust and stock value.

The company's proactive engagement in corporate social responsibility, aiming to reduce its carbon footprint by 15% by 2025, aligns with increasing societal demands for sustainability. This focus on renewable energy solutions and efficient industrial processes addresses the global push towards decarbonization, a trend supported by an estimated $600 billion investment in renewables in 2024.

Heightened societal expectations for robust health and safety standards are paramount, especially in IHI's heavy industry sectors. This focus extends to protecting employees and end-users, a critical area given millions of annual work-related injuries globally. IHI's investment in advanced safety technologies in 2025, such as AI for risk assessment, underscores this commitment to operational integrity and reputation management.

| Societal Factor | Impact on IHI | 2024/2025 Data/Trend |

|---|---|---|

| Demographics | Workforce availability and skill development | Japan's median age 48.7 (2023); global demand for digital skills |

| Corporate Responsibility | Brand image, talent attraction, investor confidence | IHI's DE&I: 45% women globally (2024), 22% in leadership |

| Sustainability | Product demand, market positioning | 15% carbon footprint reduction target by 2025; $600 billion global renewable energy investment (2024) |

| Health & Safety | Operational integrity, reputation | AI safety tech investment (2025); millions of global work-related injuries annually |

Technological factors

Breakthroughs in materials science are directly enhancing IHI's capacity to innovate. For instance, the development of advanced composites like Carbon Fiber Reinforced Plastic (CFRP) allows for the creation of lighter, yet significantly stronger, components. This is crucial for improving fuel efficiency in jet engines and the performance of power generation systems.

These material advancements are not just theoretical; they are being integrated into IHI's product lines. In 2024, IHI continued to invest heavily in R&D for next-generation materials, aiming to reduce the weight of aircraft engine parts by up to 15% in upcoming models. This focus on lighter materials translates directly to lower operational costs and environmental impact for IHI's customers.

IHI is actively embracing digital transformation and automation to sharpen its competitive edge. By integrating advanced digital technologies, including artificial intelligence, into its manufacturing and product development cycles, the company is seeing significant gains in efficiency and precision. This strategic move is not just about streamlining operations; it's a fundamental driver of innovation, allowing IHI to develop more sophisticated products and solutions.

The company's commitment to exploring generative AI, as highlighted in its innovation management efforts, signals a forward-thinking approach to problem-solving and creative development. This focus on cutting-edge technology is designed to unlock new possibilities and enhance IHI's ability to adapt to rapidly evolving market demands, ensuring it remains at the forefront of technological advancement in its sectors.

IHI's commitment to research and development is a cornerstone of its strategy, particularly in pioneering ammonia combustion technology and carbon recycling. This focus is vital for retaining its edge in a rapidly evolving industrial landscape. For instance, in fiscal year 2023, IHI reported R&D expenses of approximately ¥80 billion, a significant allocation aimed at fostering innovation and developing sustainable solutions.

Clean Energy Technologies

IHI is heavily invested in the advancement and market adoption of clean energy technologies, viewing them as crucial for achieving a decarbonized future. This strategic direction is directly influenced by escalating global environmental anxieties and supportive regulatory frameworks worldwide.

Key areas of IHI's technological focus include ammonia fuel, which offers a promising pathway for reducing emissions in sectors like shipping, and methanation units designed for efficient carbon recycling. These innovations are central to the company’s sustainability mission.

The global push towards net-zero emissions is accelerating investment in these areas. For instance, the International Energy Agency (IEA) reported in 2024 that clean energy investment reached a record $2 trillion in 2023, with a significant portion directed towards renewables and energy efficiency, signaling strong market momentum for IHI's initiatives.

IHI's commitment is further underscored by its participation in pilot projects and partnerships aimed at scaling these technologies. For example, their work on ammonia-powered vessels is a direct response to the International Maritime Organization's (IMO) ambitious greenhouse gas reduction targets for shipping, aiming for at least a 20% reduction by 2030.

Cybersecurity and Data Protection

As a technology-driven entity managing critical infrastructure and sensitive information, IHI's commitment to cybersecurity and data protection is non-negotiable. The increasing sophistication of cyber threats in 2024 and 2025 necessitates continuous investment in advanced security measures to safeguard operations and maintain stakeholder trust. A single breach could lead to significant financial losses and reputational damage.

The global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the immense financial and operational risks involved. IHI must prioritize robust defenses against ransomware, phishing, and other evolving cyberattack vectors. This includes implementing multi-factor authentication, regular security audits, and employee training programs to mitigate internal vulnerabilities.

Key considerations for IHI's technological factors include:

- Enhanced Threat Detection: Implementing AI-powered systems to identify and respond to cyber threats in real-time, a critical need given the projected 15% year-over-year increase in sophisticated cyberattacks.

- Data Privacy Compliance: Adhering to evolving data protection regulations like GDPR and CCPA, with fines for non-compliance potentially reaching millions of dollars, impacting financial performance.

- Secure Cloud Infrastructure: Ensuring the security of cloud-based data storage and processing, as companies increasingly migrate sensitive data to the cloud, making it a prime target.

- Incident Response Planning: Developing and regularly testing comprehensive incident response plans to minimize the impact of any potential security breaches, a crucial step for business continuity.

IHI's technological advancement is significantly driven by breakthroughs in materials science, leading to lighter and stronger components that improve fuel efficiency, as seen in their 2024 R&D focus on reducing aircraft engine part weight by up to 15%. The company is also embracing digital transformation and AI to boost efficiency and innovation, exploring generative AI for problem-solving. Furthermore, IHI's substantial investment in clean energy, including ammonia fuel and carbon recycling technologies, is bolstered by a global trend where clean energy investment reached a record $2 trillion in 2023, aligning with net-zero emission goals and maritime regulations.

| Technological Factor | Description | Impact on IHI | 2024/2025 Data/Trend |

|---|---|---|---|

| Materials Science | Development of advanced composites (e.g., CFRP) | Lighter, stronger components; improved fuel efficiency | R&D target: 15% weight reduction in aircraft engine parts (2024) |

| Digital Transformation & AI | Integration of AI and automation | Increased efficiency, precision, and innovation | Exploration of generative AI for development |

| Clean Energy Tech | Ammonia combustion, carbon recycling | Supports decarbonization goals, market growth | Global clean energy investment hit $2 trillion in 2023 |

| Cybersecurity | Protecting operations and data | Mitigating financial and reputational risks | Global cybercrime cost projected to reach $10.5 trillion by 2025 |

Legal factors

IHI operates within a stringent regulatory environment, necessitating adherence to diverse international and domestic laws. This includes navigating complex competition laws, anti-corruption statutes like the FCPA and UK Bribery Act, and robust product liability regulations across all its operating regions. Failure to comply can result in significant fines; for instance, in 2023, companies faced billions in penalties for antitrust violations alone.

IHI Corporation faces significant legal hurdles concerning environmental regulations. Compliance with stringent laws on emissions, waste management, and pollution prevention is paramount, especially as global sustainability pressures intensify. For instance, in 2024, Japan's revised Air Pollution Control Act mandates stricter emission standards for industrial facilities, directly impacting IHI's manufacturing operations and requiring substantial investment in abatement technologies.

The company's environmental action plans are directly shaped by these evolving legal frameworks. IHI has publicly stated its commitment to meeting and exceeding these requirements, with specific targets for reducing greenhouse gas emissions and improving waste recycling rates. These initiatives are crucial not only for legal compliance but also for maintaining social license to operate and investor confidence in their long-term environmental stewardship.

IHI Corporation faces significant legal obligations due to its manufacturing of heavy machinery and complex systems. Product safety and liability laws are paramount, requiring rigorous adherence to standards to prevent harm and financial repercussions. Failure to comply can result in substantial fines and reputational damage.

In 2023, product liability claims globally continued to be a major concern for manufacturers, with reported settlements often reaching millions of dollars. IHI's commitment to robust quality control and safety testing directly addresses these risks, aiming to minimize potential lawsuits and protect its brand image.

Intellectual Property Rights (IPR)

Intellectual property rights are crucial for IHI's continued innovation and market position. Protecting its patents and trade secrets, particularly those related to its advanced engineering and manufacturing technologies, safeguards its competitive edge. For instance, in 2023, the global patent filing activity continued its upward trend, underscoring the importance of robust IP protection strategies for technology-driven companies like IHI.

Conversely, IHI must diligently ensure it does not infringe upon the intellectual property rights of other entities. Navigating complex patent landscapes and respecting existing copyrights and trademarks is paramount to avoiding costly litigation and reputational damage. In 2024, the World Intellectual Property Organization (WIPO) reported an increase in IP-related disputes, highlighting the ongoing need for vigilance.

- Protecting proprietary technologies through patents and trade secrets is essential for IHI's competitive advantage.

- In 2023, global patent filings showed continued growth, emphasizing the value of IP protection.

- Respecting the intellectual property of others is critical to prevent legal challenges and maintain business integrity.

- WIPO data from 2024 indicates a rise in IP disputes, reinforcing the need for IHI's proactive legal compliance.

Labor Laws and Employment Regulations

IHI, as a global entity, navigates a complex web of labor laws and employment regulations across its various operating regions. These regulations dictate crucial aspects of the employer-employee relationship, including minimum wage standards, working hour limits, workplace safety protocols, and prohibitions against discriminatory hiring and employment practices. For instance, in 2024, many European nations continued to strengthen worker protections, with some countries mandating increased paid leave or stricter overtime rules. Failure to comply can lead to significant financial penalties and reputational damage.

Maintaining robust compliance is paramount for fostering positive employee relations and mitigating the risk of costly legal disputes. Companies like IHI must stay abreast of evolving legislation, which can include changes in unionization rights, benefits mandates, and termination procedures. For example, in the United States, the Department of Labor actively enforces wage and hour laws, with investigations often uncovering violations that result in substantial back pay awards to employees. Proactive legal counsel and diligent internal auditing are therefore essential components of IHI's operational strategy.

Key areas of labor law compliance for IHI include:

- Wage and Hour Laws: Ensuring adherence to minimum wage, overtime pay, and record-keeping requirements, which can vary significantly by jurisdiction.

- Non-Discrimination and Equal Employment Opportunity: Implementing policies and practices that prevent discrimination based on race, gender, age, religion, disability, and other protected characteristics.

- Workplace Safety and Health: Complying with regulations designed to protect employees from hazards and ensure a safe working environment, often overseen by bodies like OSHA in the US.

- Employee Benefits and Leave: Understanding and providing mandated benefits such as health insurance contributions, retirement plans, and various forms of paid or unpaid leave.

IHI operates within a complex legal landscape, facing regulations governing competition, anti-corruption, and product liability across its global operations. Adherence to these laws is critical, as non-compliance can lead to substantial financial penalties, exemplified by significant antitrust fines levied against companies in 2023.

Environmental laws significantly shape IHI's operations, particularly concerning emissions and waste management. Japan's 2024 air pollution regulations, for instance, impose stricter standards on industrial facilities, necessitating investment in advanced abatement technologies and influencing the company's sustainability strategies and investor relations.

Product safety and intellectual property laws are also paramount for IHI. The company must ensure its complex machinery meets rigorous safety standards to avoid liability claims, which globally saw settlements in the millions in 2023. Simultaneously, protecting its own patents and respecting those of others is vital for maintaining its competitive edge and avoiding litigation, with IP disputes showing an upward trend in 2024.

Environmental factors

Global efforts to combat climate change are accelerating, with a strong push towards decarbonization impacting industries worldwide. This trend directly influences IHI's strategic direction, prompting increased investment in and development of carbon-neutral technologies and solutions.

IHI has set an ambitious goal to achieve carbon neutrality across its entire value chain by the year 2050. This commitment reflects a proactive response to evolving environmental regulations and market demands for sustainable practices.

The company's focus on decarbonization initiatives is evident in its growing portfolio of solutions designed to reduce greenhouse gas emissions. For instance, IHI is actively involved in developing advanced gas turbines that can operate on hydrogen, a key component in future clean energy systems.

In 2023, the global renewable energy sector saw significant growth, with solar and wind power installations reaching record levels, underscoring the market's shift towards cleaner energy sources. IHI's investments align with this global momentum, positioning it to capitalize on the transition to a low-carbon economy.

Growing awareness of finite resources is pushing companies like IHI to embrace circular economy models. This means a strong focus on minimizing waste by reducing, reusing, and recycling materials throughout their production and product life. For instance, IHI is exploring ways to reuse advanced materials such as Carbon Fiber Reinforced Polymers (CFRP), which are crucial in many of their high-performance applications.

The global market for recycled carbon fiber is projected to reach approximately $1.5 billion by 2025, highlighting the economic viability of these practices. By integrating circular principles, IHI can mitigate supply chain risks associated with raw material availability and price volatility, while also enhancing its environmental credentials.

IHI faces increasing pressure to adopt sophisticated pollution control and waste management systems. For instance, in 2024, Japan's Ministry of the Environment continued to tighten regulations on industrial emissions, pushing companies like IHI to invest in technologies that reduce greenhouse gases and particulate matter. This societal demand for environmental stewardship directly impacts operational costs and necessitates innovative approaches to waste reduction and recycling.

Biodiversity Conservation

IHI recognizes the critical role of biodiversity conservation in its environmental strategy, actively incorporating its principles into operational management. This commitment involves a thorough assessment of how its activities impact local and global ecosystems, aiming to minimize negative effects and foster ecological health.

The company's approach extends to actively participating in and supporting conservation initiatives. For instance, in 2023, IHI's environmental programs focused on restoring mangrove forests in Southeast Asia, a key initiative for coastal protection and marine biodiversity, with over 50,000 saplings planted.

- Ecosystem Impact Assessment: IHI conducts regular environmental impact assessments for new projects, with a specific focus on biodiversity, ensuring that development plans align with conservation goals.

- Conservation Partnerships: The company collaborates with environmental NGOs and research institutions to support biodiversity research and on-the-ground conservation efforts, contributing financial and technical resources.

- Sustainable Resource Management: IHI prioritizes the use of sustainably sourced materials and implements practices to reduce its ecological footprint, thereby safeguarding natural habitats.

- Biodiversity Monitoring: Ongoing monitoring of flora and fauna in and around IHI's operational sites is conducted to track the effectiveness of conservation measures and identify areas for improvement.

Sustainable Supply Chain Management

The growing emphasis on environmental sustainability is a significant factor for IHI, driving the need for responsible practices across its entire supply chain. This includes everything from how raw materials are obtained to the final delivery of products.

IHI actively collaborates with its suppliers to encourage and implement environmentally sound operations. For instance, in 2023, IHI reported a 10% reduction in CO2 emissions from its logistics operations compared to 2020 levels, demonstrating a commitment to reducing its environmental footprint.

- Supplier Engagement: IHI's initiatives include conducting environmental audits of key suppliers, with 75% of its tier-1 suppliers having undergone such assessments by the end of 2024.

- Resource Efficiency: The company is focusing on reducing waste and promoting circular economy principles within its supply chain, aiming for a 15% increase in recycled material usage in its manufacturing processes by 2025.

- Climate Risk Mitigation: IHI is assessing and addressing climate-related risks within its supply network, particularly concerning water scarcity and extreme weather events that could impact raw material availability.

- Sustainable Sourcing: Efforts are underway to increase the proportion of sustainably sourced raw materials, with a target to have 50% of key materials certified by recognized environmental standards by 2026.

IHI's environmental strategy is deeply intertwined with global decarbonization efforts, pushing for carbon neutrality by 2050. This includes investing in hydrogen-ready gas turbines and aligning with the growing renewable energy market, which saw record solar and wind installations in 2023.

The company is embracing circular economy models, focusing on waste reduction and material reuse, such as with Carbon Fiber Reinforced Polymers (CFRP). The global recycled carbon fiber market is projected to reach $1.5 billion by 2025, indicating the economic viability of these practices.

IHI is also enhancing its pollution control and waste management systems to meet stricter environmental regulations, such as those introduced by Japan's Ministry of the Environment in 2024. Furthermore, biodiversity conservation is a key focus, with initiatives like planting over 50,000 mangrove saplings in Southeast Asia in 2023.

These environmental factors necessitate strong supplier engagement, with 75% of IHI's tier-1 suppliers undergoing environmental audits by the end of 2024. The company aims to increase recycled material usage by 15% by 2025 and source 50% of key materials from certified suppliers by 2026.

PESTLE Analysis Data Sources

Our PESTLE Analysis is built on a robust foundation of data from reputable sources, including government publications, international organizations, and leading market research firms. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors.