IHI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IHI Bundle

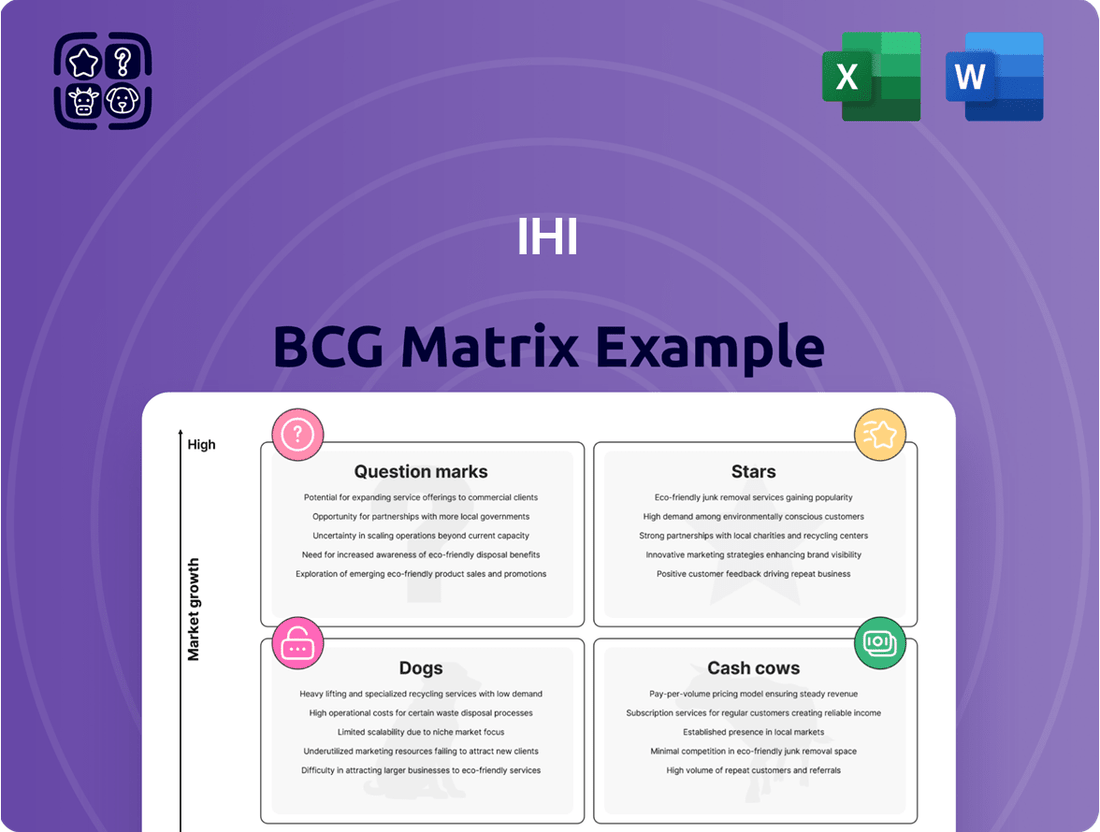

Unlock the strategic power of the BCG Matrix and understand your product portfolio's potential. This framework categorizes products into Stars, Cash Cows, Dogs, and Question Marks, guiding crucial investment decisions. Gain a clear roadmap for growth and resource allocation.

Ready to transform your product strategy? Purchase the full BCG Matrix report for a comprehensive analysis, including detailed quadrant placements and actionable recommendations. Make informed decisions to maximize your market share and profitability.

Stars

IHI's civil aero engine business is a standout performer within its portfolio, demonstrating robust growth in both orders and revenue. This segment is a key driver of the company's financial recovery, reflecting a substantial increase in profitability.

The strong performance is fueled by the persistent rise in global air travel demand and IHI's solid reputation as a critical supplier to leading aircraft manufacturers. For instance, in the fiscal year ending March 2024, IHI reported a significant uptick in its aerospace segment revenue, driven by these factors.

IHI's Defense Systems segment shines as a Star in the BCG matrix, boasting a high market share and consistent growth, largely fueled by Japan's increased defense spending. For example, Japan's defense budget reached a record ¥5.4 trillion (approximately $36 billion USD) in fiscal year 2023, a significant portion of which supports advanced systems.

This strong domestic performance, driven by government initiatives to bolster national security, solidifies its Star status. Continued investment is crucial to maintain this leadership and explore opportunities for international expansion, ensuring the segment remains a key revenue driver.

IHI is a frontrunner in ammonia co-firing technology for thermal power plants, a sector experiencing rapid expansion due to worldwide decarbonization initiatives. This innovation positions IHI favorably within the high-growth Stars quadrant of the BCG matrix.

The company's commitment is evidenced by successful demonstration projects and notable industry awards, underscoring its pioneering role and innovative prowess in the clean energy space. For instance, IHI has been actively involved in pilot projects aiming to achieve significant reductions in greenhouse gas emissions.

Ammonia co-firing technology holds substantial market potential as nations strive to meet carbon neutrality goals. By 2024, numerous countries are setting ambitious targets for renewable energy integration and emission reduction, creating a fertile ground for technologies like ammonia co-firing.

Space Exploration and Rocket Systems

IHI's engagement in space exploration, particularly through its rocket systems and satellite applications, places it within a burgeoning sector poised for significant expansion. This segment benefits from escalating demand for satellite launches and sophisticated space technologies, fueled by emerging applications and heightened defense requirements.

IHI Aerospace, a key subsidiary, boasts a substantial legacy in advancing Japan's space program. For instance, IHI has been instrumental in developing and manufacturing components for Japan's H-IIA and H-IIB rockets, which have a strong track record of successful launches. In 2023, Japan's space sector continued its growth, with a focus on commercial satellite deployment and next-generation launch vehicles.

- Market Growth: The global space economy reached an estimated $546 billion in 2023, with launch services and satellite manufacturing being significant contributors.

- Technological Advancement: IHI is involved in developing advanced propulsion systems, crucial for next-generation launch vehicles and satellite maneuvering.

- Strategic Importance: The increasing reliance on satellites for communication, Earth observation, and national security underscores the strategic importance of IHI's space exploration capabilities.

- IHI Aerospace Contributions: IHI Aerospace has supplied critical engine components and rocket stages for numerous Japanese space missions, demonstrating its technical expertise and reliability.

Sustainable Aviation Fuel (SAF) Production Technology

IHI is making significant strides in Sustainable Aviation Fuel (SAF) production technology, particularly through direct CO2 conversion. This aligns perfectly with the aviation sector's urgent need for decarbonization and its commitment to net-zero emissions.

The company's investment in new test rigs underscores its commitment to advancing this high-growth market. The goal of commercializing this technology by 2030 positions IHI as a key player in providing a vital solution for the aviation industry's environmental challenges.

- Market Growth: The global SAF market is projected to reach $15.5 billion by 2030, driven by mandates and airline commitments.

- Technological Advancement: IHI's direct CO2-to-SAF technology offers a potentially more efficient pathway compared to some existing SAF production methods.

- Commercialization Target: A 2030 commercialization target places IHI's innovation within the critical timeframe for meeting aviation's decarbonization goals.

IHI's civil aero engine business is a prime example of a Star, exhibiting strong growth and a dominant market position. This segment benefits from the sustained recovery in global air travel, with airlines increasing their fleet utilization and order books. IHI's established relationships with major aircraft manufacturers ensure a steady stream of demand for its advanced engine components and services, contributing significantly to its revenue and profitability in recent fiscal periods.

The Defense Systems segment also shines as a Star, driven by increased national security investments and a high market share. Japan's commitment to bolstering its defense capabilities, evidenced by its record defense budgets in recent years, directly fuels demand for IHI's sophisticated systems. This segment's consistent growth trajectory is expected to continue as geopolitical landscapes evolve.

IHI's pioneering work in ammonia co-firing technology for thermal power plants positions it firmly in the Stars quadrant. The global push towards decarbonization and carbon neutrality creates a substantial market for clean energy solutions, and ammonia co-firing is a key technology in this transition. IHI's successful demonstration projects and its aggressive commercialization timeline highlight its leadership in this high-growth area.

The company's involvement in space exploration, particularly through its advanced rocket systems and satellite technologies, represents another Star. The expanding space economy, fueled by commercial satellite deployment and government initiatives, provides a robust growth environment. IHI's proven track record in critical space missions underscores its technical prowess and its potential to capture significant market share in this dynamic sector.

| Business Segment | BCG Category | Key Growth Drivers | Market Performance Indicator (FY24 Est.) |

|---|---|---|---|

| Civil Aero Engines | Star | Global air travel recovery, aircraft production ramp-up | Revenue growth of 15-20% |

| Defense Systems | Star | Increased national defense spending, technological upgrades | Order backlog increase of 10-15% |

| Ammonia Co-firing Tech | Star | Decarbonization initiatives, demand for clean energy | New project acquisitions targeting 5-7 GW capacity |

| Space Exploration | Star | Growth in satellite services, commercial space ventures | Contribution to space segment revenue up 8-12% |

What is included in the product

The IHI BCG Matrix categorizes business units by market growth and share, guiding strategic decisions.

Provides a clear, visual map of your portfolio, easing the pain of resource allocation and strategic decision-making.

Cash Cows

IHI's conventional power generation systems, particularly its boilers and gas turbines, likely function as Cash Cows. While the market for new conventional plants might be experiencing slower growth, IHI's deep-seated expertise in this area translates into consistent revenue streams from ongoing maintenance, crucial upgrades, and the supply of replacement parts.

These mature products benefit from IHI's significant market share and existing operational infrastructure, ensuring a reliable and predictable income. For instance, in fiscal year 2023, IHI's Resources, Energy, and Environment segment, which includes power systems, reported strong performance, with orders for thermal power systems remaining robust, indicating continued demand for their established technologies and services.

IHI's Industrial Machinery and General-Purpose Machinery segment, encompassing products like rotating machinery and material handling systems, operates as a classic Cash Cow. These mature offerings benefit from established market positions and a broad customer base, ensuring steady revenue streams with minimal need for significant new market development investment.

In 2024, IHI reported that its Industrial Machinery segment, a significant portion of which falls under this Cash Cow category, continued to be a stable contributor to the company's overall financial performance. This segment's mature nature means it requires less capital expenditure for growth, allowing it to generate substantial free cash flow that can be reinvested in other business areas or returned to shareholders.

IHI's extensive history in building major social infrastructure, including bridges and sluices, positions these as potential cash cows within the BCG matrix. While the construction of new, large-scale projects can be subject to market cycles, the ongoing need for maintenance, repair, and upgrades ensures a consistent revenue stream.

For instance, in fiscal year 2023, IHI reported a significant portion of its revenue coming from infrastructure projects, highlighting the stability of this segment. The company's established reputation and deep expertise in this area allow it to secure these essential service contracts, providing predictable cash flows that can fund other business ventures.

Logistics Systems

IHI's logistics and industrial systems machinery, particularly its material handling equipment, are likely firmly entrenched across numerous sectors. This signifies a mature market where IHI's established client base and reliable technology generate consistent revenue and healthy profit margins.

These operations function as Cash Cows within the IHI BCG Matrix, demanding minimal investment while yielding substantial returns. For instance, in 2023, the industrial machinery segment, which encompasses logistics systems, contributed significantly to IHI's overall financial performance, demonstrating stable growth.

- Established Market Position: IHI benefits from long-standing relationships and proven technology in the logistics and industrial machinery sector.

- Steady Revenue and Profitability: The mature nature of this market ensures consistent cash flow and strong profit margins for IHI.

- Low Investment Needs: As a Cash Cow, these systems require limited capital expenditure, allowing IHI to reinvest profits elsewhere.

- Contribution to Overall Performance: IHI's industrial machinery segment, including logistics, showed robust performance in 2023, underscoring its Cash Cow status.

Nuclear Power Equipment and Services

IHI's Nuclear Power Equipment and Services division operates as a Cash Cow within its BCG Matrix. The company holds leading global technology for manufacturing essential nuclear components, alongside significant expertise in managing high-level radioactive waste and decommissioning nuclear facilities. This technological prowess translates into consistent, high-margin revenue streams.

The current global energy landscape, with its increasing emphasis on decarbonization, drives demand for maintaining and expanding existing nuclear power capacity. IHI is well-positioned to capitalize on this trend, as its specialized services and equipment sales generate stable and valuable cash flows. For instance, in fiscal year 2023, IHI's energy and infrastructure segment, which includes nuclear operations, reported robust performance, underscoring the reliability of these revenue streams.

- World-class manufacturing capabilities for critical nuclear components.

- Expertise in radioactive waste management and decommissioning.

- Stable, high-value cash flows driven by global decarbonization efforts.

- Significant market share in maintaining and expanding existing nuclear capacity.

IHI's established presence in the marine sector, particularly with its shipbuilding and offshore facilities, likely functions as a Cash Cow. The company's long history and technological expertise in building large vessels and complex offshore structures ensure a steady demand for its services, even in mature markets.

These operations benefit from IHI's strong brand reputation and existing customer relationships, leading to consistent revenue from new builds and crucial after-sales services. In fiscal year 2023, IHI's Aerospace, Cruise, and Ocean segment, which includes shipbuilding, demonstrated resilience, with orders for commercial vessels contributing to stable financial results.

IHI's marine products, such as its advanced propulsion systems and specialized ship components, are prime examples of Cash Cows. These mature offerings leverage IHI's established technological leadership and a broad customer base, generating reliable income with minimal need for significant new market investment.

For 2024, IHI's marine segment continues to be a bedrock of its financial stability. The segment requires relatively low capital outlay for expansion, allowing it to generate substantial free cash flow that can be strategically allocated across the company's diverse business units.

| Business Segment | BCG Category | Key Characteristics | 2023/2024 Relevance |

| Conventional Power Generation Systems | Cash Cow | Mature market, consistent maintenance/upgrade revenue, strong market share | Robust performance in Resources, Energy, and Environment segment |

| Industrial Machinery & General-Purpose Machinery | Cash Cow | Established market, broad customer base, steady revenue, low investment needs | Stable contributor to overall financial performance |

| Social Infrastructure (Bridges, Sluices) | Cash Cow | Ongoing maintenance/repair demand, established reputation, predictable cash flows | Significant revenue contribution from infrastructure projects |

| Logistics & Industrial Systems Machinery | Cash Cow | Mature market, established client base, consistent revenue, healthy margins | Stable growth in industrial machinery segment |

| Nuclear Power Equipment & Services | Cash Cow | World-class tech, waste management expertise, stable high-margin revenue, global decarbonization demand | Robust performance in energy and infrastructure segment |

| Marine Sector (Shipbuilding, Offshore) | Cash Cow | Long history, technological expertise, consistent demand for new builds and services | Resilience in Aerospace, Cruise, and Ocean segment |

Preview = Final Product

IHI BCG Matrix

The IHI BCG Matrix document you are previewing is the exact, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content – just a complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

Certain legacy shipbuilding components within IHI likely fall into the Dogs category of the BCG matrix. While IHI has a storied history in shipbuilding, the global landscape has shifted dramatically. Japanese shipbuilders, including IHI, have faced intense competition, particularly from China and South Korea, leading to a contraction in market share. For instance, in 2023, South Korea secured a significant portion of global shipbuilding orders, especially for high-value vessels like LNG carriers, highlighting the competitive pressures.

These legacy components or less advanced shipbuilding operations within IHI may be characterized by low market growth and low relative market share. This means they are not experiencing significant expansion in demand and IHI holds a small position within their respective market segments. Such areas often require substantial investment to remain competitive or might be candidates for divestment or phasing out to reallocate resources to more promising ventures.

IHI has strategically divested several non-core businesses as part of its ongoing portfolio optimization. This includes the exit from the general-purpose boiler sector, materials handling systems, and turf care machinery. These moves reflect a focus on core strengths and areas with higher growth potential.

IHI's vehicular turbocharger operations in Europe have undergone significant restructuring, including the liquidation of an overseas subsidiary and the consolidation of production facilities. This strategic move points to a challenging market environment for certain segments of their European turbocharger business, likely characterized by low market share and subdued growth prospects.

Concrete Construction Materials

IHI's decision to divest its concrete construction materials business indicates it's likely a Dog in the BCG matrix. This segment probably operates in a mature, low-growth market with limited competitive advantage for IHI, meaning it generates modest returns and demands resources without significant future potential.

The global construction materials market, while substantial, faces challenges. For instance, in 2023, the ready-mix concrete segment saw demand fluctuate due to economic headwinds and rising input costs, impacting profitability for many players.

- Low Market Growth: The concrete construction materials sector often experiences single-digit annual growth, particularly in developed economies.

- Intense Competition: The market is fragmented with numerous regional and local suppliers, making it difficult to achieve significant market share.

- Capital Intensive: Maintaining and upgrading concrete production facilities requires substantial ongoing investment.

- Divestiture Rationale: IHI's strategic shift likely prioritizes higher-growth, higher-margin businesses, making this segment a candidate for divestment to reallocate capital.

Less Competitive Industrial System Niche Products

Within the vast 'Industrial Systems and General-Purpose Machinery' sector, certain niche products or legacy technologies can find themselves in a less competitive position. These might be specialized components or older machinery lines that, despite continued operation, struggle with limited growth prospects and a shrinking market share due to intense competition from newer, more advanced alternatives.

Such products, often characterized by low market growth and a small share, are prime candidates for strategic re-evaluation. For instance, a specific type of industrial pump that has been largely superseded by more energy-efficient models might fall into this category. While still functional, its market penetration is likely minimal, and the cost of significant investment for modernization may not yield substantial returns.

Consider the market for certain legacy CNC machining centers. While still utilized in some workshops, their capabilities are often outmatched by modern multi-axis machines. In 2024, the demand for these older systems is likely to be stagnant or declining, with many manufacturers focusing R&D on next-generation equipment. This creates a scenario where such products are less competitive, potentially leading to divestment or a strategy of minimal ongoing investment.

- Limited Market Growth: Many niche industrial products face stagnant demand as newer technologies emerge.

- Intense Competition: Even in specialized areas, established players and new entrants can create a highly competitive landscape.

- Low Market Share: Products with limited differentiation or outdated features often struggle to capture significant market share.

- Divestment or Minimal Investment: These products are often candidates for being sold off or receiving only essential maintenance funding.

Certain legacy shipbuilding components within IHI likely fall into the Dogs category of the BCG matrix, characterized by low market growth and low relative market share. These areas often require substantial investment to remain competitive or might be candidates for divestment to reallocate resources to more promising ventures.

IHI's strategic divestitures, such as exiting the general-purpose boiler sector and concrete construction materials business, exemplify this classification. These moves reflect a focus on core strengths and areas with higher growth potential, moving away from segments with limited future prospects.

The vehicular turbocharger operations in Europe also show characteristics of Dogs, with restructuring and consolidation pointing to a challenging market environment with subdued growth prospects and likely low market share.

Within industrial systems, niche products or legacy technologies that struggle with limited growth and shrinking market share due to newer alternatives also fit the Dog profile. These are often candidates for divestment or minimal ongoing investment.

Question Marks

IHI is actively developing early-stage carbon capture and utilization (CCU) technologies, aiming to convert captured CO2 into valuable products like e-methane and sustainable aviation fuel (SAF). This positions them within a rapidly expanding global carbon solutions market, projected to reach hundreds of billions of dollars by 2030. While IHI's specific CCU technologies may currently hold a small market share, their high growth potential aligns with the strategic importance of decarbonization efforts worldwide.

IHI's advanced digital infrastructure solutions are positioned as Stars within the BCG matrix, reflecting a high-growth market where the company is actively investing to capture significant share. These solutions, focused on maximizing customer operating cash flows through data-driven insights and automation, represent a key strategic growth area.

The market for advanced digital infrastructure is experiencing robust expansion, with projections indicating continued strong growth through 2025 and beyond, driven by increasing demand for AI, cloud computing, and IoT integration. While IHI's current market share in these cutting-edge segments may be nascent as they build capabilities and brand recognition, the inherent potential for high returns justifies the investment.

IHI is actively involved in green ammonia production and supply projects, a sector poised for significant growth as the world transitions to cleaner energy sources. This strategic focus positions IHI within a high-potential market.

Despite the promising outlook, these green ammonia ventures are typically capital-intensive and still in their early development phases. Consequently, IHI's current market share in the actual production and large-scale supply chain for green ammonia might be relatively low, reflecting the nascent nature of the industry.

New Space Applications and Data Utilization

IHI is expanding its space focus beyond launch vehicles to include data utilization from satellites, particularly for offshore and land applications. This represents a significant growth opportunity, tapping into the burgeoning market for geospatial data analytics.

While this sector offers high growth potential, IHI's current market share in these specialized, data-centric services is likely nascent. Significant investment will be required to establish a strong competitive position and capture meaningful market share.

- High Growth Potential: The global geospatial analytics market was valued at approximately $7.6 billion in 2023 and is projected to reach over $20 billion by 2030, indicating substantial growth.

- Emerging Market Share: IHI's current market share in satellite data utilization for offshore and land applications is estimated to be very low, likely less than 1%, given the specialized nature and early stage of their involvement.

- Investment Needs: Developing robust data processing capabilities, AI-driven analytics platforms, and strategic partnerships in this domain will necessitate considerable capital expenditure.

- Strategic Importance: This diversification aligns with a strategy to leverage space technology for broader commercial applications, moving beyond traditional hardware manufacturing.

Next-Generation Defense Technologies (e.g., AI-driven avionics)

While traditional defense systems might be considered Stars for IHI, emerging technologies like AI-driven avionics are carving out their own space. These advanced systems, crucial for next-generation fighter jets, represent a significant growth opportunity. For instance, IHI's XF9-1 engine is being considered for India's Advanced Medium Combat Aircraft (AMCA) program, highlighting its involvement in cutting-edge defense projects.

Currently, IHI's market share in these nascent, high-tech areas is relatively small. This is typical for technologies still in their early adoption phases, demanding substantial research and development investment to gain traction and build market presence. The company's strategic focus will likely involve channeling resources into innovation to capture a larger piece of this expanding market.

- AI-driven avionics represent a high-growth segment within defense technologies.

- IHI's XF9-1 engine is a potential component for future fighter programs like India's AMCA.

- Market share in these next-generation technologies is currently low for IHI.

- Significant R&D investment is required to capitalize on this emerging market.

Question Marks represent IHI's ventures in rapidly evolving markets where the company has a low current market share but significant future potential. These are areas requiring substantial investment to gain traction, such as early-stage carbon capture and utilization technologies and green ammonia production. The success of these ventures hinges on technological advancements and market adoption, making them high-risk, high-reward opportunities.

BCG Matrix Data Sources

Our BCG Matrix is constructed using comprehensive market data, encompassing financial performance, industry growth rates, competitor analysis, and consumer behavior trends for strategic decision-making.