The IHC Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The IHC Group Bundle

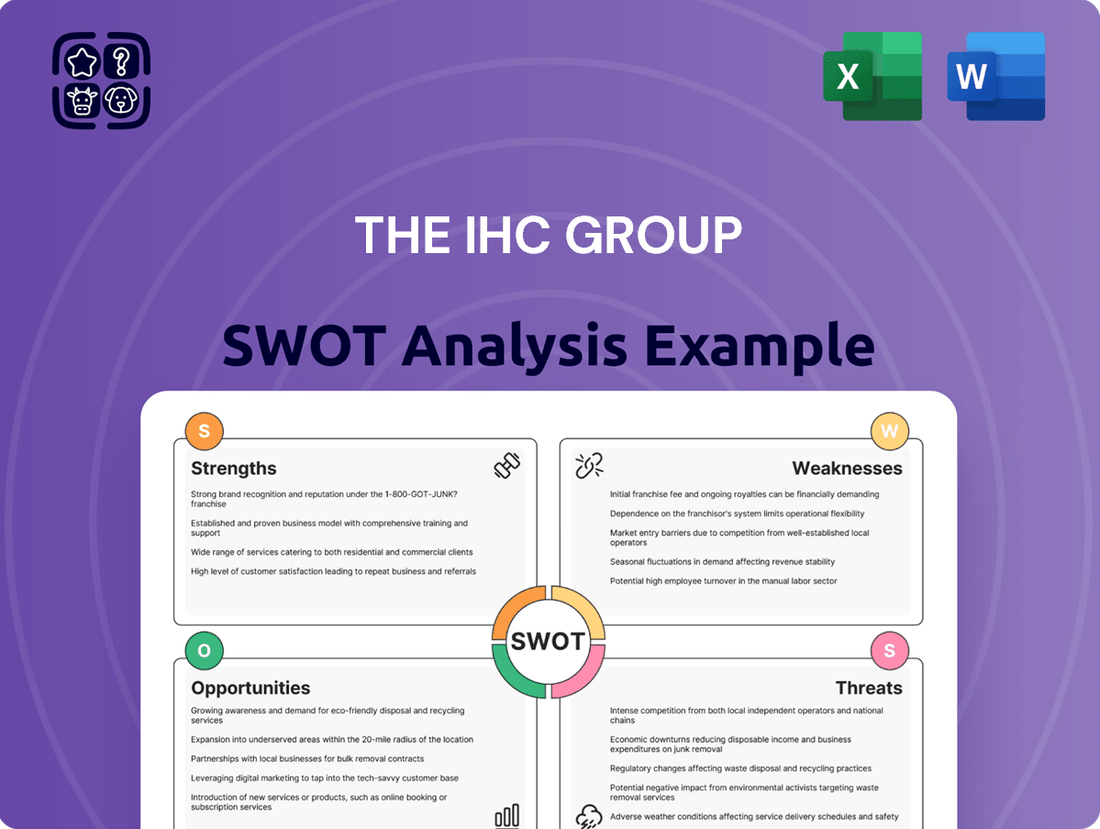

The IHC Group's SWOT analysis reveals a strong market presence and a commitment to innovation, but also highlights potential challenges in a dynamic industry. Understanding these internal capabilities and external pressures is crucial for strategic decision-making.

Want the full story behind the company’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

The IHC Group boasts a highly diversified product portfolio, encompassing life insurance, annuities, medical stop-loss, group term life, short-term medical, and various supplemental health insurance offerings. This breadth of products allows the company to serve a wide array of customer needs and market segments.

This strategic diversification is a significant strength, as it reduces the company's dependence on any single product line, thereby mitigating risk and fostering greater revenue stability. For example, in 2024, the supplemental health insurance segment continued to show robust growth, contributing significantly to the overall financial performance.

The IHC Group's specialization in niche markets, particularly medical stop-loss insurance, offers a distinct competitive advantage. This focus allows them to cater effectively to employers increasingly adopting self-funded health plans, a trend driven by the desire to manage healthcare costs and mitigate the impact of unpredictable, high-cost medical events.

The IHC Group's reinsurance capabilities are a significant strength, allowing it to underwrite risks more effectively and manage its capital efficiently. This internal capacity not only supports its core insurance operations but also presents opportunities for generating fee income and diversifying revenue.

By reinsuring a portion of its risks, IHC Group can better absorb potential losses and maintain financial stability, particularly in volatile market conditions. For instance, in 2024, the global reinsurance market saw premiums increase, highlighting the demand for such services, and IHC's participation in this space positions it favorably.

Strategic Acquisition Activity

The IHC Group has actively pursued strategic acquisitions to fuel its expansion. A notable example is the May 2024 acquisition of Spot Pet Insurance Services, a move designed to broaden its market presence and diversify its product portfolio within the pet insurance sector.

These strategic moves allow IHC Group to integrate new capabilities and potentially enhance its competitive standing. By acquiring companies like Spot Pet Insurance, IHC Group can leverage existing customer bases and operational synergies to drive overall business growth and strengthen its market position.

- Strategic Growth Through Acquisitions: Demonstrated by the May 2024 acquisition of Spot Pet Insurance Services.

- Market Expansion: Acquisitions help broaden the company's reach into new customer segments and geographic areas.

- Diversification of Offerings: Integrating new businesses allows for a wider range of products and services.

- Capability Integration: Acquisitions bring in new technologies, expertise, and operational efficiencies.

Focus on Individual and Group Solutions

The IHC Group's strategic advantage lies in its ability to cater to both individual and group insurance needs. This dual market approach allows them to tap into a wider customer base, from individuals seeking personal coverage to employers looking for employee benefits. This flexibility is crucial in the dynamic insurance sector.

By offering solutions for both segments, IHC Group can achieve greater market penetration and diversify its revenue streams. This broad appeal helps them adapt to different economic conditions and customer demands, ensuring a more robust business model. For instance, their group offerings can provide stability during periods of lower individual policy sales.

This dual focus also enables IHC Group to cross-sell products effectively. Individuals who initially purchase personal insurance might later become part of a group plan through their employer, or vice versa. This integrated approach fosters customer loyalty and maximizes lifetime value.

The company's commitment to both individual and group markets is reflected in its product development and sales strategies. For 2024, industry analysts project continued growth in the group benefits sector, with employers increasingly prioritizing comprehensive health and wellness packages for their employees. IHC Group is well-positioned to capitalize on this trend.

- Broader Market Reach: Serves both individual consumers and employer-sponsored group plans.

- Revenue Diversification: Reduces reliance on a single market segment.

- Cross-Selling Opportunities: Leverages existing customer relationships across different product lines.

- Market Responsiveness: Adapts offerings to meet diverse individual and group needs.

The IHC Group's diversified product suite, spanning life insurance, annuities, medical stop-loss, and supplemental health, provides a robust foundation for revenue stability and risk mitigation. Its specialization in niche areas like medical stop-loss insurance offers a competitive edge, catering to employers seeking cost management solutions. Furthermore, the company's reinsurance capabilities enhance risk underwriting and capital efficiency, positioning it favorably in a growing reinsurance market.

| Segment | 2024 Growth Projection | Key Offering |

|---|---|---|

| Supplemental Health | Robust Growth | Addresses diverse health needs |

| Medical Stop-Loss | High Demand | Cost management for self-funded plans |

| Group Term Life | Stable | Employee benefit solutions |

What is included in the product

Delivers a strategic overview of The IHC Group’s internal and external business factors, highlighting its market strengths, operational gaps, and potential risks.

Provides a clear SWOT analysis for identifying and addressing potential market challenges, thus relieving strategic uncertainty.

Weaknesses

As a subsidiary of Geneve Holdings following its 2022 take-private transaction, Independence Holding Company's (IHC) financial disclosures might be less extensive than those of a publicly traded company. This reduced public transparency can make it harder for external parties to fully assess IHC's ongoing financial health and performance.

The IHC Group's health insurance and medical stop-loss offerings are particularly vulnerable to escalating healthcare expenses. This includes the impact of costly new pharmaceuticals and a general uptick in patient service usage. For instance, the Centers for Medicare & Medicaid Services projected in 2024 that national health spending would grow by 5.5% in 2024, reaching $4.8 trillion, a trend that directly affects insurers.

This exposure to inflation can significantly squeeze underwriting margins and challenge the company's long-term financial health. Without robust strategies for price adjustments and effective cost containment measures, profitability could be compromised.

The IHC Group's operations are significantly influenced by the regulatory landscape of the insurance sector. For instance, potential changes to healthcare legislation in 2024 or 2025, such as modifications to the Affordable Care Act (ACA), could directly affect IHC's health insurance offerings, impacting market access and revenue streams.

Increased compliance demands stemming from evolving regulations can also elevate operational expenses. In 2023, the U.S. health insurance industry saw administrative costs average around 10-15% of premium revenue, a figure that could rise with more stringent reporting or oversight, thereby pressuring profitability for companies like IHC.

Competition in Core Markets

The IHC Group operates within intensely competitive sectors, including life, annuity, and health insurance. Established companies with significant market share and brand recognition present a formidable challenge.

Market dynamics are further complicated by ongoing consolidation, particularly among stop-loss carriers. This trend intensifies the competitive environment, potentially exerting downward pressure on premium rates and contract terms for IHC Group.

- Intense Competition: Life, annuity, and health insurance markets are characterized by a large number of established competitors.

- Market Consolidation: Increased mergers and acquisitions among stop-loss carriers heighten competitive pressures.

- Premium Pressure: Consolidation can lead to reduced pricing power and tighter margins for IHC Group.

- Terms and Conditions: A concentrated market may result in less favorable terms being offered by competitors.

Integration Challenges Post-Acquisition

Integrating acquired companies, like Spot Pet Insurance, into The IHC Group's existing operations can be complex. These challenges can arise from differing IT systems, operational processes, and even corporate cultures. For instance, a significant hurdle in such integrations often involves harmonizing customer service platforms and data management to ensure a seamless experience for policyholders.

Failure to effectively integrate can directly impact financial performance. In 2023, companies that experienced prolonged integration periods post-acquisition reported an average of 15% higher operational costs during the first year compared to those with smoother transitions. This can erode the anticipated benefits of the acquisition, such as increased market share or expanded product offerings.

The IHC Group must navigate these integration hurdles to fully leverage its acquisitions. Key areas of focus include:

- Streamlining IT Systems: Ensuring compatibility and efficient data flow between The IHC Group and acquired entities.

- Cultural Alignment: Fostering a unified organizational culture to improve collaboration and employee retention.

- Synergy Realization: Actively managing the integration process to achieve projected cost savings and revenue growth.

- Customer Experience Management: Maintaining and enhancing customer satisfaction during and after the integration process.

The IHC Group faces significant pressure from rising healthcare costs, with a 5.5% national health spending growth projected for 2024 by CMS, impacting underwriting margins. Regulatory shifts, such as potential Affordable Care Act modifications in 2024-2025, could directly affect revenue streams and market access.

Intense competition in life, annuity, and health insurance markets, coupled with industry consolidation, particularly among stop-loss carriers, may reduce pricing power and profitability for IHC Group. Integrating acquisitions, like Spot Pet Insurance, presents operational complexities, with prolonged integration periods in 2023 leading to an average of 15% higher operational costs.

| Weakness | Description | Impact |

| Rising Healthcare Costs | Increasing expenses for pharmaceuticals and patient services. | Squeezed underwriting margins, potential profitability challenges. |

| Regulatory Uncertainty | Potential changes to healthcare legislation and compliance demands. | Altered market access, increased operational expenses. |

| Competitive Landscape | Intense competition and market consolidation in insurance sectors. | Reduced pricing power, pressure on contract terms. |

| Acquisition Integration | Complexity in integrating acquired entities' systems and cultures. | Higher operational costs, delayed synergy realization. |

Preview the Actual Deliverable

The IHC Group SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of The IHC Group's Strengths, Weaknesses, Opportunities, and Threats. It’s designed to offer actionable insights for strategic planning.

Opportunities

The self-funded employer market is a significant growth area, with employers increasingly seeking ways to manage rising healthcare expenses. This shift towards self-funding presents a prime opportunity for IHC Group to expand its reach within this segment.

In 2024, the medical stop-loss market was projected to reach $30 billion, driven by this trend. IHC Group is well-positioned to capitalize on this expansion, particularly by serving small and medium-sized businesses that are adopting self-funded plans.

Favorable economic and demographic trends are significantly boosting the annuity market. An aging population, with a growing need for reliable retirement income, coupled with persistently elevated interest rates, is fueling robust demand for annuity products. This creates a substantial growth opportunity for IHC Group's annuity offerings.

The insurance sector's embrace of digital transformation and AI presents significant opportunities for IHC Group. By integrating advanced analytics and artificial intelligence, IHC can streamline operations, refine underwriting processes, and effectively manage expenses. For instance, the global AI in insurance market was valued at approximately $1.5 billion in 2023 and is projected to reach over $13 billion by 2030, showcasing the immense potential for efficiency gains and improved decision-making.

Investing in these cutting-edge technologies will enable IHC Group to deliver superior products and foster deeper customer engagement. AI-powered tools can personalize offerings, expedite claims processing, and provide more accurate risk assessments, ultimately leading to enhanced customer satisfaction and a stronger competitive edge in the evolving market landscape.

Expansion in Supplemental Health Offerings

The rising cost of healthcare and shifting consumer demands are fueling a significant expansion opportunity in supplemental health offerings. IHC Group is well-positioned to leverage this trend, given its established presence in the market for products that fill the gaps left by traditional insurance plans. This growing consumer interest in comprehensive coverage solutions presents a clear avenue for growth.

The supplemental health insurance market is projected to see robust growth. For instance, the U.S. supplemental health insurance market was valued at approximately $50 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of around 6% through 2030. This growth is driven by factors such as:

- Increasing deductibles and out-of-pocket expenses in major medical plans.

- A desire for financial protection against unexpected medical costs.

- The aging population's specific health needs.

Strategic Partnerships and Market Rationalization

The IHC Group can pursue strategic partnerships to enhance its market position. This involves identifying health insurers looking to consolidate or divest certain business lines, creating opportunities for IHC to acquire or merge, thereby expanding its geographic reach and product offerings. For instance, in 2024, the US health insurance market saw several consolidation activities, with major players acquiring smaller regional insurers, indicating a trend towards market rationalization that IHC can leverage.

Rationalizing its own business lines and geographic presence allows IHC to focus on areas with high growth potential and where its specialized products are most competitive. This strategic pruning can free up resources for investment in underserved markets. By 2025, projections suggest continued growth in specialized health insurance segments, particularly for chronic condition management and niche demographic needs, areas where IHC has demonstrated strength.

- Strategic Alliances: Explore collaborations with complementary healthcare providers or technology firms to offer integrated health solutions.

- Market Expansion: Target underserved or emerging markets where specialized insurance products, like those for specific chronic diseases, can capture significant market share.

- Acquisition Opportunities: Consider acquiring smaller, financially sound competitors or specific business units from larger insurers undergoing restructuring in 2024-2025.

- Product Specialization: Deepen focus on niche insurance products that cater to specific demographic needs or health conditions, differentiating from generalist insurers.

The growing trend of employers shifting to self-funded health plans presents a substantial opportunity for IHC Group to expand its market share, especially within the small and medium-sized business sector. This is underscored by the medical stop-loss market's projected $30 billion valuation in 2024.

Favorable demographic shifts and economic conditions are driving significant demand in the annuity market, creating a growth avenue for IHC's retirement income solutions. Additionally, the increasing cost of healthcare and evolving consumer preferences are boosting the supplemental health insurance market, which was valued at approximately $50 billion in 2023 and is expected to grow.

The digital transformation within the insurance industry, particularly the adoption of AI, offers IHC Group a chance to enhance operational efficiency and customer engagement. By leveraging AI, the company can refine underwriting and claims processing, capitalizing on a market projected to grow from $1.5 billion in 2023 to over $13 billion by 2030.

Strategic partnerships and potential acquisitions in a consolidating health insurance landscape, evidenced by market rationalization activities in 2024, allow IHC to broaden its reach and product portfolio. Focusing on niche markets and specialized insurance products catering to specific demographic needs or chronic conditions further strengthens its competitive position.

Threats

Health insurance providers, including The IHC Group, are navigating a landscape of heightened regulatory oversight. Bipartisan legislative actions and public dissatisfaction with denied claims and escalating costs are driving this trend. For instance, proposed legislation in 2024 aimed to increase transparency in claim denials and medical billing practices, signaling a tougher stance.

In 2025, health plans will encounter new mandates concerning health equity, enhanced consumer protections, and stricter data privacy protocols. These evolving requirements will undoubtedly elevate compliance costs and operational complexities for companies like The IHC Group, demanding significant investment in systems and personnel to ensure adherence.

The increasing use of healthcare services, coupled with a rise in expensive medical claims, presents a substantial financial challenge for The IHC Group. This trend is particularly driven by the escalating costs of specialty drugs and advanced medical procedures.

For insurers like The IHC Group, this can result in inadequate premiums to cover expenses, thereby diminishing profit margins. For instance, the Centers for Medicare & Medicaid Services (CMS) projected that national health spending in the U.S. would grow by 5.4% in 2024, reaching $5.1 trillion. This upward trajectory in healthcare expenditure directly impacts the cost of claims that stop-loss insurers must cover.

The early part of 2025 is showing signs of economic deceleration, with consumer demand weakening. This trend could put a damper on growth expectations for the entire insurance sector, including companies like IHC Group.

As consumers face tighter budgets, they may scale back on certain insurance purchases or opt for more fundamental, less expensive plans. For instance, a projected 1.5% dip in real disposable income for the average US household in 2025 could directly impact discretionary spending on enhanced insurance coverage.

Market Consolidation and Competition from Larger Players

The stop-loss insurance market is seeing increasing consolidation, with major players like UnitedHealth Group and Anthem, now Elevance Health, continuing to expand their market share. This trend poses a significant threat to mid-sized companies such as IHC Group, as larger competitors often leverage greater economies of scale. For instance, in 2023, the top five health insurers in the US accounted for over 70% of the market, a figure expected to grow.

These larger entities can often offer more competitive pricing due to their operational efficiencies and substantial financial reserves. Their ability to invest heavily in technology and product development further amplifies their competitive advantage. This dynamic can make it challenging for IHC Group to compete on price and innovation, potentially impacting its ability to attract and retain clients in the evolving landscape of stop-loss insurance.

- Market Share Concentration: Leading stop-loss carriers are increasingly dominating the market, making it harder for smaller firms to gain traction.

- Economies of Scale: Larger insurers benefit from lower per-unit costs, enabling them to offer more aggressive pricing.

- Pricing Power: The dominance of major players can lead to increased pricing pressure on IHC Group.

- Competitive Disadvantage: Limited resources compared to larger competitors can hinder IHC Group's ability to invest in innovation and market expansion.

Uncertainty in Government Healthcare Policies

Uncertainty surrounding government healthcare policies, particularly potential changes to the Affordable Care Act (ACA), presents a significant threat to The IHC Group. The expiration of federal premium subsidies, for instance, could shrink the pool of insured individuals, directly impacting the number of patients health insurers like IHC can serve. This policy volatility creates a challenging and unpredictable operating landscape for the company.

The ongoing debate and potential modifications to healthcare regulations in 2024 and 2025 mean that IHC Group must remain agile. For example, shifts in Medicaid expansion or changes to Medicare Advantage regulations could alter revenue streams and market access. This policy flux necessitates continuous strategic adaptation and risk management.

- Policy Volatility: Potential changes to the ACA, including subsidy expirations, could reduce insured patient numbers.

- Operating Challenges: Shifts in government healthcare spending or regulations can create unpredictable revenue and cost structures.

- Market Access: Modifications to insurance marketplaces or provider network requirements directly impact The IHC Group's ability to reach customers.

- Regulatory Compliance: Evolving healthcare laws require ongoing investment in compliance, diverting resources from growth initiatives.

The IHC Group faces significant competitive pressures from larger, more established insurers who benefit from greater economies of scale and market share concentration. This allows them to offer more aggressive pricing and invest more heavily in technology, potentially disadvantaging IHC Group.

The escalating cost of healthcare, driven by specialty drugs and advanced procedures, strains profit margins for stop-loss insurers. With national health spending projected to reach $5.1 trillion in 2024, the increasing frequency and cost of claims pose a direct financial threat.

Economic deceleration and weakening consumer demand in 2025, marked by a projected 1.5% dip in real disposable income for US households, could lead individuals to opt for less comprehensive or cheaper insurance plans, impacting IHC Group's premium growth.

Policy volatility surrounding healthcare regulations, including potential changes to the ACA, creates an unpredictable operating environment. Shifts in subsidies or coverage mandates can directly affect the size of the insured pool and revenue streams.

| Threat | Description | Impact on IHC Group | Relevant Data/Example |

|---|---|---|---|

| Market Consolidation | Increasing dominance of large players in the stop-loss market. | Reduced competitive landscape, pricing pressure. | Top 5 US health insurers held over 70% market share in 2023. |

| Rising Healthcare Costs | Escalation in specialty drug prices and medical procedures. | Strain on profit margins due to higher claim payouts. | Projected 5.4% growth in US national health spending in 2024 to $5.1 trillion. |

| Economic Slowdown | Weakening consumer demand and reduced disposable income. | Potential decrease in demand for enhanced insurance products. | Projected 1.5% dip in real disposable income for US households in 2025. |

| Regulatory Uncertainty | Potential changes to healthcare policies like the ACA. | Unpredictable operating environment, potential reduction in insured individuals. | Ongoing legislative debates regarding healthcare subsidies and coverage mandates. |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of reliable data, including IHC Group's official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a robust understanding of the company's performance and the competitive landscape.