The IHC Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

The IHC Group Bundle

Unlock the hidden forces shaping The IHC Group's trajectory. Our PESTLE analysis dives deep into political stability, economic fluctuations, evolving social demographics, technological advancements, environmental regulations, and legal frameworks impacting the company. Gain a critical understanding of these external factors to anticipate challenges and seize opportunities.

Don't get left behind in a rapidly changing market. Our comprehensive PESTLE analysis of The IHC Group provides actionable intelligence, empowering you to make informed strategic decisions. Download the full version now to gain a competitive edge and future-proof your investments.

Political factors

Government healthcare policy shifts, including potential amendments to the Affordable Care Act (ACA) or new legislative initiatives, directly impact health insurers like IHC. For example, ongoing debates surrounding ACA repeal or modification could alter market stability and product demand. In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed changes to ACA marketplace plans, signaling continued policy evolution.

Changes in federal or state mandates regarding coverage, essential health benefits, or subsidies can significantly alter market dynamics and the viability of certain insurance plans. For instance, shifts in Medicaid expansion policies at the state level directly influence the pool of eligible individuals for health insurance products. In 2025, several states are expected to continue evaluating or implementing changes to their Medicaid programs, impacting the broader health insurance landscape.

Insurers must constantly adapt their offerings to remain compliant and competitive under evolving regulations. This requires agile product development and a keen understanding of legislative trends. The ability to navigate these policy changes effectively is crucial for maintaining market share and profitability in the dynamic health insurance sector.

Regulatory oversight from entities like state insurance departments and the NAIC significantly impacts The IHC Group's operational costs and product innovation. For instance, increased capital requirements or stricter reserve mandates, which can be influenced by political agendas, directly affect how much capital insurers must hold, potentially limiting investment in new ventures. The NAIC's adoption of updated risk-based capital (RBC) requirements in 2024, for example, aims to strengthen insurer solvency, a move that could necessitate adjustments in The IHC Group's capital management strategies.

Changes in corporate tax rates, premium taxes, or other industry-specific taxes at federal or state levels can directly affect the profitability and financial planning of insurance companies like IHC Group. For instance, if the US federal corporate tax rate were to decrease from its current 21%, it could boost IHC's net income, allowing for greater reinvestment or shareholder returns.

Policy decisions regarding tax incentives for health savings accounts (HSAs) or other insurance-related deductions can also influence consumer demand for certain products. For example, an expansion of tax deductibility for health insurance premiums could spur growth in IHC's group health insurance offerings.

IHC Group must closely monitor these evolving tax landscapes to optimize its financial strategies and product pricing, ensuring competitiveness and sustained profitability in the dynamic insurance market.

Political Stability and Trade Relations

Political stability within the United States is a bedrock for investor confidence, directly influencing the economic outlook and, consequently, the insurance market. A stable political climate in 2024 and projected into 2025 provides the predictability that insurers and their clients rely on for long-term financial planning.

While IHC Group's core business is domestic, its potential engagement in reinsurance or international partnerships means global trade policies and geopolitical shifts remain relevant. For instance, the ongoing evolution of trade agreements in late 2024 could introduce new considerations for cross-border financial services.

- Investor Confidence: Historically, periods of political uncertainty have correlated with dips in consumer spending and business investment, impacting demand for insurance products.

- Regulatory Environment: Changes in government administration can lead to shifts in financial regulations, affecting capital requirements and operational compliance for insurance companies.

- Global Interconnectedness: Even domestically focused insurers can be indirectly affected by international trade disputes or sanctions that disrupt broader economic activity.

Public Health Initiatives and Funding

Government-backed public health campaigns, like those focused on chronic disease management or pandemic preparedness, directly shape the health landscape. For instance, increased investment in preventative care programs, such as those seen in the 2024 US budget proposals aiming to bolster community health centers, can lead to a healthier population, potentially reducing the frequency and severity of insurance claims for The IHC Group.

Furthermore, the level of government funding allocated to public health infrastructure plays a crucial role. In 2023, the US Centers for Disease Control and Prevention (CDC) received approximately $8.7 billion in funding, supporting a wide array of health initiatives. Changes in this funding can impact the overall health of the population, influencing the demand for various health insurance products and the associated risk profiles for insurers.

The IHC Group must monitor these political factors closely.

- Government health spending in 2024 is projected to remain a significant factor influencing population health outcomes.

- Preventative health initiatives, if expanded, could lead to a reduction in long-term chronic disease claims.

- Pandemic response funding and strategies will continue to be a critical consideration for health insurers' risk assessment.

Government healthcare policy shifts, including potential amendments to the Affordable Care Act (ACA) or new legislative initiatives, directly impact health insurers like IHC. For example, ongoing debates surrounding ACA repeal or modification could alter market stability and product demand. In 2024, the Centers for Medicare & Medicaid Services (CMS) proposed changes to ACA marketplace plans, signaling continued policy evolution.

Changes in federal or state mandates regarding coverage, essential health benefits, or subsidies can significantly alter market dynamics and the viability of certain insurance plans. For instance, shifts in Medicaid expansion policies at the state level directly influence the pool of eligible individuals for health insurance products. In 2025, several states are expected to continue evaluating or implementing changes to their Medicaid programs, impacting the broader health insurance landscape.

IHC Group must closely monitor these evolving tax landscapes to optimize its financial strategies and product pricing, ensuring competitiveness and sustained profitability in the dynamic insurance market. Political stability within the United States is a bedrock for investor confidence, directly influencing the economic outlook and, consequently, the insurance market. A stable political climate in 2024 and projected into 2025 provides the predictability that insurers and their clients rely on for long-term financial planning.

What is included in the product

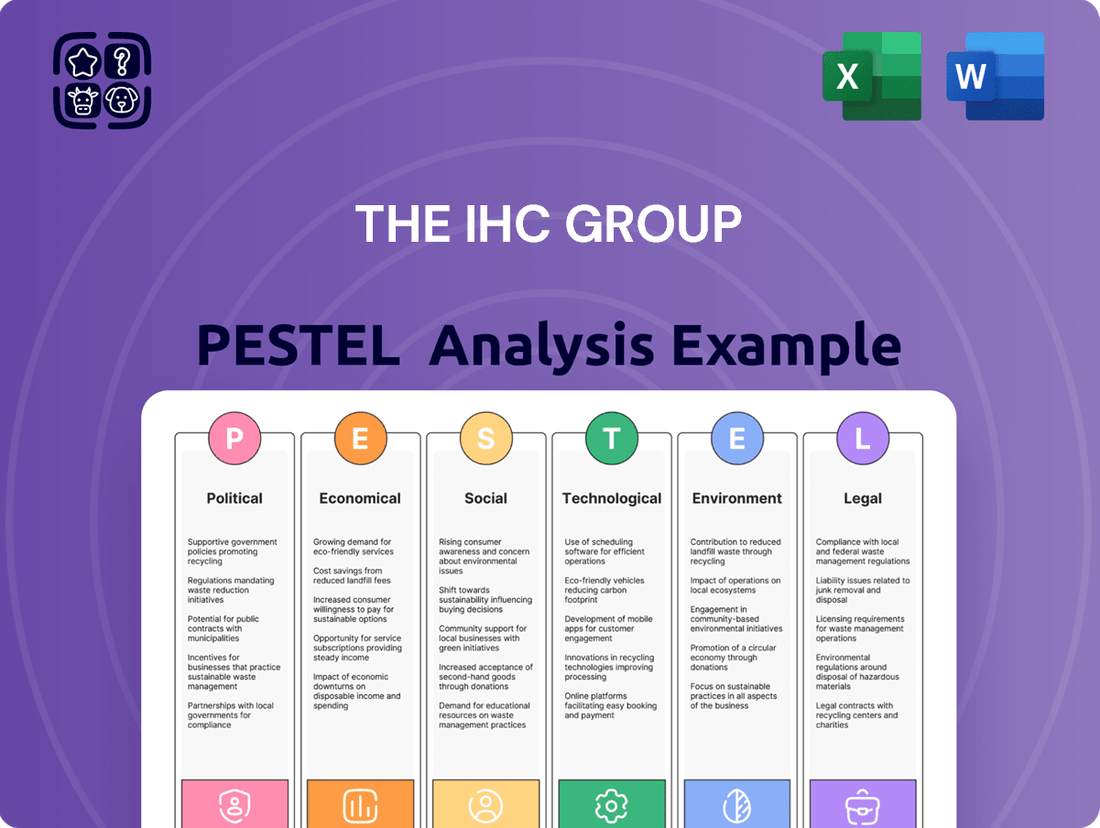

This PESTLE analysis of The IHC Group meticulously examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing its operations and strategic direction.

It provides actionable insights for stakeholders to navigate external challenges and capitalize on emerging opportunities within its operating landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors impacting The IHC Group.

Helps support discussions on external risk and market positioning during planning sessions by clearly outlining the PESTLE factors affecting The IHC Group.

Economic factors

Changes in interest rates, particularly those set by the Federal Reserve, significantly influence the investment income of insurance companies like The IHC Group. When rates rise, the substantial reserves insurers hold, which are invested in various assets, can generate higher returns, boosting profitability. For instance, in early 2024, the Federal Reserve maintained its benchmark interest rate in the 5.25%-5.50% range, a level that generally favors investment income for insurers compared to periods of very low rates.

Conversely, periods of declining interest rates can compress profit margins for insurance providers. This is especially true for life and annuity products, which are designed to pay out over long time horizons and are therefore quite sensitive to the prevailing interest rate environment. Lower rates mean less income generated from the invested premiums, impacting the financial viability of these long-term commitments.

Rising inflation presents a significant challenge for health insurers like The IHC Group. Increased costs for medical services and administrative operations directly translate to higher claims payouts and a squeeze on operational margins. For instance, the U.S. medical care inflation rate hovered around 5.5% in early 2024, impacting providers and subsequently insurers.

For life insurance products, inflation's impact is equally concerning. It diminishes the real value of future death benefits and annuity payments, potentially affecting consumer demand and the attractiveness of long-term contracts. Insurers must adapt by adjusting premiums, product features, and investment strategies to maintain profitability and policyholder value amidst these eroding purchasing powers.

The health of the U.S. economy directly impacts IHC Group's business. Strong economic growth typically means more people are employed, leading to higher disposable incomes and a greater ability to purchase insurance. For instance, the U.S. unemployment rate stood at a low 3.9% in May 2024, indicating a robust labor market that generally supports demand for insurance products.

Conversely, economic slowdowns can pose challenges. If the economy falters and job losses increase, individuals might cut back on discretionary spending, including insurance. Similarly, employers might reduce benefits packages to manage costs, directly affecting IHC's group insurance offerings. The projected GDP growth for the U.S. in 2024, estimated around 2.5%, suggests a generally favorable environment, though potential shifts in employment can still influence market dynamics.

Consumer Disposable Income

Consumer disposable income is a critical driver for non-mandatory insurance products offered by IHC Group. When households have more money left after essential expenses, they are more inclined to purchase supplemental health or enhanced life insurance policies. For instance, in the U.S., the personal saving rate, a proxy for disposable income available for spending or saving, stood at approximately 3.9% in April 2024, indicating a moderate level of discretionary funds. This trend directly impacts IHC's potential for sales growth and premium revenue generation.

Several economic factors influence this disposable income, and consequently, IHC's market performance:

- Wage Growth: Stagnant or declining real wages can limit consumers' ability to afford additional insurance premiums. U.S. average hourly earnings saw a 3.9% increase year-over-year as of April 2024, a figure that needs to be considered against inflation.

- Inflation: Higher inflation erodes purchasing power, leaving less discretionary income for insurance. The Consumer Price Index (CPI) rose 3.4% in the twelve months ending April 2024, impacting how much consumers can allocate to non-essential spending.

- Consumer Confidence: A strong economy and positive outlook encourage spending on insurance. The Conference Board Consumer Confidence Index was 97.0 in April 2024, showing a slight dip from the previous month, which could signal cautious spending.

- Interest Rates: While not directly impacting disposable income, interest rates can influence investment returns and overall financial well-being, indirectly affecting the capacity for insurance purchases.

Capital Market Volatility

Capital market volatility directly influences The IHC Group's investment portfolio, impacting its solvency and financial stability. For instance, significant downturns in equity markets, such as the S&P 500 experiencing a 10% drop in a single quarter, can erode the value of assets held by the insurer. This necessitates careful management of investment strategies to mitigate potential losses.

Fluctuations in bond yields also play a crucial role. Rising interest rates, a common feature of volatile markets, can decrease the market value of existing bonds, presenting another challenge for IHC's asset management. The ability to adapt to these shifts is paramount for maintaining a strong financial position.

Consumer behavior is also sensitive to market swings. During periods of high volatility, individuals might become more risk-averse, potentially reducing demand for investment-linked insurance products and favoring more stable, albeit lower-yield, options. This shift requires IHC to be agile in its product offerings and marketing strategies.

- Impact on Investment Portfolio: A 5% decline in global equity markets in early 2024, for example, would directly reduce the value of IHC's invested assets.

- Solvency Ratios: Volatility can stress solvency ratios, potentially requiring IHC to hold more capital against its investments.

- Consumer Demand Shifts: Increased market uncertainty can lead to a 15% to 20% shift in consumer preference towards fixed annuities over variable ones.

- Risk Management Imperative: Robust hedging strategies and diversified investment portfolios are essential for IHC to navigate these turbulent capital markets effectively.

Economic conditions significantly shape The IHC Group's operational landscape. Interest rate movements directly affect investment income from reserves, with the Federal Reserve's benchmark rate holding steady between 5.25%-5.50% in early 2024, generally benefiting insurers. Conversely, rising inflation, with U.S. medical care inflation around 5.5% in early 2024, increases claim costs and operational expenses.

A robust economy, evidenced by a 3.9% U.S. unemployment rate in May 2024, typically correlates with higher insurance demand due to increased employment and disposable income. Consumer spending, influenced by wage growth (3.9% average hourly earnings increase year-over-year as of April 2024) and inflation (3.4% CPI increase ending April 2024), directly impacts IHC's revenue potential.

| Economic Factor | Impact on The IHC Group | Relevant Data (Early-Mid 2024) |

|---|---|---|

| Interest Rates | Affects investment income on reserves | Fed Funds Rate: 5.25%-5.50% |

| Inflation | Increases claim costs and operational expenses | Medical Care Inflation: ~5.5% |

| Unemployment Rate | Correlates with insurance demand | U.S. Unemployment: 3.9% (May 2024) |

| Wage Growth | Influences consumer ability to purchase insurance | Avg. Hourly Earnings: +3.9% YoY (April 2024) |

| Consumer Price Index (CPI) | Impacts purchasing power and disposable income | CPI: +3.4% YoY (April 2024) |

What You See Is What You Get

The IHC Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing the IHC Group's PESTLE analysis. This comprehensive report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. You can trust that the insights and structure you see are what you'll gain immediate access to.

Sociological factors

The aging U.S. population, a significant demographic shift, presents a dual-edged sword for health and life insurers like IHC Group. By 2030, all Baby Boomers will be 65 or older, a trend that will increase demand for healthcare services, potentially leading to higher claims. This demographic wave also fuels a greater need for retirement solutions, such as annuities and life insurance, as individuals plan for longer lifespans.

IHC Group needs to strategically adapt its product portfolio to cater to the evolving age distribution. For instance, the Centers for Medicare & Medicaid Services projects national health spending to grow by an average of 5.4% annually from 2021 to 2030, underscoring the increased utilization by older adults. This necessitates innovative offerings that balance risk management with the financial security needs of an aging populace.

Consumers are increasingly prioritizing preventative care, fitness, and mental health services, significantly altering how they utilize healthcare. This growing awareness means insurers like The IHC Group must consider expanding benefits to cover these evolving wellness areas, potentially impacting future claims.

For instance, a 2024 survey indicated that over 60% of adults reported actively seeking ways to improve their physical and mental well-being, a trend that directly influences demand for services beyond traditional medical treatment.

By developing robust wellness programs, The IHC Group can encourage healthier lifestyles among its policyholders, which could lead to a reduction in claims frequency and severity in the long run.

Modern consumers, across all sectors including insurance, increasingly demand seamless digital interactions and highly personalized experiences. This shift is evident in the growing preference for online policy management, digital claims processing, and readily available mobile access to account information. For instance, a 2024 survey indicated that over 70% of insurance customers prefer digital channels for policy inquiries and claims submission, a figure projected to rise further by 2025.

To remain competitive, IHC Group must prioritize investments in robust, user-friendly digital platforms. Meeting these evolving expectations is crucial for enhancing customer satisfaction and ensuring long-term retention. Companies that fail to adapt risk losing market share to more digitally adept competitors, as evidenced by the increasing customer churn rates reported by insurers with lagging digital capabilities in the 2023-2024 period.

Lifestyle Changes and Remote Work

The increasing prevalence of remote and hybrid work models is fundamentally reshaping the landscape of employee benefits. This shift necessitates that insurers like The IHC Group re-evaluate traditional group health and life insurance structures, which were often built around physical office environments. For instance, a 2024 survey indicated that 60% of US workers now expect some form of remote work flexibility, a significant increase from pre-pandemic levels. This trend suggests a growing demand for more adaptable and personalized group insurance offerings that cater to a distributed workforce.

These lifestyle changes also have subtle yet significant implications for health risks. With altered daily routines and potentially reduced physical activity for some remote workers, insurers may need to consider how these behavioral shifts could impact long-term health outcomes and claims. For example, data from early 2025 suggests a slight uptick in certain sedentary-related health concerns among populations with predominantly remote work arrangements. This necessitates a proactive approach to wellness programs and benefit design.

- Increased Demand for Flexible Benefits: As more employees work remotely, there's a growing need for insurance plans that accommodate varied work locations and schedules, moving away from one-size-fits-all solutions.

- Impact on Health Risk Assessment: Changes in daily activity levels and routines associated with remote work can influence employee health profiles, requiring insurers to adapt their risk assessment models.

- Adaptation of Group Plans: The IHC Group will likely need to develop or refine group insurance products that offer greater portability and customization to suit the evolving needs of a dispersed workforce.

- Focus on Digital Health Engagement: To address potential health impacts of remote work, there's an opportunity to integrate digital wellness tools and resources into benefit packages, promoting healthier lifestyles regardless of work location.

Healthcare Affordability Concerns

Persistent concerns about the rising cost of healthcare, including increasing out-of-pocket expenses, significantly shape how consumers select health insurance. This societal pressure is a key driver for demand in more budget-friendly plans, options with higher deductibles, or supplemental policies designed to mitigate these costs. For instance, in 2024, the average annual premium for employer-sponsored family health coverage reached $24,000, with workers contributing an average of $6,500 annually towards these premiums.

The IHC Group needs to strategically develop a diverse range of product lines to effectively cater to the varying affordability levels and coverage needs present across different consumer segments. This includes offering plans that balance cost with essential benefits, as well as exploring innovative solutions like health savings accounts (HSAs) that provide tax advantages for managing medical expenses.

- Rising Premiums: In 2024, average annual premiums for employer-sponsored family health coverage hit $24,000, with employees shouldering an average of $6,500.

- Consumer Demand: There's a growing societal demand for more affordable health insurance options, including high-deductible plans and supplemental policies.

- Product Diversification: IHC must offer a spectrum of products to meet diverse affordability and coverage needs.

- Cost Management Tools: Solutions like HSAs are gaining traction as consumers seek ways to manage out-of-pocket medical expenses.

Societal attitudes towards health and wellness are evolving, with a pronounced shift towards preventative care and mental well-being. By 2024, over 60% of adults were actively seeking ways to improve their physical and mental health, indicating a demand for broader insurance coverage beyond traditional medical treatments. This trend suggests that The IHC Group should expand its offerings to include wellness programs and services that cater to these growing consumer priorities.

Technological factors

The insurance industry is undergoing a significant transformation driven by Insurtech innovations. Technologies like Artificial Intelligence (AI) and machine learning are revolutionizing underwriting, fraud detection, and customer service. For instance, AI-powered tools can analyze vast datasets to offer more accurate risk assessments and personalized pricing, which is crucial for companies like IHC Group.

The adoption of AI in insurance is projected to yield substantial efficiency gains. Global spending on AI in insurance was estimated to reach over $5 billion in 2023 and is expected to grow considerably by 2025, indicating a strong industry trend towards leveraging these advanced technologies. IHC can capitalize on this by integrating AI for improved operational efficiency and a more responsive customer experience.

The increasing reliance on digital channels for customer interaction, from initial quotes to claims submission and policy management, necessitates robust online platforms and mobile applications. For instance, by the end of 2024, it's projected that over 85% of customer interactions for many insurance providers will occur digitally, highlighting a significant shift in engagement.

Insurers must provide intuitive and secure digital interfaces to meet evolving consumer preferences and streamline operational processes. This digital shift impacts sales, service, and retention strategies, with companies investing heavily in user experience to maintain a competitive edge. For example, a 2025 survey indicated that 70% of policyholders prefer self-service digital options for policy management.

Big data analytics is revolutionizing the insurance industry, enabling more precise risk assessments and personalized offerings. In 2024, the global big data analytics market was valued at an estimated $271.8 billion, with projections indicating continued strong growth, suggesting significant investment and adoption by companies like IHC.

For IHC, harnessing these capabilities means developing sophisticated predictive models for claims, which can lead to improved underwriting accuracy and the identification of emerging market trends. This data-driven approach allows for more informed decision-making, potentially leading to more profitable risk selection and optimized marketing strategies.

Telemedicine and Digital Health Integration

The rapid expansion of telemedicine and digital health solutions significantly reshapes healthcare delivery and access. This trend directly impacts health insurance claims by potentially lowering the frequency of in-person visits and broadening access to medical services. For example, by the end of 2024, it's projected that over 70% of healthcare providers will offer some form of virtual care, a substantial increase from pre-pandemic levels.

Insurers like The IHC Group must actively integrate these digital health advancements into their coverage frameworks and claims processing systems. This adaptation is crucial to accurately reflect the changing ways consumers utilize healthcare services. By 2025, the global digital health market is expected to reach over $600 billion, underscoring the scale of this transformation.

- Shift in Care Delivery: Telemedicine reduces reliance on traditional brick-and-mortar facilities.

- Claims Processing Evolution: Insurers need to adapt to new billing codes and data formats for virtual services.

- Increased Accessibility: Digital health expands care options for patients in remote areas or with mobility issues.

- Market Growth: The digital health sector is experiencing robust growth, necessitating insurer adaptation.

Cybersecurity and Data Privacy

The increasing digitization of insurance operations, particularly within The IHC Group, amplifies the risk associated with cyberattacks and data breaches. As more sensitive policyholder information is managed electronically, safeguarding this data becomes a critical operational imperative. For instance, in 2024, the global average cost of a data breach reached $4.45 million, a figure that underscores the potential financial fallout for companies like IHC.

Maintaining customer trust and avoiding substantial financial and reputational harm hinges on the effective protection of personal and financial data. A significant data breach could lead to regulatory fines, loss of business, and a damaged brand image, impacting IHC's long-term viability. The General Data Protection Regulation (GDPR) and similar privacy laws worldwide impose strict requirements on data handling, with non-compliance often resulting in penalties of up to 4% of global annual revenue.

Consequently, implementing and maintaining robust cybersecurity measures is not merely a technical consideration but a fundamental aspect of The IHC Group's operational integrity and strategic planning. This includes investing in advanced threat detection systems, regular security audits, and comprehensive employee training to mitigate vulnerabilities. The proactive management of these technological factors is essential for sustained success in the modern insurance landscape.

- Rising Cost of Data Breaches: The global average cost of a data breach in 2024 was $4.45 million, highlighting the financial risks.

- Regulatory Compliance: Adherence to data privacy regulations like GDPR, which can impose fines up to 4% of global annual revenue, is crucial.

- Reputational Risk: Protecting sensitive policyholder information is paramount for maintaining customer trust and avoiding reputational damage.

- Operational Integrity: Strong cybersecurity is vital for the secure and continuous operation of digitized insurance services.

Technological advancements are reshaping the insurance landscape, demanding adaptation from companies like The IHC Group. Insurtech, particularly AI and machine learning, is enhancing underwriting accuracy and customer service. By 2025, global spending on AI in insurance is expected to see significant growth beyond its 2023 estimate of over $5 billion.

Digital channels are now paramount for customer engagement, with projections indicating over 85% of customer interactions occurring digitally by the end of 2024. This necessitates intuitive and secure online platforms, as a 2025 survey revealed 70% of policyholders prefer digital self-service options.

Big data analytics, valued at an estimated $271.8 billion globally in 2024, enables more precise risk assessment and personalized offerings, crucial for IHC's strategic decision-making.

The rise of telemedicine and digital health, with over 70% of healthcare providers offering virtual care by the end of 2024, requires insurers to adapt their coverage and claims processing. The digital health market is projected to exceed $600 billion by 2025.

However, increased digitization elevates cybersecurity risks, with the global average cost of a data breach reaching $4.45 million in 2024. Compliance with data privacy regulations, like GDPR, is essential, as penalties can reach up to 4% of global annual revenue.

| Technology Trend | Impact on Insurance | Key Data Point (2024/2025) |

| Insurtech (AI/ML) | Improved underwriting, fraud detection, customer service | Global AI spending in insurance projected to grow significantly beyond $5 billion (2023 estimate) by 2025 |

| Digital Channels | Enhanced customer engagement, self-service | Over 85% of customer interactions expected to be digital by end of 2024; 70% prefer digital self-service (2025 survey) |

| Big Data Analytics | Precise risk assessment, personalized offerings | Global Big Data market valued at $271.8 billion (2024) |

| Digital Health/Telemedicine | Changes in claims processing, expanded care access | Over 70% of providers offering virtual care by end of 2024; Digital health market to exceed $600 billion by 2025 |

| Cybersecurity | Increased risk of data breaches, need for robust protection | Average cost of data breach: $4.45 million (2024); GDPR fines up to 4% of global annual revenue |

Legal factors

The insurance sector faces a dynamic regulatory environment, with ongoing shifts at federal and state levels impacting licensing, solvency, market conduct, and product approvals. For instance, the National Association of Insurance Commissioners (NAIC) continually revises guidelines, with recent discussions in 2024 focusing on cybersecurity standards and data privacy, directly affecting how companies like IHC manage sensitive information.

These evolving legal requirements, such as potential changes to risk-based capital (RBC) frameworks or updated consumer protection mandates, can significantly alter IHC's operational costs and strategic planning. Failure to adapt to new legislation, like state-specific mandates on telehealth coverage which gained traction in 2023-2024, could lead to substantial penalties and impede market participation.

The IHC Group operates within a complex web of data privacy and security laws. Regulations like HIPAA, governing health information, and a growing number of state-specific privacy acts, such as the California Consumer Privacy Act (CCPA) and its successor, the California Privacy Rights Act (CPRA), dictate how insurance companies handle policyholder data. These laws mandate stringent requirements for data collection, storage, and usage, with non-compliance carrying the risk of substantial financial penalties and significant reputational harm. For instance, in 2023, the U.S. saw a record number of data breaches impacting millions of individuals, highlighting the increasing scrutiny on data protection practices across industries.

Consumer protection laws, such as those preventing unfair business practices and requiring clear product information, significantly shape how insurance companies like IHC Group function. For instance, regulations mandating transparent disclosure of policy terms and conditions directly impact marketing and sales strategies, ensuring policyholders understand their coverage.

The enforcement of these laws, including those governing fair claims handling, can necessitate operational adjustments. In 2024, regulatory bodies continued to scrutinize insurer practices, with a focus on prompt and equitable claim resolution, potentially increasing compliance costs for companies that fall short.

Antitrust and Competition Laws

Antitrust and competition laws are crucial for the insurance sector, impacting everything from mergers to daily business practices. These regulations are designed to prevent monopolistic behavior and ensure a fair playing field for all companies, ultimately benefiting consumers through greater choice and potentially lower prices. For a company like IHC Group, navigating these laws is paramount, especially as the insurance industry continues to see consolidation. Failure to comply can lead to significant legal hurdles and financial penalties.

Specifically, antitrust scrutiny often falls on mergers and acquisitions. In 2024 and looking into 2025, regulatory bodies are actively reviewing large-scale consolidations within financial services. IHC Group must meticulously assess any potential strategic growth through acquisitions to guarantee adherence to these competition mandates. This proactive approach helps mitigate risks associated with anti-competitive practices.

The core aim of these laws is to foster a dynamic and competitive market. This environment encourages innovation and efficiency, driving better product offerings and service standards. For IHC, understanding and respecting these legal frameworks is not just about avoiding penalties, but also about contributing to a healthier, more robust insurance marketplace.

Key considerations for IHC Group regarding antitrust laws include:

- Merger and Acquisition Scrutiny: Ensuring all proposed consolidations are reviewed for potential anti-competitive effects.

- Competitive Practices: Adhering to regulations that prevent price-fixing, market allocation, and other monopolistic behaviors.

- Regulatory Compliance: Staying updated on evolving antitrust legislation and enforcement trends, particularly those impacting the insurance industry.

- Consumer Protection: Recognizing that compliance ultimately serves to protect consumers by promoting a competitive marketplace.

Contract Law and Claims Litigation

The legal framework governing insurance contracts and claims is paramount for The IHC Group. Evolving interpretations of contract law and significant court rulings in claims litigation directly impact how payouts are managed and how policy terms are structured. For instance, in 2024, the U.S. saw continued scrutiny on claims handling practices, with some states proposing stricter regulations aimed at consumer protection in dispute resolution.

Navigating this complex legal landscape is crucial for IHC to mitigate litigation risks and ensure fair claims settlements. The potential for class-action lawsuits or individual claims challenging policy interpretations can lead to substantial financial liabilities and reputational damage. Staying abreast of new precedents, such as those arising from the 2024 insurance litigation trends, is therefore a key strategic imperative.

- Contract Law Interpretation: Shifts in how insurance contracts are legally interpreted can alter coverage obligations and claims processing.

- Claims Litigation Trends: An increase in litigation, particularly concerning disputed claims, can escalate operational costs and necessitate adjustments in policy wording.

- Regulatory Compliance: Adherence to evolving legal standards in claims handling and contract disputes is vital to avoid penalties and maintain market trust.

- Precedent Setting: Landmark court decisions in 2024 and 2025 could establish new benchmarks for insurance claim payouts and policyholder rights.

The IHC Group must navigate an evolving legal landscape, with federal and state regulations constantly shifting, impacting everything from licensing to data privacy. For instance, the NAIC's ongoing work on cybersecurity standards in 2024 directly influences how IHC handles sensitive policyholder information, with potential penalties for non-compliance.

Consumer protection laws, including those mandating transparent policy disclosures and fair claims handling, shape IHC's operational strategies and marketing efforts. Increased regulatory scrutiny on claims practices in 2024, with some states proposing stricter consumer protection measures, underscores the need for meticulous adherence to avoid financial and reputational damage.

Antitrust laws are critical, especially concerning mergers and acquisitions, as regulatory bodies actively review consolidations in financial services through 2025. IHC Group's proactive assessment of any growth strategy against these competition mandates is essential to prevent anti-competitive practices and associated penalties.

Legal frameworks governing insurance contracts and claims are paramount, with court rulings in 2024 impacting payout management and policy structuring. Adherence to evolving legal standards in claims handling and contract disputes is vital to mitigate litigation risks, as demonstrated by increased scrutiny on insurer practices in 2024.

Environmental factors

Climate change is escalating health risks, with extreme weather events becoming more common and severe. This trend directly impacts public health, leading to increased instances of heatstroke, respiratory problems exacerbated by poorer air quality, and a wider spread of diseases carried by insects and other vectors. For instance, the World Health Organization projects that between 2030 and 2050, climate change could cause approximately 250,000 additional deaths per year from malnutrition, malaria, diarrhea, and heat stress alone.

These escalating health challenges pose significant financial implications for health insurers like The IHC Group. Higher claims are anticipated for treating climate-related illnesses, necessitating a critical review and adjustment of their risk assessment methodologies and pricing strategies to remain solvent and competitive in this evolving landscape.

The growing emphasis on Environmental, Social, and Governance (ESG) factors is significantly reshaping investment strategies, even within the insurance sector. Institutional investors, regulators, and policyholders are increasingly scrutinizing how insurers incorporate ESG principles into their operations and investment portfolios. For instance, by the end of 2024, global sustainable investment assets were projected to exceed $50 trillion, a testament to this growing trend.

This heightened focus means IHC Group may face considerable pressure to integrate ESG considerations into its investment decisions. Such integration could influence asset allocation strategies, potentially favoring investments in renewable energy or sustainable infrastructure, which might impact long-term financial returns as the market adapts to these new priorities.

The global imperative for sustainability is increasingly shaping business operations, with companies like The IHC Group facing pressure to reduce their carbon footprints, improve waste management, and utilize resources responsibly. For instance, in 2024, the insurance sector saw a growing trend of investing in green bonds, with global issuance projected to reach over $1 trillion by the end of the year, reflecting a commitment to environmentally sound investments and operations.

While these environmental factors may seem less direct for an insurer compared to regulatory changes, embracing sustainable practices can significantly bolster brand reputation. Studies from 2024 indicate that over 60% of consumers consider a company's environmental stance when making purchasing decisions, suggesting that a strong sustainability profile can attract a wider customer base and a more engaged workforce.

Public Health Crises and Pandemics

The emergence and spread of public health crises, like the COVID-19 pandemic, pose substantial environmental risks for health and life insurers. These events can trigger a dramatic increase in claims, strain healthcare systems, and destabilize economies. For instance, the World Health Organization reported over 775 million confirmed COVID-19 cases globally by early 2024, underscoring the scale of such health emergencies.

IHC Group needs to integrate robust scenario planning for these health crises into its risk modeling and business continuity strategies. This proactive approach is crucial for maintaining operational resilience and financial stability when faced with widespread health impacts and economic fallout.

- Increased Mortality and Morbidity Claims: Pandemics directly lead to higher payouts for life and health insurance policies.

- Healthcare System Strain: Overwhelmed hospitals and medical facilities can disrupt the provision of care, impacting claim processing and costs.

- Economic Downturns: Public health crises often trigger recessions, affecting premium collections and investment returns.

- Behavioral Shifts: Consumer behavior regarding health, insurance purchasing, and risk perception can change significantly.

Regulatory Focus on Climate-Related Financial Risks

Insurance regulators worldwide, including those in the United States, are sharpening their focus on the financial implications of climate change for the insurance industry. This heightened scrutiny encompasses potential disruptions to asset values, shifts in underwriting risks, and overall solvency concerns.

This regulatory trend could translate into new mandates for climate-related financial risk disclosure and potentially introduce capital charges designed to buffer against these emerging threats. For companies like IHC, this means an increased need for robust data collection and transparent reporting practices concerning their climate risk exposure.

- Increased Reporting Requirements: Expect more detailed disclosures on how climate change impacts underwriting, investments, and operational resilience.

- Capital Adequacy Adjustments: Regulators may implement capital requirements that directly correlate with a company's exposure to climate-related financial risks.

- Data Management and Analytics: Companies will need to invest in sophisticated data systems to track, analyze, and report on climate risk factors effectively.

Environmental factors significantly influence health insurers like The IHC Group. Escalating climate change leads to increased health risks, such as heatstroke and respiratory issues, potentially driving up claims. For instance, the World Health Organization projects a quarter-million additional deaths annually between 2030 and 2050 due to climate change impacts like malnutrition and heat stress.

The growing demand for ESG integration means IHC Group faces pressure to align investments with sustainability. By the close of 2024, global sustainable investment assets were anticipated to surpass $50 trillion, highlighting this shift. This could lead IHC to favor renewable energy investments, impacting long-term returns as markets adapt.

Public health crises, exemplified by COVID-19 with over 775 million confirmed cases globally by early 2024, present substantial risks. These events can cause a surge in claims and economic instability, necessitating robust scenario planning for operational resilience and financial stability.

The insurance sector is also seeing a commitment to environmentally sound practices, with global green bond issuance projected to exceed $1 trillion in 2024. Companies demonstrating strong sustainability, where over 60% of consumers consider environmental stance in purchasing decisions, can enhance brand reputation and customer engagement.

PESTLE Analysis Data Sources

Our PESTLE analysis for The IHC Group is informed by a comprehensive blend of official government publications, reputable financial news outlets, and specialized industry research. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both current and authoritative.