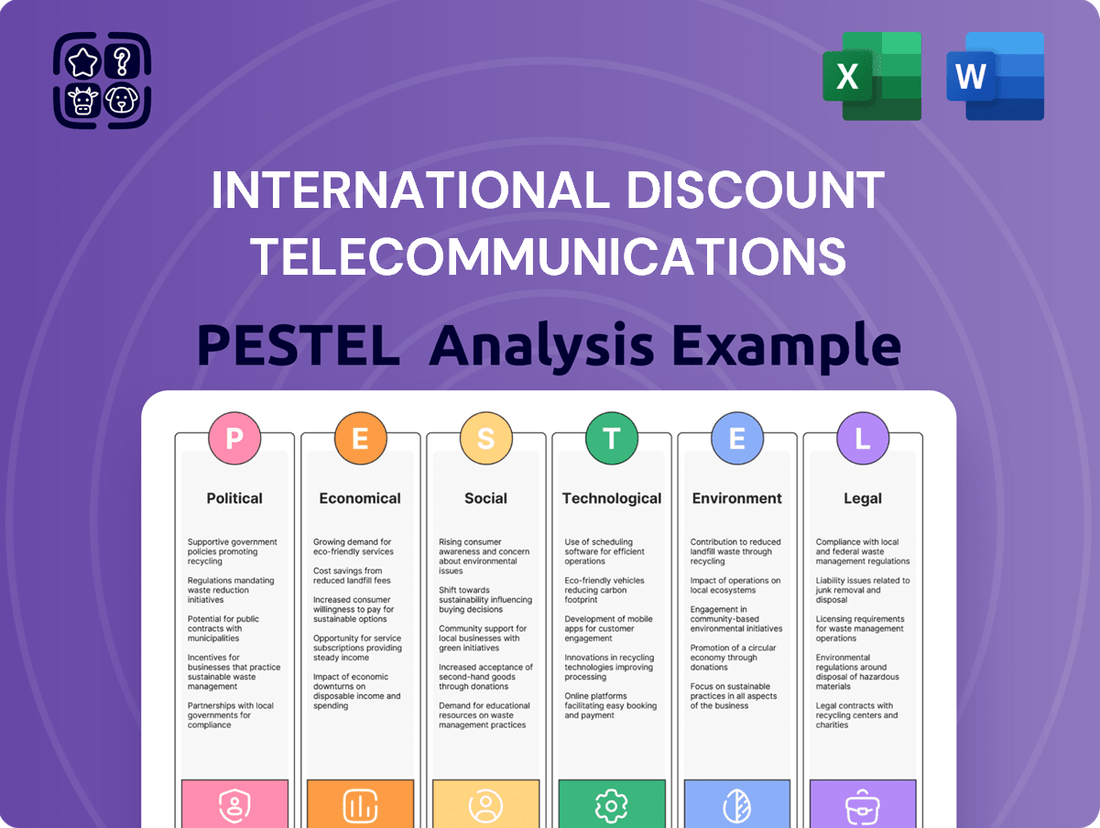

International Discount Telecommunications PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Discount Telecommunications Bundle

Unlock the strategic advantages International Discount Telecommunications holds by understanding the Political, Economic, Social, Technological, Legal, and Environmental forces at play. Our comprehensive PESTLE analysis delves deep into these external factors, offering actionable insights to navigate the dynamic telecommunications landscape. Equip yourself with the knowledge to anticipate market shifts and capitalize on emerging opportunities. Download the full PESTLE analysis now and gain a crucial competitive edge.

Political factors

Global political stability is a critical backdrop for international telecommunications and payment services. Instability can disrupt operations and create uncertainty for companies like IDT Corporation.

Trade policies, including tariffs and sanctions, directly influence IDT's ability to conduct business across borders. For instance, a 2023 report indicated that ongoing trade disputes between major economies could add significant costs to cross-border data transmission and financial services, potentially impacting IDT's wholesale carrier and money transfer segments.

Shifts in international relations can also lead to new regulations affecting data flow and financial transactions. In 2024, several countries are reviewing their data localization laws, which could impose new operational burdens and limit revenue streams for telecommunications providers operating internationally.

Governments globally are intensifying their oversight of data privacy and communication security. For IDT Corporation, this means navigating a complex web of evolving rules, with potential impacts on operational costs and service delivery. For instance, the European Union's General Data Protection Regulation (GDPR) continues to set a high bar, and many nations are implementing similar data localization requirements, demanding that user data be stored within their borders.

New or more stringent regulations concerning lawful interception and cybersecurity can lead to substantial compliance expenses and operational hurdles for IDT's communications business. These stricter mandates, especially around data residency and robust cybersecurity measures, directly influence how IDT can manage its infrastructure and offer competitive pricing for its services.

The fintech sector, including money transfer services like IDT's BOSS Money, faces a dynamic regulatory environment aimed at preventing financial crimes. Governments worldwide are strengthening oversight to combat money laundering, terrorist financing, and fraud, impacting how these services operate.

New regulations, such as more stringent Know Your Customer (KYC) and Anti-Money Laundering (AML) rules, are being implemented. For BOSS Money, this translates to increased operational costs and greater complexity in compliance, necessitating ongoing adjustments to their systems and procedures. For instance, in 2024, many jurisdictions saw updated AML directives, increasing the scrutiny on digital transaction platforms.

Government Support for Digital Transformation

Governments worldwide are actively fostering digital transformation and financial inclusion, presenting significant opportunities for IDT Corporation. These efforts aim to modernize economies and broaden access to digital services, directly benefiting companies like IDT that offer communication and remittance solutions.

Initiatives focused on digitizing economies, expanding broadband infrastructure, and promoting digital payments are crucial. These policies enlarge the potential customer base for IDT's offerings, especially in developing regions where demand for digital communication and money transfer services is surging. For instance, by mid-2024, many nations are reporting substantial increases in digital payment adoption, with some seeing growth rates exceeding 20% year-over-year, directly impacting the market for IDT's services.

- Digital Economy Growth: Global governments are investing heavily in digital infrastructure, with projected spending on digital transformation initiatives reaching trillions of dollars by 2025.

- Broadband Expansion: Many countries are setting targets to achieve near-universal broadband coverage by 2027, opening up new markets for communication services.

- Financial Inclusion Drive: Initiatives to increase access to digital financial services are expanding the user base for remittance and mobile money platforms, a key area for IDT.

- E-commerce and Digital Services: The rise of e-commerce and digital service adoption, supported by government policies, directly correlates with increased demand for international communication and payment solutions.

Political Influence on Infrastructure Development

Government initiatives play a crucial role in shaping the telecommunications landscape. For instance, the US Department of Commerce's Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, aims to expand broadband access, directly impacting the wholesale carrier services market that IDT operates within. This substantial investment signals a strong political commitment to infrastructure enhancement.

Policies promoting specific technologies, like the push for 5G deployment, can accelerate network build-outs. In 2024, many countries are continuing to invest heavily in 5G, with global capital expenditures on 5G networks projected to reach hundreds of billions of dollars, creating opportunities for companies like IDT that provide the underlying network capacity and cloud communication solutions.

- Government Funding: Significant public investment in broadband expansion, such as the BEAD program, directly benefits wholesale infrastructure providers.

- Technology Mandates: Policies favoring 5G or fiber optic deployment can create demand for IDT's services and influence network availability.

- Regulatory Environment: Favorable regulations on infrastructure sharing or spectrum allocation can reduce costs and expand market reach for telecommunication services.

Global political stability is a critical backdrop for international telecommunications and payment services, with instability potentially disrupting operations and creating uncertainty for companies like IDT Corporation.

Trade policies, including tariffs and sanctions, directly influence IDT's ability to conduct business across borders, with ongoing trade disputes potentially adding significant costs to cross-border data transmission and financial services.

Shifts in international relations can lead to new regulations affecting data flow and financial transactions, with countries reviewing data localization laws in 2024, potentially imposing new operational burdens and limiting revenue streams.

Governments worldwide are intensifying oversight of data privacy and communication security, requiring companies like IDT to navigate a complex web of evolving rules that can impact operational costs and service delivery.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting International Discount Telecommunications, offering actionable insights for strategic decision-making.

It delves into the Political, Economic, Social, Technological, Environmental, and Legal landscapes, equipping stakeholders with a clear understanding of market dynamics and potential challenges.

A clear, actionable PESTLE analysis for International Discount Telecommunications that identifies key external factors, simplifying complex market dynamics to alleviate strategic planning headaches.

This PESTLE analysis acts as a pain point reliever by offering a structured overview of the external landscape, enabling International Discount Telecommunications to proactively address potential challenges and capitalize on opportunities.

Economic factors

Global economic growth directly impacts the demand for International Discount Telecommunications (IDT) services. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight increase from 3.1% in 2023, indicating a generally stable but not booming economic environment. This growth influences consumer and business spending on telecommunications and cross-border payment services.

Disposable income is a critical driver for IDT's retail services. As economies expand and employment rises, consumers tend to have more discretionary income, which can be allocated to international calls or remittances. Conversely, economic slowdowns can lead to reduced spending on non-essential services, potentially impacting IDT's revenue from these segments.

Economic conditions also shape IDT's wholesale business. During periods of strong global trade and economic activity, businesses are more likely to utilize IDT's international calling and carrier services. A robust global economy in 2024 and 2025, as anticipated by many economic forecasts, would likely support increased wholesale transaction volumes for the company.

Currency exchange rate volatility poses a significant challenge for IDT Corporation, given its extensive global operations. Fluctuations in exchange rates directly impact the profitability of its BOSS Money international money transfer service and the cost structure of its wholesale carrier services. For instance, a strengthening US dollar against other currencies could reduce the dollar value of revenues earned in those foreign markets.

In 2024, major currency pairs like EUR/USD and GBP/USD have experienced notable swings, with the Euro trading around 1.08 against the dollar and the Pound Sterling near 1.27 in early to mid-year. These movements can affect IDT's revenue recognition and operational expenses, as earnings and costs denominated in foreign currencies must be converted back to USD. This dynamic necessitates careful financial hedging strategies to mitigate potential losses and capitalize on favorable currency movements.

Rising inflation presents a significant challenge for International Discount Telecommunications (IDT), directly impacting its operating expenses. We've seen a notable uptick in costs related to labor, energy consumption for network operations, and the procurement of essential infrastructure components. For instance, the US Consumer Price Index (CPI) reported an annual inflation rate of 3.4% as of April 2024, a figure that directly translates to higher input costs for businesses like IDT.

While IDT has historically maintained robust gross profit margins, sustained inflationary pressures pose a risk of margin compression. If the company is unable to pass on these increased costs to its customers through price adjustments for its telecommunication services, its profitability could be negatively affected. For example, if IDT's cost of goods sold increases by 5% due to inflation, but they can only raise service prices by 3%, their gross margin will shrink.

Competition and Pricing Pressures in Telecommunications

The telecommunications sector, especially for international discount services, is a battlefield of fierce competition. This intense rivalry often translates into significant pricing pressures, compelling companies like IDT to continuously adjust their rates to remain competitive.

These pricing pressures can directly impact IDT's revenue streams and overall profitability, particularly within its more traditional communication services. For instance, the global VoIP market, a key area for discount providers, was projected to reach approximately $73.1 billion in 2024, with significant growth driven by competitive pricing strategies and increasing adoption.

- Intense Competition: The global telecommunications market is characterized by numerous players, including major carriers and specialized VoIP providers, all vying for market share.

- Pricing Wars: Aggressive pricing strategies are common, forcing companies to offer lower per-minute rates or bundled packages to attract and retain customers.

- Margin Squeeze: While increased volume can offset lower prices, sustained price reductions can lead to a squeeze on profit margins, especially for services with high infrastructure costs.

- Innovation Pressure: Competition also drives innovation in service offerings and technology, requiring continuous investment to stay ahead.

Digital Remittance Market Growth

The global digital remittance market is booming, projected to reach $65.2 billion by 2027, a significant jump from $35.5 billion in 2022. This expansion is fueled by widespread mobile and internet access, making digital transfers more appealing than traditional methods. IDT's Fintech division, especially BOSS Money, is well-positioned to capitalize on this shift, as consumers increasingly favor speed and convenience.

This economic tailwind offers a substantial opportunity for IDT. The increasing adoption of digital platforms for sending money internationally directly benefits services like BOSS Money, which offer a faster and often more cost-effective alternative to traditional brick-and-mortar remittance providers. For instance, mobile money transactions in emerging markets have seen exponential growth, with estimates suggesting over 1.5 billion active mobile money accounts globally by the end of 2024.

- Market Expansion: The digital remittance market is expected to grow at a compound annual growth rate (CAGR) of 12.9% from 2023 to 2030.

- User Adoption: Over 80% of remittance flows in many developed countries are now facilitated through digital channels.

- Cost Efficiency: Digital remittances typically offer lower fees compared to traditional bank transfers or money transfer operators.

- Technological Drivers: Advancements in mobile technology and secure payment gateways are key enablers of this growth.

Global economic growth directly impacts demand for IDT's services, with the IMF projecting 3.2% global growth for 2024. This growth influences consumer and business spending on telecommunications and cross-border payments. Economic conditions also shape IDT's wholesale business, with robust global trade in 2024 and 2025 likely supporting increased wholesale transaction volumes.

Currency exchange rate volatility is a significant challenge for IDT's global operations. Fluctuations directly impact the profitability of BOSS Money and the cost structure of wholesale services. For example, the EUR/USD traded around 1.08 and GBP/USD near 1.27 in mid-2024, affecting IDT's revenue and expenses when converted to USD.

Rising inflation, with the US CPI at 3.4% in April 2024, increases IDT's operating expenses for labor, energy, and infrastructure. Sustained inflation could compress profit margins if IDT cannot fully pass these costs onto customers, potentially reducing profitability.

The telecommunications sector faces intense competition, leading to pricing pressures that affect IDT's revenue and profitability, especially in its traditional communication services. The global VoIP market, projected to reach $73.1 billion in 2024, sees growth driven by competitive pricing.

What You See Is What You Get

International Discount Telecommunications PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—a comprehensive PESTLE analysis for International Discount Telecommunications, fully formatted and ready to use.

This is a real screenshot of the product you’re buying—a detailed breakdown of Political, Economic, Social, Technological, Legal, and Environmental factors impacting International Discount Telecommunications, delivered exactly as shown, no surprises.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete PESTLE analysis ready for your strategic planning.

Sociological factors

Global migration continues to reshape demographics, with millions moving across borders annually. These movements directly fuel the demand for international money transfer services, as migrant workers send vital remittances home.

IDT's BOSS Money business thrives on these trends; for instance, remittances to Latin America, a key corridor for many migrant workers, reached an estimated $156 billion in 2024, showcasing the significant market opportunity.

The growth of large diaspora communities in countries like the United States, numbering over 50 million people of foreign birth as of recent estimates, further solidifies the need for accessible and affordable international money transfer solutions.

Global digital literacy is on the rise, with an estimated 5.3 billion internet users worldwide as of early 2024, a significant increase from previous years. This growing comfort with technology, coupled with widespread smartphone adoption, is a boon for companies like IDT. As more people gain access to and proficiency with digital tools, the market for cloud communication and digital payment solutions naturally expands, making it easier for IDT to reach a broader customer base.

Consumers today expect seamless, rapid, and straightforward international money transfers and communication services. IDT's offerings, like its BOSS Money app, directly address this by providing real-time transactions and intuitive interfaces, which is a significant draw. For instance, the digital remittance market, a key area for IDT, saw substantial growth, with global remittance flows reaching an estimated $831 billion in 2024, underscoring the demand for efficient solutions.

Trust and Security Concerns

Consumer trust in digital security is paramount for International Discount Telecommunications (IDT). As more transactions move online, concerns about data privacy and the safety of financial information directly influence customer adoption and loyalty. Reports from 2024 indicate that over 60% of consumers are hesitant to share personal data online due to security fears, a figure that could significantly impact IDT's service uptake.

Any lapse in security, such as a data breach or perceived misuse of customer information, can severely damage IDT's brand reputation. This erosion of trust can lead to customer churn across all its business segments, from voice and messaging to its mobile virtual network operator (MVNO) services. For instance, a major data breach affecting a telecommunications provider in late 2023 resulted in a 15% drop in customer satisfaction and a significant increase in customer support inquiries related to security.

- Data Privacy Regulations: Evolving regulations like GDPR and similar frameworks globally impose strict requirements on data handling, increasing compliance costs and potential penalties for IDT.

- Cybersecurity Threats: The increasing sophistication of cyberattacks poses a constant threat to IDT's infrastructure and customer data, necessitating continuous investment in robust security measures.

- Consumer Awareness: Heightened consumer awareness of online risks means that any security incident, however minor, can be amplified through social media, rapidly impacting public perception of IDT.

Impact of Remote Work and Hybrid Models

The widespread adoption of remote and hybrid work arrangements has significantly boosted the need for dependable and adaptable cloud-based communication services. This shift directly supports IDT's net2phone business, as companies increasingly rely on robust Voice over Internet Protocol (VoIP) and collaboration platforms to manage their dispersed teams.

By 2024, a substantial portion of the global workforce is expected to continue in hybrid or fully remote roles, creating sustained demand for the very solutions IDT offers. For instance, a 2023 report indicated that over 50% of knowledge workers globally were in hybrid or remote setups, a trend anticipated to persist and grow.

- Increased Demand for Cloud Communication: The ongoing preference for flexible work models drives consistent demand for cloud-based VoIP and collaboration tools.

- IDT's Strategic Advantage: IDT's net2phone segment is well-positioned to capitalize on this trend by providing essential services for distributed workforces.

- Market Growth: Projections for the unified communications and collaboration market indicate continued expansion, fueled by the sustained adoption of remote and hybrid work.

Societal shifts towards digital-first interactions continue to shape consumer behavior, directly impacting demand for telecommunication services. As populations become more interconnected, the need for seamless global communication solutions like those offered by IDT grows. This trend is further amplified by increasing global digital literacy, with billions now online and comfortable with digital transactions.

The growing acceptance of remote and hybrid work models is a significant sociological factor benefiting IDT's cloud communication segment. Companies are increasingly investing in VoIP and collaboration tools to support dispersed workforces, a trend expected to persist. This sustained demand for flexible communication solutions positions IDT's net2phone business favorably in the evolving work landscape.

Technological factors

The financial technology landscape is evolving at an unprecedented pace. Innovations like Application Programming Interfaces (APIs), blockchain, and real-time payment networks are fundamentally reshaping how money moves across borders. For International Discount Telecommunications (IDT), this presents a significant opportunity.

IDT's Fintech segment is well-positioned to capitalize on these technological shifts. By integrating advanced fintech solutions, the company can develop and offer money transfer services that are not only faster and more secure but also considerably cheaper for its customers. This strategic adoption of new technologies is crucial for maintaining and strengthening IDT's competitive standing in the global market.

Consider the growing adoption of real-time payment systems; by the end of 2024, it's projected that over 70% of global transactions will be conducted digitally, with real-time capabilities becoming increasingly standard. This trend highlights the immediate need for companies like IDT to adapt and leverage these advancements to meet consumer demand for instant and efficient financial services.

The ongoing advancement of cloud communications and Voice over Internet Protocol (VoIP) is a significant factor for IDT's net2phone. This evolution directly impacts the competitiveness and appeal of their business solutions.

Innovations that enhance call quality, enable seamless scaling, and integrate with popular workplace collaboration platforms are vital for securing and keeping business clients. For instance, the global cloud communications market was valued at approximately $12.5 billion in 2023 and is projected to reach over $25 billion by 2028, highlighting the strong demand for these evolving technologies.

The accelerating global deployment of 5G networks is a pivotal technological factor for telecommunications companies like IDT. By the end of 2024, it's projected that over 3 billion people will have access to 5G, a number expected to climb significantly in 2025, enabling faster data transmission and reduced latency.

This enhanced connectivity directly benefits IDT by improving the quality and reliability of its voice and data services. The lower latency inherent in 5G opens doors for new, high-bandwidth applications, potentially boosting demand for IDT's international calling and messaging platforms.

Artificial Intelligence and Machine Learning Integration

The integration of Artificial Intelligence (AI) and Machine Learning (ML) is poised to significantly reshape IDT's operational landscape. In its telecommunications segment, AI can drive network optimization, predict maintenance needs, and enhance customer experience through intelligent chatbots and personalized service offerings. For its fintech operations, AI is crucial for advanced fraud detection, risk assessment, and streamlining transaction processes, potentially reducing losses and improving efficiency.

These technologies offer a pathway to greater operational efficiency and the creation of more sophisticated, customer-centric services. For instance, by mid-2024, many telecom operators were reporting substantial improvements in customer query resolution times by implementing AI-powered virtual assistants, with some seeing a reduction of up to 30% in human agent workload for routine inquiries. This trend is expected to accelerate, allowing IDT to allocate resources more effectively.

- AI-driven fraud detection: Fintech services can leverage AI to identify and prevent fraudulent transactions in real-time, a critical factor given the projected 15% year-over-year growth in digital payment fraud globally through 2025.

- Network optimization: In telecommunications, ML algorithms can analyze vast datasets to predict network congestion and proactively manage resources, aiming to improve service quality and reduce infrastructure costs.

- Enhanced customer service: AI-powered chatbots and virtual assistants can handle a significant volume of customer interactions, offering 24/7 support and personalized responses, thereby boosting customer satisfaction.

- Process automation: Automating back-office tasks through AI can lead to substantial cost savings and increased speed in areas like billing, customer onboarding, and regulatory compliance.

Cybersecurity Technologies and Threats

The escalating complexity of cyber threats demands ongoing investment in advanced cybersecurity for IDT's platforms. In 2024, the global average cost of a data breach reached $4.45 million, underscoring the financial imperative for robust defenses. This trend is projected to continue, with cybercrime costs expected to reach $10.5 trillion annually by 2025, highlighting the critical need for proactive security measures in telecommunications and payment processing.

Maintaining the integrity of customer data and ensuring uninterrupted service are paramount. IDT must navigate a landscape where regulations like GDPR and CCPA impose strict data protection requirements. Failure to comply can result in significant penalties, further emphasizing the need for sophisticated cybersecurity solutions to safeguard sensitive information and uphold customer trust.

- Growing Threat Landscape: Cyberattacks are becoming more frequent and sophisticated, targeting critical infrastructure like telecommunications.

- Financial Impact: The average cost of a data breach in 2024 was $4.45 million, with global cybercrime costs projected to hit $10.5 trillion by 2025.

- Regulatory Compliance: Adherence to data protection laws such as GDPR and CCPA is crucial to avoid substantial fines and maintain operational legitimacy.

- Technological Investment: Continuous upgrades to firewalls, intrusion detection systems, encryption, and AI-powered threat analysis are essential for IDT's security posture.

Technological advancements are fundamentally reshaping the telecommunications and fintech sectors. Innovations such as AI, 5G deployment, and real-time payment systems are creating new opportunities and demands for companies like IDT. By embracing these technologies, IDT can enhance its service offerings, improve operational efficiency, and maintain a competitive edge in the rapidly evolving global market.

Legal factors

International Discount Telecommunications (IDT), through its Fintech arm, including BOSS Money, operates under a complex web of Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These rules are designed to prevent illicit financial activities and are constantly being updated by authorities worldwide.

Compliance is paramount, as failure to adhere to these evolving mandates, which often introduce more rigorous Know Your Customer (KYC) procedures and enhanced transaction monitoring, can result in substantial fines. For instance, in 2023, financial institutions globally faced billions in AML-related penalties, underscoring the significant financial and reputational risks associated with non-compliance.

IDT's ability to maintain its operating licenses and its reputation within the financial services sector hinges on its robust compliance framework. This includes investing in advanced technology for transaction screening and reporting, as well as ongoing training for its staff to navigate these critical legal requirements effectively.

As a global telecommunications provider, IDT must navigate a complex web of international data privacy and protection laws. Regulations like the General Data Protection Regulation (GDPR) in Europe, which came into full effect in 2018 and has seen significant enforcement actions, mandate strict rules for collecting, processing, and storing customer data. Failure to comply can result in substantial financial penalties, with GDPR fines potentially reaching up to 4% of global annual revenue or €20 million, whichever is higher.

IDT's commitment to data privacy is crucial for maintaining customer trust and avoiding reputational damage. For instance, in 2023, numerous companies faced scrutiny and fines for data breaches and non-compliance with privacy regulations, highlighting the significant risks involved. Adhering to these evolving legal frameworks, including those in the United States like the California Consumer Privacy Act (CCPA), ensures operational integrity and safeguards sensitive customer information, which is vital for a business handling millions of user accounts.

The European Union's Payment Services Directives, notably PSD2 and the anticipated PSD3, along with evolving open banking frameworks, are reshaping the landscape for payment service providers like International Discount Telecommunications (IDT). These regulations foster increased competition by mandating secure data sharing between financial institutions, directly impacting how IDT can integrate with and offer its services.

Compliance with PSD2 and the upcoming PSD3 necessitates robust security measures and transparent data handling practices for IDT. This regulatory environment encourages innovation in payment solutions and requires IDT to adapt its operational models to ensure secure and efficient interactions with third-party providers, ultimately affecting its competitive positioning in the market.

Telecommunications Licensing and Interconnection Agreements

IDT's telecommunications services are governed by a complex web of national and international licensing. These licenses are crucial for operating its communications segment and providing wholesale carrier services globally. For instance, in 2024, regulatory bodies worldwide continued to refine spectrum allocation policies, impacting how companies like IDT can utilize wireless frequencies, which can directly influence operational costs and service delivery.

Changes in licensing requirements, such as new fees or compliance mandates, can significantly alter IDT's operating expenses. Furthermore, shifts in interconnection agreements, the terms under which different telecom networks connect and exchange traffic, directly influence IDT's ability to offer competitive wholesale rates and maintain market access. These agreements are often subject to negotiation and regulatory oversight, making them a dynamic factor.

- Regulatory Scrutiny: Telecom licenses are subject to ongoing review and potential modification by national authorities, impacting IDT's operational framework.

- Interconnection Rate Fluctuations: Changes in mandated interconnection rates can directly affect IDT's revenue streams from wholesale traffic termination.

- Spectrum Availability: Access to and cost of spectrum for mobile and wireless services, a key area of regulatory policy, can influence IDT's investment decisions and service offerings.

Consumer Protection Laws

Consumer protection laws are a significant legal factor for International Discount Telecommunications (IDT). These regulations, especially those focusing on fair pricing, clear fee disclosures, and effective dispute resolution, directly impact IDT's telecommunications and payment services. For instance, in the US, the Federal Communications Commission (FCC) enforces rules like the Truth in Billing Act, requiring clear and accurate billing information for telecommunications services. Similarly, the Consumer Financial Protection Bureau (CFPB) oversees many aspects of payment services, ensuring transparency and fairness.

Compliance with these consumer protection frameworks is crucial for maintaining customer trust and avoiding costly legal battles and penalties. In 2024, regulatory scrutiny over telecommunications pricing and hidden fees remained high across major markets. Companies like IDT must ensure their service agreements and billing practices align with regulations such as the GDPR in Europe, which mandates clear consent and data protection for consumers, and similar consumer rights legislation in countries like Brazil and India, where IDT operates.

- Fair Pricing and Transparency: Regulations mandate clear disclosure of all charges, preventing deceptive pricing practices.

- Dispute Resolution: Robust mechanisms are required to handle customer complaints effectively and efficiently.

- Data Privacy: Laws like GDPR and CCPA dictate how consumer data is collected, used, and protected in communication and payment services.

- Regulatory Compliance: Adherence to a patchwork of international and national consumer protection laws is essential to avoid fines and reputational damage.

International Discount Telecommunications (IDT) must navigate a complex global legal landscape, including stringent Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) regulations. These require robust Know Your Customer (KYC) procedures and transaction monitoring, with global AML penalties in 2023 exceeding billions for non-compliant financial institutions.

Data privacy laws, such as the GDPR, impose strict rules on handling customer data, with potential fines up to 4% of global annual revenue. In 2023, numerous companies faced penalties for data breaches, highlighting the critical need for IDT to maintain strong data protection practices.

Evolving payment service directives like PSD2 and upcoming PSD3 necessitate secure data sharing and transparent practices, impacting IDT's competitive positioning. Furthermore, telecommunications licensing, including spectrum allocation policies refined in 2024, directly influences IDT's operational costs and service offerings.

Consumer protection laws demand fair pricing and clear fee disclosures, with regulatory scrutiny on telecommunications pricing remaining high in 2024. Compliance with these varied international and national laws is essential to avoid substantial fines and reputational damage.

Environmental factors

The extensive network infrastructure and data centers that power International Discount Telecommunications (IDT) operations are substantial energy consumers. As global awareness of climate change grows, IDT, like many in the telecom sector, is under increasing pressure to demonstrate a commitment to sustainability.

This pressure translates into a strategic imperative to lower its carbon footprint. For instance, the global ICT sector's energy consumption was projected to reach over 10% of total global electricity demand by 2026, highlighting the scale of the challenge.

Consequently, IDT is incentivized to invest in and adopt renewable energy sources for its facilities and implement more energy-efficient technologies across its network. This shift is not just about environmental responsibility but also about operational cost reduction and maintaining a positive brand image in a market increasingly valuing eco-conscious practices.

The telecommunications industry, including companies like IDT, grapples with significant electronic waste (e-waste) challenges as equipment lifecycles shorten. This trend is expected to intensify, with global e-waste generation projected to reach 74.7 million metric tons by 2030, a substantial increase from 53.6 million metric tons in 2019.

Consequently, IDT faces growing regulatory pressure and public scrutiny concerning the responsible management and recycling of its hardware. This environmental factor could necessitate investments in sustainable disposal practices and impact supply chain logistics, potentially increasing operational costs.

Climate change is increasingly leading to more frequent and intense extreme weather, a significant concern for telecommunications. These events, such as hurricanes and floods, can directly damage IDT's physical infrastructure, including cell towers and fiber optic cables, causing service disruptions for customers.

The physical risks associated with these weather patterns necessitate substantial investments in building more resilient infrastructure. For instance, in 2024, the global economic cost of weather and climate disasters reached hundreds of billions of dollars, highlighting the potential impact on companies like IDT that rely on stable infrastructure.

Regulatory Pressure for Green Initiatives

Governments and international organizations are stepping up regulations, pushing sectors like telecommunications towards more eco-friendly operations and requiring detailed environmental, social, and governance (ESG) reporting. This means IDT must adapt to these changing expectations to safeguard its reputation and appeal to investors who prioritize sustainability.

The global push for decarbonization is intensifying. For instance, the European Union's Green Deal aims for climate neutrality by 2050, which translates into stricter emissions standards and energy efficiency mandates for all industries, including telecom infrastructure and operations. IDT’s compliance with these evolving regulations will be crucial for its long-term viability and market access.

- Increased scrutiny on carbon footprints: Telecom companies face growing pressure to measure and reduce their greenhouse gas emissions across all operations, from data centers to network equipment.

- Mandatory ESG disclosures: Regulatory bodies are increasingly requiring public companies to report on their ESG performance, making transparency in environmental impact a non-negotiable aspect of corporate governance.

- Incentives for renewable energy adoption: Governments are offering tax credits and subsidies for adopting renewable energy sources, which can help offset the high energy consumption of telecommunications networks.

- Circular economy principles: There's a growing expectation for companies to implement strategies for e-waste reduction and responsible disposal of electronic equipment, aligning with circular economy models.

Resource Scarcity and Supply Chain Resilience

The telecommunications industry, including companies like International Discount Telecommunications (IDT), faces growing concerns over resource scarcity. Critical materials like rare earth elements, essential for advanced semiconductor manufacturing in network equipment, are subject to geopolitical influences and potential supply disruptions. For instance, China's dominance in rare earth processing, accounting for roughly 60% of global production in 2023, highlights this vulnerability.

This scarcity directly impacts procurement costs and operational efficiency for IDT. As global demand for 5G infrastructure and advanced mobile devices continues to rise, the pressure on these limited resources intensifies. Companies are increasingly prioritizing supply chain resilience and environmental responsibility. This involves diversifying sourcing, investing in recycling technologies, and ensuring ethical labor practices throughout the value chain.

IDT's strategic approach must therefore incorporate robust risk management for its supply chain. This includes:

- Diversifying Material Sourcing: Exploring alternative suppliers and geographical regions to mitigate reliance on single sources for critical components.

- Investing in Circular Economy Practices: Implementing or supporting initiatives for electronic waste recycling and material recovery to reduce reliance on virgin resources.

- Supplier Audits and Partnerships: Collaborating with suppliers who demonstrate strong environmental, social, and governance (ESG) credentials and robust business continuity plans.

- Technological Innovation: Supporting research and development into alternative materials or more efficient manufacturing processes that reduce the need for scarce resources.

The telecommunications sector, including International Discount Telecommunications (IDT), is a significant consumer of energy, contributing to its carbon footprint. With global electricity demand from ICT projected to exceed 10% by 2026, IDT faces pressure to adopt renewable energy and enhance energy efficiency to reduce emissions and operational costs.

The growing challenge of electronic waste (e-waste) is also a critical environmental factor, with global generation expected to reach 74.7 million metric tons by 2030. IDT must manage its hardware responsibly, potentially increasing costs through investments in sustainable disposal and recycling practices.

Extreme weather events, exacerbated by climate change, pose a direct threat to IDT's physical infrastructure, leading to service disruptions. The economic impact of such disasters, which reached hundreds of billions of dollars globally in 2024, underscores the need for resilient infrastructure investments.

Stricter environmental regulations and mandatory ESG disclosures are becoming standard, requiring IDT to demonstrate transparency and commitment to sustainability to maintain investor appeal and regulatory compliance, such as the EU's Green Deal aiming for climate neutrality by 2050.

PESTLE Analysis Data Sources

Our PESTLE Analysis for International Discount Telecommunications is grounded in data from reputable sources including the ITU, World Bank, and leading market research firms. We incorporate regulatory updates from various national telecommunications authorities and economic indicators from global financial institutions.