International Discount Telecommunications Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Discount Telecommunications Bundle

Curious about International Discount Telecommunications' market standing? This preview offers a glimpse into their product portfolio's potential, hinting at growth opportunities and areas needing attention.

Unlock the full strategic picture by purchasing the complete BCG Matrix. Discover precisely which of their offerings are Stars, Cash Cows, Dogs, or Question Marks, and gain actionable insights to guide your investment decisions.

Don't miss out on the detailed quadrant analysis and expert recommendations that will empower you to navigate the competitive telecommunications landscape with confidence.

Stars

BOSS Money's digital remittance channel is a shining example of a Star within the International Discount Telecommunications (IDT) BCG Matrix. Its digital-first approach has fueled remarkable growth, evidenced by a 31% year-over-year revenue increase and a 32% surge in transactions during Q3 2025.

This stellar performance has directly boosted the Fintech segment's profitability, expanding its adjusted EBITDA margin to a robust 13.0% in Q3 2025, a significant leap from just 1.0% in Q3 2024. This trajectory firmly establishes BOSS Money as a dominant force in the international money remittance market.

National Retail Solutions (NRS) continues its significant expansion, reaching approximately 36,600 active terminals across 31,700 independent retail locations by June 2025. This growth directly bolsters IDT's overall financial performance.

The increasing terminal count has driven robust recurring revenue for NRS, which saw a 23% year-over-year increase in Q3 2025. This performance is a key contributor to IDT's consolidated revenue and profitability.

NRS Merchant Services and its Software-as-a-Service (SaaS) offerings are a significant growth engine, earning them a Star position. In the second quarter of 2025, merchant services revenue saw a substantial 37% increase year-over-year, while SaaS fees climbed by 33%.

These high-margin products are directly contributing to the segment's robust Adjusted EBITDA and income from operations. This performance underscores the company's effective strategy in monetizing its point-of-sale (POS) platform, showcasing strong financial health and market traction.

net2phone's Cloud Communications (UCaaS/CCaaS)

net2phone's Cloud Communications (UCaaS/CCaaS) is positioned as a star within the International Discount Telecommunications BCG Matrix. The company has demonstrated robust expansion, reaching over 415,000 seats by April 2025. This growth is further supported by an 11% annual increase in subscription revenue on a constant currency basis during Q3 2025.

The strategic emphasis on higher revenue-per-seat CCaaS solutions, coupled with ongoing market penetration in the U.S., Brazil, and Mexico, highlights net2phone's strong growth potential. This focus suggests a trajectory towards becoming a substantial profit contributor for the organization.

- Consistent Growth: Over 415,000 seats served as of April 2025.

- Revenue Increase: 11% annual subscription revenue growth (constant currency) in Q3 2025.

- Strategic Focus: Emphasis on higher revenue-per-seat CCaaS offerings.

- Market Expansion: Continued growth in key markets like the U.S., Brazil, and Mexico.

BOSS Money's Overall Fintech Segment Performance

BOSS Money's Fintech segment demonstrated exceptional growth in Q3 2025, with revenue climbing by 25% year-over-year. This surge was significantly bolstered by a remarkable 20-fold increase in Adjusted EBITDA, highlighting the segment's expanding profitability.

The strong performance is attributed to strategic initiatives, including effective cross-marketing efforts and the expansion of its retail agent network. These factors have solidified BOSS Money's market presence and its capacity to translate growth into substantial earnings.

- Revenue Growth: 25% year-over-year in Q3 2025.

- Adjusted EBITDA Improvement: 20-fold increase compared to the prior year.

- Key Drivers: Successful cross-marketing and expanded retail agent networks.

- Market Position: Strong and increasingly profitable.

Stars within IDT's portfolio represent high-growth, high-market-share businesses. BOSS Money, with its 31% year-over-year revenue increase in Q3 2025 and expanding EBITDA margins, exemplifies this. Similarly, NRS's expanding terminal network, leading to a 23% recurring revenue jump in Q3 2025, and net2phone's 11% subscription revenue growth in Q3 2025 with over 415,000 seats by April 2025, showcase their strong market positions and growth trajectories.

| Business Unit | Market Position | Growth Rate | Profitability Indicator | Key Metric |

|---|---|---|---|---|

| BOSS Money | High | 31% YoY Revenue (Q3 2025) | 13.0% Adj. EBITDA Margin (Q3 2025) | 32% Transaction Growth (Q3 2025) |

| NRS | High | 23% YoY Recurring Revenue (Q3 2025) | Growing Contribution to Consolidated Profit | 36,600 Active Terminals (June 2025) |

| net2phone | High | 11% YoY Subscription Revenue (Q3 2025) | Strong Profit Contributor Potential | 415,000+ Seats (April 2025) |

What is included in the product

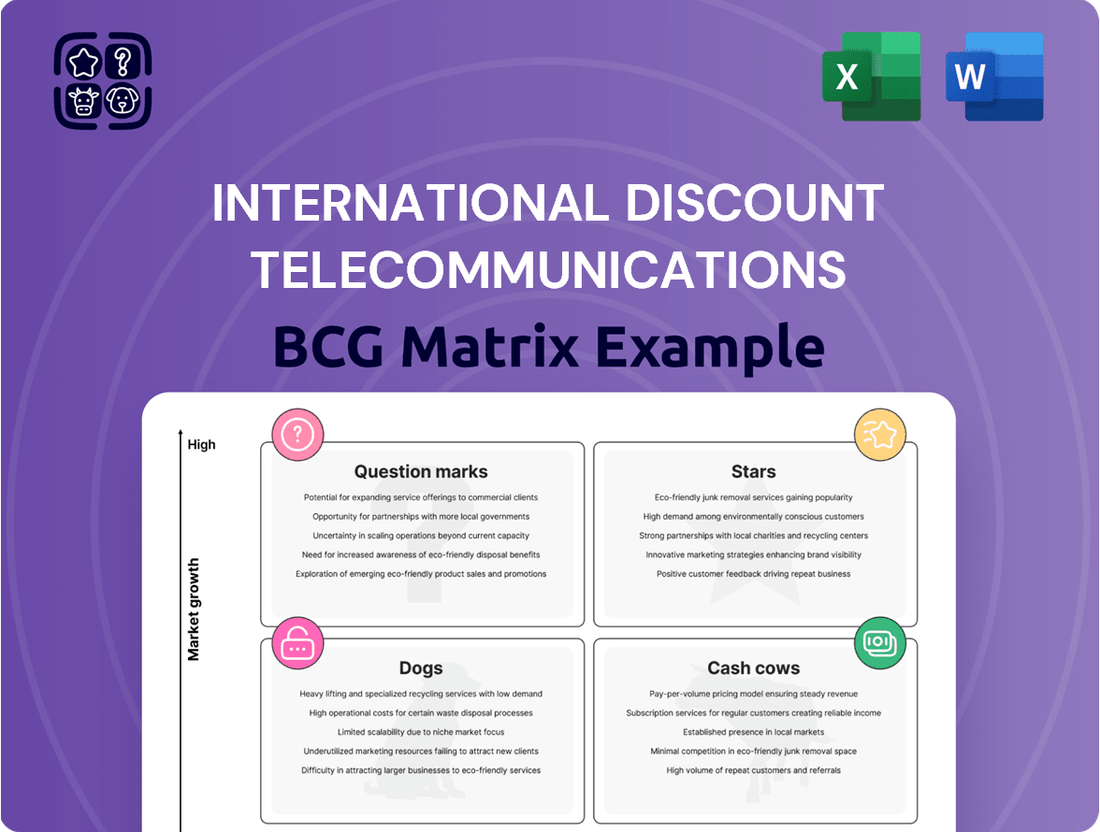

This BCG Matrix offers a strategic overview of International Discount Telecommunications' product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

It provides insights into investment, holding, or divestment strategies for each quadrant.

The International Discount Telecommunications BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's position to alleviate strategic confusion.

Cash Cows

Traditional Communications, encompassing wholesale voice and SMS, remains a significant cash generator for IDT despite a slow revenue downturn. This segment benefits from IDT's established high market share in a mature industry.

Operational efficiencies and strategic pricing adjustments are key to sustaining profitability in this segment. For instance, in fiscal year 2024, IDT reported that its Communications segment, which includes these traditional services, generated $60 million in operating income, showcasing its continued cash-generating capability.

The BOSS Revolution Calling Service, a legacy product within International Discount Telecommunications' Traditional Communications segment, functions as a classic cash cow. This mature offering benefits from a deeply entrenched customer base and requires very little in terms of marketing or development investment, allowing it to reliably funnel profits back into the company. In 2024, the calling service continued its trend of stable revenue generation, contributing significantly to the company's overall financial health and providing capital for growth initiatives in other areas.

IDT Digital Payments, within the broader Traditional Communications segment of IDT Corporation, is a prime example of a Cash Cow in the BCG Matrix. This mature business has demonstrated improved unit pricing, directly boosting its contribution to the company's income from operations.

The steady revenue and robust cash flow generated by IDT Digital Payments, along with other digital prepaid services, underscore its Cash Cow status. While growth prospects are modest, the high operational efficiency ensures consistent profitability, making it a reliable income generator for the company.

Optimized Traditional Communications Operations

IDT's strategic focus on optimizing its Traditional Communications operations has successfully improved its financial performance. Despite a dip in revenue, the company has seen increased income from operations, a clear indicator of its cash cow status. This segment's resilience is a testament to effective cost management and efficiency improvements.

The ability of Traditional Communications to generate substantial profits, even with declining revenues, highlights its role as a stable cash generator for IDT. This segment's strong profitability, driven by cost-cutting measures and operational enhancements, solidifies its position as a key contributor to the company's overall financial health.

- Revenue Stability: While not growing, the traditional segment provides consistent revenue streams.

- Profitability Focus: IDT has prioritized profitability through efficiency gains and cost reductions.

- Cash Generation: The segment acts as a reliable source of cash to fund other business areas.

- Operational Streamlining: Investments in optimizing operations have yielded positive economic results.

IDT Global's High-Margin Route Optimization

IDT Global, within the broader Traditional Communications sector, is navigating the industry's decline in paid-minute voice traffic by focusing on higher-margin routes. This strategic pivot is crucial for maintaining profitability in a mature business segment.

This approach ensures that IDT Global continues to generate robust cash flows, even as overall voice usage decreases. The company's ability to optimize its traffic mix directly translates into sustained financial stability.

- Focus on High-Margin Routes: IDT Global prioritizes traffic that yields better profitability, compensating for lower overall volumes.

- Mitigating Industry Decline: The strategy directly addresses the industry-wide shrinkage in paid-minute voice services.

- Ensuring Cash Flow: This operational efficiency is key to maintaining solid cash generation from its established voice business.

- Financial Stability: The consistent cash flow contributes significantly to the company's overall financial health and resilience.

The Traditional Communications segment, including services like BOSS Revolution Calling and IDT Digital Payments, continues to be IDT's primary cash cow. Despite a general revenue downturn in wholesale voice and SMS, this segment's focus on operational efficiencies and strategic pricing has maintained strong profitability. In fiscal year 2024, this segment generated $60 million in operating income, demonstrating its reliable cash-generating capability.

IDT Global's strategic shift to higher-margin routes within Traditional Communications is key to its cash cow status, effectively counteracting declining voice traffic. This focus ensures continued robust cash flows, contributing significantly to IDT's overall financial stability.

| Segment | BCG Category | FY2024 Operating Income | Key Strategy | Outlook |

| Traditional Communications (incl. BOSS Revolution, Digital Payments, IDT Global) | Cash Cow | $60 million | Operational efficiencies, strategic pricing, focus on high-margin routes | Stable cash generation, funding growth initiatives |

Delivered as Shown

International Discount Telecommunications BCG Matrix

The International Discount Telecommunications BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report designed for strategic decision-making.

Dogs

Certain legacy voice termination routes within the International Discount Telecommunications (IDT) portfolio likely fall into the dogs category of the BCG Matrix. These routes are characterized by low market growth, as demand for traditional voice services continues to decline due to the rise of digital communication platforms.

These underperforming routes often struggle with profitability, potentially barely breaking even. In 2024, the global voice over IP (VoIP) market, while still substantial, saw its growth rate moderate, with legacy circuit-switched termination facing even greater pressure.

The commoditization of voice services means these routes generate minimal revenue per minute, tying up valuable resources and capital that could be better deployed in higher-growth areas. For instance, IDT’s own financial reports have indicated a strategic focus on shifting away from lower-margin, declining voice segments.

Obsolete international calling card products, separate from the main BOSS Revolution service, are likely experiencing very low demand. These older, physical cards have been largely superseded by more convenient digital and app-based communication methods, leading to a negligible market share.

The decline in relevance for these traditional calling cards means they are probably generating minimal revenue. This situation can create a cash trap, where resources are tied up in a product that offers little return, especially as the market continues its strong migration towards mobile and internet-based calling solutions.

Within International Discount Telecommunications' (IDT) broad range of ventures, small, early-stage initiatives that haven't gained traction and consistently underperform are classified as Non-Strategic, Non-Performing Small Ventures. These ventures are drains on resources, consuming capital and management attention without contributing to market share or revenue growth. For instance, a hypothetical small venture within IDT's portfolio focused on a niche IoT communication platform might have shown only a 2% market penetration by early 2024, despite significant initial investment.

These underperforming ventures represent a clear signal for divestiture. Their continued existence ties up capital that could be better allocated to more promising segments of IDT's business, such as their established telecom services or burgeoning media and entertainment divisions. In 2023, IDT reported a consolidated net income of $87.7 million, highlighting the importance of optimizing resource allocation across its various business units.

Highly Competitive, Low-Margin Wholesale Data Services

Some niche wholesale data services, if facing intense competition and offering extremely thin margins without significant volume, could be considered Dogs in the International Discount Telecommunications BCG Matrix. These services would offer little differentiation, making it difficult to gain market share or generate substantial profit in a crowded market. For example, certain legacy wholesale bandwidth provisioning services might fall into this category, especially if they haven't adapted to newer, more efficient technologies.

These "Dog" services are characterized by low growth and low market share, consuming resources without generating significant returns. In 2024, the wholesale data market, while growing, is highly fragmented, with major players often dominating through economies of scale. Smaller providers of specialized or older data services struggle to compete on price and innovation, leading to these challenging market positions.

- Low Growth: The segment of the wholesale data market occupied by these services is not expanding rapidly.

- Low Market Share: The company holds a small percentage of the total market for these specific data services.

- Thin Margins: Profitability per unit sold is minimal due to intense price competition.

- Limited Differentiation: The services offered are largely commoditized, making it hard to stand out from competitors.

Geographically Limited, Declining Legacy Services

Geographically limited, declining legacy services within International Discount Telecommunications (IDT) would likely fall into the Dogs category of the BCG Matrix. These are services, perhaps older voice or data plans, that are tied to specific, shrinking regional markets or rely on outdated technologies. Their market share is low, and the overall market for them is not growing, often contracting.

Maintaining these services can be a significant drain on resources for IDT. For instance, if a particular legacy service is only used in a region where subscriber numbers have steadily decreased, the cost of infrastructure and support might outweigh the revenue generated. By the end of 2024, many telecommunication companies have been actively divesting or phasing out such services to focus on more profitable, high-growth areas.

- Low Market Share: These services typically serve a small, often diminishing, customer base.

- Low Market Growth: The overall demand for these specific legacy offerings is in decline.

- Resource Drain: Continued investment in outdated infrastructure or niche markets can divert capital from more promising ventures.

- Strategic Review: Companies like IDT often consider options such as divestiture or managed decline for these portfolio components.

Legacy voice termination routes within International Discount Telecommunications (IDT) are prime examples of "Dogs" in the BCG Matrix. These routes face declining demand due to the widespread adoption of digital communication, leading to low market growth. In 2024, the global market for traditional circuit-switched voice termination continued to shrink, with VoIP services dominating the landscape.

These segments are often characterized by minimal profitability, potentially just breaking even, and tie up capital in low-margin services. IDT's strategic reports have consistently highlighted a move away from these declining voice segments. For example, the company's focus shifted towards its BOSS Revolution platform, which leverages newer communication technologies.

Obsolete international calling card products, separate from IDT's main offerings, also fit the Dog classification. These have seen a drastic reduction in demand as consumers opt for app-based or digital communication methods. By early 2024, the market share for such physical cards was negligible, representing a cash drain rather than a revenue generator.

Niche wholesale data services with thin margins and little differentiation, especially those not updated with newer technologies, can also be classified as Dogs. These services struggle to gain market share in a competitive environment. In 2024, while the wholesale data market grew, smaller providers of legacy services found it challenging to compete with larger players offering economies of scale and more advanced solutions.

| BCG Category | IDT Business Segment Example | Market Growth | Market Share | Profitability |

| Dogs | Legacy Voice Termination Routes | Low (Declining) | Low | Low/Break-even |

| Dogs | Obsolete International Calling Cards | Very Low (Negligible) | Very Low | Very Low |

| Dogs | Niche Legacy Wholesale Data Services | Low | Low | Thin Margins |

Question Marks

net2phone's AI-powered solutions, including their new AI Agents and upcoming AI Coach, are positioned as potential high-growth ventures. These innovations aim to boost customer interaction and cut operational expenses, reflecting a strategic move into a burgeoning market.

Currently, these AI offerings represent a small fraction of net2phone's overall market presence, indicating they are in the early stages of development. Significant investment will be necessary to scale these solutions and capture a larger market share, moving them from their current position towards becoming market leaders or 'Stars' in the BCG matrix.

IDT's NRS segment is introducing new point-of-sale (POS) formats, including self-ordering kiosks and Android tablets for smaller retailers. These innovations aim to tap into emerging markets with significant growth prospects.

While these new POS systems are designed to capture new customer segments, their market share remains minimal as they are in the initial stages of deployment and adoption. For instance, as of early 2024, the kiosk and tablet POS systems represent a very small fraction of IDT's overall NRS revenue, reflecting their nascent market penetration.

Beyond BOSS Money, International Discount Telecommunications' (IDT) fintech segment encompasses several early-stage initiatives. These ventures, while not as established as BOSS Money, are poised for high growth within the rapidly expanding fintech sector. Their current market share is minimal, necessitating significant investment to foster development and achieve scalability.

In 2024, the global fintech market was valued at over $1.3 trillion and is projected to grow substantially. These smaller IDT initiatives are positioned to capture a portion of this growth, though their current contribution is modest. Their success hinges on their ability to innovate and gain traction against larger, more entrenched competitors.

BOSS Money's Expansion into New Geographic Corridors

BOSS Money's strategic push into new remittance corridors, including Venezuela, Brazil (leveraging the Pix system), and Eritrea, highlights its ambition to tap into high-growth potential in previously underserved regions. These markets, while offering significant upside, currently represent a minimal share of IDT's overall remittance volume, positioning them as question marks within the BCG matrix.

The challenge for IDT lies in the substantial investment required to build brand awareness and operational infrastructure in these nascent markets. For instance, while Brazil's Pix system offers a streamlined digital payment pathway, capturing market share from established players necessitates aggressive marketing and competitive pricing strategies. In 2023, IDT reported its total remittance revenue was $1.15 billion, with these newer corridors contributing a small fraction, underscoring the need for focused development.

- High Growth Potential: Expansion into Venezuela, Brazil, and Eritrea targets markets with significant remittance inflows and a growing demand for digital transfer services.

- Low Market Share: These new corridors currently hold a negligible market share for IDT, requiring substantial investment to gain traction.

- Competitive Landscape: IDT faces established remittance providers in these markets, necessitating differentiation through service quality and pricing.

- Investment Requirement: Capturing market share demands strategic financial commitment for marketing, compliance, and operational scaling.

NRS's Advertising and Data Monetization Initiatives

NRS is strategically expanding its advertising technology capabilities and increasing the deployment of screens across new retail locations. This initiative is designed to capitalize on its extensive transaction data, enabling monetization and providing access to an urban consumer base concentrated within independent retailers.

The company's focus on advertising and data monetization represents a significant growth opportunity, leveraging its existing infrastructure and customer reach. However, this segment is still in its nascent stages of development and market penetration.

- Advertising Tech Development: NRS is investing in building out its advertising technology stack to facilitate data-driven campaigns and ad placements.

- Screen Deployment: The company is actively deploying screens in new retail locations to expand its advertising footprint and reach.

- Data Monetization: NRS aims to monetize its vast transaction data by offering targeted advertising solutions to brands.

- Market Position: While holding a low current market share in this nascent advertising segment, NRS is positioned to capture growth by leveraging its existing retail network and customer data.

Question Marks within IDT's portfolio represent ventures with high growth potential but low market share. These are typically new products or market entries that require significant investment to develop and scale. Their future success is uncertain, making them a key focus for strategic evaluation and potential resource allocation.

BCG Matrix Data Sources

Our International Discount Telecommunications BCG Matrix is built on robust market data, encompassing financial reports, competitor analysis, and global telecom industry research to provide strategic insights.