International Discount Telecommunications Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

International Discount Telecommunications Bundle

International Discount Telecommunications operates in a dynamic telecom landscape, where understanding the competitive forces is crucial for success. Our analysis reveals the intricate interplay of buyer power, supplier leverage, the threat of new entrants, and the intensity of rivalry.

The complete report reveals the real forces shaping International Discount Telecommunications’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The telecommunications infrastructure market is highly concentrated, with a small number of key players like Ericsson, Nokia, and Huawei dominating. This limited competition means these suppliers hold substantial power, influencing pricing and dictating contract terms for companies like International Discount Telecommunications (IDT). For instance, in 2023, the global telecom equipment market was valued at over $100 billion, with these three companies consistently holding significant market share.

This supplier concentration directly translates into leverage for these manufacturers. They can command higher prices for their essential equipment and services, and negotiate favorable payment and delivery terms. For IDT, this means that a significant portion of their capital expenditure and operational costs are subject to the decisions of a few powerful entities, potentially squeezing profit margins.

IDT, like many telecommunications firms, depends heavily on specialized technology providers for essential network infrastructure. The unique specifications of components such as high-capacity fiber-optic cables and advanced network routers often mean there are few alternative suppliers. This reliance on niche products can make it difficult and costly for IDT to switch providers, giving those suppliers significant leverage.

The international wholesale voice carrier market, crucial for IDT's operations, exhibits moderate concentration. A handful of large multinational carriers hold a substantial portion of the market share, which inherently grants them significant leverage.

This market structure means IDT has fewer alternatives for sourcing wholesale voice services, thereby increasing the bargaining power of these dominant suppliers. For instance, in 2024, the top five global wholesale voice carriers are estimated to manage over 60% of international traffic volumes, a figure that underscores their market influence.

Potential for Forward Integration by Suppliers

The bargaining power of suppliers can be significantly amplified if major telecom equipment manufacturers or wholesale voice carriers were to integrate forward into providing retail telecommunication services. This would transform them from suppliers into direct competitors for International Discount Telecommunications (IDT). Such a move would dramatically shift the power dynamic, as these integrated entities would possess greater control over pricing and terms, directly impacting IDT's cost structure and market position.

While this remains a theoretical threat, the potential for forward integration by suppliers is a critical consideration. For instance, in 2024, the global telecommunications equipment market was valued at over $100 billion, with a few dominant players. If even one of these major players decided to enter the retail service market, it could disrupt the competitive landscape for companies like IDT.

- Supplier Threat: Major telecom equipment manufacturers or wholesale voice carriers integrating forward into retail services would become direct competitors to IDT.

- Increased Bargaining Power: Such integration would significantly enhance supplier bargaining power by creating direct competition.

- Market Disruption: This theoretical threat could lead to altered pricing and terms for IDT if it materializes.

- Industry Value: The global telecommunications equipment market's substantial size, exceeding $100 billion in 2024, highlights the potential impact of major players entering new segments.

Cost of Switching Suppliers

The cost of switching suppliers significantly impacts the bargaining power of suppliers for International Discount Telecommunications (IDT). When IDT needs to change its core infrastructure providers or wholesale voice carriers, the process can be quite expensive and disruptive. This involves not just the financial outlay for new contracts but also the complex technical work to integrate new systems and the risk of service interruptions during the transition. These substantial switching costs effectively lock IDT into existing supplier relationships, giving those suppliers more leverage.

For example, in the telecommunications sector, integrating new wholesale voice carriers often requires significant upfront investment in network configuration and testing. IDT's reliance on these specialized services means that even minor changes can necessitate extensive engineering resources. The potential for service degradation or downtime during a switch is a major deterrent, further solidifying the position of incumbent suppliers.

- High Switching Costs: IDT faces considerable expenses and operational challenges when changing core infrastructure or wholesale voice providers.

- Technical Integration: The complexity of integrating new systems and ensuring seamless service continuity creates a barrier to switching.

- Contractual Obligations: Existing long-term contracts with suppliers can also impose penalties or significant costs for early termination.

- Supplier Leverage: These factors collectively increase the bargaining power of IDT's current suppliers, as switching is a costly and risky endeavor.

The bargaining power of suppliers for International Discount Telecommunications (IDT) is considerable due to the concentrated nature of the telecommunications equipment market, with major players like Ericsson and Nokia holding significant sway. Furthermore, the reliance on specialized components and the high costs associated with switching providers solidify supplier leverage. The international wholesale voice carrier market also contributes, as a few large multinational carriers manage a substantial portion of global traffic, giving them considerable influence over IDT.

| Supplier Type | Market Concentration | Key Factors Influencing Bargaining Power | Impact on IDT |

|---|---|---|---|

| Telecom Equipment Manufacturers | High (e.g., Ericsson, Nokia, Huawei dominate) | Limited alternatives, specialized technology, high switching costs | Higher equipment prices, stricter contract terms |

| Wholesale Voice Carriers | Moderate (few large multinational carriers) | Significant market share, control of international traffic volumes | Less flexibility in sourcing voice services, potential price pressure |

What is included in the product

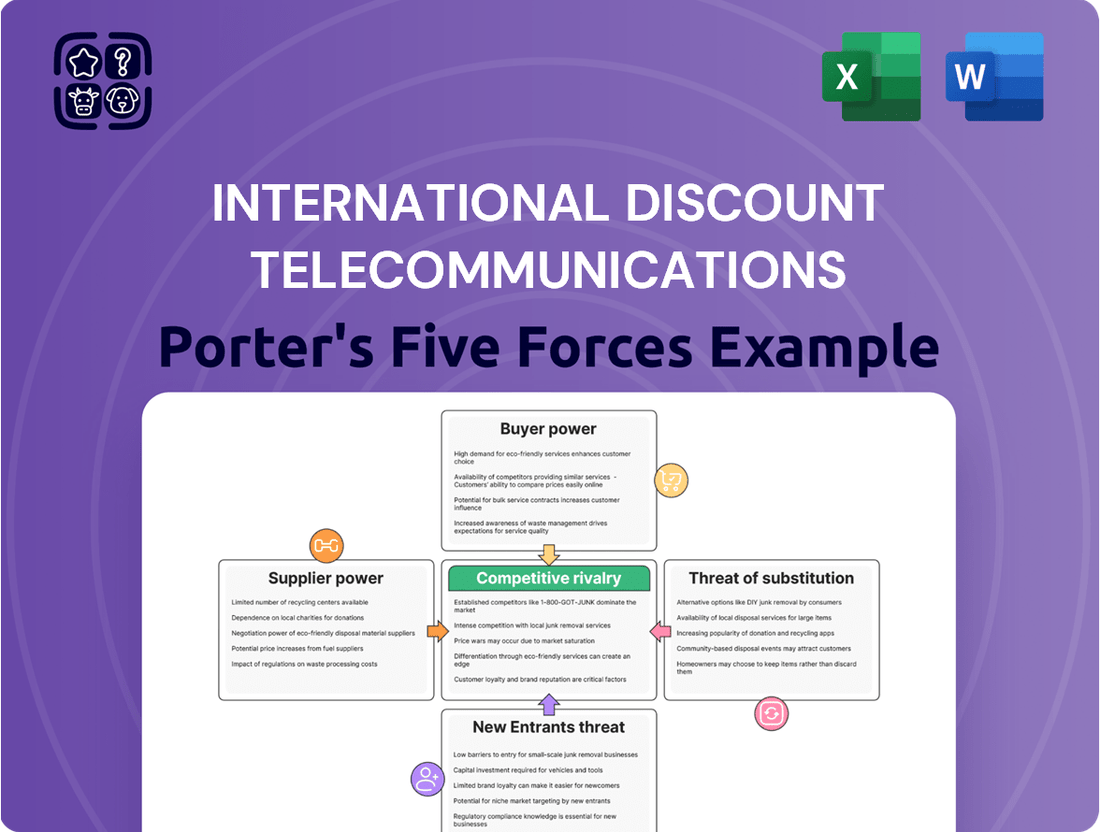

This analysis identifies the key competitive forces impacting International Discount Telecommunications, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within the telecommunications industry.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces on a customizable dashboard.

Gain a clear, actionable understanding of market dynamics to proactively address potential challenges and capitalize on opportunities within the telecommunications sector.

Customers Bargaining Power

Customers in the discount international telecommunications sector exhibit extreme price sensitivity, relentlessly pursuing the most affordable call and data rates. This inherent price-consciousness significantly amplifies their bargaining power, as even marginal price variations can trigger provider switches.

In 2024, the average monthly cost for international calling plans from discount providers often hovered around $10-$20, with many customers actively comparing these rates across multiple providers. For instance, a 5% difference in per-minute charges could easily lead a customer to switch, demonstrating a low switching cost and high price elasticity.

For International Discount Telecommunications, the bargaining power of customers is amplified by low switching costs. In the retail telecommunications and money transfer sectors, it's typically easy and inexpensive for consumers to switch providers, especially with the prevalence of digital platforms and mobile apps. This ease of transition empowers customers to readily explore and adopt alternative services.

The international telecommunications and money transfer market is quite crowded, with many companies vying for customers. This means clients have plenty of options to explore, making it easier for them to shop around for the best deals or switch providers if they're not satisfied.

In 2024, the global remittance market, a key area for international money transfer services, was projected to reach over $800 billion, highlighting the significant volume and customer base available to various providers. This sheer volume of transactions underscores the competitive landscape where customer choice is paramount.

Digital Platforms Increase Price Transparency

Digital platforms have significantly boosted price transparency in the telecommunications sector, particularly for international services. Online comparison sites and mobile apps allow consumers to easily view and contrast pricing structures, feature sets, and customer reviews for various international calling and money transfer providers. This accessibility empowers customers to make more informed decisions and exert pressure on companies to offer more competitive rates.

The ease of comparison directly translates into a stronger bargaining position for customers. For instance, in 2024, the global remittance market, a closely related sector, saw significant competition driven by digital solutions, with fees often falling below 5% for many digital transfers, a stark contrast to traditional methods. This trend is mirrored in international calling services, where platforms highlight cost savings, forcing providers to align their pricing to attract and retain users.

- Increased Price Comparison: Customers can readily compare international calling rates and money transfer fees across numerous providers via online platforms and apps.

- Demand for Competitive Rates: Enhanced transparency empowers consumers to negotiate or switch to providers offering more favorable pricing.

- Impact on Profit Margins: Providers face pressure to reduce margins to remain competitive in a market where price is easily verifiable.

- Shift to Value-Based Pricing: Companies are increasingly focusing on bundled services and added value rather than solely competing on price.

Increasing Demand for Value-Added Services

Customers, while still mindful of price, are increasingly seeking more than just basic telecommunication and money transfer services. They are actively looking for value-added features like heightened security, quicker transaction processing, and seamless integration with other financial tools.

This shift means providers such as IDT need to continuously innovate to cater to these evolving customer expectations. For instance, in 2024, the global fintech market saw a significant surge in demand for integrated financial solutions, with many consumers prioritizing platforms that offer a comprehensive suite of services.

- Demand for Enhanced Security: Customers are more aware of digital threats and expect robust security measures for their transactions.

- Preference for Faster Transactions: Real-time or near real-time transaction speeds are becoming a standard expectation.

- Integration with Other Financial Apps: Users want their communication and money transfer services to work harmoniously with other financial management tools they use.

- Desire for Personalized Services: Tailored offers and customized user experiences are also influencing customer choices.

Customers in the discount international telecommunications sector hold significant bargaining power due to their extreme price sensitivity and low switching costs. This allows them to readily compare providers and switch for even minor savings, forcing companies to offer competitive pricing. For instance, in 2024, a mere 5% difference in per-minute charges could prompt a customer to switch, highlighting the intense price elasticity in this market.

| Factor | Description | 2024 Impact Example |

| Price Sensitivity | Customers prioritize the lowest call and data rates. | Average monthly plans around $10-$20, with customers comparing rates. |

| Switching Costs | Ease and low cost of moving between providers. | Digital platforms simplify provider changes, empowering customer choice. |

| Market Competition | Numerous providers offer abundant customer options. | The global remittance market, exceeding $800 billion in 2024, shows high customer choice. |

| Price Transparency | Online tools facilitate easy comparison of pricing and features. | Digital remittance fees often below 5% in 2024, pressuring telecom pricing. |

Preview Before You Purchase

International Discount Telecommunications Porter's Five Forces Analysis

This preview showcases the complete Porter's Five Forces analysis for International Discount Telecommunications, offering a detailed examination of industry competition, bargaining power of buyers and suppliers, threat of new entrants, and the threat of substitute products. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You can confidently proceed with your purchase knowing you will receive this exact, professionally formatted analysis, providing immediate strategic insights into the telecommunications market.

Rivalry Among Competitors

IDT operates in both international telecommunications and fintech, sectors known for their fragmentation and fierce competition. Numerous global and regional companies vie for market share, making it challenging to maintain a dominant position.

For instance, the global telecommunications market, while consolidating somewhat, still features a multitude of providers offering various services, from traditional voice and data to newer digital solutions. In 2024, the competitive landscape remains robust, with companies constantly innovating to attract and retain customers amidst price pressures.

In the discount telecommunications and money transfer industries, price is a major battleground. Companies frequently engage in aggressive price cuts to attract customers, which can unfortunately lead to shrinking profit margins for players like IDT. This intense focus on price can create a challenging environment where the lowest cost often wins.

For instance, in 2024, the average international money transfer fee globally hovered around 4.3%, a figure that has seen consistent pressure downwards due to competitive forces. This pressure directly impacts the profitability of companies operating in this space, forcing them to constantly optimize their cost structures to remain competitive.

The telecommunications and fintech sectors are in a constant state of flux due to rapid technological advancements. Companies like IDT must continually invest in emerging technologies such as 5G, the Internet of Things (IoT), and blockchain to stay ahead of the curve and maintain their competitive edge. For example, in 2024, global spending on 5G infrastructure was projected to exceed $170 billion, highlighting the significant investment required to adopt these new standards.

Presence of Large, Established Players and Niche Innovators

IDT faces intense competition from a broad spectrum of players. This includes giants like AT&T and Verizon, along with financial services behemoths and nimble fintech innovators. The market also features specialized carriers targeting specific underserved niches, all vying for market share.

This dynamic environment means IDT must constantly adapt to varying competitive strategies. For instance, in 2024, the global telecommunications market saw continued consolidation, with major players leveraging scale to offer bundled services, while fintech startups rapidly gained traction with digital-first offerings.

- Established Players: Large telecom operators with extensive infrastructure and brand recognition.

- Fintech Startups: Agile companies disrupting traditional financial services with innovative technology.

- Niche Carriers: Specialized providers focusing on specific market segments or services.

- Financial Institutions: Banks and other financial firms expanding into telecommunications-related services.

Regulatory and Compliance Burdens

Operating globally in telecommunications and financial services means International Discount Telecommunications (IDT) must contend with a complex web of regulations. These compliance burdens can act as a significant hurdle for new entrants, potentially limiting competitive rivalry by raising the cost and difficulty of market entry.

For established players like IDT, however, adeptly managing these regulatory landscapes can become a source of competitive advantage. Companies that can successfully navigate differing legal frameworks, data privacy laws, and financial service requirements across various jurisdictions can differentiate themselves.

- Regulatory Complexity: Telecommunications and financial services are among the most heavily regulated industries globally.

- Compliance Costs: Adhering to diverse international regulations incurs substantial operational and legal expenses.

- Barrier to Entry: For instance, the financial services sector often requires specific licensing and capital requirements that can deter smaller, less capitalized competitors.

- Competitive Differentiation: IDT's established infrastructure and experience in managing these complexities can provide a distinct edge over emerging rivals.

Competitive rivalry is a defining characteristic for IDT, operating in both telecommunications and fintech. The sheer number of players, from global giants to agile startups, intensifies this rivalry, often leading to price wars and a constant need for innovation. For example, in 2024, the global mobile communications market saw intense competition, with average revenue per user (ARPU) facing downward pressure in many developed markets.

This fierce competition forces companies like IDT to differentiate through service quality, technological advancement, and cost efficiency. The pressure to offer competitive pricing, especially in the discount telecommunications and money transfer segments, directly impacts profit margins. In 2024, the average international money transfer fee remained a key battleground, with many providers striving to offer rates below the global average of approximately 4.3%.

The dynamic nature of these industries means IDT must continuously adapt to new technologies and evolving customer demands. For instance, the push towards 5G and digital-first financial solutions in 2024 required significant investment, creating a challenging environment for companies unable to keep pace. This constant need to innovate and invest is a direct result of the high level of competitive rivalry.

| Competitor Type | Key Characteristics | Impact on IDT |

|---|---|---|

| Large Telecom Operators | Extensive infrastructure, brand loyalty, bundled services | Price pressure, need for service differentiation |

| Fintech Startups | Agile, digital-native, innovative payment solutions | Disruption of traditional services, rapid market share gains |

| Specialized Carriers | Niche market focus, tailored services | Erosion of specific market segments |

| Global Money Transfer Providers | Competitive fees, wide reach, digital platforms | Intense price competition in remittance services |

SSubstitutes Threaten

The proliferation of over-the-top (OTT) communication apps like WhatsApp, Telegram, and Messenger poses a substantial threat to IDT's core business. These platforms offer free or very low-cost messaging and voice calls, directly competing with IDT's traditional revenue streams from these services.

As of early 2024, WhatsApp boasts over 2 billion monthly active users globally, while Telegram has surpassed 800 million users, highlighting the massive user base that has shifted to these substitute services. This widespread adoption means a significant portion of the market now relies on these apps for communication, reducing demand for IDT's paid services.

For International Discount Telecommunications' (IDT) Fintech segment, especially its money transfer services, digital payment platforms and mobile wallets represent a significant threat of substitutes. Services like PayPal, Zelle, and Wise offer increasingly convenient and often faster ways for consumers to send money, directly competing with traditional remittance channels.

The global digital payments market is booming, with projections indicating continued strong growth. For instance, the digital payments market size was valued at approximately $7.7 trillion in 2023 and is expected to reach over $15 trillion by 2030, showcasing the increasing adoption of these alternative payment methods.

The rise of blockchain and cryptocurrencies presents a significant threat of substitutes for traditional remittance services like International Discount Telecommunications (IDT). These digital assets enable faster and potentially cheaper cross-border transactions, bypassing traditional banking infrastructure. For instance, by mid-2024, the global remittance market was projected to reach over $1 trillion, with a growing portion exploring crypto-based solutions due to their efficiency.

Direct Bank Transfers and Online Banking Services

Direct bank transfers and online banking services from traditional financial institutions represent a significant threat of substitutes for International Discount Telecommunications (IDT). These established players, while often carrying higher fees, provide a familiar and trusted channel for international payments. For instance, in 2024, major banks continued to facilitate cross-border transactions, leveraging their extensive networks and regulatory compliance. Customers who prioritize security or have long-standing relationships with their banks might opt for these services, especially for substantial sums where the perceived risk of newer platforms is a concern.

The threat is amplified by the convenience and accessibility of online banking portals offered by these institutions. Users can initiate transfers from their existing accounts, often without needing to register on a new platform. This integration into existing financial ecosystems makes them a readily available alternative. Data from 2023 indicated that a substantial portion of international remittances still flowed through traditional banking channels, underscoring their persistent relevance as a substitute, even as fintech solutions gain traction.

- Traditional Banks' Online Platforms: Offer international money transfer services, often at a higher cost but with established trust.

- Customer Preference for Familiarity: Some customers, particularly those making larger transactions or valuing established financial relationships, prefer traditional banking channels.

- Integration into Existing Financial Ecosystems: Online banking services allow users to transfer funds directly from their existing accounts, reducing friction compared to new platform registration.

Integrated Communication and Collaboration Tools

Integrated communication and collaboration platforms pose a significant threat of substitution for standalone voice services offered by companies like International Discount Telecommunications (IDT) through its net2phone service. These comprehensive solutions, such as Microsoft Teams and Zoom, bundle voice, video conferencing, and instant messaging into a single application. This consolidation reduces the perceived need for separate voice-only or traditional telephony solutions.

For instance, in 2024, the widespread adoption of hybrid work models has accelerated the demand for unified communication systems. Businesses are increasingly looking for platforms that streamline employee interaction and productivity, making integrated tools more attractive than piecemeal communication services. This trend directly impacts the market share for dedicated voice providers.

- Consolidation of Services: Platforms like Microsoft Teams and Zoom offer voice, video, and messaging, reducing reliance on separate voice providers.

- Hybrid Work Impact: Increased adoption of hybrid work in 2024 drives demand for unified communication solutions.

- Cost-Effectiveness: Bundled services can offer cost savings compared to subscribing to multiple, separate communication tools.

- User Experience: A single, integrated interface often provides a more seamless and user-friendly experience for employees.

The threat of substitutes for International Discount Telecommunications (IDT) is multifaceted, impacting both its communication and money transfer segments. For its communication services, over-the-top (OTT) platforms like WhatsApp and Telegram offer free messaging and voice calls, directly eroding IDT's traditional revenue. Similarly, integrated communication suites such as Microsoft Teams and Zoom, which bundle voice with video and messaging, present a strong substitute for standalone voice solutions like IDT's net2phone, especially with the 2024 trend of hybrid work favoring unified platforms.

In the money transfer arena, digital payment platforms and mobile wallets like PayPal and Wise are increasingly displacing traditional remittance channels. The global digital payments market, valued at approximately $7.7 trillion in 2023 and projected to exceed $15 trillion by 2030, underscores this shift. Furthermore, cryptocurrencies offer a faster, potentially cheaper alternative for cross-border transactions, a growing consideration in the over $1 trillion global remittance market by mid-2024. Even traditional banks' online platforms, despite higher fees, remain a relevant substitute due to their established trust and integration into existing financial ecosystems, with a substantial portion of remittances still flowing through these channels as of 2023.

Entrants Threaten

The digital nature of many of IDT's services, especially in fintech and app-based communications, presents a low barrier to entry. This means new companies can launch innovative digital solutions with less upfront investment compared to industries requiring extensive physical infrastructure. For instance, the global fintech market is projected to reach $2.5 trillion by 2025, indicating significant growth and a welcoming environment for new digital players.

The threat of new entrants, particularly from fintech startups and niche players, remains a significant concern for International Discount Telecommunications (IDT). These agile companies can swiftly introduce specialized payment and money transfer solutions, often utilizing cutting-edge technologies such as artificial intelligence and blockchain. For instance, in 2024, the global fintech market was valued at over $1.1 trillion, demonstrating its rapid growth and attractiveness to new ventures aiming to disrupt traditional financial services.

While stringent regulations can deter newcomers, certain government policies, particularly those designed to encourage fintech innovation and digital payment adoption, can paradoxically lower entry barriers. For instance, initiatives like the Payment Systems Regulation Act in various jurisdictions aim to streamline processes for digital financial services, potentially making it easier for new players to enter the telecommunications discount market.

Technological Advancements Lowering Development Costs

Technological advancements are significantly lowering the barriers to entry in the telecommunications sector. Accessible cloud computing platforms, for instance, have drastically reduced the need for substantial upfront investment in physical infrastructure. In 2023, the global cloud computing market was valued at over $500 billion, illustrating the scale of readily available resources for new players.

Furthermore, the proliferation of open APIs and user-friendly development tools empowers startups to innovate and launch services with greater speed and less capital. This democratization of technology means that companies can now build sophisticated digital communication and payment solutions more efficiently. For example, many fintech startups in 2024 are leveraging low-code development platforms, cutting down development cycles by an estimated 30-50% compared to traditional methods.

This trend directly impacts the threat of new entrants for International Discount Telecommunications (IDT). Companies can now more easily develop and deploy competitive services, potentially eroding IDT's market share.

- Reduced Infrastructure Costs: Cloud services eliminate the need for massive capital expenditures on hardware and data centers.

- Faster Time-to-Market: Open APIs and development tools accelerate product creation and deployment.

- Increased Innovation: Lower development costs foster a more dynamic and competitive landscape.

- Lower Capital Requirements: Startups can enter the market with significantly less funding than previously required.

Brand Loyalty and Network Effects as a Barrier

For International Discount Telecommunications (IDT), established brand recognition, particularly in underserved markets, presents a significant barrier. New entrants would need to invest heavily to build comparable trust and awareness. This is crucial in the telecommunications sector where customer switching costs, though not always monetary, can be high due to inconvenience and established relationships.

Furthermore, IDT benefits from strong network effects across its platforms, such as NRS and BOSS Money. These platforms boast extensive retailer networks, creating a virtuous cycle where more users attract more retailers, and vice versa. For instance, BOSS Money’s reach in 2024 allows for convenient top-ups and remittances, making it a more attractive option than a new service with a limited network. Building such an interconnected ecosystem requires substantial time and capital, deterring potential competitors.

- Brand Loyalty: IDT's established presence in specific demographics fosters loyalty, making it harder for new players to gain market share.

- Network Effects: The expansive retailer networks of platforms like BOSS Money create a significant hurdle for new entrants aiming to offer comparable convenience and accessibility.

- Investment Required: Replicating IDT's established infrastructure and customer base would necessitate considerable upfront investment in technology, marketing, and partnership development.

The threat of new entrants for International Discount Telecommunications (IDT) is moderate, influenced by both decreasing and increasing barriers. While technological advancements and digital platforms lower initial capital requirements, IDT's established brand, extensive network effects, and regulatory compliance create significant hurdles for newcomers.

| Factor | Impact on New Entrants | IDT's Advantage |

|---|---|---|

| Technology & Digital Platforms | Lowered barriers, reduced infrastructure costs (e.g., cloud computing market exceeded $500 billion in 2023) | New entrants can leverage readily available tech |

| Capital Requirements | Reduced for digital services; fintech market over $1.1 trillion in 2024 | New entrants can launch with less upfront investment |

| Brand Recognition & Loyalty | High barrier; requires significant investment to build trust | IDT's established presence in specific markets |

| Network Effects | High barrier; requires time and capital to replicate extensive networks (e.g., BOSS Money's 2024 reach) | Virtuous cycle of users and retailers |

| Regulatory Environment | Can be a barrier, but some policies encourage fintech innovation | IDT's experience navigating compliance |

Porter's Five Forces Analysis Data Sources

Our International Discount Telecommunications Porter's Five Forces analysis is built upon a foundation of comprehensive data, including annual reports from leading telecom providers, industry-specific market research from firms like Gartner and IDC, and regulatory filings from international telecommunications authorities.

We supplement this with insights from financial databases such as Bloomberg and S&P Capital IQ, alongside macroeconomic indicators and global trade association reports, to provide a robust assessment of competitive forces.