iDreamSky Technology PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iDreamSky Technology Bundle

Navigate the dynamic landscape of the gaming industry with our comprehensive PESTLE analysis of iDreamSky Technology. Understand the political, economic, social, technological, legal, and environmental factors that are shaping its future. Gain a strategic advantage by anticipating market shifts and identifying opportunities.

Unlock actionable intelligence on iDreamSky Technology's external environment. Our expertly crafted PESTLE analysis delves into critical trends, from evolving regulations to shifting consumer preferences. Equip yourself with the insights needed to make informed decisions and bolster your competitive edge.

Don't get left behind in the fast-paced gaming sector. Our PESTLE analysis for iDreamSky Technology provides a clear roadmap of external influences. Download the full report now to gain a deeper understanding and confidently chart your course for success.

Political factors

The Chinese government exerts significant control over its gaming sector, with a strong focus on content and youth gaming hours. New regulations enacted in 2024 cap online gaming for minors at one hour on weekdays and two hours on weekends, prohibiting play between 10 p.m. and 8 a.m. These measures are designed to curb gaming addiction and foster better habits among younger players.

Securing game licenses, known as Banhao, from China's National Press and Publication Administration (NPPA) is a crucial step for operating games within the country. The NPPA demonstrated a commitment to increasing approvals, with 1,416 games greenlit in 2024, comprising 1,306 domestic and 110 foreign titles.

However, the licensing pathway for foreign games can present additional hurdles and extended timelines. A significant development is Shanghai's pilot program, set to commence in July 2025, which intends to simplify the process for foreign games developed within China by categorizing them as domestic titles.

The Chinese government's strict content regulations significantly impact the gaming industry, including iDreamSky Technology. Games must align with socialist values, leading to the prohibition of politically sensitive, violent, or morally questionable content. For instance, titles exploring controversial Chinese history or featuring supernatural elements have faced censorship or outright bans, as seen with various game approvals being delayed or denied in the past.

This regulatory environment demands meticulous localization and content adaptation for iDreamSky's game portfolio. Developers must navigate these restrictions carefully to ensure compliance, which can involve altering narratives, removing specific imagery, or even redesigning gameplay mechanics. The financial implications are substantial, as non-compliance can lead to significant revenue loss and market exclusion.

Data Protection and User Privacy

Chinese data protection laws, like the Personal Information Protection Law (PIPL) enacted in 2021, impose strict requirements on companies handling user data, including gaming firms. iDreamSky must ensure robust security measures to prevent misuse or mishandling of player information, a critical compliance area. This regulatory landscape directly impacts how iDreamSky collects, stores, and processes user data, potentially influencing its operational costs and strategies for user engagement.

The implementation of real-name registration and anti-addiction systems for minors is a significant political factor for iDreamSky. These mandates, enforced by bodies like the National Press and Publication Administration (NPPA), aim to curb gaming addiction among younger demographics. For instance, the NPPA has previously set limits on gaming time for minors, requiring companies to verify user identities and enforce these restrictions, which iDreamSky, as a major player, must diligently adhere to.

- PIPL Compliance: iDreamSky must adhere to China's Personal Information Protection Law, ensuring secure data handling and user privacy.

- Real-Name Registration: Mandatory for all users, this system helps enforce age-appropriate gaming access and content.

- Anti-Addiction Measures: iDreamSky is required to implement systems that limit gaming time for minors, aligning with government directives.

Government Support for Digital Content

While China's regulatory landscape for digital content can be stringent, there's also a clear governmental push to cultivate the industry. For instance, Shanghai launched a pilot program in late 2023 aimed at boosting digital creative industries, including gaming and online content. This dual approach highlights a strategy to encourage growth and innovation within specific sectors while maintaining oversight on content and its societal influence.

This support can translate into tangible benefits for companies like iDreamSky Technology. Government initiatives often include tax incentives, funding opportunities for research and development, and streamlined approval processes for certain types of digital content. Such measures are designed to foster a competitive domestic market and encourage the export of Chinese digital cultural products.

- Government Initiatives: Shanghai's digital creative industry pilot program (launched late 2023) aims to foster growth.

- Financial Impact: Potential for tax breaks and R&D funding from supportive government policies.

- Market Dynamics: Aims to balance industry growth with social and content regulation.

The Chinese government's regulatory approach significantly shapes iDreamSky's operations, with strict content guidelines and youth protection measures. In 2024, new rules limited minors' online gaming to one hour on weekdays and two on weekends, with specific time restrictions, impacting user engagement for iDreamSky.

Securing game licenses, or Banhao, remains a critical political factor, with 1,416 games approved in 2024, including 110 foreign titles, indicating a steady, albeit controlled, licensing environment. Shanghai's pilot program, starting July 2025, aims to streamline approvals for foreign games developed in China by treating them as domestic titles, potentially easing iDreamSky's market entry for such projects.

Compliance with China's Personal Information Protection Law (PIPL) is paramount, requiring robust data security and privacy protocols for iDreamSky. The government's ongoing enforcement of real-name registration and anti-addiction systems further necessitates diligent adherence to these political mandates.

| Regulatory Area | 2024/2025 Impact | iDreamSky Consideration |

|---|---|---|

| Minor Gaming Limits | 1 hr/weekday, 2 hrs/weekend (2024) | User acquisition and retention strategies |

| Game Licensing (Banhao) | 1,416 approvals in 2024 (110 foreign) | Navigating approval timelines and requirements |

| Content Censorship | Adherence to socialist values, no sensitive topics | Localization and content adaptation |

| Data Protection (PIPL) | Strict user data handling requirements | Robust security and privacy infrastructure |

| Foreign Game Pilot Program (Shanghai) | Domestic classification for games developed in China (from July 2025) | Potential for simplified market entry |

What is included in the product

This PESTLE analysis of iDreamSky Technology examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting its operations and strategic positioning.

It provides a comprehensive understanding of the external macro-environment, highlighting key trends and their implications for iDreamSky's growth and risk management.

The iDreamSky Technology PESTLE analysis serves as a pain point reliever by providing a structured framework to proactively identify and address external factors, enabling strategic adjustments and mitigating potential market disruptions.

Economic factors

China's gaming market is a powerhouse, holding its position as the largest globally. Projections indicate continued expansion, with an estimated market size of $66.13 billion by 2025 and a significant leap to $107.98 billion by 2030. This impressive growth is fueled by a vast gamer base and ongoing technological innovation.

This substantial market presents a compelling opportunity for iDreamSky Technology, especially within the mobile gaming segment, which currently leads the industry. The sheer scale and projected growth of China's gaming sector offer a fertile ground for iDreamSky's strategic development and market penetration.

iDreamSky Technology's financial health is heavily reliant on its gaming segment, which constituted over 96% of its total revenue in 2024. This concentration highlights the critical importance of successful game development and marketing for the company's overall performance.

Despite a significant 21% revenue decrease in 2024, iDreamSky anticipates a return to profitability in the first half of 2025. This optimistic outlook is fueled by the anticipated success of new game releases and enhanced profit margins from its self-developed titles.

Chinese consumer spending on education, culture, and entertainment saw a robust 9.8% increase in 2024, underscoring a significant demand for digital entertainment. This trend directly benefits companies like iDreamSky, which operates within the entertainment sector.

Younger demographics are increasingly valuing emotional connections and unique experiences. They demonstrate a willingness to spend more on products that resonate with their personal values, a key insight for iDreamSky's strategy regarding IP derivatives and fashion-forward merchandise.

Increased Competition and Market Dynamics

The Chinese gaming market, a key battleground for iDreamSky, is characterized by intense competition. Giants like Tencent and NetEase consistently capture significant market share, making it challenging for smaller developers to gain traction. This dynamic necessitates continuous innovation and strategic differentiation to stand out.

The industry sees a constant influx of new entrants each year, further intensifying the competitive landscape. Consumer preferences are also in constant flux, demanding that companies like iDreamSky stay agile and responsive to emerging trends and player desires. Staying ahead requires not just good games, but a deep understanding of what players want next.

Key competitive factors in the Chinese gaming market include:

- Market Dominance: Tencent and NetEase hold substantial portions of the market, setting a high bar for new and existing players.

- Innovation Imperative: The need to consistently develop fresh, engaging content is paramount to retain and attract players.

- Evolving Consumer Tastes: Rapid shifts in player preferences require adaptability in game design and marketing strategies.

Global Expansion Opportunities

With China's domestic gaming market experiencing a slowdown and increased regulatory scrutiny, Chinese game developers like iDreamSky are actively pursuing international growth. This strategic shift is driven by the need to diversify revenue streams and tap into markets with higher growth potential.

iDreamSky took a significant step in this direction by establishing its first overseas office in Riyadh, Saudi Arabia, in May 2024. This move is specifically designed to facilitate the global launch of its internally developed game, 'Strinova,' and to serve as a publishing hub for the Middle East and North Africa (MENA) region.

- International Market Growth: The global games market is projected to reach $200 billion in 2024, with significant growth expected in emerging regions like MENA.

- iDreamSky's MENA Strategy: The Riyadh office aims to leverage iDreamSky's expertise in publishing and game development to capture a share of this expanding market.

- Strinova's Potential: The global launch of 'Strinova' in 2024/2025 will be a key indicator of iDreamSky's ability to compete on an international stage.

China's economic landscape presents both opportunities and challenges for iDreamSky. While consumer spending on entertainment, a key sector for iDreamSky, saw a robust 9.8% increase in 2024, the overall economic growth rate moderated. The company's financial performance is closely tied to consumer discretionary spending, which can be sensitive to economic fluctuations.

The government's economic policies, particularly those impacting the technology and gaming sectors, are crucial. Regulatory changes can significantly influence market access and operational costs for companies like iDreamSky.

iDreamSky's strong reliance on its gaming segment, which accounted for over 96% of its revenue in 2024, makes it particularly vulnerable to shifts in consumer spending habits and economic downturns.

The company's strategic pivot towards international markets, evidenced by its Riyadh office establishment in May 2024, aims to mitigate risks associated with domestic market concentration and tap into global economic growth opportunities.

What You See Is What You Get

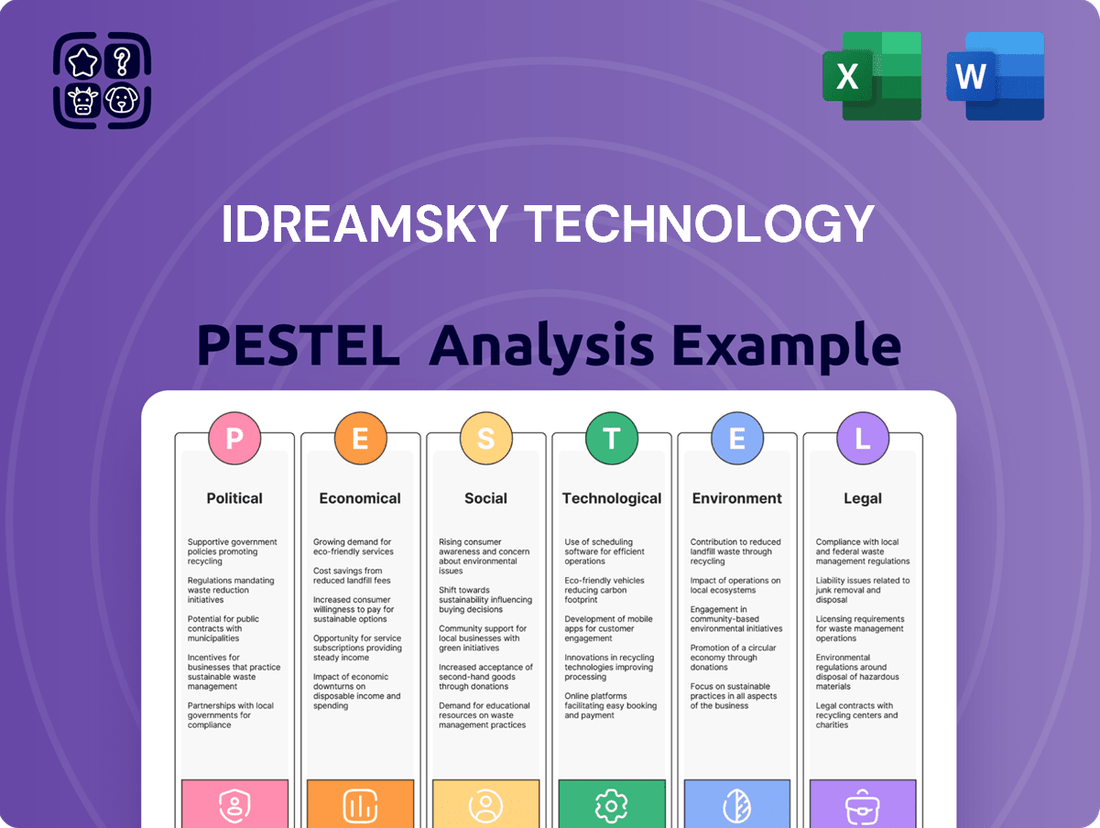

iDreamSky Technology PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive iDreamSky Technology PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll gain a clear understanding of the external forces shaping iDreamSky's market landscape, enabling informed decision-making.

Sociological factors

Societal concerns regarding excessive gaming among young people have prompted significant regulatory action, particularly in China. These concerns have manifested in strict limitations on both playtime and in-game spending for minors. For instance, China's National Press and Publication Administration (NPPA) has implemented regulations restricting minors to a maximum of three hours of online gaming per day, specifically on Fridays, Saturdays, Sundays, and public holidays, as of August 2021.

iDreamSky, operating within this environment, is compelled to integrate robust real-name registration and anti-addiction systems. These measures are not merely compliance requirements but directly influence how a substantial portion of their user base can engage with their games. The effectiveness of these systems in balancing user experience with regulatory mandates is a key factor for companies like iDreamSky, impacting player retention and monetization strategies for younger demographics.

Chinese gaming's growing global footprint is a significant cultural export, with titles featuring traditional aesthetics and narratives achieving international success. This trend highlights an opportunity for iDreamSky to infuse its own games and intellectual property with these resonant cultural elements, potentially attracting a wider global player base.

For instance, games like Genshin Impact, developed by miHoYo, have not only achieved massive commercial success, reportedly earning over $4 billion globally by early 2024, but have also been credited with popularizing Chinese cultural themes and art styles worldwide. This demonstrates a tangible market appetite for culturally rich gaming experiences.

Chinese consumers, especially the younger demographic, are increasingly prioritizing emotional engagement and immersive experiences over mere functionality in their entertainment. This shift is evident as they seek out higher-quality games and novel content, a trend that perfectly complements iDreamSky's strategic direction towards a varied game library and console gaming opportunities.

For instance, the mobile gaming market in China saw a significant rise in player spending on premium titles and in-game purchases that offer enhanced experiences, with data from 2023 indicating a growing willingness to invest in games that provide deeper engagement and social interaction.

Growth of IP Derivatives and Trendy Products

iDreamSky's strategic expansion into intellectual property (IP) derivatives and the sale of trendy, IP-themed merchandise directly capitalizes on a significant sociological trend: consumers increasingly desire tangible connections to their beloved games and characters. This isn't just about gaming; it reflects a broader societal shift where individuals gravitate towards products that align with their personal values, interests, and fandoms.

The market for licensed merchandise, particularly within the gaming and entertainment sectors, has seen robust growth. For instance, the global market for licensed merchandise reached an estimated $300 billion in 2023, with gaming and esports merchandise being a substantial contributor. iDreamSky's approach taps into this by offering products that allow fans to express their affinity for specific IPs.

This strategy is further bolstered by several key sociological observations:

- Rise of Fandom Culture: The internet and social media have amplified fandoms, creating communities that actively seek out and support their favorite IPs through various forms of engagement, including merchandise.

- Experiential Consumption: Consumers are increasingly prioritizing experiences and products that enhance their connection to passions, moving beyond purely functional purchases.

- Nostalgia Marketing: The appeal of familiar characters and universes, often rooted in nostalgia, remains a powerful driver for purchasing IP-related products across different age demographics.

Social Engagement through Gaming Communities

Chinese gamers increasingly seek social engagement, making games with robust in-game communication and multiplayer features highly attractive. This trend was evident in 2023, with mobile gaming revenue in China reaching an estimated $29.5 billion, underscoring the importance of community-driven experiences.

iDreamSky can leverage this by focusing on game development that prioritizes social interaction and collaborative gameplay. For instance, games that encourage team-based play and offer integrated chat functionalities are likely to resonate strongly with the target audience.

Navigating the regulatory landscape is crucial; iDreamSky must develop games that adhere to government guidelines on in-game communication to prevent misuse and maintain a positive community environment. This includes implementing moderation systems and clear user conduct policies.

- Community Focus: Games emphasizing social interaction and collaboration are key to capturing the Chinese gaming market.

- Revenue Potential: The significant revenue generated by mobile gaming in China highlights the demand for engaging, community-oriented titles.

- Regulatory Compliance: Adherence to government regulations on in-game communication is essential for sustainable growth and user safety.

Societal concerns regarding excessive gaming among young people have led to strict regulations in China, impacting playtime and spending. iDreamSky must integrate robust real-name registration and anti-addiction systems to comply, influencing user engagement and monetization, especially for younger demographics.

Technological factors

Mobile gaming remains a powerhouse in China, with smartphone adoption rates soaring and making games more accessible than ever. iDreamSky, as a leading mobile game publisher, directly capitalizes on these ongoing technological leaps. These advancements translate into more visually stunning games, intricate gameplay mechanics, and ultimately, a more engaging experience for players.

The Chinese gaming sector is embracing AI at an impressive pace, with a recent survey indicating that over 80% of domestic game developers are integrating artificial intelligence. This widespread adoption highlights AI's critical role in shaping the future of game creation and player engagement.

For iDreamSky, this technological shift presents a significant opportunity. AI's ability to enhance user experience through personalized content and adaptive gameplay, coupled with its power to streamline development processes, can lead to more efficient production cycles and innovative game designs. This integration can unlock new levels of creativity and operational efficiency.

The expansion of 5G networks globally is a significant technological driver for iDreamSky. By mid-2024, 5G coverage was estimated to reach over 60% of the world's population, a figure projected to climb further in 2025. This enhanced connectivity directly fuels the growth of cloud gaming, enabling smoother, lower-latency gameplay experiences and reducing the need for high-end local hardware. This trend could broaden iDreamSky's addressable market by making its games accessible to a wider audience who may not own powerful gaming devices.

Emphasis on Self-Developed Products and Tech Stack

iDreamSky Technology's recent financial resurgence, marked by a positive profit turnaround, is largely driven by the successful introduction of its own developed games. This highlights a significant enhancement in its internal development capabilities, a crucial technological factor for sustained growth.

The company's strategic decision to build its proprietary tech stack is a key enabler. This self-sufficiency allows iDreamSky to move beyond merely publishing games to actively developing and innovating within the competitive gaming landscape, fostering greater control over its product pipeline and technological advancements.

- Proprietary Tech Stack: iDreamSky's investment in its own technology infrastructure provides a foundation for future game development and innovation.

- Internal Development Focus: The success of self-developed products underscores the company's growing capacity to create and launch original content.

- Innovation Capability: Building its own tech stack positions iDreamSky to adapt to and lead technological trends in the gaming industry.

Cross-Play Ecosystems and Diversified Platforms

As the cost of acquiring new users escalates, gaming developers are increasingly focusing on cross-play ecosystems, integrating mobile, PC, and console experiences. This shift allows for broader audience reach and deeper player engagement across different devices.

iDreamSky Technology is strategically positioned to capitalize on this trend. The company's established presence in console gaming, coupled with its ambitious plans to release the PC title 'Strinova' globally, with a strong possibility of a mobile adaptation, directly addresses this market evolution. This diversification of platforms and engagement models is crucial for sustained growth in the competitive gaming landscape.

- Cross-Play Adoption: A significant portion of gamers now expect cross-play functionality, with reports indicating over 60% of players engaging with titles that offer it.

- iDreamSky's PC Push: The global launch of 'Strinova' on PC represents a key step in iDreamSky's platform diversification strategy.

- Mobile Integration Potential: The potential for 'Strinova' to extend to mobile platforms further broadens its market accessibility and revenue streams.

The increasing integration of Artificial Intelligence (AI) in game development, with over 80% of Chinese developers adopting it by early 2024, allows iDreamSky to personalize player experiences and streamline production. Furthermore, the global expansion of 5G networks, reaching over 60% of the world's population by mid-2024 and continuing to grow, enhances cloud gaming accessibility, reducing hardware barriers for a wider audience. iDreamSky's focus on developing its proprietary tech stack and internal game development capabilities, evidenced by the success of its self-developed titles, positions it to leverage these technological advancements for innovation and sustained growth.

| Technology Factor | Impact on iDreamSky | Supporting Data (2024/2025 Estimates) |

|---|---|---|

| AI Integration in Gaming | Enhanced player personalization, streamlined development | Over 80% of Chinese game developers adopting AI (early 2024) |

| 5G Network Expansion | Improved cloud gaming, broader market access | 60%+ global population coverage (mid-2024), projected growth through 2025 |

| Proprietary Tech Stack & Internal Development | Increased innovation, control over product pipeline | Successful launch of self-developed games driving profit turnaround |

| Cross-Play Ecosystems | Wider audience reach, deeper engagement | Over 60% of gamers engage with cross-play titles |

Legal factors

The National Press and Publication Administration (NPPA) in China maintains a rigorous licensing system for all online games. This process is fundamental for iDreamSky's operations, as it dictates market access for their titles. In 2024 alone, the NPPA approved more than 1,400 game licenses, highlighting the volume and importance of this regulatory hurdle.

China's stringent regulations on minors' gaming time, including limits to specific hours and days, directly impact iDreamSky's user engagement. Proposed draft rules in December 2023 further aimed to cap in-game spending for those under 18, a critical segment for many gaming companies.

iDreamSky must integrate robust real-name registration and anti-addiction systems to comply with these legal frameworks. This adherence will necessitate adjustments to its monetization strategies, potentially affecting revenue streams derived from younger demographics and altering user engagement models.

Content censorship and compliance are significant legal hurdles for gaming companies operating in China, including iDreamSky Technology. The Chinese government enforces stringent regulations on game content, prohibiting politically sensitive material, excessive violence, and morally objectionable themes. This necessitates iDreamSky to meticulously vet all licensed and internally developed games to ensure they adhere to these evolving guidelines. For instance, in 2023, China's National Press and Publication Administration continued to review and approve new game titles, with a focus on content alignment. This can significantly impact game design choices, requiring developers to adapt narratives and gameplay elements to meet regulatory expectations, potentially affecting the global appeal of certain titles.

Intellectual Property Rights Protection

Intellectual property rights protection is paramount for iDreamSky Technology, a company that publishes both licensed and internally developed games. The strength and reliability of China's intellectual property laws directly impact the company's ability to secure its valuable game assets and foster its intellectual property derivatives business. Recent efforts in China to bolster IP enforcement are therefore a key consideration.

The evolving legal landscape in China means iDreamSky must stay abreast of changes in IP protection. For instance, China's Supreme People's Court has been actively working to improve IP case handling efficiency and the quality of judgments. This is crucial for iDreamSky's strategy, especially as the digital content market continues to expand.

- China's commitment to strengthening IP protection is demonstrated by legislative updates and increased enforcement actions.

- iDreamSky's reliance on IP protection is fundamental to its business model, covering both licensed and self-developed content.

- The company's ability to safeguard its game assets and IP derivatives is directly tied to the effectiveness of China's legal framework.

Data Privacy and Cybersecurity Laws

Chinese law, including the Personal Information Protection Law (PIPL) enacted in 2021, mandates robust data privacy and cybersecurity measures for gaming companies. iDreamSky must adhere to stringent regulations concerning the collection, processing, storage, and transfer of user data, with significant penalties for non-compliance. For instance, PIPL can impose fines up to 5% of annual turnover or RMB 1 million for violations, impacting user trust and operational continuity.

These legal factors necessitate continuous investment in cybersecurity infrastructure and data handling protocols. iDreamSky's compliance efforts directly influence its ability to operate within the Chinese market and safeguard its reputation. Failure to meet these evolving legal standards could result in substantial fines and reputational damage, affecting its market position.

- PIPL Fines: Up to 5% of annual turnover or RMB 1 million.

- Data Handling: Strict requirements for collection, processing, and storage.

- User Trust: Compliance is crucial for maintaining player confidence.

- Reputational Risk: Non-compliance can lead to significant damage.

iDreamSky operates within a tightly regulated Chinese gaming market, requiring adherence to strict content censorship and licensing from the National Press and Publication Administration (NPPA). The NPPA's ongoing review of game content, as seen in 2023, means iDreamSky must continually adapt game narratives and designs to comply with evolving guidelines, potentially impacting global appeal.

Intellectual property protection is critical for iDreamSky's business, which relies on both licensed and self-developed games. China's commitment to strengthening IP enforcement, with initiatives like improved IP case handling efficiency by the Supreme People's Court, directly supports iDreamSky's ability to safeguard its assets and expand its IP derivatives business.

Compliance with China's Personal Information Protection Law (PIPL), enacted in 2021, is paramount. Violations can lead to substantial fines, potentially up to 5% of annual turnover or RMB 1 million, underscoring the need for robust data privacy and cybersecurity measures to maintain user trust and operational continuity.

| Regulation Area | Key Requirement | Potential Impact on iDreamSky | Relevant Data/Period |

|---|---|---|---|

| Game Licensing | NPPA approval for online games | Market access for titles | Over 1,400 game licenses approved in 2024 |

| Content Regulation | Adherence to content guidelines (no sensitive material) | Game design adaptation, potential impact on global appeal | Ongoing NPPA review of game content (2023) |

| Data Privacy | Compliance with PIPL for data handling | Fines up to 5% of annual turnover or RMB 1 million for violations | PIPL enacted in 2021 |

Environmental factors

The energy demands of data centers and gaming infrastructure are substantial, directly impacting iDreamSky's operational footprint. Globally, data centers are estimated to consume around 1% of the world's electricity, a figure projected to rise significantly. For instance, in 2023, the International Energy Agency reported that ICT sector energy consumption, which includes data centers, reached approximately 1.5% of total global electricity use.

As environmental consciousness intensifies, iDreamSky will likely encounter escalating pressure to integrate energy-efficient solutions and sustainable operational methodologies. This could involve investments in advanced cooling systems, renewable energy sourcing for its facilities, and optimizing server utilization to reduce overall power consumption, aligning with global sustainability goals and potential regulatory shifts.

While iDreamSky's core business is mobile gaming, its expansion into console experiences and intellectual property (IP) licensing means it's indirectly linked to the lifecycle of gaming hardware. This connection brings the issue of electronic waste, or e-waste, into play. The sheer volume of discarded gaming consoles and accessories is a significant environmental concern.

The global e-waste problem is escalating. In 2023 alone, an estimated 62 million tonnes of e-waste were generated worldwide, a figure projected to reach 82 million tonnes by 2030, according to the UN's Global E-waste Monitor 2024. This growing mountain of discarded electronics, including gaming hardware, poses a substantial environmental challenge.

This increasing e-waste burden could lead to stricter environmental regulations in the future. Companies like iDreamSky, even indirectly involved, might face greater scrutiny regarding product lifecycles, recyclability, and responsible disposal practices as governments worldwide aim to mitigate the environmental impact of electronics.

The gaming industry is increasingly focusing on environmental responsibility, with a growing push for 'green gaming' and sustainable operations. This trend reflects a global shift in consumer awareness and expectations regarding environmental impact.

For iDreamSky, this means considering how its game development and business practices align with these emerging sustainability standards. For instance, as of early 2024, many major tech companies are setting ambitious carbon reduction targets, which could set a precedent for the gaming sector.

Adopting eco-friendly approaches, such as optimizing energy consumption in data centers or using sustainable materials in any physical products, could become a competitive advantage and a requirement for market access.

Impact of Climate Change on Infrastructure and Operations

Extreme weather events, increasingly linked to climate change, pose a growing risk to the physical infrastructure supporting technology companies. For iDreamSky, this could translate into disruptions affecting data center operations, crucial for hosting and delivering their mobile games. For instance, a significant heatwave in a region hosting a key data center could lead to increased cooling costs or even temporary outages, impacting service availability.

Supply chains for gaming hardware, while not iDreamSky's direct operational concern, are also vulnerable. Flooding or severe storms could impede the manufacturing and transportation of components, potentially affecting the availability of devices used by gamers. The World Meteorological Organization reported that in 2023, extreme weather events caused an estimated $100 billion in economic losses globally, highlighting the tangible financial impact of these environmental shifts.

- Data Center Resilience: Climate change impacts like rising temperatures and increased frequency of extreme weather events can strain data center cooling systems and potentially lead to service disruptions.

- Supply Chain Vulnerability: Disruptions in global supply chains due to climate-related events can affect the availability and cost of hardware components used by gamers.

- Increased Operational Costs: Companies may face higher operational expenses related to climate adaptation, such as enhanced cooling for data centers or rerouting logistics due to weather-related infrastructure damage.

Corporate Social Responsibility and Environmental Reputation

Companies are increasingly held accountable for their social and environmental impact, with corporate social responsibility (CSR) becoming a key performance indicator. iDreamSky's proactive engagement in environmental stewardship can significantly bolster its brand image, attracting both consumers and investors who prioritize sustainability. This is particularly relevant as the global gaming sector, which saw revenues reach an estimated $184.4 billion in 2023, faces growing pressure to adopt greener practices.

iDreamSky's commitment to environmental, social, and governance (ESG) principles can translate into tangible benefits. For instance, by investing in energy-efficient data centers or promoting responsible e-waste management, the company can reduce its operational footprint. Such initiatives not only align with evolving regulatory landscapes but also resonate with a growing segment of the market. By 2024, it's projected that ESG investing will continue its upward trajectory, influencing corporate valuations and investor decisions.

- Enhanced Brand Reputation: Demonstrating environmental responsibility can improve iDreamSky's public image and attract environmentally conscious gamers.

- Investor Appeal: A strong ESG profile is increasingly important for attracting investment, with sustainable funds attracting substantial capital inflows.

- Risk Mitigation: Proactive environmental management can help iDreamSky avoid potential regulatory penalties and reputational damage associated with environmental non-compliance.

- Market Differentiation: In a competitive gaming market, a clear commitment to sustainability can set iDreamSky apart from its peers.

The increasing global focus on climate change and environmental sustainability directly impacts iDreamSky's operational and strategic considerations. Growing awareness around energy consumption, particularly for data centers powering online gaming, necessitates a move towards more efficient and renewable energy solutions. The company must also navigate the escalating issue of electronic waste, a byproduct of the gaming hardware ecosystem, as regulatory pressures and consumer expectations for eco-friendly practices intensify.

| Environmental Factor | Impact on iDreamSky | Data/Statistic (2023-2025) |

| Energy Consumption | Increased operational costs and need for sustainable energy sourcing for data centers. | Global data center electricity consumption estimated at 1-1.5% of total global electricity use. |

| Electronic Waste (E-waste) | Potential future regulatory scrutiny on product lifecycles and disposal practices. | Global e-waste generation reached ~62 million tonnes in 2023, projected to reach 82 million tonnes by 2030. |

| Climate Change & Extreme Weather | Risk of disruptions to data center operations and supply chain vulnerabilities for gaming hardware. | Extreme weather events caused an estimated $100 billion in global economic losses in 2023. |

PESTLE Analysis Data Sources

Our PESTLE analysis for iDreamSky Technology is built on a comprehensive review of official government reports, reputable financial news outlets, and leading industry publications. We meticulously gather data on regulatory changes, economic indicators, and technological advancements impacting the gaming and entertainment sectors.