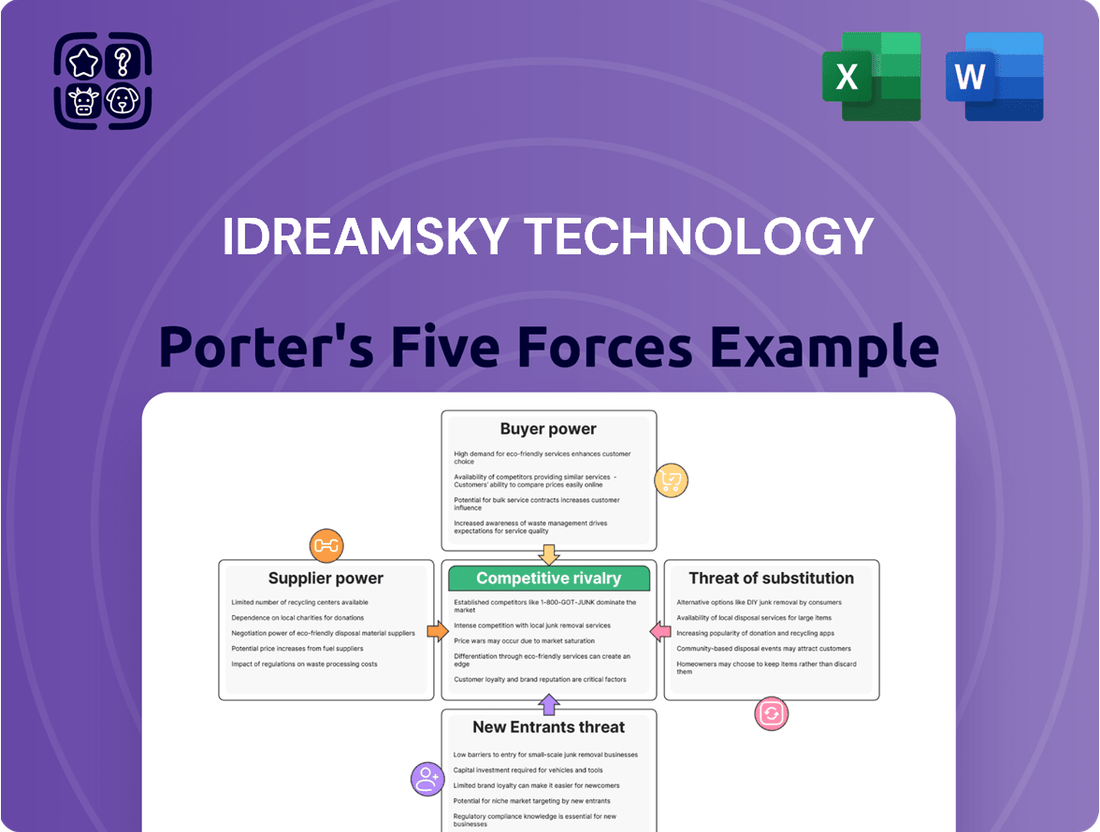

iDreamSky Technology Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iDreamSky Technology Bundle

Understanding the competitive landscape for iDreamSky Technology is crucial for any stakeholder. Our analysis reveals the intense rivalry among existing players and the significant bargaining power of its suppliers, impacting profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore iDreamSky Technology’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

iDreamSky's reliance on licensed games places considerable bargaining power in the hands of game developers and intellectual property (IP) holders. For instance, in 2023, the global games market generated an estimated $184 billion, highlighting the immense value of popular titles. Developers of highly sought-after games can leverage this demand to negotiate more favorable revenue-sharing agreements, directly impacting iDreamSky's profitability.

The strength of globally recognized IPs is a significant factor. These established franchises often come with a built-in audience, reducing marketing risks for publishers like iDreamSky. In 2024, continued strong performance in the mobile gaming sector, which is a key focus for iDreamSky, means that developers of successful mobile titles wield even greater influence over licensing terms.

Technology and platform providers, including those offering game engines and cloud infrastructure, possess some bargaining power. This is particularly true for specialized or widely adopted solutions. For instance, while many cloud services are becoming commoditized, leading providers like Amazon Web Services (AWS) and Microsoft Azure continue to hold significant leverage due to their scale and advanced offerings, impacting cost structures for companies like iDreamSky.

For its console game experiences and IP derivatives, iDreamSky relies on hardware and component manufacturers. The bargaining power of these suppliers is significant, particularly for specialized console components and materials needed for popular IP-themed merchandise. A limited number of specialized suppliers for high-demand or niche items can dictate terms, impacting iDreamSky's production costs and availability. For instance, in 2024, the global semiconductor shortage continued to affect the availability and pricing of electronic components, a trend that directly influences the cost of gaming consoles and related peripherals.

Marketing and Advertising Channels

In China's hyper-competitive gaming landscape, effective marketing and user acquisition are paramount for success. Suppliers of advertising space, user acquisition platforms, and promotional services, particularly those offering extensive reach and sophisticated targeting, wield considerable bargaining power. iDreamSky's substantial investment in marketing to attract and retain its player base means the cost and efficacy of these channels directly influence its financial performance.

The bargaining power of these marketing suppliers is amplified by several factors:

- Limited Differentiation: While some platforms offer unique features, many advertising channels in China can be seen as relatively interchangeable, allowing suppliers to command higher prices if they are perceived as essential.

- High Switching Costs: For iDreamSky, shifting significant marketing budgets between platforms can be complex and time-consuming, involving new campaign setups and performance tracking, which can deter frequent changes and strengthen existing supplier relationships.

- Concentration of Key Channels: A few dominant advertising platforms and user acquisition networks in China capture a large share of the market, giving these key suppliers more leverage in negotiations.

Talent Pool (Game Developers, Designers, Marketers)

The availability of skilled talent, including game developers, designers, artists, and marketing specialists, is a critical input for iDreamSky, particularly for its internally developed titles. A shortage of highly experienced professionals or intense competition for talent can drive up labor costs and extend development cycles.

This gives skilled individuals and talent agencies some bargaining power, as their expertise is essential for creating successful games and expanding the business. For example, in 2024, the global gaming industry continued to face a competitive labor market, with specialized roles like AI programmers and senior game designers seeing significant demand and salary increases.

- Talent Shortages: Certain specialized roles in game development, such as experienced Unreal Engine developers or AI specialists, remained in high demand throughout 2024, leading to increased recruitment costs for companies like iDreamSky.

- Rising Labor Costs: The competitive landscape for talent contributed to an upward trend in salaries and benefits for experienced game industry professionals in 2024, impacting iDreamSky's operational expenses.

- Impact on Development: Delays in securing key personnel or the need to invest more in recruitment and retention efforts can directly affect the timeline and budget for iDreamSky's game development projects.

The bargaining power of suppliers for iDreamSky is significant, particularly for game developers and IP holders whose popular titles are crucial for the company's revenue. In 2023, the global games market reached $184 billion, underscoring the value of these content creators.

Developers of highly sought-after games can negotiate favorable terms, directly impacting iDreamSky's profitability, especially in the thriving mobile gaming sector of 2024. Furthermore, specialized technology providers and hardware manufacturers also hold sway, influencing cost structures and product availability.

The labor market for skilled game development talent also presents a challenge, with high demand for specialized roles in 2024 driving up recruitment costs and impacting project timelines.

| Supplier Type | Bargaining Power Factor | Example Impact on iDreamSky |

|---|---|---|

| Game Developers/IP Holders | High demand for popular titles | Negotiation of more favorable revenue-sharing agreements |

| Technology Providers (e.g., Cloud Services) | Scale and advanced offerings | Influence on operational cost structures |

| Hardware Manufacturers | Specialized components, potential shortages | Impact on production costs and availability of gaming hardware |

| Marketing & User Acquisition Platforms | Market dominance, limited differentiation | Increased advertising expenses |

| Skilled Labor | Talent shortages in specialized roles | Higher recruitment costs and potential development delays |

What is included in the product

This analysis dissects the competitive forces impacting iDreamSky Technology, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Instantly identify and mitigate competitive threats with a comprehensive Porter's Five Forces analysis, simplifying complex market dynamics for iDreamSky Technology.

Customers Bargaining Power

Individual mobile gamers in China, numbering 679 million in the first half of 2025, typically wield low individual bargaining power. This is largely due to the vast selection of games available and the prevalence of the free-to-play model, which minimizes upfront costs for consumers.

However, their collective power can be significant. Gamers can exert influence by shifting their engagement to rival games if they are dissatisfied with a particular title's quality, the frequency of new content, or its payment structures.

The competitive landscape of the Chinese mobile gaming market offers players an abundance of choices. This includes a wide variety of free-to-play games, further amplifying the potential for mass migration if player sentiment turns negative towards a specific offering.

App stores like Apple's App Store and Google Play are critical distribution channels for iDreamSky, giving them significant leverage. These platforms act as gatekeepers, controlling access to a vast user base and influencing game visibility. Their ability to dictate terms, including revenue-sharing models and promotional placements, means iDreamSky faces substantial customer bargaining power.

Console gamers and consumers of IP derivative products for iDreamSky Technology possess moderate bargaining power. While many are loyal to specific game intellectual properties, the sheer volume of alternative entertainment options, from other gaming platforms to streaming services, provides them with significant leverage. In 2023, the global gaming market was valued at over $180 billion, showcasing the vast array of choices available to consumers.

These consumers can exert their power by choosing to delay purchases, seeking out discounted items, or opting for competing products that offer better value or more appealing features. iDreamSky must therefore focus on delivering high-quality experiences and merchandise that justify their price points, especially considering that the average consumer spends several hours per week on entertainment activities, making their choices highly selective.

Mini-Game Users

The increasing popularity of mini-games, especially on platforms like WeChat, highlights a customer base that values easy access and casual gameplay. This segment's low commitment and quick engagement cycles mean they can readily shift between different games, directly impacting iDreamSky's approach to developing and distributing these titles, particularly concerning monetization strategies for in-app purchases.

Mini-game users often exhibit a strong preference for low-friction entry points and immediate gratification. For instance, in 2023, the mobile gaming market saw continued growth in casual and hyper-casual segments, which often encompass mini-game experiences. iDreamSky's ability to capture and retain this user base hinges on offering compelling, easily accessible content that encourages ongoing engagement and spending.

- High Accessibility: Mini-games on platforms like WeChat offer instant play without lengthy downloads.

- Low Switching Costs: Users can easily move between different mini-games, increasing competition for attention.

- Spending Habits: This user segment often engages in microtransactions for cosmetic items or progression boosts.

- Platform Dependence: The success of mini-games is tied to the user base and features of the host platform, such as WeChat.

Trend-Following Consumers in IP Derivatives

For trendy, IP-themed products, customer bargaining power is directly linked to how quickly consumers shift their preferences and the variety of similar offerings available. iDreamSky's customers, particularly those drawn to fleeting IP trends, can exert significant pressure if a product's novelty fades or if competitors quickly introduce comparable items. This means their willingness to pay top dollar is often temporary.

The rapid cycle of trends in the IP derivative market means consumers can easily switch to the next popular item, thereby increasing their bargaining power. For instance, a study in early 2024 indicated that consumer engagement with specific IP-themed merchandise can drop by over 40% within six months if not refreshed. This necessitates iDreamSky's constant innovation to maintain customer loyalty and justify premium pricing.

- Consumer Trend Sensitivity: In 2024, the lifespan of popular IP-driven product trends has shortened, often lasting less than a year, increasing customer leverage.

- Availability of Alternatives: The market for IP-themed merchandise is crowded, with numerous companies replicating successful concepts, giving consumers more choices and thus more power.

- Brand Association vs. Novelty: While strong IP can initially command loyalty, if the novelty wears off and alternatives emerge, customers will readily shift, impacting iDreamSky's pricing power.

- Innovation Imperative: iDreamSky must continuously invest in new IP collaborations and product development to keep pace with evolving consumer tastes and mitigate customer bargaining power.

Individual mobile gamers generally have low bargaining power due to the vast number of games available and the prevalence of free-to-play models, minimizing upfront costs for consumers. However, their collective power is significant; dissatisfaction with game quality or monetization can lead to mass migration to competing titles, which are plentiful in the competitive Chinese market.

App stores, as primary distribution channels, hold considerable sway over iDreamSky by controlling user access and game visibility. Their ability to dictate terms, including revenue sharing, grants them significant leverage.

Consumers of IP derivative products possess moderate bargaining power, influenced by the wide array of entertainment options available. In 2023, the global gaming market exceeded $180 billion, underscoring the numerous alternatives consumers can choose from, allowing them to delay purchases or opt for competing products.

The bargaining power of customers for trendy, IP-themed products is directly tied to the rapid shift in consumer preferences and the availability of similar offerings. In 2024, the lifespan of popular IP-driven product trends has shortened, often lasting less than a year, significantly increasing customer leverage and iDreamSky's need for continuous innovation.

| Customer Segment | Bargaining Power Level | Key Influencing Factors | Example Data/Observation |

|---|---|---|---|

| Individual Mobile Gamers (China) | Low (Individual), High (Collective) | Abundance of games, free-to-play model, ease of switching | 679 million mobile gamers in China (H1 2025) |

| App Store Users | High | Gatekeeper role, control over visibility and terms | Apple App Store, Google Play |

| Console Gamers & IP Product Consumers | Moderate | Loyalty to IP vs. variety of entertainment options | Global gaming market > $180 billion (2023) |

| Mini-Game Users | Low to Moderate | Low commitment, quick engagement cycles, preference for low-friction entry | Growth in casual/hyper-casual segments (2023) |

| IP-Themed Product Buyers | Moderate to High | Trend sensitivity, availability of alternatives, novelty lifespan | Trend lifespan < 1 year (2024 observation) |

Same Document Delivered

iDreamSky Technology Porter's Five Forces Analysis

This preview showcases the complete iDreamSky Technology Porter's Five Forces Analysis, offering a thorough examination of competitive forces within the mobile gaming industry. The document you see here is precisely what you will receive immediately after purchase, ensuring no discrepancies or missing information. You can trust that this professionally formatted analysis is ready for your immediate use and strategic planning.

Rivalry Among Competitors

The Chinese mobile gaming arena is exceptionally crowded, with a vast array of both domestic and international companies fiercely competing for dominance. iDreamSky Technology operates within this highly saturated environment, facing formidable rivals.

Key competitors such as Tencent Games and NetEase Games are titans in this space. In 2023, these two giants alone captured more than 50% of the total revenue generated by domestic computer and mobile games, underscoring their significant market power and the intense pressure they exert on other players like iDreamSky.

The competitive landscape is heavily influenced by giants like Tencent Games and NetEase Games, who dominate the Chinese market. Tencent, the world's largest game company, and NetEase, a formidable competitor, possess vast portfolios, substantial financial backing, and robust distribution networks. This concentration of power makes it incredibly difficult for smaller entities, such as iDreamSky, to directly challenge them for prime game titles or significant market share.

iDreamSky's strategy of diversifying its game portfolio with both licensed third-party titles and internally developed games directly intensifies competition. This approach pits them against publishers who focus on securing exclusive IP licenses and those who excel at creating original, engaging content, all vying for player attention in a crowded marketplace.

The fierce competition to acquire desirable IP licenses is a significant factor, as is the challenge of developing original titles that can resonate with and retain players. For instance, in 2023, the global mobile gaming market generated over $90 billion, highlighting the immense value and intense competition for market share.

Evolving Regulatory Landscape and Market Trends

China's regulatory environment significantly influences the competitive dynamics within the gaming industry. Changes in game approval processes, content restrictions, and monetization policies can swiftly alter market positions. For instance, in 2023, the National Press and Publication Administration (NPPA) continued to issue gaming licenses, but the pace and focus of approvals remained a key factor for companies like iDreamSky.

Companies demonstrating agility in adapting to these evolving regulations and capitalizing on emerging market trends are better positioned. The increasing demand for esports, the rise of mini-games, and the expansion of cross-platform play present opportunities for those who can innovate and integrate these elements into their offerings. In 2024, the continued growth of mobile gaming, projected to reach over $100 billion globally, underscores the importance of adapting to platform shifts and player preferences.

- Regulatory Adaptability: Companies that can navigate China's shifting gaming regulations, including content guidelines and licensing, gain a competitive edge.

- Trend Capitalization: Success hinges on leveraging popular trends like esports, mini-games, and cross-platform integration.

- Market Growth: The global mobile gaming market's continued expansion, with significant contributions from Asia, provides a fertile ground for adaptable players.

International Expansion and Localization Efforts

Chinese gaming companies, including iDreamSky, are actively pursuing international markets for expansion, which naturally heightens global competition. This push into new territories means iDreamSky faces rivals not only from within China but also from established global players. For instance, in 2023, the global games market was projected to generate over $184 billion, showcasing the immense opportunity and the intensity of the battle for market share.

Success in these diverse overseas markets hinges on robust localization strategies, adapting games to suit varied cultural preferences and gaming habits. Companies that can effectively tailor their offerings to local tastes are better positioned to capture international user bases and revenue. This presents a significant challenge, as what resonates in one region may not in another, demanding considerable investment in market research and content adaptation.

The global expansion trend means iDreamSky is increasingly competing for international players and revenue streams against a broad spectrum of competitors. This intensified rivalry necessitates continuous innovation and strategic differentiation to stand out in crowded international markets.

- Global gaming market revenue projected to exceed $184 billion in 2023.

- Localization is key for Chinese gaming companies to succeed internationally.

- Intensified competition for global user bases and revenue streams.

The competitive rivalry for iDreamSky Technology is intense, primarily driven by dominant players like Tencent Games and NetEase Games, who collectively held over 50% of China's domestic mobile game revenue in 2023. These giants possess vast resources, extensive game portfolios, and strong distribution networks, making it challenging for iDreamSky to compete directly for top-tier intellectual property and market share. iDreamSky's strategy of diversifying with both licensed and self-developed games further intensifies this rivalry, pitting them against specialists in IP acquisition and original content creation. The global mobile gaming market, projected to exceed $100 billion in 2024, offers significant opportunities but also amplifies competition as companies like iDreamSky expand internationally, facing established global players and necessitating strong localization efforts.

| Competitor | Market Share (China, 2023 Est.) | Key Strengths | Impact on iDreamSky |

|---|---|---|---|

| Tencent Games | Significant majority | Vast IP portfolio, extensive distribution, strong R&D | Dominates market, limits iDreamSky's access to premium IP |

| NetEase Games | Substantial portion | Strong original IP development, robust player base, international presence | Direct competitor for player attention and talent |

| Other Domestic & International Players | Fragmented | Niche specialization, innovative gameplay, aggressive marketing | Contribute to market saturation, require constant differentiation |

SSubstitutes Threaten

The most significant substitutes for mobile games are other forms of digital entertainment. Platforms like TikTok, streaming services for movies and TV shows, social media, and music consumption all vie for consumers' limited leisure time. This intense competition can divert users and their spending away from mobile gaming.

The broader console and PC gaming markets act as significant substitutes for iDreamSky's core mobile game publishing operations. Gamers often choose these platforms for more immersive, high-fidelity, or traditional gameplay experiences, especially as cross-platform compatibility and cloud gaming solutions become more prevalent. For instance, the global PC gaming market was valued at approximately $50 billion in 2023, and the console gaming market is projected to reach over $100 billion by 2028, indicating substantial consumer spending on alternative gaming avenues.

Beyond digital alternatives, offline entertainment like sports, hobbies, and social gatherings present a significant threat of substitutes for iDreamSky's mobile games. As individuals allocate more time and discretionary spending to these real-world activities, the demand for mobile gaming can diminish. For instance, a growing trend in outdoor recreation or a resurgence in live events could divert consumer attention and budgets away from in-app purchases and playtime.

Casual and Mini-Games on Social Platforms

The proliferation of casual and mini-games on social platforms presents a significant threat of substitutes for iDreamSky Technology. These embedded games, often found within super-apps like WeChat, offer instant gratification and require minimal commitment, directly competing for user attention and time that might otherwise be spent on iDreamSky's more established mobile titles.

This trend is particularly impactful as social platforms foster high user engagement. For instance, WeChat's mini-game ecosystem has seen explosive growth, with some titles attracting hundreds of millions of daily active users. This accessibility and the inherent social sharing features make them a convenient alternative to downloading and engaging with standalone apps, potentially siphoning off a portion of iDreamSky's target audience. The low barrier to entry for both players and developers in the mini-game space further intensifies this competitive pressure.

- Social Platform Integration: Mini-games leverage existing social networks, facilitating easy sharing and viral growth, a powerful draw for users.

- Low Commitment, High Accessibility: These games are designed for quick play sessions and require no separate download, making them effortlessly accessible.

- User Time Diversion: The sheer volume of users engaging with mini-games on platforms like WeChat directly competes for the limited leisure time of mobile users.

- Rapid Development Cycles: The ease of development for mini-games allows for a constant influx of new, often trend-driven content, keeping users engaged with the platform.

IP Derivatives from Other Media

The threat of substitutes for iDreamSky's IP derivatives is significant, as consumers have numerous options beyond gaming-related merchandise. This includes a vast market of collectibles and merchandise stemming from popular movies, television series, anime, and comic books. For example, the global market for licensed merchandise, which encompasses many of these non-gaming categories, was projected to reach over $300 billion in 2024, demonstrating the sheer breadth of alternatives available to consumers.

These non-gaming IP derivatives directly compete for discretionary spending. If a consumer is interested in purchasing a collectible or themed item, they might opt for merchandise from a blockbuster film or a highly anticipated anime series instead of a gaming-related product. This broad competitive landscape means iDreamSky must ensure its IP derivatives are compelling enough to stand out against a wide array of established and popular entertainment franchises.

- Broad Market Competition: Consumers can choose merchandise from movies, TV shows, anime, and comics, not just games.

- Consumer Spending Diversion: The popularity of non-gaming IPs can draw spending away from gaming-related derivatives.

- Market Size Indicator: The licensed merchandise market, exceeding $300 billion in 2024, highlights the extensive substitute options.

The threat of substitutes for iDreamSky Technology's mobile games is multifaceted, encompassing both digital and offline entertainment. Other digital platforms like TikTok and streaming services compete for leisure time and spending, while console and PC gaming offer more immersive experiences. The global PC gaming market was valued at around $50 billion in 2023, illustrating a significant alternative.

Furthermore, casual games integrated into social platforms like WeChat pose a direct threat due to their accessibility and viral nature, with some titles reaching hundreds of millions of daily active users. Beyond digital realms, offline activities such as hobbies and social events also divert consumer attention and discretionary income.

| Substitute Category | Examples | Market Data (Approx.) |

| Digital Entertainment | TikTok, Streaming Services, Social Media | Global digital ad spending expected to exceed $700 billion in 2024. |

| Console & PC Gaming | Immersive, high-fidelity gaming experiences | Global PC gaming market: ~$50 billion (2023) |

| Social Platform Games | WeChat mini-games | High user engagement, rapid growth |

| Offline Entertainment | Sports, Hobbies, Social Gatherings | Consumer spending on leisure activities varies by region. |

Entrants Threaten

The mobile gaming market, especially for casual titles, presents relatively low barriers to entry. Developers can access user-friendly tools and widely available app store distribution, allowing new games to appear rapidly and boosting market saturation. For instance, in 2024, the hyper-casual segment continued to see a high volume of new game releases, with thousands of new titles hitting app stores monthly.

Launching AAA mobile games or securing licenses for popular intellectual property (IP) demands significant capital. This includes substantial investment in game development, extensive marketing campaigns, and attracting top talent. For instance, major mobile game studios often spend tens of millions of dollars on development and marketing for a single flagship title, creating a formidable barrier for smaller, less capitalized new entrants.

iDreamSky Technology benefits from its existing strong relationships with game developers and its own valuable IP portfolio. These established assets provide a distinct advantage, allowing them to navigate the high capital requirements more effectively than newcomers who would need to build these capabilities from scratch.

The Chinese gaming market presents a formidable barrier to entry due to its intricate and constantly shifting regulatory framework. New companies, particularly those from overseas, must contend with rigorous game approval processes and stringent content censorship, making market access a lengthy and expensive undertaking.

Navigating these complex regulations and securing the requisite licenses is a significant challenge that deters many potential new entrants. For instance, in 2023, China's National Press and Publication Administration (NPPA) continued its review of new game titles, with a notable slowdown in approvals compared to previous years, highlighting the ongoing regulatory scrutiny.

Brand Recognition and User Acquisition Costs

Established companies like iDreamSky already possess significant brand recognition and a loyal user base. This existing presence creates a substantial barrier for newcomers. For instance, in 2024, the mobile gaming market continued to see massive marketing spend, with top-tier user acquisition costs for a single install often exceeding $5 in competitive genres.

New entrants face the daunting task of investing heavily in marketing and user acquisition to even get noticed in a saturated market. The sheer volume of games available means that breaking through the noise requires substantial capital. This high cost of acquiring players can make it incredibly difficult for new companies to achieve profitability and scale, especially when competing against well-established and financially robust incumbents.

The threat is amplified by the economics of user acquisition:

- High Marketing Spend: New entrants must allocate significant budgets to advertising across various platforms to attract initial users.

- User Retention Challenges: Even if users are acquired, retaining them requires ongoing engagement strategies and continuous content updates, adding to operational costs.

- Incumbent Advantage: Established players can leverage their existing user data and network effects to acquire new users more efficiently and at a lower cost.

Access to Distribution Channels and Data Analytics

While app stores offer broad access, securing prime visibility and effective distribution for new mobile games is a significant hurdle. Established players like iDreamSky leverage deep relationships with platform holders, substantial marketing budgets, and sophisticated data analytics to understand player behavior and optimize revenue streams. For instance, in 2024, the cost of acquiring a new user in the hyper-casual mobile game market could range from $0.50 to $2.00 or more, depending on the game's quality and the platform, making it difficult for new entrants without established marketing infrastructure.

Newcomers often lack the crucial data analytics capabilities that established publishers possess to refine user engagement and monetization strategies. iDreamSky's 'one-stop' service system for developers, which likely includes robust analytics tools and insights, provides a distinct advantage. This allows them to iterate quickly on game design and marketing based on real-time user data, a level of operational efficiency that is hard for new entrants to replicate quickly.

- Distribution Costs: New entrants face high marketing and user acquisition costs, estimated to be significantly higher than for established publishers with existing user bases.

- Data Analytics Gap: The ability to collect, analyze, and act upon vast amounts of user data is critical for optimization, a capability often underdeveloped in new companies.

- Platform Relationships: Strong relationships with app stores can influence featuring and visibility, creating an uneven playing field for those without established connections.

- Marketing Budgets: Competing for user attention requires substantial marketing investment, which can be prohibitive for smaller, newer entities.

The threat of new entrants for iDreamSky Technology is moderate, primarily due to substantial capital requirements for AAA mobile game development and IP acquisition. While casual game development has low barriers, significant investment in marketing and talent is essential for competitive titles. For instance, major mobile game launches in 2024 often involved tens of millions of dollars in development and marketing spend, a considerable hurdle for new players.

Furthermore, the complex and evolving regulatory landscape in China, particularly concerning game approvals and content censorship, acts as a significant deterrent. New entrants, especially international ones, face lengthy and costly processes to gain market access, a challenge that established players like iDreamSky have already navigated.

The cost of user acquisition in 2024 remained high, with hyper-casual game installs sometimes costing over $0.50 to $2.00. This, combined with the need for strong platform relationships and advanced data analytics to optimize engagement and monetization, creates a steep learning curve and financial burden for newcomers, limiting the immediate threat of widespread new competition.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for iDreamSky Technology is built upon a foundation of publicly available information, including company annual reports, investor presentations, and regulatory filings. We also incorporate insights from reputable industry research firms and financial news outlets to capture current market dynamics and competitive landscapes.