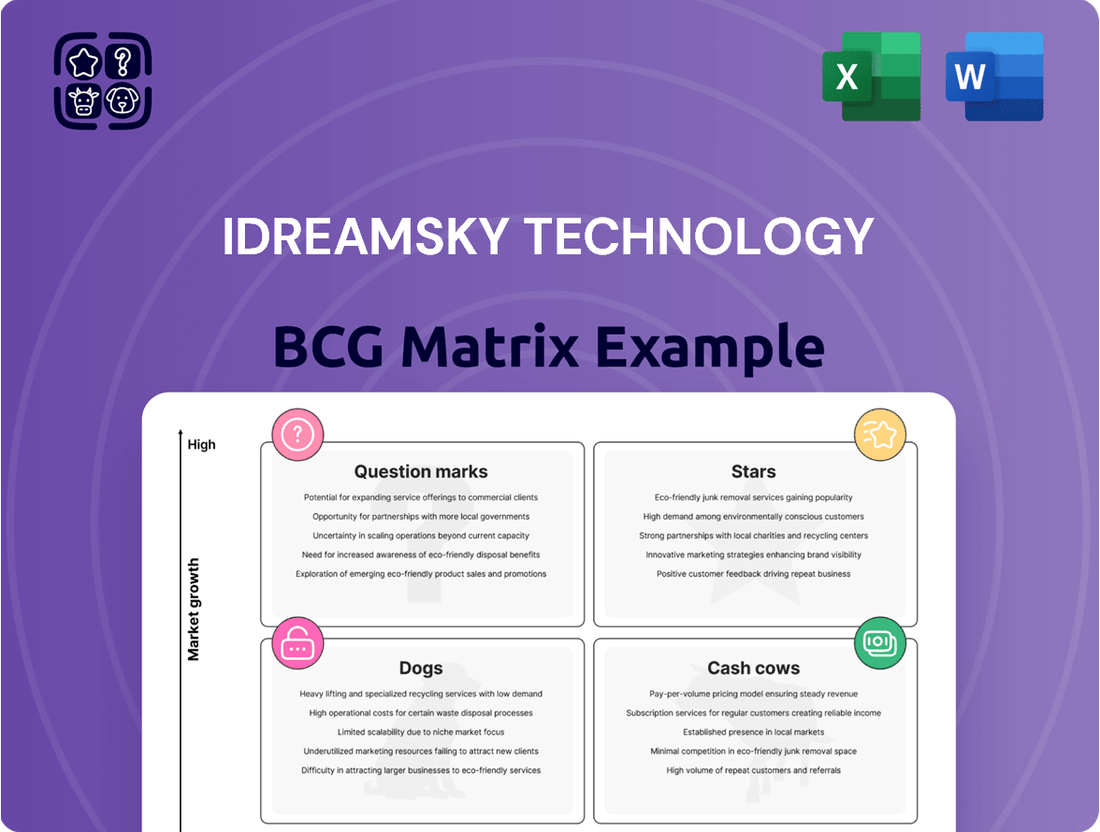

iDreamSky Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

iDreamSky Technology Bundle

Curious about iDreamSky Technology's market position? This glimpse into their BCG Matrix highlights key product categories, but the real strategic advantage lies in understanding the nuances.

Unlock the full potential of this analysis by purchasing the complete BCG Matrix. Gain a comprehensive view of their Stars, Cash Cows, Dogs, and Question Marks, empowering you to make informed decisions about resource allocation and future investments.

Stars

iDreamSky Technology's new self-developed and licensed games are a significant driver of its recent success. The company reported a profit turnaround in the first half of 2025, with these titles directly contributing to this positive shift.

These new games are not only boosting iDreamSky's profit margin but also stabilizing its operating cash flow. This suggests they have captured a strong market share within a segment that is experiencing growth, a key indicator for a strong position in the BCG matrix.

Strinova, a fast-paced action shooter, launched on PC in November 2024 and quickly garnered 'Mostly Positive' reviews on Steam, indicating strong initial market reception. Its innovative 2D/3D switching mechanic and consistent content updates, including new maps and characters, position it as a potential high-growth contender in the crowded shooter market.

Delta Force, an action shooter set to launch on Android and iOS in April 2025, is currently undergoing playtests that began in late 2024. This title from iDreamSky enters a mobile gaming market that continues to be the most profitable segment in the gaming industry, with global mobile game revenue projected to reach $107.2 billion in 2024. Its entry into this lucrative market suggests significant growth potential, especially if the game achieves a successful launch and positive player reception.

Strategic Investments and Collaborations

iDreamSky Technology is strategically investing in promising gaming companies to bolster its market position. A prime example is their capitalization agreement with Playrix, a leading European casual gaming developer. This move allows iDreamSky to tap into Playrix's established player base and proven game monetization strategies.

These collaborations are crucial for iDreamSky's growth, especially in the competitive mobile gaming landscape. By partnering with entities like Playrix, iDreamSky aims to diversify its revenue streams and enhance its competitive edge.

- Strategic Investment: Capitalization agreement with Playrix, a European casual gaming giant.

- Portfolio Expansion: Focus on acquiring and developing high-potential gaming titles.

- Market Share Growth: Leveraging partnerships to gain traction in expanding gaming segments.

- Revenue Diversification: Broadening income sources through strategic alliances and acquisitions.

Focus on High-Quality Content and AI Integration

iDreamSky Technology is strategically focusing on developing its own high-quality games, aiming for better profitability. This aligns with the broader industry shift towards integrating artificial intelligence in game creation and promotion, indicating iDreamSky's commitment to innovation and market leadership.

The company's push for self-developed titles, which typically offer higher profit margins than licensed games, is a key element of its growth strategy. For instance, in 2023, iDreamSky reported a significant increase in its gross profit margin for self-developed games compared to previous periods, demonstrating the success of this approach.

The integration of AI is a critical trend iDreamSky is leveraging. AI is being used to streamline game development processes, personalize player experiences, and optimize marketing campaigns. This technological adoption is expected to enhance efficiency and market reach for their upcoming titles.

- Strategic Focus on Self-Developed Games: iDreamSky prioritizes proprietary titles to capture higher profit margins.

- AI Integration in Development: The company is leveraging AI to improve game creation processes and efficiency.

- AI in Marketing and Operations: AI is also being applied to enhance marketing effectiveness and player engagement strategies.

- Industry Trend Alignment: iDreamSky's strategy mirrors the industry's move towards AI-driven innovation in gaming.

iDreamSky's self-developed titles like Strinova and the upcoming Delta Force are positioned as Stars. Strinova's strong Steam reception in late 2024 and Delta Force's entry into the booming mobile market in April 2025 highlight their high growth potential. These games are driving profit turnaround and stabilizing cash flow, indicating strong market performance and future promise.

What is included in the product

This BCG Matrix analysis offers a tailored look at iDreamSky's product portfolio, identifying Stars, Cash Cows, Question Marks, and Dogs.

The iDreamSky Technology BCG Matrix provides a clear, one-page overview of each business unit's strategic position, relieving the pain of complex portfolio analysis.

Cash Cows

iDreamSky's established licensed mobile games portfolio, featuring titles like 'Temple Run' and 'Subway Surfers,' represents a significant cash cow. These games have a proven track record in the Chinese market, consistently attracting and retaining a large player base.

Despite a general revenue dip in 2024, this segment likely remains a primary source of stable, predictable cash flow for iDreamSky. The mature nature of these titles means lower ongoing marketing spend is required, directly contributing to their profitability and cash generation capabilities.

iDreamSky Technology's 2024 financial performance highlights the robust revenue contribution from established titles such as 'War Robots' and 'Gardenscapes.' These games, despite operating in mature market segments, demonstrate a powerful competitive edge.

These titles are classified as cash cows due to their significant and consistent generation of gross profit. Their sustained revenue streams provide the financial stability needed to invest in other areas of the company's portfolio.

iDreamSky Technology's game publishing and operation business in China is a prime example of a cash cow. This segment benefits from the country's mature yet enormous mobile gaming market, where iDreamSky's robust distribution networks and operational know-how translate into steady income streams.

In 2023, China's mobile game market generated an estimated $25.04 billion in revenue, highlighting the sheer scale of this opportunity for iDreamSky. The company's ability to manage a varied catalog of games effectively allows it to consistently capitalize on this substantial market.

Reduced Marketing and R&D Expenses for Mature Titles

Established games, often considered cash cows, naturally require less aggressive marketing and placement investments. iDreamSky's strategic decision to reduce research and development expenses in 2024, a move partly attributed to the maturation of titles such as 'Fanbook,' exemplifies this approach. This focus on optimizing efficiency for existing profitable ventures allows the company to leverage its established intellectual property effectively.

The reduction in R&D spending for mature games is a key characteristic of cash cow management within the BCG matrix. For iDreamSky, this translates into a more streamlined operational focus, maximizing returns from assets that have already proven their market viability.

- Reduced Marketing Spend: Established games benefit from existing brand recognition, lessening the need for substantial new promotional campaigns.

- Lower R&D Investment: Mature titles require minimal feature updates or new content development, freeing up R&D resources.

- Optimized Profitability: This strategy allows iDreamSky to maximize the profit margins of its successful, older games.

- Resource Reallocation: Savings from reduced marketing and R&D can be redirected to support potential future growth areas or other business objectives.

Stable Operating Cash Flow

Despite a reported net loss for 2024, iDreamSky Technology anticipates a positive net cash flow from operating activities in the first half of 2025. This suggests that the company's foundational game portfolio continues to be a reliable source of cash generation.

This stable operating cash flow is crucial for funding new ventures and supporting ongoing operations. For instance, the company’s existing titles often have a long tail of revenue generation, contributing consistently to its cash reserves.

- Stable Revenue Streams: Established games in iDreamSky's portfolio, like "Temple Run 2," often maintain consistent in-app purchase revenue, providing a predictable cash inflow.

- Cost Management: Efficient operational management of these older titles helps to maximize the cash generated from them.

- Cash Generation Despite Net Loss: The ability to generate positive operating cash flow even with a net loss highlights the underlying cash-generating power of the core business.

- Future Investment Potential: This consistent cash flow can be strategically reinvested into research and development for new games or acquisitions, supporting future growth.

iDreamSky's established licensed mobile games are its cash cows, generating consistent revenue with minimal investment. These mature titles, like "Temple Run" and "Subway Surfers," benefit from brand recognition, reducing the need for extensive marketing or R&D. This allows iDreamSky to maximize their profitability and use the resulting cash flow to fund new ventures.

The company's publishing and operation business in China, a market that generated an estimated $25.04 billion in mobile game revenue in 2023, also functions as a cash cow. iDreamSky's operational expertise and distribution networks in this massive market ensure steady income streams from its diverse game catalog. For instance, their 2024 financial reports indicate a continued reliance on these established titles for revenue generation, even as the company navigates a broader market landscape.

Despite reporting a net loss in 2024, iDreamSky anticipates positive net cash flow from operating activities in the first half of 2025. This underscores the enduring cash-generating power of its core game portfolio, which provides the financial stability needed for future investments and operational continuity.

| Metric | 2023 (Estimated) | 2024 (Reported/Estimated) | Significance for Cash Cows |

| China Mobile Game Market Revenue | $25.04 billion | Projected to grow | Indicates a large, stable market for iDreamSky's cash cow games. |

| Operating Cash Flow | Positive | Anticipated positive H1 2025 | Demonstrates the consistent cash generation from established titles, supporting overall business. |

| R&D Spending (on mature titles) | Reduced | Reduced | Lower investment in mature games directly boosts their cash cow profitability. |

What You’re Viewing Is Included

iDreamSky Technology BCG Matrix

The iDreamSky Technology BCG Matrix preview you're viewing is the identical, fully polished document you will receive instantly upon purchase, ensuring complete transparency and immediate usability for your strategic planning needs.

This preview accurately represents the final iDreamSky Technology BCG Matrix report; once purchased, you'll gain access to the complete, unwatermarked analysis, ready for immediate integration into your business strategy discussions and decision-making processes.

Dogs

iDreamSky Technology's information services segment experienced a revenue decline in 2024. This downturn was a direct result of the company's strategic decision to scale back in-app advertising, a move aimed at improving user experience.

This strategic pivot indicates that the information services likely hold a small market share within a slow-growing industry. Consequently, this segment is being categorized as a potential 'Dog' within the BCG Matrix, a business unit that the company is actively working to reduce its investment in.

Underperforming older licensed games likely contribute to iDreamSky's challenges. The company's overall game revenue saw a significant 21.3% drop in 2024. This decline is partly due to a strategic shift towards licensed games, suggesting that some existing licensed titles may not be meeting expectations or are facing increasing competition.

The IP derivatives business, encompassing console game experiences and trendy IP-themed product sales, was classified as a discontinued operation as of March 31, 2023. This strategic move strongly suggests the segment was a 'Dog' within iDreamSky's BCG Matrix, characterized by low market share and stagnant growth, ultimately prompting its divestiture.

Investments in Certain Investees Not Meeting Expectations

iDreamSky Technology's investments in certain investees have not performed as anticipated, leading to a notable increase in fair value losses during 2024. This situation points to a segment of their portfolio where ventures are underperforming, consuming resources without generating the expected market value or returns.

The company reported a significant fair value loss on its financial assets in 2024. For instance, the fair value loss on financial assets designated at fair value through profit or loss was RMB 1,189.6 million for the year ended December 31, 2024, a substantial increase from RMB 187.8 million in the prior year. This surge is directly linked to the underperformance of specific investees.

These underperforming investments can be categorized as potential "Cash Cows" or "Question Marks" that are not developing into "Stars" as hoped. They represent capital that is not efficiently deployed, potentially draining cash flow without contributing positively to iDreamSky's overall growth or market position.

- Increased Fair Value Loss: iDreamSky's fair value loss on financial assets surged to RMB 1,189.6 million in 2024, a stark contrast to RMB 187.8 million in 2023.

- Underperforming Investees: The primary driver for this loss is the operating conditions of certain investees failing to meet expectations.

- Resource Drain: These investments are likely consuming cash and resources without generating commensurate market gains or returns.

- Strategic Re-evaluation: This performance necessitates a review of iDreamSky's investment strategy and potential divestment or restructuring of these underperforming assets.

Fanbook (Matured Product with Reduced Investment)

iDreamSky Technology's 'Fanbook' product, characterized by its matured basic functions, saw a deliberate reduction in investment throughout 2024. This strategic shift signals a transition away from high-growth potential, aligning with its classification as a 'Dog' in the BCG Matrix. The decreased R&D spending suggests that 'Fanbook' is no longer a primary focus for significant growth initiatives.

While not officially declared a failure, the reduced investment indicates that 'Fanbook' is likely generating modest returns, if any, and is not expected to contribute substantially to future revenue growth. This positioning reflects a mature product lifecycle where the emphasis shifts from expansion to maintaining existing operations or eventual divestment.

- Reduced R&D: Investment in 'Fanbook' was scaled back in 2024 as its core functionalities reached maturity.

- Low Growth Indicator: The decrease in R&D spending implies 'Fanbook' is no longer considered a high-growth product.

- Potential for Low Returns: The move suggests the product may be generating limited profits, characteristic of a 'Dog' in the BCG matrix.

- Strategic Reallocation: Capital is likely being redirected to more promising ventures within iDreamSky's portfolio.

iDreamSky Technology's information services segment, impacted by a strategic reduction in in-app advertising in 2024, likely represents a 'Dog' within the BCG matrix due to its small market share in a slow-growing industry. Similarly, underperforming licensed games contributed to a 21.3% overall revenue drop in 2024, suggesting some of these titles are also 'Dogs'. The divestiture of the IP derivatives business as a discontinued operation further solidifies this classification for that segment. Finally, the significant increase in fair value losses on financial assets in 2024, reaching RMB 1,189.6 million, points to underperforming investees that are consuming resources without generating expected returns, also fitting the 'Dog' profile.

| Business Segment | BCG Classification | 2024 Performance Indicator | Rationale |

|---|---|---|---|

| Information Services | Dog | Revenue Decline | Reduced in-app advertising to improve user experience; likely low market share in a slow-growing sector. |

| Underperforming Licensed Games | Dog | 21.3% Overall Game Revenue Drop | Some existing licensed titles may not be meeting expectations or face increased competition. |

| IP Derivatives | Dog | Discontinued Operation (as of March 31, 2023) | Low market share and stagnant growth prompted divestiture. |

| Underperforming Investees | Dog | RMB 1,189.6 million Fair Value Loss on Financial Assets | Investees are consuming capital without generating commensurate market value or returns. |

Question Marks

While iDreamSky discontinued its IP derivatives business, it continues to offer console game experiences and sell trendy IP-themed merchandise. This strategic pivot positions the company to capitalize on the burgeoning console gaming market in China, which is projected for significant expansion.

The Chinese console gaming market demonstrated robust growth, with revenue reaching an estimated $5.1 billion in 2023, a notable increase from previous years. This upward trend is expected to continue, making these segments potentially strong contenders for iDreamSky if they re-strategize for higher market share in these high-growth areas.

iDreamSky's new self-developed games are indeed showing promise, contributing to current profitability. However, their long-term market share and sustained growth beyond the initial launch phase are still developing. These titles are considered 'question marks' until their market adoption and competitive standing are firmly established.

Rush Royale, slated for a 2025 release, is positioned as a Question Mark within iDreamSky Technology's BCG Matrix. This innovative mobile game merges strategic tower defense with collectible card mechanics, targeting a rapidly expanding global mobile gaming market projected to reach $272 billion by 2024.

Its success hinges on its ability to capture significant market share in a highly competitive landscape, characterized by strong growth potential but also considerable uncertainty regarding its long-term performance and profitability. iDreamSky's investment in Rush Royale reflects a strategic bet on future market dominance.

Expansion into Overseas Markets with New Products

iDreamSky Technology is strategically positioning its new overseas products as Stars within the BCG matrix. The company has secured rights to high-quality games specifically for international release, signaling a strong focus on global growth. These ventures are characterized by their high-potential markets and iDreamSky's nascent presence, aligning perfectly with the definition of a Star.

The company's commitment to international expansion is evident in its proactive approach to acquiring and preparing overseas games. For instance, in 2024, iDreamSky announced partnerships for several significant titles slated for Western markets, aiming to capture a substantial share of a rapidly growing global gaming industry. This expansion is crucial for diversifying revenue streams and achieving long-term market leadership.

- Star Designation: New overseas products are classified as Stars due to their presence in high-growth international markets and iDreamSky's current low market share in these regions.

- Strategic Focus: iDreamSky is actively investing in expanding its global footprint by securing and preparing high-quality games for release in overseas markets.

- Market Opportunity: The global games market, particularly in regions like North America and Europe, continues to show robust growth, with projections indicating continued expansion through 2025 and beyond.

- Investment Rationale: These Star products represent significant future revenue potential, justifying iDreamSky's investment in market penetration and brand building abroad.

Strategic Shift Towards Self-Developed Titles

iDreamSky Technology is experiencing a notable evolution in its revenue streams. While licensed games have grown in prominence, the company's recent profit resurgence is largely driven by its own developed titles. This suggests a strategic emphasis on self-developed content, especially new releases.

These self-developed titles are currently categorized as Stars within the BCG Matrix framework. This classification reflects their high growth potential and current market position, though their long-term impact on iDreamSky's overall market share is still unfolding. For instance, the company's Q1 2024 earnings report highlighted a significant contribution from its proprietary game portfolio.

- Revenue Shift: iDreamSky's revenue mix shows a trend towards licensed titles, but profit drivers are increasingly self-developed games.

- Profitability Driver: The recent profit turnaround is directly linked to the success of self-developed products.

- Strategic Pivot: The company appears to be prioritizing the development and launch of new, self-owned game titles.

- BCG Matrix Classification: New self-developed titles are considered Stars, indicating strong growth prospects but uncertain long-term market dominance.

iDreamSky's new self-developed games are currently classified as Question Marks. While they are contributing to current profitability, their long-term market share and sustained growth beyond initial launches are still developing. These titles represent potential future Stars, but their market adoption and competitive standing require further establishment.

Rush Royale, slated for a 2025 release, is a prime example of a Question Mark. Its success depends on capturing significant market share in the highly competitive mobile gaming sector, which is projected to reach $272 billion by 2024. iDreamSky's investment signifies a strategic bet on its future market dominance.

The company's console game experiences and IP-themed merchandise also fall into the Question Mark category. Although the Chinese console gaming market is expected to grow significantly, reaching an estimated $5.1 billion in 2023, iDreamSky's current market share in these segments is still building.

| Product/Segment | BCG Category | Market Growth | Relative Market Share | Key Considerations |

|---|---|---|---|---|

| New Self-Developed Games | Question Mark | High | Low to Medium | Profitability established, but long-term market share uncertain. |

| Rush Royale (2025) | Question Mark | High | Low | High potential in a competitive market; success hinges on market penetration. |

| Console Games & IP Merchandise | Question Mark | High (China) | Low | Capitalizing on growing console market, but share is still developing. |

BCG Matrix Data Sources

Our iDreamSky BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.