Identiv SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Identiv Bundle

Identiv's strong market position in identity solutions is bolstered by its innovative technology and diverse product portfolio. However, navigating competitive pressures and evolving cybersecurity threats presents significant challenges.

Want the full story behind Identiv's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Identiv's strength lies in its dedicated focus on specialized IoT solutions, particularly in RFID and Bluetooth Low Energy (BLE) technologies. This strategic pivot allows the company to concentrate its resources and expertise on high-demand sectors like Digital Product Passports and cold chain monitoring, positioning it for growth in these expanding markets.

Identiv's RFID and Bluetooth Low Energy (BLE) IoT solutions are incredibly versatile, finding their way into more than 1.5 billion applications worldwide. This wide reach spans critical sectors such as healthcare, consumer electronics, luxury goods, smart packaging, and logistics, showcasing the company's ability to cater to a broad spectrum of industry needs.

This extensive market penetration is a significant strength, as it inherently diversifies Identiv's revenue streams. By not being overly dependent on any single industry, the company is better positioned to weather sector-specific downturns and capitalize on growth opportunities across various markets, enhancing overall business resilience.

Identiv's strategic partnerships are a significant strength, evidenced by collaborations like the one with Tag-N-Trac to bolster pharmaceutical cold chain management. This alliance aims to leverage Identiv's secure identity solutions within a critical supply chain sector.

Further strengthening its market position, Identiv partnered with InPlay Technologies for smart Bluetooth Low Energy (BLE) labels. These collaborations are designed to expand Identiv's reach into burgeoning IoT logistics and digital identity markets, driving innovation and product enhancement.

Strong Balance Sheet Post-Asset Sale

Identiv's balance sheet received a significant boost following the Q3 2024 sale of its physical security business to Vitaprotech for $145 million. This influx of capital provides Identiv with substantial financial flexibility.

The company plans to strategically deploy this capital to fuel future organic growth and pursue targeted mergers and acquisitions. Additionally, the funds will bolster working capital, enhancing overall operational resilience.

- Strengthened Financial Position: The $145 million asset sale in Q3 2024 significantly improved Identiv's liquidity and capital structure.

- Funding for Growth: The proceeds are earmarked for organic expansion and strategic M&A activities, supporting future development.

- Enhanced Working Capital: The capital infusion will also be used to meet ongoing working capital requirements, ensuring smooth operations.

Commitment to Innovation and Product Development

Identiv's dedication to innovation is a significant strength, fueling a strong product development pipeline. This commitment is clearly demonstrated by their introduction of advanced technologies like next-generation HF NFC-enabled RFID inlays and BLE-enabled smart labels. This forward-thinking approach ensures Identiv stays ahead of market trends and meets evolving customer needs.

Their focus on research and development allows them to consistently bring cutting-edge solutions to market. For instance, in Q1 2024, Identiv reported a 7% increase in revenue year-over-year, partly driven by new product introductions in their Identity segment. This investment in innovation directly contributes to their competitive edge and ability to capture new market opportunities.

- Robust R&D Pipeline: Continuously developing next-generation RFID and BLE technologies.

- Market Responsiveness: Ensuring products meet evolving industry demands.

- Competitive Advantage: Innovation drives market leadership and differentiation.

- Revenue Growth Driver: New product launches contribute to financial performance, as seen in early 2024 results.

Identiv's core strength is its specialized focus on IoT solutions, particularly in RFID and Bluetooth Low Energy (BLE) technologies. This specialization allows them to concentrate resources on high-demand areas like Digital Product Passports and cold chain monitoring, positioning them for growth in these expanding markets.

The company's RFID and BLE IoT solutions have a massive global reach, powering over 1.5 billion applications across diverse sectors including healthcare, consumer electronics, and logistics. This broad market penetration diversifies revenue streams, making Identiv more resilient to industry-specific downturns.

Strategic partnerships are a key strength, such as their collaboration with Tag-N-Trac for pharmaceutical cold chain management and with InPlay Technologies for smart BLE labels. These alliances expand Identiv's presence in critical IoT logistics and digital identity markets.

Identiv's financial position was significantly bolstered by the $145 million sale of its physical security business in Q3 2024. This capital infusion provides substantial flexibility for organic growth, strategic acquisitions, and enhanced working capital, supporting operational stability and future development.

The company's commitment to innovation is evident in its strong product development pipeline, featuring advanced technologies like next-generation HF NFC-enabled RFID inlays and BLE smart labels. This focus on R&D, which contributed to a 7% revenue increase in their Identity segment in Q1 2024, ensures they remain competitive and responsive to evolving market demands.

| Strength Area | Key Technologies | Market Reach | Financial Impact | Strategic Alliances |

|---|---|---|---|---|

| Specialization | RFID, BLE | 1.5+ Billion Applications | N/A | N/A |

| Diversification | N/A | Healthcare, Electronics, Logistics, Luxury Goods | Revenue Resilience | N/A |

| Partnerships | N/A | Pharmaceutical Cold Chain, IoT Logistics | N/A | Tag-N-Trac, InPlay Technologies |

| Financial Health | N/A | N/A | $145M Asset Sale (Q3 2024) | N/A |

| Innovation | NFC RFID, BLE Smart Labels | N/A | 7% Identity Revenue Growth (Q1 2024) | N/A |

What is included in the product

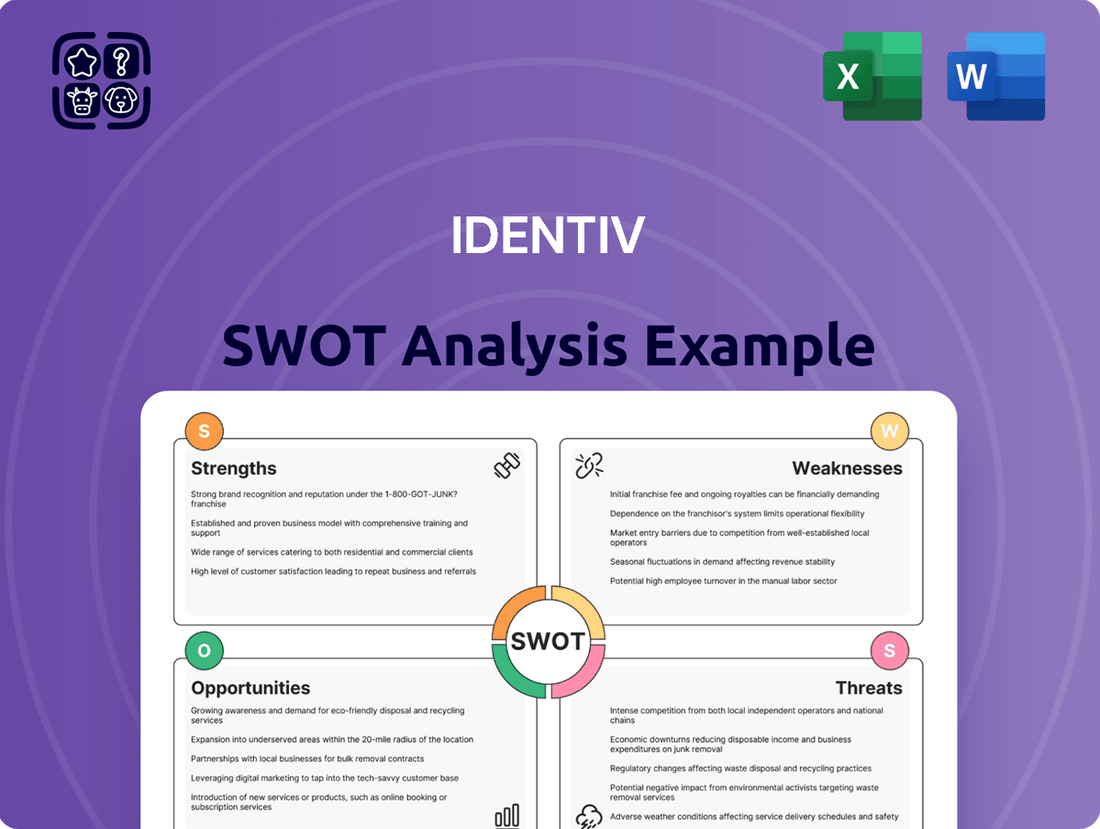

Identiv's SWOT analysis provides a comprehensive look at its internal strengths and weaknesses, alongside external opportunities and threats, to inform strategic decisions.

Identiv's SWOT analysis provides a clear, actionable framework to identify and address critical vulnerabilities, transforming potential threats into strategic advantages.

Weaknesses

Identiv's strategic pivot towards higher-margin products has led to a noticeable dip in revenue during its transition. For the first quarter of 2025, the company reported $5.3 million in revenue, a decrease from the $6.7 million recorded in the same period of 2024. This financial outcome is a direct consequence of their deliberate decision to shed less profitable business segments, highlighting the short-term cost of their long-term strategic realignment.

Identiv is experiencing significant pressure on its gross margins. For instance, the GAAP gross margin saw a sharp decrease to 2.5% in the first quarter of 2025, a considerable drop from 7.3% in the same period of 2024. This trend was also reflected in non-GAAP gross margin figures.

This margin compression is largely attributed to the increased costs associated with shifting production to Thailand. The need to maintain dual manufacturing sites during this transition period further adds to these incremental expenses, directly impacting profitability.

Identiv has a history of operating losses and negative cash flows, which is a significant concern. As of December 31, 2024, the company reported an accumulated deficit of $340.1 million, a clear indicator of past unprofitability. The company anticipates continuing to experience losses in the foreseeable future.

Operational Costs Associated with Production Transition

Identiv's strategic shift of RFID production from Singapore to Thailand, aimed at enhancing long-term efficiency, is currently a source of increased operational costs. These incremental expenses stem from maintaining dual manufacturing facilities during the transition period.

The company anticipates completing this production migration by the end of the second quarter of 2025. Until then, Identiv faces short-term operational hurdles and a notable cost burden associated with this significant undertaking.

- Dual Manufacturing Costs: Maintaining operations in both Singapore and Thailand concurrently adds to overhead.

- Transition Expenses: Costs include setup, training, and potential inefficiencies during the handover phase.

- Projected Completion: The transition is slated for completion by Q2 2025, after which cost savings are expected.

- Impact on Margins: These temporary cost increases could pressure short-term profit margins.

Reliance on Macroeconomic Stability

Identiv's financial health and future growth are significantly tied to the broader economic climate. Current market conditions and anticipated customer spending play a crucial role in their outlook. For instance, a downturn in the global economy, as seen with persistent inflation and interest rate hikes throughout 2023 and into early 2024, can directly dampen demand for Identiv's security and identification solutions.

A challenging macroeconomic environment can directly impact customer demand for Identiv's products and services. This sensitivity means the company's ability to seize growth opportunities can be hampered if businesses and governments reduce spending due to economic uncertainty. For example, if major clients delay or scale back projects requiring smart cards or identity management systems, Identiv's revenue streams could be negatively affected.

- Economic Sensitivity: Identiv's performance is vulnerable to shifts in global economic stability, impacting customer purchasing power and project investments.

- Demand Fluctuations: Macroeconomic headwinds, such as recessionary fears or supply chain disruptions, can lead to unpredictable changes in demand for their security and identification technologies.

- Growth Opportunity Impact: A weakened economy may force potential clients to postpone or cancel initiatives that would otherwise drive Identiv's expansion, limiting their ability to capitalize on market trends.

Identiv faces challenges with its gross margins, which saw a significant decline. The GAAP gross margin dropped to 2.5% in Q1 2025, a stark contrast to the 7.3% reported in Q1 2024, indicating pressure on profitability from its core operations.

The company's ongoing production migration from Singapore to Thailand is a substantial source of increased costs. Maintaining dual manufacturing sites during this transition period, which is expected to conclude by Q2 2025, adds to operational expenses and impacts short-term financial performance.

Identiv has a history of operating losses, with an accumulated deficit of $340.1 million as of December 31, 2024. The company anticipates continuing to incur losses in the near future, highlighting a persistent struggle with overall profitability.

| Metric | Q1 2024 | Q1 2025 | Change |

| Revenue | $6.7 million | $5.3 million | -20.9% |

| GAAP Gross Margin | 7.3% | 2.5% | -65.8% |

| Accumulated Deficit (as of Dec 31) | N/A | $340.1 million | N/A |

What You See Is What You Get

Identiv SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. This comprehensive document provides a thorough examination of Identiv's Strengths, Weaknesses, Opportunities, and Threats. You'll gain valuable insights to inform your strategic decisions.

Opportunities

The expanding adoption of the Internet of Things (IoT) is a major tailwind for Identiv. Industries are increasingly looking for secure ways to connect devices and manage data, and Identiv's RFID and Bluetooth Low Energy (BLE) technologies are perfectly positioned to meet this need. This growing reliance on secure identification across sectors like healthcare, logistics, and smart packaging directly fuels demand for their offerings.

Identiv is making significant strides in the burgeoning Digital Product Passport (DPP) market, a sector poised for substantial growth, particularly with upcoming European Union regulations mandating their use. This strategic focus positions Identiv to capitalize on a new wave of compliance-driven demand.

The company's proactive engagement, exemplified by collaborations such as the one with Narravero, is designed to expedite DPP adoption and ensure regulatory adherence for businesses. These partnerships are crucial for unlocking new revenue opportunities as the DPP landscape solidifies.

Identiv's recent sale of its physical security business generated $145 million in proceeds. This influx of capital is a significant opportunity to fuel expansion and innovation within its core IoT operations.

This substantial financial resource directly supports Identiv's strategic pivot towards a pure-play IoT focus. It enables accelerated investment in research and development, enhancing their product portfolio and market reach in the rapidly growing IoT sector.

Furthermore, the $145 million provides a strong foundation for targeted mergers and acquisitions. This allows Identiv to strategically acquire complementary technologies or companies, consolidating its position and expanding its competitive advantage in the IoT landscape.

Untapped Potential in Cold Chain and Healthcare

Identiv has a compelling opportunity to capitalize on the growing demand for secure tracking and identification within the cold chain and healthcare industries. Strategic partnerships, like the one with Tag-N-Trac for pharmaceutical cold chain monitoring, are crucial. This collaboration taps into a market segment where temperature integrity and traceability are paramount, directly addressing regulatory compliance and product safety needs.

The company's work with Novanta to provide RFID solutions for healthcare further underscores this potential. These sectors are increasingly reliant on efficient, secure data capture and management to ensure patient safety and operational effectiveness. Identiv's technology is well-positioned to meet these stringent requirements, offering a pathway to substantial market penetration and revenue growth in these specialized, high-value areas.

- Cold Chain Market Growth: The global cold chain logistics market was valued at approximately $270 billion in 2023 and is projected to reach over $500 billion by 2030, driven by pharmaceutical and food industries.

- Healthcare RFID Adoption: The healthcare RFID market is expected to grow significantly, with projections indicating a compound annual growth rate (CAGR) of over 15% from 2023 to 2028.

- Regulatory Drivers: Increasing global regulations for pharmaceutical product traceability and temperature monitoring create a strong demand for solutions like those Identiv offers.

New Product Development and Innovation

Identiv's commitment to new product development, evidenced by its continuous investment, positions it to capitalize on evolving market demands. A prime example is the development of next-generation BLE-enabled smart labels, targeting the growing industrial IoT sector. This strategic focus allows Identiv to address emerging needs and secure future revenue streams.

Innovation in core technologies is another significant opportunity. By integrating advanced solutions, such as NXP's ICODE 3 for NFC-enabled RFID inlays, Identiv can create distinct competitive advantages. This focus on cutting-edge technology not only enhances product performance but also opens doors to new applications and customer segments, reinforcing its market position.

The company's proactive approach to innovation is reflected in its expanding product portfolio. For instance, Identiv's recent advancements in secure credentialing and IoT solutions are designed to meet the increasing demand for robust identity and access management. These developments are crucial for maintaining leadership in rapidly evolving technological landscapes.

- Focus on Industrial IoT: Development of BLE-enabled smart labels for industrial applications addresses a growing market need.

- NFC Technology Advancements: Innovation with technologies like NXP's ICODE 3 for NFC RFID inlays creates competitive differentiation.

- Expanding Secure Credentialing: Continuous investment in secure identity solutions caters to increasing global demand for robust security.

Identiv is well-positioned to leverage the expanding Internet of Things (IoT) market, with its RFID and BLE technologies addressing the growing need for secure device connectivity and data management across various industries. The company's strategic entry into the Digital Product Passport (DPP) market, driven by upcoming EU regulations, presents a significant opportunity for compliance-driven revenue. Furthermore, the $145 million from its physical security business sale provides substantial capital for expansion, innovation, and potential acquisitions within its core IoT operations.

| Opportunity Area | Description | Market Data/Growth Potential |

|---|---|---|

| IoT Expansion | Leveraging RFID and BLE for secure device connectivity | IoT market projected to grow significantly, with RFID segment expanding as a key enabler. |

| Digital Product Passports (DPP) | Capitalizing on regulatory mandates for product traceability | EU regulations driving demand, creating a new market for compliance solutions. |

| Cold Chain & Healthcare | Providing secure tracking and identification for sensitive goods | Cold chain market expected to exceed $500 billion by 2030; Healthcare RFID CAGR over 15% (2023-2028). |

| Product Innovation | Developing next-gen BLE smart labels and advancing NFC tech | Focus on industrial IoT and enhanced NFC integration to meet evolving market needs. |

Threats

Identiv operates in the highly competitive Internet of Things (IoT) and security markets, facing pressure from both established companies and emerging startups. This fierce rivalry in areas like RFID, NFC, and access control solutions can drive down prices and necessitate constant investment in new technologies to stay ahead.

The security market, in particular, saw significant consolidation and investment in 2024, with companies like Genetec and Verkada expanding their offerings. This trend intensifies the challenge for players like Identiv to differentiate their products and capture market share amidst a crowded landscape.

Challenging macroeconomic conditions, including persistent inflation and the potential for slower global growth in 2024 and 2025, could dampen customer demand for Identiv's security and identification solutions. This economic environment might also lead potential clients to delay or reduce investments in new technologies, impacting Identiv's revenue streams.

Global market uncertainties, such as geopolitical tensions and fluctuating interest rates, create a more challenging landscape for Identiv to pursue strategic mergers and acquisitions. Such uncertainties can increase the cost of capital and make it harder to identify and integrate suitable acquisition targets, potentially hindering growth through inorganic expansion.

Identiv's strategic shift of production to Thailand presents a significant threat. This transition period, ongoing through 2024 and into 2025, inherently risks supply chain disruptions, potentially delaying the delivery of crucial products like secure identity solutions. The company is navigating a complex phase with dual manufacturing sites, which historically can increase operational complexities and associated costs.

Technological Obsolescence and Rapid Innovation Cycle

The Internet of Things (IoT) and secure identification sectors are characterized by relentless technological evolution, posing a significant threat of obsolescence for Identiv's current product lines. Competitors are constantly introducing newer, more efficient solutions. For instance, the rapid development in NFC and secure element technology means that even recently launched products could be surpassed by next-generation offerings within a short timeframe.

Identiv faces the imperative to consistently invest in research and development to stay ahead of this innovation curve. Failure to do so risks losing market share to more agile competitors who can adapt more quickly to emerging standards and technological breakthroughs. This ongoing need for adaptation is a critical challenge in maintaining a competitive edge.

Key areas of technological advancement impacting Identiv include:

- Advancements in chip miniaturization and power efficiency for IoT devices.

- Emergence of new cryptographic algorithms and security protocols.

- Development of more sophisticated contactless and embedded technologies.

- Integration of AI and machine learning into identity and access management solutions.

Regulatory and Compliance Changes

Changes in regulations concerning data security and privacy, such as evolving GDPR or CCPA requirements, could necessitate significant adjustments to Identiv's product development and operational processes. For instance, new mandates for data encryption or anonymization might require substantial R&D investment and could impact the cost-effectiveness of existing solutions.

Industry-specific compliance, like the emerging requirements for Digital Product Passports in sectors such as textiles or electronics, could also present challenges. Identiv's solutions, particularly those involving secure identification and data management, might need to be adapted to meet these new standards, potentially affecting their marketability and requiring costly re-engineering.

The company's ability to navigate these evolving regulatory landscapes is crucial. For example, if new privacy laws in key markets like the EU or California impose stricter controls on data collection and processing for IoT devices or secure credentials, Identiv would need to ensure its offerings remain compliant, which could involve substantial software updates and hardware redesigns.

- Data Security Regulations: Evolving privacy laws may require enhanced data encryption and anonymization, impacting product design and cost.

- Industry-Specific Compliance: Emerging standards for Digital Product Passports could necessitate adaptations in Identiv's secure identification and data management solutions.

- Market Acceptance Impact: Non-compliance or slow adaptation to new regulations could hinder market acceptance and require costly modifications to existing product lines.

Identiv faces intense competition in the IoT and security markets, with rivals constantly innovating and potentially driving down prices. Economic headwinds like inflation and slower global growth in 2024-2025 could reduce customer spending on security solutions. Furthermore, geopolitical uncertainties and rising capital costs can complicate strategic acquisitions, hindering inorganic growth.

SWOT Analysis Data Sources

This Identiv SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and accurate strategic overview.