Identiv Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Identiv Bundle

Uncover the strategic potential of Identiv's product portfolio with our comprehensive BCG Matrix analysis. See at a glance which products are driving growth, which are generating steady revenue, and which require careful consideration. Don't miss out on critical insights that can shape your investment decisions.

Ready to transform your understanding of Identiv's market position? Purchase the full BCG Matrix report to gain detailed quadrant breakdowns, actionable strategies for each product category, and a clear roadmap for optimizing your resource allocation. Elevate your strategic planning today.

Stars

Identiv's RFID solutions for healthcare, focusing on medication delivery and pharmaceutical cold chain, tap into a robust growth sector. The healthcare RFID market was projected to reach $3.5 billion by 2024, indicating substantial opportunity.

Strategic alliances, including those with Novanta and Tag-N-Trac, bolster Identiv's capabilities in this vital area. These partnerships are crucial for navigating the complex regulatory landscape and ensuring secure, efficient tracking of sensitive medical supplies.

The escalating need for enhanced patient safety and supply chain integrity in healthcare directly supports Identiv's strategic positioning. By addressing these critical demands, Identiv is well-placed to capture a significant share of this expanding market.

Identiv is focusing on high-value IoT applications like luxury goods and smart packaging. These areas leverage advanced RFID and Bluetooth Low Energy (BLE) technologies, commanding premium prices and generating ongoing revenue. The company is aiming to be a leader in these specialized, high-growth markets.

Identiv's specialty RFID and BLE tags represent a strong contender in the BCG matrix, showcasing high market growth potential. These technically advanced components are essential for driving digital transformation across diverse sectors, from logistics to asset tracking.

The company's dedication to engineering precision and its ability to ramp up production rapidly provide a significant competitive edge. For instance, in 2024, the global RFID market was projected to reach over $20 billion, with specialized tags forming a significant and growing segment.

Digital Product Passports (DPP)

The burgeoning market for Digital Product Passports (DPP) represents a significant growth avenue for Identiv, driven by the increasing need for supply chain transparency and robust anti-counterfeiting measures. This sector is expected to see substantial expansion, with RFID and NFC technologies at its core, enabling unique digital identities for physical goods.

Identiv is strategically positioned to benefit from this trend, offering a comprehensive suite of RFID and NFC transponders and tags. These products are designed to provide the foundational technology for DPPs, allowing for enhanced product traceability and authenticity verification throughout the lifecycle of a product.

- Market Growth: The global digital product passport market is projected to grow significantly, with some estimates suggesting a compound annual growth rate (CAGR) exceeding 15% in the coming years, fueled by regulatory mandates and consumer demand for product information.

- Technology Adoption: RFID and NFC technologies are central to DPP implementation, with adoption rates increasing across various industries including fashion, electronics, and pharmaceuticals.

- Identiv's Offering: Identiv's portfolio includes a wide range of secure RFID and NFC tags and inlays, capable of storing unique product data and facilitating secure digital interactions.

RFID Reader Modules in High-Growth Sectors

Identiv's involvement in RFID reader modules, particularly through its partnership with Novanta for ThingMagic modules, positions it within a high-growth area. This segment is crucial for Identiv's strategy to offer comprehensive RFID solutions.

The RFID reader market is experiencing significant expansion, driven by the increasing adoption of RFID technology across various industries. This growth is fueled by the demand for enhanced efficiency in areas like supply chain management and healthcare.

- Market Growth: The global RFID market, including readers, was valued at approximately $12.0 billion in 2023 and is projected to reach around $35.0 billion by 2028, exhibiting a compound annual growth rate (CAGR) of over 23% during this period.

- Key Applications: High-growth sectors for RFID readers include retail inventory management, logistics and supply chain, healthcare for patient and asset tracking, and access control systems.

- Strategic Partnerships: Identiv's collaboration with Novanta's ThingMagic brand provides access to advanced reader technology, enabling them to bundle their RFID tags with high-performance readers, thereby strengthening their end-to-end offering.

- Competitive Advantage: By integrating their secure RFID tags with leading reader modules, Identiv enhances its value proposition, catering to customers seeking integrated and reliable identification solutions.

Identiv's specialty RFID and BLE tags are positioned as Stars in the BCG matrix, reflecting their operation in high-growth markets with strong competitive potential. These advanced components are crucial for digital transformation across sectors like logistics and asset tracking.

The company's commitment to engineering excellence and rapid production scaling provides a significant competitive advantage. In 2024, the global RFID market was projected to exceed $20 billion, with specialized tags representing a substantial and growing segment of this value.

The growing demand for Digital Product Passports (DPPs) presents a significant growth opportunity for Identiv, driven by the need for supply chain transparency and anti-counterfeiting. RFID and NFC technologies are central to this expansion, providing unique digital identities for products.

Identiv's comprehensive suite of RFID and NFC transponders and tags offers the foundational technology for DPPs, enhancing product traceability and authenticity verification throughout a product's lifecycle.

| Category | Market Growth | Identiv's Position | Strategic Focus |

| Specialty RFID/BLE Tags | High (e.g., DPP market CAGR >15%) | Strong potential, leveraging advanced tech | High-value IoT, luxury goods, smart packaging |

| RFID Reader Modules | High (Global RFID market ~$12B in 2023, growing >23% CAGR) | Key player via Novanta partnership | End-to-end solutions, integrated offerings |

What is included in the product

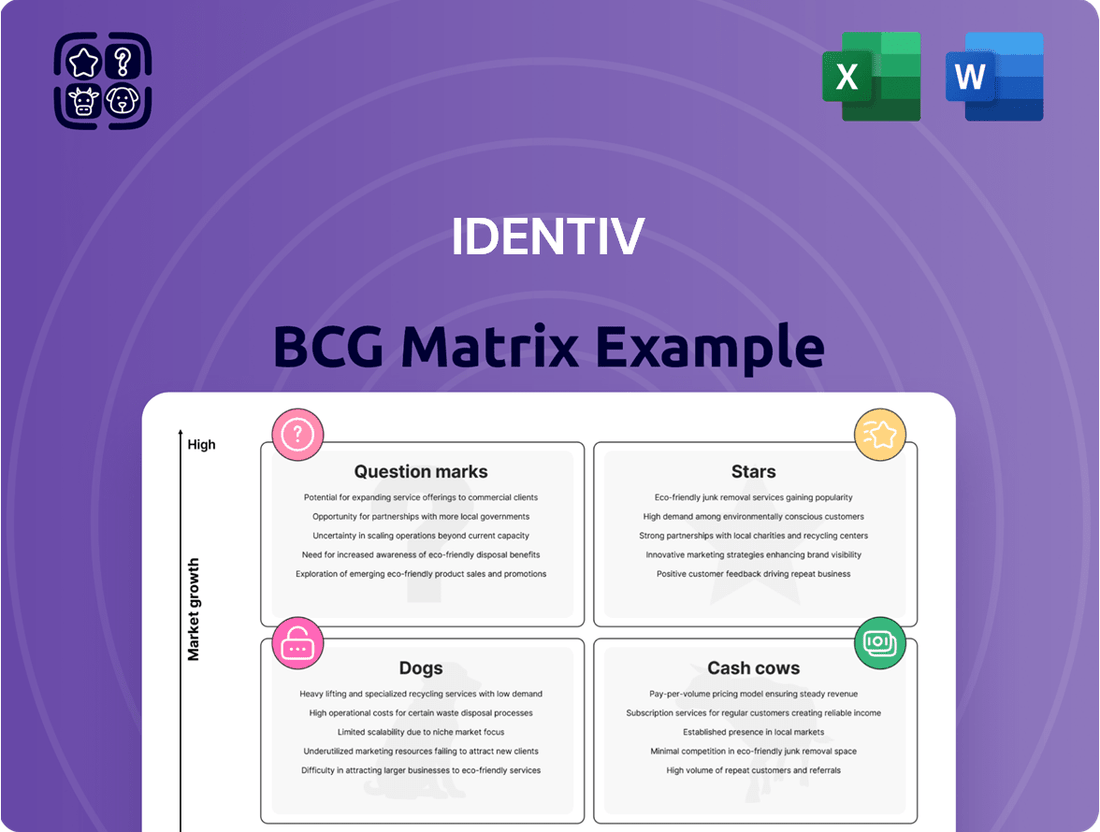

The Identiv BCG Matrix analyzes its product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs to guide strategic decisions.

Identiv's BCG Matrix simplifies complex portfolio analysis, offering a clear visual of business unit performance to reduce strategic decision-making paralysis.

Cash Cows

Identiv's established RFID and NFC transponders and tags are a cornerstone of their business, acting as significant cash cows. These products, integral to numerous established applications, benefit from broad market penetration in sectors that have already embraced the technology. Their consistent revenue generation stems from a stable demand and Identiv's established competitive position in these mature markets.

While Identiv divested its physical security business, some foundational technologies from legacy access control systems may persist as cash cows within their IoT portfolio. These components, often embedded in existing customer solutions, likely represent mature products with established market share that require minimal ongoing investment, thereby generating steady, predictable cash flow. For instance, if Identiv retains certain smart card or reader technologies that are still widely deployed, these could continue to yield revenue through maintenance contracts or low-volume sales to existing clients.

Identiv's core authentication solutions, a cornerstone of secure identification across government and enterprise sectors, likely function as cash cows within the BCG matrix. These mature offerings, vital for robust security infrastructure, generate consistent, albeit low-growth, revenue.

The established nature of these solutions translates into high profit margins and predictable cash flow. For instance, in 2023, Identiv reported revenue from its Premises and Identity divisions, which house these authentication products, contributing significantly to overall financial stability, with the Identity segment alone showing resilience.

Library RFID Solutions

Identiv's RFID solutions tailored for libraries are a prime example of a cash cow in their product portfolio. This is a well-established market where RFID technology has proven its value for inventory management, security, and patron services. The consistent demand for these reliable, low-maintenance solutions translates into steady, predictable revenue streams for Identiv.

These library RFID solutions likely operate in a mature market, meaning growth opportunities might be incremental rather than explosive. Identiv can focus on maintaining its market share and maximizing profitability from existing customer relationships. The inherent stability of library budgets and the ongoing need for efficient operations ensure a consistent demand for these offerings.

- Mature Market: Library RFID is a proven application, indicating a stable, established demand.

- Reliable Revenue: These solutions generate consistent, low-maintenance income for Identiv.

- Profitability Focus: The strategy here is to milk the existing market rather than aggressive expansion.

- Steady Cash Generation: The consistent demand contributes significantly to Identiv's overall cash flow.

Maintenance and Support Services for Mature Products

Identiv's mature RFID and NFC products, such as their legacy security credentials and identification tags, likely function as Cash Cows within the BCG Matrix. These established offerings benefit from consistent demand, generating predictable revenue streams through ongoing maintenance and support contracts. In 2024, the security and identification market, where Identiv operates, continued to show resilience, with many sectors relying on these mature technologies for critical infrastructure and access control.

The profit margins on these services are typically robust. This is because the initial development costs have been amortized, and the primary expenses involve skilled personnel for support and software updates. For instance, a significant portion of Identiv's revenue in 2023, which formed the basis for 2024 projections, came from its established product lines, underscoring the stability of these cash-generating assets.

- Recurring Revenue: Maintenance and support contracts provide a predictable income stream.

- High Profit Margins: Lower variable costs associated with mature product support lead to strong profitability.

- Stable Customer Base: Long-term deployment of these products ensures a loyal and consistent customer base.

- Low Investment Needs: Minimal reinvestment is required for growth, allowing free cash flow generation.

Identiv's established RFID and NFC transponders and tags, particularly those used in mature markets like library security and legacy access control, represent key cash cows. These products benefit from broad market penetration and consistent demand, leading to stable revenue generation with minimal ongoing investment. For example, the Identity segment, which includes many of these established solutions, demonstrated resilience in 2023, contributing significantly to Identiv's overall financial stability.

These mature offerings, such as library RFID solutions, operate in markets where the technology is proven and widely adopted, ensuring reliable, low-maintenance income. The focus for these products is on maximizing profitability from existing customer relationships rather than aggressive expansion. Identiv's 2024 strategy likely continues to leverage these stable cash-generating assets, capitalizing on their high profit margins due to amortized development costs and lower variable expenses.

| Product Category | BCG Matrix Status | Key Characteristics | Market Example | Financial Contribution |

| RFID & NFC Transponders/Tags | Cash Cow | Mature market, broad penetration, stable demand, low investment needs | Library RFID, Legacy Security Credentials | Consistent, predictable revenue, high profit margins |

| Authentication Solutions | Cash Cow | Established, vital for security infrastructure, mature offerings | Government and Enterprise Access Control | Steady, low-growth revenue, significant portion of 2023 financial stability |

What You’re Viewing Is Included

Identiv BCG Matrix

The Identiv BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks or placeholder content, just the complete, analysis-ready strategic tool. You can confidently rely on this preview as a true representation of the professional-grade report that will be yours to use for immediate business planning and decision-making.

Dogs

Identiv's physical security business, encompassing access cards and identity readers, was divested in Q3 2024 to Vitaprotech. This segment clearly falls into the 'Dog' category within the BCG Matrix. Its lower strategic alignment with Identiv's future pure-play IoT ambitions meant it was likely a drain on resources without offering significant growth potential or high profit margins for the company's evolving strategy.

Identiv's strategic shift involves divesting from its non-strategic, low-margin RFID and BLE business segments. These areas, while contributing to revenue, fail to meet the company's profitability benchmarks and strategic objectives. This includes products and customer relationships in commoditized or slow-growth market niches.

In 2023, Identiv reported that its RFID segment revenue was $105.8 million, a decrease from $117.4 million in 2022. This decline reflects the company's active management of its portfolio, focusing on higher-margin opportunities and potentially exiting less profitable product lines within the RFID and BLE space.

Identiv's legacy BLE transponder and mobile products experienced a revenue decrease in fiscal year 2024. This decline suggests these segments may be facing challenges such as increased competition or waning demand, resulting in a lower market share and growth potential within the company's offerings.

The company's strategic shift is evident as they are now concentrating their BLE efforts on more specialized, higher-value applications. This move indicates a recognition that the broader market for these legacy products may be maturing or becoming less profitable, necessitating a pivot towards niche opportunities.

Undifferentiated Standard RFID Tags

Undifferentiated standard RFID tags fall into the Dogs quadrant of the BCG matrix. This is because Identiv, like many players in this space, faces intense competition with minimal differentiation. In 2024, the global RFID market, while growing, sees significant price pressure in the standard tag segment, leading to lower profit margins for manufacturers.

These segments typically offer limited growth potential and minimal competitive advantage for Identiv if they lack a unique technological edge or substantial market share. Companies often strategically reduce investment in these areas to optimize capital allocation, as returns are generally low. For instance, while the overall RFID market is projected to reach over $30 billion by 2026, the standard tag segment's growth rate is often outpaced by more specialized or innovative RFID solutions.

- Low Profit Margins: Intense competition in standard RFID tags limits pricing power, resulting in reduced profitability for Identiv.

- Limited Growth Potential: The market for undifferentiated tags is often saturated, offering minimal opportunities for significant expansion.

- Capital Allocation Strategy: Identiv may choose to divest or minimize investment in these areas to focus resources on higher-growth, more profitable segments.

- Market Saturation: The prevalence of numerous suppliers offering similar products creates a challenging environment for gaining substantial market share.

Products with High Production Costs

Products that previously faced high production costs, particularly those manufactured in Singapore before the shift to the Thailand facility, likely experienced reduced profitability. These cost pressures, coupled with potentially low market share or slow growth, would have positioned them squarely in the 'Dog' category of the BCG Matrix.

The operational transition itself has been a significant factor, impacting Identiv's gross margins. For instance, in the first quarter of 2024, Identiv reported a gross margin of 27.4%, a decrease from 31.5% in the same period of 2023, reflecting these ongoing production adjustments and associated costs.

- High Production Costs: Products manufactured in Singapore prior to the Thailand facility transition.

- Low Profitability: Resulting from elevated production expenses.

- Low Market Share/Growth: Characteristics that would place these products in the 'Dog' quadrant.

- Margin Pressure: The production transition itself has exerted downward pressure on gross margins, as seen in Q1 2024 figures.

Identiv's divestment of its physical security business in Q3 2024 to Vitaprotech, and the strategic reduction in less profitable RFID and BLE segments, clearly places these as Dogs in the BCG Matrix. These areas, characterized by low margins and limited growth potential, no longer align with Identiv's focus on pure-play IoT. For example, RFID segment revenue declined to $105.8 million in 2023 from $117.4 million in 2022, signaling a strategic pruning of underperforming assets.

Undifferentiated standard RFID tags and legacy BLE transponder products represent Identiv's Dog quadrant. These offerings face intense competition and price pressure, leading to low profit margins. The company's gross margin saw a decrease to 27.4% in Q1 2024 from 31.5% in Q1 2023, partly due to production cost adjustments and the nature of these commoditized products.

| Product Segment | BCG Quadrant | Key Characteristics | Financial Data Point | Strategic Implication |

| Physical Security (Divested) | Dog | Low strategic alignment, drain on resources | Divested Q3 2024 | Resource reallocation to core IoT |

| Standard RFID Tags | Dog | High competition, low differentiation, price pressure | RFID segment revenue down in 2023 | Focus on higher-value RFID solutions |

| Legacy BLE Transponders | Dog | Maturing market, potential waning demand | Revenue decrease in FY 2024 | Pivot to specialized, higher-value applications |

Question Marks

The ID-Pixels Battery Assisted Tag, a collaboration with Wiliot, is a cutting-edge IoT device combining RFID and Bluetooth Low Energy (BLE) capabilities. Its nomination for a 'Best New Product Award' highlights its innovative nature and potential to seamlessly connect digital information with physical items.

This tag is positioned within the Stars quadrant of the BCG Matrix due to its high growth potential. While it's still in its nascent stages of market penetration and actively working to capture significant market share, its unique multi-sensor functionality and integration of advanced wireless technologies suggest a promising future in the expanding IoT landscape.

Identiv's bitse.io 3.0 platform, a key component of their IoT strategy, is positioned to capitalize on the growing trend of digital transformation for physical products. This platform enables businesses to easily convert their existing products into connected, data-generating assets, tapping into a market with significant expansion potential. As of early 2024, the IoT market is projected to reach over $1.1 trillion, highlighting the immense opportunity for platforms like bitse.io.

While bitse.io 3.0 signifies a leap forward in Identiv's offering, its position within the BCG matrix would likely be that of a question mark. The platform is in a high-growth industry, but it's still in the early stages of establishing its market presence and gaining widespread adoption. Identiv is investing in this area, aiming to transform it into a star performer, but its current market share and revenue contribution are still developing.

Identiv's strategic emphasis on Smart Home IoT solutions positions it within a dynamic and expanding market. The global smart home market was valued at approximately $105 billion in 2023 and is projected to reach over $200 billion by 2028, indicating substantial growth potential.

Despite this high-growth trajectory, Identiv's current penetration and market share within the smart home segment are likely nascent. This suggests the Smart Home IoT Solutions category for Identiv would be classified as a 'Question Mark' in the BCG matrix, requiring strategic evaluation and potentially significant investment to gain traction.

Emerging IoT Logistics Applications

Identiv's collaborations, such as with InPlay, highlight a strategic move into emerging IoT logistics applications, aiming to boost global supply chain efficiency with smart BLE labels. While these ventures tap into high-growth potential, their market share is still in its nascent stages, requiring significant investment to establish leadership. For instance, the global IoT in logistics market was projected to reach USD 44.5 billion by 2025, showcasing the substantial opportunity Identiv is targeting.

- Smart BLE Labels: Co-development with InPlay targets enhanced tracking and data collection in logistics.

- Market Potential: The IoT in logistics sector presents significant growth opportunities, with the global market expected to expand considerably in the coming years.

- Investment Needs: Scaling these IoT solutions requires substantial capital to compete effectively and gain market traction.

New Digital Identity Solutions for Enterprise

Identiv's commitment to innovation, particularly in its Internet of Things (IoT) security solutions, positions it to develop novel digital identity offerings for enterprises. These emerging solutions are designed to meet the increasing enterprise demand for secure digital transformation initiatives.

The company's ongoing research and development efforts, potentially leveraging its expertise in secure credentialing and access control, could yield new products that address the complexities of modern digital identity management. For instance, advancements in secure element technology and the integration of blockchain for verifiable credentials are areas of active exploration across the industry.

These new digital identity solutions are likely in their early development phases, meaning they require significant market education and a concerted push for adoption to capture substantial market share. Industry analysts noted in early 2024 that enterprise adoption of advanced digital identity solutions, while growing, still faces hurdles related to integration complexity and perceived ROI.

- Innovation Focus: Identiv's core IoT security solutions provide a foundation for developing new enterprise digital identity products.

- Market Demand: These solutions cater to the escalating need for secure digital transformation across various industries.

- Nascent Stage: The new offerings are likely in early market entry, necessitating education and adoption strategies.

- Growth Potential: Successful market penetration could lead to significant traction and increased market share for Identiv.

Question Marks represent business units or products in high-growth markets but with low market share. Identiv's emerging digital identity solutions for enterprises fit this profile, requiring substantial investment to gain traction and market education to drive adoption.

Similarly, their smart BLE labels for logistics, developed in collaboration with partners like InPlay, target a rapidly expanding sector but are still in the early stages of market penetration. These initiatives, while promising, necessitate significant capital outlay to secure a competitive position.

The bitse.io 3.0 platform also falls into the Question Mark category, operating within the booming IoT market but needing to establish a stronger foothold and demonstrate widespread adoption to transition into a Star. Identiv's strategy involves nurturing these areas to achieve future market leadership.

| Identiv Business Area | Market Growth | Market Share | BCG Matrix Position | Strategic Focus |

|---|---|---|---|---|

| Emerging Digital Identity Solutions | High | Low | Question Mark | Market education, adoption strategies, R&D investment |

| Smart BLE Labels (Logistics) | High | Low | Question Mark | Capital investment, partnership development, scaling operations |

| bitse.io 3.0 Platform | High | Low | Question Mark | Product development, market penetration, customer acquisition |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer acquisition costs, and industry growth rates, to accurately position each product.