Identiv Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Identiv Bundle

Identiv's competitive landscape is shaped by several key forces, including the bargaining power of buyers and the threat of substitute products. Understanding these dynamics is crucial for navigating the market effectively.

The complete report reveals the real forces shaping Identiv’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers for Identiv's specialized components, such as RFID chips and access control hardware, significantly impacts supplier bargaining power. If a limited number of companies provide these critical inputs, they can exert more influence over pricing and availability.

Identiv's dependence on advanced technologies for its RFID and Bluetooth Low Energy (BLE) solutions means certain suppliers, particularly those with unique patents or proprietary manufacturing processes, may hold a stronger negotiating position. For instance, in 2023, the global RFID market was valued at approximately $18.5 billion, with a significant portion driven by specialized chip manufacturers.

Identiv's ability to switch between suppliers for its RFID and NFC-enabled transponders, readers, and tags, along with access control systems, significantly influences supplier power. If Identiv faces high switching costs, such as the need for extensive retooling of manufacturing processes, redesigning existing products, or the lengthy and costly process of requalifying new suppliers, then its suppliers will wield greater bargaining power. For example, in 2023, the semiconductor industry, a key component for Identiv's readers, experienced supply chain disruptions that led to increased lead times and prices, demonstrating how supplier-specific challenges can elevate their leverage.

The uniqueness of Identiv's supplier offerings directly impacts supplier bargaining power. If suppliers provide highly specialized or proprietary components, like advanced RFID or Bluetooth Low Energy (BLE) chips, which are critical for Identiv's secure identification solutions and difficult for Identiv to source elsewhere, these suppliers gain significant leverage. This is particularly true if these components are essential for Identiv's competitive edge.

Threat of Forward Integration by Suppliers

Suppliers could potentially escalate their bargaining power by integrating forward into Identiv's core business. This means they might begin manufacturing and selling the complete security and identification solutions that Identiv currently offers. Such a move would directly challenge Identiv's market position and increase the leverage suppliers hold.

The threat of forward integration by suppliers is a significant consideration for Identiv. If a key supplier were to start offering finished products, it could disrupt Identiv's supply chain and customer relationships. For instance, if a chip manufacturer decided to also offer RFID tags with integrated software, they could bypass Identiv’s value-added services.

However, the feasibility of this threat is often constrained by the substantial barriers to entry in producing and marketing complex security solutions. Developing the necessary technology, establishing distribution channels, and building brand recognition in the security sector requires considerable investment and expertise. In 2024, the global market for identity and access management solutions, a key area for Identiv, continued to see significant investment, indicating high barriers to entry for new players.

- Forward Integration Threat: Suppliers might enter Identiv's market by producing finished security and identification solutions, thereby increasing their bargaining power.

- Market Impact: This could lead to direct competition, potentially bypassing Identiv and impacting its revenue streams.

- Barrier to Entry: The complexity and high investment required for developing and marketing comprehensive security solutions may limit the likelihood of widespread supplier forward integration.

Importance of Identiv to Supplier's Business

The significance of Identiv as a client for its suppliers directly influences the suppliers' bargaining power. If Identiv constitutes a substantial part of a supplier's overall revenue, that supplier may be more amenable to negotiating favorable terms and pricing.

Conversely, if Identiv represents a minor portion of a larger supplier's business, the supplier would likely possess greater leverage. For instance, in 2023, Identiv reported total revenue of $244.9 million. The impact of Identiv's purchasing volume on any single supplier's revenue would determine the extent of this leverage.

- Supplier Dependence: If Identiv is a key customer, suppliers are more likely to offer competitive pricing and terms to retain their business.

- Customer Concentration: A supplier with many diverse customers will have less incentive to concede to Identiv's demands compared to one heavily reliant on Identiv.

- Volume Discounts: Identiv's purchasing volume can be a significant factor in negotiating better prices from its suppliers.

- Market Position of Supplier: A dominant supplier in its niche will naturally have more bargaining power, regardless of Identiv's size.

Suppliers' bargaining power for Identiv is influenced by the concentration of critical component providers and the uniqueness of their offerings, especially for specialized RFID and access control hardware. Identiv's dependence on these unique technologies, such as advanced RFID chips, means suppliers with proprietary processes or patents can command greater leverage. For example, in 2023, the global RFID market, valued at approximately $18.5 billion, saw significant influence from specialized chip manufacturers.

High switching costs for Identiv, including retooling or requalifying new suppliers for components like RFID transponders and readers, strengthen supplier leverage. Supply chain disruptions in the semiconductor industry in 2023, which impacted lead times and prices for components used in Identiv's readers, underscore this vulnerability.

The threat of suppliers integrating forward into Identiv's market, offering finished security solutions, is tempered by high barriers to entry. The global identity and access management market, a key area for Identiv, continued to attract substantial investment in 2024, highlighting the significant capital and expertise required to compete effectively.

| Factor | Impact on Supplier Bargaining Power | Supporting Data/Example |

| Supplier Concentration | High if few suppliers exist for critical components. | Global RFID market driven by specialized chip manufacturers. |

| Uniqueness of Offering | High if components are proprietary or essential for competitive edge. | Advanced RFID/BLE chips for secure identification solutions. |

| Switching Costs | High if retooling, requalification, or redesign is needed. | 2023 semiconductor supply chain disruptions increased lead times/prices. |

| Forward Integration Threat | Moderate; limited by high market entry barriers. | 2024 investment in IAM market indicates high barriers. |

| Identiv's Importance to Supplier | Low if Identiv is a small customer; High if Identiv is a major client. | Identiv's 2023 revenue was $244.9 million; impact varies by supplier reliance. |

What is included in the product

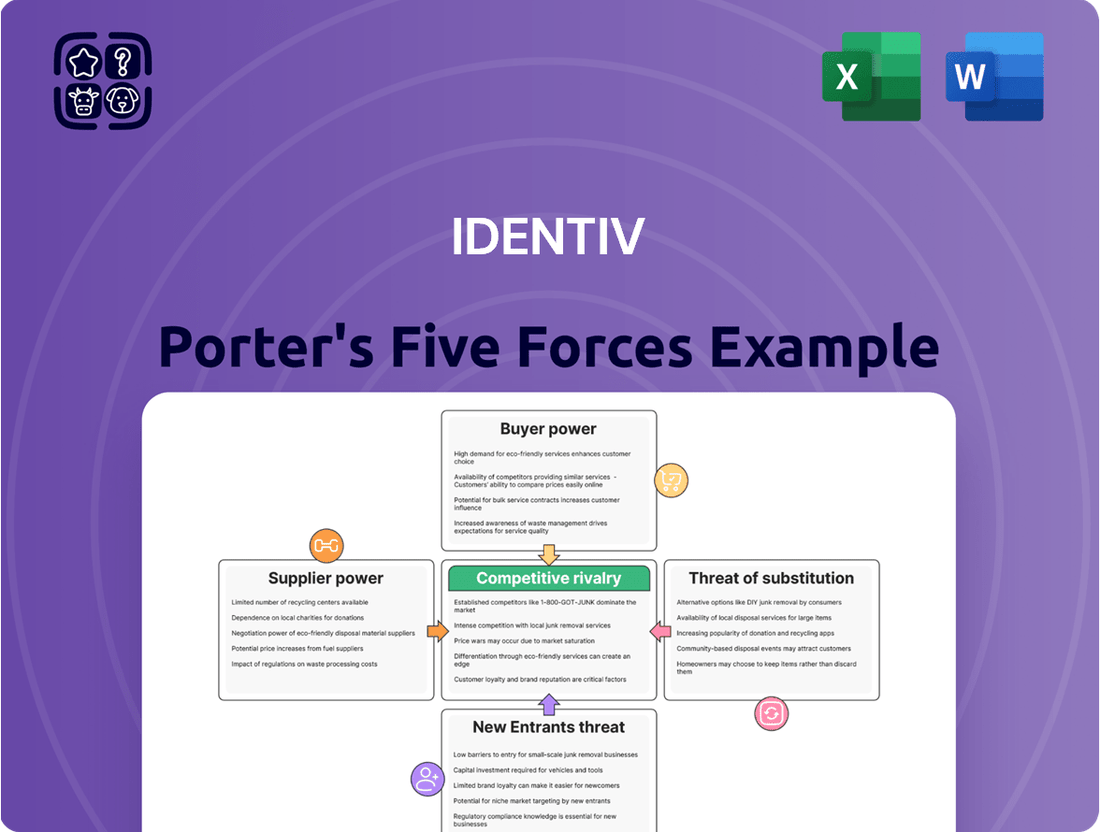

Identiv's Porter's Five Forces analysis meticulously dissects the competitive intensity and profitability potential within the identity and access management sector.

Effortlessly identify and mitigate competitive threats with a visually intuitive framework, turning market complexity into actionable insights.

Customers Bargaining Power

The concentration of Identiv's customer base, especially within critical sectors like government, healthcare, and large enterprises, significantly shapes customer bargaining power. When a few major clients represent a substantial portion of Identiv's income, these key customers gain considerable leverage. This leverage can manifest as demands for reduced pricing, tailored product or service configurations, or more favorable payment schedules. For instance, in 2024, a single customer was responsible for 11% of Identiv's total net revenue, illustrating the potential influence held by such significant accounts.

The costs customers face when moving from Identiv's products to a competitor's directly influence how much sway they hold. If switching requires substantial outlays for new hardware, complex software integration, or extensive employee retraining, customers will be less inclined to switch, thereby diminishing their bargaining power.

Conversely, Identiv's customers wield greater power if the process of switching is straightforward and inexpensive. For instance, in 2024, the cybersecurity solutions market saw a trend towards more interoperable systems, potentially lowering switching costs for some Identiv customer segments.

The sheer number of alternative physical security and secure identification solutions available significantly impacts Identiv's customers' bargaining power. When customers can readily find comparable RFID, NFC, and access control systems from various providers, their ability to negotiate better terms with Identiv increases. The access control market is quite dynamic, with numerous players offering diverse technologies, making it easier for customers to switch if pricing or features aren't competitive.

Customer Price Sensitivity

Customer price sensitivity is a significant factor influencing Identiv's bargaining power of customers. In sectors like government and large enterprises, where Identiv has a strong presence, customers often operate under strict budget constraints or engage in competitive bidding. This can lead to a high degree of price sensitivity, pushing Identiv to maintain competitive pricing structures, which in turn can affect its profit margins.

Identiv's revenue for the first quarter of 2024 was $31.5 million, a slight decrease from $32.7 million in the same period of 2023. This indicates that pricing pressures, potentially stemming from customer sensitivity, could be a contributing factor to revenue performance.

- Government Contracts: Many government tenders require bids that prioritize cost-effectiveness, making price a primary decision driver for these customers.

- Enterprise Procurement: Large enterprises often have dedicated procurement departments focused on negotiating the best possible prices for goods and services, including identity solutions.

- Competitive Landscape: The identity solutions market is competitive, with various providers vying for market share, further intensifying price pressures from customers.

Customer's Ability to Backward Integrate

The threat of customers developing their own in-house security and identification solutions, a move known as backward integration, can significantly boost their bargaining power. This means customers might try to replicate Identiv's offerings internally if they find them too costly or not perfectly suited to their unique requirements.

While building sophisticated RFID or advanced access control systems from scratch is a substantial undertaking, very large enterprises with significant resources might explore this option. For instance, a major global corporation could potentially invest in developing proprietary identification technology if the cost of Identiv's solutions, or those of competitors, becomes prohibitive or if they have highly specialized security needs unmet by standard market products.

- Customer Backward Integration Threat: Large clients may develop in-house security and identification solutions, increasing their bargaining power against providers like Identiv.

- Feasibility for Complex Tech: While challenging for advanced RFID and access control, substantial enterprises might consider this if off-the-shelf options are too expensive or inadequate.

- Cost and Customization Drivers: The decision to backward integrate is often driven by the high cost of existing solutions or a lack of tailored features to meet specific enterprise needs.

Identiv's customers, particularly large enterprises and government entities, possess significant bargaining power due to concentrated purchasing and price sensitivity. In 2024, a single customer accounted for 11% of Identiv's revenue, highlighting the leverage these major clients can exert through pricing demands or requests for tailored solutions. The ease of switching to competitors further amplifies this power, especially as market trends favor interoperability, potentially lowering adoption costs for alternative solutions.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Context |

|---|---|---|

| Customer Concentration | High leverage for key clients | Single customer represented 11% of revenue. |

| Switching Costs | Lower power if switching is easy | Market trends towards interoperability may reduce costs. |

| Price Sensitivity | Customers can negotiate lower prices | Government and enterprise sectors often have strict budgets. |

| Availability of Substitutes | Customers have more options | Dynamic access control market with numerous providers. |

Preview the Actual Deliverable

Identiv Porter's Five Forces Analysis

This preview showcases the comprehensive Identiv Porter's Five Forces Analysis, detailing the competitive landscape for the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, allowing you to immediately leverage its insights into Identiv's market position and strategic considerations.

Rivalry Among Competitors

Identiv operates within a highly competitive arena, facing a significant number of rivals. The physical security and secure identification sectors are populated by a diverse array of companies, ranging from large, established corporations to smaller, specialized firms. This broad spectrum of competitors suggests a market where innovation and adaptation are crucial for success.

Specifically, Identiv has identified 328 active competitors. Prominent among these are companies such as Impinj, known for its RFID technology, Allegion, a major player in security and access solutions, and HID Global, a leader in identity solutions. Other notable competitors include Kopin and 3D Systems, highlighting the varied technological expertise present in the market. This extensive list underscores the fragmented nature of the competitive landscape and the constant pressure Identiv faces to differentiate its offerings.

The rapid expansion of the RFID, NFC, and access control sectors fuels intense competition. For instance, the global RFID market is anticipated to reach approximately $30 billion by 2026, indicating substantial growth opportunities that naturally attract more players. This robust growth rate means companies are actively competing to capture a larger slice of an expanding pie.

Identiv's competitive rivalry is significantly influenced by how distinct its products and services are from those offered by competitors. The company concentrates on RFID and Bluetooth Low Energy (BLE) enabled Internet of Things (IoT) solutions, aiming to provide secure access, efficient asset tracking, and robust digital identity management across various sectors, including healthcare and government agencies.

A key factor in moderating rivalry is Identiv's emphasis on technological innovation and specialized features. For instance, their secure credentialing solutions, which are vital for government and enterprise access control, represent a higher barrier to entry and differentiation than more commoditized RFID tags. This focus on niche, high-security applications can lessen the pressure of direct price competition.

Switching Costs for Customers

Low switching costs for customers in the physical security and secure identification sectors can significantly ramp up competitive rivalry. When it’s easy for clients to jump to another provider, companies must work harder to keep them happy and retain their business. This dynamic means more aggressive pricing and innovation to stand out.

For Identiv, this means that if a customer can easily switch from their access control systems or identity credentials to a competitor's offering without incurring substantial costs or disruption, the pressure to maintain competitive pricing and superior product features is constant. This ease of transition directly impacts how fiercely companies vie for market share.

- Low Switching Costs: Customers can readily adopt alternative solutions from competitors, intensifying rivalry.

- Impact on Identiv: Ease of customer transition pressures Identiv on pricing and product innovation.

- Market Dynamics: Companies must actively compete for market share due to low barriers to customer movement.

Exit Barriers

High exit barriers within the physical security and secure identification sector, stemming from specialized machinery, substantial R&D investments, and long-term customer contracts, can significantly intensify competitive rivalry. Companies find themselves compelled to remain in the market, even when facing diminished profitability, to avoid substantial losses associated with exiting.

This situation often forces businesses to engage in aggressive price competition or to invest heavily in innovation to maintain their position. For instance, the significant capital expenditure required for advanced semiconductor fabrication facilities used in secure credential manufacturing presents a considerable hurdle for companies considering a market exit.

- Specialized Assets: High costs associated with specialized manufacturing equipment for smart cards and RFID tags make divesting difficult and costly.

- R&D Investment: Substantial, ongoing investment in research and development for new security technologies locks companies into the market.

- Contractual Obligations: Long-term supply agreements with governments or large enterprises create commitments that are hard to break without penalty.

Identiv faces intense competition from numerous players in the physical security and secure identification markets, including Impinj and Allegion. This rivalry is amplified by the rapid growth in sectors like RFID, with the global market projected to reach around $30 billion by 2026, attracting more participants.

Identiv's strategy to mitigate rivalry centers on technological differentiation, particularly in secure credentialing and IoT solutions leveraging RFID and BLE. However, low customer switching costs in these markets mean Identiv must continuously innovate and offer competitive pricing to retain business.

| Competitor | Key Focus Areas | Identiv Overlap |

|---|---|---|

| Impinj | RFID technology, IoT solutions | RFID tags, readers, software |

| Allegion | Access control, security hardware | Physical access solutions |

| HID Global | Identity solutions, access control | Secure credentials, access management |

SSubstitutes Threaten

The threat of substitutes for Identiv's RFID and NFC solutions is significant, particularly from emerging biometric technologies. Systems like fingerprint and facial recognition are gaining traction in access control, offering an alternative to traditional card or tag-based methods.

For instance, the global biometric access control market was valued at approximately $3.2 billion in 2023 and is projected to grow substantially, indicating a strong shift towards these alternative identification methods. This growth presents a direct challenge to Identiv's existing market share.

Traditional physical security methods, like mechanical locks and human guards, remain viable substitutes for Identiv's digital solutions, especially for businesses with tighter budgets or less critical security needs. These established methods can offer a perceived lower cost of entry, making them attractive alternatives in certain market segments.

For digital identity and authentication, purely software-based solutions like multi-factor authentication apps and cloud-based identity verification services can act as substitutes for physical security credentials. These digital alternatives offer convenience and can be more cost-effective for some users.

The market is experiencing a growing trend towards IoT-based security systems integrated with cloud computing platforms, further bolstering the viability of software-based authentication. For instance, in 2024, the global identity and access management market was projected to reach over $20 billion, with a significant portion driven by software-centric solutions.

Emerging Technologies

Emerging technologies pose a significant threat of substitution for Identiv's offerings. For instance, the rapid advancement of AI-powered surveillance systems and drone security solutions could offer alternative, potentially more comprehensive security paradigms. These innovations might diminish the need for traditional identity and access management solutions that form Identiv's core business. In 2024, the global AI in security market was valued at approximately $25.7 billion and is projected to grow substantially, indicating a strong shift towards these advanced technologies.

Cyber-physical security solutions represent another avenue of substitution. These integrated systems can offer a holistic approach to security, potentially bypassing the need for separate identity verification components. As these technologies mature and become more accessible, they could erode Identiv's market share by providing a more integrated and efficient security framework. The market for IoT security, a key component of cyber-physical security, is expected to reach over $35 billion by 2025, highlighting the increasing adoption of these integrated solutions.

- AI-Powered Surveillance: Offers advanced threat detection and response capabilities, potentially reducing reliance on physical access controls.

- Drone Security: Provides aerial monitoring and rapid deployment for security, acting as a substitute for ground-based surveillance and access points.

- Cyber-Physical Security: Integrates digital and physical security measures, potentially consolidating identity and access management into broader security platforms.

Cost-Effectiveness of Substitutes

The cost-effectiveness of substitute solutions is a crucial factor in assessing their threat to Identiv. If alternative technologies or methods offer similar security and identification functions at a substantially lower price point, customers might be tempted to switch. This could directly affect Identiv's market share and its ability to maintain current pricing structures.

For instance, while Identiv specializes in secure identity solutions like RFID tags and smart cards, simpler, less secure, or less durable identification methods might exist at a fraction of the cost. Consider the difference between a high-security RFID credential used for access control and a basic printed barcode or QR code. While the latter is far cheaper to produce, it offers significantly less security and durability.

- Lower Cost Alternatives: Basic identification methods such as printed badges or simple QR codes offer significantly lower production costs compared to Identiv's advanced RFID or smart card solutions.

- Compromised Security: These cheaper substitutes often come with a trade-off in security, making them vulnerable to duplication or tampering, which is a key differentiator for Identiv's offerings.

- Market Segment Impact: For applications where the highest level of security is not paramount, the cost advantage of substitutes can erode Identiv's market share in those specific segments.

- Value Proposition: Identiv's value proposition must continually emphasize the superior security, durability, and functionality that justify its higher price point against these less sophisticated alternatives.

The threat of substitutes for Identiv's offerings is considerable, especially from rapidly evolving biometric and software-based solutions. For example, the global biometric system market was valued at approximately $3.2 billion in 2023 and is expected to see significant growth, highlighting a shift towards these alternatives in access control and identification.

Furthermore, purely software-based identity and access management solutions, like multi-factor authentication apps, are increasingly prevalent. The global identity and access management market was projected to exceed $20 billion in 2024, with software-centric solutions driving a large portion of this growth.

Emerging technologies such as AI-powered surveillance, valued at roughly $25.7 billion in 2024, and integrated cyber-physical security systems, with the IoT security market alone projected to surpass $35 billion by 2025, also present strong substitution threats by offering more comprehensive or integrated security paradigms.

These substitutes can pose a threat due to their potential cost-effectiveness. While Identiv's secure credentials offer high security, simpler alternatives like printed badges or QR codes are far cheaper, though they sacrifice security and durability, impacting Identiv’s market share in less security-critical segments.

| Substitute Category | Examples | 2023/2024 Market Data (Approx.) | Key Threat Factor |

|---|---|---|---|

| Biometric Technologies | Fingerprint, Facial Recognition | Biometric Systems Market: $3.2 billion (2023) | Growing adoption in access control |

| Software-Based IAM | MFA Apps, Cloud Identity Verification | IAM Market: >$20 billion (2024 Projection) | Convenience and cost-effectiveness |

| Advanced Surveillance | AI Surveillance, Drone Security | AI in Security Market: $25.7 billion (2024) | Comprehensive security paradigms |

| Integrated Cyber-Physical Security | IoT Security Platforms | IoT Security Market: >$35 billion (by 2025) | Holistic security approach |

Entrants Threaten

The capital requirements for entering the physical security and secure identification market, particularly in developing and manufacturing RFID, NFC, and access control hardware, present a substantial hurdle for newcomers. Significant upfront investment is typically needed for research and development, establishing state-of-the-art manufacturing facilities, and building a robust supply chain. For instance, companies like HID Global, a major player, invest heavily in advanced manufacturing processes and intellectual property, creating a high bar for any aspiring competitor.

Established players in the identity solutions market, like Identiv, often possess significant advantages due to economies of scale. This means they can produce their products, like secure identity credentials and RFID tags, at a lower cost per unit than a new company just starting out. For instance, Identiv's ability to source raw materials in bulk and optimize its manufacturing processes allows it to offer competitive pricing that newcomers would struggle to match without substantial initial investment.

For new companies looking to enter the identity solutions market, securing access to established distribution channels and customer relationships is a significant hurdle. Identiv, with its existing networks across government, healthcare, education, and enterprise sectors, presents a formidable barrier. These established relationships mean newcomers must invest heavily to build trust and penetrate markets already served by Identiv.

Brand Loyalty and Differentiation

Building strong brand loyalty and differentiating offerings are significant hurdles for new entrants in the security and identification sector. Identiv's commitment to specialized solutions, such as secure identity credentials and RFID technologies, fosters deep customer relationships and trust. For example, in 2024, companies in the identity management space that demonstrated robust security protocols and a clear value proposition often saw higher customer retention rates.

New competitors face the challenge of replicating Identiv's established reputation and the substantial investment required to cultivate similar levels of customer confidence. Their ability to gain market share hinges on their capacity to not only match but exceed Identiv's differentiated product features and service reliability. Without this, potential customers are likely to stick with proven providers.

Identiv's long-standing presence in various industries, including government and healthcare, has allowed them to build a solid foundation of trust. This history translates into a significant advantage, as new entrants must overcome the inertia of existing customer relationships and prove their own dependability in critical security applications. The market often favors established players when the stakes are high.

- Brand Recognition: Identiv's established brand name acts as a deterrent, requiring new entrants to invest heavily in marketing and awareness campaigns.

- Customer Loyalty: Existing customer relationships, built on trust and performance, make it difficult for new companies to attract and retain clients.

- Product Differentiation: Identiv's focus on specialized, high-security solutions creates a unique market position that is challenging for newcomers to replicate.

- Switching Costs: For many Identiv customers, the cost and complexity of switching to a new provider can be substantial, further reinforcing brand loyalty.

Regulatory and Compliance Hurdles

The physical security and secure identification industry, especially within government and healthcare, presents substantial regulatory and compliance challenges for new entrants. Navigating complex certifications, industry standards, and data privacy laws like GDPR or HIPAA requires significant investment and expertise, acting as a considerable barrier to entry.

Identiv, for instance, operates in markets where compliance is paramount. In 2024, the global identity and access management market was valued at approximately $35.5 billion, with a significant portion driven by regulatory mandates for secure identification and data protection.

- Stringent Certifications: New companies must obtain approvals from various governmental and industry bodies, a process that can be lengthy and costly.

- Data Privacy Laws: Adherence to regulations like GDPR and CCPA is non-negotiable, demanding robust data handling and security protocols from day one.

- Industry-Specific Standards: Sectors like aviation or critical infrastructure have unique security standards that must be met, adding another layer of complexity.

The threat of new entrants for Identiv is moderate, primarily due to high capital requirements and established brand loyalty. Significant investment is needed for R&D and manufacturing in secure identification technologies. Furthermore, the need to navigate complex regulations and build customer trust in a security-conscious market presents substantial barriers.

| Factor | Identiv's Position | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High (R&D, Manufacturing) | Significant barrier |

| Brand Loyalty & Switching Costs | Strong customer relationships | Challenging to penetrate |

| Regulatory Compliance | Established expertise | Requires substantial investment and time |

| Economies of Scale | Cost advantages | New entrants face higher unit costs |

Porter's Five Forces Analysis Data Sources

Our Identiv Porter's Five Forces analysis is built upon a robust foundation of data, drawing from publicly available company filings, industry-specific market research reports, and reputable financial news outlets to provide a comprehensive view of the competitive landscape.