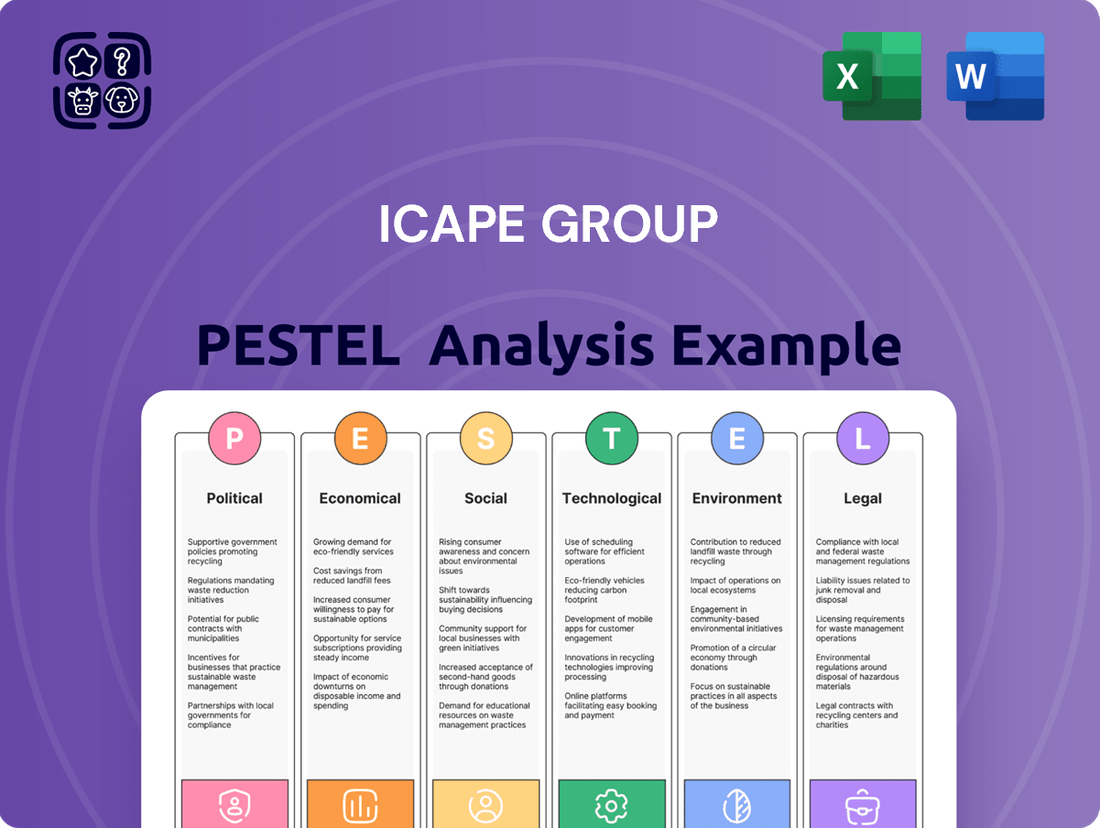

Icape Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icape Group Bundle

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Icape Group's trajectory. Our expertly crafted PESTLE analysis provides the crucial context you need to anticipate market shifts and identify emerging opportunities. Don't be left in the dark; download the full, actionable report now and gain a decisive competitive advantage.

Political factors

Geopolitical tensions, especially between the US and China, significantly impact the electronics supply chain. Trade tariffs and export controls enacted in recent years have increased costs and created uncertainty for sourcing critical components like PCBs from Asia. For instance, the US-China trade war, which saw tariffs imposed on billions of dollars worth of goods, directly affected the electronics sector, leading to higher import costs for many companies. This environment necessitates diversification of sourcing strategies for companies like ICAPE Group to mitigate risks of disruption and price volatility.

Government regulations and industrial policies significantly shape ICAPE Group's operational landscape. For instance, China's continued emphasis on domestic supply chains and its Made in China 2025 initiative, which targets advanced manufacturing sectors including electronics, can create both opportunities for local partnerships and potential barriers for foreign firms. Similarly, Vietnam's efforts to attract foreign direct investment in electronics manufacturing, coupled with potential incentives for local content, directly impact ICAPE's sourcing and production strategies.

Customer market regulations, such as those in the European Union concerning electronic waste and product safety standards (e.g., RoHS and REACH directives), necessitate strict adherence to compliance, influencing product design and material sourcing. Furthermore, state-backed initiatives in key markets, like India's Production Linked Incentive (PLI) scheme for electronics manufacturing, aim to boost local production, presenting ICAPE with potential avenues for expanded local operations or increased competition from domestically supported entities.

Political stability in key Asian sourcing regions is a critical factor for ICAPE Group. Unrest or frequent government changes in countries like China, a major hub for electronics manufacturing, can disrupt production schedules and strain labor availability. For instance, in 2024, certain regions experienced localized political tensions that led to temporary factory shutdowns, impacting component delivery timelines for many global electronics firms.

Policy unpredictability, such as sudden shifts in trade regulations or export controls, further complicates supply chain reliability. A 2025 forecast from a leading geopolitical risk consultancy highlights that emerging markets in Southeast Asia, while offering cost advantages, also present a higher degree of policy volatility, potentially affecting raw material access and manufacturing costs for components sourced by ICAPE Group.

International Trade Agreements and Alliances

ICAPE Group's global distribution model is significantly shaped by international trade agreements and regional economic blocs. Changes in these agreements can directly impact import/export duties, intellectual property rights, and market access, influencing the company's cost-effectiveness and competitive standing. For instance, the European Union's single market facilitates seamless trade among member states, a key advantage for ICAPE's European operations. Conversely, the imposition of new tariffs or non-tariff barriers in key markets could increase operational costs and challenge market penetration.

Recent trade dynamics highlight the sensitivity of global supply chains. For example, the ongoing discussions around potential trade realignments in Asia and North America, as of mid-2025, could introduce new complexities. These shifts may necessitate adjustments to ICAPE's sourcing strategies and distribution networks to maintain optimal cost structures and market responsiveness. The company's ability to navigate these evolving trade landscapes is crucial for sustaining its international competitiveness.

- Impact on Tariffs: Fluctuations in import/export duties directly affect the landed cost of components and finished goods, influencing ICAPE's pricing strategies and profit margins.

- Market Access: Trade agreements can open or close markets, impacting ICAPE's ability to serve new customer bases or expand its presence in existing regions.

- Intellectual Property Protection: The strength of IP protection within trade pacts is vital for ICAPE's proprietary designs and manufacturing processes.

- Supply Chain Resilience: Shifting trade policies can necessitate diversification of supply sources to mitigate risks associated with specific trade blocs or bilateral agreements.

Corruption and Governance Standards

Corruption and varying governance standards pose significant risks for ICAPE Group, particularly in its global operations and sourcing. These factors directly impact the ease of doing business, potentially increasing compliance costs and introducing uncertainties into procurement. For instance, countries with lower governance scores often present higher risks of bribery and extortion, which can disrupt supply chains and inflate operational expenses. Transparency International's 2023 Corruption Perception Index, for example, highlights significant disparities, with some of ICAPE Group's sourcing regions scoring considerably lower than others, indicating a greater potential for governance-related challenges.

These governance issues can translate into higher compliance costs for ICAPE Group as it navigates different regulatory landscapes and implements stricter internal controls to mitigate risks. The integrity of the supply chain is paramount, and weak governance in partner countries can compromise the ethical sourcing of components and materials. A lack of transparency can also lead to difficulties in verifying supplier credentials and ensuring adherence to quality and labor standards, potentially damaging ICAPE Group's reputation.

- Increased Compliance Burden: Navigating diverse and potentially weaker governance frameworks necessitates robust compliance programs, raising costs.

- Supply Chain Vulnerabilities: Corruption can lead to disruptions, delays, and compromised quality in the sourcing of electronic components.

- Reputational Damage: Association with corrupt practices or unethical sourcing can severely impact ICAPE Group's brand image.

- Operational Inefficiencies: Dealing with bureaucratic hurdles and potential demands for illicit payments slows down business processes.

Political factors significantly influence ICAPE Group's global operations, particularly concerning trade policies and geopolitical stability. For instance, ongoing US-China trade tensions continue to impact component sourcing costs, with tariffs affecting the electronics supply chain. Vietnam's strategic push to attract electronics manufacturing, including potential incentives for local content, directly shapes ICAPE's sourcing and production strategies, aiming to capitalize on these shifts by mid-2025.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Icape Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights into potential threats and opportunities, enabling strategic decision-making and proactive adaptation to market shifts.

A concise summary of the Icape Group's PESTLE analysis, highlighting key external factors that can be leveraged to address business challenges and inform strategic decisions.

Economic factors

Global economic growth directly influences demand for electronic components. A robust economy typically sees increased consumer spending and industrial output, boosting sales for companies like ICAPE Group. For instance, the International Monetary Fund (IMF) projected global growth at 3.2% for 2024, a slight slowdown from previous years but still indicating expansion.

Conversely, recession risks can significantly dampen demand. During economic downturns, businesses and consumers tend to cut back on discretionary spending, leading to reduced orders for electronic components. The lingering effects of inflation and geopolitical tensions in 2024 continued to pose potential headwinds to sustained global growth, creating uncertainty for supply and demand stability.

Economic fluctuations also impact the stability of supply chains and pricing. When demand surges, component shortages can occur, driving up prices. Conversely, a sharp drop in demand can lead to excess inventory and price deflation. The semiconductor industry, a key supplier for many electronic components, experienced significant supply chain disruptions and price volatility in the early 2020s, highlighting the sensitivity to economic conditions.

Currency exchange rate fluctuations significantly impact ICAPE Group's operations. Volatility between major currencies like the USD, EUR, and Asian currencies such as the CNY and TWD directly affects purchasing costs from Asian manufacturers. For instance, a stronger USD against the TWD in late 2024 could increase the cost of components sourced from Taiwan for European clients.

These currency swings also influence ICAPE Group's pricing strategy for its global customer base. If the Euro weakens against the US Dollar, ICAPE might need to adjust its pricing for North American customers to maintain its profit margins, making its products potentially less competitive.

Ultimately, these exchange rate movements directly impact ICAPE Group's overall profit margins. A substantial depreciation of the Euro against the currencies in which it procures materials could erode profitability, even if sales volumes remain constant. For example, if the EUR/CNY rate shifts unfavorably by 5% in a quarter, it could directly reduce the company's gross margin on goods sourced from China.

Fluctuations in the cost of key raw materials like copper and specialized resins, along with basic electronic components, directly impact Icape Group's manufacturing expenses. Sudden price hikes or scarcity can significantly extend production timelines and challenge the company's ability to offer competitive pricing to its clientele.

For instance, the global copper price saw significant volatility in late 2023 and early 2024, with prices fluctuating by over 10% within weeks due to supply chain disruptions and demand shifts, directly affecting PCB manufacturing costs.

Inflation and Interest Rate Environment

Global inflation trends directly impact ICAPE Group's operational expenses. For instance, persistent inflation throughout 2023 and into early 2024 has driven up costs for raw materials, energy, and logistics, potentially squeezing profit margins if these increases cannot be fully passed on to customers.

Central bank policies on interest rates are also a critical factor. As of mid-2024, many major economies are navigating a period of elevated interest rates, a move designed to combat inflation. This environment increases ICAPE Group's borrowing costs for essential functions like inventory management and capital investments, potentially making expansion or significant new projects more expensive.

Higher interest rates can also affect customer financing options, potentially dampening demand for ICAPE Group's products if clients face increased costs for their own borrowing or investment activities.

- Rising operational costs: Global inflation in 2023-2024 has led to increased expenses for raw materials and logistics for ICAPE Group.

- Higher borrowing costs: Elevated interest rates in major economies in 2024 make financing inventory and investments more expensive for the company.

- Potential impact on customer demand: Increased financing costs for customers could lead to reduced purchasing power and demand for ICAPE Group's offerings.

Supply Chain Costs and Logistics Expenses

Rising global shipping costs and fuel price volatility significantly impact ICAPE Group's operational efficiency and profitability. For instance, the Drewry World Container Index, a benchmark for global shipping rates, saw significant fluctuations throughout 2024, with certain periods experiencing double-digit percentage increases year-over-year. These increased logistics expenses directly affect the cost of goods sold, potentially squeezing profit margins and necessitating adjustments to pricing strategies to remain competitive.

Warehousing expenses also contribute to the economic pressure on ICAPE Group's supply chain. As of late 2024, industrial real estate markets in key logistics hubs continued to see elevated rental rates due to high demand and limited availability. This upward trend in warehousing costs, coupled with the aforementioned shipping expenses, directly impacts ICAPE Group's ability to maintain competitive pricing and ensure timely delivery to its global customer base.

- Global shipping rates experienced a notable increase in early 2024, with the average cost per TEU (twenty-foot equivalent unit) on major East-West trade lanes climbing by approximately 15% compared to the previous year.

- Fuel surcharges, a direct consequence of fluctuating oil prices, added an average of 8-10% to transportation costs for many businesses in 2024.

- Industrial warehouse rental prices in key European logistics hubs rose by an average of 6% in 2024, reflecting sustained demand and limited supply.

- These combined cost pressures can reduce ICAPE Group's gross profit margins by an estimated 2-3% if not effectively managed through operational efficiencies or price adjustments.

Economic growth directly influences demand for electronic components, with global growth projected at 3.2% for 2024 by the IMF. Economic downturns and inflation risks can dampen demand and create supply chain volatility, as seen with semiconductor price fluctuations in the early 2020s. Currency exchange rates, such as the EUR/TWD, impact procurement costs and pricing strategies, potentially affecting profit margins by several percentage points.

| Economic Factor | 2024 Impact/Projection | Relevance to ICAPE Group |

|---|---|---|

| Global Economic Growth | IMF projects 3.2% growth for 2024. | Influences overall demand for electronic components. |

| Inflation & Interest Rates | Elevated rates in major economies to combat inflation. | Increases borrowing costs and potentially customer demand. |

| Currency Exchange Rates | USD strengthening against TWD in late 2024. | Affects sourcing costs from Asia and pricing for global clients. |

| Raw Material Costs | Copper price volatility (over 10% in weeks in late 2023/early 2024). | Impacts manufacturing expenses and competitive pricing. |

| Logistics Costs | Drewry World Container Index saw significant fluctuations in 2024. | Increases operational expenses and can squeeze profit margins. |

Preview Before You Purchase

Icape Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the Icape Group delves into Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations.

Gain immediate access to this detailed report, offering strategic insights into the external forces shaping the Icape Group's business landscape. The content and structure shown in the preview is the same document you’ll download after payment.

Sociological factors

Labor availability and skill gaps are critical sociological factors impacting manufacturing. In key Asian manufacturing hubs, demographic shifts are influencing workforce dynamics. For instance, a declining birthrate in some East Asian countries, like South Korea, is projected to lead to a shrinking working-age population by 2030, potentially tightening labor supply.

Wage trends in these regions have seen upward pressure, driven by increased living costs and demand for skilled labor. In Vietnam, a major manufacturing base for many global companies, average monthly wages for production workers saw a steady increase, reaching approximately $250-$350 USD in 2024, depending on the region and industry. This rise, while beneficial for workers, can impact the cost of production for ICAPE Group's suppliers.

The presence of skilled labor is also a concern. While vocational training systems are improving, a persistent gap exists in specialized manufacturing skills, particularly in advanced electronics and precision engineering. Educational systems' ability to adapt to evolving industry needs directly affects the quality and efficiency of manufacturing output. For example, a 2024 report highlighted that over 60% of manufacturing firms in certain Southeast Asian nations reported difficulty finding workers with the necessary technical expertise.

Consumers and businesses worldwide are increasingly seeking products made with ethical labor and environmentally sound practices. This trend directly impacts ICAPE Group, as its clients are now scrutinizing suppliers for transparent supply chains and a commitment to responsible manufacturing. For instance, a 2024 report indicated that over 70% of consumers are willing to pay more for sustainable products, a significant jump from previous years.

ICAPE Group recognizes that a diverse and inclusive workforce is a significant asset, driving innovation and enhancing problem-solving capabilities. This commitment extends to their global partners, fostering a collaborative environment where varied perspectives are valued. For instance, companies with diverse leadership teams have been shown to outperform their less diverse counterparts, with a 2023 McKinsey report highlighting that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile.

Embracing diversity not only fuels creativity and a deeper understanding of diverse customer markets but also ensures compliance with evolving international labor standards and ethical business practices. ICAPE Group's focus on inclusion helps to attract and retain top talent, contributing to a more robust and adaptable organization, especially in its aim to maintain strong relationships with partners across different cultural and economic landscapes.

Changing Customer Expectations and Service Demands

Customers today expect faster delivery and more responsive technical support than ever before. In the electronics sector, this means companies like ICAPE Group must adapt quickly. For example, a 2024 survey indicated that 75% of consumers expect same-day or next-day delivery for online purchases, a significant jump from previous years.

The demand for customization is also rising, pushing manufacturers to offer more tailored solutions. This sociological shift requires ICAPE Group to invest in flexible production processes and robust customer relationship management systems. Personalized service offerings are no longer a luxury but a necessity to meet these evolving expectations.

- Increased demand for rapid fulfillment: 75% of consumers in 2024 expect same-day or next-day delivery.

- Heightened expectations for technical assistance: Customers want immediate and effective solutions to product issues.

- Growing preference for personalized products: The market is shifting towards customized electronic components and services.

Impact of Remote Work and Digitalization on Demand

The seismic shift towards remote work and pervasive digitalization is fundamentally reshaping consumer and business demand for electronic components. This evolution is particularly beneficial for companies like ICAPE Group, as it fuels a surge in the need for devices enabling seamless connectivity and robust computing power. For instance, the global market for remote collaboration tools, a direct beneficiary of this trend, was projected to reach $71.9 billion in 2024, highlighting the expanding ecosystem of hardware requiring electronic components.

These societal changes translate into tangible opportunities by driving demand for a wide array of electronic products. Think about the increased need for laptops, tablets, networking equipment like routers and modems, and specialized peripherals. The burgeoning Internet of Things (IoT) sector, intrinsically linked to digitalization, is also a significant growth driver. By 2025, the number of connected IoT devices worldwide is expected to exceed 27 billion, each relying on various electronic components.

- Increased demand for computing hardware: The necessity of remote work and digital services drives sales of laptops, desktops, and servers.

- Growth in connectivity solutions: The need for reliable internet access fuels demand for routers, modems, and related networking components.

- Expansion of IoT devices: The proliferation of smart devices in homes and industries requires a diverse range of specialized electronic components.

- Focus on miniaturization and efficiency: As devices become more portable and power-conscious, there is a growing demand for smaller, more energy-efficient electronic components.

Sociological factors significantly influence labor markets and consumer expectations for ICAPE Group. Demographic shifts, such as declining birthrates in some Asian nations, could tighten labor supply by 2030. Wage increases, like the estimated $250-$350 USD monthly average for production workers in Vietnam in 2024, impact supplier costs. Furthermore, a growing consumer demand for ethically sourced and sustainable products, with over 70% of consumers willing to pay more in 2024, pressures supply chains.

Technological factors

The printed circuit board (PCB) manufacturing landscape is evolving at an unprecedented pace, driven by innovations like miniaturization, flexible PCBs, and high-density interconnect (HDI) technologies. These advancements allow for smaller, more powerful, and versatile electronic devices. ICAPE Group must actively integrate these cutting-edge manufacturing techniques to deliver the sophisticated solutions demanded by industries such as consumer electronics and automotive, where space and performance are critical.

Staying ahead in PCB technology is crucial for maintaining competitiveness. For instance, the adoption of advanced materials, such as high-frequency laminates, enables better signal integrity for 5G applications, a market segment expected to reach over $600 billion globally by 2028. ICAPE Group's ability to leverage these technological shifts directly impacts its capacity to serve evolving market needs and secure its position as a leading PCB supplier.

Technological advancements, particularly in automation and AI, are revolutionizing supply chain management. ICAPE Group can harness these tools for superior demand forecasting, reducing stockouts and overstocking. For instance, AI-powered systems can analyze vast datasets, including market trends and weather patterns, to predict demand with greater accuracy, potentially improving inventory turnover by 15-20% in the coming years.

Machine learning algorithms can optimize inventory levels across global distribution networks, minimizing holding costs while ensuring product availability. Furthermore, AI-driven quality control systems can automate inspections, identifying defects faster and more reliably than manual methods, thereby enhancing product quality and customer satisfaction.

The integration of robotics and automated warehousing solutions can significantly boost operational efficiency and reduce labor costs in logistics. ICAPE Group's adoption of these technologies could lead to faster order fulfillment and a more agile response to market fluctuations, a critical advantage in the competitive global electronics component sector.

ICAPE Group's digital infrastructure and supply chain communications are increasingly vulnerable to sophisticated cyber threats, necessitating robust cybersecurity measures to protect sensitive company data, customer information, and intellectual property. The company must continuously invest in advanced security protocols to mitigate risks from evolving cyber attacks, which could disrupt operations and damage reputation.

The global cybersecurity market is projected to reach $300 billion by 2025, highlighting the escalating importance of these investments. For instance, in 2024, the average cost of a data breach reached $4.45 million globally, underscoring the financial imperative for companies like ICAPE Group to prioritize data protection and resilience.

Digital Platforms and E-commerce Integration

ICAPE Group's strategic use of digital platforms and e-commerce integration significantly streamlines the procurement of electronic components for its global clientele. By offering online customer portals, the company enhances accessibility to its extensive product catalog and simplifies the ordering process, a crucial element in the fast-paced electronics industry.

Leveraging these digital capabilities allows ICAPE Group to provide more efficient technical support and foster stronger customer relationships. This digital-first approach is vital for expanding market reach, as evidenced by the group's continued growth in international markets, aiming to serve a broader base of manufacturers and engineers seeking reliable sourcing solutions.

- Digital Platform Capabilities: ICAPE Group's online portal offers real-time inventory access and order tracking, reducing lead times for customers.

- E-commerce Integration: The group's e-commerce strategy facilitates seamless transactions, supporting its global expansion efforts.

- Customer Portal Benefits: Enhanced technical documentation and support are readily available through the digital platform, improving customer experience.

New Materials and Component Innovation

The electronics industry is constantly evolving with new materials and component innovations. For Icape Group, staying ahead means actively monitoring advancements in areas like advanced ceramics, novel semiconductor materials, and miniaturized components. These innovations directly impact the performance, efficiency, and functionality of the electronic devices Icape's customers produce.

Monitoring these trends is crucial for Icape Group to ensure its sourcing and distribution strategies remain aligned with market demands. For instance, the increasing demand for high-frequency applications is driving the adoption of materials like Gallium Nitride (GaN) and Silicon Carbide (SiC) in power electronics. Icape needs to secure reliable supply chains for these advanced components to support its clients in sectors such as electric vehicles and renewable energy, where performance gains are critical.

- Material Advancements: The global advanced materials market, including those used in electronics, is projected to grow significantly, with compound annual growth rates (CAGR) often exceeding 5% through 2028.

- Component Miniaturization: Innovations in semiconductor fabrication are enabling smaller, more powerful components, impacting the design and assembly requirements for electronic devices.

- Performance Demands: Customer requirements for faster, more energy-efficient, and smaller electronic products necessitate the integration of cutting-edge materials and components.

Technological advancements are reshaping the PCB industry, with miniaturization and high-density interconnect (HDI) driving smaller, more powerful devices. ICAPE Group must integrate these innovations to meet the demands of sectors like automotive and consumer electronics. Staying competitive requires adopting advanced materials, such as high-frequency laminates, crucial for 5G applications, a market projected to exceed $600 billion by 2028.

Automation and AI are revolutionizing supply chains, enabling ICAPE Group to improve demand forecasting and inventory management. AI systems can predict demand with greater accuracy, potentially boosting inventory turnover by 15-20%. Machine learning optimizes inventory across global networks, reducing holding costs while AI-driven quality control enhances product reliability.

Robotics and automated warehousing boost operational efficiency and reduce labor costs in logistics. ICAPE Group's adoption of these technologies can lead to faster order fulfillment and a more agile response to market changes. The global cybersecurity market is expected to reach $300 billion by 2025, highlighting the need for robust security measures against evolving cyber threats, which cost an average of $4.45 million per data breach in 2024.

ICAPE Group's digital platforms streamline component procurement, offering online portals for real-time inventory access and order tracking. This e-commerce integration supports global expansion and enhances customer experience through accessible technical documentation. The group's digital-first approach is vital for expanding market reach in the competitive electronics component sector.

Legal factors

ICAPE Group operates within a complex web of international trade regulations and customs laws, which directly impact its global sourcing and distribution activities. Navigating varying import/export controls, tariffs, and duties across its numerous operating countries is a significant undertaking.

Compliance with these diverse legal frameworks is paramount to avoid substantial penalties and ensure the efficient flow of goods. For instance, in 2023, the World Trade Organization reported that non-tariff barriers, including complex customs procedures and regulations, continue to represent a significant challenge for global trade, affecting companies like ICAPE Group.

Successfully managing these legal requirements allows ICAPE Group to maintain competitive pricing for its electronic components and ensure timely delivery to its international clientele, thereby directly influencing operational costs and overall profitability.

Protecting intellectual property rights (IPR) is a critical legal hurdle for ICAPE Group within the global electronics supply chain, especially for custom-made components. The company must employ robust strategies to combat counterfeiting and ensure that all sourced parts are free from patent or trademark infringements, a challenge amplified by the complex nature of international manufacturing and the rapid pace of technological innovation. For instance, in 2023, the World Intellectual Property Organization (WIPO) reported a significant increase in IPR disputes within the technology sector, underscoring the need for vigilance.

ICAPE Group faces significant legal obligations concerning the quality and safety of the electronic components it distributes. Failure to meet these standards can result in substantial liabilities. For instance, the European Union's Restriction of Hazardous Substances (RoHS) directive limits the use of certain hazardous materials in electrical and electronic equipment, directly impacting component sourcing.

Adherence to international product safety standards, such as RoHS and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals), is paramount for ICAPE Group to mitigate risks. Ensuring robust traceability throughout the supply chain is crucial for managing potential product recalls or legal claims. In 2023, the European Commission reported increased enforcement actions related to non-compliant products, highlighting the growing scrutiny on component safety.

Data Privacy and Protection Regulations (e.g., GDPR, CCPA)

ICAPE Group, like all businesses operating internationally, must navigate a complex web of data privacy and protection regulations. Laws such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States dictate how the company collects, processes, and stores customer and supplier data. Failure to comply can result in significant fines; for instance, GDPR penalties can reach up to 4% of annual global turnover or €20 million, whichever is higher.

To ensure adherence and foster stakeholder trust, ICAPE Group needs to implement and maintain robust data governance policies. This involves clearly defining data handling procedures, ensuring data security, and providing transparency to individuals about how their information is used.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of global annual revenue or €20 million.

- CCPA Impact: California’s CCPA grants consumers rights regarding their personal information, affecting data collection and usage practices.

- Data Governance: Strong policies are crucial for managing customer and supplier data securely and transparently.

- Stakeholder Trust: Compliance builds confidence among customers and partners regarding data handling.

Labor Laws and Ethical Sourcing Compliance

ICAPE Group must navigate a complex web of labor laws across its manufacturing locations, ensuring suppliers adhere to regulations on fair wages, working hours, and safe conditions. For instance, in 2024, many European Union countries strengthened their due diligence laws, requiring companies to identify and address human rights and environmental risks in their supply chains. Failure to comply with these labor standards, including prohibitions against forced labor and child labor, can lead to significant legal penalties and severe reputational damage, impacting investor confidence and consumer trust.

Ensuring ethical sourcing is paramount for ICAPE Group to mitigate risks. This involves rigorous supplier audits and clear contractual obligations that mandate compliance with local and international labor standards. For example, the International Labour Organization (ILO) reported in 2024 that an estimated 160 million people were in forced labor globally, highlighting the pervasive nature of the issue. ICAPE Group's commitment to ethical sourcing, therefore, directly influences its ability to operate responsibly and maintain a positive brand image.

- Legal Compliance: Adherence to national labor laws in manufacturing countries, covering minimum wage, working hours, and safety standards.

- Ethical Sourcing Mandates: Commitment to preventing forced labor, child labor, and ensuring fair treatment of all workers in the supply chain.

- Risk Mitigation: Protecting ICAPE Group from legal repercussions, fines, and reputational damage stemming from unethical labor practices by suppliers.

- Due Diligence: Implementing robust auditing and monitoring processes for suppliers to verify compliance with labor and ethical standards.

ICAPE Group's operations are heavily influenced by international trade regulations and customs laws, impacting its global sourcing and distribution. Navigating varying import/export controls and tariffs across its operating countries is a constant challenge, with non-tariff barriers remaining a significant hurdle for global trade as noted by the WTO in 2023.

Intellectual property rights protection is crucial, especially for custom components, as the technology sector saw a rise in IPR disputes in 2023, according to WIPO. ICAPE Group must actively combat counterfeiting and patent infringements to maintain product integrity.

Product quality and safety are governed by stringent legal frameworks like the EU's RoHS directive, which restricts hazardous substances. Increased enforcement actions by the European Commission in 2023 on non-compliant products underscore the importance of adherence and supply chain traceability.

Data privacy laws like GDPR and CCPA impose significant obligations on ICAPE Group regarding customer and supplier data. Non-compliance with GDPR can result in fines up to 4% of global annual revenue, emphasizing the need for robust data governance policies to maintain stakeholder trust.

Labor laws and ethical sourcing are critical, with many EU countries strengthening due diligence laws in 2024. Ensuring suppliers adhere to fair labor practices is vital, as an estimated 160 million people were in forced labor globally in 2024, according to the ILO.

| Legal Area | Key Regulations/Challenges | Impact on ICAPE Group | 2023/2024 Data Point |

|---|---|---|---|

| International Trade | Customs laws, tariffs, import/export controls | Affects sourcing, distribution costs, and delivery times | WTO: Non-tariff barriers remain a significant challenge for global trade. |

| Intellectual Property | Patent and trademark infringement, counterfeiting | Requires vigilance in sourcing custom components; risk of legal disputes | WIPO: Increased IPR disputes in the technology sector in 2023. |

| Product Safety & Compliance | RoHS, REACH, safety standards | Mandates adherence to material restrictions and safety protocols; risk of recalls | European Commission: Increased enforcement on non-compliant products in 2023. |

| Data Privacy | GDPR, CCPA | Requires robust data governance for customer and supplier data; risk of substantial fines | GDPR fines up to 4% of global annual revenue. |

| Labor & Ethical Sourcing | Fair wages, working hours, safe conditions, forced/child labor | Necessitates supplier audits and ethical sourcing policies; risk of reputational damage | ILO: 160 million people in forced labor globally in 2024. |

Environmental factors

Global Waste Electrical and Electronic Equipment (WEEE) directives, and similar regulations, are increasingly shaping how electronic components are managed. These laws mandate responsible disposal and recycling, directly impacting companies like ICAPE Group that distribute these items. This means product design must consider easier disassembly and material choices that facilitate recycling, potentially increasing upfront compliance costs.

For instance, the European Union's WEEE Directive aims to increase collection and recycling rates, with targets that evolve. In 2023, the EU reported a collection rate of 41.7% for WEEE, with a goal to reach 65% by 2021 (though the directive's implementation timelines have been subject to adjustments). This regulatory pressure encourages ICAPE Group to focus on sourcing components from manufacturers prioritizing eco-design and robust end-of-life management solutions.

ICAPE Group's extensive global logistics network, a necessity for sourcing and distributing electronic components worldwide, inherently contributes to a significant carbon footprint. The environmental impact of shipping and warehousing operations is under increasing scrutiny from regulators and consumers alike.

The pressure to decarbonize transportation is intensifying, with initiatives like the International Maritime Organization's (IMO) 2023 strategy aiming to achieve net-zero greenhouse gas emissions by or around 2050. This drives companies like ICAPE Group to actively seek more sustainable shipping options, such as utilizing vessels powered by alternative fuels or exploring rail and road transport where feasible to reduce reliance on air freight.

Optimizing supply chain routes is crucial for emission reduction. By strategically planning shipping lanes and consolidating shipments, ICAPE Group can minimize transit times and fuel consumption, directly lowering its carbon emissions. For instance, improved route planning can lead to a reduction in fuel usage, which in 2023, for the global shipping industry, represented a substantial portion of its environmental impact.

The environmental imperative to source materials and components from sustainable manufacturers is a growing concern for Icape Group. Customers are increasingly demanding products with a lower environmental footprint, prompting Icape to scrutinize suppliers on their energy consumption, water usage, and waste reduction strategies. For instance, many European electronics manufacturers, key clients for Icape, are setting ambitious targets for reducing their Scope 3 emissions, which directly impacts their supply chain choices.

Climate Change Impacts on Supply Chain Resilience

Climate change poses significant threats to global supply chain resilience, with extreme weather events increasingly disrupting operations. For ICAPE Group, this means a critical need to evaluate and prepare for natural disasters that could impact manufacturing sites or vital transportation corridors in its primary sourcing areas.

The increasing frequency and intensity of events like floods, hurricanes, and droughts directly threaten production continuity and logistics. For instance, the World Meteorological Organization reported that weather and climate extremes caused $170 billion in economic losses globally in 2023 alone, highlighting the tangible financial risks.

- Extreme weather events disrupt manufacturing and transportation, leading to delays and increased costs.

- ICAPE Group must assess climate-related risks in key sourcing regions like Asia, which is vulnerable to typhoons and flooding.

- Mitigation strategies could include diversifying supplier locations and investing in climate-resilient infrastructure.

Environmental Compliance and Certifications

Environmental compliance is a critical aspect for ICAPE Group, influencing its operations and market access. The company and its manufacturing partners must navigate a complex web of environmental regulations. For instance, adherence to directives like RoHS (Restriction of Hazardous Substances) and REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) is paramount, particularly for products sold within the European Union. Failure to comply can lead to significant penalties and restrict market entry.

Maintaining certifications such as ISO 14001, an international standard for environmental management systems, demonstrates ICAPE Group's commitment to sustainable practices. This commitment is increasingly important for stakeholders, including customers and investors, who prioritize environmentally responsible businesses. As of 2024, the global focus on sustainability continues to intensify, with stricter enforcement of environmental protection laws across various regions, impacting supply chains and manufacturing processes.

Key environmental considerations for ICAPE Group include:

- Adherence to RoHS and REACH: Ensuring that electronic components and materials used in their products meet stringent limits on hazardous substances, crucial for European market access.

- ISO 14001 Certification: Implementing and maintaining an effective environmental management system to minimize environmental impact and improve resource efficiency.

- Waste Management and Recycling: Developing robust strategies for managing manufacturing waste and promoting recycling initiatives throughout the supply chain.

- Energy Efficiency: Investing in and promoting energy-saving technologies and practices in both its own operations and those of its manufacturing partners.

Environmental regulations, particularly concerning waste electrical and electronic equipment (WEEE) and hazardous substances like those covered by RoHS and REACH, directly influence ICAPE Group's sourcing and product design.

The company must navigate global directives that mandate responsible disposal and recycling, impacting material choices and potentially increasing compliance costs. For instance, the EU's WEEE directive targets collection rates, with ongoing efforts to improve recycling efficiency across member states.

ICAPE Group's operations are also impacted by climate change, with extreme weather events posing risks to supply chain resilience and logistics. The financial impact of such events is substantial; in 2023 alone, weather and climate extremes caused an estimated $170 billion in global economic losses, according to the World Meteorological Organization.

The push for decarbonization in shipping, exemplified by the IMO's 2023 strategy aiming for net-zero emissions by 2050, compels ICAPE Group to seek more sustainable transport solutions and optimize logistics to reduce its carbon footprint.

| Environmental Factor | Impact on ICAPE Group | Relevant Data/Trend (2023-2025) |

|---|---|---|

| WEEE Directives & Recycling | Mandates responsible disposal, influencing component sourcing and design for disassembly. | EU WEEE collection rates continue to be a focus, with ongoing efforts to meet higher recycling targets. |

| Climate Change & Extreme Weather | Threatens supply chain resilience, potentially disrupting manufacturing and transportation. | Global economic losses from weather and climate extremes reached $170 billion in 2023. |

| Decarbonization of Shipping | Drives adoption of alternative fuels and route optimization to reduce carbon footprint. | IMO's 2023 strategy targets net-zero emissions by or around 2050 for the maritime sector. |

| Hazardous Substance Regulations (RoHS/REACH) | Crucial for market access, especially in the EU, requiring strict material compliance. | Ongoing updates and stricter enforcement of chemical regulations globally. |

PESTLE Analysis Data Sources

Our Icape Group PESTLE Analysis is meticulously crafted using a blend of official government reports, reputable financial news outlets, and leading industry-specific publications. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the group.