Icape Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icape Group Bundle

Curious about the Icape Group's strategic positioning? This glimpse into their BCG Matrix reveals how their diverse product portfolio stacks up in terms of market share and growth potential.

Understand which of Icape's offerings are poised for future success (Stars) and which are currently generating significant cash flow (Cash Cows). Don't miss out on the full analysis that will unlock actionable insights.

Purchase the complete Icape Group BCG Matrix report to gain a comprehensive understanding of their market dynamics, identify potential areas for investment, and make informed strategic decisions for future growth.

Stars

ICAPE Group is aggressively pursuing strategic acquisitions in high-growth regions like the United States, Asia, and the United Kingdom. This expansion aims to solidify its market presence and capitalize on increasing demand for PCBs and custom parts in these key areas. For instance, the acquisitions of Kingfisher PCB and ALR Services in the UK, along with NTW in Japan, are pivotal moves to expand market share.

These targeted investments are crucial for capturing burgeoning business momentum and are integral to ICAPE Group's ambitious growth objectives, targeting significant contributions by 2026. The company's strategy focuses on integrating entities that can immediately enhance its capabilities and market reach in regions demonstrating robust growth potential.

ICAPE Group is seeing a significant boost in its business momentum, starting from late 2024 and carrying through the first half of 2025. This positive trend is largely fueled by robust demand in both the United States and Asian markets.

This strong performance in the US and Asia positions these markets as Stars within the BCG matrix for ICAPE Group. The company recognizes this growth opportunity and is actively increasing its presence and sales efforts in these key regions to meet its ambitious growth and profitability goals.

The core ICAPE activity, specialized PCB distribution, consistently drives over 80% of the Group's annual revenue. This strong performance solidifies its position as a Star in the BCG matrix.

Despite market volatility, ICAPE's leadership and expansion in PCB distribution, bolstered by strategic acquisitions and a growing global footprint, enable it to secure substantial market share in expanding sub-sectors. For instance, in 2024, the Group reported a significant increase in its revenue from PCB distribution, reflecting its ability to capitalize on demand for advanced PCB solutions.

Enhanced Service Offering and Supply Chain Expertise

ICAPE Group distinguishes itself through a comprehensive suite of services that extend far beyond simple component distribution. This includes rigorous quality control, efficient logistics, expert supply chain management, and dedicated technical support, all designed to streamline the customer experience. Their extensive global network of subsidiaries and strategic partners further solidifies this advantage.

By acting as a one-stop-shop and applying its deep expertise across the entire Printed Circuit Board (PCB) value chain, ICAPE Group secures and grows its market share. This integrated approach allows them to attract new clients in an expanding market, reinforcing their leading position. For instance, in 2024, ICAPE Group reported a significant increase in its service-based revenue, highlighting the success of this strategy.

- Comprehensive Service Portfolio: Quality control, logistics, supply chain management, and technical support.

- Global Network: Subsidiaries and strategic partners worldwide.

- One-Stop-Shop Advantage: Covering the entire PCB value chain.

- Market Position: Leading in a growing market due to integrated service model.

Post-Integration Synergies and Operational Efficiency

ICAPE Group actively pursues post-acquisition synergies, integrating entities like PCS and Studio E2 to bolster its Star portfolio. This strategic move, coupled with a stringent cost control approach, is designed to amplify the growth trajectory of these high-potential businesses.

By optimizing structural costs and streamlining operations following acquisitions, ICAPE significantly enhances the efficiency and profitability of its Star segments. This dedication to operational excellence is crucial for cultivating new market leaders and ensuring their sustained competitive advantage.

- Synergy Realization: ICAPE's integration of PCS and Studio E2 aims to unlock value through cross-selling opportunities and operational efficiencies.

- Cost Optimization: A rigorous focus on controlling structural costs across the Group supports the investment in and growth of Star entities.

- Efficiency Gains: Enhancing operational efficiency within acquired assets directly contributes to the increased profitability of ICAPE's high-growth segments.

- Market Leadership: The strategy is geared towards enabling these optimized segments to emerge as sustainable market leaders.

ICAPE Group's core PCB distribution business, consistently generating over 80% of its annual revenue, firmly establishes it as a Star in the BCG matrix. This segment benefits from robust demand, particularly in the United States and Asia, which are experiencing significant growth. For instance, ICAPE reported a substantial revenue increase from PCB distribution in 2024, underscoring its ability to capitalize on the demand for advanced PCB solutions.

The company's strategic acquisitions, like NTW in Japan, further bolster its Star position by expanding its market share in high-growth regions. By integrating these entities and optimizing operations, ICAPE enhances the efficiency and profitability of its Star segments, aiming to cultivate new market leaders.

ICAPE's comprehensive service portfolio, including quality control, logistics, and technical support, combined with its one-stop-shop advantage across the PCB value chain, solidifies its leading market position. This integrated approach attracted new clients in an expanding market, as evidenced by a significant increase in service-based revenue in 2024.

| BCG Category | ICAPE Group Segment | Market Growth | Market Share | Strategic Focus |

|---|---|---|---|---|

| Stars | PCB Distribution | High (US, Asia) | High | Invest for growth, maintain leadership |

| Stars | Acquired High-Growth Entities (e.g., NTW) | High | Growing | Integrate, optimize, and expand |

What is included in the product

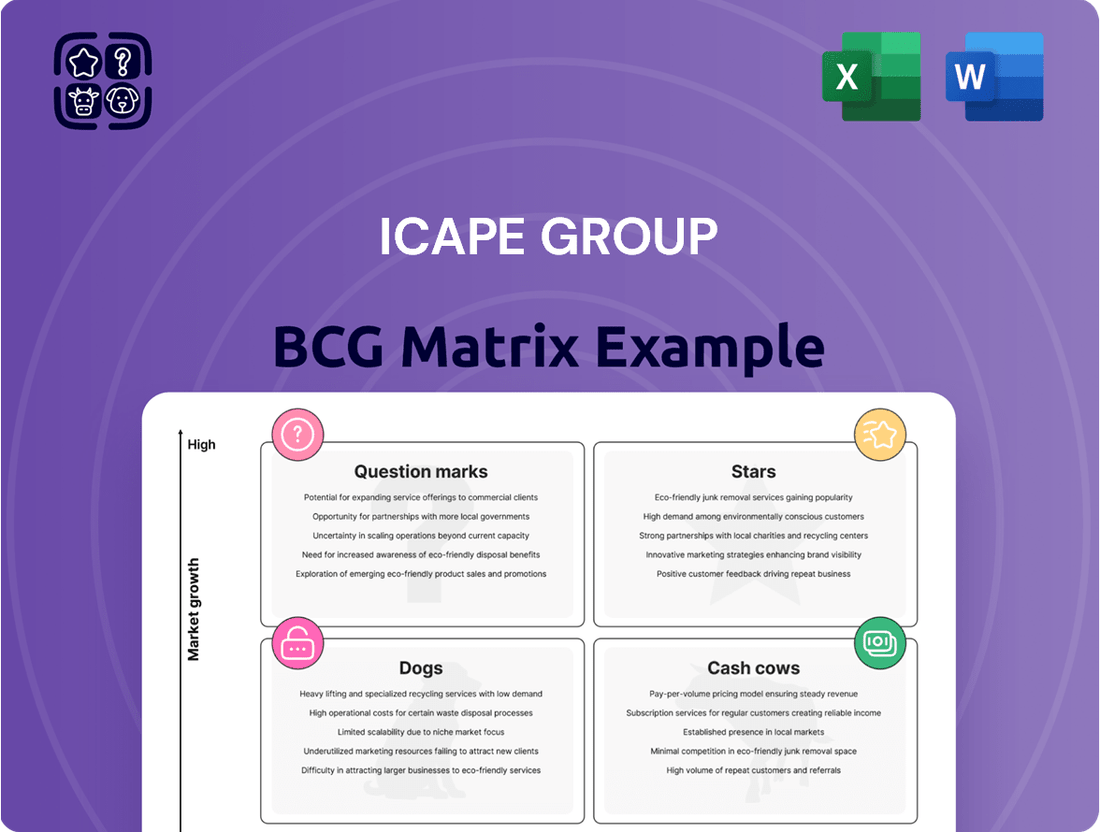

The Icape Group BCG Matrix analyzes its product portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The Icape Group BCG Matrix offers a clear, one-page overview, instantly relieving the pain of complex strategic analysis.

Cash Cows

ICAPE Group's established global PCB distribution network, operating since 1999, is a prime example of a Cash Cow. This mature business, boasting 39 subsidiaries and a significant footprint in China, efficiently serves 3,650 recurring customers across more than 60 countries.

The extensive reach and deep market penetration generate substantial and consistent cash flow, requiring minimal additional investment for upkeep. This stability underscores its position as a reliable generator of profits for the ICAPE Group.

The Custom-Made Electromechanical Parts (CIPEM) activity is a significant contributor to the Icape Group, generating between 18% and 24.2% of the total revenue. This segment, characterized by its focus on specialized electromechanical components, serves as a dependable cash generator for the company.

While CIPEM might not be at the forefront of rapid expansion, its strength lies in its established customer base and a broad range of offerings. These factors ensure a steady and predictable income stream, which is crucial for the Group's financial stability and ability to invest in other growth areas.

ICAPE Group's long-term customer relationships are a significant cash cow. With thousands of recurring clients, the company enjoys a predictable revenue stream from its established customer base. This loyalty minimizes the need for extensive marketing efforts, ensuring a consistent cash inflow.

These strong relationships are built on ICAPE Group's commitment to quality and reliable service. By focusing on customer satisfaction and efficient supply chain management, the company cultivates a dependable base of repeat business, solidifying its position as a consistent cash generator.

Supply Chain Management and Procurement Expertise

ICAPE Group's core business of simplifying procurement and ensuring reliable supply through Asian manufacturers is a mature, highly efficient operation. This expertise is a dependable cash cow, generating strong profit margins from optimized sourcing and logistics.

The continuous refinement of these processes further enhances efficiency and cash flow. For instance, in 2024, ICAPE Group reported a significant increase in its gross profit margin, partly attributed to these streamlined procurement strategies.

- Mature Business Model: ICAPE Group's established procurement services in Asia are a stable source of income.

- Optimized Sourcing & Logistics: Efficient operations lead to high profit margins.

- Continuous Improvement: Ongoing process refinement boosts cash flow.

- 2024 Performance: Demonstrated strong profitability due to procurement expertise.

Dividend Distribution Policy

Icape Group's dividend distribution policy highlights its status as a cash cow within its BCG matrix. The proposed dividend of €0.13 per share for the 2024 financial year, equating to 28% of its consolidated net income, demonstrates a robust and consistent ability to generate surplus cash.

This commitment to returning value to shareholders, a practice maintained since its initial public offering, underscores the maturity and stability of Icape's core business segments. These operations are reliably profitable, consistently producing more cash than is needed for reinvestment, thus supporting a predictable dividend payout.

- Dividend Payout Ratio: 28% of consolidated net income for 2024.

- Dividend per Share: €0.13 proposed for the 2024 financial year.

- Policy Consistency: Dividend distribution has been a practice since the company's IPO.

- Financial Health Indicator: Signals strong and predictable cash generation from core operations.

ICAPE Group's established global PCB distribution network, operating since 1999, is a prime example of a Cash Cow. This mature business, boasting 39 subsidiaries and a significant footprint in China, efficiently serves 3,650 recurring customers across more than 60 countries, generating substantial and consistent cash flow with minimal additional investment. The Custom-Made Electromechanical Parts (CIPEM) activity, contributing between 18% and 24.2% of total revenue, also acts as a dependable cash generator due to its established customer base and broad offerings, ensuring a steady and predictable income stream.

| Business Segment | Role in BCG Matrix | Key Characteristics | Financial Contribution (Example) |

|---|---|---|---|

| Global PCB Distribution | Cash Cow | Mature, established network, high customer retention, minimal investment needed. | Consistent revenue generation, supports dividend payouts. |

| Custom-Made Electromechanical Parts (CIPEM) | Cash Cow | Dependable income, established customer base, broad product range. | 18%-24.2% of total revenue. |

What You’re Viewing Is Included

Icape Group BCG Matrix

The Icape Group BCG Matrix you are previewing is the identical, fully formatted document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, contains no watermarks or demo content, ensuring you get a professional and actionable report ready for strategic implementation. You can confidently use this preview as a direct representation of the high-quality, analysis-ready file that will be yours to edit, print, or present. This is the exact BCG Matrix report designed to provide clear insights into Icape Group's business units and their market positions.

Dogs

Within Icape Group's portfolio, underperforming legacy segments or clients represent areas where older product lines or established customer bases are struggling to keep pace with evolving market demands. These segments often face intense competition, leading to shrinking sales and a diminished market share. For instance, if a legacy product line, historically a strong performer, now accounts for less than 5% of total group revenue in 2024 and shows a year-over-year decline of 10%, it would fit this category.

Such segments typically offer minimal revenue contribution while simultaneously consuming valuable resources that could be better allocated elsewhere. Imagine a client segment that, despite its long-standing relationship, now represents only 2% of Icape Group's customer base and has seen its order volume decrease by 15% in the past year. These situations necessitate a thorough assessment, often leading to decisions about divestiture or substantial operational restructuring to improve profitability or viability.

The accounting fraud discovered in Icape Group's US subsidiary, leading to a $4.5 million loss over several years, clearly marks this operation as a significant cash trap within the company's portfolio. This situation directly impacts operational efficiency and profitability, aligning it with the characteristics of a 'Dog' in the BCG matrix if not swiftly and effectively managed.

The financial drain caused by this fraud, amounting to millions, diverts crucial capital and management attention away from more promising ventures. For instance, in 2024, companies facing such internal control failures often see their stock prices decline significantly, reflecting investor concerns about governance and financial stability.

While Icape Group's overall performance shows promise in early 2025, certain established or slower-moving business areas might be facing internal contraction. These segments, if they also hold a minor position in their respective markets, would be classified as Dogs in the BCG matrix.

For instance, if a specific product line, like older generation printed circuit boards (PCBs) with dwindling demand, experiences a 5% year-over-year organic sales decline in Q1 2025, and its market share is only 2%, it would likely fall into the Dog category. Such units necessitate careful evaluation for potential divestment or a strategic decision to reduce capital allocation.

Inefficient Post-Acquisition Integrations

Inefficient post-acquisition integrations can transform ICAPE Group's acquired entities into Problem Children within the BCG matrix. This occurs when the anticipated synergy benefits fail to materialize or when integration costs become excessively burdensome, draining resources instead of generating value. For instance, if an acquired company, despite initial promise, struggles to capture market share or achieve projected growth post-integration, it can become a significant cash drain.

These underperforming acquisitions require ongoing investment without delivering commensurate returns. In 2023, for example, the global M&A integration failure rate was estimated to be between 70% and 90%, highlighting the commonality of these challenges. For ICAPE Group, this translates to a need for rigorous due diligence and robust integration planning to mitigate the risk of creating these cash-trapping entities.

- High Integration Costs: Acquisitions that exceed their budgeted integration expenses can quickly become financial burdens.

- Failure to Achieve Synergies: When cost savings or revenue enhancements from an acquisition do not meet expectations, the acquired entity may not justify its continued investment.

- Underperformance Post-Acquisition: If the acquired business fails to grow or capture market share as planned, it will likely consume more cash than it generates.

- Resource Drain: Problem Children divert management attention and capital that could be better allocated to more promising ventures within the ICAPE Group portfolio.

Overly Diversified or Niche Offerings with Limited Scale

ICAPE Group might find itself with offerings that are too specialized or cater to markets that aren't growing. These could be custom-made components for legacy systems or highly specific industrial applications with few potential buyers. Such products often struggle to achieve economies of scale, leading to higher production costs and lower profit margins.

These niche offerings, if they represent a small portion of the market and have minimal growth potential, would likely fall into the Dogs category of the BCG matrix. For instance, if ICAPE Group had a product line serving a declining industry, and that line only accounted for 1% of their total revenue with no foreseeable expansion, it would be a prime candidate for review. In 2024, companies are increasingly scrutinizing such low-return segments to reallocate capital towards more promising ventures.

- Low Market Share: Products serving very small, stagnant markets typically have inherently low market share.

- Limited Growth Prospects: The lack of expansion in the target market directly translates to poor growth potential for the offering.

- Resource Drain: These products can consume valuable R&D, manufacturing, and sales resources without yielding significant returns.

- Strategic Review Candidates: Offerings in this category are often candidates for divestment, phasing out, or significant restructuring to improve profitability or eliminate resource drain.

Dogs within Icape Group's portfolio represent business segments or products with low market share and low growth potential. These often include legacy products or those in declining industries, consuming resources without generating significant returns. For instance, a product line with a 2% market share and a 5% year-over-year sales decline in early 2025 would be classified as a Dog.

The accounting fraud in the US subsidiary, resulting in a $4.5 million loss, clearly positions that operation as a significant cash trap, a characteristic of a Dog if not managed. This diverts capital and attention from more promising ventures, impacting overall financial health and potentially leading to stock price declines, as seen in similar cases in 2024.

Similarly, poorly integrated acquisitions that fail to achieve synergies or grow market share can become Dogs, draining resources. The global M&A integration failure rate, estimated between 70% and 90% in 2023, underscores the risk of creating such cash-trapping entities within Icape Group's portfolio.

Niche offerings catering to stagnant or declining markets also fall into the Dog category. If Icape Group has a product line serving a declining industry, accounting for only 1% of revenue with no expansion prospects, it's a prime candidate for review, mirroring the trend of companies scrutinizing low-return segments in 2024.

Question Marks

ICAPE Group's electronic assembly activity is currently a classic Question Mark in its BCG Matrix. This new venture targets a potentially high-growth market, but the Group's current market share is minimal. Significant investment is necessary to build brand recognition and secure customer buy-in for this emerging service.

This strategic move requires substantial capital outlay, positioning it as a cash consumer without immediate guaranteed returns. The future potential is considerable, but the inherent uncertainty of establishing a foothold in a competitive landscape firmly places it in the Question Mark category, demanding careful management and strategic decision-making for growth.

Recent smaller acquisitions, such as Kingfisher PCB and ALR Services, represent Icape Group's strategic moves into new markets, particularly within the UK. While these entities show promise for future growth, their current status requires significant attention for integration.

The consolidation phase, beginning in Q1 2025, is critical for these acquisitions to fully contribute to Icape Group's market share. Their potential is high, but they are still in the early stages of becoming Stars in the BCG matrix, necessitating ongoing investment and strategic direction.

New geographical market entries for ICAPE Group represent classic "Question Marks" in the BCG matrix. These ventures are characterized by a low current market share within a rapidly expanding market. For instance, ICAPE's recent expansion into the Southeast Asian market, particularly Vietnam, fits this profile. Vietnam's electronics manufacturing sector is projected to grow significantly, but ICAPE's initial presence there is modest.

These markets require substantial investment to build brand awareness, establish distribution networks, and adapt products to local needs. The goal is to transform these question marks into future "Stars" by capturing a larger share of the growing market. ICAPE's strategy in these regions focuses on targeted marketing campaigns and building strong local partnerships to accelerate adoption.

Expansion of Services Beyond Core PCB/Technical Parts

Expanding beyond its core PCB and custom technical parts distribution, ICAPE Group is exploring new service offerings and product categories. These ventures, while in early stages, represent significant growth opportunities. However, they currently hold a small market share and necessitate considerable investment in marketing and operations to achieve market penetration.

For instance, the Group might consider venturing into areas like advanced testing services for electronic components or specialized logistics solutions for the electronics supply chain. These adjacent markets often exhibit robust growth trajectories, with the global electronic components market projected to reach over $1 trillion by 2028, according to recent analyses.

- New Service Exploration: Identifying and developing services that complement existing PCB and technical parts distribution, such as advanced testing or supply chain management solutions.

- High Growth Potential Markets: Targeting market segments within the broader electronics industry that demonstrate strong future growth prospects.

- Nascent Market Share: Acknowledging that these new initiatives start with a low percentage of the target market.

- Investment Requirements: Recognizing the need for substantial capital and resources for marketing, sales, and operational development to build traction.

Investments in Emerging Technologies or Niche PCB Applications

Investments in emerging technologies or niche PCB applications would be classified as Question Marks within the ICAPE Group BCG Matrix. These segments, while holding potential for future high growth, currently exhibit low market share. For example, ICAPE's exploration into advanced semiconductor packaging PCBs or specialized PCBs for quantum computing, while promising, are in nascent stages of market development.

- Emerging Technology Focus: ICAPE's investment in areas like flexible hybrid electronics (FHE) or PCBs for advanced medical wearables places them in a Question Mark category. These markets are projected for substantial growth, with the global FHE market anticipated to reach USD 5.8 billion by 2028, growing at a CAGR of 12.5%.

- Niche Application Development: Pursuing niche PCB applications, such as those for high-frequency communication modules or specialized aerospace components, also falls under Question Marks. These markets are often characterized by high technical barriers to entry and require significant R&D investment.

- Market Share and Investment: Currently, ICAPE's market share in these specific emerging or niche sectors is likely small, necessitating substantial capital allocation for research, development, and market penetration efforts. This investment is crucial to transform these Question Marks into potential Stars in the future.

Question Marks in ICAPE Group's BCG Matrix represent new ventures or markets with low current market share but high growth potential. These require significant investment to build brand recognition and capture market share, with the aim of transforming them into Stars. The Group's expansion into new geographical regions, such as Southeast Asia, and its exploration of new service offerings like advanced testing services exemplify these Question Marks. The success of these initiatives hinges on strategic capital allocation and effective market penetration strategies, with the global electronic components market projected to exceed $1 trillion by 2028.

| BCG Category | ICAPE Group Example | Market Characteristic | Investment Need | Potential Outcome |

|---|---|---|---|---|

| Question Mark | New Geographical Markets (e.g., Vietnam) | High Market Growth, Low Market Share | High (Brand building, distribution) | Star (if successful) |

| Question Mark | New Service Offerings (e.g., Advanced Testing) | High Market Growth, Low Market Share | High (R&D, marketing) | Star (if successful) |

| Question Mark | Emerging Technologies (e.g., FHE PCBs) | High Market Growth, Low Market Share | High (R&D, market penetration) | Star (if successful) |

BCG Matrix Data Sources

Our Icape Group BCG Matrix is built on comprehensive market data, integrating financial reports, industry growth trends, and internal sales figures to accurately position each business unit.