Icape Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icape Group Bundle

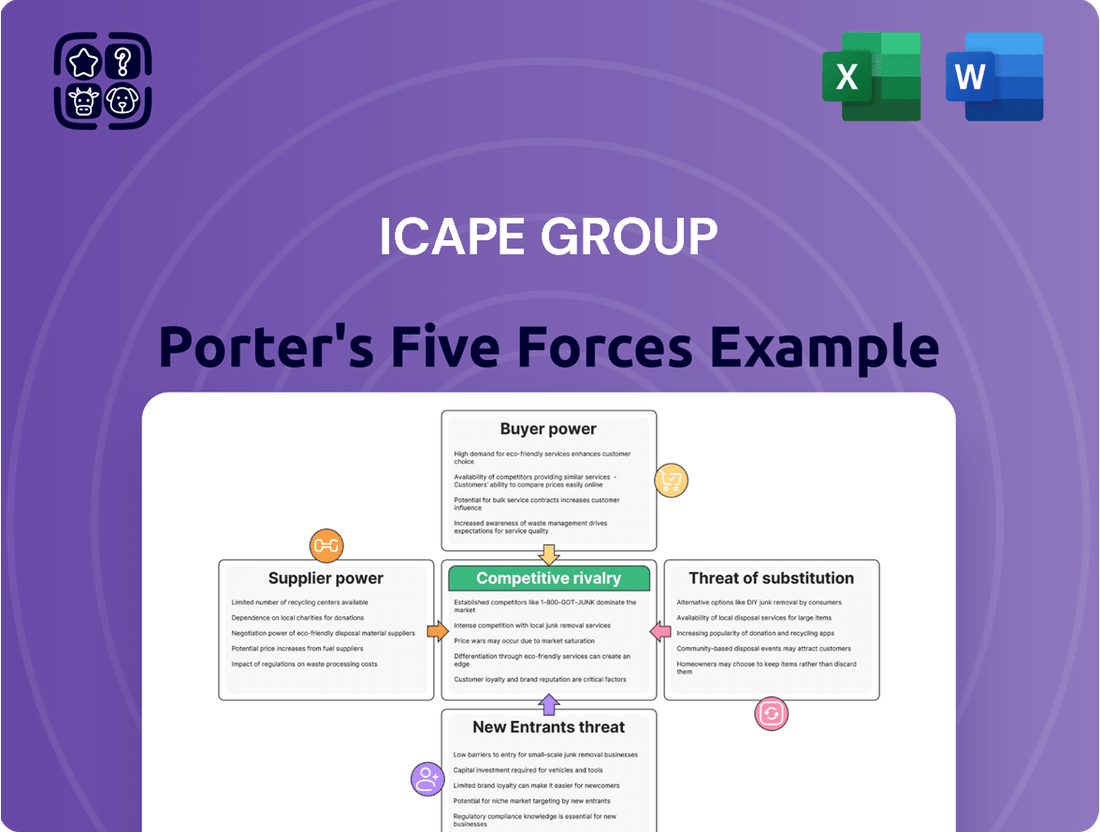

Our Porter's Five Forces analysis for Icape Group reveals a dynamic competitive landscape, highlighting significant buyer power and the intense threat of substitutes. Understanding these forces is crucial for navigating Icape Group's market. The complete report offers a deep dive into each force, providing actionable insights to inform your strategy.

Suppliers Bargaining Power

The electronic components market, especially for specialized PCBs and technical parts, sees a limited number of top-tier manufacturers, many located in Asia, where ICAPE Group sources heavily. This concentration means these crucial suppliers can wield considerable influence over pricing and contract conditions, particularly for unique technologies or components in high demand.

For instance, in 2024, the global PCB market was valued at approximately $75 billion, with a significant portion of high-specification production concentrated among a few dominant players. This situation can empower these key suppliers, allowing them to dictate terms, especially when demand outstrips supply for advanced or proprietary components.

ICAPE Group's strategy of building and maintaining an extensive network of qualified manufacturers is a critical countermeasure. This diversification helps to reduce reliance on any single supplier and provides a degree of negotiation leverage, mitigating the risk associated with the bargaining power of a concentrated supplier base.

For ICAPE Group, the cost of switching suppliers for highly specialized or custom-made components can be substantial. This includes expenses related to re-qualifying new suppliers, potential re-engineering of parts, and the risk of production delays. These significant barriers empower existing suppliers, making it challenging for ICAPE to easily change sources without considerable financial impact, especially for critical components with stringent technical specifications.

The global nature of the electronic components industry, where ICAPE Group operates, significantly mitigates supplier bargaining power. By sourcing from diverse regions, ICAPE can avoid dependency on any single manufacturer or geographical area, a crucial strategy in today's volatile market.

ICAPE Group's extensive network, boasting 39 subsidiaries and 88 strategic partners, predominantly located in China, is a testament to its commitment to supply chain diversification. This broad reach allows for the cultivation of multiple supplier relationships, thereby reducing the leverage any individual supplier might hold.

This widespread sourcing capability provides ICAPE with a significant advantage. If one supplier attempts to increase prices or impose unfavorable terms, ICAPE can readily shift procurement to alternative sources, effectively diluting individual supplier power and ensuring competitive pricing for its customers.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward, meaning they start distributing or selling directly to end-customers, is generally low for ICAPE Group. This is because ICAPE typically handles a wide array of standard components, making it less attractive for specialized manufacturers to bypass their established distribution channels. However, for highly niche or proprietary technologies, this threat could become more pronounced, as suppliers might see an opportunity to capture more value by controlling the entire supply chain. ICAPE's robust service model, which includes rigorous quality control and efficient logistics management, serves as a significant deterrent against such forward integration by its suppliers.

For instance, in the semiconductor industry, where ICAPE operates, a supplier of a unique, high-demand chip might consider direct sales if they believe they can better manage customer relationships and technical support. However, the complexity of global logistics and the need for broad product portfolios often make this unfeasible for many. ICAPE's ability to consolidate orders, manage inventory, and provide tailored solutions for diverse customer needs makes it a valuable partner, reducing the incentive for suppliers to integrate forward.

- Low Threat for Standard Components: Suppliers of common electronic components generally lack the incentive to integrate forward into distribution due to ICAPE's efficient consolidation and logistics.

- Potential for Niche Technologies: For highly specialized or proprietary parts, suppliers might explore direct sales, increasing their bargaining power.

- ICAPE's Value Proposition: ICAPE's comprehensive services, including quality assurance and supply chain management, create a barrier to supplier forward integration.

Importance of ICAPE's Volume to Suppliers

ICAPE Group's substantial purchasing volume, evidenced by its monthly delivery of 26 million printed circuit boards (PCBs) and 6 million technical parts, positions it as a key client for its manufacturing partners. This significant demand grants ICAPE considerable bargaining power, enabling it to negotiate more favorable pricing and terms. The sheer scale of ICAPE's orders makes its business crucial to supplier revenue streams, creating a balanced dependency that influences negotiations.

The bargaining power of suppliers for ICAPE Group is moderated by ICAPE's significant purchasing volume. This high demand means suppliers are reliant on ICAPE's consistent orders, which can translate into better pricing and contract terms for ICAPE. For instance, ICAPE's monthly dispatch of 26 million PCBs and 6 million technical components underscores its importance as a customer.

- Significant Customer Volume: ICAPE Group handles monthly deliveries of 26 million PCBs and 6 million technical parts, making it a major client for its suppliers.

- Bargaining Leverage: This high volume allows ICAPE to negotiate for better pricing and more favorable contractual terms due to its importance to supplier revenues.

- Supplier Dependency: The substantial nature of ICAPE's orders creates a mutual dependency, helping to balance the power dynamic between ICAPE and its suppliers.

The bargaining power of suppliers within the electronic components market, particularly for ICAPE Group, is influenced by market concentration and the uniqueness of products. With a limited number of high-tier manufacturers for specialized PCBs and technical parts, these suppliers can command better pricing, especially for in-demand or proprietary items. For example, the global PCB market's estimated $75 billion valuation in 2024 highlights the scale, with a significant portion of high-specification production held by a few dominant entities.

ICAPE Group mitigates this by maintaining a broad network of suppliers, reducing reliance on any single source and fostering competitive negotiation. The cost and complexity of switching suppliers for custom components, involving re-qualification and potential production delays, empower existing suppliers. However, ICAPE's extensive global sourcing strategy, including its 39 subsidiaries and 88 strategic partners, primarily in China, diversifies risk and limits individual supplier leverage.

ICAPE's substantial order volume, delivering 26 million PCBs and 6 million technical parts monthly, grants significant negotiation power. This scale makes ICAPE a crucial client, fostering a balanced dependency that allows for favorable pricing and terms, effectively counteracting supplier influence.

What is included in the product

This analysis meticulously examines the competitive intensity, buyer and supplier power, threat of new entrants, and the impact of substitutes on Icape Group's market position.

Quickly identify and address competitive threats with a visual breakdown of each force, enabling proactive strategy adjustments.

Customers Bargaining Power

ICAPE Group's global reach across diverse sectors like aerospace, telecommunications, automotive, and energy highlights a fragmented customer base. This broad distribution of clients, each with unique needs, inherently limits the bargaining power of any single customer.

With no single client representing an overwhelmingly large percentage of ICAPE's total revenue, individual customers have less leverage to dictate pricing or terms. ICAPE's business model is designed to streamline the procurement process for this wide array of clients, further diffusing concentrated customer power.

For more standardized printed circuit boards (PCBs) and technical components, customers often encounter low switching costs. This means they can readily move to another supplier if they find better pricing or service elsewhere. The global marketplace for these parts is filled with many distributors offering similar products, making it simple for buyers to shop around and change providers. In 2024, the PCB market saw continued price competition among distributors, highlighting this dynamic.

ICAPE Group actively counters this by providing significant value-added services. These include rigorous quality control processes, efficient logistics management, and dedicated technical support. These offerings differentiate ICAPE, making it more than just a component supplier and increasing customer loyalty beyond simple price comparisons.

Electronic manufacturers in 2025 are intensely focused on building resilient supply chains and want more control over their component sourcing. This shift means they are less willing to depend on just one electronics manufacturing services (EMS) or original design manufacturer (ODM) partner.

This growing demand for supply chain security significantly boosts the bargaining power of these customers. They are now actively seeking distribution partners, like ICAPE Group, that can guarantee a steady flow of components, especially with ongoing geopolitical uncertainties and market fluctuations impacting global trade.

Availability of Alternative Distribution Channels

Customers can bypass traditional distributors like ICAPE by sourcing components directly from manufacturers or through online platforms. This increased accessibility to alternative supply chains empowers them, especially for high-volume or standardized parts. For instance, the growth of B2B e-commerce in the electronics component market, which saw significant expansion in 2024, provides readily available competitive options.

The proliferation of digital marketplaces and direct-to-consumer models means customers are no longer solely reliant on integrated service providers. This shift allows them to compare pricing and terms more easily, thereby amplifying their negotiation leverage. In 2024, many manufacturers expanded their direct sales channels, further fragmenting the distribution landscape.

- Direct Sourcing: Customers can negotiate directly with component manufacturers, cutting out intermediary markups.

- Online Marketplaces: Platforms like Alibaba and specialized electronics distributors' websites offer a wide array of suppliers and competitive pricing.

- Specialized Brokers: Smaller, niche brokers can cater to specific customer needs, offering alternatives to full-service distributors.

Price Sensitivity in a Challenging Market Environment

In today's economic climate, marked by geopolitical uncertainties and subdued global economic activity, customers are demonstrating a pronounced sensitivity to price. This means they are more likely to shop around and compare options based on cost.

ICAPE Group's financial performance in 2024 clearly illustrates this trend, with revenue figures reflecting the difficulties of a challenging market. Customers are actively prioritizing cost-saving measures, influencing purchasing decisions significantly.

This elevated customer price sensitivity directly translates into increased bargaining power for them. Distributors and suppliers, like ICAPE Group, are therefore under pressure to maintain competitive pricing strategies and offer enhanced value propositions to retain business.

- Heightened Price Sensitivity: Customers are more inclined to seek the lowest prices due to economic pressures.

- Impact on ICAPE Group: 2024 revenue data indicates customers are prioritizing cost efficiencies.

- Increased Bargaining Power: Customers can demand better terms and pricing from suppliers.

- Competitive Pressure: Distributors must offer competitive pricing and value to secure sales.

ICAPE Group's diverse customer base, spanning multiple industries, means no single client holds significant sway. This broad distribution limits individual customer leverage, as confirmed by ICAPE's 2024 revenue figures which show a reliance on a wide client portfolio rather than a few dominant buyers.

While switching costs for standard components are generally low, ICAPE mitigates this by offering value-added services like quality control and logistics, fostering loyalty beyond price. The increasing customer demand for supply chain security, driven by 2025 market trends, further empowers buyers seeking reliable distribution partners.

Customers can bypass traditional distributors by sourcing directly or through online platforms, a trend amplified by the 2024 growth in B2B e-commerce for electronic components. This accessibility increases customer bargaining power, pushing suppliers to maintain competitive pricing and robust value propositions.

| Factor | Impact on ICAPE Group | Customer Bargaining Power |

|---|---|---|

| Customer Fragmentation | Limited leverage for individual clients. | Low to Moderate |

| Switching Costs | Low for standard parts, mitigated by value-added services. | Moderate to High |

| Supply Chain Security Demand (2025) | Increased customer leverage for reliable partners. | High |

| Direct Sourcing & Online Platforms | Amplified customer negotiation power. | High |

| Price Sensitivity (2024 Economic Climate) | Customers prioritize cost, increasing demands. | High |

Preview Before You Purchase

Icape Group Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis of the Icape Group, detailing the competitive landscape and strategic positioning within its industry. The document displayed here is the exact, fully formatted report you’ll receive immediately after purchase, offering actionable insights without any placeholders or alterations.

Rivalry Among Competitors

The electronic component distribution market, particularly for printed circuit boards (PCBs), features a crowded field of competitors. This includes major global distributors alongside numerous smaller, specialized regional firms, creating a highly fragmented landscape.

While ICAPE Group operates a substantial global network with 39 subsidiaries and strategic alliances, the industry's fragmentation ensures that no single entity commands a dominant market share. This dynamic intensifies competitive pressures across the board.

For instance, in 2024, the global PCB market was estimated to be worth over $80 billion, with hundreds of distribution companies vying for a piece of this vast market. This sheer volume of participants underscores the intense rivalry.

The global printed circuit board (PCB) market is projected for steady growth, with an estimated output value increase of approximately 5.0% in 2024, reaching around $68.75 billion by 2025. This moderate expansion, while positive, means that companies within the industry are actively competing for market share rather than simply benefiting from a rapidly expanding overall market.

This dynamic intensifies rivalry, as businesses focus on strategies to capture a larger portion of the available market. Companies are likely to engage in price competition, product innovation, and efforts to secure key customer contracts to differentiate themselves and gain an advantage.

Competitive rivalry in PCB and technical parts distribution extends beyond mere price, heavily emphasizing value-added services. ICAPE Group distinguishes itself by offering a robust suite of services, including rigorous quality control, efficient logistics, integrated supply chain management, and dedicated technical support. This focus on superior service, unwavering reliability, and deep technical expertise is crucial for gaining a competitive advantage in the market.

Strategic Acquisitions and Consolidation Efforts

ICAPE Group's competitive rivalry is intensified by its strategic acquisition strategy, exemplified by recent deals like the acquisition of Kingfisher PCB and NTW. These moves are not just about growth; they actively consolidate the market, absorbing smaller competitors and bolstering ICAPE's position. This trend of larger players acquiring smaller ones is a hallmark of a dynamic industry where scale and market penetration are key battlegrounds.

This consolidation directly fuels rivalry among the remaining significant players. As companies like ICAPE Group grow through acquisition, they gain economies of scale and a wider geographic or product reach, putting pressure on other major entities to respond. This creates a cycle where market share gains by one firm necessitate strategic counter-moves by others, leading to a more aggressive competitive environment.

- Acquisition of Kingfisher PCB: This acquisition by ICAPE Group in 2023 aimed to strengthen its presence in the printed circuit board (PCB) sector, a key area of competition.

- NTW Acquisition: The integration of NTW further expanded ICAPE's capabilities and market access, contributing to the ongoing consolidation trend.

- Market Consolidation Impact: Such M&A activities reduce the number of independent players, often leading to increased price competition and innovation efforts among the larger, consolidated entities.

Global and Geopolitical Influences on Supply Chains

Geopolitical tensions, such as the ongoing trade disputes and regional conflicts, are significantly heightening the importance of supply chain resilience. This environment means companies that can offer diverse sourcing options and adapt to local market needs, like ICAPE, are better positioned to navigate disruptions and gain a competitive edge.

The global push towards nearshoring and reshoring is actively reshaping competitive landscapes. This trend intensifies competition in specific regions as companies bring production closer to home, forcing distributors to re-evaluate and adapt their strategies to remain competitive and efficient.

- Geopolitical Risk: Increased global instability, exemplified by ongoing trade tensions, directly impacts supply chain reliability.

- Supply Chain Resilience: Companies like ICAPE, with diversified sourcing and local presence, are better equipped to manage disruptions.

- Nearshoring/Reshoring Trends: These shifts concentrate competitive intensity in new geographical areas, requiring strategic adjustments from distributors.

- Competitive Advantage: Flexibility in delivery and local responsiveness become critical differentiators in a volatile global market.

Competitive rivalry within the electronic component distribution sector, particularly for PCBs, is intense due to a fragmented market with numerous global and regional players. ICAPE Group, despite its extensive network, faces constant pressure from competitors focused on price, innovation, and value-added services. The industry saw a global PCB market value exceeding $80 billion in 2024, with hundreds of distributors competing. This intense competition is further fueled by strategic acquisitions, like ICAPE's purchase of Kingfisher PCB and NTW, which consolidate market share and pressure remaining players to adapt.

| Competitor Type | Market Share Focus | Key Competitive Factors |

|---|---|---|

| Global Distributors | Broad product range, economies of scale | Price, logistics efficiency, supplier relationships |

| Regional Specialists | Niche markets, localized service | Technical expertise, quick response times, customer intimacy |

| ICAPE Group | Global reach with localized support | Value-added services (quality control, supply chain management), technical expertise, strategic acquisitions |

SSubstitutes Threaten

Customers increasingly have the ability to bypass distributors and connect directly with PCB manufacturers, especially for substantial orders. This trend is amplified by the availability of online platforms that facilitate direct sourcing, potentially reducing lead times and costs for buyers. For instance, in 2024, the global electronics manufacturing services market, which includes PCB production, was valued at over $70 billion, indicating a vast network of potential direct suppliers.

The threat of direct sourcing is particularly potent for price-sensitive customers who possess the internal capabilities to manage international logistics, quality assurance, and supplier relationships. Companies with significant purchasing power, such as those in the automotive or telecommunications sectors, are more likely to explore these direct channels to optimize their supply chain costs. This can exert downward pressure on the margins of intermediaries like ICAPE Group.

Larger original equipment manufacturers (OEMs) and electronics manufacturing services (EMS) providers can possess the in-house capabilities to design and manufacture certain printed circuit boards (PCBs) or technical components. This direct control over the production process, while requiring significant capital investment, bypasses the need for external distributors like ICAPE Group.

This internal capacity represents a direct substitute, allowing these entities to manage their supply chains more tightly and potentially reduce lead times. For instance, a major electronics manufacturer might invest in its own PCB fabrication facilities, thereby diminishing its reliance on specialized distributors for its core component needs.

Advances in chip packaging, like Chip on Wafer on PCB (CoWoP), are emerging as a potential substitute threat to traditional PCBs. These innovations can integrate more functionality directly onto chips, potentially reducing the need for complex PCB designs. For instance, the growing adoption of advanced packaging in high-performance computing and AI accelerators, sectors that saw significant investment in 2024, could shift demand away from standard PCB solutions.

Availability of Refurbished or Used Components

The increasing availability of refurbished or used electronic components presents a significant threat of substitutes for companies like ICAPE Group. This market is expanding, fueled by consumers and businesses looking for cost-effective solutions, especially for older or less performance-critical applications. For instance, the global market for refurbished electronics was estimated to be worth over $50 billion in 2023 and is projected to grow substantially in the coming years.

While ICAPE Group’s core strategy revolves around supplying new, high-quality components, the presence of these cheaper, pre-owned alternatives can divert demand. This is particularly true for market segments where price sensitivity is high or for designs that do not require the latest technological advancements. The accessibility of these secondary market components can therefore cap the pricing power and market share expansion for new component suppliers.

Key considerations regarding this threat include:

- Cost Advantage: Refurbished components are typically offered at a lower price point than new ones, making them attractive to budget-conscious buyers.

- Market Segmentation: The threat is more pronounced in segments where component performance is not the primary driver, such as in certain industrial equipment or legacy systems.

- Environmental Concerns: Growing awareness around sustainability and e-waste can also indirectly boost the appeal of refurbished components as a more environmentally friendly option.

- Quality Variability: While ICAPE focuses on guaranteed quality, the performance and reliability of refurbished parts can vary, posing a risk for end-users who opt for them.

Software-Defined Hardware and Virtualization

While not a direct replacement for physical components, the rise of software-defined hardware and virtualization presents a subtle threat. These technologies can streamline electronic systems, potentially reducing the sheer number of specialized physical parts needed. For instance, in 2024, the global virtualization market was valued at approximately $77.1 billion, demonstrating significant adoption and continued growth, which could indirectly influence demand for certain PCBs and technical components.

This trend means that instead of needing multiple discrete hardware chips for various functions, a single piece of hardware could be programmed via software to perform those roles. This could lessen the reliance on a diverse range of physical components that companies like ICAPE might otherwise supply.

The long-term implication is a potential shift in the bill of materials for many electronic devices. As software takes on more hardware functions, the demand for some specific, complex physical parts might decrease, impacting the overall market for component distributors.

- Software-Defined Hardware: Enables flexible functionality through programming rather than dedicated chips.

- Virtualization Growth: The global virtualization market reached an estimated $77.1 billion in 2024, indicating strong industry adoption.

- Reduced Component Complexity: Potential to decrease the number and variety of physical parts in electronic systems.

- Indirect Impact on PCB Demand: A shift towards software solutions could indirectly reduce the need for certain types of printed circuit boards.

The threat of substitutes for ICAPE Group primarily stems from direct sourcing by customers, the increasing use of advanced chip packaging technologies, and the growing market for refurbished electronic components. Furthermore, the rise of software-defined hardware and virtualization offers a more indirect but potentially significant substitute by reducing the need for certain physical components.

| Substitute Type | Description | Impact on ICAPE Group | Relevant 2024 Data/Trends |

|---|---|---|---|

| Direct Sourcing | Customers bypassing distributors to buy directly from manufacturers. | Reduces ICAPE's role and potentially margins. | Global electronics manufacturing services market valued over $70 billion in 2024. |

| Advanced Chip Packaging | Technologies like CoWoP integrating more functionality onto chips. | May decrease demand for complex PCBs. | Significant investment in AI accelerators in 2024, driving advanced packaging adoption. |

| Refurbished Components | Pre-owned electronic parts offered at lower prices. | Diverts price-sensitive customers, caps pricing power. | Global refurbished electronics market worth over $50 billion in 2023, with continued growth. |

| Software-Defined Hardware/Virtualization | Software performing hardware functions, reducing physical parts. | Indirectly lowers demand for certain components. | Global virtualization market reached approx. $77.1 billion in 2024. |

Entrants Threaten

Establishing a truly global distribution network, complete with subsidiaries, robust logistics, and essential quality control laboratories, demands a significant upfront capital outlay. For instance, building out the infrastructure comparable to ICAPE Group's extensive international presence would likely involve hundreds of millions of dollars in investment.

This substantial financial barrier effectively deters many smaller or less capitalized potential entrants from even considering competing on a global scale. They simply cannot afford the initial investment required to match the operational reach and capabilities of established players like ICAPE Group.

ICAPE Group's established strength lies in its extensive network of qualified manufacturers, predominantly located in Asia, and its deeply rooted relationships with a global customer base. This robust infrastructure is a significant barrier for newcomers.

New entrants would need substantial time and investment to replicate ICAPE Group's trusted supplier connections and cultivate a diverse, reliable customer portfolio. For instance, building a comparable global distribution network, which ICAPE has spent years developing, is a costly and time-consuming endeavor, often requiring significant upfront capital and demonstrating consistent product quality and delivery reliability to gain traction.

In the competitive electronic components sector, brand reputation and trust are critical differentiators. ICAPE Group has cultivated a strong image as a reliable technological expert and a comprehensive, one-stop-shop solution provider for its clients.

New entrants face a significant hurdle in replicating ICAPE Group's established trust and quality perception. Building this level of brand equity, essential for securing high-value, long-term contracts, takes considerable time and consistent performance, making it a substantial barrier.

Economies of Scale and Cost Advantages of Incumbents

Established players like ICAPE Group benefit significantly from economies of scale. Their large purchasing volumes translate into lower per-unit costs for components and materials, a distinct advantage over newcomers. For instance, in 2024, ICAPE's substantial order volumes likely secured more favorable pricing from suppliers compared to a new entrant placing smaller initial orders.

These scale advantages extend to logistics and operational efficiency. ICAPE's established distribution networks and optimized warehousing mean lower costs per shipment and faster delivery times. A new entrant would struggle to match these efficiencies, potentially facing higher shipping fees and longer lead times, thereby increasing their overall cost of doing business.

Consequently, new entrants would likely find it challenging to compete on price. Incumbent distributors, like ICAPE, can absorb higher overheads and still offer competitive pricing due to their optimized cost structures. This makes it difficult for new companies to gain market share without significant initial investment or a highly differentiated offering.

- Economies of Scale: ICAPE's large operational scale in 2024 allows for bulk purchasing discounts, reducing material costs.

- Logistical Efficiency: Established distribution networks minimize per-unit shipping and warehousing expenses for ICAPE.

- Cost Disadvantage for Newcomers: New entrants face higher initial per-unit costs, hindering price competitiveness.

- Price Competition Barrier: Incumbents' cost advantages create a significant hurdle for new distributors aiming to compete on price.

Regulatory Complexities and Compliance Requirements

The electronic component distribution sector is characterized by significant regulatory complexities, particularly concerning international trade policies and tariffs. For instance, in 2024, the ongoing geopolitical tensions and evolving trade agreements between major economic blocs continue to create an unpredictable tariff landscape. Companies like ICAPE Group, with years of experience, possess the established infrastructure and expertise to navigate these intricate international trade regulations and compliance requirements efficiently. This allows them to manage customs, duties, and varying regional standards more effectively, thereby mitigating risks and controlling costs associated with cross-border distribution.

New entrants, conversely, face a substantial barrier to entry due to these regulatory hurdles. The learning curve for understanding and adhering to diverse international trade policies, product compliance standards, and import/export laws across different jurisdictions is steep. This necessitates significant investment in legal counsel, compliance personnel, and robust operational frameworks. For example, a new distributor might incur upwards of 15-20% in additional costs on initial shipments due to unforeseen import duties or compliance failures, significantly impacting their profitability and market competitiveness compared to established players like ICAPE Group.

- Navigating International Trade Policies: In 2024, the global trade environment remains dynamic, with ongoing adjustments to tariffs and trade agreements impacting the cost of electronic components.

- Regional Regulations: Compliance with diverse regional standards for product safety, environmental impact, and data privacy adds layers of complexity for distributors.

- Established Expertise vs. New Entrant Hurdles: ICAPE Group's established compliance infrastructure provides a significant advantage over new entrants who face steep learning curves and higher initial operational costs.

- Cost of Non-Compliance: Potential fines and shipment delays due to regulatory missteps represent a substantial financial risk for new businesses entering the market.

The threat of new entrants for ICAPE Group is moderate. While the electronic component distribution market offers opportunities, significant barriers exist. ICAPE's established global distribution network, built over years, represents a substantial capital investment, likely in the hundreds of millions of dollars, which deters smaller competitors. Furthermore, cultivating trusted supplier relationships and a diverse customer base requires considerable time and consistent performance, making it difficult for newcomers to replicate ICAPE's established infrastructure and brand equity.

Economies of scale provide ICAPE with a distinct cost advantage. In 2024, their large purchasing volumes likely secured more favorable pricing from suppliers compared to new entrants. This extends to logistics, where ICAPE's optimized distribution networks lead to lower per-unit shipping costs and faster delivery. Consequently, new companies face a price competition barrier, as incumbents can absorb higher overheads due to their optimized cost structures.

Navigating the complex regulatory landscape of international trade policies and tariffs presents another significant hurdle. The dynamic global trade environment in 2024, with evolving trade agreements and geopolitical tensions, requires established expertise to manage customs and compliance efficiently. New entrants face steep learning curves and higher initial operational costs, potentially incurring 15-20% in additional expenses on initial shipments due to unforeseen duties or compliance failures.

| Barrier to Entry | Impact on New Entrants | ICAPE Group Advantage |

|---|---|---|

| Capital Investment for Global Distribution | High barrier, requiring hundreds of millions of dollars | Established infrastructure and operational reach |

| Building Supplier and Customer Relationships | Time-consuming and requires consistent performance | Deeply rooted, trusted connections |

| Economies of Scale & Cost Advantages | Higher per-unit costs, hindering price competitiveness | Bulk purchasing discounts and logistical efficiencies |

| Regulatory and Trade Policy Navigation | Steep learning curve, potential for costly errors | Years of experience and established compliance frameworks |

Porter's Five Forces Analysis Data Sources

Our Icape Group Porter's Five Forces analysis is built upon a robust foundation of publicly available data, including Icape's annual reports, investor presentations, and competitor filings. We also leverage industry-specific market research reports and trade publications to provide a comprehensive understanding of the competitive landscape.